The market for single-use filtration assemblies focuses on preassembled and disposable filtration systems in biopharmaceutical production, vaccine development, laboratory research, and sterile drug processing. The filtration assemblies provide efficiency, sterility assurance, and minimal cross-contamination risk, which has made them critical elements in biologics manufacture, cell and gene therapy, and monoclonal antibody (mAb) production.

Growing uptake of single-use bioprocessing technologies; biopharmaceutical demand; and regulatory emphasis on sterility and contamination control is bolstering the market. In addition, the advancements of technology such as membrane filtration, disposable filters with high capacity, and automated filtration technology are leading to the growth of the market.

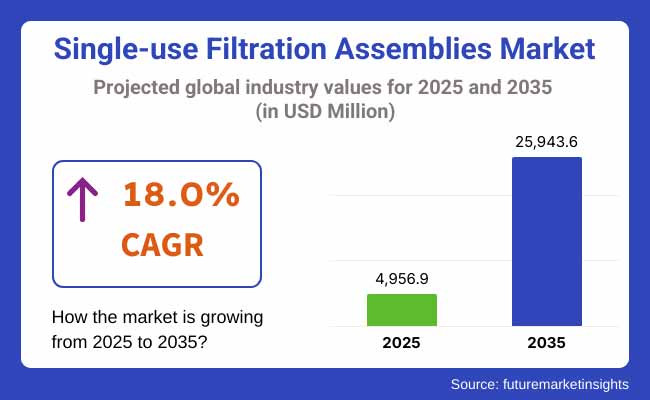

In 2025, the global single-use filtration assemblies market is projected to reach approximately USD 4,956.9 million, with expectations to grow to around USD 25,943.6 million by 2035, reflecting a Compound Annual Growth Rate (CAGR) of 18.0% during the forecast period.

Forthcoming disposables growth trend, rising pharma manufacturing investments, growing demand for scalable and flexible filtration technologies are aspects addressed by the forecasted CAGR. Regulatory conformity for aseptic processing and sterility assurance is expected to drive market accommodation as well.

Robust biopharmaceutical manufacturing facilities, increasing adoption of single-use bioprocessing, and stringent regulatory requirements pertaining to production of sterile drugs are widely held to drive majority share of the single-use filtration assemblies market in North America. With FDA guidelines putting non-contaminated biologics and vaccine processing at the forefront, it is the USA and our neighbour to the north that dominate these critical therapies. Increasing investments in personalized medicine and the production of gene therapy are also supporting market demand.

Europe is a large share of the market, with Germany, France, and the United Kingdom beneath popular pharmaceutical R&D, biologics manufacturing, and GMP-driven compliance-bioprocessing innovation. The growth of this market within the region is being supplemented by high-efficiency single-use filtration assembly demand, especially on the conditions of sterile manufacture, and GMP guidance set forth by European medicines agency, in addition to growth due to expands in monoclonal antibody (mAb) manufacturing and increasing biosimilar trends.

Growing pharmaceutical and biotech industries coupled with rise in government incentives for biologics manufacturing is expected to drive the market for single-use filtration assemblies in the Asia-Pacific, with the region expected to generate the maximum share of revenue in the global market, followed by high demand for cost-efficient bioprocessing solutions across China, India, Japan, South Korea, etc.

Market growth is driven by the region's contract manufacturing organizations (CMOs), increased vaccine manufacturing, and investment in biopharma infrastructure. Moreover, a rising focus on sterility and contamination prevention from regulatory authorities is expected to create further adoption in the market.

Challenges

High Costs and Waste Management Concerns

The single-use filtration assemblies market is hampered by fact that single-use systems (SUS) are more costly than traditional stainless-steel filtration systems. The upcharge for disposable parts could be an obstacle for biopharmaceutical and other biotech companies had planned on being cost-efficient. The plastic-based disposable filtration PCIU dealer units are also waste management and sustainability issues, causing companies to seek environmentally friendly materials.

Opportunities

Growth in Biopharmaceuticals, Cell Therapy, and Sterile Manufacturing

Increasing demand for biopharmaceuticals, targeted medicine and sterile filtration options is driving single-use filtration systems market in various application across biopharmaceutical market including cell & gene therapy, biotech manufacturing and vaccine production. Pre-sterilized, automated and scalable single-use assemblies are developed to maximize process efficiency, contamination control, and leverage cost-saving. In addition, the increasing trend towards continuous bioprocessing and modular bio manufacturing is also increasing market potential for single-use filtration solutions.

The market witnessed accelerated adoption of single-use filtration assemblies owing to COVID-19 vaccine manufacturing, the rising production of biologics, and increasing interest in sterile bioprocessing as per the trends from 2020 to 2024. Concerns about supply chain disruption, material shortages and waste disposal regulations were hurdles to broad adoption.

However, in 2025 to 2035, the market will be set to switch to sustainable, high-efficiency, and automated single-use filtration systems. The biotechnology industry constituting biopharmaceuticals will continue to deploy systems such as biodegradable polymers, AI-based filtration monitoring and closed-loop bioprocessing systems in an integrated fashion which will only increase the biopharmaceutical manufacturing capacity. Market growth will be driven by favorable regulatory changes promoting flexible, rapid-deployment bioprocessing solutions.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, EMA, and cGMP guidelines for biologics and vaccine production |

| Technology Innovations | Growth in pre-sterilized, modular filtration assemblies |

| Market Adoption | High demand in COVID-19 vaccine production, monoclonal antibody (mAb) manufacturing, and cell therapy |

| Sustainability Trends | Challenges in plastic waste management and recycling of SUS components |

| Market Competition | Dominated by bioprocessing leaders (Merck Millipore, Sartorius, Danaher/Pall, Thermo Fisher Scientific, Cytiva) |

| Consumer Trends | Demand for cost-effective, contamination-free bio manufacturing solutions |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter mandates on sustainability, waste reduction, and AI-driven process validation |

| Technology Innovations | Advancements in biodegradable single-use systems, AI-powered filtration monitoring, and closed-loop sterile processing |

| Market Adoption | Expansion into continuous bioprocessing, precision medicine, and AI-optimized filtration systems |

| Sustainability Trends | Large-scale adoption of eco-friendly single-use materials and sustainable filtration solutions |

| Market Competition | Rise of biotech startups, AI-driven bioprocessing firms, and sustainable bio manufacturing innovators |

| Consumer Trends | Growth in AI-integrated, automated single-use filtration for real-time process optimization |

The USA market for single-use filtration assemblies continues to grow, driven by biopharmaceutical product manufacturing, vaccine manufacturing, and cell therapies, among others. Life Sciences SUT Market Growth the demand for single-use technologies for improving working efficiency, reducing risk of contamination, and reducing downtime for bioprocessing are the driving forces for the life sciences SUT market.

So, the factors including availability of large biopharma companies and contract manufacturing organizations (CMOs), as well as FDA regulated approval for single-use systems, are also fuelling market growth. The growing demand for monoclonal antibodies (mAbs) and biosimilar has also begun to drive the adoption of single-use filtration assemblies.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 18.4% |

Increasing investments toward biopharmaceutical Manufacturing and advanced biologics is driving the UK Single-use Filtration Assemblies market. The demand for single-use filtration products in vaccine research and personalized medicine is being further driven by the National Health Service (NHS) and private healthcare agencies.

Increased bioprocessing innovation, public funding of eco-sustainable and efficient bio manufacturing techniques, and growing use of cell and gene therapies is also driving market growth. In addition to that, processes are becoming more efficient through the integration of automation and digital monitoring with single-use filtration systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 17.7% |

The single-use assemblies market for EU filtration is experiencing considerable growth driven by the increasing adoption of disposable bioprocessing technology across the pharmaceutical and biotech industries. Fostering demand for single-use systems is a trend toward efficient and economical production solutions.

Germany, France, and Switzerland are the leading markets with very high investment in biopharma R&D and GMP-compliant manufacturing plants. Market trends are being further stimulated by the EU's stress on minimising environmental footprint by adoption of sustainable single-use bioprocessing solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 17.6% |

The growth of Japan's single-use filtration assemblies market is driven by an increasing focus on precision medicine, regenerative therapies, and vaccine production. Manufacturing businesses in Japan are racing to adopt single use technologies that maximize efficiency and eliminate cross contamination risks in sterile processing environments.

Market growth is also being driven by government, policies in support of, ensure the innovative and efficient production of biologics, increased demand for advanced filtration products in stem cell research. Additionally, the strong pharmaceutical production standards in Japan is impacting the market for single use filtration systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 18.0% |

The South Korea single-use filtration assemblies market is growing due to the increasing investments in biopharmaceuticals and the growing output of biosimilar, along with government efforts towards promoting the development of the country's bio economy. The rise of Contract Development and Manufacturing Organizations (CDMO) along with the advancements in bioprocessing are opening doors for single-use filtration technologies.

Additionally, the introduction of flexible manufacturing systems and government support for next-generation bioprocessing technology further drives market growth. Additionally, the rising applications of single-use filtration assemblies in vaccine production and high value biologics manufacturing in the country are also propelling the market in South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 17.8% |

Across applications such as single-use and membrane filtration assemblies, separation accuracy, bioburden removal, contaminant elimination, and sterilization are of utmost importance among industries. Semi-permeable membranes with suitable pore sizes are used in this process to provide effective removal of bacteria, viruses, and particulates while maintaining product integrity.

It is also widely used for pharmaceutical sterile filtration, biologics purification, and vaccine production, which is one of the driving forces behind the wide adoption of membrane filtration. Multiple biopharmaceutical companies utilize membrane filters in order to create endotoxin-free drug compounds, in accordance with very strict regulatory requirements such as GMP and FDA regulations.

Additionally, membrane filtration allows for aseptic processing of cell culture media, buffer solutions, and intravenous (IV) drug production to provide products free from contaminants. Most manufacturers prefer the scalable characteristics of single-use membrane filtration systems with their minimal cross-contamination risk, disposal characteristics, and effective process control and validation.

While advantageous, however, membrane filtration has limitations in filter plugging, pressure limits, and inefficiencies in processing time, and thus manufacturers developed a range of advanced polymer-based membranes, high-flux design for membrane structure, and hybrid filtration technology, ensuring enhanced throughput and operational efficiency.

Depth filtration is a vital solid-liquid separation process that offers high particle retention and removal of impurities before fine membrane filtration and downstream processing. The trick uses porous filter media from cellulose, diatomaceous earth, or synthetic polymers for effective particulate catch and long filtration life.

Depth filtration is predominantly used for high-capacity removal of contaminants making it ideal for pre-filtration, clarification and bulk fluid processing. Depth filtration is routinely used by most pharmaceutical and bioprocessing industries to remove cell debris, aggregates and endotoxins to ensure higher product yield and purification efficiency.

In addition, depth filtration enhances processing efficiency across a wide range of processes, including plasma fractionation, mAb purification, and protein separation, delivering high product quality and requirements for infrequent filter replacement. Single-use depth filtration assemblies are preferred by most manufacturers due to lower cleaning validation requirements, shorter downtime, and greater biopharmaceutical workflow efficiency.

However, depth filtration suffers from filter saturation and non-uniformly distributed pores, leading to the development of improved performance and higher contaminant catchment efficiency nanofiber depth filters, multi-layer filtration matrices, and hybrid depth–membrane filtration systems.

Pharmaceutical production is one of the largest consumers of single-use filtration assemblies because pharmaceutical manufacturers want sterile, closed-system filtration processes that are compliant with industry standards to protect product integrity. Providing a robust solution for injectable medications, oral products, and parenteral treatments, these filtration systems play a decisive role as end-to-end contamination control in pharmaceutical manufacturing lines.

One of the greatest driving forces boosting the adoption of single-use filtration technology in pharmaceutical industries is its role in minimizing cross-contamination risk, reducing turnaround times and offering batch-to-batch reproducibility assurance. Many drug makers employ single-use depth filtration and membrane assemblies as quality production products during both active pharmaceutical ingredient (API) processing and buffer preparation through to final drug sterilization, all to GMP quality production standards.

Furthermore, single-use filtration optimuntinizes process validation and the scaleup process in vaccine production and gene therapy and new drugs formulation pipelines, resulting in enhanced process efficiency and cost savings. Disposable filtration assemblies are used by most contract development and manufacturing organizations (CDMOs), ensuring rapid production scale-up and reduced cleaning.

Even though pharmaceutical filtration process offers many benefits, there are significant challenges in terms of extractables, leachable and compatibility of materials which acts as driving forces for the manufacturers to invest on polymer based advanced filtration materials, gamma-sterilized filtration units and low-binding filter membranes which ensures better pharmaceutical safety and process efficiency.

The bioprocessing and biopharmaceutical sector relies heavily on single-use filtration assemblies as biologics, cell-based therapies and recombinant proteins require ultra-pure filtration systems to preserve product potency and sterility. Pall’s innovative single-use filtration systems support clarification, viral clearance, and downstream purification of cell culture with the highest efficiency for bioprocessing operations.

Particularly, its need in mAb manufacturing, vaccine production, and cell therapy are some of the key aspects attracting bioprocessing to shift towards single-use filtration. Majority of biopharma industries use depth and membrane filtration step in upstream and downstream processing to achieve optimal removal of host cell proteins, DNA contaminants and viral particles.

Moreover, single-use filtration offers more flexibility for the use of continuous bioprocessing and single-use bioreactor (SUB), with higher turnaround times, low contamination risk and ease of scale-up. The majority of manufacturers of biologics offer single use filtration unit modules in a completely adaptable way, thus reflecting changing bioprocessing modalities.

Single-use filtration in bioprocessing is one of its advantages that require accurate filtration validation followed by downstream processes such as sterile connection and lower leachable risk which is resulting a high tendency of companies to invest in pre-sterilized and gamma-irradiated filtration assembly, closed-loop filtration systems and nine AI-based process monitoring solution, awarding greater manufacturing reliability of biopharmaceuticals.

The global single-use filtration assemblies market is growing at a rapid pace. Major factors propelling market demand include an increasing usage in biopharmaceutical production, vaccine production, and laboratory studies. The trend is toward single-use filtration systems because of their efficiency, contamination management and lower risk for cross-contamination, along with cost savings, which makes them important in drug discovery, bioprocessing, and sterile filtration.

Disposable bioprocessing, increased demand for biologics, and the stringent regulatory requirements for sterility assurance are driving the market.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Merck KGaA | 18-22% |

| Danaher Corporation (Pall Corporation & Cytiva) | 14-18% |

| Sartorius AG | 12-16% |

| Thermo Fisher Scientific Inc. | 10-14% |

| Parker Hannifin Corporation | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Merck KGaA | Provides Millipore single-use filtration assemblies for sterile filtration in bioprocessing and pharmaceutical manufacturing. |

| Danaher Corporation (Pall Corporation & Cytiva) | Specializes in high-efficiency single-use filtration systems for biologics, cell culture, and gene therapy applications. |

| Sartorius AG | Develops customizable single-use filtration assemblies for upstream and downstream bioprocessing. |

| Thermo Fisher Scientific Inc. | Offers high-purity single-use filtration solutions for vaccine and monoclonal antibody production. |

| Parker Hannifin Corporation | Manufactures single-use filtration systems for liquid and gas sterilization in pharmaceutical and biotech industries. |

Key Market Insights

Merck KGaA (18-22%)

Merck dominates the single-use filtration market with Millipore Express® filters and single-use filtration systems, widely used in biopharmaceutical processing and cell therapy applications.

Danaher Corporation (Pall Corporation & Cytiva) (14-18%)

Danaher leads in advanced bioprocess filtration solutions, offering high-efficiency sterile filtration systems for large-scale biologics and vaccine production.

Sartorius AG (12-16%)

Sartorius provides scalable, single-use filtration assemblies, enabling rapid production and contamination-free processing in pharmaceutical manufacturing.

Thermo Fisher Scientific Inc. (10-14%)

Thermo Fisher focuses on customized single-use filtration solutions, ensuring high sterility assurance for vaccines, monoclonal antibodies, and gene therapy drugs.

Parker Hannifin Corporation (8-12%)

Parker Hannifin supplies filtration systems for bioprocessing, optimizing liquid and gas filtration for pharmaceutical and biotech applications.

Other Key Players (26-32% Combined)

Several emerging and regional players are expanding the single-use filtration market with cost-effective and specialized solutions, including:

The overall market size for single-use fltration assemblies market was USD 4,956.9 million in 2025.

The single-use fltration assemblies market is expected to reach USD 25,943.6 million in 2035.

Growing adoption of biopharmaceutical manufacturing, increasing demand for cost-effective and contamination-free filtration solutions, and rising focus on flexible and scalable production processes will drive market growth.

The top 5 countries which drives the development of single-use fltration assemblies market are USA, European Union, Japan, South Korea and UK.

Bioprocessing and biopharmaceuticals expected to grow to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by Product, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 17: Global Market Attractiveness by Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Application, 2023 to 2033

Figure 19: Global Market Attractiveness by Product, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Attractiveness by Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Application, 2023 to 2033

Figure 39: North America Market Attractiveness by Product, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 77: Europe Market Attractiveness by Type, 2023 to 2033

Figure 78: Europe Market Attractiveness by Application, 2023 to 2033

Figure 79: Europe Market Attractiveness by Product, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Type, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 99: South Asia Market Attractiveness by Product, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Product, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Type, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Product, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 157: MEA Market Attractiveness by Type, 2023 to 2033

Figure 158: MEA Market Attractiveness by Application, 2023 to 2033

Figure 159: MEA Market Attractiveness by Product, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Filtration and Separation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Filtration Paper Market Growth and Forecast 2024 to 2034

Ultrafiltration Membranes Market Analysis by Material Type, End-Use, and Region through 2025 to 2035

Dairy Filtration Systems Market Size and Share Forecast Outlook 2025 to 2035

Depth Filtration Market Size, Growth, and Forecast 2025 to 2035

Liquid Filtration Market Size and Share Forecast Outlook 2025 to 2035

Data Exfiltration Market Size and Share Forecast Outlook 2025 to 2035

Coolant Filtration Skids Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Membrane Filtration Systems Market Size and Share Forecast Outlook 2025 to 2035

Portable Filtration System Market Growth – Trends & Forecast 2024-2034

Laboratory Filtration Devices Market Size and Share Forecast Outlook 2025 to 2035

Industrial Filtration Market Growth - Trends & Forecast 2025 to 2035

Laboratory Filtration Equipment Market Growth – Trends & Forecast 2019-2027

Normal Flow Filtration Products Market Size and Share Forecast Outlook 2025 to 2035

Membrane Microfiltration Market Size and Share Forecast Outlook 2025 to 2035

Industrial Air Filtration Market Size and Share Forecast Outlook 2025 to 2035

Mask Bacterial Filtration Efficiency Tester Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Filtration Market Growth - Trends & Forecast 2025 to 2035

Compressed Air Filtration and Dryer System Market Growth - Trends & Forecast 2025 to 2035

GCC Industrial Air Filtration Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA