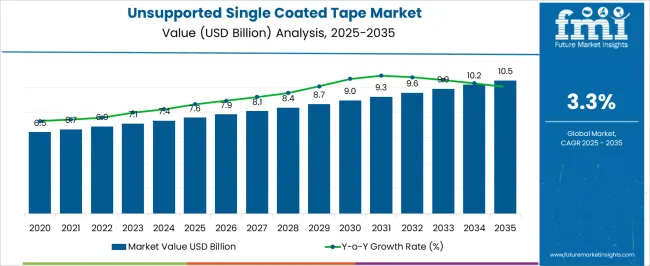

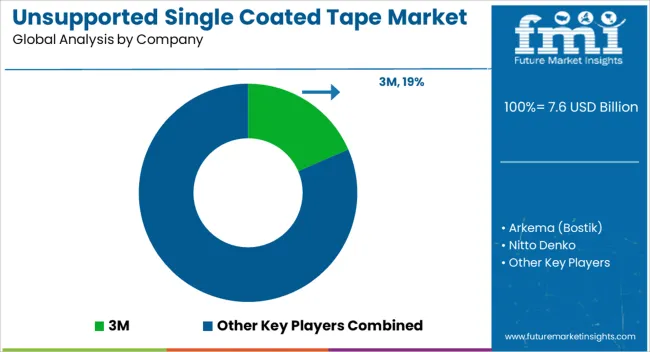

The Unsupported Single Coated Tape Market is estimated to be valued at USD 7.6 billion in 2025 and is projected to reach USD 10.5 billion by 2035, registering a compound annual growth rate (CAGR) of 3.3% over the forecast period.

| Metric | Value |

|---|---|

| Unsupported Single Coated Tape Market Estimated Value in (2025 E) | USD 7.6 billion |

| Unsupported Single Coated Tape Market Forecast Value in (2035 F) | USD 10.5 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

The unsupported single coated tape market is experiencing robust growth. Increasing industrial applications, rising demand in automotive and electronics sectors, and the need for high-performance adhesive solutions are driving market expansion. Current dynamics are characterized by the adoption of advanced tape formulations, enhanced adhesive technologies, and growing awareness of product durability and reliability.

Manufacturers are focusing on improving product consistency, operational efficiency, and compliance with regulatory standards. The future outlook is supported by increasing automotive production, expanding electronics manufacturing, and rising use in industrial assembly and packaging applications.

Technological innovations in coating techniques, substrate materials, and adhesion performance are expected to enhance product functionality Growth rationale is anchored on the versatility of single coated tapes across diverse applications, the ability to meet stringent performance requirements, and the strategic alignment of manufacturers with end-user industries, which collectively underpin sustainable revenue growth and wider market penetration over the forecast period.

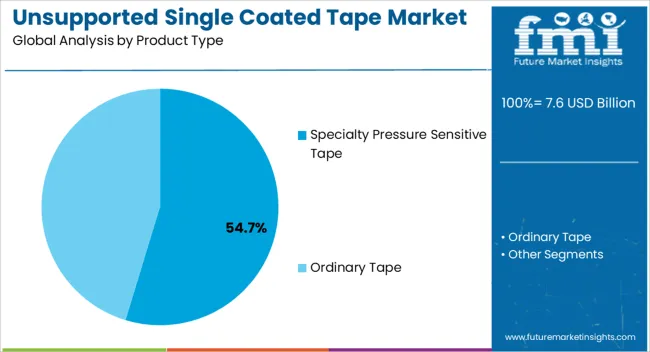

The specialty pressure sensitive tape segment, representing 54.7% of the product type category, has emerged as the leading product due to its superior adhesion properties and suitability for high-performance applications. Its adoption has been driven by consistent quality, reliability under extreme conditions, and compatibility with a wide range of substrates.

Demand stability has been reinforced by industrial applications requiring precision bonding, while advancements in tape formulation and coating technology have enhanced durability and operational efficiency. Manufacturers have strengthened supply chain integration and regulatory compliance, ensuring broad acceptance across key industries.

Continued focus on innovation, including custom formulations and high-temperature resistant variants, is expected to sustain the segment’s market share and support incremental growth across commercial and industrial applications.

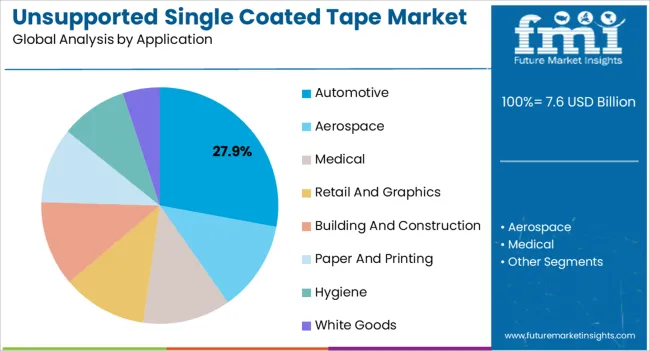

The automotive application segment, holding 27.9% of the application category, has maintained prominence due to increasing adoption in assembly, insulation, and component bonding processes. Its growth has been facilitated by the expansion of automotive manufacturing, rising demand for lightweight and high-performance materials, and integration of advanced adhesive solutions in production lines.

Reliability, ease of use, and cost-effectiveness have strengthened acceptance among OEMs and tier-1 suppliers. Technological enhancements in tape performance, combined with adherence to industry standards, have reinforced its suitability for automotive applications.

Future expansion is expected to be driven by the electrification of vehicles, increasing production volumes, and adoption of advanced manufacturing techniques, ensuring that automotive remains a key contributor to the overall market growth.

| Attributes | Details |

|---|---|

| Unsupported Single Coated Tape Market Size (2020) | USD 6.5 billion |

| Unsupported Single Coated Tape Market Size (2025) | USD 7.6 billion |

The market valuation of unsupported single-coated tapes appreciated from USD 6.5 billion in 2020 to USD 7.6 billion by 2025. Presently, it stands at a valuation of USD 10.5 billion and is projected to arrive at USD 10.9 billion by 2035, as per the latest market study. Key factors that have been propelling the product sales include:

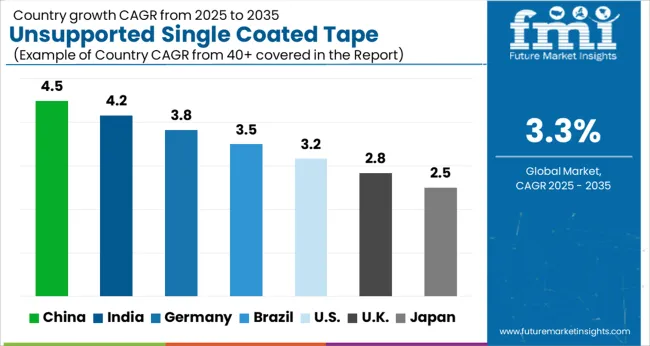

The India unsupported single coated tape market is predicted to expand at a CAGR of 6.2% through 2035. Market scope is predicted to be impacted by the following factors:

The unsupported single coated tape market in China is estimated to record a CAGR of 5.4% over the assessment period. Mentioned below are the key factors that are impelling sales of these tapes.

The sales of unsupported single coated tape in the United Kingdom are predicted to expand at a CAGR of 4.1% through 2035. Compared to other countries in Europe, the rate of product sales is expected to be higher than Germany, Italy, and France, where the CAGRs have been estimated to be 2.1%, 3.2%, and 3.5%, respectively, throughout the forecast period. New legislation related to the use of adhesive tapes is a major factor dimming the prospects for unsupported single coated tape in the region.

For a robust future of adhesive-tape-related organizations, these organizations are expected to adapt to the new legal requirements by integrating their business models with these regulatory updates. In the future, companies, whether large or small, who incorporate regulatory concerns in product development, product procurement, and sustainable development are predicted to achieve success in unsupported single coated tape business.

The unsupported single coated tape market in Canada is predicted to have higher growth prospects than in the United States. Since the market reach in the United States is already quite high for the established players, they are seeking new markets with potential for growth. The following factors are positively impacting the sales of unsupported single coated tape in Canada:

In Asia Pacific, Thailand is another significant market for unsupported single coated tape. The market in the country is predicted to register a CAGR of 5.4% through 2035.

| Top Product Type | Market Share (2025) |

|---|---|

| Ordinary Tape | 55.6% |

By product type, the ordinary tape segment accounts for 55.6% of the market share. These tapes are used for their versatility and effectiveness and find extensive applications in sectors like construction, medical, automotive, white goods, etc. Since these sectors exhibit healthy growth, the rate at which unsupported single-coated tape is purchased is predicted to be steady.

These tapes are found to be utilized in both industrial as well as consumer use, and their utilization goes beyond the regular uses like securing wires, masking areas while painting, sealing packages, etc.

| Top Application | Market Share (2025) |

|---|---|

| Building and Construction | 31.1% |

Unsupported single-coated tape is an essential tool for many contractors working in the construction and building sector. Due to its versatility, cost-effectiveness, and convenience, the product finds extensive application in the construction sector. The building and construction sector is predicted to account for a 31.1% share of the global market

Healthy growth of the building and construction sector is projected to spur demand for unsupported single-coated tape to seal and bond multiple building materials like plywood, drywall, roofing materials, and insulation. The demand for these tapes to mask off areas during wall painting and various finishing processes is also projected to upsurge.

Key players are strategizing to expand their businesses in emerging markets where the construction and packaging sectors are thriving. Market participants are also striving to develop high-performing tapes that can beat harsh weather conditions and maintain their adhesiveness for longer periods.

A key focus while moving forward is product sustainability. For instance, Nitto Denko Corporation, one of the leading players in the unsupported single coated tape market, offers an eco-friendly single-sided tape, HF-105E, which is hand-cuttable, flexible, and capable of adhering to the surface of the substrate. It is effective in fixing harnesses for automobile roof materials.

| Company Name | Details |

|---|---|

| Arkema (Bostik) | The firm is headquartered in France, and it produces an extensive range of products like sealants, adhesives, and coatings. The Bostik division is a key producer of unsupported single coated tape, thus serving industries like packaging, construction, and automotive. |

| 3M | The company is headquartered in the United States. It develops a broad range of products like tapes, adhesives, medical devices, and abrasives. The Industrial Adhesives and Tapes Division is a key producer of unsupported single coated tape. |

| Nitto Denko | The company is headquartered in Osaka. It develops a range of products like tapes, adhesives, and optical films. |

| Scapa | The conglomerate is based in Blackburn. It manufactures multiple products like release liners, labels, and adhesive tapes. The Industrial Division of the company produces unsupported single coated tape. |

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 3.3% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Product Type, Application, Region |

| Regions Covered | North America; Latin America; Western Europe; Easter Europe; Asia Pacific; Middle East and Africa |

| Key Countries Profiled | The United States, Canada, Brazil, Argentina, Germany, The United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia and New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | Arkema (Bostik); 3M; Nitto Denko; Scapa; Avery Dennison; Syntac Coated Products; Intertape Polymer, Adhesives Research; Berry Plastics; Cantech; American Biltrite; Shurtape Technologies; Essentra; Adhesive Applications; Mactac; Main Tape; tesa SE; DYNAREX; DeWAL Industries, Medline Medical; Lamart Corp.; McKesson; Johnson & Johnson; Cardinal Health; Worthen Industries; Coroplast Tape Corporation; CCT Tapes |

| Customization | Available Upon Request |

The global unsupported single coated tape market is estimated to be valued at USD 7.6 billion in 2025.

The market size for the unsupported single coated tape market is projected to reach USD 10.5 billion by 2035.

The unsupported single coated tape market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in unsupported single coated tape market are specialty pressure sensitive tape and ordinary tape.

In terms of application, automotive segment to command 27.9% share in the unsupported single coated tape market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Single Air Chamber Hydro-pneumatic Suspension Market Forecast and Outlook 2025 to 2035

Single-channel Frequency Synthesizer Market Size and Share Forecast Outlook 2025 to 2035

Single-axis Drives Market Size and Share Forecast Outlook 2025 to 2035

Single Roller Cone Bits Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Spot Welder Machine Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Spot Welder Market Size and Share Forecast Outlook 2025 to 2035

Single-use Bioreactors Market Size and Share Forecast Outlook 2025 to 2035

Single Board Computer Market Size and Share Forecast Outlook 2025 to 2035

Single-Serve Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Recloser Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Portable Conventional Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Screw Extruder Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Single Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Portable Generators Market Size and Share Forecast Outlook 2025 to 2035

Single Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Single Axis Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA