The Health and Fitness Club market is experiencing steady growth, driven by increasing health awareness, lifestyle changes, and rising demand for personalized wellness services across urban populations. The adoption of fitness club memberships is being fueled by growing interest in physical fitness, mental well-being, and preventive healthcare. Innovations in service offerings, such as personalized training, digital fitness solutions, and holistic wellness programs, are enhancing customer engagement and satisfaction.

The market is also benefiting from increased disposable income, urbanization, and the proliferation of health-focused campaigns by governments and private organizations. Integration of technology-enabled solutions, including mobile applications for workout tracking and virtual coaching, is further enhancing the member experience while improving operational efficiency.

Demographic trends, particularly among young and middle-aged adults, are shaping service preferences and driving the adoption of fitness programs As health and wellness continue to be prioritized globally, the Health and Fitness Club market is expected to sustain robust growth, with innovative services and personalized offerings acting as key drivers of expansion.

| Metric | Value |

|---|---|

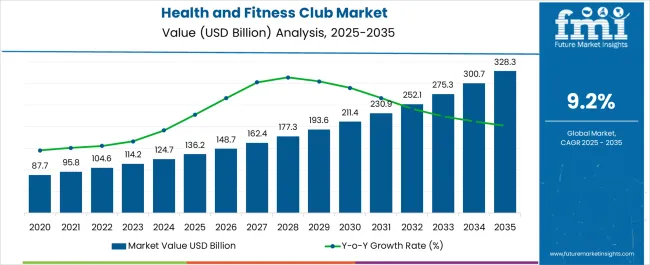

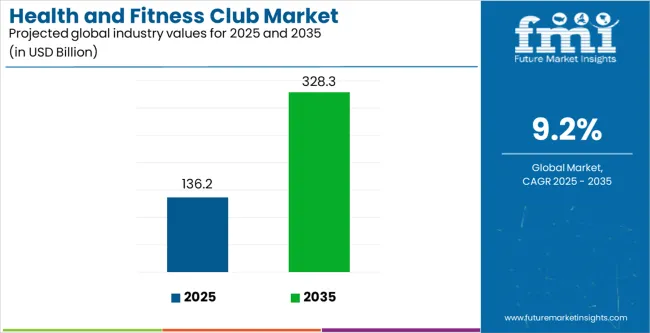

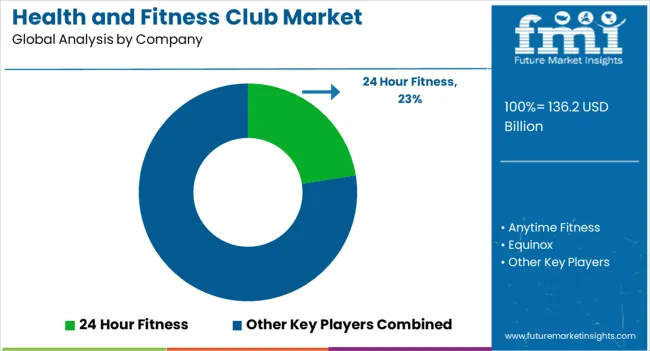

| Health and Fitness Club Market Estimated Value in (2025 E) | USD 136.2 billion |

| Health and Fitness Club Market Forecast Value in (2035 F) | USD 328.3 billion |

| Forecast CAGR (2025 to 2035) | 9.2% |

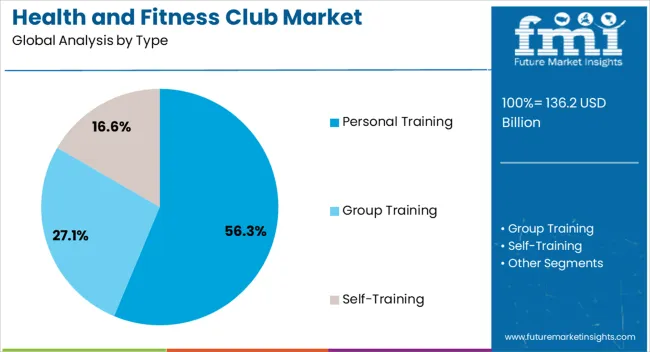

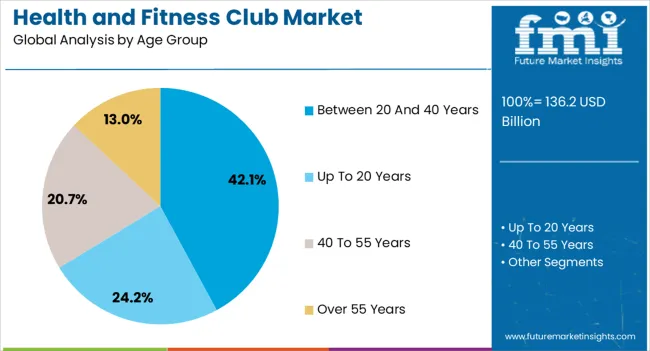

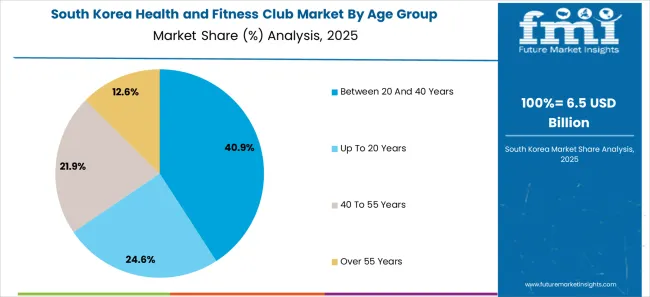

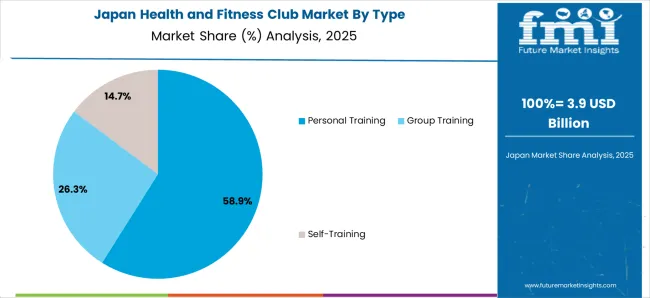

The market is segmented by Type and Age Group and region. By Type, the market is divided into Personal Training, Group Training, and Self-Training. In terms of Age Group, the market is classified into Between 20 And 40 Years, Up To 20 Years, 40 To 55 Years, and Over 55 Years. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The personal training segment is projected to hold 56.3% of the Health and Fitness Club market revenue in 2025, establishing it as the leading type. Growth in this segment is driven by the increasing demand for tailored fitness programs that meet individual health goals, including strength training, weight management, and functional fitness. Certified personal trainers provide customized workout plans, continuous guidance, and motivation, enhancing member engagement and results.

The ability to adapt sessions to specific fitness levels and objectives increases perceived value, supporting higher retention rates. Integration with digital platforms, including fitness tracking applications and remote coaching, further strengthens adoption. As awareness of personalized fitness benefits grows, both in urban and semi-urban areas, demand for personal training services is expanding.

Health-conscious consumers are prioritizing individualized attention and measurable outcomes, which reinforces the market position of this segment The continued focus on personalized health solutions, combined with technological enhancements, is expected to maintain personal training as the leading type in the Health and Fitness Club market.

The 20 to 40 years age group segment is anticipated to account for 42.1% of the market revenue in 2025, making it the leading age category. Growth is being driven by the rising health consciousness, fitness awareness, and lifestyle-related wellness priorities among young adults and working professionals. Individuals in this age range are highly responsive to structured fitness programs, personalized training, and technology-enabled solutions that track progress and provide real-time insights.

Engagement is further enhanced by the integration of group classes, social challenges, and digital fitness platforms that foster motivation and accountability. Urbanization, increasing disposable income, and exposure to global fitness trends are further supporting adoption.

Members in this age group often seek holistic approaches combining physical training, nutrition guidance, and mental wellness, which drives preference for comprehensive club offerings As health and wellness become integral to professional and personal lifestyles, the 20 to 40 years segment is expected to remain the primary revenue contributor, reinforcing the market’s focus on tailored services for this active demographic.

Boutique Fitness Studio

Demand for Boutique fitness centers has risen, particularly among millennials and Gen-Z. These fitness centers cater to individuals ready to pay a premium price for a curated workout experience. Rise of social media and influencer culture is making fitness a more attractive lifestyle choice.

With people spending half their time on social media, the craze to keep themselves in shape and look more attractive has added to these centers. This trend of bodybuilding, zero-figure, and fresh skin has added weight to the growth of the gym and health clubs market.

Corporatization of Jobs

The modern way of life is characterized by long working hours, which makes people stagnant with no body movements. Due to this increasing urbanization and a sedentary lifestyle, people are now more focused on their health to stay active. This, in turn, is also boosting the growth of corporate well-being programs and employee wellness initiatives, contributing to the overall demand for fitness clubs.

Health Concerns

Awareness about the importance of physical fitness and healthy lifestyle choices is a key factor driving the market of gyms and health fitness clubs. With the western lifestyle, the emergence of a snacking culture has heightened obesity and health issues.

Considering the rising incidence of chronic diseases in developed and developing economies, health and fitness chains in the market are introducing awareness campaigns and free trial periods for more entries. This attracts a substantial consumer base to the market.

Rising disposable income and changing consumer preferences contribute to increased health and wellness spending.

Conveniently Located Fitness Clubs

Thriving construction industry is giving rise to a greater number of apartments offering perks like fitness clubs and yoga centers. The availability of free or concessional fitness centers induces people to visit them more. This has upsurged the workout club market overall.

Technological Advancements

Advancements in technology have led to the development of new fitness equipment and wearable technology, attracting more consumers to fitness clubs. Wearables and mobile tracking trends have escalated the sense of fitness from the young to the older generation. The subconscious behavior of fulfilling this health target adds to the gym industry crowd.

Lack of awareness among the target audience regarding the benefits of health and fitness clubs is stymying the market growth of gyms or fitness clubs. Easy accessibility to a plethora of information on social media and short video platforms is forcing the general public to work out from their homes instead of joining expensive fitness clubs.

Limited accessibility of the club, specifically in areas with no proper transportation facilities, and thus high membership fees discourage potential clients from joining the club. Thus, the availability of low-cost alternative fitness options such as homework out of outdoor activities deters the health and fitness club market.

Shortage of skilled fitness trainers and instructors leads to poor quality of service, which upsets the clients on moving forward to fitness goals. Shortcomings of innovation and creativity in terms of fitness programs and classes offered by clubs demotivate the younger and older generations to go off track.

Fitness clubs are no longer relegated to being construed as halls for the wealthy. Affordable plans and a focus on fitness among consumers with tight purses is seeing the consumer base for fitness clubs widen.

Technology has played a vital role in the shift of personalized workout plans, nutrition guidance, and progress tracking. With a 9.0% CAGR, personal training is skyrocketing in the health and fitness club market through 2035.

| Attributes | Details |

|---|---|

| Top Type | Personal Training |

| CAGR (2025 to 2035) | 9.0% |

Celebrities play a significant role in shaping fitness trends and popularizing exercise routines. These celebrities often opt for personal trainers and thus personal training. This tendency among the affluent population is setting bars for personal training.

The trend of boutique fitness studios with smaller class sizes and high-quality personal trainers is catering to individuals who seek a tailored fitness experience. Personalization has become a key trend in the fitness industry as people are now more focused on goals and preferences and are seeking prioritized attention. The market of personal training in the health and fitness industry has been uplifted by promoting engagement and adherence to fitness regimes.

Age groups between 20 and 40 years are drawing the market statistics with an 8.8% CAGR for 2025 to 2035.

| Attributes | Details |

|---|---|

| Age Group | Between 20 and 40 Years |

| CAGR (2025 to 2035) | 8.8% |

Age group of 20 and 40 years desire a healthy lifestyle and are more health conscious. They are more likely to prioritize fitness and seek to connect with more people. Cities are a hub of opportunity to realize this potential of fitness, and younger are mostly shifting to cities for the betterment of their future. With this, the rising disposable income and lifestyle changes caused the growth of the gymnasium industry in these age groups.

The age group of 20 to 40 years is most likely to be connected with their appearance and seek out ways to improve their physique. Health and fitness clubs offer access to equipment and facilities that can help them achieve their aesthetic goals.

Convenience of location and flexible hours for workouts are other factors that make it easier for this age group to fit gym schedules into their busy lives.

In parallel with the above information, countries must adopt ongoing trends and expand their boundaries with innovative approaches. The fashion of staying in shape has infected people of all age groups. Personal appearance and health concerns are key factors emerging as social causes with benefits for people by people.

The countries mentioned reflect their consumers' preferences, age groups, climatic variations, and thus beauty scales, acquiring companies to increase market share. We are subjecting India, China, Japan, the United States, and South Korea here.

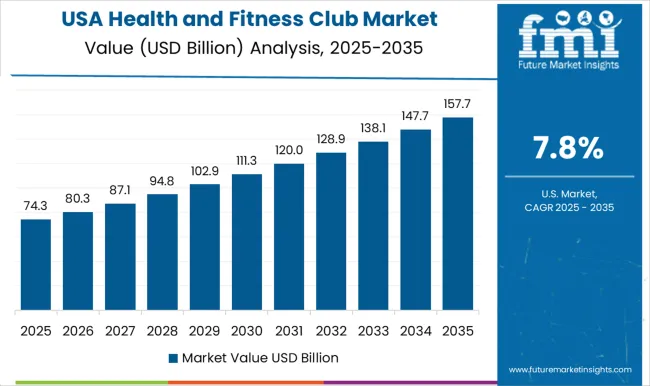

| Countries | CAGR through 2035 |

|---|---|

| South Korea | 11.1% |

| Japan | 10.9% |

| United Kingdom | 10.3% |

| China | 9.9% |

| United States | 9.6% |

South Korean virtual reality workouts have become a rage, allowing users a more immersive fitness experience. This technological advancement in South Korea has boosted the sweating experience with an 11.1% CAGR through 2035.

Versatility in fitness programs and offerings suggests the breadth of South Korean gym culture. The fashion industry, models, and influencers of South Korea have given a tough fight to the world, sparking results in fitness.

From yoga to CrossFit to aqua aerobics, the diversity shows the country's adaptability and willingness to participate in various fitness and wellness sectors. The health and fitness club market in South Korea is upsurging, with many new investors and companies contributing to this sector.

The emphasis of Japanese people on public awareness and fitness education reveals its depth in the health and fitness sector. The hectic lifestyle and lack of work-life balance have influenced the fitness center market in Japan. With a 10.9% CAGR, Japan is a prominent player in the fitness club market. Corporates in Japan provide incentives to their employees in the form of fitness club subscriptions and memberships, lifting the market growth

Japan, with its morning radio calisthenics tradition, radiates the embedding of fitness in daily life. With an adapted culture that educates its people about fitness, ensuring its longevity and growth, Japan has broadened its interest in fitness and gym industries.

The fusion of technology with fitness is a running trend in the United Kingdom. The country embraces this merger, offering smart equipment and virtual fitness solutions. This highlights the progressive gym culture in the countries, with a CAGR of 10.3% from 2025 to 2035.

The United Kingdom's population is one of the most sports-loving communities in the world, with an affinity to different sports like football, cricket, rugby, etc. This has invoked a kind of fitness in the running generation, aiding the popularity of fitness clubs and health centers.

The rise of boutique fitness studios, offering everything from spinning to HIIT to yoga, testifies to the country’s evolving gym culture. Events like the London Marathon draw international attention, while local initiatives promote community fitness and well-being.

Rising urbanization, which leads to a sizeable middle-class population, keeps the fitness club market on the right track in China. With a CAGR of 9.9% through 2035, the country is upticking the list in emerging markets.

Obesity and healthcare concerns among Chinese are key actors driving the fitness culture and uplifting the fitness club market in China. Trends like functional fitness, mental wellness, and holistic health have found their way into the gym culture. Gyms now integrate services like meditation, nutrition workshops, and recovery zones, evolving into wellness hubs in China.

Fitness has a rich history in the United States, making it a prominent player in the industry. According to IHRSA Data, more than 87.7 million individuals in the USA made use of health clubs in 2020, and the graph has green-flagged the market in the coming years with a 9.6% CAGR through 2035. Judging by these numbers, the United States leads the way, with the most gyms and the highest gym attendance rates.

Athletic lifestyle is bolstered by the continuing popularity of sports, especially due to recent sporting successes such as winning the cricket World Cup in 2025, which ensures that fitness clubs remain as popular as ever.

The health and fitness club market is a highly competitive industry, with many key players vying for a market share. Some of the biggest companies in this space include 24 Hour Fitness, Gold's Gym, Anytime Fitness, Equinox, LA Fitness, and Planet Fitness. These companies offer a range of services and amenities, from advanced equipment and personalized training to group classes and spa treatments.

Each company has its plethora of offerings with the thought of expansion. This, with the ever-lasting spirit of physical health care, is opening doors for many companies to compete despite the presence of big players. As the concerns are going to rise with changing times, the expansion of the health and fitness club market has big grounds to cover.

Recent Advancements

The global health and fitness club market is estimated to be valued at USD 136.2 billion in 2025.

The market size for the health and fitness club market is projected to reach USD 328.3 billion by 2035.

The health and fitness club market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in health and fitness club market are personal training, group training and self-training.

In terms of age group, between 20 and 40 years segment to command 42.1% share in the health and fitness club market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Healthcare Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Regulatory Affairs Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Flooring Market Size and Share Forecast Outlook 2025 to 2035

Healthcare AI Computer Vision Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Master Data Management Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Contact Center Solution Market Size and Share Forecast Outlook 2025 to 2035

Healthy Snacks Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Mobile Computers Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cloud Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Companion Robots Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Analytics Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Contract Research Organization Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Healthcare Chatbot Market - Growth Trends & Forecast 2025 to 2035

Healthcare Video Conferencing Solutions Market Analysis - Trends & Forecast 2025 to 2035

Healthy Fats Low Carb Market Trends - Demand & Consumer Shifts 2025 to 2035

Healthy Fat-Free Snacks Market Insights – Growth & Consumer Shifts 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA