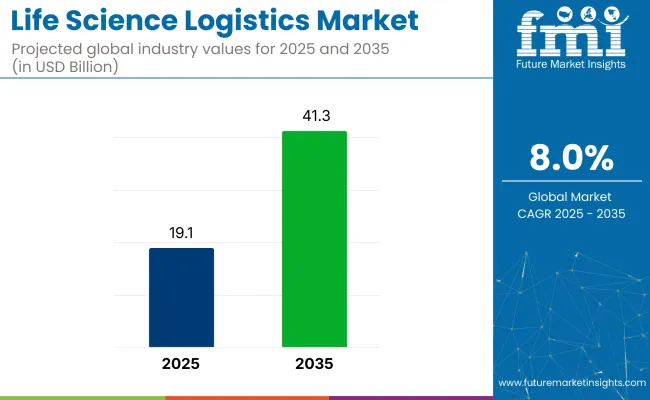

The global life science logistics market is forecasted to grow from USD 19.1 billion in 2025 to USD 41.3 billion by 2035, registering a CAGR of 8% during the forecast period.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 19.1 billion |

| Market Size in 2035 | USD 41.3 billion |

| CAGR (2025 to 2035) | 8% |

This growth is being driven by the rising demand for specialized logistics services dedicated to the transportation, storage, and distribution of sensitive life science products such as pharmaceuticals, biotechnology products, and medical devices. The increasing complexity of life science supply chains, combined with the critical need for temperature-controlled logistics and cold chain management, is further propelling industry expansion worldwide.

The role of innovation and strategic partnerships is being emphasized by industry leaders. As noted by Klaus Dohrmann, Head of Innovation and Trend Research at DHL, “When significant investment is made in the industry, partnerships to drive innovation are facilitated.

Internal expertise is leveraged to identify strong use cases for new technologies.” Major logistics providers such as DHL, FedEx, UPS Healthcare, and Kuehne + Nagel are focusing on expanding service offerings, technological innovation, and geographic footprint to meet growing demands.

The increasing adoption of personalized medicine, biologics, and vaccines is also accelerating the need for specialized logistics solutions. With rising healthcare awareness and pharmaceutical manufacturing growth, the industry is expected to witness sustained growth and technological advancement through 2035.

The industry holds a specialized share within its parent markets. In the logistics and supply chain market, it accounts for approximately 5-7%, as life science logistics is a niche sector focusing on the transport of sensitive healthcare products. Within the healthcare and pharmaceutical supply chain market, the share is higher, around 10-12%, driven by the critical need for timely and safe delivery of medical supplies and drugs.

In the cold chain logistics market, the logistics represents about 15-18%, due to the essential role of temperature-controlled transportation for pharmaceuticals and biologics. Within the biotechnology market, the share is around 3-5%, as it supports the transportation of research materials and biotech products. In the medical devices market, the logistics holds about 4-6%, supporting the transport of sensitive and high-value medical devices.

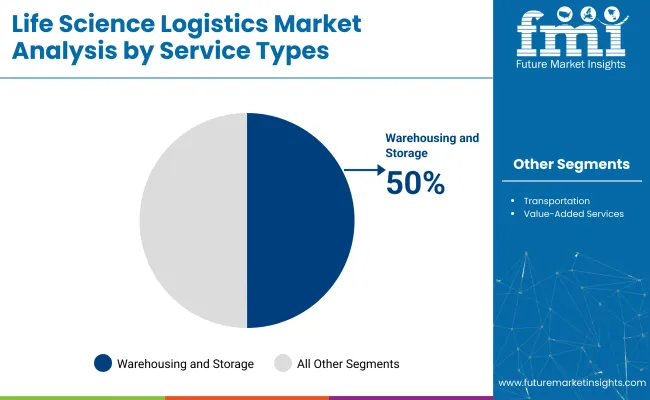

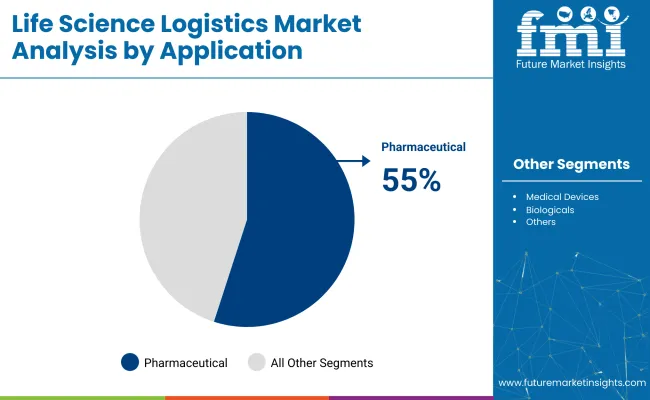

The industry is expected to be dominated by pharmaceuticals, capturing 55% of the end-user share in 2025. Warehousing and storage services will lead with 50% of the service type industry, while pharmaceuticals will also lead logistics applications with a 45% share.

Warehousing and storage services are expected to capture 50% of the industry in 2025 due to their vital role in maintaining the integrity of sensitive life science products such as pharmaceuticals, biologics, and vaccines. These services are essential for ensuring the safe storage and inventory management of temperature-sensitive products that require strict environmental controls.

With the increasing global demand for life-saving therapies and biologics, warehousing solutions that offer advanced temperature-controlled facilities, security, and tracking systems are critical. These services ensure compliance with regulatory requirements and provide flexibility in managing global supply chains.

Pharmaceuticals are projected to hold a dominant 45% share of the industry in 2025 due to the critical need for safe, temperature-controlled transportation and storage of sensitive products such as drugs, biologics, and vaccines.

The rising global demand for life-saving medications and advanced biologics has increased the complexity of logistics operations, requiring specialized handling, packaging, and transportation solutions. The logistics providers are focusing on developing advanced systems to manage the end-to-end supply chain, ensuring timely delivery and compliance with stringent regulatory requirements. The sector’s reliance on precise inventory tracking and cold chain solutions further drives its dominance.

Pharmaceutical companies are projected to capture 55% of the industry in 2025 due to their significant need for efficient, temperature-controlled logistics to transport and store drugs, biologics, and vaccines. The sector 's reliance on precise logistics operations is driven by the growing global demand for life-saving treatments and the increasing complexity of drug formulations, especially biologics.

These companies require specialized logistics services that comply with strict regulatory requirements, including cold chain management and inventory tracking. As the pharmaceutical industry continues to expand, especially in emerging industries, the demand for advanced logistics services will remain a key driver for this segment.

The industry is driven by rising demand for temperature-sensitive products, advancements in cold chain technologies, and the growth of clinical trials. However, challenges such as escalating transportation costs, stringent regulations, and managing temperature-sensitive shipments hinder broader industry growth.

Rising Demand for Temperature-Sensitive Life Science Products

The industry is expanding due to the increasing demand for temperature-sensitive products like pharmaceuticals and biologics, advancements in cold chain technologies, and the growth of clinical trials.

Rising chronic diseases and biologic therapies are driving the need for specialized logistics, while innovations such as real-time temperature monitoring and IoT-enabled tracking are improving efficiency. The surge in clinical trials is further intensifying demand for reliable and timely transportation of clinical materials, shaping the future of the industry.

Challenges Hindering Growth in the Life Science Logistics Industry

The industry faces several challenges, including rising transportation costs, stringent regulatory compliance requirements, and the complexities of managing temperature-sensitive shipments. The increasing cost of fuel and limited carrier capacity are driving up logistics expenses, while complex regulations across various regions add operational difficulties.

Ensuring the integrity of temperature-sensitive products requires sophisticated infrastructure and monitoring systems. These obstacles demand strategic planning and investment in technology to maintain industry growth.

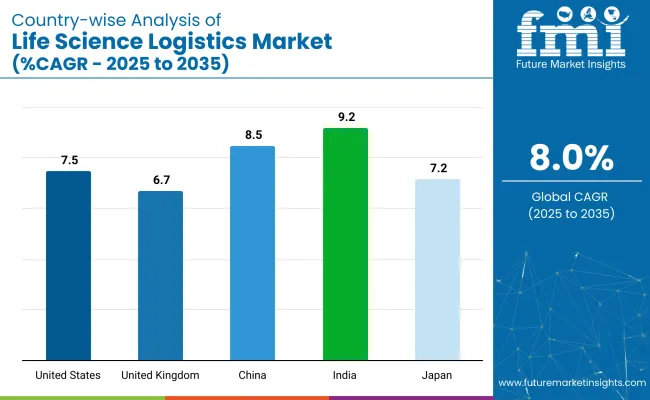

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 7.5% |

| United Kingdom | 6.7% |

| China | 8.5% |

| India | 9.2% |

| Japan | 7.2% |

The industry demand is projected to rise at an 8% CAGR from 2025 to 2035. Of the five profiled countries out of 40 covered, India leads at 9.2%, followed by China at 8.5% and the United States at 7.5%, while Japan records 7.2% and the United Kingdom posts 6.7%.

These rates translate to a growth premium of +15% for India, +7% for China, and -6% for the United Kingdom versus the baseline, while the United States and Japan show more moderate growth. Divergence reflects local catalysts: rapid healthcare infrastructure development in India, increasing demand for life sciences logistics driven by expanding pharmaceutical and biotechnology industries in China, and steady demand in the USA and Japan. The United Kingdom shows more conservative growth due to industry saturation and economic factors.

The industry in the United States is set to record a CAGR of 7.5% through 2035. Industry growth is being driven by regulatory adherence, FDA-aligned handling protocols, and a high-volume demand for temperature-sensitive biologics.

FedEx Healthcare, UPS Healthcare, and DHL Supply Chain have expanded temperature-controlled capabilities through specialized fleet upgrades and GMP-compliant warehousing. Real-time tracking using IoT sensors and blockchain has strengthened visibility, while large-scale vaccine and personalized medicine distribution has prompted infrastructure modernization.

Sales of the logistics services in the United Kingdom are projected to grow at a CAGR of 6.7% through 2035. Demand is being supported by strict regulatory mandates under MHRA and GDP frameworks, combined with innovation in last-mile delivery. Logistics providers such as Kuehne + Nagel and DHL have invested in AI-enabled storage optimization and temperature-tracking technologies.

Vaccine and biologic shipments remain central drivers, while automation in warehousing and predictive route mapping enhances consistency. Brexit-adjusted trade protocols have elevated demand for compliant cross-border transit solutions.

Demand for the logistics services in China is estimated to grow at a CAGR of 8.5% through 2035. Cold-chain capacity is scaling in response to surging pharmaceutical production and export logistics, particularly for vaccines and biosimilars.

SF Express, Yusen Logistics, and ZTO Express are expanding certified facilities and refrigerated fleet coverage to meet tightened transport regulations. Digital twin technology and integrated e-commerce fulfillment have reinforced visibility. Government mandates around drug traceability and temperature compliance are pushing the logistics toward smart tracking and sensor analytics.

The industry in India is projected to grow at a CAGR of 9.2% through 2035. Expansion is being led by the country's role as a major generic pharmaceutical exporter and rising demand for biologics. Firms including Blue Dart, Snowman Logistics, and Gati are enhancing cold chain warehousing across metro regions and industrial corridors.

GDP compliance and thermal-mapping standards are being prioritized to meet global contract terms. Adoption of IoT-based validation and energy-efficient refrigeration systems is reinforcing the appeal of Indian firms in global supply networks.

The industry in Japan is expected to grow at a CAGR of 7.2% through 2035. Industry growth is driven by advanced healthcare infrastructure and strict adherence to GDP and GMP logistics standards. Nippon Express, Yamato Transport, and Sagawa Express are deploying AI-integrated temperature management for biologics, vaccines, and active pharmaceutical ingredients.

Cold chain routes with embedded compliance modules are being optimized for rural hospital deliveries and specialty clinics. Aging demographics and long-term pharmaceutical demand sustain steady expansion.

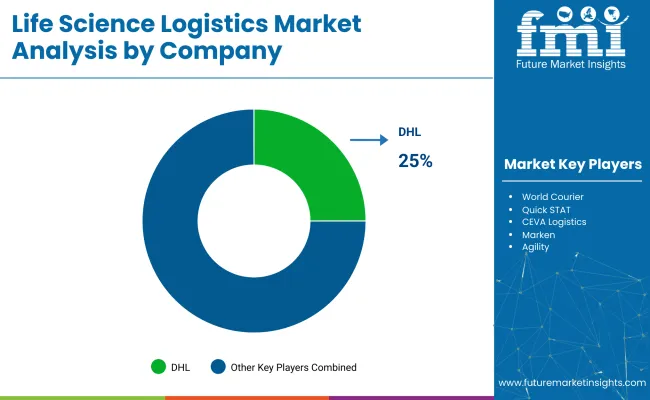

Leading Company - DHL, Industry Share - 30%.

The global industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as DHL, World Courier, and Quick STAT lead the industry with extensive service portfolios, strong R&,D capabilities, and robust distribution networks across pharmaceuticals, biotechnology, and clinical research sectors.

Key players including CEVA Logistics, Marken, and Agility offer specialized solutions tailored to specific applications and regional industries. Emerging players, such as Rhenus Group, MNX Global Logistics, and CRYOPDP, focus on innovative technologies and cost-effective solutions, expanding their presence in the global industry.

Recent Life Science Logistics Industry Developments

| Report Attributes | Details |

|---|---|

| Current Total Industry Size (2025) | USD 19.1 billion |

| Projected Industry Size (2035) | USD 41.3 billion |

| CAGR (2025 to 2035) | 8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and metric tons for volume |

| Service Types Analyzed (Segment 1) | Warehousing & storage, Transportation, Value-added services |

| Applications Covered (Segment 2) | Pharmaceuticals, Medical devices, Biologicals, Clinical trial materials |

| End Users Covered (Segment 3) | Pharmaceutical companies, Hospitals and clinics, Contract research organizations (CROs), Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East &, and Africa |

| Countries Covered | United States, Germany, United Kingdom, China, India, Japan, Brazil, Canada, Australia |

| Key Players Influencing the Industry | DHL, World Courier, Quick STAT, CEVA Logistics, Marken, Agility, Rhenus Group, MNX Global Logistics, CRYOPDP, Langham Logistics, Life Science Logistics, Biocair, Others |

| Additional Attributes | Cold-chain temperature control capabilities, Digitalization and IoT-enabled tracking, Regulatory compliance (GDP, GSP), Sustainability and green logistics initiatives, Customized packaging and labeling solutions |

The industry is segmented by service type into warehousing & storage, transportation, and value-added services.

By application, the industry includes pharmaceuticals, medical devices, biologicals, and clinical trial materials.

In terms of end users, the industry is segmented into pharmaceutical companies, hospitals and clinics, contract research organizations (CROs), and others.

The industry covers North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

The industry size is projected to be USD 19.1 billion in 2025 and USD 41.3 billion by 2035.

The expected CAGR is 8% from 2025 to 2035.

India is expected to grow the fastest with a projected CAGR of 9.2% from 2025 to 2035.

DHL is the leading company, holding a 25% industry share.

Pharmaceutical companies lead the end-user segment with a 55% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Life Science Software Market Size and Share Forecast Outlook 2025 to 2035

Life Sciences Next-generation Customer Engagement Platforms Market Size and Share Forecast Outlook 2025 to 2035

Life Science Multichannel Campaign Management Market Size and Share Forecast Outlook 2025 to 2035

Life Sciences Analytics Market Size and Share Forecast Outlook 2025 to 2035

Life Science and Chemical Instruments Market Analysis - Growth & Forecast 2024 to 2034

Logistics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Life Support Systems Market Size and Share Forecast Outlook 2025 to 2035

Logistics Robots Market Size and Share Forecast Outlook 2025 to 2035

Logistics Visibility Software Market Size and Share Forecast Outlook 2025 to 2035

Lifestyle Concierge Services Market Size and Share Forecast Outlook 2025 to 2035

Lifestyle Sneakers Industry Analysis in United Kingdom Growth, Trends and Forecast from 2025 to 2035

Key Players & Market Share in the Logistics Packaging Industry

Logistics Outsourcing Market Analysis - Growth & Forecast 2025 to 2035

Logistics Visualization System Market

Logistics Automation Market

Wildlife Tourism Market Size and Share Forecast Outlook 2025 to 2035

Wildlife Health Market Size and Share Forecast Outlook 2025 to 2035

Data Science Platform Market Size and Share Forecast Outlook 2025 to 2035

Cash Logistics Market Size and Share Forecast Outlook 2025 to 2035

Rail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA