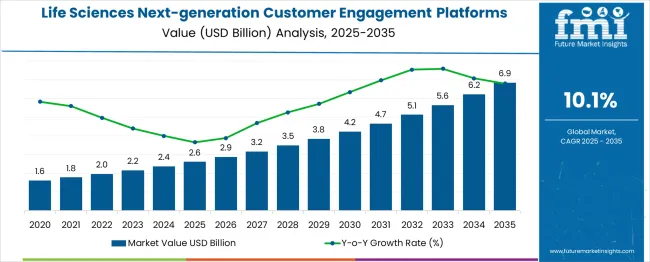

The life sciences next-generation customer engagement platforms market is valued at USD 2.6 billion in 2025 and is expected to grow to USD 6.9 billion by 2035, with a CAGR of 10.1%. From 2025 to 2027, the market shows gradual acceleration, increasing from USD 2.6 billion to USD 2.9 billion. The early growth phase is driven by the widespread adoption of AI-powered platforms and automation tools, which enable life sciences companies to enhance communication with healthcare providers and deliver personalized experiences. This period is characterized by steady demand as organizations in the life sciences sector recognize the value of improving customer engagement.

Between 2027 and 2030, the market experiences accelerated growth, rising from USD 2.9 billion to USD 3.8 billion. This phase is fueled by a stronger focus on cloud-based platforms and predictive analytics to improve customer relationship management and patient engagement. The integration of advanced technologies such as AI and machine learning into customer engagement solutions accelerates the adoption process, particularly in healthcare organizations. As the technology evolves, it meets the increasing demand for real-time, data-driven insights, expanding its reach across global markets. Despite this acceleration, the growth rate slows slightly post-2030 as the market matures, with further expansion driven by emerging regions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2.6 billion |

| Forecast Value in (2035F) | USD 6.9 billion |

| Forecast CAGR (2025 to 2035) | 10.1% |

The life sciences next-generation customer engagement platforms market draws significant demand from the customer relationship management (CRM) market, which contributes around 30-35%. CRM platforms are crucial for managing customer data, tracking interactions, and automating marketing and sales processes, making them vital for life sciences companies seeking effective customer engagement. The healthcare IT market contributes approximately 20-25%, encompassing electronic health records (EHR), telemedicine solutions, and other healthcare digital tools .

The digital marketing solutions market represents around 15-20%, as digital marketing tools like AI-driven campaign management and personalized content help life sciences companies target healthcare professionals and patients more effectively. The artificial intelligence (AI) and machine learning market also plays a major role, accounting for about 15-20%, enabling advanced customer insights, predictive analytics, and automation to improve personalized experiences. The data analytics and big data market contributes around 10-15%, leveraging analytics platforms that provide life sciences companies with valuable insights into customer behavior, helping to refine engagement strategies and optimize targeting.

Market expansion is being supported by the increasing focus on digital transformation within life sciences organizations and the corresponding demand for sophisticated customer engagement solutions that can deliver personalized experiences at scale. Modern pharmaceutical and biotechnology companies are increasingly focused on data-driven commercial strategies that can optimize customer interactions, improve engagement effectiveness, and enhance relationship quality with healthcare professionals. Next-generation platforms' proven capabilities in delivering omnichannel experiences, real-time analytics, and AI-powered insights make them essential components of contemporary life sciences commercial operations.

The growing emphasis on compliance and regulatory adherence is driving demand for platforms that can ensure transparent, compliant customer interactions while maintaining detailed audit trails and reporting capabilities. Customer preference for integrated solutions that combine content management, engagement optimization, and performance analytics is creating opportunities for comprehensive platform implementations. The rising influence of artificial intelligence, machine learning, and predictive analytics is also contributing to increased platform adoption across different therapeutic areas and commercial functions.

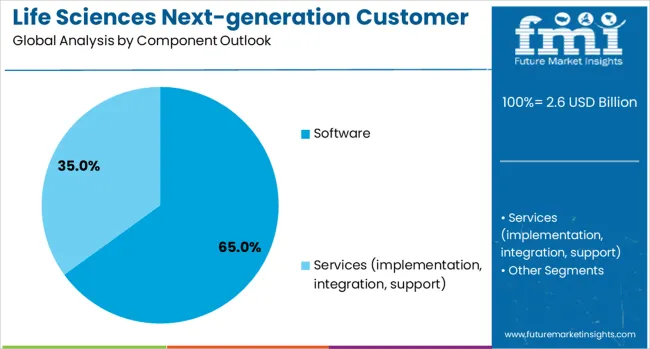

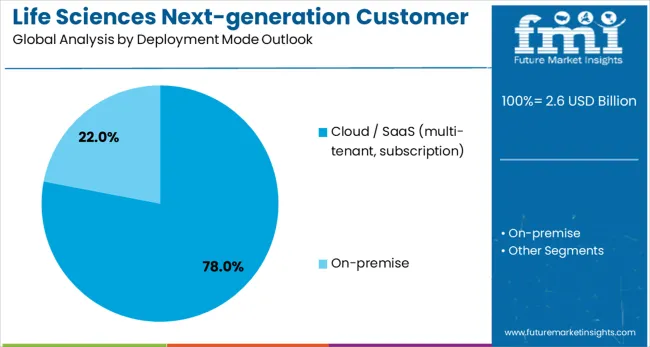

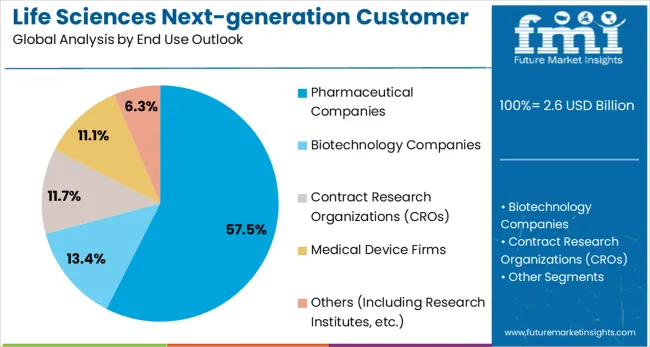

The market is segmented by component, deployment mode, functionality, and end use. By component, the market is divided into software and services (implementation, integration, support). Based on deployment mode, the market is categorized into cloud/SaaS (multi-tenant, subscription) and on-premise. In terms of functionality, the market is segmented into core engagement layers, end-to-end content management, engagement channel optimization, commercial learning and training, advanced software capabilities, and cognitive capabilities. By end use, the market is classified into pharmaceutical companies, biotechnology companies, contract research organizations (CROs), medical device firms, and others (including research institutes, etc.).

The software component is projected to account for 65% of the life sciences next-generation customer engagement platforms market in 2025, reaffirming its position as the category's primary value driver. Organizations increasingly understand the importance of comprehensive software solutions that can integrate seamlessly with existing systems while providing advanced functionality for customer engagement optimization. Software platforms' ability to deliver scalable, configurable solutions that can adapt to diverse commercial requirements makes them the preferred choice for life sciences companies seeking to modernize their customer engagement capabilities.

This component forms the foundation of most platform implementations, as it represents the core technology infrastructure that enables advanced engagement capabilities. Vendor focus on continuous innovation and feature enhancement continues to strengthen the value proposition of software solutions. With life sciences companies prioritizing platform capabilities that can support complex commercial workflows, software solutions align with both immediate operational needs and long-term strategic goals. Their broad applicability across different therapeutic areas and commercial functions ensures dominance, making software the central growth driver of next-generation customer engagement platform demand.

Cloud/SaaS deployment mode is projected to represent 78% of life sciences next-generation customer engagement platform demand in 2025, underscoring its role as the preferred deployment model for scalable, accessible customer engagement solutions. Organizations gravitate toward cloud-based solutions for their flexibility, rapid implementation capabilities, and ability to provide consistent user experiences across global teams and locations. Positioned as cost-effective, scalable solutions, cloud/SaaS platforms offer both operational efficiency benefits, such as reduced IT infrastructure requirements, and strategic advantages, including faster time-to-value and continuous platform updates.

The segment is supported by the rising adoption of subscription-based business models, where cloud/SaaS platforms provide predictable pricing and continuous value delivery. Vendors are increasingly offering integrated cloud solutions that combine customer engagement capabilities with complementary functionality such as analytics, content management, and compliance tools, enhancing overall platform appeal and justifying subscription investments. As life sciences companies prioritize agility and scalability in their commercial technology infrastructure, cloud/SaaS deployment models will continue to dominate demand, reinforcing their position as the standard deployment approach within the customer engagement platform market.

The core engagement layers functionality is forecasted to contribute 55% of the life sciences next-generation customer engagement platforms market in 2025, reflecting the fundamental importance of comprehensive engagement capabilities in modern commercial operations. Organizations are increasingly focused on functionality that enables sophisticated customer interaction management, including multi-channel communication, personalized content delivery, and real-time engagement tracking. This aligns with the growing emphasis on customer-centric commercial strategies that prioritize meaningful, relevant interactions with healthcare professionals.

Core engagement layers provide the essential foundation for effective customer relationship management, offering capabilities that directly impact commercial performance and customer satisfaction. The segment also benefits from organizational willingness to invest in functionality that delivers measurable improvements in engagement effectiveness and customer experience quality. With heightened focus on commercial excellence and the need for differentiated customer interactions, core engagement layers serve as critical enablers of competitive advantage, making them a primary driver of platform adoption and investment in the life sciences customer engagement technology category.

The pharmaceutical companies end-use segment is projected to account for 57% of the life sciences next-generation customer engagement platforms market in 2025, reflecting the sector's leadership in adopting advanced commercial technologies and digital engagement solutions. Pharmaceutical organizations consistently demonstrate strong demand for sophisticated platform capabilities that can support complex commercial operations, multi-channel customer engagement strategies, and regulatory compliance requirements. These companies recognize the strategic value of next-generation customer engagement platforms in optimizing sales effectiveness, improving customer relationships, and achieving commercial objectives.

The pharmaceutical segment benefits from substantial technology budgets, established digital transformation initiatives, and organizational focus on commercial innovation and performance optimization. Large pharmaceutical companies often serve as early adopters of new platform capabilities, driving vendor innovation and market development. With continued emphasis on commercial excellence, competitive differentiation, and customer-centric strategies, pharmaceutical companies will remain the dominant end-user segment, reinforcing their position as the primary market for advanced customer engagement platform solutions.

The life sciences next-generation customer engagement platforms market is advancing rapidly due to increasing digital transformation initiatives and growing demand for data-driven commercial strategies. The market faces challenges including system integration complexities, data privacy and security concerns, and high implementation costs. Innovation in artificial intelligence capabilities and cloud-based deployment models continue to influence product development and market expansion patterns.

The widespread adoption of artificial intelligence (AI) and machine learning (ML) is transforming how life sciences companies interact with their customers. AI is enabling platforms to generate personalized content recommendations, predict customer needs, and optimize engagement strategies in real-time. These technologies provide deep insights into customer behavior, allowing businesses to customize interactions at scale. By leveraging AI-powered analytics, companies can make data-driven decisions that enhance the customer experience, increase engagement rates, and improve overall commercial outcomes, creating a competitive edge in the market.

The increasing demand for a seamless customer experience is driving the adoption of omnichannel customer engagement solutions. Modern platforms are designed to integrate both digital and traditional channels into a unified system, allowing for consistent and personalized communication. This approach ensures that customers receive the same level of service and messaging regardless of their chosen touchpoint, be it online or in-person. By offering a cohesive engagement experience, companies can track interactions more effectively, gather valuable insights, and implement targeted strategies to optimize the customer journey and drive higher satisfaction and loyalty.

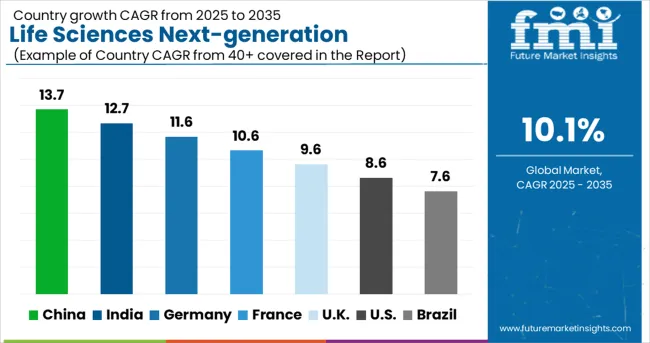

| Countries | CAGR (2025-2035) |

|---|---|

| China | 13.7% |

| India | 12.7% |

| Germany | 11.6% |

| France | 10.6% |

| UK | 9.6% |

| USA | 8.6% |

| Brazil | 7.6% |

The life sciences next-generation customer engagement platforms market is experiencing robust growth globally, with China leading at a 13.7% CAGR through 2035, driven by rapid pharmaceutical industry expansion, increasing digital adoption. India follows closely at 12.7%, supported by an expanding biotechnology sector, rising healthcare investments, and increasing adoption of digital commercial technologies. Germany shows steady growth at 11.6%, emphasizing regulatory compliance and advanced platform capabilities. France records 10.6%, focusing on pharmaceutical innovation and integrated engagement solutions. The UK shows 9.6% growth, prioritizing digital transformation and omnichannel customer experiences.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

Revenue from life sciences next-generation customer engagement platforms in China is expected to experience robust growth with a CAGR of 13.7% through 2035. This growth is largely attributed to the country’s rapidly expanding pharmaceutical industry and increasing digitalization in the commercial sector. China’s push for modernization, particularly within its pharmaceutical and biotechnology sectors, is creating significant demand for advanced customer engagement technologies. Government initiatives promoting digital transformation, alongside the rising use of cloud technologies, are driving adoption. Major pharmaceutical companies and tech vendors are strengthening their operations in tier-1 and tier-2 cities to support the growing demand for efficient and innovative commercial solutions. The competitive advantage in this market lies in the ability to integrate platforms with analytics, marketing, and customer relationship management (CRM) features, ensuring enhanced engagement across diverse customer bases.

The life sciences next-generation customer engagement platforms market in India is projected to grow at a CAGR of 12.7% through 2035. This growth is fueled by an expanding biotechnology sector, coupled with increasing pharmaceutical manufacturing capabilities and greater digital adoption across the healthcare ecosystem. India’s rapidly growing pharmaceutical industry, alongside improvements in infrastructure and healthcare access, is driving the demand for more advanced commercial solutions. The country’s increasing focus on pharmaceutical exports and global market expansion is pushing companies to adopt cutting-edge customer engagement platforms that can support complex commercial operations. Local and international technology providers are capitalizing on this opportunity by offering platforms that cater to both small-scale biotech companies and large pharmaceutical players.

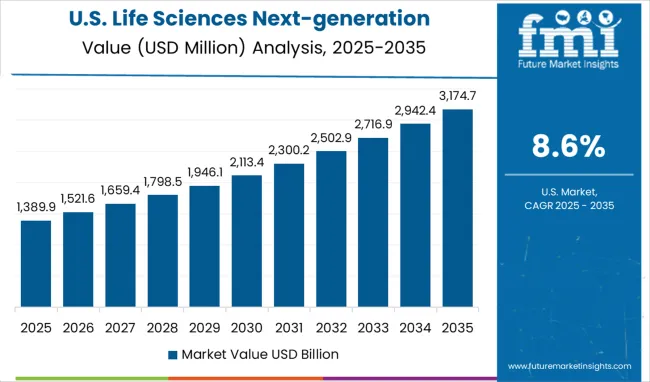

In the United States, the life sciences next-generation customer engagement platforms market is set to grow at a CAGR of 8.6% through 2035. This growth is underpinned by a mature pharmaceutical industry, a focus on commercial innovation, and strict regulatory compliance requirements. USA pharmaceutical companies are increasingly seeking platforms that offer not just customer engagement but also advanced analytics and compliance functionalities. Platforms that integrate marketing strategies with operational tools, such as CRM and sales force automation, are expected to dominate the market. The demand for integrated solutions has been further fueled by value-based care models that prioritize patient outcomes and cost-effective interventions. American companies are adopting platforms that optimize customer relationship management and streamline commercial operations across therapeutic areas.

The life sciences next-generation customer engagement platforms market in Germany is expected to grow at a CAGR of 11.6% through 2035. The country’s robust pharmaceutical industry, along with its commitment to technological innovation, plays a central role in the increasing adoption of customer engagement platforms. German companies place significant emphasis on regulatory compliance and data security, making platforms that meet these strict requirements highly sought after. The growing collaboration between pharmaceutical companies and technology providers is fostering the development of more advanced, tailored solutions that meet the unique demands of the German market. As the market moves toward a more data-driven approach, there is an increased focus on platforms that offer advanced analytics, personalization, and process automation.

The life sciences next-generation customer engagement platforms market in the United Kingdom is expected to expand at a CAGR of 9.6% through 2035. The UK has a strong life sciences innovation ecosystem, and the early adoption of digital commercial technologies is driving platform demand. British pharmaceutical and biotechnology companies are looking for solutions that can improve customer engagement effectiveness and commercial performance. The adoption of cloud-based platforms is enhancing access to advanced customer engagement capabilities. UK life sciences companies are also prioritizing customer-centric strategies, and platforms that can offer personalized, data-driven insights are becoming more popular. As the pharmaceutical industry continues to evolve, these platforms are expected to play a key role in improving patient experiences and optimizing commercial operations.

Revenue from life sciences next-generation customer engagement platforms in France is expected to grow at a CAGR of 10.6% through 2035. France has a well-established pharmaceutical industry with a focus on commercial innovation and a strong commitment to customer engagement. French life sciences companies are prioritizing platforms that can enhance both commercial effectiveness and customer relationship management while ensuring compliance with European regulations. As the demand for sophisticated commercial technologies rises, pharmaceutical companies are adopting more integrated solutions that combine marketing, sales, and analytics to drive growth. The country’s regulatory framework has spurred a demand for platforms that ensure data protection and transparency in commercial operations.

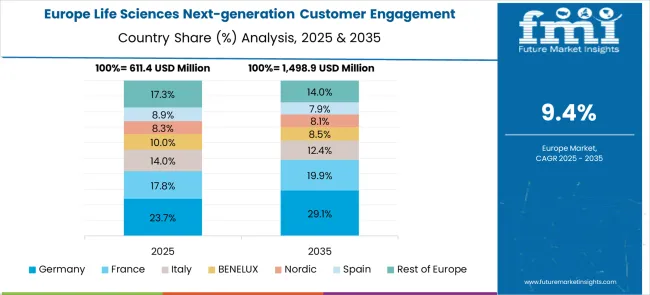

The life sciences next-generation customer engagement platforms market in Europe demonstrates mature development across major economies with Germany showing strong presence through its robust pharmaceutical industry and regulatory compliance focus, supported by companies leveraging advanced platform capabilities to maintain competitive advantage while ensuring adherence to strict European data protection and pharmaceutical regulations. France represents a significant market driven by its established life sciences sector and emphasis on innovation-driven commercial strategies, with organizations prioritizing sophisticated customer engagement solutions that combine French pharmaceutical expertise with advanced digital technologies for enhanced healthcare professional relationships.

The UK exhibits considerable growth through its life sciences innovation ecosystem and early adoption of digital commercial technologies, with companies leading the implementation of next-generation engagement platforms that support complex commercial operations and regulatory compliance requirements. Germany and France show expanding adoption of cloud-based deployment models, particularly in integrated platform solutions targeting comprehensive customer engagement optimization. BENELUX countries contribute through their focus on pharmaceutical innovation and cross-border commercial operations, while Eastern Europe and Nordic regions display growing potential driven by increasing life sciences investment and expanding adoption of digital commercial technologies across diverse pharmaceutical and biotechnology organizations.

The life sciences next-generation customer engagement platforms market is characterized by competition among established technology vendors, specialized life sciences solution providers, and emerging AI-powered platform developers. Companies are investing in advanced artificial intelligence capabilities, cloud-native architectures, integrated analytics solutions, and industry-specific functionality to deliver effective, scalable, and compliant customer engagement solutions. Platform innovation, industry expertise, and implementation success are central to strengthening product portfolios and market presence.

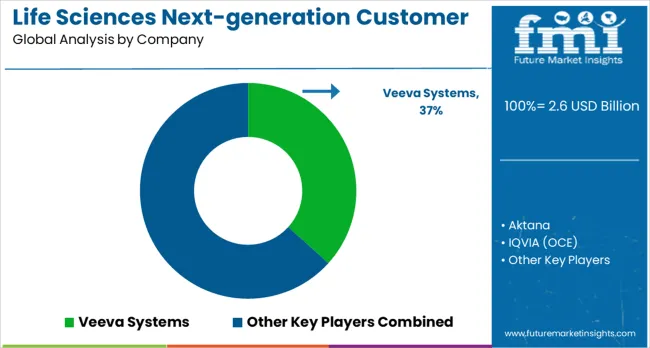

Veeva Systems, USA-based, leads the market with 37.0% global value share, offering comprehensive life sciences commercial cloud solutions with focus on CRM, content management, and customer engagement optimization. Aktana, USA, provides AI-powered commercial intelligence platforms with emphasis on next-best-action recommendations and engagement optimization. IQVIA (OCE), USA, delivers integrated commercial effectiveness solutions with focus on omnichannel customer engagement and performance analytics. Exeevo, Switzerland, focuses on digital customer experience platforms designed specifically for pharmaceutical commercial operations.

Pitcher, Austria, and Salesforce, USA, operating globally, provide comprehensive customer engagement solutions across multiple industries with specialized life sciences functionality and cloud-based deployment options. ACTO Technologies Inc., USA, emphasizes learning and training capabilities integrated with customer engagement platforms. Allego, USA, offers sales enablement and customer engagement solutions with focus on content optimization and performance improvement. Bigtincan, Australia, provides AI-powered sales enablement platforms with advanced content management and customer engagement capabilities. ODAIA Intelligence Inc., Canada, delivers AI-driven commercial intelligence and customer engagement optimization solutions specifically designed for life sciences organizations.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2.6 billion |

| Component | Software, Services (implementation, integration, support) |

| Deployment Mode | Cloud/SaaS (multi-tenant, subscription), On-premise |

| Functionality | Core Engagement Layers, End-to-end content management, Engagement channel optimization, Commercial learning and training, Advanced Software Capabilities, Cognitive Capabilities |

| End Use | Pharmaceutical Companies, Biotechnology Companies, Contract Research Organizations (CROs), Medical Device Firms, Others (Including Research Institutes, etc.) |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Veeva Systems, Aktana, IQVIA (OCE), Exeevo, Pitcher, Salesforce, ACTO Technologies Inc., Allego, Bigtincan, ODAIA Intelligence Inc., Qstream Inc., Seismic, Tellius, and Viseven |

| Additional Attributes | Dollar sales by platform capability and deployment model, regional adoption trends, competitive landscape, customer preferences for cloud versus on-premise solutions, integration with existing commercial technology ecosystems, innovations in artificial intelligence, machine learning capabilities, and omnichannel customer experience optimization |

North America

Europe

East Asia

South Asia & Pacific

Latin America

Middle East & Africa

The global life sciences next-generation customer engagement platforms market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the life sciences next-generation customer engagement platforms market is projected to reach USD 6.9 billion by 2035.

The life sciences next-generation customer engagement platforms market is expected to grow at a 10.1% CAGR between 2025 and 2035.

The key product types in life sciences next-generation customer engagement platforms market are software and services (implementation, integration, support).

In terms of deployment mode outlook, cloud / saas (multi-tenant, subscription) segment to command 78.0% share in the life sciences next-generation customer engagement platforms market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Life Support Systems Market Size and Share Forecast Outlook 2025 to 2035

Life Science Software Market Size and Share Forecast Outlook 2025 to 2035

Lifestyle Concierge Services Market Size and Share Forecast Outlook 2025 to 2035

Life Science Multichannel Campaign Management Market Size and Share Forecast Outlook 2025 to 2035

Life Science Logistics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lifestyle Sneakers Industry Analysis in United Kingdom Growth, Trends and Forecast from 2025 to 2035

Life Science and Chemical Instruments Market Analysis - Growth & Forecast 2024 to 2034

Life Sciences Analytics Market Size and Share Forecast Outlook 2025 to 2035

Wildlife Tourism Market Size and Share Forecast Outlook 2025 to 2035

Wildlife Health Market Size and Share Forecast Outlook 2025 to 2035

Early Life Nutrition Market Size and Share Forecast Outlook 2025 to 2035

Plant life Extensions (PLEX) and Plant Life Management (PLIM) for Nuclear Reactors Market

Marine Life Raft Market Size and Share Forecast Outlook 2025 to 2035

Second-Life Battery Storage Systems Market Size and Share Forecast Outlook 2025 to 2035

Service Lifecycle Management Application Market Size and Share Forecast Outlook 2025 to 2035

Product Life-Cycle Management (PLM) IT Market Size and Share Forecast Outlook 2025 to 2035

Aviation Life Rafts Market Size and Share Forecast Outlook 2025 to 2035

Contract Lifecycle Management Market Growth – Trends & Forecast 2025 to 2035

Lymphoproliferative Disorder Treatment Market

Agile Application Life-Cycle Management Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA