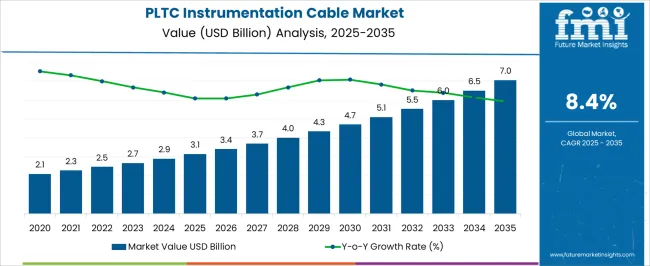

The PLTC instrumentation cable market is estimated to be valued at USD 3.1 billion in 2025 and is projected to reach USD 7.0 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period. The 10-year growth comparison of the PLTC instrumentation cable market reveals a steady and robust expansion. During the early years, growth is expected to be consistent, with values increasing from USD 3.1 billion in 2025 to USD 3.4 billion in 2026 and reaching USD 4 billion by 2028. This upward trajectory indicates a rising demand for high-quality instrumentation cables across industries such as industrial automation, power generation, and process control, where precision, reliability, and safety in signal transmission are critical.

By 2035, the PLTC instrumentation cable market is projected to more than double in size, reaching USD 7 billion. The steady growth pattern reflects the continued emphasis on durable, efficient, and high-performance cable solutions to support complex industrial operations. Industries increasingly rely on instrumentation cables to ensure accurate monitoring, control, and communication in harsh and demanding environments. This trend highlights the market’s critical role in enabling operational reliability and efficiency, offering significant opportunities for manufacturers and suppliers who provide certified, high-performance cable solutions designed to meet evolving industrial standards and rigorous application requirements.

| Metric | Value |

|---|---|

| PLTC Instrumentation Cable Market Estimated Value in (2025 E) | USD 3.1 billion |

| PLTC Instrumentation Cable Market Forecast Value in (2035 F) | USD 7.0 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The PLTC instrumentation cable market is a specialized segment within the broader electrical cables and wires market, where it holds approximately 3-4% share, driven by its critical role in transmitting signals for control, monitoring, and instrumentation applications. In the industrial automation market, PLTC instrumentation cables account for about a 4-5% share, as they are essential for connecting sensors, controllers, and actuators, ensuring accurate data flow and efficient automated operations.

Within the process control and instrumentation market, these cables capture roughly a 5-6% share, reflecting their widespread use in industries such as oil and gas, chemicals, and pharmaceuticals, where precise monitoring and signal integrity are paramount. In the energy and power distribution market, the segment represents around a 2-3% share, as PLTC cables are primarily used for instrumentation rather than bulk power transmission, supporting substation and control room operations.

In the industrial machinery and equipment market, the share is close to 3-4%, as these cables facilitate reliable communication between machine components and control systems, enhancing operational efficiency.

The PLTC instrumentation cable market is expanding steadily, driven by the need for reliable communication and signal transmission in critical industrial environments. The market benefits from stringent safety norms in hazardous areas, rising automation levels, and demand for precision monitoring in industries such as oil & gas, utilities, and process manufacturing.

Innovations in insulation materials, fire resistance, and shielding capabilities have improved the operational reliability of these cables in both onshore and offshore installations. As industries continue transitioning toward digital control systems, the use of PLTC-rated cables is gaining prominence for secure, interference-resistant performance across complex setups.

Government-led infrastructure modernization and increasing investment in industrial IoT systems further support market momentum.

The PLTC instrumentation cable market is segmented by type, end use, and geographic regions. By type, the PLTC instrumentation cable market is divided into overall shielded pairs/triads and individual shielded pairs. In terms of end use, the PLTC instrumentation cable market is classified into Oil & gas, Chemical, Process automation, Manufacturing, and Others. Regionally, the PLTC instrumentation cable industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

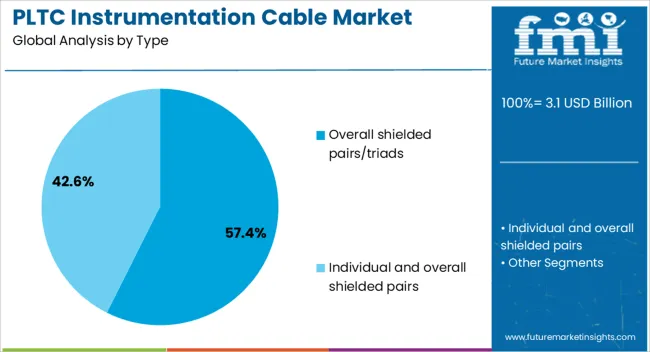

The overall shielded pairs/triads segment is expected to lead the market with 57.40% share in 2025, making it the dominant cable type. This leadership stems from its superior protection against electromagnetic interference (EMI), which is crucial in signal-critical applications.

Industries with sensitive instrumentation systems, especially in hazardous or high-noise environments, prefer shielded configurations for maintaining signal integrity and reducing downtime. The design flexibility offered by triads and paired structures enables customized installations, supporting a variety of analog and digital signal needs.

As data accuracy and regulatory compliance become increasingly vital in automated plants, shielded cable types are projected to remain the top choice for long-term industrial deployment.

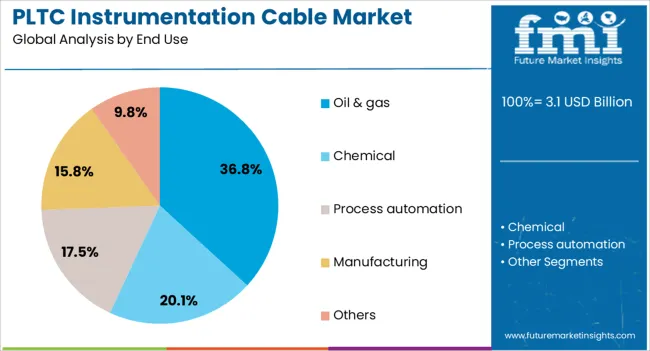

Oil & gas is projected to account for 36.80% of the PLTC instrumentation cable market share in 2025, emerging as the leading end-use sector. The segment’s dominance is driven by the critical need for reliable communication systems in exploration, drilling, and production environments.

From offshore rigs to downstream facilities, harsh conditions and explosive atmospheres demand cables that comply with stringent safety standards such as NEC Article 725 and Class I, Div 2 specifications. PLTC-rated cables meet these needs while offering robust resistance to oil, chemicals, and mechanical wear.

The ongoing digitalization of upstream and midstream operations, especially in remote monitoring and control systems, is expected to reinforce demand in this high-stakes industry further.

The PLTC instrumentation cable market is expanding due to rising demand from industrial automation, process control, and infrastructure projects. Opportunities exist in customized, high-performance solutions, while trends emphasize regulatory compliance and safety standards. Challenges include raw material cost volatility and competitive pressures. Overall, the market outlook remains positive, driven by increasing industrial automation, smart infrastructure adoption, and the need for reliable, safe, and high-performance cabling solutions across various sectors globally.

The PLTC (Power-Limited Tray Cable) instrumentation cable market is witnessing increased demand due to growing industrial automation, infrastructure expansion, and process control applications. Industries such as oil & gas, power generation, chemical processing, and manufacturing require reliable cabling solutions for signal transmission, instrumentation, and control. PLTC cables offer enhanced safety, flexibility, and flame resistance, making them ideal for complex industrial environments. Expansion of smart factories and automated plants is further driving the adoption of high-quality instrumentation cabling solutions globally.

Significant opportunities are emerging in providing customized and high-performance PLTC cables tailored for specialized industrial applications. Cables with advanced insulation, UV resistance, and corrosion protection are gaining traction for offshore, chemical, and power sector projects. Manufacturers offering cables that support longer runs, higher voltage ratings, and multi-core configurations are well-positioned to capitalize on market growth. Additionally, emerging markets with expanding industrial and energy infrastructure present new avenues for adoption, particularly in regions investing in automation and smart plant initiatives.

A key trend shaping the market is adherence to rigorous safety standards and regulatory compliance. PLTC cables are increasingly designed to meet NEC, UL, and IEC certifications, ensuring flame retardancy, low smoke emission, and reliable performance under hazardous conditions. Industries are prioritizing cables that reduce fire risk and support long-term operational safety. Integration of digital instrumentation and IoT-based monitoring is also driving demand for cables that maintain signal integrity under high electromagnetic interference (EMI) conditions, reflecting the broader trend toward safer and more connected industrial environments.

The PLTC instrumentation cable market faces challenges from fluctuating raw material costs, particularly copper and specialized polymer insulation. Price volatility can impact project budgets and limit adoption in cost-sensitive sectors. Additionally, intense competition among cable manufacturers pressures profit margins and compels continuous product innovation. Supply chain disruptions and regional variations in standards also add complexity to market operations. Overcoming these challenges requires cost-efficient manufacturing, diversified sourcing, and adherence to international standards to maintain product reliability while remaining competitive.

| Country | CAGR |

|---|---|

| China | 11.3% |

| India | 10.5% |

| Germany | 9.7% |

| France | 8.8% |

| UK | 8.0% |

| USA | 7.1% |

| Brazil | 6.3% |

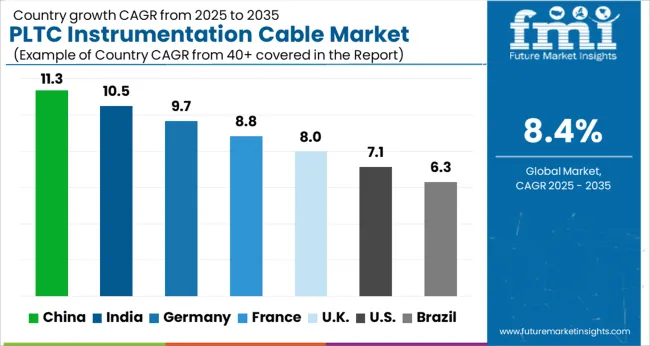

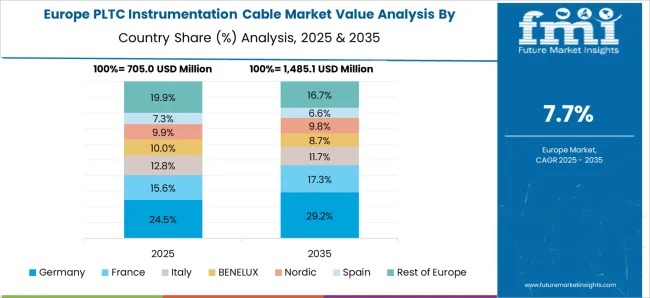

The global PLTC instrumentation cable market is projected to grow at a CAGR of 8.4% from 2025 to 2035. China leads with a growth rate of 11.3%, followed by India at 10.5% and Germany at 9.7%. The United Kingdom records a growth rate of 8%, while the United States shows the slowest growth at 7.1%. Expansion is supported by rising industrial automation, energy infrastructure development, and increasing demand for reliable instrumentation systems. Emerging economies like China and India benefit from rapid industrial growth and manufacturing expansion, while developed countries such as Germany, UK, and USA focus on advanced monitoring, energy efficiency, and compliance with industrial safety standards. This report includes insights on 40+ countries; the top markets are shown here for reference.

The PLTC instrumentation cable market in China is growing at 11.3% CAGR, the highest among leading countries. Growth is driven by industrial automation, renewable energy projects, and large-scale manufacturing facilities. Domestic manufacturers are expanding production capacity and introducing high-performance, durable cables to meet energy and instrumentation requirements. Adoption is further accelerated by smart factories, process monitoring systems, and infrastructure modernization initiatives. Strong government support for industrial expansion reinforces market growth.

The PLTC instrumentation cable market in India is advancing at 10.5% CAGR, fueled by rising manufacturing, energy, and process automation sectors. Industrial facilities increasingly adopt high-performance instrumentation cables for safety, monitoring, and operational efficiency. Domestic production and technology partnerships with global suppliers enhance availability and reliability. Expansion of energy infrastructure and process industries, including oil, gas, and chemicals, further boosts adoption. Growing awareness of industrial safety standards accelerates demand across multiple sectors.

The PLTC instrumentation cable market in Germany is growing at 9.7% CAGR, supported by advanced manufacturing, industrial automation, and energy sector modernization. German manufacturers adopt high-performance, flame-retardant, and durable cables for process monitoring and safety applications. Automation in automotive, chemicals, and industrial machinery contributes to steady demand. Regulatory standards for industrial safety and energy efficiency reinforce adoption. The market also benefits from modernization of existing industrial plants and smart manufacturing initiatives.

The PLTC instrumentation cable market in the United Kingdom is expanding at 8% CAGR, influenced by industrial automation, energy, and process industries. Adoption of high-performance cables is driven by monitoring, control, and safety applications in manufacturing and energy sectors. Infrastructure upgrades and industrial modernization projects further fuel market growth. Manufacturers are increasingly offering durable, flame-retardant, and reliable cables to meet strict industrial and safety requirements.

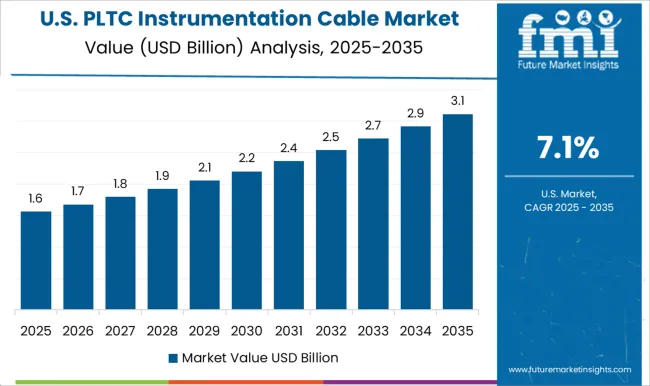

The PLTC instrumentation cable market in the United States is growing at 7.1% CAGR, the slowest among leading countries. Growth is supported by industrial automation, energy, and process monitoring needs. Adoption of high-reliability cables is emphasized for manufacturing, oil, gas, and energy infrastructure applications. Upgrades of aging facilities and integration with smart systems enhance demand. Manufacturers are focusing on flame-retardant, durable, and high-performance cables to ensure safety and operational efficiency.

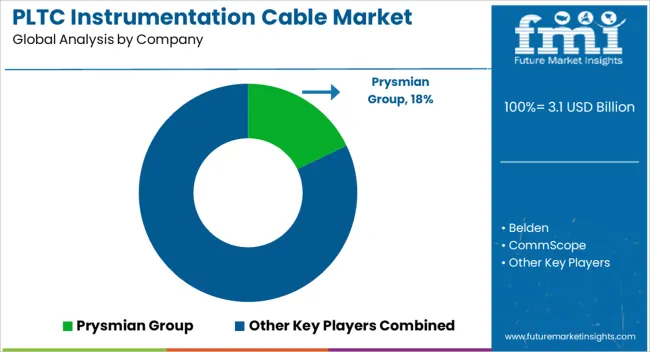

Leading suppliers in the PLTC instrumentation cable market, such as Prysmian Group, Belden, and CommScope, are competing by providing high-performance cables engineered for reliable signal transmission in industrial, automation, and control systems. Prysmian Group emphasizes cables that meet rigorous safety and electrical standards, with brochures highlighting flame retardancy, low signal loss, and mechanical robustness. Belden focuses on precision-engineered solutions for complex instrumentation networks, promoting durability and long-term reliability. CommScope and Elsewedy Electric present products designed for high-density installations, emphasizing flexibility, ease of routing, and minimal maintenance.

Fujikura and Furukawa Electric highlight advanced insulation and shielding technologies that protect against interference and environmental stresses, ensuring consistent performance in demanding conditions. Other key players, including Helukabel, Lapp Group, and LS Cable & Systems, differentiate through customizable cable constructions, catering to specific industrial and automation applications. Nexans, NKT, and Polycab emphasize global availability and standardized compliance, positioning themselves as reliable partners for large-scale projects. Kabelwerk Eupen, Shawcor, Sumitomo, Technikabel, and TFKable focus on specialized solutions such as high-temperature, chemical-resistant, or multi-conductor configurations, appealing to niche markets. Product brochures consistently highlight performance metrics, certification standards, and application suitability, framing cables as critical enablers of precise and safe instrumentation systems. Market competition is driven by quality, regulatory compliance, and the ability to provide tailored solutions for complex industrial networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.1 Billion |

| Type | Overall shielded pairs/triads and Individual and overall shielded pairs |

| End Use | Oil & gas, Chemical, Process automation, Manufacturing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Prysmian Group, Belden, CommScope, Elsewedy Electric, Fujikura, Furukawa Electric, Helukabel, Hellenic Group, Kabelwerk Eupen, Lapp Group, Leoni, LS Cable & Systems, Nexans, NKT, Polycab, Shawcor, Sumitomo, Technikabel, and TFKable |

| Additional Attributes | Dollar sales by cable type (single-core, multi-core) and insulation material (PVC, XLPE) are key metrics. Trends include growing demand for reliable, flexible instrumentation cables in industrial and automation applications, along with increasing focus on safety and fire resistance. Regional adoption, technological advancements, and regulatory compliance are driving market growth. |

The global PLTC instrumentation cable market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the PLTC instrumentation cable market is projected to reach USD 7.0 billion by 2035.

The PLTC instrumentation cable market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in PLTC instrumentation cable market are overall shielded pairs/triads and individual and overall shielded pairs.

In terms of end use, oil & gas segment to command 36.8% share in the PLTC instrumentation cable market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Instrumentation Valve and Fitting Market Trends & Forecast for 2025 to 2035

Instrumentation and Control Devices Market Growth – Trends & Forecast 2024-2034

Safety Instrumentation Systems Market – Trends & Forecast 2025 to 2035

Modular Instrumentation Platform Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Process Instrumentation Market Growth - Trends & Forecast 2025 to 2035

Microplate Instrumentation and Supplies Market Growth - Trends & Forecast 2025 to 2035

Microplate Instrumentation and Systems Market Growth - Trends & Forecast 2025 to 2035

Synchrotron Instrumentation Market Size and Share Forecast Outlook 2025 to 2035

Geotechnical Instrumentation And Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Chromatography Instrumentation Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Instrumentation Market Size, Growth, and Forecast 2025 to 2035

Water Analysis Instrumentation Market Analysis – Size, Share, and Forecast 2025 to 2035

Water Automation & Instrumentation Market Trends & Forecast by Process Stage, Automation Technology, Instrumentation, End-User and Region through 2035

Process Automation and Instrumentation Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Process Automation and Instrumentation Market Share & Provider Insights

Cable Line Fault Indicator Market Size and Share Forecast Outlook 2025 to 2035

Cable Tray Market Size and Share Forecast Outlook 2025 to 2035

Cable Granulator Market Size and Share Forecast Outlook 2025 to 2035

Cable Distribution Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Cable Accessories Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA