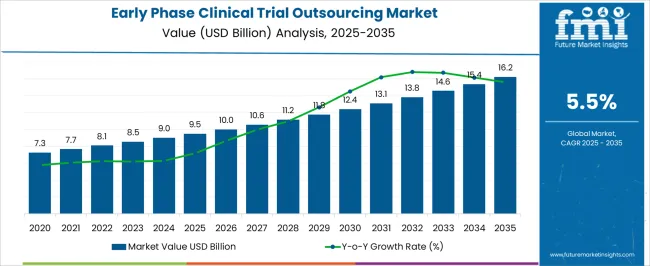

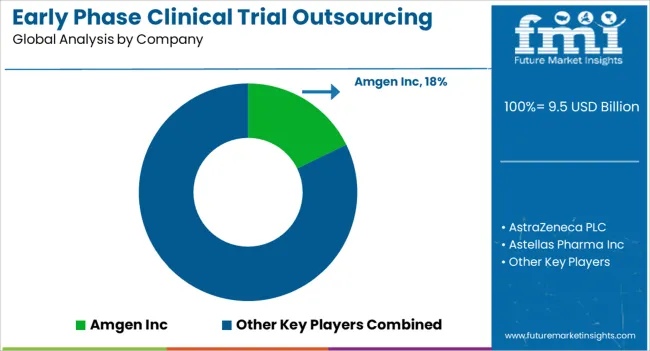

The Early Phase Clinical Trial Outsourcing Market is estimated to be valued at USD 9.5 billion in 2025 and is projected to reach USD 16.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Early Phase Clinical Trial Outsourcing Market Estimated Value in (2025 E) | USD 9.5 billion |

| Early Phase Clinical Trial Outsourcing Market Forecast Value in (2035 F) | USD 16.2 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The Early Phase Clinical Trial Outsourcing market is witnessing robust growth, driven by the increasing demand for cost-effective and efficient solutions in drug development. Rising complexities in early phase clinical trials, coupled with stringent regulatory requirements, have led pharmaceutical and biotechnology companies to outsource specialized trial activities to experienced service providers. Outsourcing enables accelerated study initiation, optimized resource allocation, and access to advanced technologies for patient recruitment, monitoring, and data management.

Continuous innovation in clinical trial design, decentralized trial solutions, and digital platforms has enhanced operational efficiency and reduced timelines. Regulatory compliance and quality standards are increasingly emphasized, making outsourcing an attractive approach for minimizing risk.

Strategic partnerships between sponsors and contract research organizations (CROs) facilitate scalability and flexibility in managing early phase studies As pharmaceutical pipelines expand and companies seek to reduce costs while ensuring high-quality data generation, the market is expected to sustain long-term growth, with service providers offering integrated and specialized solutions driving adoption across the industry.

The early phase clinical trial outsourcing market is segmented by trial phase, services, end user, and geographic regions. By trial phase, early phase clinical trial outsourcing market is divided into Phase 1, Phase 0, and Phase 2. In terms of services, early phase clinical trial outsourcing market is classified into Regulatory Services, Clinical Data Management (CDM), Medical Writing, Site Management, Pharmacovigilance (PV), Risk-Based Monitoring, Bio Statistical Services, and Protocol Development. Based on end user, early phase clinical trial outsourcing market is segmented into Pharmaceutical Companies, Biopharmaceutical Companies, Drug Discovery Companies, and Medical Devices Companies. Regionally, the early phase clinical trial outsourcing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

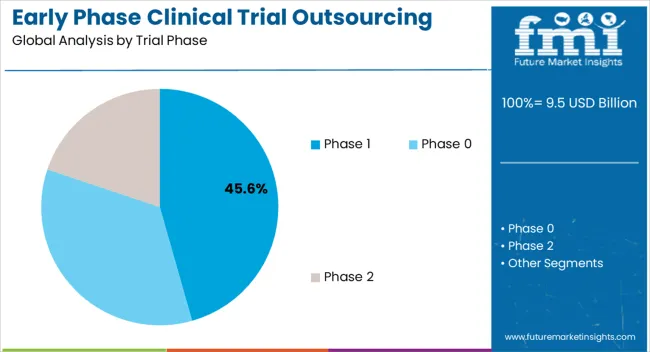

The Phase 1 trial phase segment is projected to hold 45.6% of the market revenue in 2025, establishing it as the leading trial phase. Growth in this segment is being driven by the increasing complexity of first-in-human studies, dose escalation studies, and safety assessments that require specialized expertise and infrastructure. Early phase trials demand precise monitoring of pharmacokinetics, pharmacodynamics, and adverse events, which CROs with advanced capabilities can efficiently manage.

Outsourcing Phase 1 trials allows sponsors to access state-of-the-art facilities, experienced personnel, and innovative trial designs without significant capital investment. Additionally, the ability to accelerate trial timelines while maintaining compliance with regulatory standards is a key driver of adoption.

With rising demand for novel therapeutics and biologics, Phase 1 studies remain critical for demonstrating safety and informing subsequent trial phases As pharmaceutical and biotechnology companies continue to focus on efficiency and risk mitigation, the Phase 1 segment is expected to maintain its dominant market position.

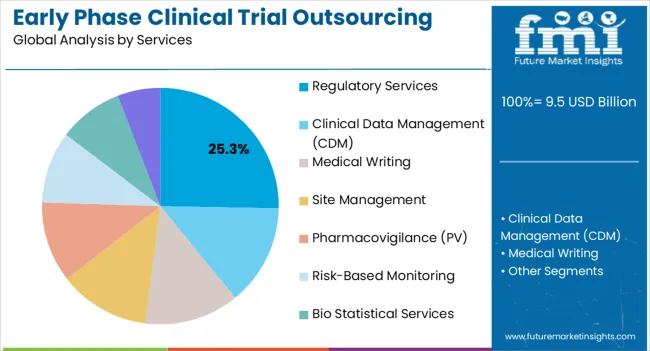

The regulatory services segment is anticipated to account for 25.3% of the market revenue in 2025, making it the leading service category. Its growth is being driven by the increasing complexity of global regulatory requirements and the need for compliance across multiple jurisdictions. Early phase clinical trials require detailed submissions, protocol approvals, and ongoing reporting, which are efficiently handled by specialized regulatory service providers.

Outsourcing these services ensures timely approvals, risk mitigation, and alignment with international standards. Integration of regulatory expertise with trial design and monitoring supports operational efficiency and accelerates study timelines. The increasing focus on data integrity, audit readiness, and quality assurance further enhances demand for regulatory services.

As pharmaceutical companies expand clinical pipelines and target multiple markets, regulatory outsourcing remains a critical function to ensure compliance and successful trial execution The segment is expected to maintain its leading position, driven by the growing complexity of regulatory frameworks and the need for expert guidance.

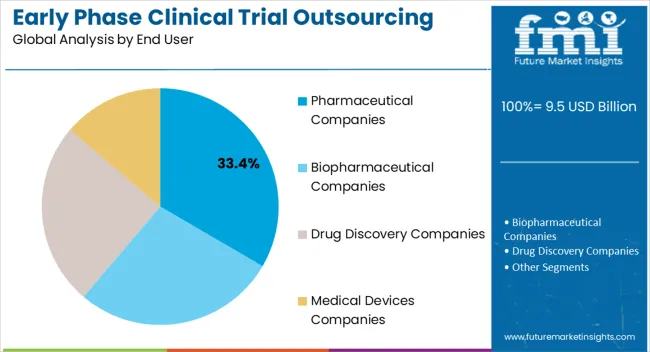

The pharmaceutical companies end user segment is projected to hold 33.4% of the market revenue in 2025, establishing it as the largest end-use industry. Growth is being driven by the increasing need for cost-effective solutions, risk mitigation, and accelerated development timelines in early phase clinical trials. Outsourcing to experienced CROs enables pharmaceutical companies to access advanced technologies, specialized expertise, and dedicated infrastructure without significant capital expenditure.

This allows sponsors to focus on core research and development activities while ensuring compliance and data quality. The rising demand for novel therapies, biologics, and small molecules has increased reliance on outsourced early phase trial services to maintain pipeline efficiency.

Strategic collaborations between pharmaceutical companies and CROs facilitate flexibility in managing complex protocols, patient recruitment, and regulatory submissions As global clinical development continues to expand and trial complexity increases, pharmaceutical companies are expected to remain the primary end users, supporting the growth and adoption of outsourcing solutions across early phase clinical trials.

Clinical trials are generally conducted to collect data regarding safety and efficacy of new drugs and devices development. There are multiple stages of drug approval in clinical trial process before drug or device can be sold in the market.

In general, drugs or devices must undergo several phases of clinical trial that include preclinical, clinical trials to get market approval. Clinical trials are done on human subjects in different phases such as phase 0, phase 1, phase 2, phase 3, and phase 4 or post marketing surveillance to testify the products safety and efficacy.

Early phase clinical trials include Phase 0, Phase 1, and Phase 2 stages of clinical trials which are essential to ascertain the safety and efficacy of the drug or devices in target population. Clinical trials outsourcing in pharmaceutical and medical devices industry has been a market trend owing to increased expertise of Clinical Research Organizations (CROs) coupled cost saving strategies adopted the numerous drug development companies in the market.

Early phase clinical trial outsourcing market is driven by increasing cost associated with in house clinical trials along with drug discovery companies’ effort to improve cost efficiency of its operations. Several studies indicate that more than 50% of the early phase clinical trials are outsourced to global and speciality CROs.

In addition, increased spending on small molecules research & development, increasing investment in small biopharmaceutical companies, rising product pipelines of large pharmaceutical companies expected to boost the revenue growth of early phase clinical trial outsourcing market over the forecast period.

However, increased per-patient cost, difficulties in recruiting/retaining the subjects (patients), and sudden dropout or withdrawal of patient from the clinical trial or study may impact the market revenue growth negatively over the forecast period.

Early phase clinical trial outsourcing market is undergoing market changes due to the higher competition among key service providers who are scaling up service offering and global capabilities for gaining market share. Majority pharma companies are continuously outsourcing the clinical trials to broad range of service providers (CROs).

Non-traditional service providers will also continue to enter into the market place by means of partnership or acquisition. By trial phase type, sub segment such as phase 2 in the global early phase clinical trial outsourcing market is expected to grow in positive traction owing to comparatively larger patient pool and increased number of drug candidates in the above mentioned phase.

Geographically, early phase clinical trial outsourcing market is segmented into regions viz. North America, Latin America, Europe, Asia Pacific and Japan, Middle East and Africa. North America and Europe region is projected to maintain its lions share over the forecast period.

Advanced healthcare infrastructure, availability of diverse patient pool is expected to propel the demand for early phase clinical trial outsourcing market during the forecast period in the above mentioned region. Asia Pacific region is expected to be the moderately growing regional market.

Growing healthcare facilities, increased healthcare awareness, and conducive regulatory environment for conducting clinical trials in countries like Australia and China are mainly generating the demand for early phase clinical trials in the region.

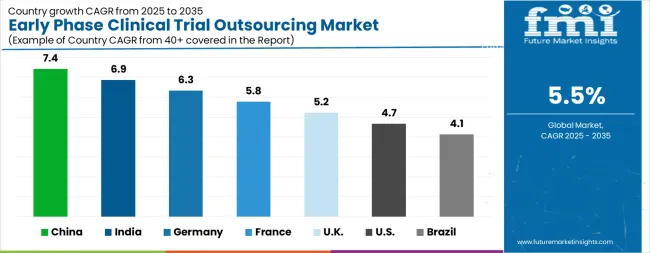

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The Early Phase Clinical Trial Outsourcing Market is expected to register a CAGR of 5.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.4%, followed by India at 6.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.1%, yet still underscores a broadly positive trajectory for the global Early Phase Clinical Trial Outsourcing Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.3%. The USA Early Phase Clinical Trial Outsourcing Market is estimated to be valued at USD 3.5 billion in 2025 and is anticipated to reach a valuation of USD 5.5 billion by 2035. Sales are projected to rise at a CAGR of 4.7% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 506.3 million and USD 312.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.5 Billion |

| Trial Phase | Phase 1, Phase 0, and Phase 2 |

| Services | Regulatory Services, Clinical Data Management (CDM), Medical Writing, Site Management, Pharmacovigilance (PV), Risk-Based Monitoring, Bio Statistical Services, and Protocol Development |

| End User | Pharmaceutical Companies, Biopharmaceutical Companies, Drug Discovery Companies, and Medical Devices Companies |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amgen Inc, AstraZeneca PLC, Astellas Pharma Inc, Bayer AG, Bristol-Myers Squibb Company, Celgene Corporation, Eli Lilly, and F.Hoffmann-La Roche Ltd |

The global early phase clinical trial outsourcing market is estimated to be valued at USD 9.5 billion in 2025.

The market size for the early phase clinical trial outsourcing market is projected to reach USD 16.2 billion by 2035.

The early phase clinical trial outsourcing market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in early phase clinical trial outsourcing market are phase 1, phase 0 and phase 2.

In terms of services, regulatory services segment to command 25.3% share in the early phase clinical trial outsourcing market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA