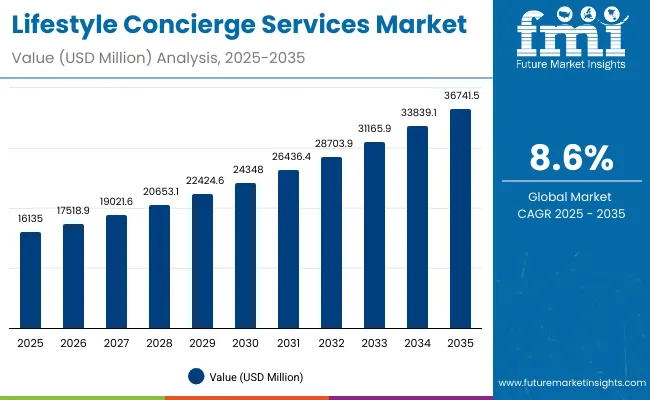

The Lifestyle Concierge Services Market is expected to record a valuation of USD 16,135.1 million in 2025 and USD 36,741.5 million in 2035, with an increase of USD 20,606.5 million, which equals a growth of 127.7% over the decade. The overall expansion represents a CAGR of 8.6% and more than a 2X increase in market size.

Lifestyle Concierge Services Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 16,135.1 million |

| Market Forecast Value in (2035F) | USD 36,741.5 million |

| Forecast CAGR (2025 to 2035) | 8.6% |

During the first five-year period from 2025 to 2030, the market increases from USD 16,135.1 million to USD 24,348.0 million, adding USD 8,213.0 million, which accounts for 39.9% of the total decade growth. This phase records steady adoption in travel planning, dining reservations, and wellness coordination, driven by the rising demand for premium and personalized experiences. Travel planning & reservations dominate this period as they cater to over 29% of concierge requests requiring end-to-end management.

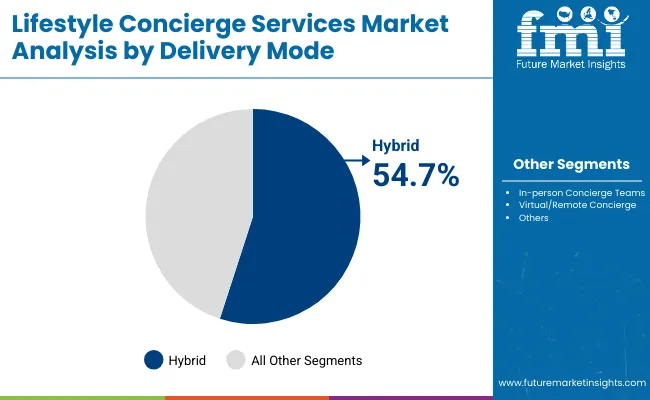

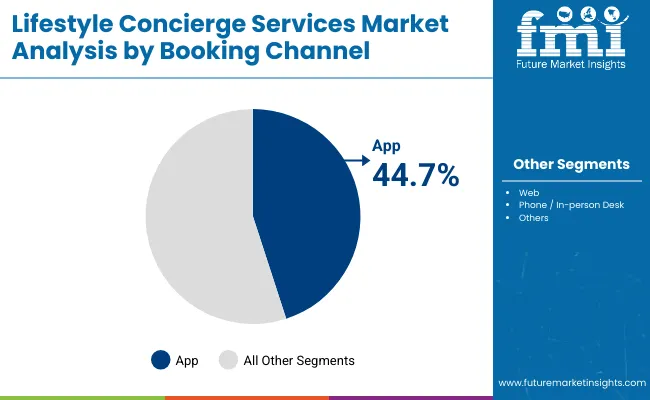

The second half from 2030 to 2035 contributes USD 12,393.5 million, equal to 60.1% of total growth, as the market jumps from USD 24,348.0 million to USD 36,741.5 million. This acceleration is powered by widespread deployment of app-based concierge solutions, AI-driven personalization, and hybrid concierge teams combining onsite and remote services. Hybrid delivery models capture the largest share above 54% by the end of the decade. Subscription-driven membership models and corporate contracts add recurring revenue, increasing the subscription share beyond 50% in total value.

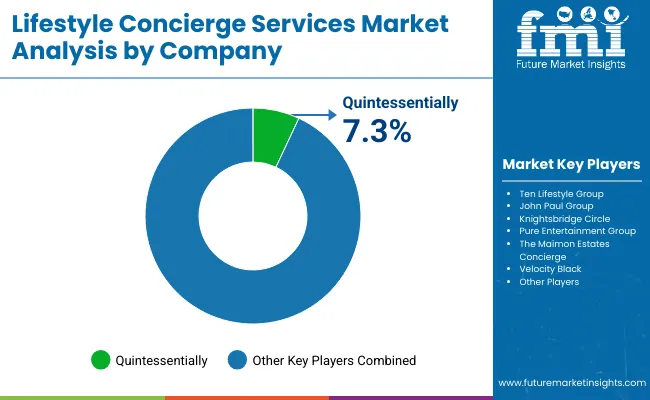

From 2020 to 2024, the Lifestyle Concierge Services Market grew from USD 12,000 million to USD 15,200 million, driven by strong demand among ultra-high-net-worth individuals and luxury travelers. During this period, the competitive landscape was dominated by luxury-focused players controlling nearly 75% of revenue, with leaders such as Quintessentially, Ten Lifestyle Group, and John Paul Group focusing on premium travel planning and exclusive lifestyle experiences. Competitive differentiation relied on access to exclusive events, coverage, and membership tiers, while virtual concierge solutions were often bundled as an auxiliary offering rather than a primary revenue stream. Corporate adoption had minimal traction, contributing less than 15% of the total market value.

Demand for concierge services will expand to USD 16,135.1 million in 2025, and the revenue mix will shift as digital-first solutions and subscription-driven models grow to over 45% share. Traditional concierge leaders face rising competition from app-based providers offering AI-driven personalization, multilingual customer support, and subscription-based luxury access. Major players are pivoting to hybrid models, integrating digital platforms and remote workflow capabilities to retain relevance. Emerging entrants specializing in mobile-first concierge apps, virtual travel assistance, and industry-specific lifestyle platforms are gaining share. The competitive advantage is moving away from network exclusivity alone to ecosystem strength, scalability, and recurring revenue streams.

Rising demand for luxury lifestyle management services has accelerated the adoption of concierge solutions globally. Hybrid concierge delivery has gained popularity due to its ability to blend personal attention with digital convenience. The rise of app-based booking has contributed to enhanced efficiency, real-time updates, and wider accessibility. Segments such as travel, dining, and wellness are driving demand for concierge solutions that integrate seamlessly into the lifestyles of UHNWIs, HNWIs, corporate executives, and luxury travelers.

Expansion of subscription memberships and corporate concierge contracts has fueled market growth. Innovations in mobile apps, AI-driven personalization, and virtual concierge support are expected to open new application areas. Segment growth is expected to be led by travel planning & reservations in service type, hybrid concierge in delivery mode, and app-based booking channels due to their convenience, adaptability, and scalability.

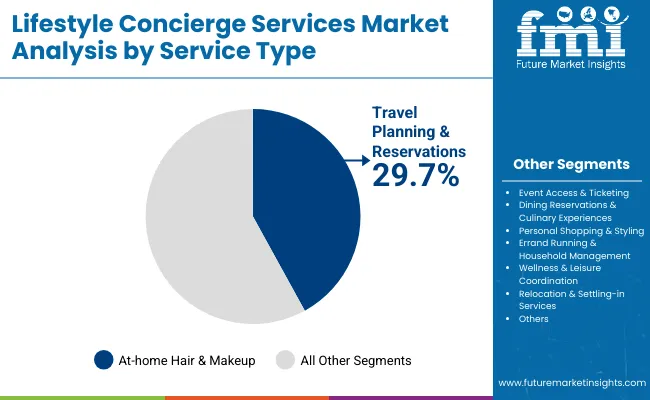

The market is segmented by service type, end user, delivery mode, pricing model, booking channel, and region. Service types include travel planning & reservations, event access & ticketing, dining reservations & culinary experiences, personal shopping & styling, errand running & household management, wellness & leisure coordination, and relocation & settling-in services, highlighting the core elements driving adoption. End user classification covers UHNW & HNW individuals, corporate executives & business owners, luxury travelers, and expats & relocating professionals to cater to different lifestyle requirements.

Based on delivery mode, the segmentation includes in-person concierge teams, virtual/remote concierge, and hybrid (onsite + remote). In terms of pricing model, categories encompass membership/subscription retainers, pay-per-request or ad hoc services, and corporate contracts. Booking channels include app, web, and phone or in-person desk, reflecting the multiple ways clients access services. Regionally, the scope spans North America, Latin America, Europe, Asia-Pacific, and the Middle East & Africa, with country-level coverage including the United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, and South Africa.

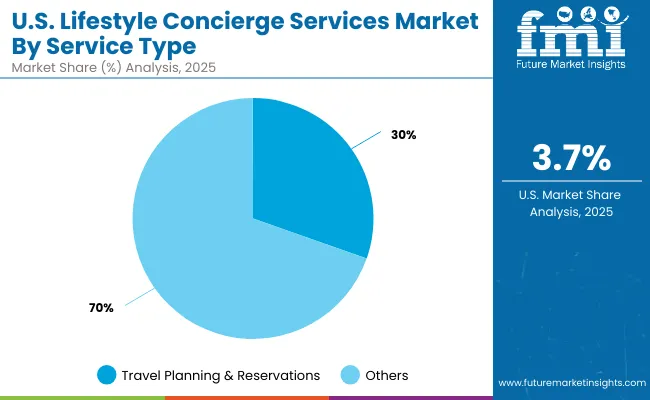

| Service Type Segment | Market Value Share, 2025 |

|---|---|

| Travel planning & reservations | 29.7% |

| Others | 70.3% |

The travel planning & reservations segment is projected to contribute 29.7% of the Lifestyle Concierge Services Market revenue in 2025, maintaining its lead as the dominant service category. This growth is driven by strong demand for personalized itineraries, exclusive access to luxury travel experiences, and end-to-end trip management for UHNWIs, HNWIs, and corporate executives. Travel continues to serve as the cornerstone of concierge offerings, with clients prioritizing seamless, curated journeys that integrate flights, accommodation, dining, and unique experiences.

The segment’s growth is also supported by concierge providers expanding into destination-specific partnerships, private aviation, and bespoke cultural access. As mobility rises and premium travel becomes more experiential, travel planning & reservations is expected to retain its position as the foundation of lifestyle concierge services worldwide.

| Delivery Mode Segment | Market Value Share, 2025 |

|---|---|

| Hybrid (onsite + remote) | 54.7% |

| Others | 45.3% |

The hybrid concierge segment is projected to contribute 54.7% of the Lifestyle Concierge Services Market revenue in 2025, positioning itself as the dominant delivery mode. This growth is driven by the blending of personal in-person services with virtual concierge platforms, enabling providers to scale globally while maintaining exclusivity. Hybrid models cater to both traditional clients who value face-to-face interaction and younger luxury consumers who prefer instant access via digital apps.

The segment’s momentum is also supported by rising demand for flexibility, cross-border service continuity, and 24/7 responsiveness. As concierge firms adopt digital-first strategies and integrate AI-driven personalization with human expertise, hybrid delivery models are expected to remain the backbone of the industry, offering both efficiency and exclusivity.

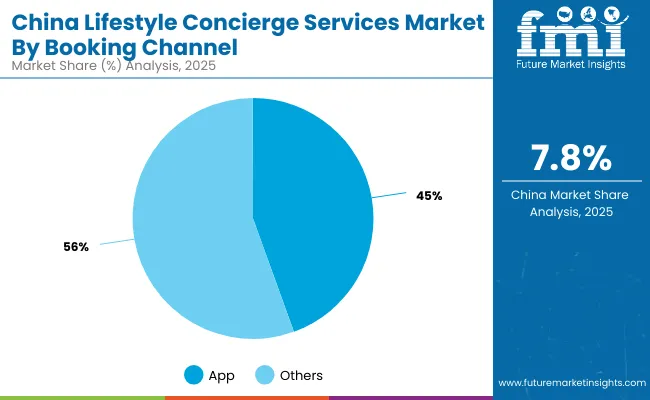

| Booking Channel Segment | Market Value Share, 2025 |

|---|---|

| App | 44.7% |

| Others | 55.3% |

The app-based booking segment is projected to contribute 44.7% of the Lifestyle Concierge Services Market revenue in 2025, emerging as the leading booking channel. Growth is being driven by the increasing adoption of mobile-first lifestyles, especially in Asia-Pacific and Europe, where affluent millennials and Gen Z consumers seek instant concierge access. Mobile platforms provide real-time updates, seamless integration with lifestyle apps, and AI-powered personalization, making them the preferred interface for modern clients.

The segment’s rise is also supported by concierge providers investing in proprietary apps, membership platforms, and loyalty ecosystems to strengthen client engagement. As app penetration deepens in emerging luxury hubs like China and India, the channel is expected to surpass traditional web and phone-based bookings, establishing itself as the core access point for concierge services.

Drivers

Rising HNWI and UHNWI Population

The increase in the number of high-net-worth (HNW) and ultra-high-net-worth individuals (UHNWIs) is one of the strongest drivers for the Lifestyle Concierge Services Market. These individuals represent the core consumer base for concierge services, as they consistently demand bespoke solutions tailored to their lifestyle preferences. According to industry wealth reports, regions such as Asia-Pacific (particularly China and India) are witnessing a sharp rise in new wealth creation, supported by rapid economic expansion, entrepreneurial growth, and investment inflows. These markets alone are forecast to contribute disproportionately to the concierge industry’s growth, with India expected to record a CAGR of 9.5% and China at 8.6% from 2025 to 2035.

In mature markets such as the USA, the UHNWI base is well-established, fueling demand for premium memberships and legacy concierge programs offered by providers like Quintessentially and Ten Lifestyle Group. Services such as luxury travel arrangements, dining access, and exclusive event management are particularly sought after by affluent clients who value both time savings and access to experiences unavailable through traditional channels. Moreover, as wealth becomes increasingly global, affluent individuals demand concierge services that extend across geographies, supporting travel, relocation, and cultural immersion. This increasing wealth concentration, combined with the aspirational spending habits of rising elites, ensures sustained long-term demand for personalized lifestyle management solutions worldwide.

Shift Toward Digital and Hybrid Concierge Models

Another critical driver is the shift toward digital and hybrid concierge models. Consumers increasingly expect real-time access, seamless digital interactions, and tailored recommendations delivered through mobile apps, websites, and remote platforms. In 2025, app-based bookings already account for 44.7% (USD 7,212.3 million) of market revenue, demonstrating the rapid adoption of digital-first engagement channels. Hybrid concierge models, blending in-person exclusivity with digital convenience, dominate the delivery mode landscape with a 54.7% share (USD 8,825.8 million) in 2025. This shift is being propelled by a new generation of luxury consumers, including millennials and Gen Z, who prefer mobile-first solutions and value accessibility, transparency, and instant gratification.

At the same time, traditional UHNWIs still expect personalized attention, making hybrid models the optimal solution to serve both segments. Digital enhancements such as AI-driven personalization, predictive recommendations, and integration with AR/VR for virtual experiences are redefining how concierge providers deliver value. For service providers, digital and hybrid models offer operational scalability, cost efficiency, and data-driven insights into customer preferences. Firms can track client behavior, anticipate needs, and upsell premium experiences more effectively through digital ecosystems. This growing reliance on technology is not only reshaping customer expectations but also positioning hybrid concierge delivery as the cornerstone of the market’s evolution.

Restraints

High Membership Costs and Limited Accessibility

While demand is strong, one of the key restraints for the Lifestyle Concierge Services Market is its exclusivity due to high membership and service costs. Premium providers often charge thousands of dollars annually for membership retainers, with additional costs for pay-per-request services. This pricing model restricts access to a narrow group of UHNWIs and HNWIs, leaving aspirational luxury consumers underserved. For instance, top-tier concierge clubs such as Knightsbridge Circle require fees upwards of USD 25,000 annually, pricing out even affluent but not ultra-rich consumers. This exclusivity, while maintaining brand prestige, limits overall market penetration.

Unlike mass luxury or premium consumer services, concierge offerings are not easily scalable to middle-class luxury consumers without diluting value. This cost barrier is especially evident in developing economies where the base of wealthy consumers is still growing but not yet comparable to mature markets. As a result, despite promising CAGR levels in emerging countries, the absolute number of potential clients remains constrained by affordability challenges. Unless new models such as tiered subscription plans or entry-level digital memberships gain traction, the industry risks being confined to a narrow elite segment. This limited accessibility curtails overall addressable market size, restraining revenue potential despite rising wealth levels.

Dependence on Travel and Event Industries

Another critical restraint lies in the concierge market’s heavy dependence on industries such as travel, events, and dining. Historically, concierge services have been closely tied to arranging flights, hotel stays, fine dining, and exclusive event access segments that are highly sensitive to economic conditions, travel restrictions, and regulatory changes. This dependency makes the market vulnerable to external shocks, as evidenced during the COVID-19 pandemic when mobility restrictions significantly reduced demand for concierge services. Even as recovery is underway, the volatility of the travel sector continues to present challenges.

Airline disruptions, geopolitical instability, and event cancellations can directly impact service volumes and revenue streams for concierge providers. This reliance also creates cyclical seasonality, with peak demand aligning with travel seasons and event calendars. Providers must diversify offerings into areas such as wellness, personal shopping, and household management to mitigate this dependency. Without greater diversification, the industry risks being overly exposed to external crises that may suppress demand in its largest service categories. While diversification is underway, the reliance on travel and events remains a structural vulnerability restraining more stable growth.

Key Trends

App-Based Concierge Platforms Gaining Traction

A major trend reshaping the industry is the rise of app-based concierge services. By 2025, mobile app bookings already represent 44.7% (USD 7,212.3 million) of concierge revenues, reflecting how clients increasingly prefer digital-first access. Apps allow clients to request services in real time, access curated recommendations, and integrate with digital wallets, loyalty programs, and AI-driven personalization. Providers such as Velocity Black and Ten Lifestyle Group are at the forefront, offering members access to bespoke experiences through sophisticated app ecosystems.

This trend is particularly pronounced among affluent millennials and Gen Z consumers, who favor seamless mobile interactions over traditional phone or in-person concierge channels. In markets like China and India, where mobile adoption is exceptionally high, apps are rapidly becoming the dominant gateway to concierge services. Providers are leveraging AI to anticipate client needs, recommend experiences, and ensure seamless booking. Over the next decade, app-first concierge platforms are expected to account for the majority of incremental growth, fundamentally redefining how clients engage with concierge providers.

Expansion of Corporate Concierge Programs

A second key trend is the growing adoption of concierge services within corporate ecosystems. Businesses, especially in North America and Europe, are increasingly integrating concierge services as part of employee benefits, executive support, and wellness programs. Corporate concierge contracts enable organizations to provide their senior executives and high-value employees with access to services ranging from travel management to personal errands, enhancing productivity and satisfaction. This trend is being fueled by growing corporate interest in retaining top talent and differentiating employee experiences in competitive industries.

Companies view concierge offerings as a strategic investment in employee well-being and efficiency, particularly as work-life balance becomes a priority. By 2035, corporate contracts are projected to account for a significantly larger share of concierge revenues, diversifying the market beyond its reliance on UHNWIs and HNWIs. As corporate adoption expands, concierge providers are tailoring services to business-specific needs, including relocation support, executive event planning, and 24/7 assistance for international travel. This growing trend not only broadens the client base but also introduces recurring, large-scale contracts that strengthen revenue stability.

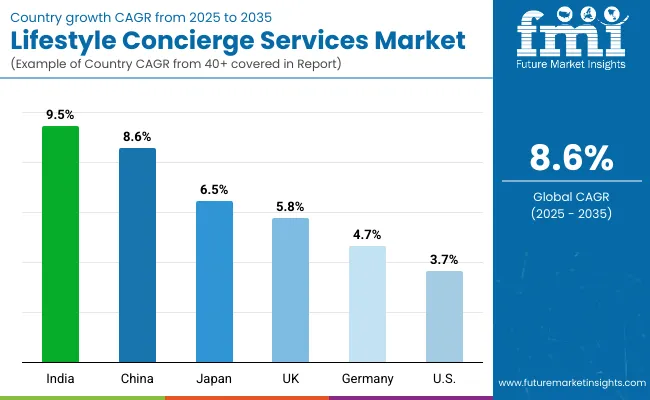

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 8.6% |

| USA | 3.7% |

| India | 9.5% |

| UK | 5.8% |

| Germany | 4.7% |

| Japan | 6.5% |

The Lifestyle Concierge Services Market shows strong regional disparity in adoption speed, largely influenced by wealth creation, digital adoption, luxury travel demand, and corporate contract penetration. Asia-Pacific emerges as the fastest-growing region, anchored by India at 9.5% CAGR and China at 8.6% CAGR. This acceleration is driven by rising UHNW/HNW populations, expansion of luxury tourism, and widespread adoption of app-based concierge platforms. China’s momentum is supported by digital-first concierge providers and strong demand from younger luxury travelers, while India’s growth reflects rapid wealth creation, international relocation support, and growing corporate usage. Europe maintains a steady growth profile, led by Germany (4.7%), France (5.2%), and the UK (5.8%).

Growth is fueled by strong corporate concierge adoption, demand from expats, and institutional partnerships. Germany benefits from corporate and relocation contracts tied to its international business hubs. The UK remains a hub for elite concierge providers such as Knightsbridge Circle and Bon Vivant, while France sees demand from both luxury travelers and cultural event access. North America shows moderate expansion, with the USA at 3.7% CAGR, reflecting market maturity and slower HNWI growth compared to Asia. Growth here is increasingly service-driven, supported by corporate wellness programs and technology-enhanced concierge platforms rather than pure travel-driven models. In Latin America, Brazil records 4.5% CAGR, with rising affluence and international travel fueling demand for concierge services, particularly among executives and expatriates.

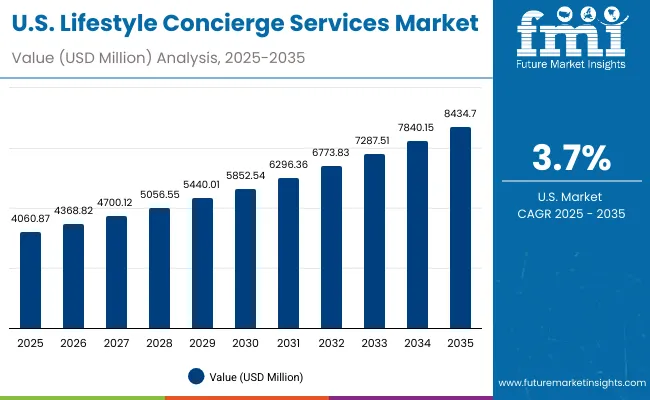

| Year | USA Lifestyle Concierge Services |

|---|---|

| 2025 | 4060.9 |

| 2026 | 4368.8 |

| 2027 | 4700.1 |

| 2028 | 5056.6 |

| 2029 | 5440.0 |

| 2030 | 5852.5 |

| 2031 | 6296.4 |

| 2032 | 6773.8 |

| 2033 | 7287.5 |

| 2034 | 7840.2 |

| 2035 | 8434.7 |

The Lifestyle Concierge Services Market in the USA is projected to grow at a CAGR of 3.7% from 2025 to 2035, reaching USD 8,434.7 million by 2035. As one of the most mature markets globally, the USA is characterized by steady demand from UHNWIs and HNWIs who continue to invest in high-tier memberships and premium concierge services. Established players such as Quintessentially and Ten Lifestyle Group are strong in the region, offering clients exclusive travel arrangements, dining access, and cultural experiences.

Corporate adoption is also rising, with businesses increasingly offering concierge benefits to executives as part of employee engagement and retention programs. Despite slower growth compared to Asia-Pacific, the USA market is evolving toward hybrid delivery models, combining traditional in-person concierge teams with digital platforms. There is growing traction for wellness and lifestyle coordination services, alongside errand-running and household management solutions, reflecting shifts in consumer behavior toward convenience and holistic lifestyle management. With steady demand from legacy UHNWIs and expanding interest from corporate clients, the USA will maintain a significant share of the market, though its relative contribution will decline slightly from 25.2% in 2025 to 23.0% by 2035.

The Lifestyle Concierge Services Market in the UK is expected to expand at a CAGR of 5.8% between 2025 and 2035, with London remaining the core hub of demand. The city’s concentration of UHNWIs, executives, and expatriates sustains strong interest in concierge offerings spanning luxury travel, dining, and event access. Leading firms such as Knightsbridge Circle and Bon Vivant continue to dominate through their reputation for exclusivity and deep industry networks, securing access to high-profile events like Wimbledon, Royal Ascot, and Fashion Week.

Another factor fueling growth is the rising influx of expatriates and relocating professionals, many of whom rely on concierge services for settling-in assistance. Housing, schooling, and everyday lifestyle management are increasingly important for executives moving into the UK’s financial and cultural hubs. Alongside this, the UK’s role as a center for arts, culture, and heritage ensures consistent demand for bespoke cultural and entertainment services. Digital concierge adoption is also picking up, complementing traditional in-person service with app-based convenience.

India is forecast to be the fastest-growing market at a CAGR of 9.5%, reflecting sharp growth in HNWI households and luxury consumption. Rising affluence in tier-1 cities like Mumbai and Delhi, as well as expanding demand in tier-2 cities, is creating a broader client base for concierge services. Travel planning, exclusive dining experiences, and wellness coordination are gaining momentum, driven by aspirational lifestyles and international exposure among Indian elites.

Relocation concierge services are also expanding rapidly, especially for returning NRIs and multinational executives entering the Indian market. At the same time, India’s mobile-first consumer behavior is accelerating the uptake of app-based concierge platforms. Providers are increasingly integrating AI-driven personalization and multilingual support, making services more accessible to diverse clients. This blend of rising wealth, digital readiness, and corporate adoption positions India as one of the strongest growth pillars in the market.

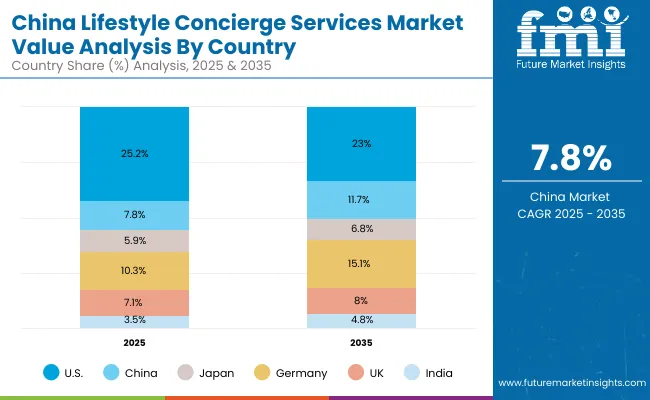

| Countries | 2025 Share (%) |

|---|---|

| USA | 25.2% |

| China | 7.8% |

| Japan | 5.9% |

| Germany | 10.3% |

| UK | 7.1% |

| India | 3.5% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 23.0% |

| China | 11.7% |

| Japan | 6.8% |

| Germany | 15.1% |

| UK | 8.0% |

| India | 4.8% |

China is expected to grow at a CAGR of 8.6%, the second-fastest among major economies, supported by rapid digital adoption and rising luxury consumption. The country’s younger affluent consumers, especially millennials and Gen Z, are driving demand for experiential concierge services delivered through mobile platforms. Domestic firms such as Luxury Concierge China are competing with international players, supported by strong local tech integration and cultural familiarity.

App-based concierge platforms already account for 44.5% of bookings (USD 559.0 Million in 2025), reflecting China’s dominance in digital-first service adoption. Alongside travel and dining, corporate contracts are growing as enterprises adopt concierge programs to enhance executive productivity. Outbound luxury tourism, particularly to Europe and the USA, continues to be a strong demand driver, while domestic tourism and cultural event services further strengthen the market.

The Lifestyle Concierge Services Market is undergoing a notable geographic shift in revenue contribution between 2025 and 2035. In 2025, the USA leads with a 25.2% share, reflecting its status as a mature market with a strong base of UHNWIs and established concierge providers. However, its share is projected to decline to 23.0% by 2035, as faster growth in Asia and Europe reshapes the landscape. Germany rises from 10.3% to 15.1%, supported by corporate adoption, relocation demand, and strong HNWI concentration, while the UK increases from 7.1% to 8.0% through cultural event-driven services and expatriate relocation support.

Japan also sees a modest increase from 5.9% to 6.8%, benefiting from steady luxury consumption and rising demand for hybrid concierge models. Asia-Pacific countries are expected to record the most significant share gains. China expands from 7.8% to 11.7%, driven by app-based concierge platforms, younger luxury consumers, and outbound travel. India grows from 3.5% to 4.8%, the fastest CAGR globally, supported by rising wealth creation, mobile-first adoption, and corporate concierge contracts. Together, China and India are projected to more than double their combined share of the market, making Asia-Pacific a leading growth engine. These trends highlight the shift in market power from traditional Western strongholds to rapidly expanding Asian and European economies, reshaping competitive strategies for concierge service providers.

| Service Type Segment | Market Value Share, 2025 |

|---|---|

| Travel planning & reservations | 30.4% |

| Others | 69.6% |

The Lifestyle Concierge Services Market in the USA is valued at USD 4,060.9 million in 2025, with travel planning & reservations leading at 30.4% (USD 1,234.5 million), followed by other services such as event access, dining, shopping, and relocation at 69.6% (USD 2,826.4 million). The dominance of travel planning reflects the mature USA market’s focus on seamless luxury experiences, where UHNWIs and HNWIs prioritize exclusive travel arrangements, private aviation, and premium hospitality bookings.

Cultural and sporting events also drive high demand, with concierge firms offering exclusive access to sold-out venues. This segment leadership positions travel planning as the cornerstone of USA concierge services, underpinning growth despite the market’s maturity. While other services such as household management and wellness are expanding, travel remains central due to its experiential value and high spending potential. Over the next decade, hybrid concierge models are expected to reinforce this trend, combining digital accessibility with personalized service to strengthen client loyalty.

| Booking Channel Segment | Market Value Share, 2025 |

|---|---|

| App | 44.5% |

| Others | 55.5% |

The Lifestyle Concierge Services Market in China is valued at USD 1,256.2 million in 2025, with app-based bookings leading at 44.5% (USD 559.0 million), compared to other channels such as web, phone, and in-person desks at 55.5% (USD 697.2 million). The dominance of app-based platforms reflects China’s mobile-first consumer behavior, where affluent millennials and Gen Z prefer digital-first engagement. Concierge providers leverage apps to deliver AI-powered recommendations, real-time booking, and integrated payments, aligning with the expectations of China’s younger luxury clients.

This advantage positions app-based bookings as a long-term growth engine, driving the country’s projected 8.6% CAGR through 2035. Domestic firms like Luxury Concierge China are scaling aggressively, supported by competitive tech ecosystems and strong consumer adoption. As luxury travel, dining, and corporate concierge contracts expand, app channels are expected to surpass traditional booking methods, cementing digital-first models as the backbone of China’s concierge market.

The Lifestyle Concierge Services Market is moderately fragmented, with a mix of luxury service leaders, boutique specialists, and region-specific providers competing across diverse lifestyle segments. leaders such as Quintessentially, Ten Lifestyle Group, and John Paul Group hold significant recognition, leveraging exclusive partnerships, coverage, and strong brand equity. Their strategies increasingly emphasize hybrid concierge delivery, digital-first platforms, and tailored memberships catering to UHNWIs and corporate clients.

Established mid-sized players, including Knightsbridge Circle, Pure Entertainment Group, and Velocity Black, are highly focused on niche audiences and curated experiences. These firms accelerate adoption through elite memberships, event-driven offerings, and proprietary mobile platforms that target younger luxury consumers. Their ability to combine exclusivity with personalized technology-driven engagement makes them especially relevant for high-net-worth individuals seeking differentiated experiences.

Specialized providers such as The Maimon Estates Concierge, The Fixer Lifestyle Group, Bon Vivant, and Luxury Concierge China concentrate on ultra-niche services, regional markets, or sector-specific experiences. Their strength lies in customization, local cultural integration, and flexibility, which allow them to adapt to the unique demands of expatriates, relocating professionals, and aspirational luxury clients. Competitive differentiation is shifting away from traditional exclusivity and personal networks toward integrated ecosystems that include AI-powered personalization, app-based client engagement, and subscription-driven models. Firms that successfully combine reach with digital innovation, while retaining cultural sensitivity and bespoke service quality, are expected to capture greater market share in the coming decade.

Key Developments in Lifestyle Concierge Services Market

| Item | Value |

|---|---|

| Quantitative Units | USD 16,135.1 million |

| Service Type | Travel planning & reservations, Event access & ticketing, Dining reservations & culinary experiences, Personal shopping & styling, Errand running & household management, Wellness & leisure coordination, Relocation & settling-in services |

| End User | UHNW & HNW individuals, Corporate executives & business owners, Luxury travelers, Expats & relocating professionals |

| Delivery Mode | In-person concierge teams, Virtual/remote concierge, Hybrid (onsite + remote) |

| Pricing Model | Membership/subscription retainer, Pay-per-request/ad hoc, Corporate contracts |

| Booking Channel | App, Web, Phone / in-person desk |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Quintessentially, Ten Lifestyle Group, John Paul Group, Knightsbridge Circle, Pure Entertainment Group, The Maimon Estates Concierge, Velocity Black, The Fixer Lifestyle Group, Bon Vivant, Luxury Concierge China |

| Additional Attributes | Dollar sales by service type and booking channel, rising demand for hybrid concierge delivery, adoption of app-based and subscription-driven models, sector-specific growth in luxury travel, corporate wellness, and relocation support, digital-first engagement through AI-powered personalization, regional trends driven by wealth creation and expat inflows, and innovations in mobile platforms and hybrid concierge ecosystems. |

The Global Lifestyle Concierge Services Market is estimated to be valued at USD 16,135.1 million in 2025.

The market size for the Global Lifestyle Concierge Services Market is projected to reach USD 36,741.5 million by 2035.

The Global Lifestyle Concierge Services Market is expected to grow at a CAGR of 8.6% between 2025 and 2035.

The key service types in the Global Lifestyle Concierge Services Market are travel planning & reservations, event access & ticketing, dining reservations & culinary experiences, personal shopping & styling, errand running & household management, wellness & leisure coordination, and relocation & settling-in services.

In terms of delivery mode, the hybrid concierge segment is expected to command a 54.7% share in 2025, making it the dominant category.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beauty Concierge Services Market Size and Share Forecast Outlook 2025 to 2035

Lifestyle Sneakers Industry Analysis in United Kingdom Growth, Trends and Forecast from 2025 to 2035

M2M Services Market Size and Share Forecast Outlook 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

Bot Services Market Size and Share Forecast Outlook 2025 to 2035

Spa Services Market Size and Share Forecast Outlook 2025 to 2035

USA Concierge Medicine Market Analysis by Speciality, Ownership, and Region through 2035

Microservices Orchestration Market Growth - Trends & Forecast 2025 to 2035

VOIP Services Market Analysis - Trends, Growth & Forecast through 2034

Global AI HR Services Market Size and Share Forecast Outlook 2025 to 2035

Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Oracle Services Market Analysis – Trends & Forecast 2024-2034

Seismic Services Market Size and Share Forecast Outlook 2025 to 2035

AR Tour Services Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Tableau Services Market Size and Share Forecast Outlook 2025 to 2035

Managed Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Walk-in Services Market Growth – Trends & Forecast 2024-2034

The AI Legal Services Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Podiatry Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Catering Services Market Analysis by Service Type, Application and End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA