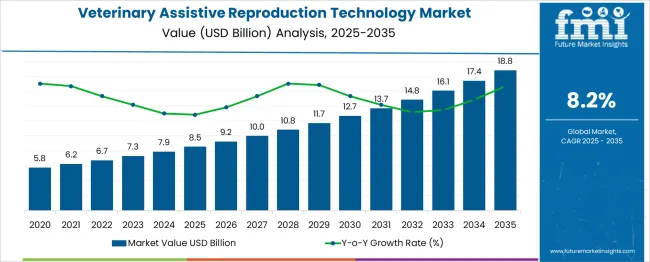

The Veterinary Assistive Reproduction Technology Market is estimated to be valued at USD 8.5 billion in 2025 and is projected to reach USD 18.8 billion by 2035, registering a compound annual growth rate (CAGR) of 8.2% over the forecast period. A Growth Momentum Analysis shows a marked acceleration in market value over the forecast period. Between 2025 and 2029, the market increases from USD 8.5 billion to USD 10.8 billion, contributing an incremental USD 2.3 billion.

During this phase, the market experiences a CAGR of 6.9%, driven by advancements in animal breeding technologies, rising demand for high-quality livestock, and growing awareness about genetic improvements in the agriculture and veterinary sectors. From 2029 to 2035, the market experiences a sharper rise, increasing from USD 10.8 billion to USD 18.8 billion, representing a USD 8 billion growth.

This period exhibits a heightened CAGR of 10.5%, reflecting a surge in demand for reproductive technologies, particularly in livestock and companion animals. The increasing adoption of advanced reproductive technologies across diverse animal species, along with growing global focus on improving livestock genetics, plays a central role in this rapid market expansion.

The growth momentum is characterized by a steady rise in the first half of the forecast, followed by a significant surge in the latter half, driven by technological advancements and broader industry adoption.

| Metric | Value |

|---|---|

| Veterinary Assistive Reproduction Technology Market Estimated Value in (2025 E) | USD 8.5 billion |

| Veterinary Assistive Reproduction Technology Market Forecast Value in (2035 F) | USD 18.8 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

The veterinary assistive reproduction technology market is witnessing consistent growth, influenced by the rising demand for genetic improvement, livestock productivity, and advanced breeding management practices. Increasing emphasis on optimizing reproductive efficiency among commercial breeders and livestock operators is encouraging the adoption of artificial techniques to improve conception rates and herd quality.

Regulatory support for ethical animal breeding and rising awareness about hereditary disease control in animal populations are shaping long-term growth strategies. The market is further supported by the integration of data-driven breeding programs, semen quality tracking, and synchronization protocols, enabling better control over reproductive outcomes.

Technological innovations, such as real-time ultrasound and mobile insemination services, are streamlining field-level applications. As food security concerns escalate and demand for high-quality animal protein increases globally, veterinary reproductive technologies are expected to play a critical role in modern animal husbandry.

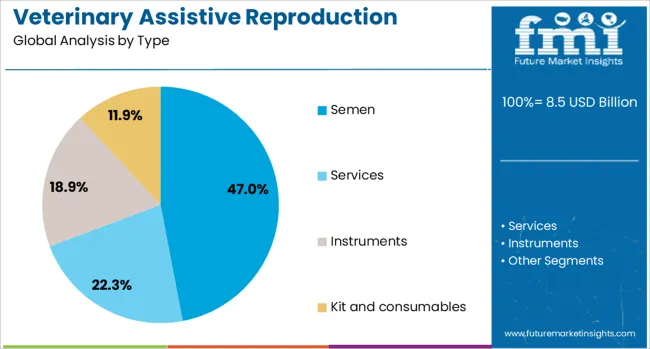

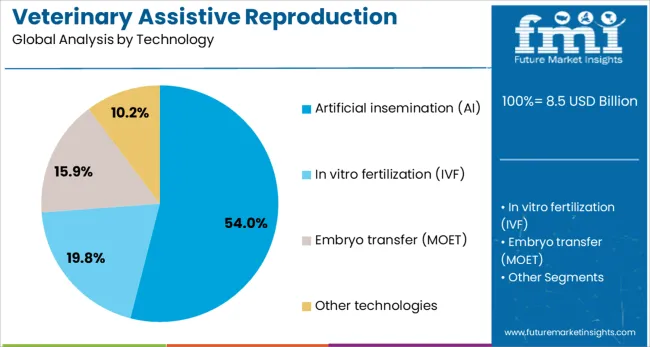

The veterinary assistive reproduction technology market is segmented by type, technology, animal type, end use, and geographic regions. The veterinary assistive reproduction technology market is divided by type into Semen, Services, Instruments, kits, and consumables. In terms of technology, the veterinary assistive reproduction technology market is classified into Artificial insemination (AI), In vitro fertilization (IVF), Embryo transfer (MOET), and Other technologies.

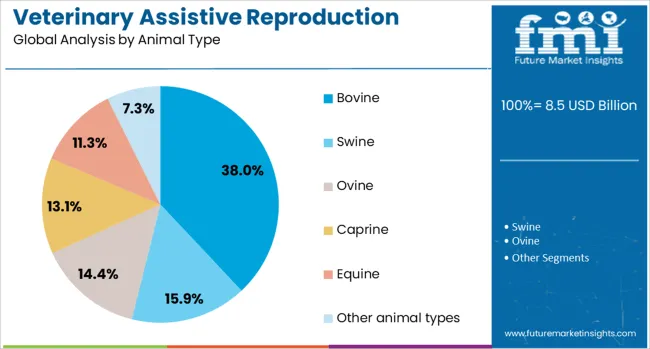

Based on animal type, the veterinary assistive reproduction technology market is segmented into Bovine, Swine, Ovine, Caprine, Equine, and Other animal types. The veterinary assistive reproduction technology market is segmented into Veterinary clinics and hospitals, Animal breeding centers, Research institutes and universities, and Other end uses.

Regionally, the veterinary assistive reproduction technology industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Semen is expected to account for 47.0% of the veterinary assistive reproduction technology market revenue in 2025, positioning it as the dominant type segment. This leadership is attributed to the growing need for targeted genetic improvement, wider availability of semen from high-value sires, and logistical ease in distribution and storage.

The use of processed and cryopreserved semen allows for scheduled breeding, increased conception accuracy, and disease transmission control. Its utility across a broad range of livestock operations-from dairy farms to breeding centers-has further strengthened its position.

The continued investment in semen quality enhancement and genomic selection techniques is expected to reinforce its role in enabling scalable and sustainable reproduction programs.

Artificial insemination is projected to contribute 54.0% of total market revenue in 2025, establishing it as the leading technology. Its dominance stems from high adoption among commercial livestock breeders due to its cost-effectiveness, disease control benefits, and proven improvement in genetic outcomes.

AI facilitates precision breeding while minimizing the risks associated with natural mating, particularly in large-scale bovine and swine operations. Increasing veterinary training programs and on-site reproductive health services have expanded access to AI, especially in rural and emerging economies.

As animal welfare standards tighten and producers seek efficient, ethical, and productivity-driven breeding techniques, artificial insemination remains central to modern reproductive management systems.

Bovine species are expected to lead the market by contributing 38.0% of the total revenue in 2025, making them the top animal type in veterinary assistive reproduction. This dominance is driven by the high economic value of dairy and beef cattle, coupled with global demand for superior herd genetics and improved milk yields.

Structured breeding programs supported by national livestock development schemes have increased the uptake of reproductive technologies in bovines. The species’ favorable response to synchronization protocols, fertility treatments, and artificial insemination enhances reproductive efficiency and genetic consistency across herds.

As dairy supply chains expand and meat producers focus on productivity, bovine breeding continues to anchor the demand for advanced reproduction technologies.

The veterinary assistive reproduction technology market is growing due to increased demand for advanced breeding techniques in livestock and companion animals. Technologies like artificial insemination, embryo transfer, and genetic testing are driving improvements in animal productivity and quality. However, high costs and regulatory barriers remain significant challenges. Opportunities lie in ongoing technological advancements and expanding animal breeding practices, particularly in emerging markets. The integration of AI and genetic technologies is also transforming breeding strategies, offering more precise and efficient reproductive management for improved livestock production.

The veterinary assistive reproduction technology market is growing due to the rising demand for advanced animal reproduction techniques, particularly in livestock farming and animal breeding. Farmers and breeders are increasingly adopting technologies such as artificial insemination (AI), embryo transfer, and genetic testing to improve livestock quality and productivity. The need for these technologies is further fueled by the growing global population, leading to higher demand for animal products like milk, meat, and eggs. Additionally, advancements in reproductive technologies that enhance fertility rates, disease resistance, and genetic quality continue to drive the adoption of assistive reproduction techniques across both commercial and domestic animal industries.

One of the main challenges in the veterinary assistive reproduction technology market is the high cost associated with the equipment, technology, and skilled labor required. The initial investment for advanced reproduction technologies, such as in vitro fertilization (IVF) and cryopreservation, is significant, making it difficult for small-scale farmers or breeders to afford. Moreover, regulatory barriers related to the use of assisted reproduction in animals, including concerns over genetic modification, ethical issues, and compliance with local laws, can create delays and complexities. These factors can hinder the widespread adoption of such technologies, especially in regions with less access to resources or favorable regulations.

Significant opportunities exist in the veterinary assistive reproduction technology market due to ongoing advancements in reproductive technologies. Innovations in genetic testing, embryo culture techniques, and gene editing are expanding the scope of veterinary assisted reproduction, offering improved breeding outcomes and animal welfare. As global demand for high-quality livestock products grows, so does the need for technologies that increase efficiency and reduce costs. The rise of personalized animal breeding practices, especially for companion animals, also presents new avenues for growth. Moreover, expanding awareness and the adoption of advanced reproductive techniques in emerging markets offer substantial growth prospects for the industry.

A key trend in the veterinary assistive reproduction technology market is the increasing integration of artificial intelligence (AI) and genetic technologies in animal breeding. AI-driven software is being used for data analysis, enabling more precise breeding decisions and improving the accuracy of genetic testing. The use of genomic tools to assess fertility, health, and genetic potential is becoming standard practice, particularly in large-scale livestock production. Additionally, advancements in gene editing and CRISPR technology are beginning to play a role in enhancing genetic traits for improved production and disease resistance. These technologies are revolutionizing animal breeding and enabling more sustainable and effective reproductive practices.

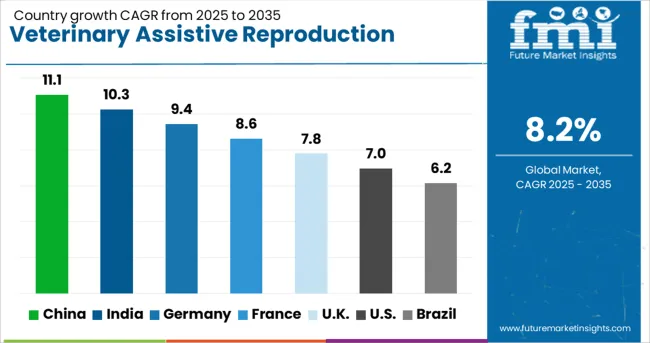

| Country | CAGR |

|---|---|

| China | 11.1% |

| India | 10.3% |

| Germany | 9.4% |

| France | 8.6% |

| UK | 7.8% |

| USA | 7.0% |

| Brazil | 6.2% |

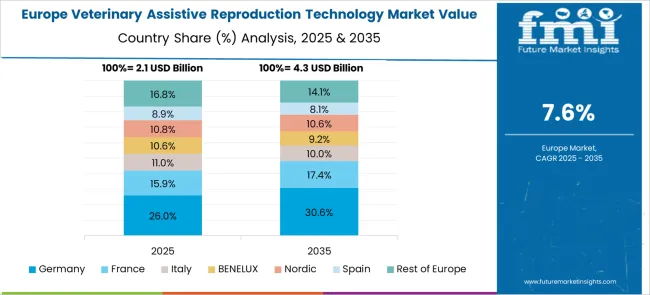

The veterinary assistive reproduction technology market is projected to grow at a CAGR of 8.2% from 2025 to 2035. China leads at 11.1%, followed by India at 10.3%, Germany at 9.4%, the United Kingdom at 7.8%, and the United States at 7.0%. These growth rates translate to a growth premium of +35% for China and +25% for India compared to the global baseline, while Germany, the UK, and the USA show slower growth. The divergence in growth can be attributed to the rapidly expanding livestock industries in BRICS nations, particularly in China and India, driven by increasing demand for animal genetics and breeding programs. In OECD countries such as Germany, the UK, and the USA, demand is driven by advanced technologies and research in animal breeding and genetics. The report features insights from 40+ countries, with the top countries shown below.

China is projected to grow at an 11.1% CAGR through 2035, driven by rapid industrialization and the growth of the livestock sector. As China continues to modernize its agricultural practices, there is a growing focus on improving animal genetics to enhance productivity in dairy, poultry, and livestock farming. The country’s increasing demand for high-quality and genetically improved animals, along with the development of its veterinary infrastructure, is expected to drive the adoption of assistive reproduction technologies. China’s investments in animal husbandry and its shift towards more efficient farming methods support market growth. The focus on sustainable and high-yield farming methods also contributes to the demand for advanced veterinary reproductive technologies.

India is expected to grow at a CAGR of 10.3% through 2035, driven by the expanding dairy and livestock farming sectors. The growing demand for high-quality animal genetics, particularly in dairy and poultry farming, is a key factor contributing to the market's growth. As India focuses on enhancing its agricultural productivity, the adoption of advanced veterinary reproductive technologies, such as artificial insemination and embryo transfer, is increasing. Furthermore, India's rising demand for high-yielding and disease-resistant animals is further propelling the need for innovative breeding technologies. The government's push for modernizing agriculture and livestock farming practices will continue to support the adoption of these technologies.

Germany is projected to grow at a CAGR of 9.4% through 2035, with demand driven by the country’s advanced agricultural sector and high demand for genetically superior animals. The market for veterinary assistive reproduction technologies in Germany is supported by its strong focus on research and innovation in animal breeding, particularly in the dairy, cattle, and poultry industries. Germany’s advanced infrastructure and well-established veterinary practices make it a key player in the European market. The country’s growing emphasis on improving livestock productivity through genetic improvement is boosting the adoption of technologies like artificial insemination, embryo transfer, and reproductive cloning.

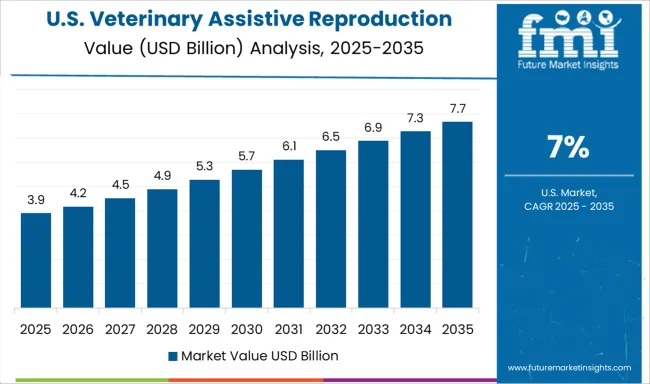

The United States is projected to grow at a CAGR of 7.0% through 2035, with demand driven by the country’s established agricultural sector and its growing focus on improving livestock breeding practices. The USA is a leader in animal genetics and the use of advanced reproductive technologies like artificial insemination, embryo transfer, and genetic testing, particularly in the dairy, beef, and poultry industries. As the demand for higher yields and disease-resistant animals increases, the need for veterinary assistive reproduction technologies continues to rise. The USA market is also supported by government research funding and an established network of veterinary professionals specializing in livestock and animal breeding.

The United Kingdom is expected to grow at a CAGR of 7.8% through 2035, with growth supported by a strong demand for advanced reproductive technologies in livestock farming. The UK is increasingly adopting artificial insemination, embryo transfer, and genetic testing as part of efforts to enhance animal breeding and productivity in the dairy and beef industries. The country’s focus on improving animal genetics, along with advancements in veterinary care and the development of more efficient farming practices, drives the adoption of these technologies. The demand for superior genetics, disease resistance, and improved yields in animals continues to support market growth.

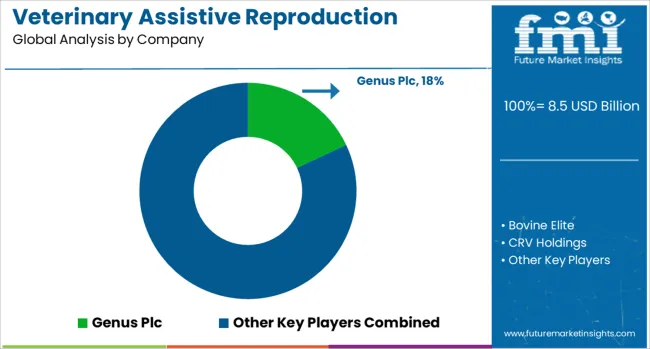

The veterinary assistive reproduction technology (ART) market is led by key players in animal genetics, reproductive technology, and biotechnology, offering advanced solutions for breeding, artificial insemination (AI), and embryo transfer in livestock and companion animals. Genus Plc is a major player, offering reproductive solutions through its subsidiary Sexing Technologies, specializing in semen sexing and AI technologies for cattle, pigs, and other animals.

CRV Holdings and Geno SA focus on genetic improvement, providing AI services and semen collection technologies for the dairy and beef cattle industries, driving better herd performance and quality. IMV Technologies and Minitube Group specialize in reproductive technologies, including semen collection, processing, and storage solutions, serving both commercial and research institutions globally.

SEMEX, Select Sires, and Swine Genetics International provide semen and genetic material for AI, working closely with farmers and veterinarians to improve breeding outcomes in both small and large animals. STgenetics offers advanced genetic technologies, including sexed semen and genomic selection, to enhance the productivity of livestock farming.

URUS Group and VikingGenetics emphasize breeding technologies for dairy and beef cattle, providing advanced reproductive solutions to optimize herd genetics and improve overall farm productivity. Competitive differentiation in the market is driven by the quality of genetic material, AI processing efficiency, and the ability to offer comprehensive genetic improvement programs.

Barriers to entry include high research and development costs, the need for extensive veterinary networks, and the strict regulatory landscape governing animal breeding technologies. Strategic priorities involve expanding genetic libraries, advancing sexed semen technology, and integrating data analytics to improve breeding decisions.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.5 Billion |

| Type | Semen, Services, Instruments, and Kit and consumables |

| Technology | Artificial insemination (AI), In vitro fertilization (IVF), Embryo transfer (MOET), and Other technologies |

| Animal Type | Bovine, Swine, Ovine, Caprine, Equine, and Other animal types |

| End Use | Veterinary clinics and hospitals, Animal breeding centers, Research institutes and universities, and Other end use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Genus Plc, Bovine Elite, CRV Holdings, Geno SA, IMV Technologies, Minitube Group, SEMEX, Select Sires, Swine Genetics International, STgenetics, URUS Group, and VikingGenetics |

| Additional Attributes | Dollar sales by technology type (artificial insemination, embryo transfer, semen collection, genetic selection) and end-use segments (dairy cattle, beef cattle, swine, equine, companion animals). Demand dynamics are driven by the increasing need for improving livestock productivity, advancing genetic performance, and reducing breeding costs in the agricultural sector. Regional trends show North America and Europe as mature markets with a strong focus on dairy and beef cattle, while Asia-Pacific is emerging as a growth hub due to increasing adoption of advanced reproductive technologies in the swine and poultry industries. |

The global veterinary assistive reproduction technology market is estimated to be valued at USD 8.5 billion in 2025.

The market size for the veterinary assistive reproduction technology market is projected to reach USD 18.8 billion by 2035.

The veterinary assistive reproduction technology market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in veterinary assistive reproduction technology market are semen, _normal semen, _sexed semen, services, instruments and kit and consumables.

In terms of technology, artificial insemination (ai) segment to command 54.0% share in the veterinary assistive reproduction technology market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Point of Care Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Allergy Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary TSE Testing Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dermatology Market Forecast Outlook 2025 to 2035

Veterinary Telemedicine Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Imaging Market Forecast and Outlook 2025 to 2035

Veterinary CRISPR-Based Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Glucometers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Anesthesia Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA