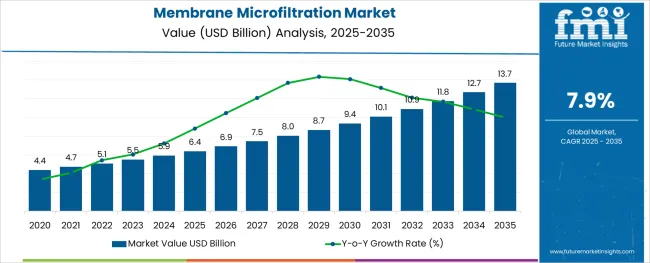

The Membrane Microfiltration Market is estimated to be valued at USD 6.4 billion in 2025 and is projected to reach USD 13.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.9% over the forecast period.

The membrane microfiltration market is growing steadily due to increasing demand for efficient separation and purification technologies across various industries. The need for high-quality filtration in biopharmaceutical processing has become particularly important as companies focus on product purity and process reliability.

Advances in membrane materials and designs have enhanced filtration performance, enabling higher throughput and better contaminant removal. The market is further driven by stricter regulatory standards that require consistent and reproducible filtration processes.

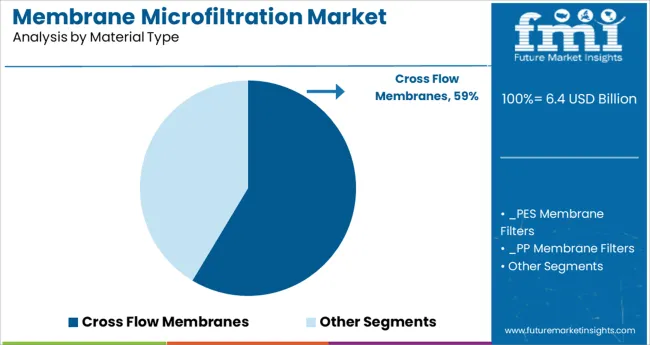

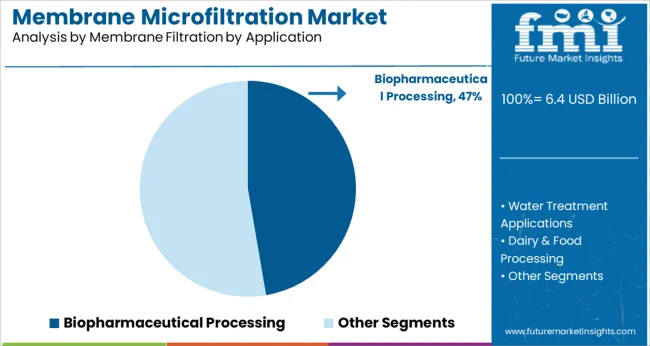

Expansion of biopharmaceutical manufacturing capacities globally is also supporting the adoption of advanced microfiltration membranes. The trend toward continuous manufacturing and process intensification has increased reliance on membrane-based technologies. Going forward, the market is expected to expand as innovations in membrane durability and fouling resistance continue. Segmental growth is anticipated to be led by cross flow membranes as the preferred material type and biopharmaceutical processing as the leading application.

The market is segmented by Material Type and Membrane Filtration by Application and region. By Material Type, the market is divided into Cross Flow Membranes and Direct Flow Membranes. In terms of Membrane Filtration by Application, the market is classified into Biopharmaceutical Processing, Water Treatment Applications, Dairy & Food Processing, Chemical Applications, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cross flow membranes segment is projected to hold 58.6% of the membrane microfiltration market revenue in 2025, securing its position as the dominant material type. This growth is attributed to the ability of cross flow membranes to minimize fouling by allowing fluid to flow tangentially across the membrane surface. This feature enhances membrane longevity and maintains high filtration efficiency.

Industries requiring continuous filtration processes have favored cross flow membranes for their stable performance and ease of integration into existing systems. Additionally, these membranes support a wide range of operating conditions and feed compositions, making them versatile across applications.

The segment’s strength is further bolstered by improvements in membrane materials that enhance chemical and thermal resistance. As demands for reliable and efficient filtration grow, cross flow membranes are expected to remain the preferred choice.

The biopharmaceutical processing segment is anticipated to represent 47.3% of the membrane microfiltration market revenue in 2025, positioning it as the leading application area. This growth has been driven by the critical role of microfiltration in removing particulates and microbial contaminants during drug production. Filtration processes are essential to ensuring product safety and compliance with regulatory requirements.

The increasing complexity of biologics and personalized medicines has escalated the need for precise and gentle filtration methods that protect product integrity. Biopharmaceutical companies have integrated membrane microfiltration into various stages of production, including cell culture harvest, clarification, and sterile filtration.

As the biopharmaceutical industry continues to expand globally, driven by rising healthcare demand, this segment is expected to sustain robust growth. Improvements in membrane technology have also enhanced process scalability and operational efficiency within this sector.

| Particulars | Details |

|---|---|

| H1, 2024 | 7.85% |

| H1, 2025 Projected | 7.91% |

| H1, 2025 Outlook | 7.71% |

| BPS Change - H1, 2025 (O) – H1, 2025 (P) | (-) 20 ↓ |

| BPS Change – H1, 2025 (O) – H1, 2024 | (-) 14 ↓ |

A comparative analysis related to the market growth rates and development prospects in the global membrane microfiltration market is presented by Future Market Insights. The market is highly influenced by the device quality production guidelines, and regulations under the impact of macro and industry factors.

Key developments in the market include the development of cost effective ceramic microfiltration membranes. The market is subject to changes in global sustainability goals and implementation of waste water management by the biopharmaceutical industries.

H1-2025 outlook period in comparison to H1-2025 projected period showed a negative growth in terms of Basis Point Share by 20 BPS. In H1-2025 when compared with H1-2024, the market growth rate of membrane microfiltration is expected to fall by 14 basis point share (BPS), as per FMI analysis.

The reduction in the BPS values is associated with the advent of the COVID-19 pandemic and the delay in production of membrane microfiltration. Moreover, the inclination of membrane microfiltration for being sensitive to oxidizing chemicals causing damage and calling for more open-pore pre-filtration has further rendered the BPS change as declining.

According to Future Market Insights (FMI), demand for membrane microfiltration technology experienced an upsurge at a CAGR worth 6.5% from 2013 to 2024. This technology is experiencing a rise in demand in the production of biopharmaceuticals in the near future in response to the increasing use of large molecule biopharmaceuticals with therapeutic properties.

Membrane microfiltration technologies acquired further importance during the COVID-19 pandemic, with lab technicians and healthcare providers deploying microfiltration techniques to extract RNA from the novel coronavirus and study its structure.

Pall Corporation, for instance, has been deploying its Nucleic Acid Binding (NAB) Nanosep® spin device and AcroPrepTM filter plates for RNA extraction of the COVID-19 virus prior to RT-PCR, and has yielded many downstream application successes.

The emergence of newer applications of membrane microfiltration presents a great deal of business opportunity for key industry players operating worldwide. The proliferation of single-use technologies and the growing demand for nanofiltration techniques contributed to the market growth of membrane microfiltration. Due to these factors, the membrane microfiltration market registering a CAGR of 7.9% in the sales indicator period.

The removal of microfibers from textile wastewater has propelled the growth of the microfiltration market. Rising pharmaceutical and biotech firms have spurred a market demand for sterile environments and contamination-free surfaces, which has resulted in market demand for membrane microfiltration.

The growing need for wastewater treatment across various regions has accelerated sales of microfiltration devices. As a result of government regulations on filtration methods and environmental concerns, market demand for microfiltration methods and devices has gained momentum.

Several private and government investments in R&D to yield better returns have propelled market demand for membrane microfiltration in the market. Increasing demand for dairy products and improvements in shelf life has intensified the market for membrane microfiltration.

Growing applications of membrane microfiltration in the industrial sector are driving growth in the global market. Growing health awareness among consumers has resulted in an increase in the market demand for membrane microfiltration in the food and beverage industry.

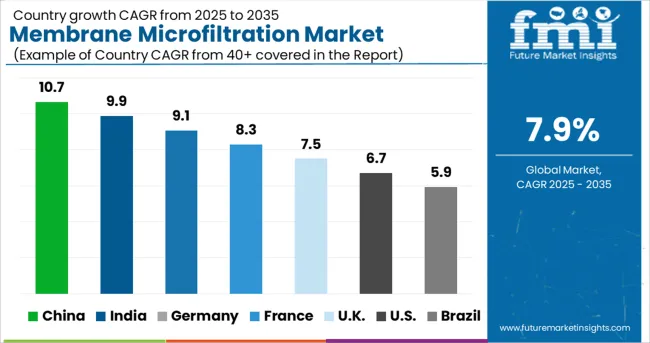

As per the analysis put forward by FMI, Western Europe is anticipated to experience the most lucrative prospects with regard to membrane microfiltration. The region is poised to accumulate a market share worth 22.1% in 2025.

Increasing government regulations on environmental and wastewater treatment have fueled market demand for membrane microfiltration. Furthermore, rapid industrialization has driven market demand for membrane microfiltration to touch new heights in the market.

As a result of a growing population, urbanization, and a scarcity of water, the membrane microfiltration market in this region is expected to present huge opportunities to the market players. The growing number of biopharmaceutical and pharmaceutical companies operating in the region is increasing the demand for microfiltration membranes.

Furthermore, investments in improving water and wastewater systems have paved the way for water treatment companies to thrive in the region. Increasing government support for industrial wastewater treatment in the region is expected to boost the market growth in the coming years. Thus, China is expected to gain a market share of 9% in 2025.

Cross-flow filtration accounts for the largest revenue share in the membrane microfiltration market and is expected to grow during the forecast period. As a result of improving membrane shelf life and helping to prevent irreversible fouling, cross-flow filtration has become increasingly popular in various end-use applications.

Cross-flow microfiltration is widely applied in pharmaceutical, food & beverage, and chemical industries. A rise in demand for higher quality and better value wines compared to traditional systems has boosted market demand for cross-flow microfiltration.

Growing consumer awareness of clean water and its health benefits is propelling the market demand for membrane microfiltration in water treatment applications. Global concerns over limited water resources will likely force governments to adopt stringent measures for wastewater treatment.

The growing demand for purified water among households has boosted the use of membrane microfiltration in the market. As governments and industries strive to meet evolving environmental regulations, demand for membrane microfiltration processes is on the rise.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2013 to 2024 |

| Market Analysis | million for Value |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Asia Pacific excluding China & Japan; China; Japan; Middle East & Africa (MEA) |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Russia, Poland, India, ASEAN, Australia, New Zealand, South Africa, GCC Countries |

| Key Market Segments Covered | Material Type, Application, Region |

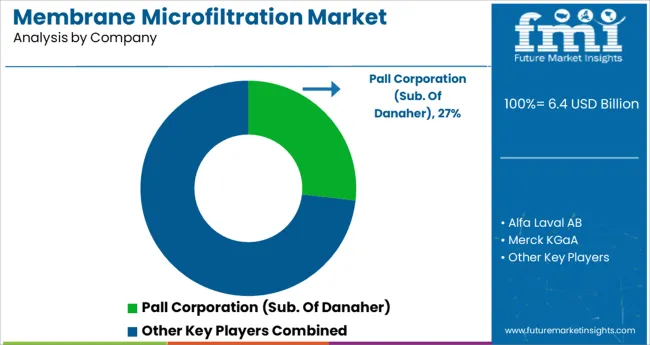

| Key Companies Profiled | Pall Corporation (Sub. Of Danaher); Alfa Laval AB; Merck KGaA; CITIC Envirotech Ltd; 3M; Parker Hannifin Corporation; Lydall, Inc.; Koch Membrane Systems Inc.; GEA Group AG; Synder Filtration, Inc. |

| Pricing | Available upon Request |

The global membrane microfiltration market is estimated to be valued at USD 6.4 billion in 2025.

It is projected to reach USD 13.7 billion by 2035.

The market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types are cross flow membranes, _pes membrane filters, _pp membrane filters, _pvdf membrane filters, _ptfe membrane filters, _peek membrane filters, _poly imide membrane filters, _cellulose membrane filters, direct flow membranes, _pes membrane filters, _pp membrane filters, _pvdf membrane filters, _ptfe membrane filters, _peek membrane filters, _poly imide membrane filters and _cellulose membrane filters.

biopharmaceutical processing segment is expected to dominate with a 47.3% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Membrane Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Membrane Filter Press Machines Market Size and Share Forecast Outlook 2025 to 2035

Membrane Separation Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Membrane Separation Technology Market Size and Share Forecast Outlook 2025 to 2035

Membrane Switch Market Size and Share Forecast Outlook 2025 to 2035

Membrane Filtration Systems Market Size and Share Forecast Outlook 2025 to 2035

Membrane Filter Cartridge Market Size and Share Forecast Outlook 2025 to 2035

Membrane Boxes Market Size and Share Forecast Outlook 2025 to 2035

Membrane Chemicals Market Growth - Trends & Forecast 2025 to 2035

Membrane Air Dryers Market Growth - Trends & Forecast 2025 to 2035

Market Leaders & Share in Membrane Boxes Manufacturing

Geomembrane Market Strategic Growth 2024-2034

Egg Membrane Powder Market

PTFE Membrane Market

Metal Membrane Ammonia Cracker Market Size and Share Forecast Outlook 2025 to 2035

Mucous Membrane Pemphigoid Treatment Market

Medical Membrane Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Membranes Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Amniotic Membrane Market Size and Share Forecast Outlook 2025 to 2035

Eggshell Membrane Powder Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA