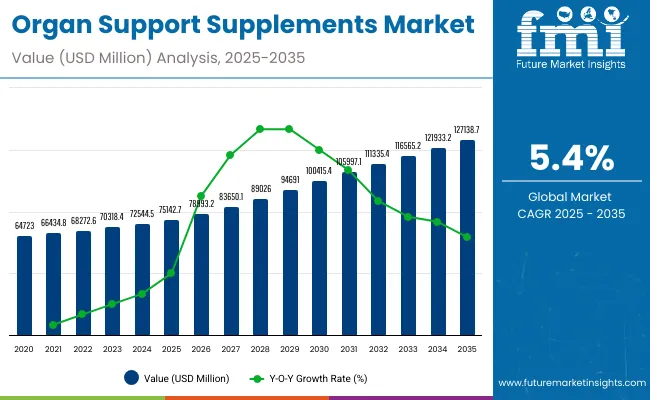

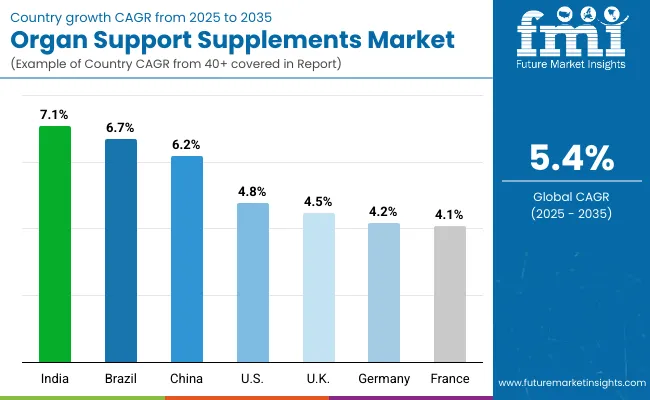

The global Organ Support Supplements Market is projected to reach a valuation of USD 75,142.7 million by 2025 and USD 127,138.7 million by 2035. This reflects a decade-long expansion of USD 51,996.0 million between 2025 and 2035. The market is anticipated to grow at a compound annual growth rate (CAGR) of 5.4%, representing a 1.69X increase over the ten-year period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 75,142.7 million |

| Industry Value (2035F) | USD 127,138.7 million |

| CAGR (2025 to 2035) | 5.4% |

During the first five-year window from 2025 to 2030, the total market size is estimated to expand from USD 75,142.7 million to approximately USD 100,415.4 million, adding USD 25272.7 million, which accounts for 48.6% of the total decade growth.

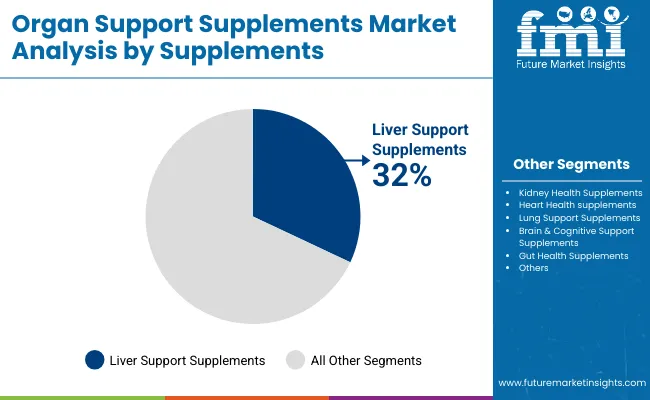

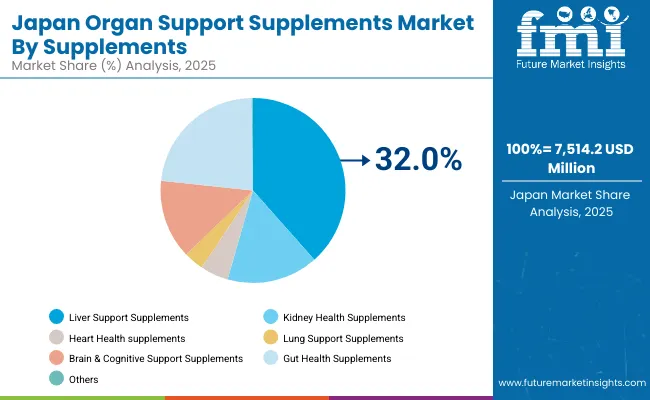

Within this period, Liver Support Supplements will remain the leading category, sustaining close to 32% share of the global market, driven by rising incidences of fatty liver disease, alcohol-related conditions, and detoxification trends. Gut Health Supplements are projected to capture nearly one-fifth of demand, while Brain and Cognitive Supplements will steadily expand, supported by the growing focus on mental wellness and aging populations.

The second half of the decade, from 2030 to 2035, contributes an incremental USD 26,723.28 million, equal to 51.4% of the total growth, as the market advances from USD 100,415.4 million to 127,138.7 million. Growth during this stage is propelled by the mass-market availability of functional beverages, gummies, and shots, which align with consumer preference for convenient formats.

By 2035, Liver Support Supplements and Gut Health Supplements together are expected to capture more than half of the global share, while Kidney and Cognitive Health Supplements gain further traction. E-commerce channels will reinforce this expansion, surpassing 28% of sales share, particularly in high-growth regions such as South Korea, India, and Brazil.

From 2020 to 2024, the overall Organ Support Supplements Market expanded from USD 64,723.0 million to USD 72,544.5 million. Leading companies such as Amway, Herbalife Nutrition, Nestlé Health Science, Bayer AG, and GNC Holdings, along with other innovators, collectively account for a significant portion of global revenues through organ-specific formulations and science-backed product launches.

Key strategies deployed by these players include portfolio expansion in liver, gut, and cognitive health supplements, development of convenient formats such as gummies, shots, and functional beverages, and omnichannel distribution that integrates e-commerce with retail pharmacies and health & wellness stores. These initiatives are strengthening brand visibility and consumer trust in preventive healthcare.

In 2025, the market is projected to reach approximately USD 75,142.7 million, driven by the shift from general wellness supplements toward organ-targeted solutions. Growth will be propelled by rising demand for liver and gut health supplements, which together capture more than half of global share, as well as increased consumer focus on brain and cognitive support linked to mental wellness and aging. End users particularly chronic disease patients and geriatric populations are increasingly adopting supplements across capsules, powders, and functional beverage formats.

At the same time, e-commerce channels, already contributing 28% of global sales, are accelerating adoption by providing personalized product recommendations and subscription-based delivery models. This trend reflects the broader transition toward preventive, convenient, and scientifically validated supplementation practices across both developed and emerging markets.

The Organ Support Supplements Market is experiencing strong growth as consumer’s worldwide face increasing demand for preventive health solutions, organ-specific wellness, and healthy aging. Major growth drivers include the rising global prevalence of liver disorders, kidney complications, cardiovascular issues, and digestive imbalances, along with heightened awareness of cognitive health. Product innovation in formats such as capsules, functional beverages, gummies, and shots makes supplementation more convenient, supporting wider adoption across multiple demographics.

Advancements in scientifically backed formulations and the integration of supplements into chronic disease management and post-treatment recovery improve consumer outcomes, strengthen compliance, and broaden applications. The shift toward personalized supplementation and the growing influence of digital health platforms and e-commerce are further accelerating uptake by enabling tailored recommendations and direct-to-consumer accessibility.

The pandemic reinforced the importance of immune resilience and long-term organ health, driving both preventive users and patients with chronic conditions toward consistent supplement use. In regions with expanding healthcare access particularly in the USA, Europe, South Korea, India, and Brazil rising disposable incomes, improved product availability, and increasing professional recommendations are fueling demand for organ support supplements that combine safety, efficacy, and consumer convenience.

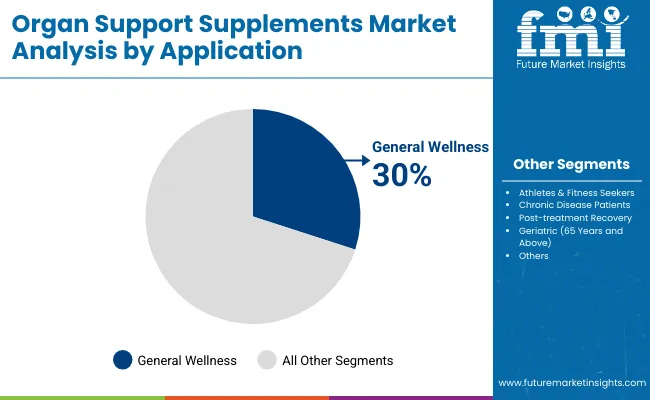

The market is segmented by supplement type, formulation type, application, and sales channel. Supplement types include Liver Support Supplements, Kidney Health Supplements, Heart Health Supplements, Lung Support Supplements, Brain & Cognitive Support Supplements, Gut Health Supplements, and Others. Application classification covers General Wellness, Athletes & Fitness Seekers, Chronic Disease Patients, Post-treatment Recovery, and Geriatric (65 Years and Above.

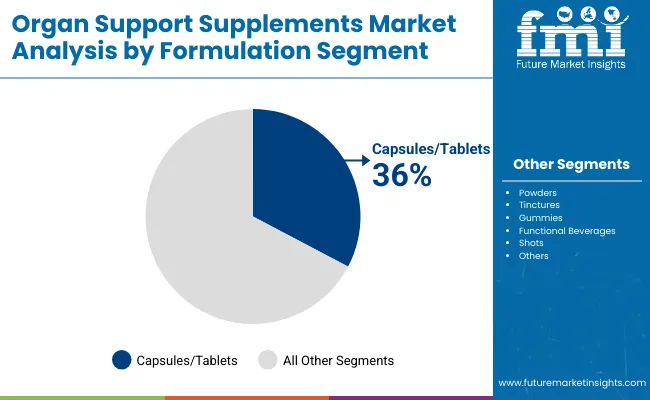

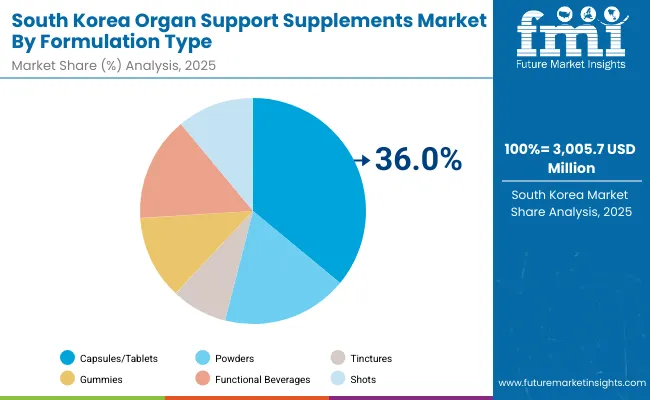

Based on formulation type, the segmentation includes Capsules/Tablets, Powders, Tinctures, Gummies, Functional Beverages, and Shots. Sales channel segmentation spans Retail Pharmacies, Drug Stores, Health & Wellness Stores, Hypermarkets and Supermarkets, and E-commerce/Online Sales. Regionally, the scope includes North America, Latin America, Western and Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa, with market performance shaped by differences in healthcare awareness, supplement penetration rates, and evolving regulatory frameworks.

| Supplements | Market Share (%) |

|---|---|

| Liver Support Supplements | 32.0% |

| Kidney Health Supplements | 13.3% |

| Heart Health supplements | 4.1% |

| Lung Support Supplements | 2.9% |

| Brain & Cognitive Support Supplements | 11.5% |

| Gut Health Supplements | 19.2% |

| Others | 17.0% |

Liver Support Supplements are expected to retain a dominant position, contributing 32.0% to the market in 2025, owing to their ability to address liver detoxification, fatty liver conditions, and alcohol-related health concerns. Their adoption has been driven by the global rise in lifestyle-related disorders and the increasing consumer awareness of liver function as a cornerstone of overall wellness. These supplements are increasingly preferred due to their capacity to support detox processes, improve digestion, and enhance energy metabolism.

Healthcare practitioners and wellness providers are recommending liver-specific formulations as part of preventive healthcare regimens, particularly for individuals with high exposure to processed foods, medications, and alcohol consumption. Industry adoption has also been supported by advancements in herbal formulations, clinically backed ingredients, and delivery innovations such as capsules, functional beverages, and gummies. Collectively, these factors have solidified the position of liver support products over other categories, making them the most widely consumed supplement type in the global organ support market.

| Formulation Segment | Market Share (%) |

|---|---|

| Capsules/Tablets | 36.00% |

| Powders | 18.00% |

| Tinctures | 8.00% |

| Gummies | 12.00% |

| Functional Beverages | 15.00% |

| Shots | 11.00% |

Capsules/Tablets have emerged as the leading formulation type, projected to hold around 36.0% of the market in 2025, driven by their convenience, dosage accuracy, and broad consumer acceptance. The increasing adoption of this format stems from its ability to provide consistent efficacy, easy storage, and affordability across diverse supplement categories.

Healthcare professionals frequently recommend capsules and tablets, reinforcing consumer trust and compliance. Rising awareness of preventive health, combined with product innovations such as improved coatings and extended-release formulations, is further fueling demand. Their widespread availability through retail pharmacies, health stores, and e-commerce platforms ensures strong penetration. The growing elderly population and chronic disease burden also support continued reliance on capsules and tablets, cementing their position over newer formats like gummies, beverages, and shots.

| Application | Market Share (%) |

|---|---|

| General Wellness | 30.00% |

| Athletes & Fitness Seekers | 16.00% |

| Chronic Disease Patients | 25.00% |

| Post-treatment Recovery | 14.00% |

| Geriatric (65 Years and Above) | 15.00% |

General Wellness is expected to remain the largest application segment, contributing around 30.0% of the market in 2025, driven by rising consumer focus on preventive health and daily nutrition. A significant share of supplement usage is directed toward maintaining overall organ health, where consistency, affordability, and accessibility are key priorities. The adoption of supplements in this segment is reinforced by their role in supporting liver, gut, and cognitive functions as part of holistic wellness routines.

Increasing product innovation in capsules, functional beverages, and gummies is making general wellness supplements more appealing across diverse consumer groups. Expanding availability through e-commerce, pharmacies, and health stores further supports market growth. Additionally, rising disposable incomes and growing health awareness in both developed and emerging regions are cementing the dominance of general wellness applications as the primary driver for organ support supplement adoption globally.

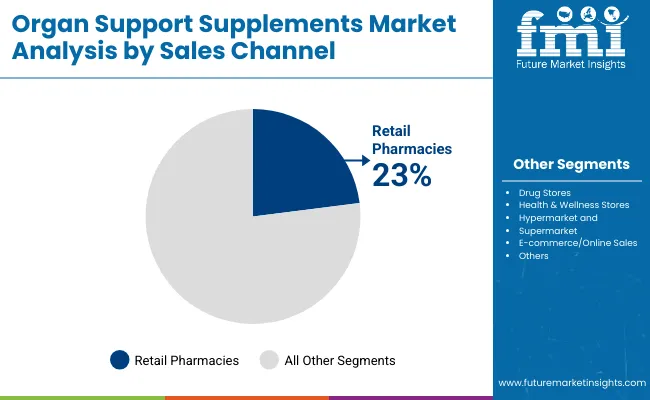

| Sales Channel | Market Share (%) |

|---|---|

| Retail Pharmacies | 23.00% |

| Drug Stores | 14.00% |

| Health & Wellness Stores | 19.00% |

| Hypermarket and Supermarket | 16.00% |

| E-commerce/Online Sales | 28.00% |

E-commerce/Online Sales are expected to remain the largest distribution channel, contributing around 28.0% of the market in 2025, driven by their critical role in offering convenience, accessibility, and personalized shopping experiences. A significant portion of supplement purchases now takes place online, where speed, variety, and subscription-based models are key adoption factors. The growing presence of wellness-focused digital platforms and direct-to-consumer brands has reinforced the dominance of online sales channels.

The adoption of e-commerce in supplement distribution is further strengthened by targeted marketing strategies, consumer reviews, and seamless home delivery, which collectively enhance trust and repeat purchasing. Expanding product availability through online pharmacies, brand-owned websites, and marketplaces is enabling wider reach, particularly in younger demographics and tech-savvy regions. Additionally, rising digital health awareness and the global shift toward convenience-driven shopping are cementing the position of e-commerce/online sales as the primary growth engine for organ support supplement adoption worldwide.

Rising Preventive Health Awareness and Targeted Organ Support Demand

The most significant growth driver in the Organ Support Supplements Market is the increasing consumer shift toward preventive healthcare and organ-specific nutrition. Rising incidences of lifestyle-related disorders, including fatty liver disease, kidney complications, cardiovascular issues, and digestive imbalances, are compelling individuals to adopt supplements as part of daily wellness routines. Categories such as liver support (32% share) and gut health (19.2% share) are at the forefront of this demand, supported by growing clinical research linking organ health to overall longevity.

Supplement adoption is further reinforced by the expansion of e-commerce platforms and digital health tools, which allow brands to offer personalized recommendations, subscription models, and rapid delivery. Healthcare professionals are increasingly endorsing organ-specific formulations as part of holistic treatment regimens, strengthening their role in chronic disease management and post-treatment recovery. Collectively, these factors are driving higher consumption of organ support supplements across both developed and emerging economies.

Regulatory Complexity and Trust Barriers in Supplement Adoption

Despite the rising demand, regulatory variation and product credibility concerns remain significant restraints in the global market. Supplement categories are regulated differently across regions ranging from FDA oversight in the USA to EFSA guidelines in Europe and diverse local standards in Asia creating inconsistencies in product approvals and labeling. This often complicates cross-border expansion for multinational brands. Additionally, consumer skepticism related to efficacy claims, product safety, and counterfeit risks acts as a barrier to adoption.

Price sensitivity in emerging markets further restricts uptake of premium formulations such as advanced functional beverages or clinically validated cognitive health products. Retail pharmacies and healthcare professionals often remain cautious in recommending products that lack strong clinical evidence or standardized certification. These challenges collectively slow market penetration in regions where regulatory clarity and consumer education are less established.

Convergence of Supplements with Functional Foods and Digital Wellness Ecosystems

A rapidly emerging trend is the integration of organ support supplements with functional food and digital health ecosystems. Consumers are increasingly seeking supplements in lifestyle-friendly formats such as gummies, shots, and functional beverages, rather than traditional tablets, fueling cross-category innovation. Major companies like Nestlé Health Science and Bayer AG are embedding supplements into broader nutritional wellness portfolios, aligning with dietary products and fitness platforms to create holistic health solutions.

Parallel to this, e-commerce and wellness apps are enabling personalized supplement plans using AI-driven health tracking and diagnostic tools, shifting procurement decisions toward customized, subscription-based solutions. The convergence of supplements with digital ecosystems and functional nutrition is redefining consumer engagement, transforming organ support supplements from standalone products into integrated components of preventive healthcare pathways. This trend is expected to accelerate adoption, particularly in digitally mature regions such as North America, Europe, and South Korea.

Asia Pacific is emerging as the fastest-growing region in the Organ Support Supplements Market, projected to grow at a CAGR of 6.6% between 2025 and 2035, with India expanding at 7.1% CAGR and China at 6.2% CAGR. Growth is driven by rising healthcare awareness, increasing disposable incomes, and greater adoption of preventive nutrition in urban populations. India is seeing strong uptake due to the rising burden of lifestyle-related diseases and expansion of digital health platforms promoting supplement use.

In China, government initiatives supporting nutrition and wellness, along with expanding e-commerce penetration, are accelerating adoption. South Korea stands out with a 6.5% CAGR, supported by consumer preference for innovative formulations such as functional beverages and shots. Collectively, Asia Pacific’s momentum is reinforced by demographic shifts, higher healthcare spending, and digital retail channels.

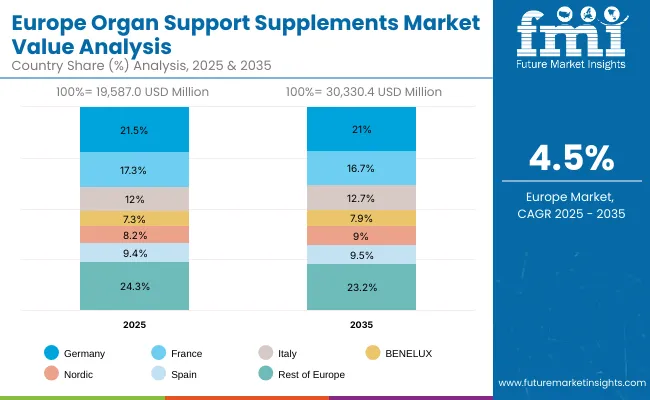

Europe is expected to grow steadily at a 4.3% CAGR through 2035. Germany is projected to expand at 4.2% CAGR, benefiting from strong adoption of liver and gut health supplements in preventive healthcare regimens.

France is estimated to grow at 4.1% CAGR, supported by product integration into mainstream retail and pharmacy networks, while the UK will expand at 4.5% CAGR, driven by online distribution and rising consumer awareness of organ-specific supplementation. Country-level revenue splits indicate Germany, the UK, and France will remain the largest markets, though France’s share is forecast to declinegradually from 17.3% in 2025 to 16.7% by 2035, reflecting strong competition across the product segment.

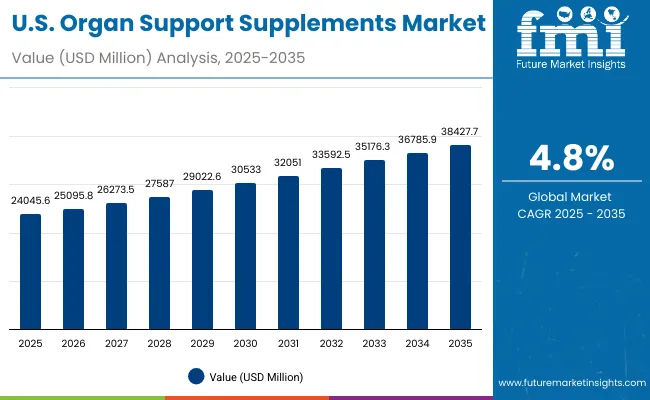

North America remains a mature but innovation-driven market, with the USA projected to grow at a 4.8% CAGR between 2025-2035. Growth is supported by increasing consumer demand for personalized supplements, subscription models, and functional formulations. Retail pharmacies and health & wellness stores continue to play a strong role, but e-commerce has rapidly become the leading channel, accounting for 28.0% of sales.

Adoption is further fueled by the high prevalence of chronic diseases and growing geriatric populations, where targeted organ support particularly liver, kidney, and cognitive supplements forms part of long-term care strategies. Market expansion is reinforced by product innovation, clinical validation efforts, and the integration of supplements into preventive health programs across healthcare providers and wellness practitioners.

The Organ Support Supplements Market in the USA is forecasted to grow at a 4.8% CAGR, primarily driven by rising consumer awareness of preventive healthcare and increasing adoption of gut, liver, and brain support supplements. Retail pharmacies and e-commerce platforms are driving penetration by offering wide accessibility and brand variety. The shift toward science-backed, functional formulations and clean-label supplements is further expanding consumer trust and adoption.

The Organ Support Supplements Market in Europe is projected to grow at a 4.3% CAGR through 2035, supported by the region’s aging population, rising demand for cognitive and heart health products, and regulatory approval of herbal/natural formulations. Consumer preferences are shifting toward capsules, powders, and functional beverages with clinically validated claims.

The Organ Support Supplements Market in India is expected to grow at a 7.1% CAGR, making it one of the fastest-growing markets globally. Growth is fueled by rising preventive healthcare awareness, expansion of nutraceutical retail networks, and increasing adoption of herbal and functional blends across Tier 1 and Tier 2 cities. Higher prevalence of chronic diseases, combined with AYUSH ministry-backed initiatives, is boosting the consumption of liver and kidney health supplements. Indian nutraceutical companies are actively launching affordable, region-specific formulations in capsule, powder, and functional beverage formats to meet evolving consumer preferences.

The Organ Support Supplements Market in China is projected to grow at a 6.2% CAGR through 2035, supported by strong government initiatives under the Healthy China 2030 plan. Rising consumer health consciousness, particularly in urban centers, is driving demand for clinically backed gut, liver, and cognitive supplements. Aging demographics and lifestyle-driven chronic conditions are further accelerating adoption of capsules, functional beverages, and gummies. Domestic players are strengthening production capacity while integrating Traditional Chinese Medicine (TCM)-inspired formulations with modern nutraceutical science to appeal to a broad consumer base.

The Organ Support Supplements Market in Japan is projected to reach USD 7,514.2 million in 2025, growing at a 3.8% CAGR through 2035. Liver, heart, and brain health supplements dominate the landscape, accounting for more than half of the segment share, driven by the country’s aging population and focus on cognitive longevity. Japan’s Food with Function Claims (FFC) regulatory framework ensures consumer confidence in clinically validated organ support products. Functional beverages and capsules are the most preferred formats, reflecting Japan’s demand for convenient and science-backed daily health solutions.

The Organ Support Supplements Market in South Korea is estimated at USD 3,005.7 million in 2025, with Capsules/Tablets holding 34.0% accounting for the largest revenue share. This dominance is driven by consumer preference for convenience and integration of supplements into daily diets. South Korea’s government-backed wellness initiatives and strong local innovation in nutraceuticals are accelerating demand for gut, brain, and liver health supplements. Younger demographics are adopting gummies and shots, while the aging population is driving steady consumption of cognitive and heart support products.

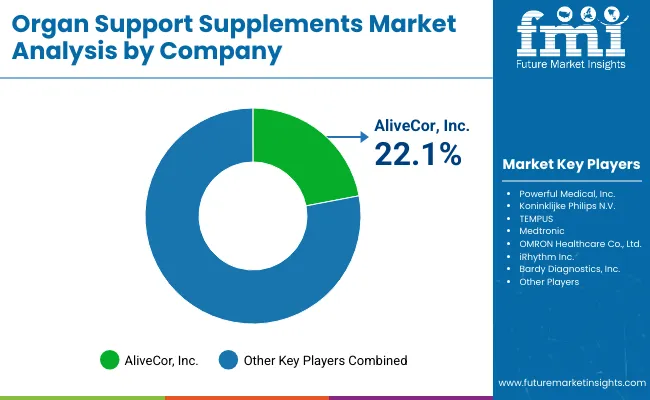

The Organ Support Supplements market is moderately fragmented, with global leaders, established nutraceutical firms, and emerging wellness brands competing across categories such as liver, kidney, gut, brain, and heart health supplements. Industry leaders such as Amway (7.5% share), Herbalife Nutrition, and GNC Holdings maintain a strong foothold through extensive distribution networks, branded wellness ecosystems, and wide product portfolios.

These companies are expanding through direct-to-consumer (D2C) channels, personalized supplement packs, and e-commerce partnerships. Their strategies increasingly focus on clean-label claims, herbal/natural positioning, and clinical validation, enabling them to capture health-conscious consumers across demographics.

Established mid-sized players such as Nestlé Health Science, Bayer AG, NOW Foods, and Nature’s Bounty (Nestlé) cater to consumers seeking trusted and science-backed products. These firms are investing in clinical research, expanding into functional beverages and gummies, and offering targeted solutions for chronic disease prevention and geriatric health. Their presence in both retail pharmacies and digital marketplaces makes them highly relevant in mature economies like Europe and North America.

Emerging brands such as Swisse Wellness, Pharmavite (Nature Made), and Thorne HealthTech are carving out niches in premium, athlete-focused, and personalized nutrition categories. Their strength lies in customized formulations, subscription-based models, and digital health integration, including at-home diagnostics paired with supplement recommendations. Many are positioning themselves as lifestyle brands, appealing strongly to younger and fitness-oriented consumers in Asia-Pacific and Latin America.

As the market evolves, competitive differentiation is shifting from traditional capsule/tablet formats toward functional beverages, gummies, and personalized nutrition ecosystems. Companies focusing on evidence-based formulations, AI-driven personalization, and omnichannel engagement are expected to gain significant traction in the next decade.

Key Developments:

| Item | Value |

|---|---|

| Market Value (2025) | USD 75, 142.7 million |

| Supplement type | Liver Support Supplements, Kidney Health Supplements, Heart Health Supplements, Lung Support Supplements, Brain & Cognitive Support Supplements, Gut Health Supplements, and Others |

| Application | General Wellness, Athletes & Fitness Seekers, Chronic Disease Patients, Post-treatment Recovery, and Geriatric (65 Years and Above |

| formulation type | Capsules/Tablets, Powders, Tinctures, Gummies, Functional Beverages, and Shots |

| Sales channel | Retail Pharmacies, Drug Stores, Health & Wellness Stores, Hypermarkets and Supermarkets, and E-commerce/Online Sales |

| Regions Covered | North America, Latin America, Western & Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | USA, Brazil, China, India, Germany, France, UK etc. |

| Key Companies Profiled | Amway, Herbalife Nutrition, GNC Holdings, Nestlé Health Science, Bayer AG, NOW Foods, Nature’s Bounty (Nestlé), Swisse Wellness, Pharmavite (Nature Made), Thorne HealthTech |

| Additional Attributes | Dollar sales by application and regions, Adoption trends of Organ, Support Supplements, Rising demand in Biotech & Research-driven Nutrition, Growing demand across Pharmacies, E-commerce and Nutraceutical Manufacturing |

The global Organ Support Supplements market is estimated to be valued at USD 75,142.7 million in 2025.

The market size for Organ Support Supplements is projected to reach USD 127,138.7 million by 2035.

The Organ Support Supplements market is expected to grow at a CAGR of 5.4% during this period.

Key supplement types Liver Support Supplements, Kidney Health Supplements, Heart Health Supplements, Lung Support Supplements, Brain & Cognitive Support Supplements, Gut Health Supplements, and Others.

The General Wellness segment is projected to command 30.0% of the market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lactation Support Supplements Market - Size, Share, and Forecast Outlook 2025-2035

Organ Static Cold Storage (SCS) Solution Market Size and Share Forecast Outlook 2025 to 2035

Organ Preservation Solution Market Size and Share Forecast Outlook 2025 to 2035

Organ Preservation & Perfusion Products Market Size and Share Forecast Outlook 2025 to 2035

Organic Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Organoids LNP Market Size and Share Forecast Outlook 2025 to 2035

Organic Salad Dressing Market Forecast and Outlook 2025 to 2035

Organoids Market Size and Share Forecast Outlook 2025 to 2035

Organic Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Organic Acai Juice Market Size and Share Forecast Outlook 2025 to 2035

Organic Beverages Market Size and Share Forecast Outlook 2025 to 2035

Organic Drinks Market Size and Share Forecast Outlook 2025 to 2035

Organic Oats Market Size and Share Forecast Outlook 2025 to 2035

Organic Dried Distillers Grain Feed Market Size and Share Forecast Outlook 2025 to 2035

Organic Hemp Market Size and Share Forecast Outlook 2025 to 2035

Organic Electronics Market Size and Share Forecast Outlook 2025 to 2035

Organometallics Market Size and Share Forecast Outlook 2025 to 2035

Organic Dyes Market Size and Share Forecast Outlook 2025 to 2035

Organic Rankine Cycle Market Size and Share Forecast Outlook 2025 to 2035

Organic Seed Varieties Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA