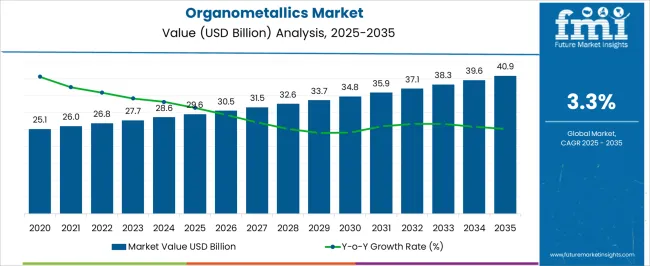

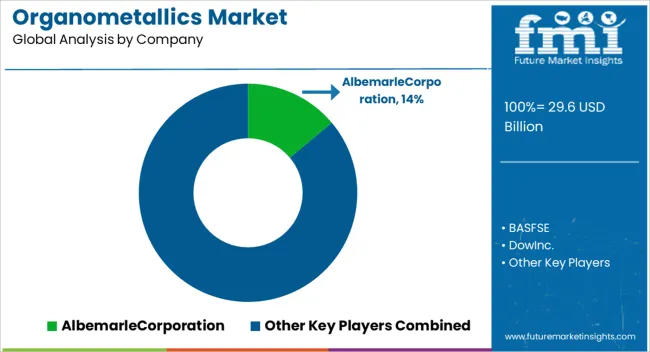

The Organometallics Market is estimated to be valued at USD 29.6 billion in 2025 and is projected to reach USD 40.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.3% over the forecast period.

The incremental growth from USD 29.6 billion in 2025 to USD 40.9 billion in 2035 suggests that production costs, particularly for high-purity organometallic compounds, remain a significant component of the overall market structure. Procurement of high-quality metals, ligands, and solvents contributes substantially to the input costs, while synthesis and processing operations demand precision and adherence to regulatory standards, adding operational overheads.

Downstream activities, including formulation into catalysts, pharmaceuticals, and specialty chemicals, influence value addition but face moderate margin expansions due to competitive pressures and relatively standardized applications across industries. The value chain further extends into distribution and logistics, where secure handling and compliance with environmental regulations incur additional costs, particularly for international shipments. Margins along the chain are stabilized by long-term supply contracts and strategic partnerships with end-use sectors such as automotive, electronics, and pharmaceuticals.

The steady progression from USD 29.6 billion to USD 40.9 billion underscores a cost-structure where raw materials and synthesis dominate, while downstream processing and distribution provide controlled value addition. Efficiency improvements, process optimization, and integrated supply chain management are expected to remain central strategies to maintain profitability, reflecting a mature yet methodically growing market characterized by consistent operational investments and controlled margin enhancement.

| Metric | Value |

|---|---|

| Organometallics Market Estimated Value in (2025 E) | USD 29.6 billion |

| Organometallics Market Forecast Value in (2035 F) | USD 40.9 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

The organometallics market is experiencing notable expansion, supported by its critical role in homogeneous catalysis, polymer synthesis, and specialty chemical manufacturing. Growing adoption of transition metal complexes in industrial-scale reactions, particularly in pharmaceutical and petrochemical applications, is shaping current market dynamics.

Technological innovations in compound synthesis and stabilization have improved the reactivity and shelf-life of organometallic intermediates, enabling greater usage across high-value chemical transformations. Regulatory emphasis on sustainable and efficient synthesis methods has further accelerated interest in organometallic-based catalytic cycles, especially for carbon-carbon coupling and asymmetric hydrogenation processes.

Additionally, advancements in process chemistry, combined with increased R&D funding by pharmaceutical and materials science industries, are paving the way for next-generation compounds with tailored reactivity The shift toward precision manufacturing and green chemistry initiatives is expected to sustain demand, particularly as organometallics continue to bridge inorganic chemistry with life sciences, nanotechnology, and energy storage innovations.

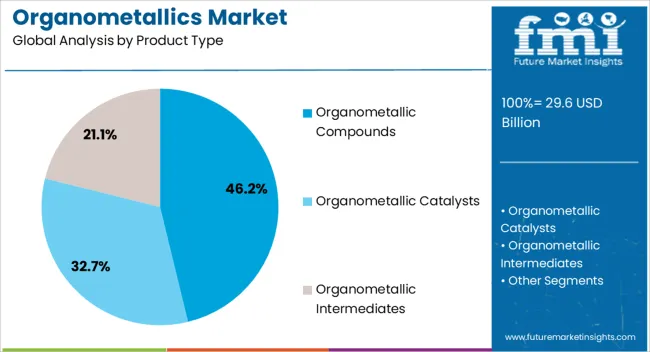

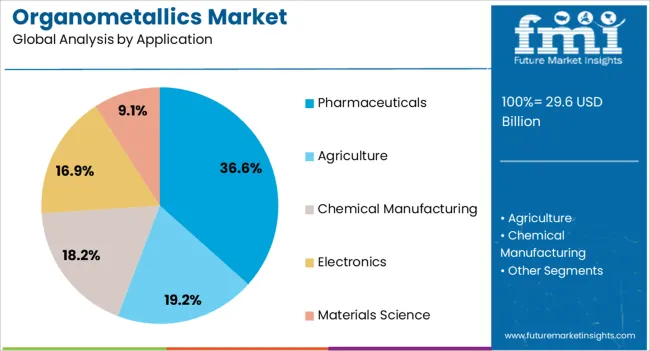

The organometallics market is segmented by product type, application, form, end user industry, and geographic regions. By product type, the organometallics market is divided into Organometallic Compounds, Organometallic Catalysts, and Organometallic Intermediates. In terms of application, the organometallics market is classified into Pharmaceuticals, Agriculture, Chemical Manufacturing, Electronics, and Materials Science.

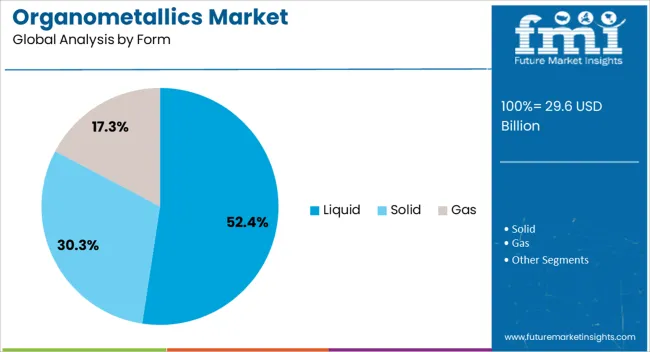

Based on form, the organometallics market is segmented into Liquid, Solid, and Gas. By end user industry, the organometallics market is segmented into Electronics, Automotive, Aerospace, Construction, and Energy. Regionally, the organometallics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Organometallic compounds are projected to account for 46.2% of the total revenue share in the organometallics market in 2025, making them the leading product type. This segment’s dominance is driven by its extensive utilization in catalytic processes, polymerization, and organic transformations. Organometallic compounds are preferred for their ability to facilitate key steps in synthesis that cannot be achieved by conventional organic or inorganic reagents alone.

The tunable electronic and steric properties of these compounds enable precise control over reaction mechanisms, which is essential for pharmaceutical manufacturing and fine chemical production. Innovations in ligand design and metal complex stabilization have significantly enhanced their application in olefin polymerization, hydrosilylation, and cross-coupling reactions.

The widespread commercial availability of transition metal-based compounds, along with their integration into automated synthesis systems, has further contributed to segment growth. As industries increasingly demand more efficient and selective catalysts, the role of organometallic compounds is expected to remain central in industrial chemistry workflows.

The pharmaceuticals segment is anticipated to hold 36.6% of the overall revenue share in the organometallics market by 2025, highlighting its significance as a key application area. Growth in this segment is being driven by the continued use of organometallic catalysts and intermediates in active pharmaceutical ingredient (API) synthesis. Metal-organic frameworks and transition metal complexes are widely applied in stereoselective and enantioselective reactions, enabling the production of complex drug molecules with higher yields and lower waste.

Increased reliance on cross-coupling and C-H activation reactions in drug development pipelines has further strengthened demand for organometallic inputs. Regulatory approval of metal-based therapeutics and radiopharmaceutical agents has also expanded the clinical scope of these compounds.

As pharmaceutical companies invest in continuous manufacturing and adopt greener synthesis approaches, the incorporation of organometallics is expected to accelerate. Their contribution to time-efficient and cost-effective synthesis of targeted drugs continues to position them as essential components in modern pharmaceutical chemistry.

The liquid form segment is expected to represent 52.4% of the organometallics market revenue share in 2025, making it the dominant form used across industries. This preference is primarily attributed to the ease of handling, accurate dosing, and uniform dispersion properties offered by liquid-phase organometallics. Liquid forms enable better solubility in reaction media, allowing for higher catalytic efficiency and better control over reaction kinetics.

In pharmaceutical and fine chemical applications, liquid organometallic reagents ensure consistent reactivity, which is critical for batch-to-batch reproducibility and regulatory compliance. Their compatibility with automated delivery systems and in-line process monitoring has further facilitated adoption in advanced manufacturing environments.

The storage stability and reduced solid-handling risks associated with liquids have made them especially suitable for moisture- and air-sensitive reactions. As continuous flow chemistry and real-time synthesis become more prevalent in industrial operations, the demand for liquid organometallics is projected to remain strong due to their operational convenience and enhanced safety profile.

The market has been expanding due to growing demand for catalysts, reagents, and functional materials across chemical, pharmaceutical, and material science industries. Organometallic compounds have been valued for their role in polymerization, organic synthesis, and catalytic applications, enhancing reaction efficiency and selectivity. Market growth has been reinforced by advancements in compound synthesis, purification technologies, and safety handling protocols.

Increasing industrial applications, research investments, and the need for sustainable chemical processes have further strengthened demand, positioning organometallics as essential intermediates in modern chemical manufacturing and advanced material development worldwide.

The market has been significantly driven by adoption in catalysis and chemical synthesis applications, where high selectivity and reaction efficiency are critical. Organometallic compounds, including transition metal complexes, have been utilized as catalysts in polymerization, hydrogenation, oxidation, and cross-coupling reactions. Their unique electronic and steric properties have allowed precise control over reaction pathways, improving product yield and quality. Chemical manufacturers, pharmaceutical companies, and research laboratories have increasingly relied on organometallic catalysts for efficient synthesis of fine chemicals, active pharmaceutical ingredients, and specialty polymers. Safety protocols, controlled environments, and high-purity standards have reinforced adoption. The growth of chemical research, green chemistry initiatives, and demand for high-performance catalysts have strengthened the importance of organometallic compounds in industrial and laboratory applications globally.

Technological innovations have strengthened the market by enhancing synthesis techniques, improving purity, and increasing operational safety. Advanced methods, including ligand design, solvent optimization, and flow chemistry, have enabled the production of highly selective and stable organometallic compounds. Analytical tools such as NMR spectroscopy, mass spectrometry, and chromatography have been employed for precise characterization, ensuring high-quality standards. Innovations in encapsulation, stabilization, and automated handling systems have enhanced safety during storage and transport. In addition, research into air- and moisture-stable complexes has facilitated broader industrial adoption. These technological advancements have enabled more efficient chemical transformations, reduced hazardous exposure risks, and allowed organometallic compounds to be applied in pharmaceutical, polymer, and specialty chemical manufacturing with improved performance and safety across global markets.

The market has been reinforced by adoption in pharmaceutical and materials science applications. Compounds have been utilized as key intermediates in drug synthesis, imaging agents, and therapeutic delivery systems. Their catalytic properties have allowed precise bond formation in complex molecules, enhancing drug efficacy and reducing synthesis time. In materials science, organometallics have been applied in the development of advanced coatings, thin films, and electronic materials. Collaboration between research institutions, pharmaceutical companies, and chemical manufacturers has encouraged innovation in ligand design, compound stability, and functional applications. Increasing focus on high-value specialty chemicals, advanced materials, and targeted drug development has strengthened demand, positioning organometallic compounds as essential components in the modern pharmaceutical and materials science industries globally.

Despite strong growth, the market has faced challenges associated with high production costs, safety considerations, and stringent regulatory compliance. Complex synthesis routes, high-purity reagents, and specialized equipment have increased manufacturing expenses. Handling risks, including sensitivity to air, moisture, and temperature fluctuations, requires controlled environments and safety protocols. Regulatory frameworks governing hazardous chemicals, environmental emissions, and occupational exposure have influenced operational practices and added compliance costs. Manufacturers have responded by investing in safer, automated handling systems, process optimization, and scalable production techniques. Continuous improvements in cost efficiency, safety measures, and compliance adherence have been critical for sustaining adoption across pharmaceutical, chemical, and materials applications, ensuring organometallic compounds remain viable and effective intermediates in global markets.

| Countries | CAGR |

|---|---|

| China | 4.5% |

| India | 4.1% |

| Germany | 3.8% |

| France | 3.5% |

| UK | 3.1% |

| USA | 2.8% |

| Brazil | 2.5% |

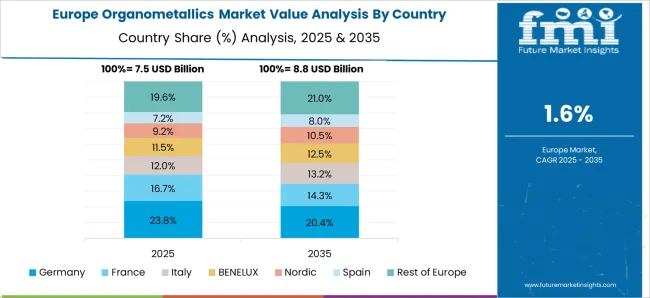

The market is projected to grow at a CAGR of 3.3% from 2025 to 2035, driven by applications in pharmaceuticals, chemical synthesis, and materials research. China leads with a 4.5% CAGR, expanding through increasing chemical manufacturing and R&D initiatives. India follows at 4.1%, supported by growing pharmaceutical and specialty chemical production. Germany, at 3.8%, benefits from advanced chemical engineering capabilities and strong research infrastructure. The UK, growing at 3.1%, focuses on specialty organometallic applications and innovation. The USA, at 2.8%, experiences steady demand driven by industrial applications and academic research programs. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a CAGR of 4.5%, supported by increasing applications in pharmaceuticals, agrochemicals, and specialty chemicals. Manufacturers are focusing on research and development to create highly pure and stable organometallic compounds suitable for complex chemical syntheses. Rising investments in chemical manufacturing facilities and innovation in catalyst technology further stimulate demand. Industrial collaborations and academic partnerships enhance knowledge exchange, enabling faster adoption of new organometallic materials. Market growth is driven by both domestic consumption and export opportunities. Regulatory compliance and quality control standards ensure product reliability and performance, influencing procurement decisions by major chemical producers.

India is anticipated to expand at a CAGR of 4.1%, supported by the growing chemical and pharmaceutical manufacturing sectors. Manufacturers focus on developing stable and high-purity compounds suitable for diverse industrial applications. Strategic partnerships between chemical companies and research institutions facilitate innovation and knowledge sharing. Government incentives for chemical research and production promote investments in high-value organometallic products. The market benefits from rising domestic consumption and increasing demand for advanced chemical intermediates in export markets. Regulatory adherence ensures quality and performance standards, strengthening buyer confidence. Emerging applications in catalysis and material sciences further enhance market potential.

Germany’s market is expected to grow at a CAGR of 3.8%, propelled by the country’s robust chemical and automotive industries. Manufacturers emphasize precision synthesis, purity, and stability of organometallic compounds to meet stringent industrial requirements. Research initiatives in catalysis, polymerization, and material development provide significant opportunities. Collaborations with academic institutions facilitate technology transfer and product innovation. Market growth is reinforced by strong domestic consumption as well as exports to Europe and Asia. Compliance with environmental and safety standards ensures market reliability and promotes adoption in industrial processes. Advanced applications in specialty chemicals and renewable energy sectors contribute to demand expansion.

The market in the United Kingdom is projected to grow at a CAGR of 3.1%, driven by pharmaceutical production, chemical intermediates, and material science applications. Manufacturers focus on high-purity compounds and innovative catalytic solutions to improve process efficiency. Strategic collaborations with universities and research institutes facilitate rapid product development and application testing. Market adoption is supported by rising demand from domestic industries and international exports. Regulatory compliance and adherence to safety standards influence buyer confidence. Emerging applications in green chemistry and sustainable processes are expected to further propel growth in the coming years.

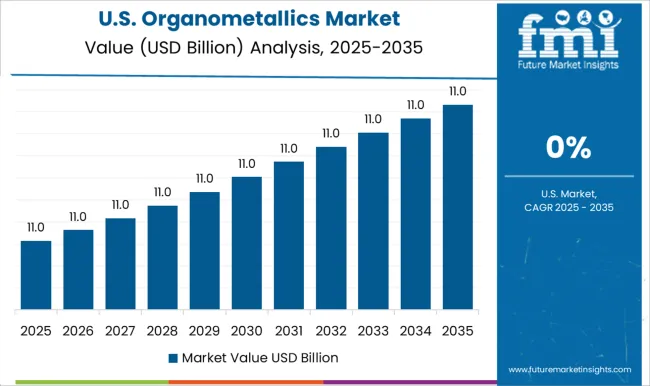

The United States market is anticipated to expand at a CAGR of 2.8%, supported by growing usage in pharmaceuticals, specialty chemicals, and advanced material applications. Manufacturers emphasize purity, stability, and scalability of organometallic compounds to meet industrial and laboratory requirements. Research and development efforts focus on novel catalytic systems and high-performance intermediates. Strategic partnerships with chemical manufacturers and academic institutions promote innovation and faster commercialization. Regulatory frameworks and quality standards ensure consistent product performance. Export opportunities to Europe and Asia provide additional revenue streams, while emerging applications in energy storage and catalysis continue to drive market potential.

The market is expanding steadily, driven by increasing applications in pharmaceuticals, electronics, and specialty chemicals. Albemarle Corporation, BASF SE, and Dow Inc. are prominent players, offering a wide portfolio of organometallic compounds that are critical for catalysts, polymerization, and advanced material synthesis. Their focus on high-purity products and scalable production processes positions them as reliable suppliers across industrial and research sectors. Sigma-Aldrich Corporation, Johnson Matthey PLC, Pfizer Inc., and AbbVie Inc. contribute to market growth by leveraging organometallics for pharmaceutical applications, including drug development, targeted therapies, and chemical intermediates. These companies emphasize innovation, quality control, and compliance with stringent regulatory standards, enabling safe and efficient use of organometallic compounds in life sciences. The electronics sector benefits from offerings by Intel Corporation, Nvidia Corporation, Qualcomm Incorporated, and Micron Technology Inc., which utilize organometallics in semiconductor fabrication, thin-film deposition, and high-performance materials. Tulip Chemicals Pvt. Ltd., Reaxis Inc., and Coastal Chemical Company LLC provide specialized solutions, catering to niche applications in chemical research, industrial catalysis, and material engineering. Collectively, these leading organometallics providers drive innovation, reliability, and performance across diverse global industries.

| Item | Value |

|---|---|

| Quantitative Units | USD 29.6 Billion |

| Product Type | Organometallic Compounds, Organometallic Catalysts, and Organometallic Intermediates |

| Application | Pharmaceuticals, Agriculture, Chemical Manufacturing, Electronics, and Materials Science |

| Form | Liquid, Solid, and Gas |

| End User Industry | Electronics, Automotive, Aerospace, Construction, and Energy |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AlbemarleCorporation, BASFSE, DowInc., Sigma-AldrichCorporation, JohnsonMattheyPLC, PfizerInc., AbbVieInc., IntelCorporation, NvidiaCorporation, QualcommIncorporated, MicronTechnologyInc., TulipChemicalsPvt.Ltd., ReaxisInc., and CoastalChemicalCompanyLLC |

| Additional Attributes | Dollar sales by compound type and application, demand dynamics across pharmaceuticals, catalysis, and chemical manufacturing sectors, regional trends in research and industrial adoption, innovation in synthesis methods and functional performance, environmental impact of production and waste management, and emerging use cases in advanced materials and specialty chemical applications. |

The global organometallics market is estimated to be valued at USD 29.6 billion in 2025.

The market size for the organometallics market is projected to reach USD 40.9 billion by 2035.

The organometallics market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in organometallics market are organometallic compounds, organometallic catalysts and organometallic intermediates.

In terms of application, pharmaceuticals segment to command 36.6% share in the organometallics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA