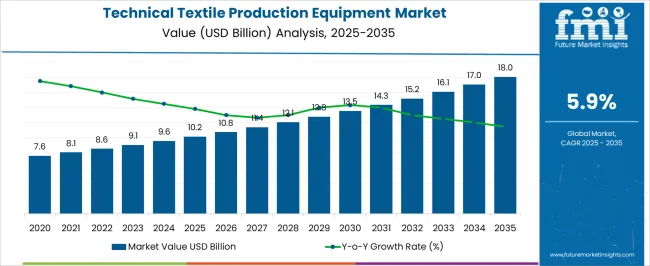

The technical textile production equipment market is estimated to be valued at USD 10.2 billion in 2025 and is projected to reach USD 18.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

Between 2021 and 2025, the market progresses from USD 7.6 billion to USD 10.2 billion, reflecting the early adoption phase where automated looms, knitting machines, and nonwoven production systems gain traction to meet the growing need for specialized textile applications. Yearly increments such as USD 8.1 billion in 2022, USD 8.6 billion in 2023, and USD 9.1 billion in 2024 illustrate consistent uptake across global manufacturing hubs. From 2026 to 2030, the market rises from USD 10.8 billion to USD 13.5 billion, contributing nearly 35% of the overall projected expansion.

This stage is driven by wider integration of digitalized equipment, energy-efficient technologies, and machinery designed for producing high-performance fibers with properties such as fire resistance, durability, and antimicrobial protection. By 2031 to 2035, the market climbs further from USD 14.3 billion to USD 18.0 billion, representing around 36% of total growth. This phase is marked by mainstream adoption of smart, sensor-enabled production systems, expansion of nonwoven technologies for hygiene and filtration, and increasing investments in equipment tailored for bio-based and recyclable textiles. The technical textile production equipment market demonstrates a strong and steady trajectory, supported by industrial innovation, shifting material preferences, and rising global demand for functional textile applications.

| Metric | Value |

|---|---|

| Technical Textile Production Equipment Market Estimated Value in (2025 E) | USD 10.2 billion |

| Technical Textile Production Equipment Market Forecast Value in (2035 F) | USD 18.0 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The technical textile production equipment market occupies a distinct position within the broader textile machinery and industrial fabric manufacturing ecosystem, representing approximately 4–6% of the global textile machinery industry, where spinning, weaving, and knitting equipment maintain a larger presence. Within specialized nonwoven and composite fabric production, technical textile machinery commands around 7–9%, supported by its capacity to deliver high-precision fiber orientation, uniform web formation, and enhanced tensile strength. In advanced industrial textile applications, including automotive, aerospace, and protective fabrics, these machines contribute close to 8–10%, driven by their ability to process high-performance fibers such as aramids, carbon, and glass without compromising material integrity.

Across healthcare and medical textiles, the share approaches 6–8%, reinforced by production of surgical gowns, masks, filtration media, and other hygiene-critical fabrics. In construction, geotextiles, and industrial filtration sectors, technical textile production equipment holds nearly 5–7% of the manufacturing machinery ecosystem, owing to its role in producing durable, high-strength fabrics for reinforcement and protective applications. While technical textile machinery remains a niche segment compared to conventional spinning and weaving systems, its adoption is rising due to growing demand for functional, high-performance fabrics across multiple industries. The deployment is further strengthened by increasing focus on precision manufacturing, quality control, and the ability to process innovative fiber blends, positioning technical textile production equipment as a critical enabler of advanced fabric solutions with potential for wider industrial integration and higher penetration across emerging industrial applications.

The market is undergoing significant expansion as industries increasingly adopt specialized machinery for producing high-performance textiles. Demand is being supported by the rapid growth of applications in automotive, healthcare, construction, and protective clothing, all requiring precise manufacturing capabilities. Advancements in automation, digital monitoring, and energy-efficient machinery are reshaping production processes, enabling higher productivity and better quality control.

The integration of Industry 4.0 principles, including IoT connectivity and predictive maintenance, is further enhancing operational efficiency across manufacturing facilities. Growing emphasis on sustainable production methods and the use of recyclable raw materials is encouraging investment in modernized equipment.

Global supply chain shifts and regional manufacturing incentives are also contributing to capacity expansion in multiple markets As end-user sectors demand greater material performance, the ability of production equipment to deliver customized, durable, and consistent technical textiles positions the market for sustained growth over the coming years.

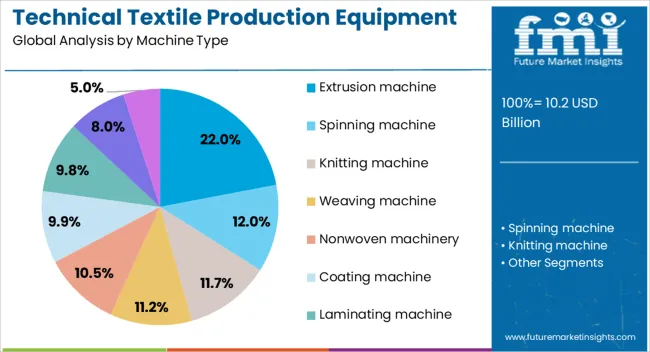

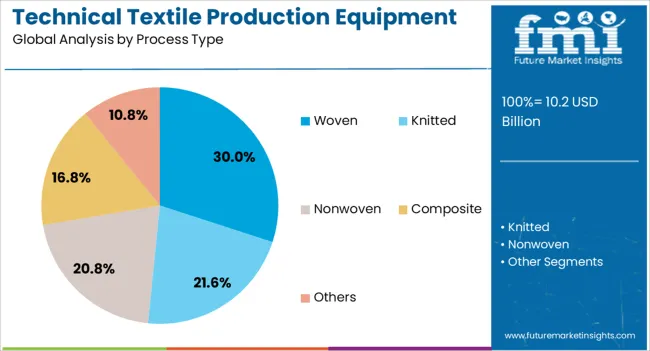

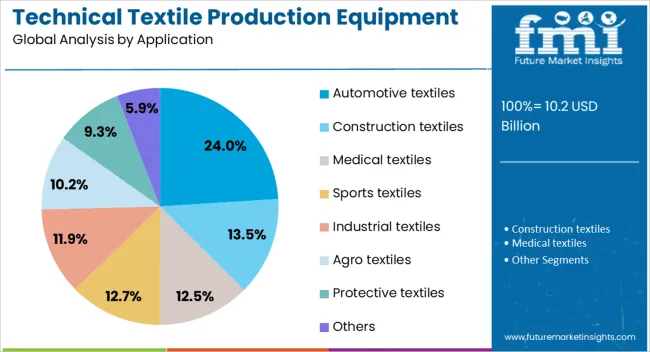

The technical textile production equipment market is segmented by machine type, process type, application, distribution channel, and geographic regions. By machine type, technical textile production equipment market is divided into extrusion machine, spinning machine, knitting machine, weaving machine, nonwoven machinery, coating machine, laminating machine, composite and bonding equipment, and others. In terms of process type, technical textile production equipment market is classified into woven, knitted, nonwoven, composite, and others. Based on application, technical textile production equipment market is segmented into automotive textiles, construction textiles, medical textiles, sports textiles, industrial textiles, agro textiles, protective textiles, and others. By distribution channel, technical textile production equipment market is segmented into direct sales and indirect sales. Regionally, the technical textile production equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The extrusion machine segment is projected to hold 22% of the market revenue share in 2025, making it the leading machine type. This leadership is attributed to the segment’s ability to produce continuous filament yarns and films with consistent quality, which are critical for technical textile applications. The adaptability of extrusion machines to process a wide range of polymers has expanded their application across diverse sectors.

Energy-efficient designs, higher throughput rates, and integration with automation systems have enhanced production economics for manufacturers. The use of advanced temperature and pressure control systems ensures uniformity in output, reducing wastage and improving material performance.

Additionally, extrusion machines have benefited from increased demand for nonwoven and composite materials, which require precise filament production The capability to adjust specifications quickly in response to changing product requirements has reinforced their role as the preferred choice for high-volume technical textile manufacturing.

The woven process type segment is expected to account for 30% of the market revenue share in 2025, making it the dominant process type. This segment’s growth has been driven by its ability to produce fabrics with exceptional strength, stability, and dimensional accuracy. Woven fabrics are essential in applications where durability and resistance to mechanical stress are critical, including industrial filters, geotextiles, and protective clothing.

The machinery used in woven textile production has evolved to support higher speeds, minimal downtime, and advanced control over weave patterns. Digital weaving technologies have allowed manufacturers to create complex fabric structures while maintaining consistent quality.

The woven process also offers versatility in combining different yarn types to achieve specific performance characteristics The reliability, precision, and adaptability of woven production methods have solidified their position as the preferred choice in high-performance textile manufacturing.

The automotive textiles application segment is projected to hold 24% of the market revenue share in 2025, leading the application segment. Growth in this area has been supported by increasing demand for advanced materials that enhance comfort, safety, and aesthetic appeal in vehicles.

Technical textiles in the automotive sector are used for seat covers, airbags, carpets, insulation, and reinforcement components, all requiring precise and efficient manufacturing processes. Production equipment capable of delivering consistent quality, integrating with automated assembly lines, and supporting high-volume output has been favored in this segment.

The push towards lightweight materials to improve fuel efficiency has further driven the use of specialized textiles, requiring machinery that can process innovative fibers and blends Compliance with stringent automotive safety and performance standards has reinforced the need for advanced production technologies, positioning the segment for sustained growth as automotive manufacturing continues to evolve globally.

Technical textile production equipment is expanding across automotive, medical, construction, and industrial sectors due to efficiency and precision. Increasing customization and high-performance fabric requirements are strengthening its adoption globally.

Technical textile production equipment is witnessing increased adoption in automotive and aerospace applications due to the growing need for lightweight, high-strength, and durable fabrics. These machines enable precise fiber orientation, uniform web formation, and enhanced mechanical properties required for airbags, seat belts, composite panels, and insulation materials. The ability to handle specialty fibers such as aramid, carbon, and glass allows manufacturers to meet strict industry standards for safety and performance. Additionally, the integration of automation in production lines ensures consistent fabric quality and reduced material waste. The demand is further amplified by the expansion of electric vehicles, aircraft seating, and insulation components, which require high-performance technical fabrics produced efficiently and reliably.

In healthcare, medical, and hygiene textile segments, technical textile production equipment is becoming essential for producing surgical gowns, masks, wound care products, and filtration media. These machines provide uniformity, contamination-free processing, and high throughput, which are critical for healthcare standards. Nonwoven and bonded fabrics manufactured with precision equipment meet stringent sterilization, tensile strength, and barrier property requirements. Hospitals, clinics, and diagnostic centers are increasingly driving demand for high-quality medical textiles. Manufacturers are investing in advanced equipment to maintain production capacity and meet global compliance standards. Growth is fueled by heightened awareness of infection control, preventive care, and increasing production of disposable hygiene products across emerging and developed regions.

Technical textile production equipment is widely utilized in producing geotextiles, industrial filtration fabrics, and reinforcement textiles for construction applications. The machinery supports high-precision manufacturing of fabrics that enhance durability, load-bearing capacity, and resistance to chemicals or environmental stress. Builders and industrial facilities prefer equipment capable of producing large volumes with consistent quality and structural integrity. Industrial filtration, including air, water, and chemical processing applications, relies on fabrics produced with specialized production systems to ensure reliability and efficiency. The adoption of such equipment is driven by the need for engineered textiles that meet project-specific requirements, including reinforcement, drainage, and protective barriers, with minimal defects and uniform performance across batches.

Manufacturers are increasingly adopting technical textile production equipment that allows flexible customization of fabrics for diverse industrial applications. Machines capable of varying fiber blends, layering patterns, and bonding techniques enable rapid product differentiation for automotive, defense, construction, and medical sectors. The ability to integrate monitoring systems ensures quality control and reduces downtime, which is critical for high-volume production. Efficiency improvements also come from modular designs that facilitate easy reconfiguration and maintenance, reducing operational costs. Production managers prioritize equipment that enhances speed, consistency, and operational safety while accommodating emerging functional requirements. This dynamic is driving broader acceptance of technical textile machinery across global industrial fabric manufacturing ecosystems.

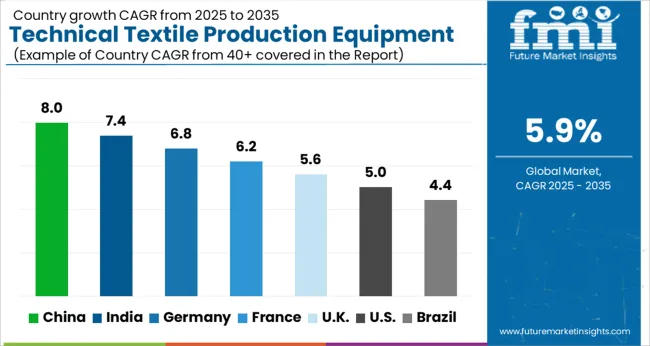

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

The technical textile production equipment market is projected to expand globally at a CAGR of 5.9% from 2025 to 2035. China leads at 8.0%, driven by large-scale automotive, construction, and industrial fabric manufacturing, alongside rising demand for high-performance nonwoven materials. India follows at 7.4% as growth in medical, hygiene, and protective textiles stimulates investments in advanced production machinery. France records 6.2%, supported by specialized production for automotive composites, aerospace textiles, and high-quality geotextiles. The UK posts 5.6% growth, where adoption is focused on industrial filtration fabrics and technical textiles for infrastructure projects. The USA remains moderate at 5.0%, with integration centered on protective fabrics, defense applications, and medical nonwovens. Asia leads momentum, with China and India steering the strongest expansion compared to European and North American markets.

The CAGR for the technical textile production equipment market in the United Kingdom stood at 4.7% during 2020–2024 and then improved to 5.6% in the 2025–2035 period. This upward trend was influenced by growing adoption in medical textile production, industrial filtration fabrics, and specialty protective textiles. The earlier period exhibited steady but moderate growth as applications remained concentrated on conventional protective fabrics and niche industrial textiles. Investments in modernizing machinery and improving production line efficiency contributed to the improved CAGR in the later period. Increased demand for high-precision, energy-efficient equipment for specialty textiles further reinforced growth. The United Kingdom strengthened its position as an important market within Europe’s technical textile machinery landscape.

The CAGR for the technical textile production equipment market in India was reported at 6.3% during 2020–2024 and expanded further to 7.4% in the 2025–2035 period. Growth in the early period was shaped by investments in nonwoven and composite textile machinery for medical, hygiene, and industrial fabrics. Later acceleration resulted from increasing demand for automotive composites, protective textiles, and filtration fabrics. Government initiatives supporting technical textile parks and industry clusters provided an additional boost. Machinery upgrades to enhance precision, efficiency, and throughput further contributed to the higher CAGR. Rising demand for high-performance textiles across construction, defense, and medical sectors strengthened India’s relevance in the Asia-Pacific technical textile equipment landscape.

The CAGR for China’s technical textile production equipment market stood at 7.1% during 2020–2024 and is projected to reach 8.0% in the 2025–2035 period. Early growth was driven by domestic demand for industrial, construction, and automotive technical textiles. The increase in CAGR during the later period was supported by higher adoption of machinery for protective textiles, high-strength composites, and nonwoven fabrics. Automation enabled precise fiber alignment and improved fabric durability, meeting industrial standards and global export requirements. Rising focus on output quality, efficiency, and machine versatility further strengthened China’s dominance in technical textile production equipment. Large-scale integration of advanced machinery reinforced the country’s leading position within the Asia-Pacific region.

The CAGR for the technical textile production equipment market in France was reported at 5.4% during 2020–2024 and is expected to rise to 6.2% during 2025–2035. Growth in the early period focused on aerospace composites, automotive specialty fabrics, and industrial filtration textiles. Machinery modernization was gradually adopted to ensure precision and consistency in processing complex fibers. In the forecast period, increasing demand for nonwoven fabrics for hygiene and medical applications, along with industrial and construction textile expansion, supported the higher CAGR. Investments in advanced fiber-handling machinery enabled higher output quality and operational efficiency. France maintained relevance by emphasizing high-value technical textiles and supporting specialized industrial production.

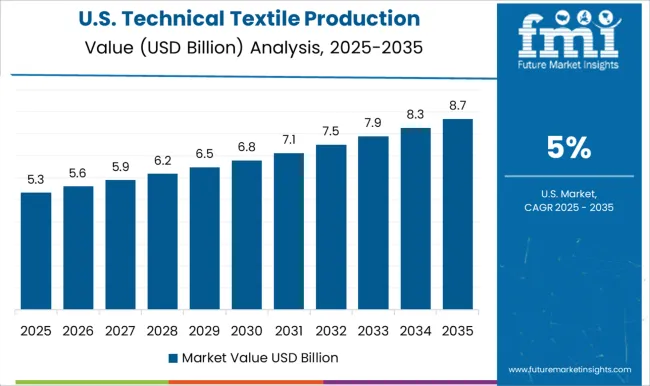

The CAGR for the technical textile production equipment market in the United States stood at 4.2% during 2020–2024 and improved to 5.0% in the 2025–2035 period. Growth during the earlier phase was moderate, supported primarily by adoption in industrial filtration, protective textiles, and automotive composites, while legacy textile machinery continued to dominate standard production lines. The improvement in CAGR during the forecast period was influenced by rising demand for high-performance fabrics in medical, automotive, and infrastructure applications, prompting machinery upgrades and line modernization. Investments in automation for precision fiber processing and composite fabric production further contributed to the higher growth rate. The adoption of advanced equipment to meet quality standards and regulatory compliance reinforced the United States’ relevance within North America’s technical textile machinery landscape.

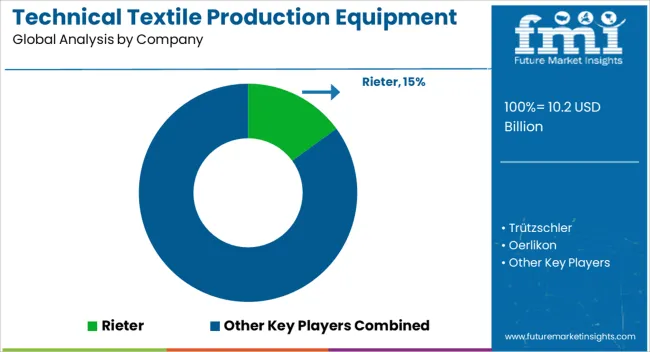

The technical textile production equipment market is influenced by a mix of multinational machinery manufacturers and specialized textile engineering firms that focus on precision, automation, and fiber handling expertise. Rieter holds a prominent position with a wide portfolio of spinning and carding machinery catering to nonwoven, industrial, and composite textiles. Trützschler remains a key player in carding, spinning, and nonwoven lines, supplying equipment to global technical textile producers. Oerlikon is recognized for advanced filament, synthetic fiber, and texturing machinery supporting automotive and industrial fabric production. Saurer and Karl Mayer strengthen the competitive landscape with weaving, knitting, and embroidery solutions for high-performance and protective fabrics.

Lindauer DORNIER focuses on precision weaving systems for industrial and medical textiles. Andritz, Picanol, Dilo, and Reifenhäuser provide specialized solutions in nonwovens, extrusion, and synthetic fiber lines, addressing hygiene, construction, and technical fabric sectors. Competitive differentiation in this market is defined by process efficiency, machinery versatility, precision handling of specialty fibers, and the ability to integrate automation and high-output production, making technical textile production equipment a pivotal segment within the global textile engineering ecosystem.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.2 billion |

| Machine Type | Extrusion machine, Spinning machine, Knitting machine, Weaving machine, Nonwoven machinery, Coating machine, Laminating machine, Composite and bonding equipment, and Others |

| Process Type | Woven, Knitted, Nonwoven, Composite, and Others |

| Application | Automotive textiles, Construction textiles, Medical textiles, Sports textiles, Industrial textiles, Agro textiles, Protective textiles, and Others |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Rieter, Trützschler, Oerlikon, Saurer, Karl Mayer, Lindauer DORNIER, Andritz, Picanol, Dilo, Reifenhäuser, and Others |

| Additional Attributes | Dollar sales, share by equipment type, share by fiber type, regional demand patterns, adoption trends in nonwoven, composite and protective fabrics, competitive positioning, machinery investment trends, and growth forecasts. |

The global technical textile production equipment market is estimated to be valued at USD 10.2 billion in 2025.

The market size for the technical textile production equipment market is projected to reach USD 18.0 billion by 2035.

The technical textile production equipment market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in technical textile production equipment market are extrusion machine, spinning machine, knitting machine, weaving machine, nonwoven machinery, coating machine, laminating machine, composite and bonding equipment and others.

In terms of process type, woven segment to command 30.0% share in the technical textile production equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Technical Films Market Size and Share Forecast Outlook 2025 to 2035

Technical Insulation Market Size and Share Forecast Outlook 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Analyzing Technical Films Market Share & Industry Leaders

Technical Fluids Market

Technical Enzymes Market Outlook – Growth, Demand & Forecast 2020 to 2030

Technical Textiles Market Growth - Trends & Forecast 2025 to 2035

Geotechnical Instrumentation And Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Textile Coatings Market Size and Share Forecast Outlook 2025 to 2035

Textile Machine Lubricants Market Size and Share Forecast Outlook 2025 to 2035

Textile Based pH Controllers Market Size and Share Forecast Outlook 2025 to 2035

Textile Transfer Paper Market Size and Share Forecast Outlook 2025 to 2035

Textile Waste Recycling Machine Market Size and Share Forecast Outlook 2025 to 2035

Textile Colorant Market – Trends & Forecast 2025 to 2035

Textile Recycling Market Analysis by Material, Source, Process, and Region: Forecast for 2025 and 2035

Textile Flooring Market Trends & Growth 2025 to 2035

Textile Tester Market Growth – Trends & Forecast 2025 to 2035

Textile Colors Market Growth - Trends & Forecast 2025 to 2035

Textile Testing, Inspection, and Certification (TIC) Market Insights - Growth & Forecast 2025 to 2035

Textile Staples Market Size & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA