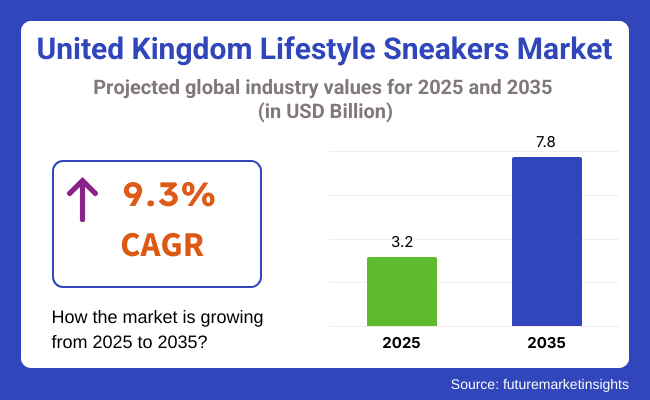

The United Kingdom lifestyle sneakers market is anticipated to be valued at USD 3.2 billion in 2025 and is set to expand at a 9.3% CAGR from 2025 to 2035. The industry will be valued at USD 7.8 billion in 2035. The major push behind this is the growing convergence of fashion and function, where sneakers are no longer seen only as sports shoes but as a statement of style across all age groups.

The United Kingdom has also witnessed a cultural change, and sneakers have become wardrobe essentials. Consumers are more trend-driven by celebrity collaborations, streetwear, and athleisure. Consumer demand has also become more aggressive in men and women across different age groups due to rising sneaker lines from global and domestic brands based on lifestyle rather than performance needs.

Sales momentum also comes from the retail digital revolution. Online buying websites, apps, and social commerce platforms have transformed how shoppers engage, delivering exclusive drops, limited releases, and immersive brand experiences. Personalization, augmented reality-based try-on functionality, and virtual waiting rooms for the most-wanted launches are reconstructing the buying journey, driving both urgency and loyalty.

Sustainability is also one of the top trends influencing purchasing habits. UK shoppers are increasingly aware of material origins and eco-responsibility. Brands that are making investments in vegan materials, recyclable soles, and low-carbon production are appealing to eco-buyers. The green trend is propelling premium price levels higher while broadening the sneaker industry with eco-friendly fashion collections.

The resale economy is also giving lifestyle sneaker sales a dynamic twist. Websites dedicated to verified second-hand sales are extending the life span of popular models, creating an alternate demand economy.

This has increased the perception of sneakers not only as fashion but as a collectible commodity. As British consumers continue seeking uniqueness, comfort, and moral value in shoes, the industry for United Kingdom lifestyle sneakers is poised to experience tremendous growth in the decade ahead.

In the coming year 2025, around 47.5% of the industry will be dominated by the low-top domain. Next, followed by mid-top, which has 28% of the industry share.As far as lightweight construction, it is used every day, as well as streetwear and even casual fits, given how low-tops can coexist with pretty much everything. From the Nike Air Force 1 Low, Adidas Stan Smith, Puma Suede Classic, and Reebok Club C 85, all the way down to a few as extremely popular, almost iconic models doing well with global sales.

This type of sneaker appeals to a variegated consumer base, ranging from teenagers to working professionals and even fashionistas among older people. A product that is particularly popular among them is this classic. The sustainable aspect of the low-top model, as seen in the Clean Classics line from Adidas, is made from recycled material, which corresponds to the changing attitude of consumers toward eco-conscious fashion. Thus, demand also increases.

Mid-top sneakers are a unique offering at 28% of the industry share for the street-guy subculture, with a particular interest in the streets. Models like the Nike Blazer Mid '77, Vans Sk8-Mid, and Air Jordan 1 Mid have a robust identity with consumers of Generation Z who are driven by cultural influences as well as exclusive drops.

While being perceived as a casual, bold fashion statement, these sneakers offer more coverage and support for the ankles. Mid-top silhouettes have become highly collectible, thanks to collaborations such as Travis Scott x Air Jordan 1 Mid and Fear of God x Vans.

In 2025, the men's section will dominate the industry with 46% of the lifestyle sneakers industry and with women at 39%. The remaining share can be attributed to unisex products and gender-neutral marketing strategies that are becoming more accepted, especially in Gen Z and younger millennial circles.

Men's top status in sneaker consumption can be traced to the history of the sneaker culture that was steadily nurtured by sports, streetwear, and hip-hop influences. Global footwear brands in sneakers, such as Nike, Adidas, Puma, and New Balance, have made relentless efforts to cater extensively to men in their product lines and collaborations.

Limited-edition items such as the released Nike Air Jordan Retro series and Adidas Yeezy models continue to whet the appetites of male consumers and sneakerheads alike. Men's sneakers also put a lot of emphasis on performance and street-ready aesthetics, and that puts tremors of demand throughout the year.

While women's sneakers form a slightly smaller segment, they have grown significantly. Brands meeting the increased demand have launched women-specific collections and collaborations: Nike's campaigns aimed at women and exclusive launches like the Air Max Dia and Jordan OG Women's series increased their female consumer base.

The Adidas Originals lines and Reebok's retro revival are similarly designed and colorway-focused. Influencer marketing, social media-driven trends, and women taking center stage in sneaker culture have been instrumental in visibility and acceptance.

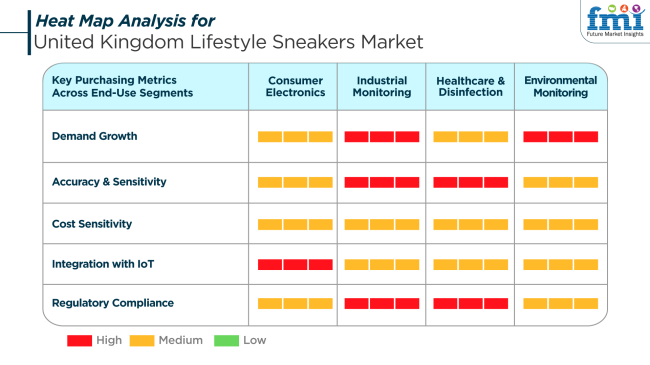

In the UK sneaker culture lifestyle economy, fashion popularity, seasonal partnership, and influencer marketing primarily generate demand. Among the consumers, especially the millennials and Gen Z, there is high demand growth fueled by the need for comfort-driven streetwear that is a reflection of individual identity as well as status. Sneaker culture has quickly become everyday essentials rather than occasional use.

Fit precision and fashion versatility also impact the industry. Customers desire high-performance features even on lifestyle items, such as moisture-wicking liners and reactive foot beds, combining form with function. Options for customization and differentiated availability of sizes are increasingly becoming a component of the shopping process.

Cost sensitivity is moderate, and the UK industry is divided between limited-edition, high-end lines and high-fashion sneaker lines. Green consumers are willing to pay extra for green products, presenting opportunities for brands to profit from green innovation. Compliance is less in this fashion-driven industry, but regulatory concerns assume more importance in imports, labeling, and material disclosure as the focus shifts to product origin.

The United Kingdom lifestyle sneakers industry is facing tremendous risks from supply chain delays, industry saturation, and shifting allegiances of consumers. Since most sneakers are produced in Asia, geopolitical unrest, logistics congestion and manpower deficiencies can disrupt production and delivery timelines.

It becomes more common when faced with big-demand releases, damaging brand reputation.The speed of the industry growth has also resulted in saturation, especially with limited drops and fast-fashion copies.

Such proliferation threatens to erode brand equity and trigger demand fatigue among consumers. Brands must walk a tightrope between exclusivity and accessibility to sustain the fever and long-term appeal.

The shifting consumer attitudes pose a reputational risk to brands that fail to meet ethical and sustainability values. Younger UK consumers increasingly expect brands to be held accountable for their environmental impact, labor ethics as well as corporate transparency. In the absence of clear commitment to such values, long-standing brands may see loss of trust and industry share over the next few years.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Product Focus: Sneakers as a fashion statement, offering style as well as comfort for everyday wear. | Technological Integration: Smart, performance-oriented sneakers with self-lacing capability, health tracking, and customization features. |

| Consumer Demographics: Mainly targeting fashion-oriented young adults, athletes, and loungewear buyers. | Broader Demographics: Wider scope to cover environment-conscious buyers and technology-conscious buyers. |

| Market Drivers: Fashion, celebrity endorsement, and growing awareness of sustainability and comfort. | Sustainability Trends: Increased emphasis on green materials, sustainable manufacturing, and minimizing carbon footprint of sneaker production. |

| Retail Channels: Strong e-commerce expansion, fueled by direct-to-consumer models and online-based retail shops powering top-line growth. | Omnichannel Retail: Expansion of e-commerce complemented by physical retail embracing digital in-store experiences (e.g., virtual try-on, in-store personalization). |

| Competition: Headlined by established worldwide brands, increasingly challenged by insurgent brands and niche start-ups. | Customization & Differentiation: Focus on unique, customized designs to appeal to unique tastes, supported by new technologies and sustainable methodologies. |

The United Kingdom lifestyle sneakers industry will expand at 7.8% CAGR during the study period of 2025 to 2035. Lifestyle sneakers have developed from a niche fashion category to an essential component of mainstream apparel consumption within the UK Driven by increasing interest in health-oriented fashion and streetwear and an emphasis on rugged, all-day wear, the demand for lifestyle sneakers is witnessing robust growth.

Urban consumers, in particular, are prioritizing comfort and aesthetics, which has significantly boosted brand growth initiatives in London, Manchester, and Birmingham. Furthermore, the rise of sneaker culture among young and millennial consumers is driving the UK to become a top consumer industry for luxury and mass-market sneaker brands. Sales momentum in the UK is underpinned by high digital penetration and the diffusion of Omni channel retail models.

Leading brands are deploying e-commerce sites and social media-driven initiatives in order to personalize shopping experiences and establish brand loyalty. In addition, limited-edition collaborations, influencer collaborations, and surprise drops have been at the center of creating demand sprees. Same-day delivery capabilities and localized stock planning are improving convenience for consumers, resulting in higher online conversion rates.

As sustainability and responsible production become more popular among UK consumers, value-sharing brands that align with green practices will continue to thrive over the next decade. UK consumer behavior is also a mix of aspirational and functional behavior. There is a group of consumers who are more than happy to spend money on quality sneakers that not only deliver but also look fantastic.

The presence of fashion-oriented shopping environments, high disposable incomes, and individualist culture have all encouraged experimentation with new, innovative designs and premium products. Consequently, the UK industry is set to rise progressively, supported by the continued demand from a broad demographic mix, the evolving retail landscape, and the country's trend-setting role within the wider European footwear industry.

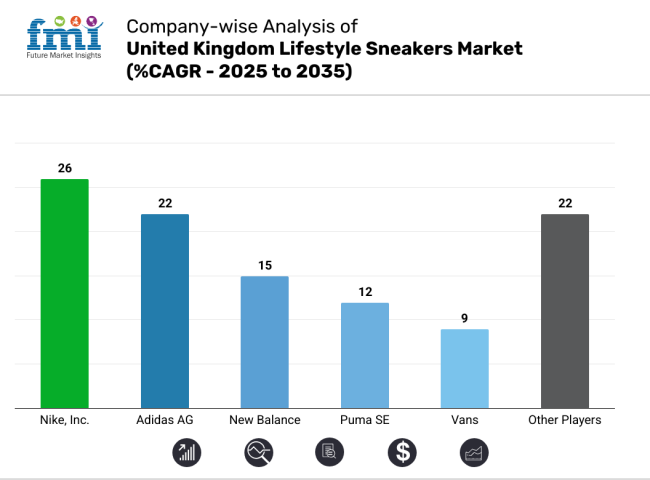

The industry remains highly competitive, driven by fashion, brand consciousness, and the blurring of style and comfort. Nike, Inc. leads the way through relentless innovation in the form of product collaborations, initiatives with sustainable materials, and a strong Omni channel retail footprint. The strong cultural affinity the company shares with the sports and streetwear culture ensures its dominance.

Adidas AG ensues with a focus on sustainable products, celebrity promotions, and limited editions, further making it more attractive by brand to a significant portion of the population. New Balance is picking up speed by combining fine craftsmanship with contemporary styles, appealing particularly to those consumers who value "athleisure" sophistication.

Puma SE, meanwhile, continues to expand its UK share of industry by collaborations with popular culture icons and emphasizing its hybrid sports-lifestyle brand image.Vans, with its skateboard culture heritage, is sustaining itself via heritage collections and artist collaborations, which appeal most to the young and urban customer.

Converse, FILA, C. & J. Clark International Limited, Grenson Shoes, and Gola are all holding their own ground via retro fashion revival efforts, British heritage branding, and segment-specific sustainability efforts. Across the competitive terrain, innovation, sustainability, and cultural salience remain the top strategic pillars.

Market Share Analysis by Company

| Company | Estimated Market Share (%) |

|---|---|

| Nike, Inc. | 22-26% |

| Adidas AG | 18-22% |

| New Balance | 12-15% |

| Puma SE | 9-12% |

| Vans | 7-9% |

| Other Players | 17-22% |

Key Company Insights

Nike, Inc. dominates the United Kingdom lifestyle sneakers category with an estimated 22-26% market share, fueled by its powerful branding, innovative product breakthroughs, and strong appeal with both sports and streetwear users. Strategic design and celebrity collaborations and a shift towards sustainable manufacturing have strengthened Nike's mass and premium appeal.

Adidas AG has approximately 18-22% industry share through use of high-profile collaborations, increasing lines of environmentally friendly sneakers, and sustained coolness in pop culture, establishing it as a popular brand with eco-conscious and fashion-conscious consumers.

New Balance holds approximately 12-15% industry share with its stress on quality materials, "Made in UK " ranges, and retro-modern designs attractive to high-end consumers who want authenticity and craftsmanship.

Puma SE maintains a 9-12% share, frequently updating its lifestyle range through collaborations with fashion influencers and sport and music, thereby establishing a leadership position in the casual-sportswear intersection segment.

Vans maintains a 7-9% share, established through its deep cultural heritage in youth culture and skateboard communities, and supplemented by artist, musician, and city-fashion brand collaborations, which keep it connected to young consumers' culture.

By product type, the industry is segmented into low-top, mid-top, and high-top.

By price band, the industry is segmented into online less than £50 (USD 60), £50 to £100 (USD 60 to USD 125), £100 to £150 (USD 125 to USD 200), £150 to £250 (USD 200 to USD 300), and above £250 (USD 300).

By end sure, the industry is segmented into men, women, and kids.

By distribution channel, the industry is segmented into online, offline, multi-brand outlets, exclusive brand outlets, and retail shops.

By countries, the industry is segmented into England, Scotland, Wales, and Northern Ireland.

The industry is slated to reach USD 3.2 billion in 2025.

The industry is predicted to reach a size of USD 7.8 billion by 2035.

Key players include Nike, Inc., Adidas AG, New Balance, Puma SE, Vans, Converse, FILA, C. & J. Clark International Limited, Grenson Shoes, and Gola (D Jacobson & Sons Ltd).

The projected CAGR for the forecast period 2025 to 2035 is 9.3%.

The industry will be dominated by the low-top domain.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Industry Analysis and Outlook Volume (Pairs) Forecast by Region, 2019 to 2034

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Industry Analysis and Outlook Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Price Band, 2019 to 2034

Table 6: Industry Analysis and Outlook Volume (Pairs) Forecast by Price Band, 2019 to 2034

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 8: Industry Analysis and Outlook Volume (Pairs) Forecast by End-user, 2019 to 2034

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 10: Industry Analysis and Outlook Volume (Pairs) Forecast by Distribution Channel, 2019 to 2034

Table 11: England Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 12: England Industry Analysis and Outlook Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 13: England Industry Analysis and Outlook Value (US$ Million) Forecast by Price Band, 2019 to 2034

Table 14: England Industry Analysis and Outlook Volume (Pairs) Forecast by Price Band, 2019 to 2034

Table 15: England Industry Analysis and Outlook Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 16: England Industry Analysis and Outlook Volume (Pairs) Forecast by End-user, 2019 to 2034

Table 17: England Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 18: England Industry Analysis and Outlook Volume (Pairs) Forecast by Distribution Channel, 2019 to 2034

Table 19: Northern Ireland Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 20: Northern Ireland Industry Analysis and Outlook Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 21: Northern Ireland Industry Analysis and Outlook Value (US$ Million) Forecast by Price Band, 2019 to 2034

Table 22: Northern Ireland Industry Analysis and Outlook Volume (Pairs) Forecast by Price Band, 2019 to 2034

Table 23: Northern Ireland Industry Analysis and Outlook Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 24: Northern Ireland Industry Analysis and Outlook Volume (Pairs) Forecast by End-user, 2019 to 2034

Table 25: Northern Ireland Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 26: Northern Ireland Industry Analysis and Outlook Volume (Pairs) Forecast by Distribution Channel, 2019 to 2034

Table 27: Scotland Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: Scotland Industry Analysis and Outlook Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 29: Scotland Industry Analysis and Outlook Value (US$ Million) Forecast by Price Band, 2019 to 2034

Table 30: Scotland Industry Analysis and Outlook Volume (Pairs) Forecast by Price Band, 2019 to 2034

Table 31: Scotland Industry Analysis and Outlook Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 32: Scotland Industry Analysis and Outlook Volume (Pairs) Forecast by End-user, 2019 to 2034

Table 33: Scotland Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 34: Scotland Industry Analysis and Outlook Volume (Pairs) Forecast by Distribution Channel, 2019 to 2034

Table 35: Wales Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 36: Wales Industry Analysis and Outlook Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 37: Wales Industry Analysis and Outlook Value (US$ Million) Forecast by Price Band, 2019 to 2034

Table 38: Wales Industry Analysis and Outlook Volume (Pairs) Forecast by Price Band, 2019 to 2034

Table 39: Wales Industry Analysis and Outlook Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 40: Wales Industry Analysis and Outlook Volume (Pairs) Forecast by End-user, 2019 to 2034

Table 41: Wales Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 42: Wales Industry Analysis and Outlook Volume (Pairs) Forecast by Distribution Channel, 2019 to 2034

Table 43: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 44: Rest of Industry Analysis and Outlook Volume (Pairs) Forecast by Product Type, 2019 to 2034

Table 45: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Price Band, 2019 to 2034

Table 46: Rest of Industry Analysis and Outlook Volume (Pairs) Forecast by Price Band, 2019 to 2034

Table 47: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by End-user, 2019 to 2034

Table 48: Rest of Industry Analysis and Outlook Volume (Pairs) Forecast by End-user, 2019 to 2034

Table 49: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 50: Rest of Industry Analysis and Outlook Volume (Pairs) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Price Band, 2024 to 2034

Figure 3: Industry Analysis and Outlook Value (US$ Million) by End-user, 2024 to 2034

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Region, 2024 to 2034

Figure 6: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Industry Analysis and Outlook Volume (Pairs) Analysis by Region, 2019 to 2034

Figure 8: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 11: Industry Analysis and Outlook Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 12: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 13: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 14: Industry Analysis and Outlook Value (US$ Million) Analysis by Price Band, 2019 to 2034

Figure 15: Industry Analysis and Outlook Volume (Pairs) Analysis by Price Band, 2019 to 2034

Figure 16: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Band, 2024 to 2034

Figure 17: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Band, 2024 to 2034

Figure 18: Industry Analysis and Outlook Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 19: Industry Analysis and Outlook Volume (Pairs) Analysis by End-user, 2019 to 2034

Figure 20: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 21: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 22: Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 23: Industry Analysis and Outlook Volume (Pairs) Analysis by Distribution Channel, 2019 to 2034

Figure 24: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 25: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 26: Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 27: Industry Analysis and Outlook Attractiveness by Price Band, 2024 to 2034

Figure 28: Industry Analysis and Outlook Attractiveness by End-user, 2024 to 2034

Figure 29: Industry Analysis and Outlook Attractiveness by Distribution Channel, 2024 to 2034

Figure 30: Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 31: England Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 32: England Industry Analysis and Outlook Value (US$ Million) by Price Band, 2024 to 2034

Figure 33: England Industry Analysis and Outlook Value (US$ Million) by End-user, 2024 to 2034

Figure 34: England Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 35: England Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 36: England Industry Analysis and Outlook Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 37: England Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 38: England Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 39: England Industry Analysis and Outlook Value (US$ Million) Analysis by Price Band, 2019 to 2034

Figure 40: England Industry Analysis and Outlook Volume (Pairs) Analysis by Price Band, 2019 to 2034

Figure 41: England Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Band, 2024 to 2034

Figure 42: England Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Band, 2024 to 2034

Figure 43: England Industry Analysis and Outlook Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 44: England Industry Analysis and Outlook Volume (Pairs) Analysis by End-user, 2019 to 2034

Figure 45: England Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 46: England Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 47: England Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 48: England Industry Analysis and Outlook Volume (Pairs) Analysis by Distribution Channel, 2019 to 2034

Figure 49: England Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 50: England Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 51: England Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 52: England Industry Analysis and Outlook Attractiveness by Price Band, 2024 to 2034

Figure 53: England Industry Analysis and Outlook Attractiveness by End-user, 2024 to 2034

Figure 54: England Industry Analysis and Outlook Attractiveness by Distribution Channel, 2024 to 2034

Figure 55: Northern Ireland Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 56: Northern Ireland Industry Analysis and Outlook Value (US$ Million) by Price Band, 2024 to 2034

Figure 57: Northern Ireland Industry Analysis and Outlook Value (US$ Million) by End-user, 2024 to 2034

Figure 58: Northern Ireland Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 59: Northern Ireland Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 60: Northern Ireland Industry Analysis and Outlook Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 61: Northern Ireland Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 62: Northern Ireland Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 63: Northern Ireland Industry Analysis and Outlook Value (US$ Million) Analysis by Price Band, 2019 to 2034

Figure 64: Northern Ireland Industry Analysis and Outlook Volume (Pairs) Analysis by Price Band, 2019 to 2034

Figure 65: Northern Ireland Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Band, 2024 to 2034

Figure 66: Northern Ireland Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Band, 2024 to 2034

Figure 67: Northern Ireland Industry Analysis and Outlook Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 68: Northern Ireland Industry Analysis and Outlook Volume (Pairs) Analysis by End-user, 2019 to 2034

Figure 69: Northern Ireland Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 70: Northern Ireland Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 71: Northern Ireland Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 72: Northern Ireland Industry Analysis and Outlook Volume (Pairs) Analysis by Distribution Channel, 2019 to 2034

Figure 73: Northern Ireland Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 74: Northern Ireland Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 75: Northern Ireland Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 76: Northern Ireland Industry Analysis and Outlook Attractiveness by Price Band, 2024 to 2034

Figure 77: Northern Ireland Industry Analysis and Outlook Attractiveness by End-user, 2024 to 2034

Figure 78: Northern Ireland Industry Analysis and Outlook Attractiveness by Distribution Channel, 2024 to 2034

Figure 79: Scotland Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 80: Scotland Industry Analysis and Outlook Value (US$ Million) by Price Band, 2024 to 2034

Figure 81: Scotland Industry Analysis and Outlook Value (US$ Million) by End-user, 2024 to 2034

Figure 82: Scotland Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 83: Scotland Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 84: Scotland Industry Analysis and Outlook Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 85: Scotland Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 86: Scotland Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 87: Scotland Industry Analysis and Outlook Value (US$ Million) Analysis by Price Band, 2019 to 2034

Figure 88: Scotland Industry Analysis and Outlook Volume (Pairs) Analysis by Price Band, 2019 to 2034

Figure 89: Scotland Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Band, 2024 to 2034

Figure 90: Scotland Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Band, 2024 to 2034

Figure 91: Scotland Industry Analysis and Outlook Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 92: Scotland Industry Analysis and Outlook Volume (Pairs) Analysis by End-user, 2019 to 2034

Figure 93: Scotland Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 94: Scotland Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 95: Scotland Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 96: Scotland Industry Analysis and Outlook Volume (Pairs) Analysis by Distribution Channel, 2019 to 2034

Figure 97: Scotland Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 98: Scotland Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 99: Scotland Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 100: Scotland Industry Analysis and Outlook Attractiveness by Price Band, 2024 to 2034

Figure 101: Scotland Industry Analysis and Outlook Attractiveness by End-user, 2024 to 2034

Figure 102: Scotland Industry Analysis and Outlook Attractiveness by Distribution Channel, 2024 to 2034

Figure 103: Wales Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 104: Wales Industry Analysis and Outlook Value (US$ Million) by Price Band, 2024 to 2034

Figure 105: Wales Industry Analysis and Outlook Value (US$ Million) by End-user, 2024 to 2034

Figure 106: Wales Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 107: Wales Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 108: Wales Industry Analysis and Outlook Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 109: Wales Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 110: Wales Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 111: Wales Industry Analysis and Outlook Value (US$ Million) Analysis by Price Band, 2019 to 2034

Figure 112: Wales Industry Analysis and Outlook Volume (Pairs) Analysis by Price Band, 2019 to 2034

Figure 113: Wales Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Band, 2024 to 2034

Figure 114: Wales Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Band, 2024 to 2034

Figure 115: Wales Industry Analysis and Outlook Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 116: Wales Industry Analysis and Outlook Volume (Pairs) Analysis by End-user, 2019 to 2034

Figure 117: Wales Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 118: Wales Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 119: Wales Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 120: Wales Industry Analysis and Outlook Volume (Pairs) Analysis by Distribution Channel, 2019 to 2034

Figure 121: Wales Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 122: Wales Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 123: Wales Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 124: Wales Industry Analysis and Outlook Attractiveness by Price Band, 2024 to 2034

Figure 125: Wales Industry Analysis and Outlook Attractiveness by End-user, 2024 to 2034

Figure 126: Wales Industry Analysis and Outlook Attractiveness by Distribution Channel, 2024 to 2034

Figure 127: Rest of Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 128: Rest of Industry Analysis and Outlook Value (US$ Million) by Price Band, 2024 to 2034

Figure 129: Rest of Industry Analysis and Outlook Value (US$ Million) by End-user, 2024 to 2034

Figure 130: Rest of Industry Analysis and Outlook Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 131: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 132: Rest of Industry Analysis and Outlook Volume (Pairs) Analysis by Product Type, 2019 to 2034

Figure 133: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 134: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 135: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Price Band, 2019 to 2034

Figure 136: Rest of Industry Analysis and Outlook Volume (Pairs) Analysis by Price Band, 2019 to 2034

Figure 137: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Price Band, 2024 to 2034

Figure 138: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Price Band, 2024 to 2034

Figure 139: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End-user, 2019 to 2034

Figure 140: Rest of Industry Analysis and Outlook Volume (Pairs) Analysis by End-user, 2019 to 2034

Figure 141: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-user, 2024 to 2034

Figure 142: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-user, 2024 to 2034

Figure 143: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 144: Rest of Industry Analysis and Outlook Volume (Pairs) Analysis by Distribution Channel, 2019 to 2034

Figure 145: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 146: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 147: Rest of Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 148: Rest of Industry Analysis and Outlook Attractiveness by Price Band, 2024 to 2034

Figure 149: Rest of Industry Analysis and Outlook Attractiveness by End-user, 2024 to 2034

Figure 150: Rest of Industry Analysis and Outlook Attractiveness by Distribution Channel, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lifestyle Concierge Services Market Size and Share Forecast Outlook 2025 to 2035

Sneakers Market Analysis - Growth & Demand Forecast 2025 to 2035

Women Sneakers Market Growth - Demand & Trends 2025 to 2035

White Sneakers Market Insights - Size & Forecast 2025 to 2035

Men’s Sneakers Market Growth – Trends & Forecast 2022-2032

Leather Sneakers Market Growth - Trends & Forecast 2025 to 2035

Waterproof Sneakers Market Analysis - Growth & Forecast 2025 to 2035

United States Hand Holes Market Size and Share Forecast Outlook 2025 to 2035

United States Commercial Refrigeration Equipment Market Forecast and Outlook 2025 to 2035

United States Dog Toys Market Size and Share Forecast Outlook 2025 to 2035

United States Biodegradable Cups and Lids Market Size and Share Forecast Outlook 2025 to 2035

United States Green Tea Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Hispanic Novelties Market Size and Share Forecast Outlook 2025 to 2035

United States Scented Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States Beetroot Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States Digital Ovulation Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States of America Digital Pregnancy Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Collision Repair Parts Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA