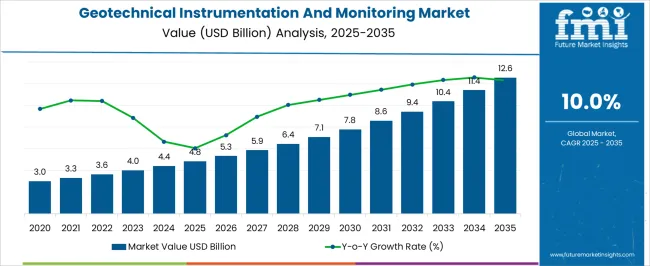

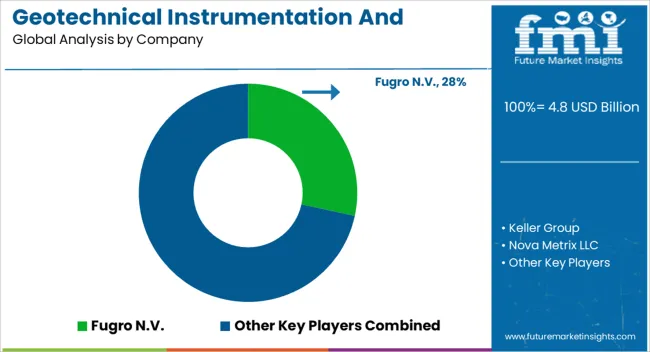

The geotechnical instrumentation and monitoring market is estimated to be valued at USD 4.8 billion in 2025 and is projected to reach USD 12.6 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period. The compound annual growth rate (CAGR) analysis reveals robust and consistent growth over the forecast period, driven by increasing demand for advanced monitoring systems in construction, mining, and infrastructure projects. Between 2025 and 2030, the market grows from USD 4.8 billion to USD 7.8 billion, contributing USD 3 billion in growth, with a CAGR of 12.4%. This early-phase growth is fueled by the rising need for real-time data to enhance safety, mitigate risks, and improve decision-making in large-scale geotechnical projects.

Additionally, government regulations mandating improved safety standards and infrastructure monitoring further drive adoption. From 2030 to 2035, the market is expected to expand from USD 7.8 billion to USD 12.6 billion, representing a growth of USD 4.8 billion, with a slightly lower CAGR of 8.7%. This deceleration reflects the market’s maturation as geotechnical instrumentation and monitoring solutions become mainstream. Despite the slower growth rate, demand remains strong due to ongoing technological innovations in sensors, automation, and data analytics, as well as continued infrastructure development in emerging economies. The overall CAGR of 10.0% highlights steady expansion, driven by increasing adoption of geotechnical monitoring technologies across various industries.

| Metric | Value |

|---|---|

| Geotechnical Instrumentation And Monitoring Market Estimated Value in (2025 E) | USD 4.8 billion |

| Geotechnical Instrumentation And Monitoring Market Forecast Value in (2035 F) | USD 12.6 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The geotechnical instrumentation and monitoring market is gaining momentum due to increasing infrastructure development, growing focus on structural health monitoring, and rising awareness of geohazard risks. Governments and private stakeholders are prioritizing the safety and longevity of infrastructure assets, including tunnels, bridges, dams, and high-rise buildings.

This is encouraging widespread adoption of monitoring solutions that offer real-time data on ground movements, structural shifts, and stress distribution. Integration of data analytics, cloud connectivity, and automation has improved system reliability and decision-making.

The regulatory environment has also evolved to mandate more robust monitoring during and after construction, further accelerating market growth. As urban expansion continues and infrastructure investments increase globally, the demand for advanced monitoring systems is expected to remain strong across both developed and emerging economies.

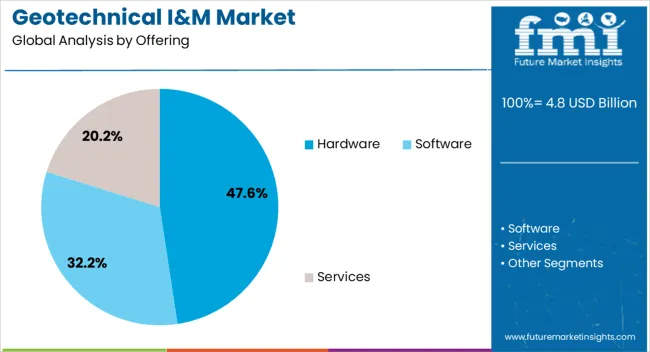

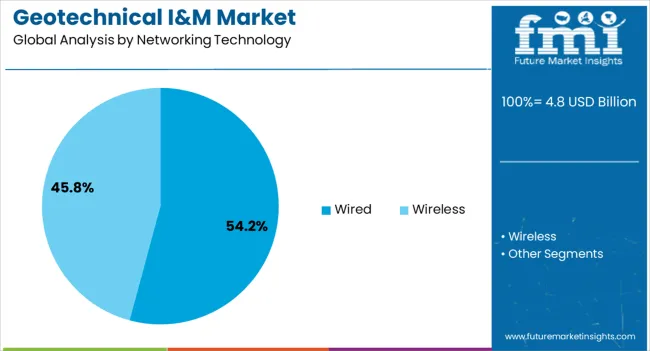

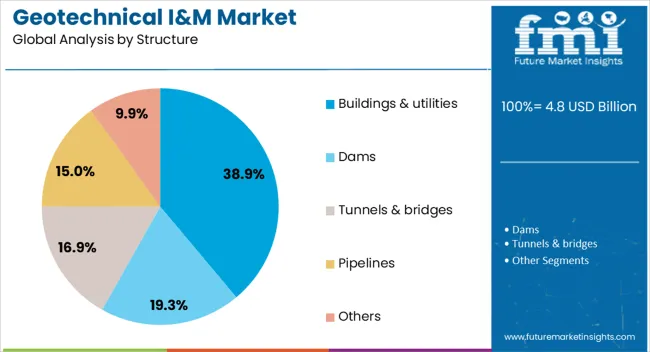

The geotechnical instrumentation and monitoring market is segmented by offering, networking technology, structure, end-use industry, and geographic regions. By offering, the geotechnical instrumentation and monitoring market is divided into Hardware, Software, and Services. In terms of networking technology, the geotechnical instrumentation and monitoring market is classified into Wired and Wireless. Based on structure, the geotechnical instrumentation and monitoring market is segmented into Buildings & utilities, Dams, Tunnels & bridges, Pipelines, and Others. By end-use industry, the geotechnical instrumentation and monitoring market is segmented into Energy, Mining, Building & infrastructure, Oil & gas, and Others. Regionally, the geotechnical instrumentation and monitoring industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment is expected to account for 47.60% of total market revenue by 2025 within the offering category, making it the largest contributor. This growth is driven by the essential role of sensors, data loggers, and other field devices in collecting precise and continuous geotechnical data.

The increasing need for durable, accurate, and field-deployable hardware systems has led to sustained investment in robust device development. Industries are prioritizing hardware that can operate under harsh environmental conditions while maintaining consistent data transmission.

With infrastructure projects requiring real-time condition assessments, the dependence on advanced hardware components has intensified, reinforcing their dominance in the offering category.

The wired segment is projected to hold 54.20% of total revenue by 2025 under the networking technology category, emerging as the leading segment. This is attributed to its reliability, reduced latency, and consistent data transmission over long monitoring periods.

In critical infrastructure projects, wired systems are preferred for their immunity to external interference and lower maintenance requirements. Unlike wireless alternatives, wired setups offer better performance in underground and high-density material environments where signal attenuation is a concern.

As structural health monitoring requires high precision and data continuity, the adoption of wired technology continues to be prioritized, securing its leadership position in this segment.

The buildings and utilities segment is expected to represent the largest share of the market by 2025 under the structure category. Rapid urbanization, increased construction activity in seismic and flood-prone zones, and aging infrastructure across major cities are primary drivers.

Structural monitoring is being embedded into buildings and utility facilities to assess stress, vibration, and tilt in real time, supporting proactive maintenance and ensuring occupant safety. Moreover, regulatory standards and insurance requirements are pushing for more comprehensive monitoring frameworks during both construction and operational phases.

The heightened focus on smart infrastructure and safety compliance has made this segment the core area of application within the geotechnical instrumentation and monitoring landscape.

The geotechnical instrumentation and monitoring market is growing as industries increasingly rely on advanced technology to monitor and assess the integrity of infrastructure projects. These solutions, which include sensors, data loggers, and monitoring systems, are essential for evaluating soil stability, structural health, and environmental conditions in construction, mining, and civil engineering projects. As safety regulations tighten and the need for real-time data in large-scale projects rises, the demand for geotechnical instrumentation and monitoring systems is set to expand. The market is also benefiting from technological advancements that allow for more accurate, reliable, and cost-effective monitoring solutions.

The primary driver behind the growth of the geotechnical instrumentation and monitoring market is the increasing need for safety and structural monitoring in infrastructure projects. With the rise in construction, mining, and civil engineering activities, ensuring the stability and safety of structures is critical to preventing accidents and maintaining operational efficiency. Geotechnical instruments are used to measure parameters such as soil movement, groundwater levels, and vibration, providing real-time data that helps to predict potential risks. The growing importance of safety standards and the desire to mitigate risks in projects are driving the adoption of advanced monitoring systems. As infrastructure projects become more complex and large-scale, the need for precise, continuous monitoring is becoming essential, further driving market demand.

The geotechnical instrumentation and monitoring market faces several challenges, mainly related to high initial costs and technical limitations. The sophisticated nature of these systems, including the required sensors, data loggers, and installation, can be expensive for businesses, particularly smaller contractors or projects with limited budgets. The technical complexity of geotechnical monitoring systems can make it difficult to implement and maintain them effectively. For instance, the integration of various monitoring devices into a cohesive system can require specialized expertise. External factors like environmental conditions can affect the accuracy of readings, which may limit the effectiveness of monitoring systems in certain applications. Overcoming these challenges, such as reducing system costs and improving technical efficiency, is vital for accelerating market growth and adoption.

The geotechnical instrumentation and monitoring market presents significant opportunities due to advancements in automation and remote monitoring technologies. Automation is making it easier to collect, analyze, and manage geotechnical data, reducing the need for manual labor and enabling real-time decision-making. The integration of IoT (Internet of Things) technologies is allowing for remote monitoring of geotechnical conditions, improving data accessibility and reducing operational costs. Advancements in sensor technology are enabling more accurate and long-lasting instruments, which are critical for large infrastructure projects. The increasing focus on smart cities and infrastructure development, especially in emerging markets, also presents growth opportunities for geotechnical instrumentation and monitoring systems. As demand for real-time, efficient monitoring grows, there will be greater investment in automated and remote solutions, further driving market expansion.

A major trend in the geotechnical instrumentation and monitoring market is the increasing integration of advanced data analytics and IoT technologies. IoT-connected geotechnical instruments allow for continuous monitoring and real-time data transmission, enabling engineers to assess potential risks and take corrective actions immediately. With the integration of cloud-based platforms, data collected from various monitoring systems can be accessed from anywhere, providing increased flexibility and control. The use of advanced data analytics allows for more accurate predictions of structural performance, helping to optimize project management and reduce the risk of failure. As industries increasingly adopt smart technologies, geotechnical instrumentation systems are becoming more advanced, offering enhanced efficiency, accuracy, and ease of use in complex monitoring applications across industries such as construction, mining, and infrastructure development.

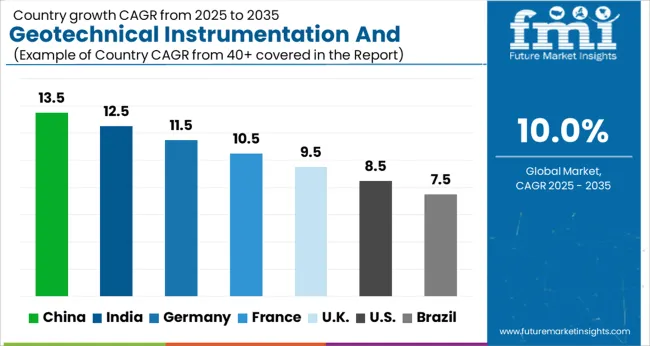

The geotechnical instrumentation and monitoring market is projected to grow at a global CAGR of 10.0% from 2025 to 2035. China leads the market with a growth rate of 13.5%, followed by India at 12.5%. France records a growth rate of 10.5%, while the UK shows 9.5% and the USA. follows at 8.5%. The market is primarily driven by the increasing demand for advanced monitoring solutions in construction, infrastructure development, and mining industries. China and India are leading the growth, supported by rapid urbanization and large-scale infrastructure projects. Developed markets like France, the UK, and the USA are witnessing steady growth as the demand for geotechnical solutions in monitoring and risk management continues to rise. The analysis spans over 40+ countries, with the leading markets shown below.

The geotechnical instrumentation and monitoring market in India is expanding at a 13.5% CAGR, supported by the rapid infrastructure development and urbanization. The increasing number of large-scale construction projects, such as high-rise buildings, bridges, and tunnels, has led to a significant demand for advanced geotechnical monitoring systems. These systems help manage risks related to soil behavior, ground stability, and structural integrity. China’s government initiatives focused on improving construction safety standards and infrastructure monitoring are also driving the adoption of geotechnical instruments. With substantial investments in public infrastructure and smart city projects, the demand for geotechnical instrumentation will continue to grow in the coming years.

The geotechnical instrumentation and monitoring market in India is expected to grow at a 12.5% CAGR, driven by the country’s increasing infrastructure investments and industrial growth. As India continues to modernize its infrastructure and expand its urban areas, the demand for geotechnical monitoring solutions is rising. These solutions help ensure the stability and safety of construction projects, particularly in high-risk areas. India’s growing focus on smart city initiatives and large infrastructure projects such as metros, highways, and dams is further supporting the market. The emphasis on minimizing construction risks and ensuring structural integrity is encouraging the adoption of geotechnical instruments.

The geotechnical instrumentation and monitoring market is projected to grow at a 10.5% CAGR, driven by the country’s ongoing infrastructure development and safety regulations. France’s construction and mining industries, which require precise monitoring of soil and ground stability, are increasing their reliance on geotechnical instruments to ensure the safety and quality of projects. Government regulations aimed at improving construction safety standards are also pushing the adoption of advanced geotechnical solutions. As France continues to focus on energy-efficient building projects, the demand for geotechnical instrumentation and monitoring systems will grow, further supporting the market.

The UK geotechnical instrumentation and monitoring market is expected to grow at a 9.5% CAGR, driven by the country’s focus on infrastructure modernization and safety improvements. The growing demand for geotechnical monitoring solutions in construction projects, including tunnels, bridges, and skyscrapers, is supporting market growth. The UK government’s stringent safety regulations and emphasis on risk management have increased the need for advanced geotechnical instruments to monitor ground behavior and structural health. the UK is investing in several large-scale infrastructure projects, such as high-speed rail and urban development, which further fuels demand for monitoring solutions in the geotechnical sector.

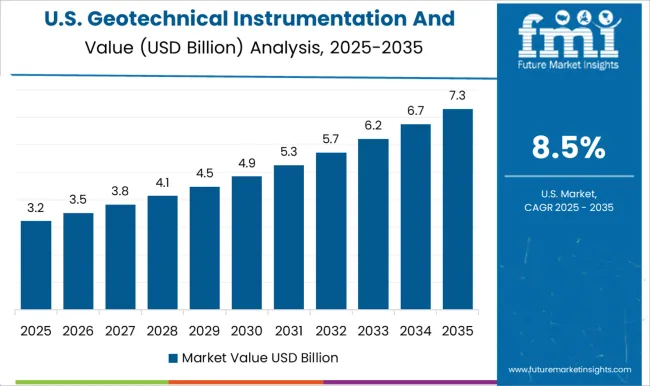

The USA geotechnical instrumentation and monitoring market is projected to grow at an 8.5% CAGR, fueled by the rising demand for monitoring technologies in construction, mining, and energy sectors. As infrastructure projects grow in complexity, especially in urban areas, the need for precise geotechnical solutions is increasing. The USA market benefits from strong regulatory frameworks that promote the use of geotechnical monitoring systems to ensure safety and minimize risk. The USA government’s focus on infrastructure renewal and sustainability initiatives is further contributing to the market’s growth. The adoption of geotechnical instruments is also growing in the energy and natural resources sectors to monitor soil conditions and ensure operational safety.

Fugro N.V. delivers design, installation, and operation of structural and geotechnical monitoring systems for infrastructure and construction projects. Keller Group provides geotechnical and structural monitoring through its affiliate GEO Instruments, covering real-time site monitoring and risk mitigation. Nova Metrix LLC operates a portfolio of geotechnical instrumentation brands supplying sensors, data loggers, and software. GEOKON, Inc. manufactures instruments such as piezometers, inclinometers, and strain gauges for long-term monitoring.

Geocomp Corporation offers geotechnical and structural monitoring services and data systems for construction and infrastructure. Sisgeo S.r.l. manufactures a wide range of instruments for geotechnical and structural monitoring. COWI A/S is an engineering consultancy that delivers structural health monitoring on complex infrastructure.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.8 Billion |

| Offering | Hardware, Software, and Services |

| Networking Technology | Wired and Wireless |

| Structure | Buildings & utilities, Dams, Tunnels & bridges, Pipelines, and Others |

| End-use Industry | Energy, Mining, Building & infrastructure, Oil & gas, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Fugro N.V., Keller Group, Nova Metrix LLC, Geokon Instruments, Inc., Geocomp Corporation, Sisgeo S.r.l., and COWI A/S |

| Additional Attributes | Dollar sales by product type (displacement sensors, strain gauges, piezometers, load cells, inclinometers, temperature sensors) and end-use segments (construction, mining, energy, infrastructure). Demand dynamics are influenced by the increasing need for structural integrity monitoring, the growing focus on safety in infrastructure projects, and the rise in demand for real-time, automated geotechnical data collection and analysis. Regional trends show strong growth in North America and Europe, where regulatory standards for construction and infrastructure safety are stringent, while Asia-Pacific is expanding due to increased infrastructure development in emerging markets. |

The global geotechnical instrumentation and monitoring market is estimated to be valued at USD 4.8 billion in 2025.

The market size for the geotechnical instrumentation and monitoring market is projected to reach USD 12.6 billion by 2035.

The geotechnical instrumentation and monitoring market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in geotechnical instrumentation and monitoring market are hardware, software and services.

In terms of networking technology, wired segment to command 54.2% share in the geotechnical instrumentation and monitoring market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Instrumentation and Control Devices Market Growth – Trends & Forecast 2024-2034

Instrumentation Valve and Fitting Market Trends & Forecast for 2025 to 2035

PLTC Instrumentation Cable Market Size and Share Forecast Outlook 2025 to 2035

Safety Instrumentation Systems Market – Trends & Forecast 2025 to 2035

Modular Instrumentation Platform Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Process Instrumentation Market Growth - Trends & Forecast 2025 to 2035

Microplate Instrumentation and Supplies Market Growth - Trends & Forecast 2025 to 2035

Microplate Instrumentation and Systems Market Growth - Trends & Forecast 2025 to 2035

Synchrotron Instrumentation Market Size and Share Forecast Outlook 2025 to 2035

Chromatography Instrumentation Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Instrumentation Market Size, Growth, and Forecast 2025 to 2035

Water Analysis Instrumentation Market Analysis – Size, Share, and Forecast 2025 to 2035

Water Automation & Instrumentation Market Trends & Forecast by Process Stage, Automation Technology, Instrumentation, End-User and Region through 2035

Process Automation and Instrumentation Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Process Automation and Instrumentation Market Share & Provider Insights

Monitoring Tool Market Size and Share Forecast Outlook 2025 to 2035

Pet Monitoring Camera Market Size and Share Forecast Outlook 2025 to 2035

Pain Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Dose Monitoring Devices Market - Growth & Demand 2025 to 2035

Brain Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA