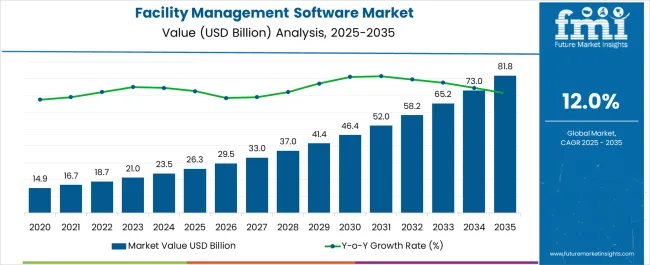

The facility management software market is estimated to be valued at USD 26.3 billion in 2025 and is projected to reach USD 81.8 billion by 2035, registering a compound annual growth rate (CAGR) of 12.0% over the forecast period.

The market operates within an increasingly complex regulatory environment that shapes both operational dynamics and competitive positioning across different geographic regions. Organizations managing physical assets must navigate intricate compliance frameworks that vary substantially between jurisdictions, creating operational friction between different stakeholder groups within enterprises. The regulatory landscape demonstrates particular complexity in sectors requiring specialized facility management protocols, where competing priorities between maintenance teams, compliance officers, and operational managers often create implementation challenges that software vendors must address through increasingly sophisticated platform architectures.

Procurement processes reveal how different organizational functions approach facility management software selection with competing criteria that often create internal conflicts during vendor evaluation phases. Technical teams prioritize system integration capabilities and performance metrics, while compliance teams focus on regulatory reporting features and audit trail functionality. Operations managers typically emphasize ease of use and workflow efficiency, creating procurement dynamics where no single solution satisfies all stakeholder requirements without significant compromise or customization.

The market demonstrates growing complexity in how organizations balance centralized facility management oversight with decentralized operational execution, particularly in sectors with strict regulatory requirements. Maintenance teams often prefer locally-managed systems that accommodate specific operational practices, while corporate facility management departments seek standardized platforms that provide consistent reporting and oversight capabilities. This tension becomes particularly acute in regulated industries where facility managers must demonstrate compliance across multiple locations while maintaining operational flexibility for local maintenance teams.

Implementation challenges consistently emerge from conflicts between standard software configurations and organization-specific compliance requirements, creating market demand for increasingly flexible platform architectures. Organizations frequently discover that initial software evaluations underestimate the complexity of integrating facility management platforms with existing compliance monitoring systems, leading to extended implementation timelines and budget overruns. The market reflects growing demand for platforms that can accommodate these integration complexities without requiring extensive custom development work.

Market trends indicate increasing demand for facility management platforms that can automatically adapt to regulatory changes without requiring extensive manual configuration updates. Organizations report substantial operational burden from maintaining compliance as regulations evolve, creating market opportunities for vendors who can provide automated regulatory update capabilities. This demand reflects growing recognition that regulatory compliance represents an ongoing operational challenge rather than a one-time implementation requirement, influencing how organizations evaluate the total cost of ownership for facility management software platforms.

| Metric | Value |

|---|---|

| Facility Management Software Market Estimated Value in (2025 E) | USD 26.3 billion |

| Facility Management Software Market Forecast Value in (2035 F) | USD 81.8 billion |

| Forecast CAGR (2025 to 2035) | 12.0% |

The facility management software market is experiencing robust growth driven by increasing demand for digital transformation in building operations, workplace optimization, and asset lifecycle management. Organizations are prioritizing automation and data driven solutions to enhance operational efficiency, reduce costs, and improve sustainability performance.

Advancements in cloud computing, IoT integration, and AI based analytics are enabling facilities to transition from reactive to predictive management models. Regulatory focus on energy efficiency, workplace safety, and compliance has also strengthened the adoption of facility management platforms across sectors including healthcare, retail, and manufacturing.

The future outlook remains strong as enterprises continue to align digital facility management initiatives with broader corporate goals of efficiency, employee experience, and environmental responsibility.

The on premise facility management software segment is projected to account for 54.20% of total revenue by 2025 within the deployment mode category, making it the leading segment. This dominance is attributed to the preference for greater control over data security, customization flexibility, and system integration with existing enterprise infrastructure.

Many industries handling sensitive operational and customer data continue to prioritize on premise solutions due to compliance requirements and stringent security standards. Additionally, the capacity to tailor features to specific organizational needs and maintain independence from internet connectivity has reinforced adoption.

As enterprises with legacy infrastructure look to balance modernization with regulatory compliance, on premise deployment remains a strong and reliable choice.

The integrated software segment is expected to hold 47.60% of market revenue by 2025 under the type category, positioning it as the leading segment. Its growth is being driven by the ability to consolidate diverse facility management functions such as maintenance, space optimization, energy tracking, and asset management into a single unified platform.

This integration improves real time visibility, enhances decision making, and reduces operational redundancies. Enterprises are increasingly valuing integrated platforms for their scalability and ability to support cross functional workflows, resulting in stronger cost efficiency and productivity gains.

The consolidation of solutions into a single software ecosystem has therefore reinforced the prominence of integrated software within this market.

The small and mid sized enterprises segment is projected to represent 42.30% of total revenue by 2025 within the enterprise size category, making it the largest contributor. The segment’s growth is being influenced by the rising need for cost effective facility management solutions that enhance efficiency while remaining affordable.

SMEs are increasingly adopting facility management software to optimize space utilization, reduce overheads, and meet compliance requirements without investing heavily in manual processes. The adoption of modular and scalable solutions has enabled SMEs to gradually expand functionalities as their operations grow.

Growing awareness of workplace safety, sustainability initiatives, and operational transparency has further accelerated adoption, positioning SMEs as a key driver of market expansion.

The facility management software market is estimated to rise at 12.0% CAGR between 2025 and 2035 in comparison with 9.5% CAGR registered during 2020 to 2025. This attributes to the growing adoption of cloud-based facility management software, increase in demand of integrated facility management software, and rise in adoption of AI and IoT in facility management software

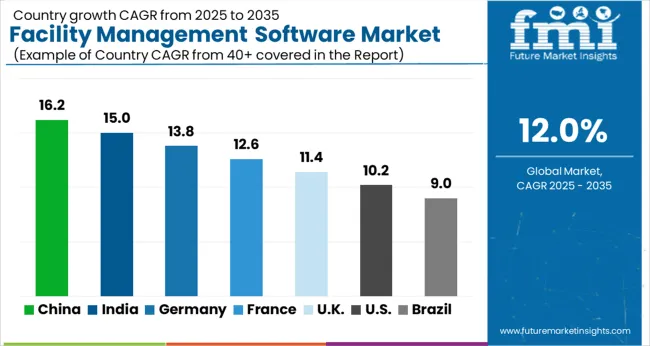

North America region is expected to dominate the global facility management software market and expected to reach ~USD 13,047.5 Million by 2035 owing to presence of major facility management software providers and increase in latest technological breakthroughs in the region. Moreover, South Asia & Pacific region is expected to grow at highest CAGR of 17.0% during 2025 to 2035. By enterprise size, large enterprise segment is expected to show the largest market share in 2025. Moreover, SMEs segment is expected to grow at the highest CAGR of 12.7% during 2025 to 2035.

Increase in the technical advancements coupled with the emergence of mobile facility management software is the major factor boosting the market growth. Furthermore, growing focus on energy efficiency improvements and optimization processes are major factors for the growth of facility management software market. The global facility management software market is anticipating to witness an increase in revenue from USD 20,985.1 Million in 2025 to USD 72,168.4 Million by 2035.

North America region accounted to the major market share of 31.7% in 2025. The region is expected to grow by 2.0X during the forecast period. North America region is estimated to grow at a CAGR of 7.3% during the forecast period. North American market is anticipated to create an absolute dollar opportunity of USD 6,599.5 Million during 2025 to 2035.

Owing to the presence of major facility management software vendors coupled with the growing adoption of the emerging technologies are major factors boosting the market growth in North America. Due to the presence of economically advanced and well-established infrastructure countries like USA and Canada, there is huge demand for facility management software. In addition to this, BFSI and IT & telecom verticals are the early adopters, which is expected to contribute the significant market share.

| Country | BPS Change (H2'22 (O) - H2'22 (P)) |

|---|---|

| USA | (+)24 |

| United Kingdom | (+)23 |

| Germany | (+)22 |

| China | (+)25 |

| India | (+)23 |

Facility management software helps organizations to optimize their costs by automating manual processes and reducing inefficiencies in facilities management in the USA had changed BPS of (+)24 BPS units for H2’22(O)-H2’22(P). United Kingdom had a BPS change of (+)23 units because the software helps to streamline operations, improve communication between stakeholders, and reduce the time and resources required to manage facilities.

Germany saw a BPS change of (+)22 units due to facility management software providing real-time data and insights that can be used to make informed decisions regarding facilities management. With increased regulations and standards, facility management software helps organizations to comply with legal and safety requirements in the China market to help a BPS change of (+)25 units.

The software enables organizations to schedule, track and manage maintenance activities, ensuring that facilities are well-maintained and reducing downtime in India allowing the BPS change of (+)23 units.

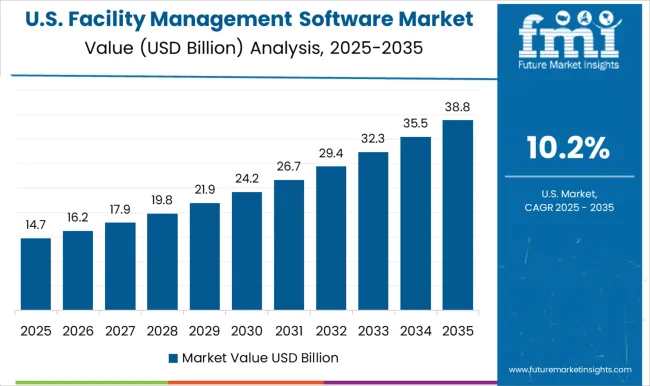

USA to Remain Dominant Market in North America

The USA market is set to report the largest market share of facilities management software in North America region, and expected to grow at CAGR 7.7% during 2025 to 2035. USA market is anticipated to create an absolute dollar opportunity of USD 5,915.7 Million during 2025 to 2035.

The increasing popularity of outsourcing the facility management solutions is one of the major factor driving the market growth in the region. According to the FMI analysis, around 44% of the facilities management is outsourced in the USA Most of the organizations in USA are shifting towards the outsourcing trend due to its benefits offered, which include time and money savings, broader expertise, and staffing flexibility among others.

Furthermore, outsourcing of facility management is gaining importance in healthcare sector, as it allows healthcare professionals to focus on patient’s caring while also ensuring that the facility functioning is at optimal level. Therefore, these developments and trends are likely to spur the demand for facilities management software in the country.

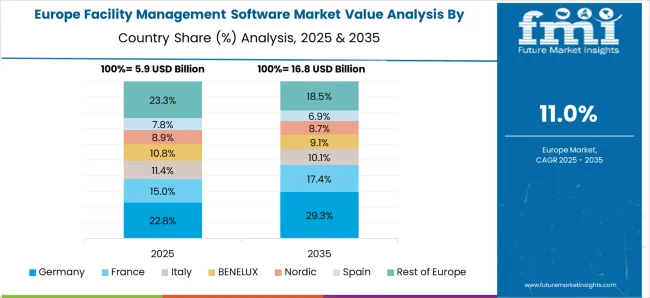

Germany will be one of the prominent country in Europe region during forecasted period

Germany accounted the major market share in 2025 in the European facility management software market. Correspondingly, it is anticipated that Germany will grow with a considerable CAGR of 10.7% during 2025 to 2035, its market accounts for the largest consumption of facilities management software with the market value of USD 1,214.5 Million in 2025. Germany market is anticipated to create an absolute dollar opportunity of USD 2,139.2 Million during 2025 to 2035.

Rising urbanization coupled with growing industrialization is the major factor responsible for the market growth in the country. In Germany, the manufacturing segment accounted around 21% of revenue share in 2025.

The manufacturing units in Germany, to follow safety and securing protocols & rules, most of them outsource the maintenance of mechanical and electrical services which are aligned with guidelines of government. Manufacturing factories try to majorly focus on their core business therefore they adopt facility management software to improve their work efficiency and overall productivity.

Based on type, the facilities management software is segmented into integrated software and standalone software. Further, standalone software is segmented into sustainability and environment management, workplace and move management, maintenance management, security management, asset, property and real estate management, and others.

Among these, integrated software accounted the major market share in 2025 and is anticipated to continue the supremacy during the forecast period. The market size of integrated software segment is anticipated to grow by 3.3X during forecast period.

Moreover, the segment is set to register the highest growth at the rate of 12.8% CAGR during 2025 to 2035. Integrated software segment is anticipated to create an absolute dollar opportunity of USD 26,732.6 Million during 2025 to 2035.

Major advantages of adopting integrated facility management software include simplified processes and streamlined operations, enhanced operational efficiency, reduced cost, reduced complexity management, and improved service delivery, with better ability to share information, while driving continuous improvement.

Therefore, due to its offered benefits over standalone software, integrated facility management software is gaining importance across the globe, which in turn is boosting the market growth.

Based on enterprise size, the market segmented into SMEs and large enterprises. Among which large enterprises accounted for the highest market share in 2025. Moreover, market size of large enterprises segment is anticipated to expand up to 2.9X during 2025 to 2035.

Whereas, the SMEs segment is set to register the highest growth rate of around 12.7% during 2025 to 2035. SMEs segment is anticipated to create an absolute dollar opportunity of USD 21,704.9 Million during 2025 to 2035.

After the pandemic, most of the SMEs have accelerated their businesses by digital transformation processes.

Number of SMEs are increasing across the world and are more likely to be focused on strengthening their digital capabilities. Growing awareness of the benefits of facilities management software among the SMEs is the major factor for the segment to grow at the highest CAGR.

SMEs are adopting facility management software, as are result of this, there is a frequent usage of cloud-based software in their business operations. Due to a lack of authentication, some cloud-based software can be vulnerable.

SMEs are encouraged by various government initiatives to go digital, therefore, the demand for the facilities management software in SMEs is expected to rise in the near future.

Based on industry segment, the healthcare sector will be a dominating segment during the forecast period. The market size of healthcare segment is anticipated to expand up to 4.6X during 2025 to 2035.

Moreover, the segment is set to register the highest growth rate of 16.4% during 2025 to 2035. Healthcare segment is anticipated to create an absolute dollar opportunity of USD 13,196.3 Million during 2025 to 2035

Healthcare facilities operate 24/7 without exception, where the maintenance team ensures to offer healthcare facilities with high-quality patient care and ensures the facility is prepared for emergencies.

Facilities management software benefits the healthcare facility managers by offering improved patient satisfaction, optimized energy consumption, and meet regulatory requirements among others.

Therefore, growing technical advances results in increase in the demand for better healthcare facilities. Additionally, growing initiatives from government, which results in the need of integrated healthcare systems. These are some of the major key factors boosting the growth for global facility management software market in healthcare industry.

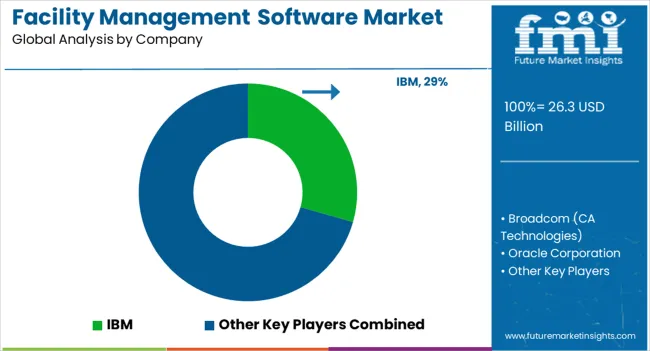

The facility management software market is growing rapidly as organizations prioritize digital transformation, smart infrastructure, and sustainability. Major players such as IBM Corporation, Oracle Corporation, and SAP SE dominate with enterprise-level integrated solutions that combine asset tracking, energy analytics, and predictive maintenance. These firms leverage AI, IoT, and cloud-based technologies to deliver intelligent platforms that enhance operational efficiency and reduce total cost of ownership across diverse facilities including commercial buildings, hospitals, and campuses.

Planon Group and Eptura are focusing on modular, user-centric systems tailored for hybrid workplaces and flexible space utilization, addressing post-pandemic workspace management challenges. Accruent LLC and Trimble Inc. emphasize data-driven asset lifecycle optimization through integration of BIM, GIS, and energy management tools, enabling enterprises to meet ESG compliance goals and operational transparency standards.

Johnson Controls International plc leads in combining facility management software with its broader smart building ecosystem, linking HVAC, lighting, and security systems under unified control. Broadcom Inc. provides advanced data center and IT infrastructure management capabilities, strengthening the link between operational technology and enterprise IT environments.

| Attribute | Details |

|---|---|

| Market value in 2025 | USD 26.3 billion |

| Market CAGR 2025 to 2035 | 12.0% |

| Share of top 5 players | Around 30% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; and the Middle East & Africa |

| Key Countries Covered | USA, Canada, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, South Korea, India, Malaysia, Indonesia, Singapore, Australia & New Zealand, GCC Countries, Turkey, North Africa and South Africa |

| Key Segments Covered | Deployment Mode, Type, Enterprise Size, Industry, and Region |

| Key Companies Profiled |

IBM Corporation, Oracle Corporation, SAP SE, Planon Group, Eptura, Accruent LLC, Johnson Controls International plc, Trimble Inc., Broadcom Inc. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global facility management software market is estimated to be valued at USD 26.3 billion in 2025.

The market size for the facility management software market is projected to reach USD 81.8 billion by 2035.

The facility management software market is expected to grow at a 12.0% CAGR between 2025 and 2035.

The key product types in facility management software market are on-premise fms and cloud-based fms.

In terms of type, integrated software segment to command 47.6% share in the facility management software market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Facility Management Services Market Analysis – Trends, Growth & Forecast 2025 to 2035

Computer Aided Facility Management (CAFM) Market Size and Share Forecast Outlook 2025 to 2035

Early Production Facility Market Size and Share Forecast Outlook 2025 to 2035

USA Skilled Nursing Facility Market Analysis – Growth & Forecast 2025 to 2035

Trends, Growth, and Opportunity Analysis of Data Center Facility in Morocco Size and Share Forecast Outlook 2025 to 2035

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Cash Management Services Market – Trends & Forecast 2025 to 2035

CAPA Management (Corrective Action / Preventive Action) Market

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Exam Management Software Market

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA