The memory support supplement market is experiencing robust growth. Increasing awareness of cognitive health, rising prevalence of age-related memory decline, and the growing focus on preventive healthcare are major factors driving demand. Current market dynamics are characterized by expanding consumer preference for brain health products, innovation in natural formulations, and continuous product diversification.

The industry is witnessing strong participation from nutraceutical manufacturers, with emphasis on efficacy, safety, and clinical validation. Regulatory frameworks promoting transparency and quality assurance are further supporting market credibility. The future outlook remains positive as consumers increasingly adopt supplements as part of daily wellness routines.

Continuous research in neuroprotective ingredients, along with digital marketing initiatives and e-commerce expansion, is expected to enhance accessibility and awareness Growth rationale is founded on increasing consumer confidence in scientifically validated formulations, growing disposable incomes, and the integration of memory support supplements into holistic health and lifestyle trends worldwide.

| Metric | Value |

|---|---|

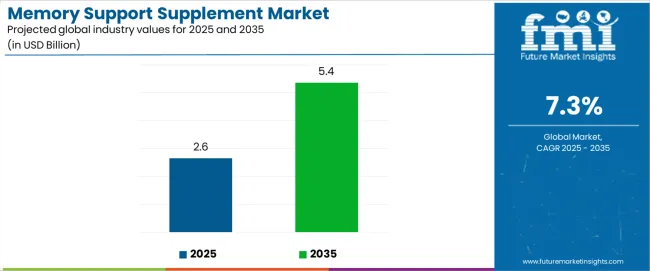

| Memory Support Supplement Market Estimated Value in (2025 E) | USD 2.6 billion |

| Memory Support Supplement Market Forecast Value in (2035 F) | USD 5.4 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

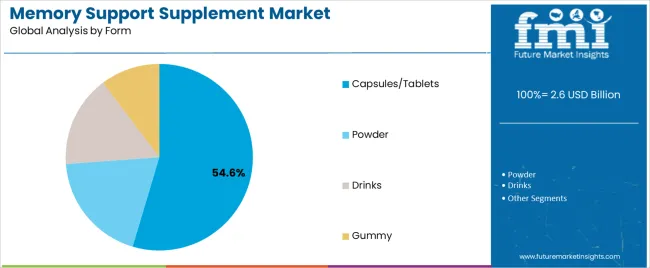

The market is segmented by Ingredient Type, Product Category, Form, and Distribution Channel and region. By Ingredient Type, the market is divided into Natural and Synthetic. In terms of Product Category, the market is classified into Over-The-Counter and Prescribed. Based on Form, the market is segmented into Capsules/Tablets, Powder, Drinks, and Gummy. By Distribution Channel, the market is divided into Online Retailers, Health Food Stores, Pharmacies and Drugstores, Professional Healthcare Practitioners, Nutrition Stores, and Healthcare Professionals. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

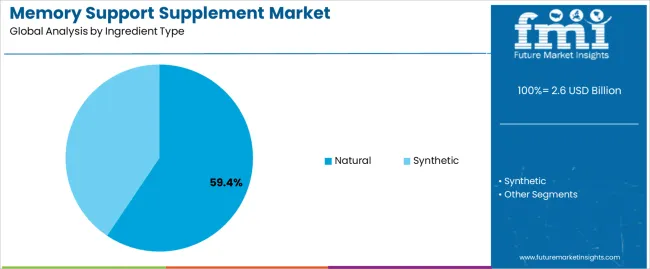

The natural ingredient segment, accounting for 59.40% of the ingredient type category, has emerged as the leading segment due to growing consumer inclination toward plant-based and herbal products. Demand has been reinforced by rising skepticism toward synthetic compounds and the perception of natural ingredients as safer and more sustainable. Formulators are focusing on incorporating clinically supported natural extracts such as ginkgo biloba, bacopa monnieri, and omega-3 fatty acids to enhance efficacy.

Regulatory encouragement for clean-label products has strengthened this segment’s position. The availability of diverse natural ingredient sources across regions has ensured stable supply chains.

Continuous product innovation and growing acceptance of botanically derived formulations have further expanded market penetration As awareness regarding long-term brain health increases, the natural segment is expected to maintain dominance through enhanced trust, transparency, and product differentiation.

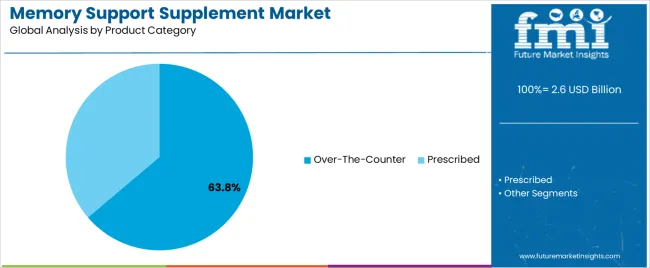

The over-the-counter segment, representing 63.80% of the product category, has maintained leadership due to easy accessibility, affordability, and growing consumer awareness of self-care practices. The shift toward preventive health management and convenience-based purchasing has driven sales through retail and online platforms. Regulatory relaxation for non-prescription supplements in several regions has facilitated greater consumer reach.

Manufacturers are leveraging brand credibility, clinical claims, and marketing transparency to build trust in OTC formulations. The widespread availability of these products in pharmacies, supermarkets, and digital channels has further contributed to their market expansion.

Continuous innovation in packaging, dosage, and formulation has supported brand differentiation and consumer retention This segment is projected to sustain its dominant position as awareness regarding cognitive wellness and proactive health maintenance continues to grow globally.

The capsules and tablets segment, holding 54.60% of the form category, has remained the preferred format due to dosage accuracy, portability, and extended shelf life. Consumers prefer this form for its convenience, ease of use, and consistent delivery of active ingredients. Manufacturers have optimized formulation processes to enhance bioavailability and absorption rates.

Tablets and capsules also allow for precise dosage standardization, which ensures compliance with regulatory and safety standards. This segment benefits from scalability in production and lower manufacturing costs compared to liquid or powder forms.

The growing adoption of sustained-release and multi-ingredient formulations is further reinforcing segment growth As consumers prioritize convenience and consistent results, capsules and tablets are expected to retain their leadership in the global memory support supplement market over the forecast period.

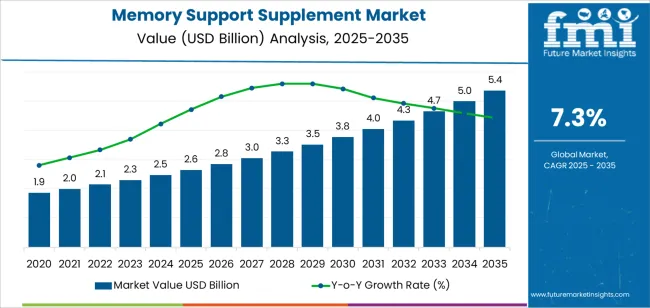

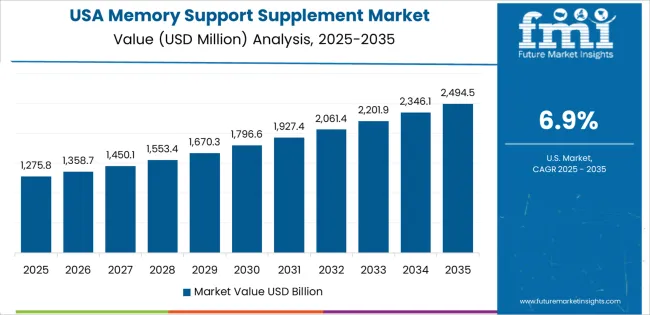

Global memory support supplement sales grew at a CAGR of 6.1% from 2020 to 2025.

Through 2035, the memory support supplement market is projected to grow at 7.3% CAGR.

The table below shows the estimated growth rates of the top four countries. The United States, Germany, and India are set to record high CAGRs of 4.5%, 6.7%, and 7.6%, respectively, through 2035.

| Countries | Value-based CAGR (2025 to 2035) |

|---|---|

| United States | 4.5% |

| China | 3.7% |

| India | 7.6% |

| Germany | 6.7% |

The United States memory support supplement industry is predicted to register a CAGR of 4.5% through 2035. Key factors deciding the upward trajectory are:

Demand for the product in China is set to advance at a CAGR of 3.7% during the projected period, highlighting steady gains. A number of factors influence the industry in China, including:

The market is in line to book a CAGR of 6.7% in Germany. Factors responsible for the solid growth include:

The Indian market is supposed to register a CAGR of 7.6% for the forecast period. Some of the key factors are enumerated below:

Demand for memory support supplements is increasing steadily in the United Kingdom. Emerging patterns in the United Kingdom market are as follows:

The below section shows the natural segment dominating by ingredient type. The segment is predicted to reach USD 1,537.0 million in 2025. Based on form, the capsules/tablets segment is anticipated to total USD 1,428.5 million in 2025.

| Top Segments | Estimated Market Value (2025) |

|---|---|

| Natural (Ingredient Type) | USD 1,537.0 million |

| Over-the-Counter (Product category) | USD 1,838.0 million |

| Capsules/Tablets (Form) | USD 1,428.5 million |

| Health Food Stores (Distribution Channel) | USD 750.0 million |

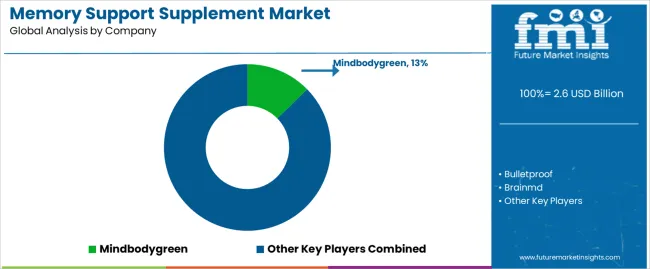

Leading pharmaceutical companies dominate the cognitive health market. They are investing in research and development to introduce novel memory supplements. Innovative start-ups and niche players disrupt the market by focusing on natural and holistic approaches.

Leading memory support supplement manufacturers invest in research and development to create tailored formulations for specific needs. Partnerships and distribution agreements are a common strategy in the industry. Other organic strategies include an increase in advertising activities and celebrity endorsements.

For instance

The global memory support supplement market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the memory support supplement market is projected to reach USD 5.4 billion by 2035.

The memory support supplement market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in memory support supplement market are natural, _panax ginseng, _ginkgo biloba, _asiatic pennywort, _ashwagandha, _bacopa monnieri, _guarana, _eleuthero, _rhodiola rosea, _schisandra chinensis, _others (maca, etc.), synthetic, _racetams, _modafinil, _sunifiram, _phosphatidylserine, _choline, _dmae, _unifiram, _hydrafinil, _citicoline and _others (adranfinil, etc.).

In terms of product category, over-the-counter segment to command 63.8% share in the memory support supplement market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Memory-Enhancing Drugs Market Size and Share Forecast Outlook 2025 to 2035

Memory Integrated Circuits (IC) Market Growth - Trends & Forecast 2025 to 2035

In-Memory Database Market Size and Share Forecast Outlook 2025 to 2035

In-Memory Analytics Tools Market Growth - Trends & Forecast through 2034

Shape Memory Alloy Market Size and Share Forecast Outlook 2025 to 2035

Shape Memory Polymer Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Memory Cube Market Size and Share Forecast Outlook 2025 to 2035

Polymer Memory Market Size and Share Forecast Outlook 2025 to 2035

India Shape Memory Alloy Market Analysis by Material Type, Component Type, Application, End Use Industry, and Region Forecast Through 2025 to 2035

3D NAND Flash Memory Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Memory Market Size and Share Forecast Outlook 2025 to 2035

Static Random Access Memory (SRAM) Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Random Access Memory (DRAM) Market Size and Share Forecast Outlook 2025 to 2035

Digital Radio Frequency Memory (DRFM) Market Size and Share Forecast Outlook 2025 to 2035

Non-volatile Dual In-line Memory Module (NVDIMM) Market Analysis - Growth & Forecast 2025 to 2035

Next Generation Non Volatile Memory Market Size and Share Forecast Outlook 2025 to 2035

Unsupported Single Coated Tape Market Size and Share Forecast Outlook 2025 to 2035

Life Support Systems Market Size and Share Forecast Outlook 2025 to 2035

Soft Support Products Market

Organ Support Supplements Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA