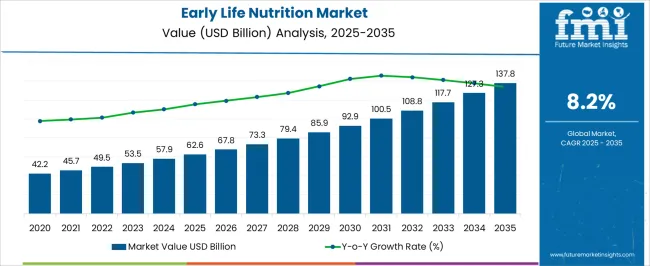

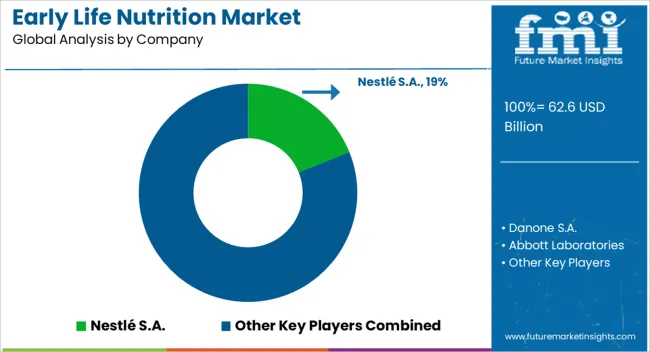

The early life nutrition market is estimated to be valued at USD 62.6 billion in 2025 and is projected to reach USD 137.8 billion by 2035, registering a compound annual growth rate (CAGR) of 8.2% over the forecast period.

The early life nutrition market is valued at USD 62.6 billion in 2025 and is projected to reach USD 137.8 billion by 2035, with a CAGR of 8.2%. Between 2021 and 2025, the market grows from USD 42.2 billion to USD 62.6 billion, passing through values of USD 45.7 billion, 49.5 billion, 53.5 billion, and 57.9 billion. The early-phase growth momentum is driven by the increasing awareness among parents and healthcare professionals about the importance of proper nutrition during infancy. The rising birth rates and growing demand for baby food and infant formula products are key contributors to this phase.

From 2026 to 2030, the market accelerates, moving from USD 62.6 billion to USD 92.9 billion, with intermediate values of USD 67.8 billion, 73.3 billion, 79.4 billion, and 85.9 billion. This period reflects heightened momentum due to expanding product innovation, greater availability of organic and specialized infant nutrition products, and the rising focus on early childhood health and development. The growing influence of health-conscious consumers also plays a significant role.

Between 2031 and 2035, the market continues to grow at a steady pace, reaching USD 137.8 billion, with values of USD 100.5 billion, 108.8 billion, 117.7 billion, and 127.3 billion. The continued focus on nutrition for infants and toddlers, coupled with rising disposable incomes in emerging economies, ensures the market maintains a strong growth trajectory throughout the forecast period.

| Metric | Value |

|---|---|

| Early Life Nutrition Market Estimated Value in (2025 E) | USD 62.6 billion |

| Early Life Nutrition Market Forecast Value in (2035 F) | USD 137.8 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

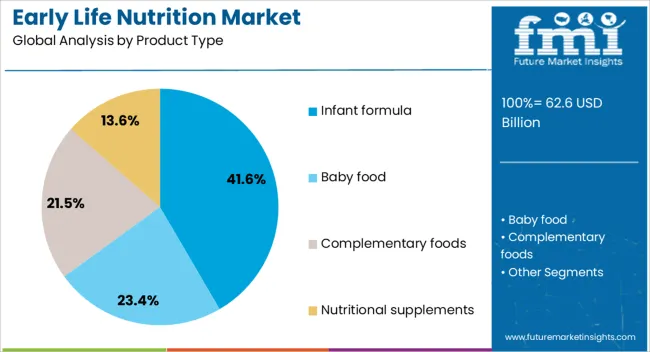

The infant formula market is the largest contributor, accounting for approximately 40-45%. Infant formula is essential for babies, particularly in cases where breastfeeding is not possible or needs to be supplemented. As parents increasingly opt for infant formula due to convenience, availability, or medical reasons, the demand for early life nutrition products grows. The baby food market follows with around 25-30%, as it encompasses a wide range of products like pureed foods, cereals, snacks, and meals designed specifically for infants and young children. This market is crucial in fulfilling the dietary needs of babies as they transition to solid foods.

The nutritional supplements market contributes approximately 15-18%, driven by the growing awareness among parents about the importance of providing additional vitamins, minerals, and other supplements to ensure optimal health and growth in the early stages of life. The healthcare and pharmaceutical market plays a role in contributing about 10-12%, as healthcare professionals guide parents toward suitable early life nutrition products, especially for infants with specific health or nutritional needs. The organic and natural food market accounts for around 8-10%, reflecting the increasing demand for organic and natural food products for babies, which are free from artificial additives and preservatives.

The early life nutrition market is experiencing strong momentum driven by growing awareness of infant health, rising birth rates in developing countries, and increased focus on nutritional interventions during the first 1,000 days of life. Urbanization, higher female workforce participation, and evolving family structures have fueled the demand for convenient, nutritionally balanced infant food solutions.

Scientific advancements in pediatric nutrition and fortified formulations are further enhancing product appeal among health-conscious parents. The market outlook remains favorable due to supportive government initiatives, improved healthcare access, and growing preference for branded, quality-assured nutritional products.

Innovations targeting specific developmental needs, combined with premiumization trends, are expected to sustain long-term growth across both mature and emerging regions. As a result, companies are intensifying product development efforts and expanding distribution networks to capture broader market share

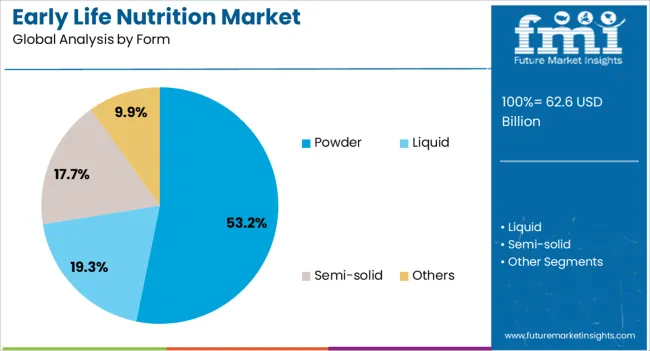

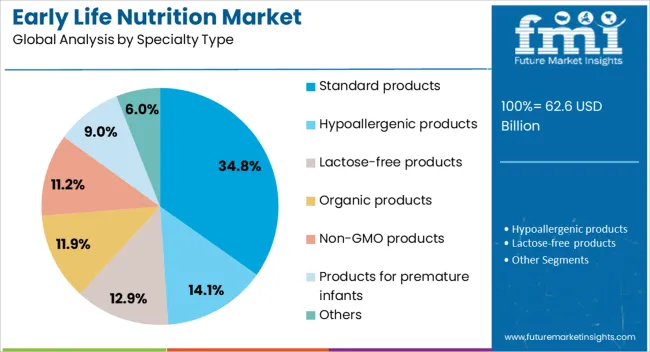

The early life nutrition market is segmented by product type, form, specialty type, age group, and geographic regions. By product type, early life nutrition market is divided into infant formula, baby food, complementary foods, and nutritional supplements. In terms of form, early life nutrition market is classified into powder, liquid, semi-solid, and others. Based on specialty type, early life nutrition market is segmented into standard products, hypoallergenic products, lactose-free products, organic products, non-GMO products, products for premature infants, and others. By age group, early life nutrition market is segmented into 0–6 months, 6–12 months, 12–24 months, 24–36 months, and above 36 months. Regionally, the early life nutrition industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The infant formula segment dominates the product type category with a 41.6% market share, highlighting its critical role in supporting infant growth and nutritional needs, particularly for non-breastfeeding mothers. The increasing rate of working women, coupled with rising awareness about early nutritional adequacy, has significantly driven adoption.

Manufacturers have invested in research to closely replicate the composition of human milk, adding essential nutrients such as DHA, prebiotics, and proteins. Regulatory backing for quality and safety standards has further instilled trust in formula-fed nutrition.

This segment continues to grow steadily, bolstered by rising income levels in emerging economies and the expansion of organized retail and e-commerce platforms. The introduction of specialized formula options catering to different developmental stages and dietary needs is expected to enhance this segment’s growth outlook

Within the form category, powder holds the leading position with 53.2% market share, attributed to its convenience, extended shelf life, and cost-effectiveness compared to ready-to-use alternatives. Powder formulations are widely adopted due to their ease of storage and ability to be precisely measured and mixed, aligning well with daily feeding routines.

This form is particularly popular in both urban and rural settings where refrigeration facilities may be limited. Manufacturers have prioritized innovation in packaging and formulation to improve solubility, nutrient retention, and hygiene during handling.

Additionally, affordability and the availability of various pack sizes contribute to its widespread adoption across different income groups. The powder segment is projected to maintain its dominance as it meets the practical and economic considerations of a broad consumer base

Standard products lead the specialty type category with a 34.8% share, reflecting their role as the foundational offering in early life nutrition. These products are designed to meet the basic nutritional needs of healthy infants and young children without specific medical or dietary conditions. The broad applicability of standard formulations has ensured consistent demand, particularly among first-time parents and across mainstream retail channels.

Formulated according to established pediatric guidelines, these products provide balanced nutrient profiles suitable for general consumption. The stability of this segment is supported by brand trust, healthcare provider recommendations, and global standardization in regulatory frameworks.

As entry-level offerings, standard products also serve as a key introduction point for families transitioning into more specialized nutrition solutions as developmental needs evolve. Continued demand from emerging markets and expanding birth cohorts is expected to uphold the segment’s leading market position

Early life nutrition includes products such as infant formula, baby food, and supplements, which provide essential nutrients during critical stages of growth and development. The market is driven by rising birth rates, increasing awareness of the benefits of early nutrition, and expanding disposable incomes in emerging economies. However, challenges related to regulatory pressures, concerns over product quality, and competition from organic and natural alternatives are present. Opportunities lie in the increasing demand for specialized formulas, such as lactose-free, soy-based, and hypoallergenic options, as well as the rise of online retail channels for baby products. Companies that focus on product innovation, safety standards, and expanding market access in developing regions are well-positioned for success in this expanding market.

The demand for early life nutrition products is being driven by increasing awareness of the critical role nutrition plays in infant health and development. As more parents and healthcare providers emphasize the importance of optimal nutrition in the first few years of life, products like infant formula and baby food are becoming essential in providing adequate nourishment when breastfeeding is not an option. Early life nutrition has been linked to improved cognitive development, immune function, and overall well-being, which has led to growing trust in the benefits of high-quality nutrition products. This heightened awareness is particularly evident in developing regions, where health education and access to affordable infant nutrition are expanding. As a result, the market for early life nutrition is experiencing robust growth.

The early life nutrition market faces several challenges, particularly around regulatory compliance, safety concerns, and market competition. Governments and regulatory bodies impose strict standards for infant food products, particularly around labeling, nutrient content, and ingredient sourcing. This regulatory landscape can vary significantly across regions, creating complexities for manufacturers trying to enter global markets. Safety concerns, especially regarding contamination and allergens, are another major challenge, as parents and caregivers prioritize the health and safety of infants. There is increasing competition from organic, natural, and plant-based alternatives, which appeal to health-conscious consumers. Manufacturers must navigate these challenges by ensuring the highest safety standards, adhering to regional regulations, and staying competitive in a growing market.

Specialized infant formulas, including lactose-free, soy-based, and hypoallergenic formulas, are in high demand due to rising concerns over allergies and dietary restrictions. Additionally, as parents seek more customized nutrition options for their children, brands are focusing on developing premium products that cater to specific needs, such as brain development or immune system support. E-commerce is playing an increasingly vital role, with more consumers turning to online platforms to purchase baby food, formula, and supplements due to convenience, a wider selection, and competitive pricing. Companies that can effectively leverage e-commerce and provide a diverse range of specialized, high-quality products are positioned to capitalize on these trends.

The early life nutrition market is experiencing a growing trend towards organic and plant-based nutrition solutions as consumers become more conscious of the ingredients in infant food products. Organic infant formula and baby food, free from pesticides, additives, and artificial preservatives, are gaining popularity among health-conscious parents who are concerned about the long-term effects of chemical exposure on their children’s development. Plant-based alternatives, such as oat milk and soy-based formulas, are also on the rise, driven by the growing interest in plant-based diets and concerns over animal-based ingredients. This shift toward organic and plant-based products is influencing market dynamics, with companies focusing on innovation to meet the changing preferences of modern parents who prioritize sustainability and health.

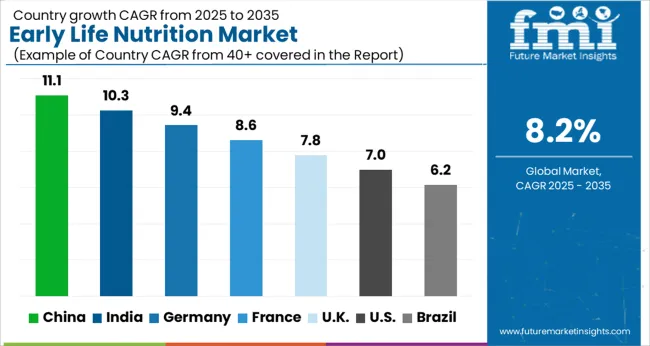

| Country | CAGR |

|---|---|

| China | 11.1% |

| India | 10.3% |

| Germany | 9.4% |

| France | 8.6% |

| UK | 7.8% |

| USA | 7.0% |

| Brazil | 6.2% |

The global early life nutrition market is projected to grow at a CAGR of 8.2% from 2025 to 2035. China leads with the highest growth rate of 11.1%, followed by India at 10.3% and Germany at 9.4%. The UK and USA show moderate growth at 7.8% and 7.0%, respectively. The market is driven by increasing awareness around child health, government initiatives supporting infant nutrition, and rising disposable incomes. There is a growing demand for specialized, organic, and fortified nutrition products for infants, as parents increasingly seek healthier, safer options for their children’s development. The analysis covers over 40 countries, with the leading markets shown below.

The early life nutrition market in China is projected to grow at a CAGR of 11.1% from 2025 to 2035. The rapid urbanization, increasing disposable income, and growing awareness regarding child nutrition are significant drivers for the market’s expansion. As the world’s most populous country, China has witnessed a steady rise in birth rates and a greater focus on child health and nutrition. The rise in dual-income households has increased the demand for convenient, high-quality nutritional products for infants and toddlers. Government initiatives promoting child health and nutrition are further strengthening this demand. The market is dominated by infant formulas, along with functional foods and beverages specifically designed for early childhood growth. With China’s robust e-commerce infrastructure, online sales of infant and early life nutrition products have grown significantly, enabling easier access to these products for parents across the country.

The early life nutrition market in India is expected to grow at a CAGR of 10.3% from 2025 to 2035. India is witnessing significant improvements in healthcare access and a greater focus on maternal and infant health. The rise in the number of working mothers, combined with increasing income levels, is leading to higher consumption of early life nutrition products such as infant formulas, baby food, and nutritional supplements. The government’s programs to promote breastfeeding, maternal health, and infant nutrition are further driving market growth. The growing awareness among urban populations about the importance of quality nutrition in early childhood is supporting demand. The expansion of organized retail and e-commerce platforms is making it easier for parents to access premium and specialized nutrition products. Furthermore, rising concerns over malnutrition and child growth are pushing parents to opt for fortified and tailored products.

The early life nutrition market in Germany is projected to grow at a CAGR of 9.4% from 2025 to 2035. Germany’s well-established healthcare system and high focus on child health have contributed to the increased demand for early life nutrition products. There is a growing preference for organic and premium baby foods among German consumers, as parents are becoming more conscious of the ingredients and nutritional value of products consumed by their infants. The market is seeing a shift towards specialized baby food, such as gluten-free, lactose-free, and fortified products. Germany’s healthcare policies emphasize the importance of nutrition during early childhood, which has resulted in increased awareness among parents about the benefits of balanced nutrition. The growing trend of healthy living, as well as a well-established regulatory framework for food safety, supports the growth of the market.

The UK early life nutrition market is expected to grow at a CAGR of 7.8% from 2025 to 2035. The market growth in the UK is driven by an increasing demand for infant formulas, baby foods, and health supplements. As more working parents opt for convenience, infant formulas and pre-packaged baby foods have become an essential part of daily childcare. Growing concerns over childhood obesity and malnutrition have led to a higher preference for fortified products with added vitamins and minerals. The UK government’s emphasis on promoting breastfeeding and child nutrition through various public health initiatives has contributed to the rising awareness about early life nutrition. The market is benefiting from innovations in baby food, with more organic, plant-based, and allergen-free options becoming available. The rising use of digital platforms for marketing and distribution has also made it easier for parents to access specialized nutrition products.

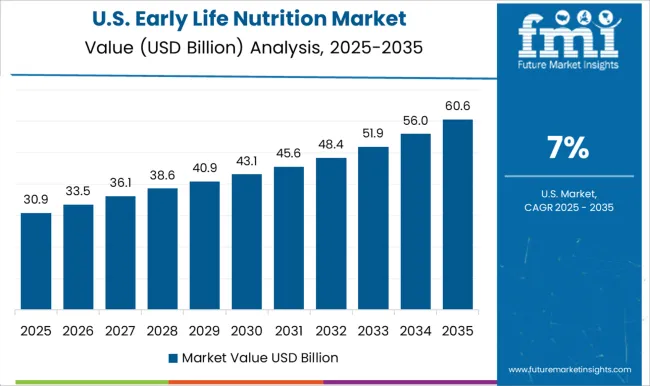

The USA early life nutrition market is projected to grow at a CAGR of 7.0% from 2025 to 2035. The demand for early life nutrition products in the USA is primarily driven by the growing number of working parents, which has led to an increase in the consumption of infant formulas and baby food products. The market is also seeing an upward trend in the adoption of organic and specialty baby foods, as parents seek safer, healthier options for their children. USA consumers are increasingly looking for products that cater to specific dietary needs, such as lactose-free, gluten-free, and non-GMO. The government’s healthcare policies, along with healthcare awareness campaigns, emphasize the importance of early childhood nutrition, further boosting market demand. The rise of e-commerce and retail channels has made it easier for parents to access a wide variety of infant nutrition products, thereby increasing market penetration.

The early life nutrition market is highly competitive, driven by demand for products that support infant health and development. Nestlé S.A. leads with its wide range of infant formulas and nutritional products, focusing on research-driven solutions that address specific developmental needs. Their products are marketed as supporting immunity, cognitive function, and digestive health, with a strong emphasis on quality and safety. Danone S.A. competes with its premium infant nutrition products, highlighting their commitment to sustainable sourcing and organic ingredients. Danone’s strategy focuses on improving nutrition for babies through a combination of natural, clean-label products and a strong presence in emerging markets.

Abbott Laboratories competes by offering a range of early life nutrition solutions that cater to both infant formulas and specialized medical nutrition. Abbott’s strategy involves using clinical research to back the effectiveness of their products, with a focus on meeting specific dietary needs for infants with health concerns. Reckitt Benckiser Group plc targets the market with its well-known brands like Enfamil, positioning itself as a leader in providing expert-backed nutrition for infants. Their product brochures emphasize benefits such as enhanced brain development and immune system support, appealing to both parents and healthcare professionals. FrieslandCampina and Hain Celestial Group offer specialized early life nutrition products, focusing on organic and plant-based solutions.

FrieslandCampina positions itself as a leading provider of organic milk-based formulas, while Hain Celestial focuses on clean and natural ingredients, appealing to the growing demand for organic baby food. Perrigo Company plc and Bellamy's Organic also cater to the organic niche, with Perrigo emphasizing the affordability and accessibility of their products, while Bellamy's focuses on premium, certified organic offerings. Product brochures from these companies often highlight health benefits such as improved brain development, digestion, and immunity, with a focus on ingredient transparency and safety. Many brochures emphasize the brands' commitment to high-quality, research-backed formulations, aiming to assure parents of the nutritional integrity of the products.

| Items | Values |

|---|---|

| Quantitative Units | USD 62.6 billion |

| Product Type | Infant formula, Baby food, Complementary foods, and Nutritional supplements |

| Form | Powder, Liquid, Semi-solid, and Others |

| Specialty Type | Standard products, Hypoallergenic products, Lactose-free products, Organic products, Non-GMO products, Products for premature infants, and Others |

| Age Group | 0–6 months, 6–12 months, 12–24 months, 24–36 months, and Above 36 months |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nestlé S.A., Danone S.A., Abbott Laboratories, Reckitt Benckiser Group plc, FrieslandCampina, Hain Celestial Group, Perrigo Company plc, and Bellamy's Organic |

| Additional Attributes | Dollar sales of early life nutrition span infant formula, baby food, and cereals, distributed via supermarkets, online, and pharmacies. Growth is fueled by health awareness, organic demand, convenience, and strong adoption across Asia-Pacific, North America, and Europe. |

The global early life nutrition market is estimated to be valued at USD 62.6 billion in 2025.

The market size for the early life nutrition market is projected to reach USD 137.8 billion by 2035.

The early life nutrition market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in early life nutrition market are infant formula, baby food, complementary foods and nutritional supplements.

In terms of form, powder segment to command 53.2% share in the early life nutrition market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Early Phase Clinical Trial Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Early-Stage Lung Cancer Diagnostics Therapy Market Size and Share Forecast Outlook 2025 to 2035

Early Production Facility Market Size and Share Forecast Outlook 2025 to 2035

NGS Solution for Early Cancer Screening Market Size and Share Forecast Outlook 2025 to 2035

Life Support Systems Market Size and Share Forecast Outlook 2025 to 2035

Life Science Software Market Size and Share Forecast Outlook 2025 to 2035

Life Sciences Next-generation Customer Engagement Platforms Market Size and Share Forecast Outlook 2025 to 2035

Lifestyle Concierge Services Market Size and Share Forecast Outlook 2025 to 2035

Life Science Multichannel Campaign Management Market Size and Share Forecast Outlook 2025 to 2035

Life Sciences Analytics Market Size and Share Forecast Outlook 2025 to 2035

Life Science Logistics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lifestyle Sneakers Industry Analysis in United Kingdom Growth, Trends and Forecast from 2025 to 2035

Life Science and Chemical Instruments Market Analysis - Growth & Forecast 2024 to 2034

Wildlife Tourism Market Size and Share Forecast Outlook 2025 to 2035

Wildlife Health Market Size and Share Forecast Outlook 2025 to 2035

Plant life Extensions (PLEX) and Plant Life Management (PLIM) for Nuclear Reactors Market

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Second-Life Battery Storage Systems Market Size and Share Forecast Outlook 2025 to 2035

Service Lifecycle Management Application Market Size and Share Forecast Outlook 2025 to 2035

Product Life-Cycle Management (PLM) IT Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA