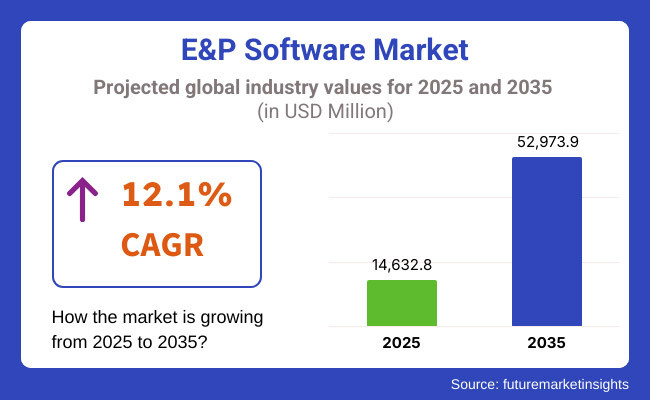

The global Exploration and Production (E&P) Software market is projected to grow significantly, from USD 14,632.8 Million in 2025 to USD 52,973.9 Million by 2035 an it is reflecting a strong CAGR of 12.1%.

The E&P (exploration & production) industry is reliant on vendors for fundamental operations like drilling, seismic surveys, and equipment provisioning. To be able to explore and produce at lower risk, these external partnerships must be managed effectively. For this reason, Companies need powerful software solutions that provide data analytics for evaluating vendor performance, ensuring compliance, and preventing operational stoppages.

Industries like oil & gas and mining are governed by stringent regulatory frameworks including OSHA/EPA standards, local environmental laws, and more. Third party vendors must comply with these regulations to stay away from possible legal or financial punishments. Integrated with compliance management tools that can be automated, E&P software solutions allow organizations to carry out comprehensive risk assessment and simplify regulatory reporting processes.

But as E&P companies lean into digital transformation, they turn more often to external providers for cloud-based analytics, IoT monitoring, and AI-driven exploration tools. A dependence that can potentially leave you as a sitting duck based on how implemented security measures of your vendor are and that is why deploying an advanced risk management solution that tracks the vendor compliance and proactively deals with security threats makes really sense.

There are growing cybersecurity threats to the sector, such as hackers targeting seismic data, drilling operations and production infrastructure. Third-party vendors can serve as the weak link in the security chain, making ongoing monitoring and real-time risk assessments imperative. Since you are an expert in cybersecurity, and oil, gas, and energy (E&P) software solutions, you deal with very sensitive data, and hence, must focus on proactive cybersecurity solutions to avoid data breaches and operational disruptions.

The North America currently dominates the global third-party risk management market owing to the stringent safety and environmental regulations. Market growth is further propelled by the presence of large software vendors and an increasing emphasis on cybersecurity. In contrast, emerging market countries such as India, and Australia, are witnessing heightened adoption as energy and mining firms look for sophisticated offerings to control vendor risks in the growth of their sectors.

| Company | Schlumberger Limited |

|---|---|

| Contract/Development Details | Awarded a contract by a national oil company to provide exploration and production software solutions, aiming to optimize reservoir management and production efficiency. |

| Date | February 2024 |

| Contract Value (USD Million) | Approximately USD 50 |

| Renewal Period | 8 years |

| Company | Halliburton Company |

|---|---|

| Contract/Development Details | Partnered with an independent oil and gas firm to deploy exploration software, enhancing seismic data interpretation and drilling operations. |

| Date | July 2024 |

| Contract Value (USD Million) | Approximately USD 45 |

| Renewal Period | 7 years |

Rising adoption of digital oilfield technologies enhances operational efficiency

The utilization of digital oilfield technologies has transformed the Exploration & Production (E&P) domain and has very efficiently contributed to maximize operational efficiencies. These technologies include advanced data analytics solutions, applications to monitor systems in real time, and automation tools to reduce human intervention and optimize workflows in oil and gas operations.

Digital solutions will enable companies to monitor the performance of equipment in real-time, predict when maintenance is needed, and optimize production schedules, in turn leading to decreased downtime and increased profitability. Integrated operations, for instance, allow onshore and offshore teams to work closely and, in this way, they can make quicker decisions and minimize operational bottlenecks.

This digital kit is instrumental in improving productivity, enabling cost savings, and performing safety measures. Consequently, the E&P software market is experiencing a boom in demand for digital solutions that provide real-time data visualization, predictive analytics, and asset management, contributing to the industry's transformation toward more efficient and technologically advanced operations.

Adoption of AI-driven analytics for predictive maintenance and drilling optimization

AI is becoming a vital tool in the E&P sector, especially in terms of predictive maintenance and drilling optimization. AI algorithms can analyze huge volumes of data from drilling operations to predict equipment failures before they actually take place, enabling proactive maintenance, and reducing unplanned downtime. Predictive capability helps machinery to run at its highest efficiency while lowering operational costs and increasing the lifespan of equipment.

Additionally, these AI-enabled analytics can be used for drilling optimization by calculating optimal parameters like mud weights and drilling speeds, resulting in improved accuracy and efficiency during drilling. Recent news has indicated that companies have greatly improved their efficiency and reduced costs by consuming data to apply AI to their drilling methods. AI is revolutionizing traditional E&P practices and laying the groundwork for data-driven decisions that have the potential to expand productivity and operational performance across the upstream oil and gas value chain.

Expansion of E&P software adoption in emerging oil-producing regions

New oil-producing areas are also now utilizing E&P software that can enhance exploration and production. This trend is fueled by the desire to Improve operational efficiency, regulatory compliance, and resource optimization. The deployment of sophisticated software solutions enables improved reservoir management, real-time data analytics, as well as optimized operations in these areas.

Such may include the adoption of integrated operations, which facilitate multi-disciplinary collaboration and lead to better decision-making and more efficient production. These are just a few of the areas where there is great demand for sophisticated E&P software as these and other regions develop their oil and gas sectors - presenting opportunities for technology providers to address the unique challenges in these markets. This contributes to the expansion of the worldwide E&P software market, and helps drive the economic growth of new oil-producing members.

High initial investment and implementation costs hinder adoption

The adoption of Exploration & Production (E&P) software is its high initial investment and implementation costs. The license, customization, and deployment of E&P software solutions can be 3 significant cost factors. This necessitates advanced infrastructure, from powerful computing systems and cloud storage to real-time analytics platforms, the cost of which drives up up-front costs; Further, the application of these software solutions to current operational frameworks requires a specific set of technical skills, increasing the overall cost.

While hardware and software costs must be budgeted for, the implementation phase is where employees need to be trained on how to use the new systems as the old way of working in the company must be overhauled with minimal disruption to the business model. Oil and gas companies are required to provide extra budgets for key onboarding, skill upgrading, and dedicated software support which adds to the overheads.

This presents a challenge for smaller exploration companies and independent operators, as the costs can be difficult to justify paving the way for slower adoption rates across the sector.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments introduced stricter environmental compliance for oil & gas exploration. |

| AI & Data-Driven Exploration | AI-powered seismic analysis optimized resource discovery. |

| Cloud & Edge Computing Adoption | Transition to cloud-based exploration software for scalability. |

| Automation & Digital Twin Technology | Digital twin technology improved predictive maintenance and asset optimization. |

| Market Growth Drivers | Increasing energy demand and digital transformation in oil & gas. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-driven predictive compliance ensures real-time adherence to industry regulations. |

| AI & Data-Driven Exploration | Quantum computing accelerates real-time reservoir simulations and exploration modeling. |

| Cloud & Edge Computing Adoption | AI-driven decentralized exploration analytics enhance real-time decision-making. |

| Automation & Digital Twin Technology | AI-powered autonomous exploration platforms enable real-time drilling adjustments. |

| Market Growth Drivers | AI-driven energy exploration optimizes sustainability and resource utilization. |

The section highlights the CAGRs of countries experiencing growth in the Exploration and Production (E&P) Software market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 14.6% |

| China | 13.5% |

| Germany | 8.2% |

| Japan | 11.9% |

| United States | 10.4% |

The push for digital transformation in China is having a major impact on Exploration & Production (E&P) and is resulting in greater uptake of advanced software globally. Major oil and gas companies in the country integrate digital tools like real-time monitoring, big data analytics, and AIdriven predictive maintenance to leverage existing data in order to create physical, digital and human interconnectedness, allowing companies to operate in a holistic way and maximize operational efficiency.

Such technologies also increase exploration accuracy, minimize production downtime, and optimize resource usage. The Chinese government has been proactively pursuing digital oilfields by advocating companies to implement cutting-edge E&P software for increased utilization of enterprise assets and operational automation.

China's Ministry of Natural Resources revealed fresh incentives digital oilfield development, striving to boost oil and gas output by 10% in five years. Data-driven exploration and resource assessment, along with minimizing the environmental impact of exploration activities, are core aspects of the projects supported by the government. With more than 70 percent of China’s onshore oilfields growing old, software-based predictive maintenance solutions are predicted to be rapidly adopted to optimally extend the life of current assets.

Moreover, the advent of cloud-based platforms is helping Chinese firms boost collaborations across exploration sites that are accelerating the adoption of software in the region. The digital transformation bolsters China’s candidature in the global oil and gas industry by increasing operational transparency and efficiency.

Deep-sea oil and gas exploration is on the rise in India, increasing the demand for enhanced E&P software to help drive deep-water wells. But growing energy demand along with decreasing onshore reserves have led the government and energy companies to focus on offshore reserves.

Advanced software is needed for reservoir simulation, real-time drilling analytics, and remote asset monitoring in deep-water projects, where complex underwater environments challenge operational efficiency and safety. Indian oil majors are doubling down on software that facilitates deep-sea mapping, and predictive drilling of oil wells to get the most out of deposits.

This is a very large investment plan of the government of India approved only recently for offshore oil and gas exploration. The Ministry of Petroleum and Natural Gas has also made policy changes to attract foreign investment in offshore drilling, providing a further fillip to demand for advanced E&P technologies.

With companies utilizing AI-driven software to significantly boost seismic data interpretation and improve drilling efficiency, more than 40% of India’s unexplored offshore blocks are up for bidding. Such developments reinforce India’s increasing dependence on technology-based solutions to ensure that dormant offshore resources are tapped, cementing the need for E&P software best practices in India’s energy policy.

In the USA, oil and gas firms are harnessing machine learning (ML) to improve drilling efficiency and minimizing operational risks. ML-enabled E&P software helps drive this by enabling companies to process massive geological datasets, forecast drilling results, and streamline well positioning.

Through predictive analytics, organizations can reduce non-productive time (NPT), decrease drilling failures, and optimize hydrocarbon recovery rates. Machine learning algorithms analyze real-time sensor data from drilling rigs, quickly improving decision-making and enhancing overall well performance.

The USA Department of Energy (DOE) recently launched a USD 500 million funding initiative aimed at promoting the implementation of AI and ML in oil and gas exploration. The project is designed to boost data-driven delay decisions and increase the sustainability of drilling operations. USA companies derived a 15% reduction in drilling costs and a 20% increase in drilling speed, as reported by recent industry buzz related to the implementation of ML centered predictive analytics.

The drive for energy efficiency and reduced emissions also spurred companies to embrace machine learning in well monitoring and optimization. This competitive edge plays out in the pursuit of advanced drilling techniques on the part of USA companies, as energy exploration & production (E&P) software underlined by machine learning starts to play a key role in the battle against global competitors.

The section contains information about the leading segments in the industry. By Solution, the Services segment is estimated to grow quickly from the period 2025 to 2035. Additionally, by Operation Type, On Shore segment hold dominant share in 2025.

| Solution | CAGR (2025 to 2035) |

|---|---|

| Services | 14.0% |

The services sub-segment of Exploration & Production (E&P) software market is expected to grow at the most noteworthy CAGR during the forecast period, due to the rising demand for implementation, training, support and consulting services. With oil and gas companies increasingly turning to sophisticated software solutions for reservoir modeling, seismic analysis, and drilling optimization, there is a growing demand for specialized services to ensure seamless integration and streamlined operations.

Fewer than 30% of energy firms have internal capabilities to manage these complex digital solutions, so they increasingly turn to third-party service providers for customization, data migration, and software maintenance.

USA Government recently announced a USD 200 million energy transition program which will be used to propose digital workforce training for oil and gas. This initiative aspires to advance the technical skill set of industry professionals, which will further amplify demand for E&P software related services.

The trend has also been increased in the surge in managed services, whereby companies even outsourced software maintenance and real-time data monitoring to specialized vendors considering the growing adoption of cloud-based solutions. With E&P software services revenues up over 25% in the past two years alone, reports suggest the industry is heading towards all-round digital support. As enterprises undergo digital transformation, the services segment will lead the market’s growth.

| Operation Type | Value Share (2025) |

|---|---|

| On Shore | 57.2% |

The biggest share of the E&P software market in terms of value is held by onshore exploration and production activities, owing to the large number of onshore oilfields and lower operational costs compared to offshore drilling. Onshore, the complexity of reservoir simulation, production forecasting, and asset management has led operators to make substantial investments in digital technologies.

Operating companies in onshore fields provide real-time monitoring and predictive maintenance to optimize resource extraction and minimize downtime, which promotes more software adoption.

The Indian government recently approved a USD 1.5 billion initiative aimed at increasing domestic onshore oil production through the digitalization of existing oil fields. It includes a 15 percent boost to crude oil output by 2027, and major investments in AI-automated predictive analytics and real-time drilling software. In much the same way, China has upped the ante in modernizing its onshore oilfields, with state-backed teams now deploying advanced digital twin technology for reservoir management.

Notably, onshore driven approaches accounted for almost 70% of new E&P software footprints in the past year, which reinforces on shore’s lead over USD 10 billion in market value. Given burgeoning energy demand and rapid advances in automation, globally, onshore oilfields should be the bedrock for E&P software spending.

The E&P software market is essential in the upstream oil and gas industry, as it allows organizations to optimize various aspects such as reservoir modelling, seismic interpretation, drilling, and production management. Digital transformation is in high demand for the energy sector as industry players leverage cloud-based infrastructure, AI-powered analytics, and automated systems for greater operational efficacy. Market is frequently knit by domain officer with multiple mining portfolios and high level of expertise in geoscience, reservoir engineering and production optimization.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Schlumberger | 25-30% |

| Halliburton | 18-22% |

| Baker Hughes | 12-17% |

| Emerson | 8-12% |

| CGG | 7-10% |

| Other Companies (combined) | 18-28% |

| Company Name | Key Offerings/Activities |

|---|---|

| Schlumberger | Industry leader with cloud-based DELFI platform, AI-powered reservoir simulation, and seismic interpretation software. Strengthens digital transformation efforts in upstream operations. |

| Halliburton | Offers DecisionSpace suite, integrating geophysical data processing, drilling, and production analytics. Expands AI-driven exploration and reservoir modeling. |

| Baker Hughes | Provides JewelSuite for subsurface modeling and advanced well planning. Focuses on cloud-based AI solutions and real-time data analytics. |

| Emerson | Owns Paradigm E&P software, enabling geoscience interpretation and reservoir modeling. Strengthens automation and digital twin technologies. |

| CGG | Specializes in geophysical data processing, seismic imaging, and reservoir characterization. Enhances cloud-based geoscience solutions. |

Strategic Outlook

Schlumberger (25-30%)

Schlumberger also leads the E&P software sector with its market-leading DELFI digital platform for reservoir modeling and seismic interpretation, which is underpinned by artificial intelligence, machine learning and cloud-based analytics. The company continues to enhance its digital transformation capabilities that help upstream operators maximize exploration and production efficiency. Schlumberger consolidates its leadership position as the premier technology provider for oil and gas software solutions through partnerships and acquisitions.

Halliburton (18-22%)

Halliburton’s DecisionSpace programs deliver a complete digital solution for exploration, drilling, and producing. To improve efficiency and reduce operational risk, the company invests a lot in AI-driven seismic processing, cloud-based reservoir simulation and workflow automation. As the E&P software landscape continues to evolve, Halliburton is a major player, with a strong focus on digital oilfield solutions.

Baker Hughes (12-17%)

Baker Hughes has its JewelSuite platform in the E&P software market, which specializes in advanced reservoir modeling, well planning, and production optimization. It combines AI-driven analytics with cloud computing that can empower real-time decision-making. Baker Hughes' alignment towards digital transformation and automation solidifies its positioning in market.

Emerson (8-12%)

Emerson (via Paradigm) brings in solid geoscience and reservoir engineering. DigialTwin TechVeeraMachineLearn HT/A2D SOLUTIONS CORPORATION is engaged in optimizing upstream operations by integrating automation, AI-powered seismic interpretation, and digital twin technologies. Emerson's focus on software as a service (SaaS) and predictive analytics further strengthens its competitive advantage.

CGG (7-10%)

CGG is a leading international provider of geoscience imaging, reservoir characterization and processing services. The company is a leader in cloud-based geoscience applications and helps oil and gas operators make data-driven decisions in exploration. CGG’s ongoing investment in AI-driven subsurface digital-twins offers it life-blood and makes it a formidable rival in field operations and geophysical E&P software.

Other Key Players (18-28% Combined)

The market is highly fragmented with niche software-solution providers such as Petroleum Experts (Petex), GE Digital, ION Geophysical, KAPPA Engineering, and Paradigm. This covers things like production modeling, well test analysis, and geophysical data processing. Broadly, their innovations drive digital transformation in upstream oil and gas operations.

In terms of solution, the segment is segregated into Software and Services.

In terms of Operation Type, the segment is segregated into On Shore and Off Shore.

In terms of Industry, it is distributed into Oil & Gas and Mining & Metallurgy.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Global Exploration and Production (E&P) Software industry is projected to witness CAGR of 12.1% between 2025 and 2035.

The Global Exploration and Production (E&P) Software industry stood at USD 14,632.8 million in 2025.

The Global Exploration and Production (E&P) Software industry is anticipated to reach USD 52,973.9 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 13.0% in the assessment period.

The key players operating in the Global Exploration and Production (E&P) Software Industry Schlumberger, Halliburton, Baker Hughes, Emerson, CGG, Petroleum Experts (Petex), GE Digital, ION Geophysical, KAPPA Engineering, Paradigm (a subsidiary of Emerson).

Table1: Global Market Value (US$ Million) Analysis (2018 to 2022) By Solution

Table2: Global Market Value (US$ Million) Forecast (2023 to 2033) By Solution

Table3: Global Market Volume (‘000 Units) Forecast (2023 to 2033) By Solution

Table4: Global Market Value (US$ Million) Analysis (2018 to 2022) By Operation Type

Table5: Global Market Value (US$ Million) Forecast (2023 to 2033) By Operation Type

Table6: Global Market Value (US$ Million) Analysis (2018 to 2022) By Deployment Mode

Table7: Global Market Value (US$ Million) Forecast (2023 to 2033) By Deployment Mode

Table8: Global Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table9: Global Market Value (US$ Million) Forecast (2018 to 2022) By Industry

Table10: Global Market Value (US$ Million) Analysis (2018 to 2022) By Region

Table11: Global Market Value (US$ Million) Forecast (2023 to 2033) By Region

Table12: North America Market Value (US$ Million) Analysis (2018 to 2022) By Solution

Table13: North America Market Value (US$ Million) Forecast (2023 to 2033) By Solution

Table14: North America Market Value (US$ Million) Analysis (2018 to 2022) By Operation Type

Table15: North America Market Value (US$ Million) Forecast (2023 to 2033) By Operation Type

Table16: North America Market Value (US$ Million) Analysis (2018 to 2022) By Deployment Mode

Table17: North America Market Value (US$ Million) Forecast (2023 to 2033) By Deployment Mode

Table18: North America Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table19: North America Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table20: North America Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table21: North America Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table22: Latin America Market Value (US$ Million) Analysis (2018 to 2022) By Solution

Table23: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Solution

Table24: Latin America Market Value (US$ Million) Analysis (2018 to 2022) By Operation Type

Table25: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Operation Type

Table26: Latin America Market Value (US$ Million) Analysis (2018 to 2022) By Deployment Mode

Table27: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Deployment Mode

Table28: Lain America Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table29: Latin America Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table30: Latin America Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table31: Latin America Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table32: Europe Market Value (US$ Million) Analysis (2018 to 2022) By Solution

Table33: Europe Market Value (US$ Million) Forecast (2023 to 2033) By Solution

Table34: Europe Market Value (US$ Million) Analysis (2018 to 2022) By Operation Type

Table35: Europe Market Value (US$ Million) Forecast (2023 to 2033) By Operation Type

Table36: Europe Market Value (US$ Million) Analysis (2018 to 2022) By Deployment Mode

Table37: Europe Market Value (US$ Million) Forecast (2023 to 2033) By Deployment Mode

Table38: Europe Market Value (US$ Million) Analysis (2018 to 2022) By Industry

Table39: Europe Market Value (US$ Million) Forecast (2023 to 2033) By Industry

Table40: Europe Market Value (US$ Million) Analysis (2018 to 2022) by Country

Table41: Europe Market Value (US$ Million) Forecast (2023 to 2033) by Country

Table42: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) By Solution

Table43: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By Solution

Table44: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) By Operation Type

Table45: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By Operation Type

Table46: South Asia & Pacific Market Value (US$ Million) Analysis (2018 to 2022) By Deployment Mode

Table47: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) By Deployment Mode

Table48: East Asia Market Value (US$ Million) Analysis (2018 to 2022) By Solution

Table49: East Asia Market Value (US$ Million) Forecast (2023 to 2033) By Solution

Table50: East Asia Market Value (US$ Million) Analysis (2018 to 2022) By Operation Type

Figure 1: Global Market Size (US$ Million) and Y-o-Y Growth Rate from 2023 to 2033

Figure 2: Global Market Size and Y-o-Y Growth Rate from 2023 to 2033

Figure 3: Global Market Value (US$ Million), 2018 to 2022

Figure 4: Global Market Value (US$ Million), 2023 to 2033

Figure 5: Global Market Value Share Analysis (2023 to 2033) By Solution

Figure 6: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Solution

Figure 7: Global Market Attractiveness By Solution

Figure 8: Global Market Value Share Analysis (2023 to 2033) By Operation Type

Figure 9: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Operation Type

Figure 10: Global Market Attractiveness By Operation Type

Figure 11: Global Market Value Share Analysis (2023 to 2033) By Deployment Mode

Figure 12: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment Mode

Figure 13: Global Market Attractiveness By Deployment Mode

Figure 14: Global Market Value Share Analysis (2023 to 2033) By Industry

Figure 15: Global Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 16: Global Market Attractiveness By Industry

Figure 17: Global Market Attractiveness By Region

Figure 18: North America Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 19: Latin America Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 20: Europe Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 21: East Asia Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 22: South Asia & Pacific Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 23: Middle East & Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 24: North America Market Value (US$ Million), 2018 to 2022

Figure 25: North America Market Value (US$ Million), 2023 to 2033

Figure 26: North America Market Value Share Analysis (2023 to 2033) By Solution

Figure 27: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Solution

Figure 28: North America Market Attractiveness By Solution

Figure 29: North America Market Value Share Analysis (2023 to 2033) By Operation Type

Figure 30: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Operation Type

Figure 31: North America Market Attractiveness By Operation Type

Figure 32: North America Market Value Share Analysis (2023 to 2033) By Deployment Mode

Figure 33: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment Mode

Figure 34: North America Market Attractiveness By Deployment Mode

Figure 35: North America Market Value Share Analysis (2023 to 2033) By Industry

Figure 36: North America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 37: North America Market Attractiveness By Industry

Figure 38: North America Market Attractiveness By Country

Figure 39: USA Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 40: Canada Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 41: Latin America Market Value (US$ Million), 2018 to 2022

Figure 42: Latin America Market Value (US$ Million), 2023 to 2033

Figure 43: Latin America Market Value Share Analysis (2023 to 2033) By Solution

Figure 44: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Solution

Figure 45: Latin America Market Attractiveness By Solution

Figure 46: Latin America Market Value Share Analysis (2023 to 2033) By Operation Type

Figure 47: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Operation Type

Figure 48: Latin America Market Attractiveness By Operation Type

Figure 49: Latin America Market Value Share Analysis (2023 to 2033) By Deployment Mode

Figure 50: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment Mode

Figure 51: Latin America Market Attractiveness By Deployment Mode

Figure 52: Latin America Market Value Share Analysis (2023 to 2033) By Industry

Figure 53: Latin America Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 54: Latin America Market Attractiveness By Industry

Figure 55: Latin America Market Attractiveness By Country

Figure 56: Brazil Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 57: Mexico Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 58: Rest of Latin America Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 59: Europe Market Value (US$ Million), 2018 to 2022

Figure 60: Europe Market Value (US$ Million), 2023 to 2033

Figure 61: Europe Market Value Share Analysis (2023 to 2033) By Solution

Figure 62: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Solution

Figure 63: Europe Market Attractiveness By Solution

Figure 64: Europe Market Value Share Analysis (2023 to 2033) By Operation Type

Figure 65: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Operation Type

Figure 66: Europe Market Attractiveness By Operation Type

Figure 67: Europe Market Value Share Analysis (2023 to 2033) By Deployment Mode

Figure 68: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment Mode

Figure 69: Europe Market Attractiveness By Deployment Mode

Figure 70: Europe Market Value Share Analysis (2023 to 2033) By Industry

Figure 71: Europe Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 72: Europe Market Attractiveness By Industry

Figure 73: Europe Market Attractiveness By Country

Figure 74: Germany Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 75: Italy Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 76: France Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 77: UK Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 78: Spain Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 79: BENELUX Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 80: Nordics Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 81: Rest of Europe Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 82: South Asia & Pacific Market Value (US$ Million), 2018 to 2022

Figure 83: South Asia & Pacific Market Value (US$ Million), 2023 to 2033

Figure 84: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Solution

Figure 85: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Solution

Figure 86: South Asia & Pacific Market Attractiveness By Solution

Figure 87: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Operation Type

Figure 88: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Operation Type

Figure 89: South Asia & Pacific Market Attractiveness By Operation Type

Figure 90: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Deployment Mode

Figure 91: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment Mode

Figure 92: South Asia & Pacific Market Attractiveness By Deployment Mode

Figure 93: South Asia & Pacific Market Value Share Analysis (2023 to 2033) By Industry

Figure 94: South Asia & Pacific Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 95: South Asia & Pacific Market Attractiveness By Industry

Figure 96: South Asia & Pacific Market Attractiveness By Country

Figure 97: India Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 98: ASEAN Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 99: Australia& New Zealand Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 100: Rest of South Asia & Pacific Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 101: East Asia Market Value (US$ Million), 2018 to 2022

Figure 102: East Asia Market Value (US$ Million), 2023 to 2033

Figure 103: East Asia Market Value Share Analysis (2023 to 2033) By Solution

Figure 104: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Solution

Figure 105: East Asia Market Attractiveness By Solution

Figure 106: East Asia Market Value Share Analysis (2023 to 2033) By Operation Type

Figure 107: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Operation Type

Figure 108: East Asia Market Attractiveness By Operation Type

Figure 109: East Asia Market Value Share Analysis (2023 to 2033) By Deployment Mode

Figure 110: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment Mode

Figure 111: East Asia Market Attractiveness By Deployment Mode

Figure 112: East Asia Market Value Share Analysis (2023 to 2033) By Industry

Figure 113: East Asia Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 114: East Asia Market Attractiveness By Industry

Figure 115: East Asia Market Attractiveness By Country

Figure 116: China Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 117: Japan Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 118: South Korea Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 119: Middle East and Africa Market Value (US$ Million), 2018 to 2022

Figure 120: Middle East and Africa Market Value (US$ Million), 2023 to 2033

Figure 121: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Solution

Figure 122: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Solution

Figure 123: Middle East and Africa Market Attractiveness By Solution

Figure 124: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Operation Type

Figure 125: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Operation Type

Figure 126: Middle East and Africa Market Attractiveness By Operation Type

Figure 127: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Deployment Mode

Figure 128: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Deployment Mode

Figure 129: Middle East and Africa Market Attractiveness By Deployment Mode

Figure 130: Middle East and Africa Market Value Share Analysis (2023 to 2033) By Industry

Figure 131: Middle East and Africa Market Value Y-o-Y Growth Trend Analysis (2018 to 2033) By Industry

Figure 132: Middle East and Africa Market Attractiveness By Industry

Figure 133: Middle East and Africa Market Attractiveness By Country

Figure 134: GCC Countries Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 135: Turkey Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 136: Northern Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 137: South Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 138: Rest of Middle East and Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Mesh Nebulizer Market Size and Share Forecast Outlook 2025 to 2035

Dandruff Control Shampoos Market Size and Share Forecast Outlook 2025 to 2035

Candidiasis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Hand & Arm Protection (PPE) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA