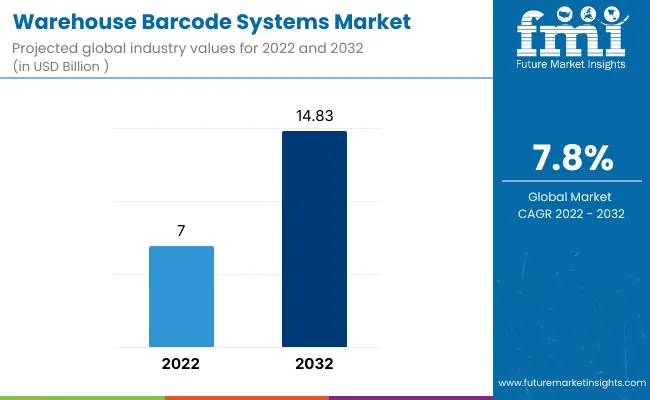

The warehouse barcode systems market is projected a promising CAGR of 7.8% during the forecast period. The market is valued at US$ 7 Billion in 2022 and is expected to cross the value of US$ 14.83 Billion by 2032.

| Attributes | Details |

| Warehouse Barcode Systems Market CAGR | 7.8% |

| Warehouse Barcode Systems Market 2022 | US$ 7 Billion |

| Warehouse Barcode Systems Market 2032 | US$ 14.83 Billion |

The improved capital flow, expanding e-commerce space and need for enhanced customer experience is to boost the demand for warehouse barcode systems. The high capital investments through government schemes and private players are expanding the warehouse barcode systems market share.

Largely used for high-speed data entry with high accuracy that ends up allowing companies to predict future demands and trend shifts, warehouse barcode systems help the corporations take a count analysis of the demand and supply, booming in sales of warehouse barcode systems.

Some of the other things that warehouse barcode systems deal with are retail operations, receiving and shipping operations, manufacturing operations and assets management, giving a pushing the demand for warehouse barcode systems in various industries. These features allow end user businesses to adopt new technology in order to enhance their productivity, expanding warehouse barcode systems market share in the global market through forecast period 2022-2032.

Thesales of warehouse barcode systems have increased as advanced technologies such as mobile barcode systems and radio frequency identification devices are used in warehouse barcode systems, reducing the costs and improving the efficiency of processes that trigger the sales of warehouse barcode systems. Advanced technologies such as LED, charge coupled device, and laser barcode scanning is helping demand for warehouse barcode systems.

Small industries think twice before opting for warehouse barcode systems as ROI here is lower than that of large enterprises. The data privacy and security concerns associated with warehouse barcode systems can also have a restraining effect on the growth of the market which declines the sales of warehouse barcode systems.

The key contributors are the leading manufacturers including automotive & transportation, food & beverages, chemicals & materials, industrial equipment & machinery, textiles & apparel, consumer goods, consumer electronics, and others.

These industries are helping in fueling the sales of warehouse barcode systems globally. The warehouse barcode systems are mostly used in retail shops and are easy to optimize the inventory, it further tracks all the items in the stock which leads to triggering demand for warehouse barcode systems in the market by end users.

The presence of companies providing global warehousing and distribution services, growth in the e-commerce industry and the investments made in improving warehouse management services leads to an increase in demand for warehouse barcode systems. The North America region is expected to fuel the sales of warehouse barcode systems as it is the dominating region among others.

The Asia Pacific is expected to lead the warehouse barcode systems market during the forecast period owing to the growth of sales emerging economies such as China and India. The growth in the e-commerce industry due to the improved purchasing abilities of people is expected to thrive the sales of warehouse barcode systems. The technological advancements and investments made in systems are expected to contribute to the growth in the demand for warehouse barcode systems.

The new players in the warehouse barcode systems market and rising awareness about the benefits of barcode systems are expected to assist the sales of warehouse barcode systems in the Middle East and Africa.

Key players are the manufacturing companies that help to sell warehouse barcode systems in the coming forecast period. Some of the warehouse barcode systems end user companies are Wasp Barcode Technologies, Barcoding Inc., System ID Barcode Solutions, Scanco Software LLC, Blue Link Associates Limited, Barcodes, Barcodes Inc, PEOPLEVOX, asap SYSTEMS, Fishbowl, and Shenzhen Chain way Information Technology Co Ltd.

The warehouse barcode systems market is quite fragmented with numerous local and regional companies catering to market requirements, fueling the sales of warehouse barcode systems.

Recent Market Development:

| Report Attribute | Details |

| Growth Rate | CAGR of 7.8% From 2022 to 2032 |

| Base year for estimation | 2020 |

| Historical data | 2015 – 2021 |

| Forecast period | 2022 – 2032 |

| Quantitative units | Revenue in USD billion, volume in kilotons, and CAGR from 2022 to 2032 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered | Offering, Components, End User & Region |

| Regional scope | North America; Latin America; Europe; Middle East and; Africa (MEA); East Asia; South Asia; Oceania |

| Country scope | U.S., Canada, Mexico, Brazil, Argentina, Germany, Italy, France, U.K, Spain, Russia, India, Indonesia, Thailand, China, Japan, South Korea, Australia & New Zealand, GCC Countries, South Africa, North Africa |

| Key companies profiled | Wasp Barcode Technologies, Barcoding Inc., System ID Barcode Solutions, Scanco Software LLC, Blue Link Associates Limited, Barcodes, Barcodes Inc, PEOPLEVOX, asap SYSTEMS, Fishbowl, and Shenzhen Chain way Information Technology Co Ltd. |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The warehouse barcode systems market is likely to thrive on a CAGR of 7.8% between 2022 and 2032.

The Asia Pacific is expected to lead the warehouse barcode systems market during forecast period.

The warehouse barcode systems market expected to hold the valuation of US$ 14.83 Billion by 2032.

Demand from automotive industry is expected to be a key driver in the warehouse barcode systems market through forecast period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Retail Warehouse Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Warehouse Design and Layout Market Size and Share Forecast Outlook 2025 to 2035

Warehouse Robotics Market Size and Share Forecast Outlook 2025 to 2035

Barcode Scanner Market Size and Share Forecast Outlook 2025 to 2035

Warehouse Tug Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Warehouse Racking Market Growth - Trends & Forecast 2025 to 2035

Barcode Printers & Consumables Market Growth - Trends & Forecast 2025 to 2035

Barcode Printers Market Growth - Trends & Forecast 2025 to 2035

Warehouse RFID Market Size, Share, Trends & Forecast 2024-2034

Barcode Labeller Machine Market

Barcode Label Market

2D Barcode Reader Market Size and Share Forecast Outlook 2025 to 2035

UK Barcode Printer Market Analysis – Demand, Growth & Forecast 2025-2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

USA Barcode Printer Market Trends – Size, Share & Industry Growth 2025-2035

Data Warehouse as a Service Market - Cloud Trends & Forecast 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Hi-Fi Systems Market Size and Share Forecast Outlook 2025 to 2035

Smart Warehouse Technologies Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA