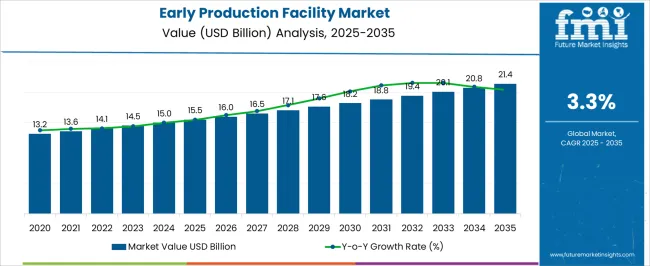

The early production facility market is estimated to be valued at USD 15.5 billion in 2025 and is projected to reach USD 21.4 billion by 2035, registering a compound annual growth rate (CAGR) of 3.3% over the forecast period.

The early production facility market is valued at USD 15.5 billion in 2025 and is expected to grow to USD 21.4 billion by 2035, with a CAGR of 3.3%. From 2021 to 2025, the market grows steadily from USD 13.2 billion to USD 15.5 billion, progressing through USD 13.6 billion, 14.1 billion, 14.5 billion, and 15.0 billion. During this period, growth is largely driven by increasing demand for early production facilities in sectors like oil and gas, energy, and manufacturing, where companies invest in infrastructure to expedite product launches and optimize production. The contribution of volume growth in this phase is dominant, as companies are focused on scaling production capacities to meet market needs.

From 2026 to 2030, the market continues its steady expansion, reaching USD 18.8 billion. Values progress through USD 16.0 billion, 16.5 billion, 17.1 billion, 17.6 billion, and 18.2 billion. During this period, price growth begins to play a more significant role as technological advancements and premium services, such as automation and digitalization, add value to early production facilities, leading to higher average prices.

Between 2031 and 2035, the market reaches USD 21.4 billion, with intermediate values passing through USD 19.4 billion, 20.1 billion, and 20.8 billion. Price growth continues to gain momentum as demand for advanced, high-tech production facilities increases, with volume growth stabilizing as the market matures.

| Metric | Value |

|---|---|

| Early Production Facility Market Estimated Value in (2025 E) | USD 15.5 billion |

| Early Production Facility Market Forecast Value in (2035 F) | USD 21.4 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

The oil and gas market is the largest contributor, accounting for around 40-45%, as EPFs are vital for rapidly developing and processing hydrocarbons during the early stages of field development, especially in remote or offshore locations before full-scale production facilities are in place. The energy infrastructure market plays a significant role, contributing approximately 20-25%, as EPFs provide essential temporary infrastructure for the extraction, processing, and transportation of oil and gas in areas where permanent facilities are not yet available. The mining and resources market also plays a key role, contributing about 15-20%, as EPFs are used in the early stages of mining operations to start production before permanent plants are operational.

The construction and engineering market is another driver, accounting for around 10-12%, as engineering firms are responsible for the design and setup of these temporary facilities, often employing modular solutions for quick deployment in various geographical regions. The renewable energy market contributes approximately 8-10%, as EPFs are used in the early stages of renewable energy projects, such as bioenergy and geothermal plants, where temporary facilities are required until larger, more permanent plants are fully developed. These parent markets underscore the importance of early production facilities in various industries, helping to ensure efficient and timely resource extraction and production.

The early production facility market is gaining steady momentum due to increasing upstream oil and gas activities, particularly in remote and underdeveloped reserves where immediate full-scale infrastructure development is not economically viable. These facilities enable rapid monetization of hydrocarbon resources by allowing early-stage production, processing, and export of oil and gas before the commissioning of permanent installations.

Rising exploration and appraisal activities in both mature and frontier regions are prompting operators to deploy modular and flexible early production solutions. Advances in separation technology, process automation, and skid-mounted modular systems are improving the efficiency, scalability, and reliability of these facilities.

Additionally, geopolitical and economic pressures are pushing oil producers to accelerate return on investment while maintaining operational safety and efficiency, further increasing reliance on temporary yet high-performing setups As the industry places greater emphasis on cost optimization and field development agility, early production facilities are becoming an essential strategy, particularly for independent operators and national oil companies seeking to balance risk, time, and capital expenditure.

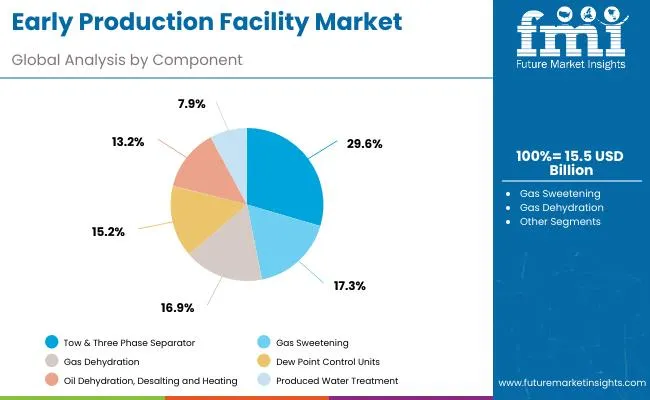

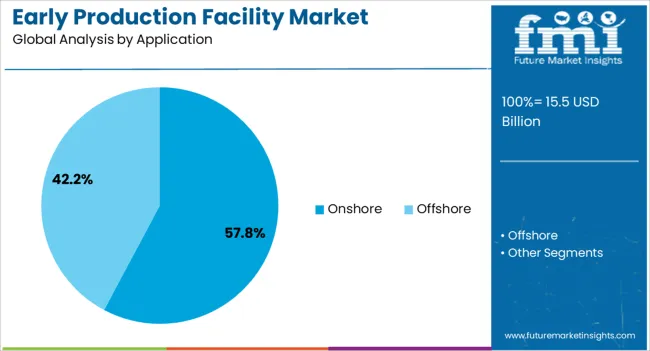

The early production facility market is segmented by component, application, and geographic regions. By component, early production facility market is divided into two- and three-phase separators, gas sweetening, gas dehydration, dew point control units, oil dehydration, desalting, and heating, and produced water treatment. In terms of application, early production facility market is classified into onshore and offshore. Regionally, the early production facility industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The two and three phase separator segment is projected to account for 29.6% of the early production facility market revenue share in 2025, making it the leading component category. This dominance is being driven by the critical role separators play in the initial treatment of multiphase well streams, ensuring the effective isolation of oil, gas, and water at the earliest stage of processing. Their widespread use in both temporary and long-term field development strategies is supported by their ability to handle high-pressure, high-volume production environments with accuracy and consistency.

Advances in separator design have enabled improved control over fluid dynamics, reducing emulsions and maximizing phase separation efficiency. Operators are increasingly deploying these systems in early production scenarios to ensure operational continuity, rapid startup, and optimal reservoir evaluation.

The growing demand for modular and transportable systems is further elevating their relevance, especially in geographically dispersed or logistically complex projects As cost control and early revenue realization remain priorities, two and three phase separators are expected to continue leading component adoption across global early production facilities.

The onshore application segment is anticipated to represent 57.8% of the early production facility market revenue share in 2025, positioning it as the dominant deployment environment. This leadership is being supported by the relatively lower infrastructure cost, logistical simplicity, and operational flexibility associated with onshore developments. Operators are increasingly leveraging early production facilities on land-based fields to accelerate first oil production and optimize appraisal strategies without waiting for complete facility build-outs.

The segment is further benefiting from rising onshore discoveries, shale field developments, and revitalization of mature fields where early monetization is economically attractive. Regulatory clearance, accessibility to service providers, and reduced transport complexity are contributing to shorter commissioning timelines and faster return on investment.

In emerging oil-producing nations, onshore early production facilities are also being adopted as a transitional step toward full-field development, enabling technical evaluation and stakeholder alignment As global upstream players continue to prioritize modular, agile, and economically viable approaches to field development, the onshore segment is expected to maintain its lead in early production facility adoption.

Early production facilities (EPFs) are used for the initial phase of production before moving to larger-scale operations. These facilities allow companies to test processes, optimize product formulations, and scale production in a controlled environment. The market is driven by the need to quickly bring new products to market, minimize risk, and streamline operations. Challenges include high setup costs, regulatory compliance, and the complexity of integrating new technologies and equipment.

Opportunities lie in the growing demand for modular and mobile production units, which offer flexibility, cost savings, and faster implementation. Trends indicate an increasing focus on digitalization, automation, and sustainability, with EPFs becoming more efficient, environmentally friendly, and adaptable to changing production needs. Suppliers offering flexible, cost-effective, and technologically advanced EPFs are well-positioned to capitalize on these market opportunities.

The early production facility market is growing due to the rising demand for flexible, scalable, and cost-effective production solutions, particularly in industries where rapid time-to-market and product testing are essential. EPFs offer companies the ability to test and validate production processes without committing to the costs and complexities of full-scale manufacturing plants. This is especially critical in sectors like pharmaceuticals, biotechnology, and oil and gas, where production needs may vary greatly between projects. EPFs enable companies to conduct smaller-scale runs, assess market demand, and adjust their processes before scaling up. As industries focus on minimizing capital expenditures and improving production efficiency, EPFs are increasingly viewed as essential tools for early-stage production.

The early production facility market faces several challenges, particularly related to high initial investment costs, regulatory compliance, and technical complexities. Setting up an EPF requires significant capital investment in equipment, infrastructure, and specialized technologies. These costs can be a barrier for smaller companies or those with limited budgets. Regulatory compliance, especially in industries like pharmaceuticals and oil and gas, adds another layer of complexity.

Manufacturers must ensure that their EPFs meet strict safety, environmental, and quality standards. Additionally, the technical integration of new technologies, such as automation, data analytics, and advanced process control systems, presents challenges in terms of compatibility and scalability. Overcoming these constraints requires careful planning, innovation, and a clear understanding of industry regulations and best practices.

Opportunities in the early production facility market are growing with the increasing demand for modular, mobile, and digitally-enabled production units. Modular EPFs, which can be customized and expanded as needed, offer flexibility and lower initial costs compared to traditional fixed facilities. This is particularly appealing to companies looking to enter new markets or test new products without committing to large-scale infrastructure. Mobile EPFs, which can be relocated and deployed in different locations, provide added flexibility for industries like oil and gas, where production sites may be temporary or remote.

Additionally, the integration of digital technologies, such as automation, IoT, and advanced analytics, is improving the efficiency, monitoring, and management of EPFs. These innovations are making EPFs more cost-effective, faster to implement, and adaptable to changing production requirements.

The early production facility market is seeing trends toward automation and digitalization to improve overall efficiency. Automation is being increasingly integrated into EPFs to reduce labor costs, improve precision, and accelerate production cycles. The use of IoT and real-time monitoring systems allows companies to track performance metrics, optimize workflows, and maintain better control over production processes. These innovations are enabling more reliable and efficient operation of EPFs, with fewer manual interventions. Moreover, advances in data analytics are helping companies identify process improvements and reduce operational bottlenecks, further enhancing the capabilities of EPFs to meet the demands of modern manufacturing.

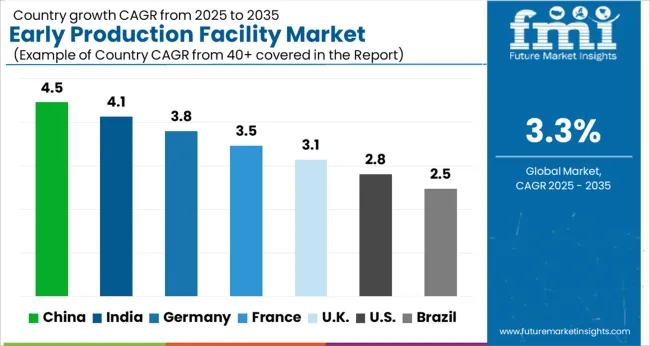

| Country | CAGR |

|---|---|

| China | 4.5% |

| India | 4.1% |

| Germany | 3.8% |

| France | 3.5% |

| UK | 3.1% |

| USA | 2.8% |

| Brazil | 2.5% |

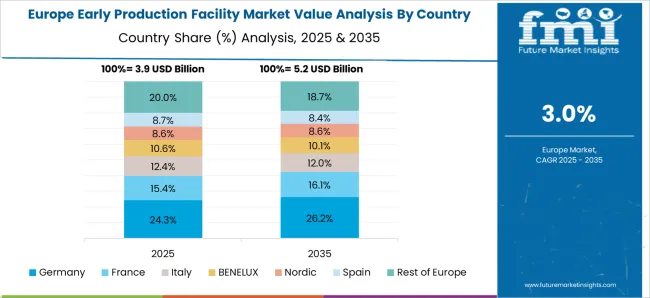

The global early production facility market is projected to grow at a CAGR of 3.3% from 2025 to 2035. China leads with the highest growth rate of 4.5%, followed by India at 4.1%. France, the UK, and the USA show more moderate growth rates, at 3.5%, 3.1%, and 2.8%, respectively. The demand for early production facilities is driven by the need for efficient oil and gas extraction, energy independence, and faster production capabilities. Increasing investments in deepwater drilling, unconventional oil extraction, and government-driven energy strategies are key growth factors for the market. The analysis includes over 40+ countries, with the leading markets detailed below.

The early production facility market in China is expected to grow at a CAGR of 4.5% from 2025 to 2035. The country’s booming energy sector, particularly in oil and gas exploration, is a significant driver of this market. China’s increasing focus on offshore and onshore oil production, alongside its growing demand for faster oil recovery and production optimization, is driving the need for advanced early production facilities (EPFs). These facilities are crucial in providing initial production capabilities, reducing time-to-market, and boosting overall efficiency.

The government’s emphasis on energy security and technological advancements in the oil and gas industry is helping improve the operational efficiency of EPFs. The market is also benefiting from China’s aggressive infrastructure development plans and its growing participation in global energy markets. As energy consumption continues to rise, the demand for early production facilities will increase, supporting China’s position as a key player in the global energy sector.

The early production facility market in India is projected to grow at a CAGR of 4.1% from 2025 to 2035. The growth of the Indian energy sector, particularly in oil and natural gas exploration, is driving the demand for EPFs. India’s increasing reliance on domestic oil and gas production to reduce import dependence is encouraging investments in early-stage production technologies. Additionally, the rise in deepwater drilling and unconventional oil extraction methods, including shale and tight gas production, is creating opportunities for early production facilities.

India’s expanding offshore oil fields and the government's commitment to improving its energy infrastructure are significant growth factors. Furthermore, the increasing need for faster production ramp-up in these fields and operational cost optimization is further pushing the adoption of EPFs. As India’s energy demand grows, these facilities will become integral to meeting the country’s production goals.

The early production facility market in Frnace is forecasted to grow at a CAGR of 3.5% from 2025 to 2035. While France's energy industry is heavily influenced by nuclear energy, the oil and gas sector still plays an essential role. The French government’s energy diversification strategy, which aims to increase natural gas production and reduce reliance on coal and oil, is driving the adoption of EPFs. Additionally, France’s participation in global energy projects and offshore drilling ventures, particularly in the North Sea, is creating demand for efficient production facilities that can rapidly increase output. France is also investing in renewable energy, but the role of EPFs in accelerating oil production in the short term remains essential to meeting the country’s energy needs. The rising cost-efficiency and faster production capabilities offered by EPFs will continue to drive market growth.

The UK early production facility market is expected to grow at a CAGR of 3.1% from 2025 to 2035. The country’s oil and gas industry, which has long been a cornerstone of the UK’s energy production, is increasingly investing in innovative production solutions like EPFs to improve operational efficiency. With the UK focusing on offshore production and reducing its carbon footprint, EPFs are being seen as a solution to minimize energy consumption and speed up production. Moreover, the country’s need to upgrade its aging infrastructure and maintain stable energy production in the North Sea is driving the market for EPFs. The UK government’s commitment to energy transition, while maintaining traditional energy sources, ensures a continued need for these facilities.

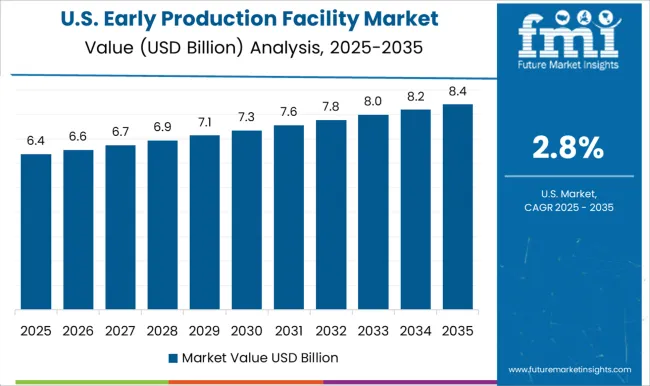

The USA early production facility market is projected to expand at a CAGR of 2.8% from 2025 to 2035. With its booming oil and gas industry, particularly in shale oil production, the USA remains a major market for EPFs. These facilities are vital in ensuring that initial production ramp-up is efficient and cost-effective in tight oil and shale gas fields. The USA government’s support for energy independence and infrastructure development, along with its continued focus on hydraulic fracturing and deepwater drilling, ensures the continued demand for EPFs. The push for faster extraction and more efficient technologies to meet growing domestic and export demand is driving the market. While the growth rate may be slower compared to other regions, the USA remains a significant consumer of EPFs due to its large-scale energy production capacity.

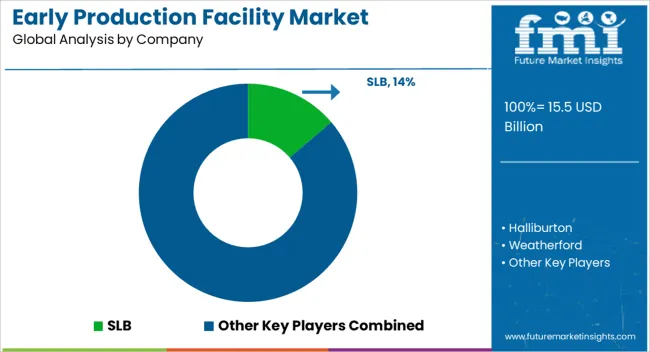

The early production facility (EPF) market is characterized by a competitive landscape driven by companies that provide specialized services for the oil and gas sector, focusing on efficient production systems for early-stage oil and gas fields. SLB (formerly Schlumberger) is a key player, offering integrated solutions for early production systems that emphasize enhanced production rates, process optimization, and the ability to scale as fields mature. The company’s expertise in reservoir engineering and oilfield services positions it as a leading provider of turnkey EPF solutions, particularly in remote and offshore environments.

Halliburton is another dominant player, providing a broad range of early production services, including facilities design, installation, and commissioning. Known for its expertise in upstream operations, Halliburton’s EPF solutions are tailored to maximize production in the early life of an oil field, helping operators reduce costs and improve overall efficiency. Weatherford competes by offering customizable solutions that provide production facilities, processing systems, and storage for oil and gas operators, especially in challenging environments such as harsh climates and deepwater regions.

Expro is recognized for its advanced flow assurance technologies, specializing in well testing, flow management, and subsea systems, which play a critical role in the early production phase. Their solutions are often deployed in offshore fields to ensure optimized early production and safe operations. TAQA focuses on providing complete EPF packages, particularly for offshore and remote locations, with a strong emphasis on efficient energy management and sustainability. TETRA Technologies, OilSERV, and CECO Environmental provide additional EPF services such as water treatment, gas separation, and environmental management, making them key players in markets where environmental compliance and system reliability are critical.

Penspen and Roska DBO offer EPC (engineering, procurement, and construction) services, catering to operators looking for flexible, cost-effective solutions. Global Process Systems and PETECS provide process engineering solutions, with a focus on scalable and modular systems that allow operators to quickly respond to production challenges. Smaller companies like Huichuan International, CPPE, Pyramid E&C, and EN-FAB also compete by offering niche solutions in modular facility design, engineering, and construction, serving both conventional and unconventional oil and gas projects. Competitive strategies in this market emphasize rapid deployment, cost-efficiency, and scalability of facilities to ensure that operators maximize the value of early production without unnecessary delays or costs. Product brochures highlight capabilities such as modular facility design, automation systems, environmental compliance, and integrated monitoring to ensure smooth early-stage production.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.5 billion |

| Component | Two & Three Phase Separator, Gas sweetening, Gas dehydration, Dew point control units, Oil dehydration, desalting, and heating, and Produced Water Treatment |

| Application | Onshore and Offshore |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SLB, Halliburton, Weatherford, Expro, TAQA, TETRA Technologies, OilSERV, CECO Environmental, Penspen, Roska DBO, Global Process Systems, PETECS, Huichuan International, CPPE, Pyramid E&C, and EN-FAB |

| Additional Attributes | Dollar sales by service type, application, and facility size are increasing, driven by demand for rapid, cost-effective oil and gas production. Growth is strong in North America, the Middle East, and Latin America. |

The global early production facility market is estimated to be valued at USD 15.5 billion in 2025.

The market size for the early production facility market is projected to reach USD 21.4 billion by 2035.

The early production facility market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in early production facility market are two & three phase separator, gas sweetening, gas dehydration, dew point control units, oil dehydration, desalting, and heating and produc.

In terms of application, onshore segment to command 57.8% share in the early production facility market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Early Phase Clinical Trial Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Early-Stage Lung Cancer Diagnostics Therapy Market Size and Share Forecast Outlook 2025 to 2035

Early Life Nutrition Market Size and Share Forecast Outlook 2025 to 2035

NGS Solution for Early Cancer Screening Market Size and Share Forecast Outlook 2025 to 2035

Production Logistics Market Size and Share Forecast Outlook 2025 to 2035

Production Printer Market - Growth, Demand & Forecast 2025 to 2035

Soda Production Machine Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Production Chemicals Market – Trends & Forecast 2025 to 2035

Aluminium Production Chemicals Market

E&P Software Market Trends – Demand & Forecast 2025-2035

Composite Textile Production Equipment Market Size and Share Forecast Outlook 2025 to 2035

Technical Textile Production Equipment Market Size and Share Forecast Outlook 2025 to 2035

Alternative Protein Production Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Assistive Reproduction Technology Market Size and Share Forecast Outlook 2025 to 2035

Induced Pluripotent Stem Cells Production Market Size and Share Forecast Outlook 2025 to 2035

Facility Management Software Market Size and Share Forecast Outlook 2025 to 2035

Facility Management Services Market Analysis – Trends, Growth & Forecast 2025 to 2035

Computer Aided Facility Management (CAFM) Market Size and Share Forecast Outlook 2025 to 2035

USA Skilled Nursing Facility Market Analysis – Growth & Forecast 2025 to 2035

Trends, Growth, and Opportunity Analysis of Data Center Facility in Morocco Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA