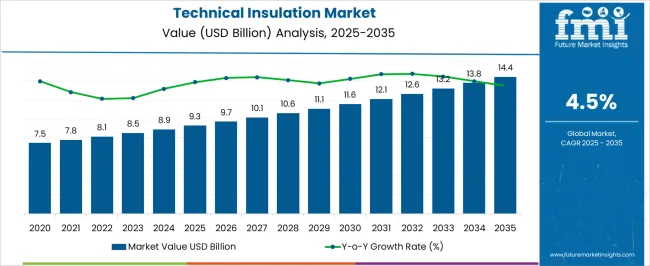

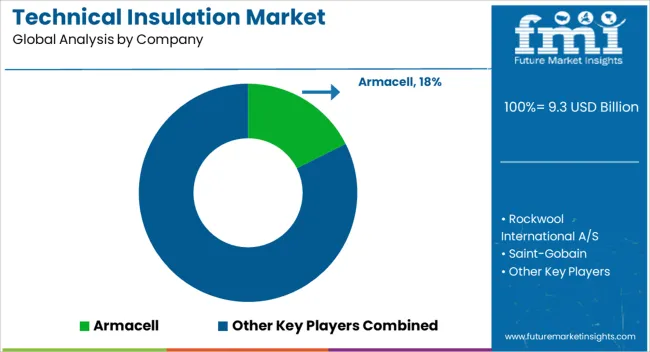

The technical insulation market is valued at USD 9.3 billion in 2025 and is projected to reach USD 14.4 billion by 2035, growing at a CAGR of 4.5% over the forecast period. Growth is driven by increasing demand from industrial sectors such as oil and gas, chemicals, and power generation, where insulation is critical for energy efficiency, process safety, and temperature management. Rising construction activity, coupled with stringent regulations on energy conservation and workplace safety, is further supporting adoption. Manufacturers are focusing on advanced materials such as mineral wool, glass wool, and elastomeric foams to address diverse industrial and building requirements. Europe and North America remain mature markets, while Asia Pacific continues to lead growth due to rapid industrial expansion and infrastructure development.

Quick Stats for Technical Insulation Market

| Metric | Value |

|---|---|

| Technical Insulation Market Estimated Value in (2025 E) | USD 9.3 billion |

| Technical Insulation Market Forecast Value in (2035 F) | USD 14.4 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The technical insulation market is witnessing sustained growth driven by stricter energy efficiency regulations, rising demand for acoustic control, and increased investment in infrastructure upgrades across industrial and commercial sectors. The push toward decarbonization in construction and manufacturing has accelerated the adoption of advanced insulation materials, especially in heating, ventilation, and cooling (HVAC) systems.

Additionally, the integration of smart building technologies and thermal management systems in modern infrastructure is promoting the need for high-performance insulation products.

Government incentives for green buildings and the enforcement of safety standards in thermal and fire protection continue to propel market expansion, especially in developed and urbanizing economies.

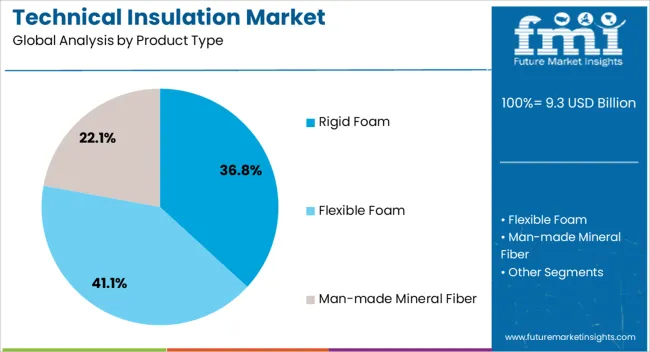

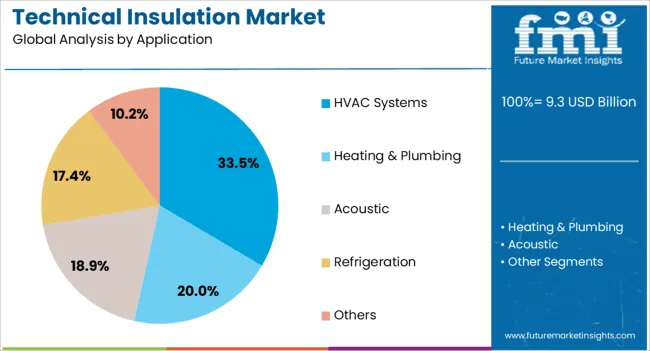

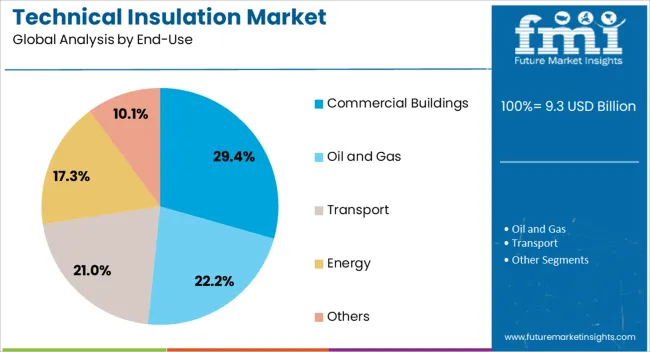

The technical insulation market is segmented by product type, application, end-use, and geographic regions. By product type, technical insulation market is divided into Rigid Foam, Flexible Foam, and Man-made Mineral Fiber. In terms of application, technical insulation market is classified into HVAC Systems, Heating & Plumbing, Acoustic, Refrigeration, and Others. Based on end-use, technical insulation market is segmented into Commercial Buildings, Oil and Gas, Transport, Energy, and Others. Regionally, the technical insulation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Rigid foam is anticipated to capture 36.80% of the market share in 2025, leading the product type segment. This dominance is driven by its excellent thermal resistance, lightweight structure, and moisture-resistant properties, which make it ideal for demanding technical insulation applications.

It is particularly well-suited for thermal insulation in HVAC, process piping, and ducting systems due to its durability and low thermal conductivity. Additionally, rigid foam's compatibility with prefabricated panels and its ease of installation across various temperature ranges contribute to its growing preference in both new construction and retrofit projects.

The material’s compliance with energy standards and ability to minimize heat loss positions it as a go-to solution for sustainable building practices.

HVAC systems are projected to hold 33.50% of the market share in 2025, making them the leading application area for technical insulation. This growth is fueled by the increasing demand for energy-efficient climate control systems in commercial and industrial settings.

Technical insulation in HVAC helps reduce energy losses, enhance thermal comfort, and meet stringent building codes related to energy consumption. The expansion of smart buildings and infrastructure renovation across urban zones is further accelerating HVAC upgrades, driving insulation demand.

Insulated ductwork and piping also contribute to reduced operational costs and emissions, aligning with sustainability goals across global regions.

Commercial buildings are set to dominate the market with a 29.40% share by 2025, establishing them as the top end-use segment. Factors contributing to this leadership include rapid urbanization, the proliferation of energy-intensive facilities such as data centers, hotels, and office complexes, and the growing importance of indoor air quality and energy conservation.

Regulations mandating efficient thermal management and noise control in public and private commercial spaces are compelling developers to integrate high-performance insulation systems.

Additionally, green building certifications such as LEED and BREEAM are influencing the adoption of advanced insulation materials, particularly in retrofit and redevelopment projects.

The technical insulation market is gaining traction as industries focus on energy efficiency, safety, and operational reliability across manufacturing, construction, and utilities. Technical insulation plays a critical role in minimizing heat loss, controlling condensation, and ensuring compliance with strict energy conservation regulations. Its demand spans power generation, oil and gas, chemical processing, and HVAC systems in commercial buildings. Rising awareness about energy costs and workplace safety, coupled with regulatory mandates, has reinforced its importance as a strategic enabler for operational excellence. With industrial expansion in emerging economies and retrofit activities in developed markets, technical insulation is increasingly recognized as essential for reducing energy waste and ensuring long-term equipment durability.

Energy-intensive industries such as oil and gas, petrochemicals, and power generation are under mounting pressure to reduce energy losses and improve efficiency. Technical insulation materials like mineral wool, glass wool, and elastomeric foams help facilities meet government-imposed energy standards while ensuring safe operation of pipelines, reactors, and boilers. Fire safety standards also push adoption in commercial and industrial buildings where insulation contributes to containment and prevention of fire spread. Growing construction activities, particularly in urban centers, are driving broader implementation of insulation solutions in HVAC and refrigeration systems. These factors establish a stable foundation for long-term demand, making compliance with energy conservation directives a primary driver of growth.

Ongoing modernization of industrial facilities in emerging markets has created a strong opportunity for technical insulation suppliers. Rapid industrialization in Asia Pacific, especially China and India, has driven large-scale adoption in power generation, steel plants, and refineries. Retrofit projects in Europe and North America also enhance demand, as aging facilities require upgraded insulation to meet stricter energy efficiency targets. Industrial operators are also integrating technical insulation to extend equipment lifespan and lower maintenance costs. This modernization trend has encouraged innovation in composite insulation products, offering higher thermal resistance and moisture control. Such developments position technical insulation as a vital enabler of energy and cost optimization strategies across sectors.

Despite the benefits, technical insulation adoption faces challenges related to installation complexity and upfront expenses. Many insulation materials require precise application techniques to achieve optimal thermal performance, leading to higher labor costs. In industries with limited budgets, the payback period associated with insulation investments may be perceived as too long, discouraging immediate implementation. Variability in insulation standards across regions also complicates procurement and design decisions for multinational projects. Additionally, price fluctuations in raw materials such as glass fibers and elastomers influence overall project economics. These barriers restrict penetration in cost-sensitive industries, limiting adoption where short-term savings are prioritized over long-term efficiency gains.

New developments in insulation materials are shaping the future trajectory of the technical insulation market. Advances in aerogels, microporous materials, and high-performance foams are offering superior thermal resistance, lightweight construction, and improved fire safety features. Demand is also rising for insulation solutions with enhanced acoustic control, especially in urban construction projects and manufacturing environments with high noise levels. Digital monitoring of insulation performance is emerging as part of smart building and industrial automation trends, enabling predictive maintenance and improved energy management. As industries move toward higher efficiency and stricter safety requirements, suppliers are expected to differentiate through innovation in material science and integrated insulation systems that combine thermal, acoustic, and fire protection attributes.

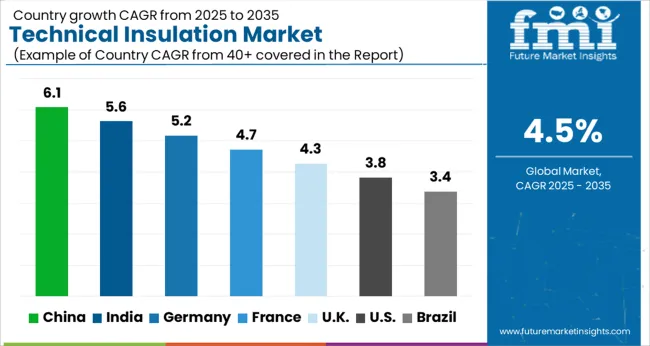

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

Technical insulation in China is advancing at a CAGR of 6.1%, supported by large-scale infrastructure expansion and industrial modernization. Power generation plants, refineries, and petrochemical complexes have increased installation of mineral wool and glass wool to comply with strict efficiency standards. Urban construction projects have expanded HVAC adoption, with insulation materials used for both thermal and acoustic management. Local producers are scaling operations to deliver high-volume, cost-effective solutions, while global players are investing in advanced materials with higher resistance to heat and fire. Manufacturing clusters emphasize the use of elastomeric foams for refrigeration and cooling systems, strengthening demand across commercial and industrial sectors.

Heavy usage in refineries and power generation plants

Mineral wool and glass wool dominate large-scale installations

Elastomeric foams gaining traction in refrigeration applications

India is recording a CAGR of 5.6% in the technical insulation market, driven by growing industrial investment in power, steel, and chemical sectors. Government initiatives for energy conservation and safety compliance are prompting greater adoption of insulation systems. Industrial operators are modernizing production facilities, where technical insulation extends equipment lifecycle and reduces energy loss. The commercial real estate sector has also contributed to rising demand for insulation in HVAC and cooling systems, particularly in urban centers. Domestic manufacturers are expanding their presence with competitively priced materials, while premium imports address niche applications requiring higher-grade performance.

Rising demand from steel, chemical, and power plants

Government energy efficiency programs boosting uptake

HVAC adoption growing in new commercial real estate projects

Germany is advancing at a CAGR of 5.2%, driven by stringent building codes and industrial energy efficiency requirements. Retrofitting of older facilities has created a consistent need for advanced insulation solutions in both industrial and commercial sectors. Automotive and chemical processing hubs have accelerated adoption of high-performance foams and mineral-based products. Energy conservation regulations in the EU are compelling industries to adopt thermal and acoustic insulation in machinery and production lines. Suppliers in Germany are investing in advanced aerogels and microporous insulation systems to meet niche industrial needs.

Strict EU energy directives drive adoption in industries

Advanced foams and aerogels supporting high-performance needs

Retrofitting projects creating long-term demand in older facilities

France is witnessing a CAGR of 4.7% in technical insulation, shaped by growing requirements in construction and industrial retrofits. Commercial building standards prioritize thermal management and fire safety, fueling demand for mineral wool and glass wool. Industrial demand has been influenced by petrochemical, oil and gas, and energy operators seeking efficiency improvements. French suppliers are leveraging lightweight insulation technologies to meet performance and regulatory needs, especially in HVAC systems. Retrofit programs in older urban buildings remain a consistent source of demand, coupled with insulation adoption in refrigeration and food processing sectors.

Construction sector driving demand for fire-resistant materials

Retrofit projects in urban areas boosting consumption

Lightweight insulation solutions expanding in HVAC systems

The UK market is projected at a CAGR of 4.3%, driven by refurbishment of commercial buildings and increased focus on reducing energy costs. Industrial operators in chemicals, pharmaceuticals, and food processing are incorporating advanced insulation to meet operational efficiency and compliance goals. Retrofit activities in aging building stock across London and other cities are supporting demand for thermal and acoustic insulation materials. Domestic players are emphasizing cost-effective solutions, while imports bring high-performance insulation such as aerogels for specialized applications. The push for reduced carbon emissions and stricter fire safety standards is expected to reinforce market expansion.

Retrofit programs dominate urban commercial demand

Strong role of pharmaceutical and food processing facilities

Imports of high-performance aerogels supplement local production

The USA is recording a CAGR of 3.8%, supported by steady adoption in manufacturing, energy, and construction sectors. Retrofitting of industrial plants has driven demand for mineral wool, while acoustic insulation is gaining importance in commercial real estate projects. Oil and gas pipelines and LNG terminals require advanced insulation systems for safety and energy conservation, reinforcing demand from energy operators. While local producers supply large-volume, low-cost materials, international suppliers deliver specialized high-temperature insulation systems for aerospace and chemical applications. Regulatory frameworks at both federal and state levels remain key drivers of adoption.

LNG terminals and pipelines strengthen industrial demand

Acoustic insulation rising in commercial real estate projects

Local producers dominate cost-sensitive large-scale projects

The metallic glasses market is supported by a specialized group of suppliers producing amorphous alloys known for their exceptional strength, elasticity, and corrosion resistance, widely used in electronics, aerospace, medical devices, and precision tools. Liquidmetal Technologies Inc. leads the market with proprietary bulk metallic glass (BMG) formulations used in high-performance components requiring near-net-shape molding and superior mechanical properties. Amorphology Inc., a spin-off from NASA’s Jet Propulsion Laboratory, offers space-grade amorphous metal parts focused on precision gears and advanced industrial applications. Asian manufacturers such as Antai Technology Co., Ltd., EPSON ATMIX Corporation, and Qingdao Yunlu Advanced Materials Technology Co., Ltd. play a growing role in producing amorphous alloy powders and parts at scale, supplying local electronics and automotive sectors. Hitachi Metals Ltd. and Usha Amorphous Metals Limited are significant regional contributors, focusing on magnetic metallic glasses for power distribution and transformer cores.

European suppliers like Exmet AB, Glassimetal Technology, and PX Group SA provide customized BMG products for watches, surgical tools, and consumer electronics, where high strength and precision formability are essential. Heraeus Holding and Materion Corporation bring material science expertise, offering tailored metallic glass solutions for medical implants, semiconductor packaging, and structural components. PrometalTech and RS Alloys contribute to niche market segments with application-specific amorphous alloys. As demand for lightweight, high-performance materials rises, these suppliers continue refining processing methods like injection molding and additive manufacturing to meet expanding needs in advanced manufacturing sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.3 Billion |

| Product Type | Rigid Foam, Flexible Foam, and Man-made Mineral Fiber |

| Application | HVAC Systems, Heating & Plumbing, Acoustic, Refrigeration, and Others |

| End-Use | Commercial Buildings, Oil and Gas, Transport, Energy, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Armacell, Rockwool International A/S, Saint-Gobain, Knauf Insulation, Owens Corning, Kingspan Group, Johns Manville, BASF SE, L'Isolante K-Flex, Kaimann GmbH, Huntsman Corporation, Fletcher Insulation, Paroc Group, ThermaXX Jackets, and Bauder Ltd. |

| Additional Attributes | Dollar sales vary by material type, including mineral wool, calcium silicate, polyurethane foam, and elastomeric insulation; by application, such as HVAC systems, piping, refrigeration, and industrial equipment; by end-use industry, spanning construction, oil & gas, power generation, and manufacturing; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by energy efficiency regulations, industrial expansion, and demand for thermal and acoustic insulation. |

The global technical insulation market is estimated to be valued at USD 9.3 billion in 2025.

The market size for the technical insulation market is projected to reach USD 14.4 billion by 2035.

The technical insulation market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in technical insulation market are rigid foam, flexible foam and man-made mineral fiber.

In terms of application, HVAC systems segment to command 33.5% share in the technical insulation market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Technical Films Market Size and Share Forecast Outlook 2025 to 2035

Technical Textile Production Equipment Market Size and Share Forecast Outlook 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Technical Textiles Market Growth - Trends & Forecast 2025 to 2035

Analyzing Technical Films Market Share & Industry Leaders

Technical Fluids Market

Technical Enzymes Market Outlook – Growth, Demand & Forecast 2020 to 2030

Geotechnical Instrumentation And Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Insulation Tester Market Size and Share Forecast Outlook 2025 to 2035

Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Insulation Paper Market Size and Share Forecast Outlook 2025 to 2035

Insulation Market Size and Share Forecast Outlook 2025 to 2035

Insulation Coatings Market Size and Share Forecast Outlook 2025 to 2035

Insulation Boards Market Size and Share Forecast Outlook 2025 to 2035

Insulation Testing Instrument Market Size and Share Forecast Outlook 2025 to 2035

OEM Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Films Market Size and Share Forecast Outlook 2025 to 2035

Thin Insulation Market Size and Share Forecast Outlook 2025 to 2035

Pipe Insulation Market Size and Share Forecast Outlook 2025 to 2035

Cold Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA