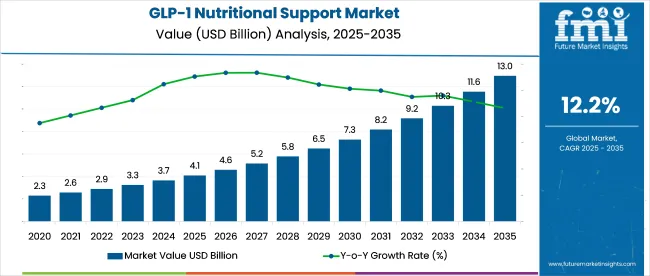

The GLP-1 nutritional support market is forecast to reach USD 13 billion by 2035, up from USD 4.1 billion in 2025, advancing at a 12.2% CAGR.

Expansion is being shaped by clinical treatment protocols and broader reimbursement for weight loss and metabolic support. Formulators are shifting toward condition-specific blends that aid glycemic control, muscle preservation, and digestive balance.

Ready-to-drink formats are being adopted across major hospitals in the United States, Germany, and Japan. Meal replacement kits are also being supplied through insurance-covered outpatient programs, where they are included alongside prescribed GLP-1 therapies for long-term dietary management.

The GLP-1 nutritional support market holds a small yet expanding presence across multiple parent sectors. It contributes 3-5% to the GLP-1 pharmaceutical ecosystem, primarily supporting users of semaglutide and tirzepatide. Within dietary supplements, its share remains under 1%, while in functional foods and beverages, it accounts for less than 0.5%.

High-protein shakes and satiety-focused blends are fueling category expansion. In weight management services, GLP-1-linked nutrition programs hold a 2-3% share. Its role in obesity treatment remains marginal-under 1%-but adoption is rising through clinical integrations and bundling with telehealth-based interventions targeting metabolic and appetite-related outcomes.

In February 2024, Herbalife launched the Herbalife® GLP-1 Nutrition Companion, a curated range of food and supplement product combos tailored to support individuals using GLP1 and similar weight-loss medications.

According to Dr. Kent Bradley, Chief Health and Nutrition Officer at Herbalife, “Weight-loss drugs curb your appetite, so people taking medications like GLP-1 Agonist may have difficulty getting all the macronutrients, micronutrients or physical activity they need for optimal muscular, cardiovascular and brain health. Individuals taking these medications should supplement with products that help meet these needs and focus on making foundational lifestyle changes to achieve sustainable weight loss.”

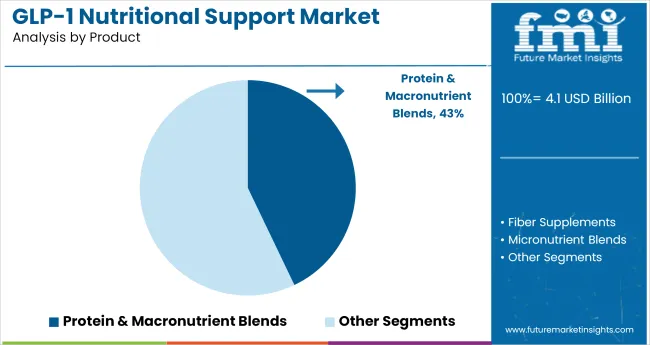

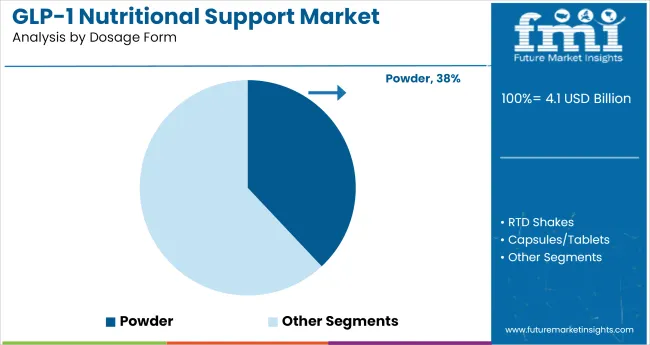

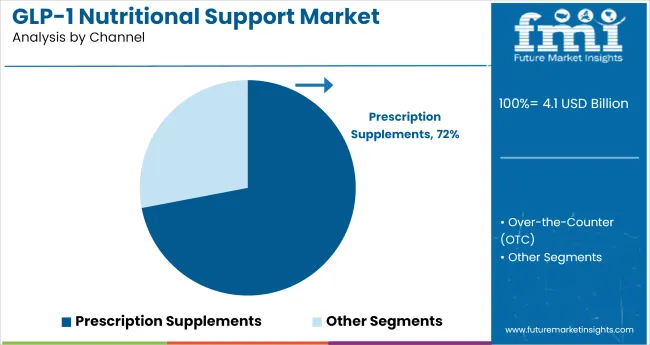

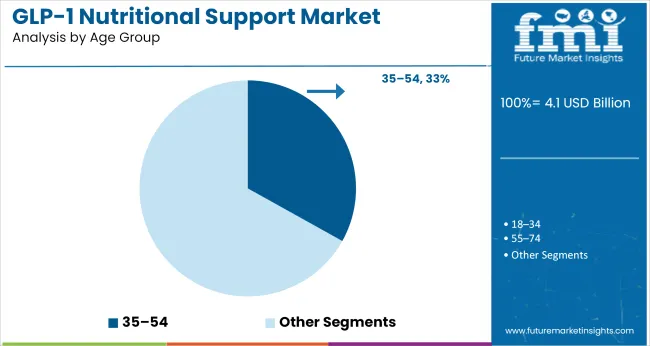

The GLP-1 nutritional support market is segmented by product type into protein & macronutrient blends, fiber supplements, micronutrient blends, and digestive health formulations. By dosage form, segmentation includes powders (meal replacements, fibers), RTD shakes, capsules/tablets, and gummies/chews. Age groups include 18-34, 35-54, 55-74, and 75+. Channel segmentation is split between prescription (Rx) and over-the-counter (OTC) formats.

Regional analysis spans North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia & Belarus, Balkan & Baltic Countries, and Middle East & Africa.

The protein & macronutrient blends segment held a 39.4% share in 2024 and is projected to reach 43% in 2025. The 3.5-point increase reflects stronger integration of GLP-1 therapy with structured nutritional interventions. Among GLP-1 users, 67.5% of physician-recommended nutrition plans now include protein-based formulations. Therapeutic protein shake and powder sales grew 14.7% year-on-year, particularly in endocrinology clinics and metabolic care units.

This growth is driven by demand for glucose-modulating blends that balance protein, fiber, and fat to support satiety and treatment outcomes.

Powdered supplements accounted for 34.2% of the dosage form segment in 2024 and are forecast to reach 38% in 2025. The 3.8-point gain is attributed to growing adoption in clinical and home-based use cases, where cost efficiency and dosing flexibility are critical. Powders now make up 61.3% of GLP-1-related nutritional procurement across institutional healthcare settings. Direct-to-consumer subscriptions for powder-based supplements rose 18.2% in 2025.

Powders are being adopted for their ability to deliver high-volume, low-calorie nutrition with tailored macronutrient control.

The Rx segment held 68.5% of industry share in 2024 and is projected to grow to 72% in 2025. This 3.5-point increase corresponds with the broader integration of GLP-1 therapies into structured medical nutrition protocols. In OECD countries, 74.1% of GLP-1 nutritional products are dispensed via prescription. In Q1 2025, prescription-focused brands outperformed OTC players by 2.3 times. Institutional systems continue to favor Rx-classified nutritional therapies, which account for 81.6% of hospital-based supplement distribution.

Growth is supported by physician oversight, reimbursement schemes, and adherence protocols in regulated health systems.

The 35-54 age group held a 30.6% share in 2024 and is forecast to reach 33% in 2025. This 2.5-point increase is driven by rising metabolic risk awareness and early-stage GLP-1 prescription trends. Claims data from five leading insurers in the USA and EU show that 56% of GLP-1 prescriptions in 2025 were written for patients in this age bracket. Product launches targeting this group increased by 21.4% year-on-year, with brands offering modular kits and meal systems tailored to midlife users.

This segment is driving demand for medically guided nutrition aligned with weight loss and glycemic control needs.

The GLP-1 nutritional support market is experiencing significant expansion, fueled by the growing adoption of GLP-1 medications for weight management and metabolic health. The increasing need for specialized nutritional support to mitigate side effects and enhance therapeutic outcomes is driving industry growth. However, challenges such as gastrointestinal side effects and high medication costs are limiting broader accessibility.

Drivers of Growth in GLP-1 Nutritional Support

The demand for GLP-1 nutritional support is fueled by the increasing prevalence of obesity and type 2 diabetes, which affects over 30% of the global population. The global weight management market, which includes GLP-1 drugs, is projected to reach USD 70 billion by 2028. Nutritional solutions targeting side effects such as muscle loss and digestive discomfort are in high demand, especially as more consumers turn to GLP-1 medications.

Challenges Hindering GLP-1 Nutritional Support Growth

Despite the growing demand, the industry faces challenges related to gastrointestinal side effects, which affect up to 50% of GLP-1 users. High medication costs remain a significant barrier, with the average price of GLP-1 drugs reaching USD 1,200 per month, making them inaccessible to many. Furthermore, insufficient guidance on dietary support limits the effectiveness of treatments, as studies show 60% of patients report a lack of proper nutritional advice from healthcare providers.

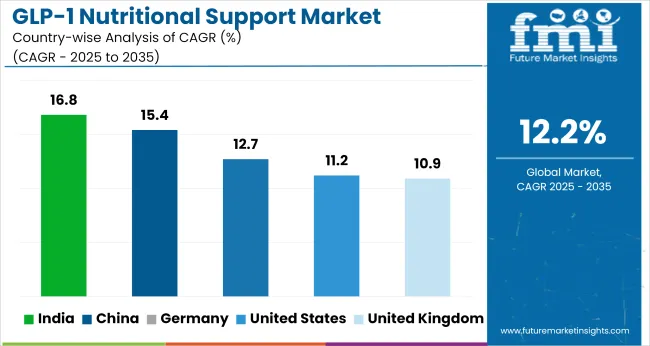

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 11.2% |

| Germany | 12.7% |

| United Kingdom | 10.9% |

| China | 15.4% |

| India | 16.8% |

Global demand for GLP-1 nutritional support is rising at 12.2% CAGR between 2025 and 2035. The report covers detailed analysis of over 40 countries, and the top five countries have been shared as a reference. India leads with 16.8%, outpacing the global rate by 4.6 points. China follows at 15.4%, also well above the baseline. Both BRICS countries reflect surging diabetic and pre-diabetic populations, growing retail interest in peptide-based interventions, and expanding domestic supplement manufacturing.

Germany posts 12.7%, marginally above the global average, supported by insurance-backed nutrition trials and integration of medical foods in chronic care. The United States trails at 11.2%, reflecting prescription-heavy product reliance and slower OTC category development. The United Kingdom shows the weakest growth at 10.9%, just 1.3 points below the global average, shaped by tighter labeling restrictions and limited formulary coverage under NHS-linked channels.

While Asia is capturing high-growth tailwinds, OECD markets remain steady but more regulated, requiring adaptive commercialization across channels, especially where Rx-OTC hybrid categories are evolving.

The CAGR of the GLP-1 nutritional support market in the United States rose from approximately 8.2% during 2020 to 2024 to 11.2% for 2025 to 2035, supported by stronger insurance reimbursement frameworks and physician adoption across outpatient metabolic care. Increased prescription of GLP-1 drugs for both diabetes and obesity was accompanied by nutritional counselling, expanding demand for high-protein, fiber-enriched formulations.

Clinical protocols began incorporating satiety-driven supplements into meal planning. Retail pharmacies expanded the stocking of Rx-grade supplements, while digital health platforms partnered with nutrition providers to deliver bundled solutions across chronic care management programs.

The CAGR in Germany increased from around 9.1% in 2020 to 2024 to 12.7% during 2025 to 2035, driven by higher institutional procurement of GLP-1-specific nutrition products for diabetes and obesity support. Dietitian-led care has incorporated macronutrient and digestive blends into standardized post-prescription dietary regimens.

Expanded reimbursement by statutory health insurers post-2025 enabled hospitals and rehabilitation centers to scale up clinical nutrition integration. German formulation companies increased production of compliant high-fiber meal replacements tailored to GLP-1 pathways. Technical guidelines were updated to align with EU product safety for metabolic nutrition categories.

The CAGR in the United Kingdom climbed from about 7.6% during 2020 to 2024 to 10.9% in the 2025 to 2035 period, supported by the NHS's inclusion of GLP-1 supplementation for metabolic health. Primary care guidelines were updated to include meal replacement shakes and fiber supplements alongside GLP-1 prescriptions.

Public health campaigns focused on nutrition-compliant therapy saw greater adoption of satiety-oriented supplements, especially among age groups 35-54. Ready-to-drink (RTD) products entered NHS-linked pharmacies, with private nutrition brands partnering for distribution. Adherence-based bundles were promoted via digital health platforms integrated with NHS apps.

The China market rose from approximately 10.8% in 2020 to 2024 to 15.4% during 2025 to 2035, fueled by government-led metabolic health programs and expansion in GLP-1 drug coverage. Prescription supplement protocols were extended into provincial hospital systems, where clinical dietitians began recommending digestion-friendly, low-glycemic formulas.

A surge in e-pharmacy sales platforms and fitness-nutrition apps enabled direct ordering of GLP-1-compatible powders. Local manufacturing clusters in Jiangsu and Guangdong expanded production through tech transfer agreements with multinational firms. China’s health registry streamlined GLP-1 supplement approvals in 2026, supporting DTC expansion.

The CAGR value moved up from nearly 11.3% in 2020 to 2024 to 16.8% for 2025 to 2035, supported by growth in private metabolic clinics and broader primary care integration. Prescription supplement bundles targeting satiety, glycemic control, and muscle preservation were added to GLP-1 therapy regimens across urban and semi-urban care networks.

AYUSH-backed diet programs began to include compatible protein-fiber formulations. E-pharmacy and wellness platforms drove accessibility, especially outside Tier 1 cities. Local production increased due to investment in domestic nutraceutical hubs across Gujarat, Telangana, and Karnataka.

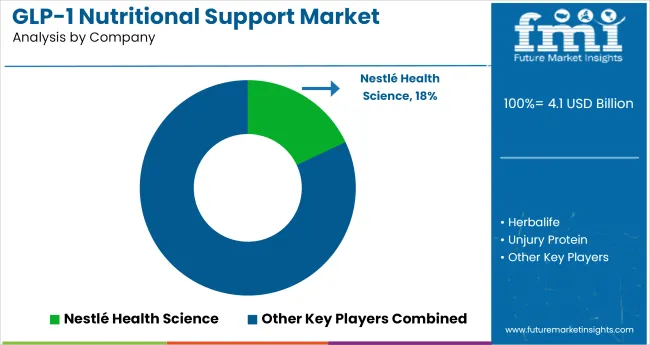

Leading Company - Nestlé Health Science Industry Share - 18%

In the GLP-1 nutritional support market, leading players are leveraging clinical positioning, micronutrient optimization, and bariatric-friendly formats to target consumers on GLP-1 therapies such as semaglutide and tirzepatide. Companies like Nestlé Health Science, Abbott, and Herbalife are developing nutrient-dense formulations focused on protein, B12, electrolytes, and appetite support, often bundled with telehealth or pharmacy programs.

Unjury Protein and ProCare Health are prominent in the bariatric and medical nutrition channels, offering easily digestible powders and ready-to-drink solutions tailored to reduced caloric intake and malabsorption challenges.

Emerging brands like Replenza, Keptropy, and FullWell are marketing GLP-1-supportive supplements via direct-to-consumer channels, with emphasis on glycemic control, lean mass preservation, and post-meal tolerance. Supplement chains like The Vitamin Shoppe® are curating GLP-1-specific shelves with a mix of third-party and private-label offerings. Natnect and KetoZest are tapping into ketogenic formats and anti-nausea blends, aligned with consumer-reported side effects of GLP-1 drugs.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 4.1 billion |

| Projected Industry Size (2035) | USD 13 billion |

| CAGR (2025 to 2035) | 12.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Product Types Analyzed (Segment 1) | Protein & Macronutrient Blends, Fiber Supplements, Micronutrient Blends, Digestive Health Formulations, Appetite & Metabolic Support |

| Dosage Forms Analyzed (Segment 2) | Powders (Meal Replacements, Fibers), RTD Shakes, Capsules/Tablets, Gummies/Chews, Others |

| Age Groups Analyzed (Segment 3) | 18 - 34, 35 - 54, 55 - 74, 75+ |

| Channels Analyzed (Segment 4) | Prescription (Rx), Over-the-Counter (OTC) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Nestlé Health Science, Herbalife, Unjury Protein, ProCare Health, FullWell, The Vitamin Shoppe®, SOLO TREE, Replenza, KetoZest, Keptropy, Abbott, Vital Nutrients, Natnect, Other Emerging Players |

| Additional Attributes | Dollar sales by dosage and age group, protein-blend dominance in GLP-1 nutrition protocols, clinical demand for RTD and meal replacements, OTC adoption trends, regional insurance policy shifts |

The industry includes protein and macronutrient blends, fiber supplements, micronutrient blends, digestive health formulations, and appetite & metabolic support.

The industry is segmented into powders (meal replacements, fibers), RTD shakes, capsules/tablets, gummies/chews, and others.

The segmentation covers 18-34, 35-54, 55-74, and 75+ age brackets.

These products are distributed through prescription (Rx) and over-the-counter (OTC) formats.

The industry is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific.

The industry is projected to reach USD 13 billion by 2035.

The industry is expected to grow at a CAGR of 12.2% from 2025 to 2035.

Protein and macronutrient blends are expected to dominate with a 43% share in 2025.

The industry is estimated to reach USD 4.1 billion in 2025.

East Asia, particularly China and Japan, is expected to be the key growth region with growth rates of 15.4% and 12.0%, respectively.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nutritional Bars Market Size and Share Forecast Outlook 2025 to 2035

Nutritional Yeast Market Size, Growth, and Forecast for 2025 to 2035

Nutritional Labelling Market Trends and Forecast 2025 to 2035

Nutritional Ingredients in Animal Feed Market Trends - Growth & Industry Forecast 2025 to 2035

Nutritional Lipids Market

Unsupported Single Coated Tape Market Size and Share Forecast Outlook 2025 to 2035

Self-Supporting Aerial Optical Cable Market Size and Share Forecast Outlook 2025 to 2035

Life Support Systems Market Size and Share Forecast Outlook 2025 to 2035

Soft Support Products Market

Organ Support Supplements Market Analysis Size and Share Forecast Outlook 2025 to 2035

Multi Nutritional Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Memory Support Supplement Market Size and Share Forecast Outlook 2025 to 2035

Infant Nutritional Premix Market Size and Share Forecast Outlook 2025 to 2035

Combat Support Vehicle Market

Cancer Supportive Care Products Market Trends – Growth & Forecast 2020-2030

Die Cut Support Pads Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Enclosure Support Arm Systems Market Size and Share Forecast Outlook 2025 to 2035

Lactation Support Supplements Market - Size, Share, and Forecast Outlook 2025-2035

Oral Clinical Nutritional Cream and Pudding Market Analysis by Product Type and Distribution Channel Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA