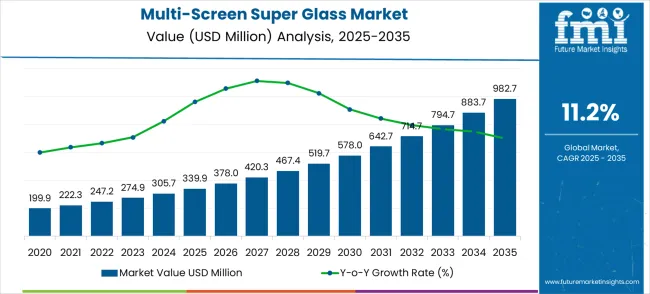

The global multi-screen super glass market is projected to reach USD 983 million by 2035, recording an absolute increase of USD 642.8 million over the forecast period. The market is valued at 340 million in 2025 and is set to rise at a CAGR of 11.2% during the assessment period. The market size is expected to grow by nearly 2.89X during the same period, supported by increasing adoption of advanced display technologies and smart glass applications in automotive and consumer electronics. Raw material cost fluctuations and complex manufacturing processes may constrain growth rates in price-sensitive market segments.

Between 2025 and 2030, the multi-screen super glass market is projected to expand from USD 340 million to USD 577.9 million, resulting in a value increase of USD 238.0 million, which represents 37% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for smart display technologies, product innovation in transparent electronics and interactive glass surfaces, and expanding automotive and consumer electronics applications. Companies are establishing competitive positions through investment in advanced coating technologies, specialized glass formulation expertise, and strategic market expansion across display manufacturers, electronics integrators, and emerging smart building applications.

From 2030 to 2035, the market is forecast to grow from USD 577.9 million to USD 983 million, adding another USD 404.8 million, which constitutes 63.0% of the ten-year expansion. This period is expected to be characterized by the expansion of specialized applications, including flexible displays and curved glass surfaces tailored for specific automotive and architectural requirements, strategic collaborations between glass manufacturers and electronics companies, and enhanced product positioning with advanced optical properties and multi-touch capabilities. The growing focus on interactive displays and smart glass integration will drive demand for sophisticated multi-screen solutions across diverse commercial and residential applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 340 million |

| Market Forecast Value (2035) | USD 983 million |

| Forecast CAGR (2025-2035) | 11.2% |

Multi-screen super glass market expands through enhanced user experience and display functionality improvements that reduce hardware complexity while increasing screen real estate. Automotive industry digitalization creates demand for integrated display systems that combine instrument clusters, infotainment centers, and navigation displays into seamless glass surfaces. Consumer electronics manufacturers require flexible display solutions that enable foldable smartphones, curved televisions, and interactive surfaces for tablets and laptops. Smart building applications drive adoption of transparent displays for retail environments, office spaces, and public venues where information presentation merges with architectural elements. Commercial display manufacturers prioritize multi-screen solutions that reduce installation complexity and maintenance requirements while supporting higher resolution and touch sensitivity. Growth faces constraints from manufacturing yield challenges that affect production costs and technical limitations in scaling complex multi-layer glass structures across larger display sizes.

The Multi-Screen Super Glass (MSSG) market is poised for rapid growth, driven by consumer electronics innovation, display manufacturing modernization, and automotive electronics adoption. By 2035, these drivers together create an incremental revenue opportunity of USD 12.5–16.0 billion.

Pathway A – Functional Multi-Screen Glass for Displays. High touch sensitivity, anti-reflective, and anti-fingerprint properties make functional MSSG ideal for smartphones, tablets, and laptops. This segment represents the largest near-term opportunity worth USD 4.0–5.5 billion, driven by foldable and multi-screen device proliferation.

Pathway B – Structural Multi-Screen Glass for Consumer Electronics. Structural MSSG provides mechanical strength and durability for consumer electronics. Its ability to withstand repeated folding, bending, and impact makes it suitable for premium devices. Expected incremental pool: USD 3.2–4.0 billion.

Pathway C – Automotive Electronics Integration. Used in infotainment systems, dashboards, and heads-up displays, MSSG ensures optical clarity and high impact resistance. Adoption in electric and autonomous vehicles drives USD 2.5–3.5 billion in revenue potential.

Pathway D – Display Manufacturing Industry Applications. Large-format display panels, monitors, and commercial screens utilize MSSG for precision and durability, supporting USD 1.5–2.0 billion incremental revenue.

Pathway E – Hybrid and Emerging Glass Types. Hybrid MSSG combining functional and structural characteristics for niche industrial, medical, and signage applications offers USD 0.8–1.2 billion potential.

Pathway F – Smart and Modular Display Systems. Integration with modular or connected display systems enhances functionality and installation efficiency, creating an opportunity of USD 0.5–0.8 billion.

Pathway G – Premium Certifications. Glass with eco-friendly production, anti-scratch, and certified durability enables premium pricing, adding USD 0.3–0.5 billion.

Pathway H – Branded and Consumer-Focused Innovations. Customizable multi-screen glass solutions for luxury and gaming devices drive a smaller but high-value pool of USD 0.2–0.4 billion.

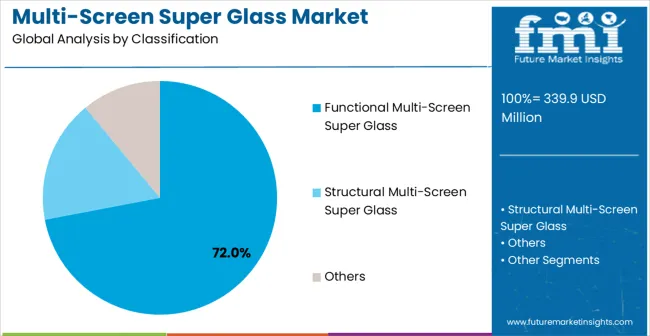

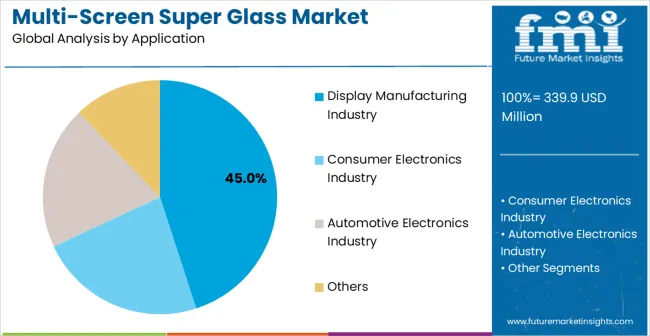

The market is segmented by product type, application, and region. By product type, the market is divided into functional multi-screen super glass, structural multi-screen super glass, and others. By application, the market is categorized into display manufacturing industry, consumer electronics industry, automotive electronics industry, and others. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

Functional multi-screen super glass dominates the market with a 72% share in 2025, largely due to its essential role in enabling interactive display technologies. These glasses integrate electrical conductivity, embedded transparent electrodes, and touch sensor arrays directly into the glass substrate, supporting touch, gesture, and proximity-based input. Device manufacturers rely on functional MSSG to create seamless, button-free user interfaces with advanced capabilities like multi-point touch recognition, pressure sensitivity, and haptic feedback.

From a technical perspective, functional multi-screen super glass offers superior optical clarity, minimal signal interference, and reliable conductivity, ensuring consistent display performance even in high-resolution or curved-screen applications. Its integrated features reduce the number of separate components required, streamlining assembly processes, lowering labor costs, and minimizing quality control challenges. Flexible and foldable display designs further enhance the demand for functional MSSG as it provides structural integrity while maintaining interactive responsiveness. The material’s ability to support ultra-thin form factors and next-generation user interface designs positions it as a critical enabler for innovative consumer electronics.

Display manufacturing represents 45% of total multi-screen super glass demand in 2025, driven by the growing need for high-performance display solutions across consumer electronics. Glass substrates used in display manufacturing must offer precise optical clarity, thermal stability, and chemical resistance to meet the exacting requirements of OLED, LED, quantum dot, and thin-film transistor (TFT) technologies. Manufacturers prioritize glass materials that can maintain strict dimensional tolerances, surface flatness, and contamination control to ensure consistent quality across large-scale production.

The display manufacturing segment benefits from multi-screen super glass’s ability to support curved, foldable, and ultra-thin screens, which are increasingly demanded by premium smartphones, tablets, laptops, and television displays. Functional glass with embedded sensors or coatings enables interactive features while simultaneously protecting delicate display layers, reducing the need for additional protective components. Advanced manufacturing processes also leverage MSSG for color filter integration, polarizer support, and touch functionality, creating opportunities for high-value, specialized glass products.

The multi-screen super glass (MSSG) market is propelled by several key demand drivers rooted in technological advancement, operational efficiency, and consumer experience enhancement. One of the primary growth catalysts is the increasing requirement for higher-resolution displays in consumer electronics, automotive dashboards, and wearable devices. As display resolutions improve, manufacturers require glass substrates that maintain exceptional optical clarity, color accuracy, and touch sensitivity while supporting higher pixel densities. This drives demand for functional and structural multi-screen super glass variants capable of integrating conductive coatings, touch sensors, and transparent electrodes into a single component.

Cost efficiency and manufacturing optimization represent another critical market driver. Integrated MSSG solutions reduce the number of discrete components in device assemblies, minimizing labor requirements, simplifying production workflows, and lowering defect rates. This directly enhances product reliability and reduces total cost of ownership for device manufacturers. The push toward intuitive and seamless user interfaces fosters adoption of MSSG that supports touch, gesture, and proximity interaction while eliminating traditional mechanical buttons. Premium consumer devices and automotive electronics, which prioritize user experience differentiation, are significant adopters due to the perceived value of responsive, high-performance glass interfaces.

The market faces several restraints. Complex multi-layer fabrication processes create challenges in achieving high production yields, driving up costs and introducing supply reliability risks. Integration of advanced electronics, sensors, and conductive materials into the glass substrate requires specialized equipment and technical expertise, limiting accessibility for smaller manufacturers. Fluctuations in raw material prices, particularly for specialty glass formulations, conductive coatings, and chemical precursors, contribute to procurement uncertainty and may affect market pricing.

Key trends shaping the MSSG market include increasing use of flexible and curved glass for next-generation smartphones, tablets, and automotive displays, enhancing product form factors and design aesthetics. Material innovations focus on improving conductivity, durability, and scratch resistance while maintaining optical clarity. Adoption is expanding beyond consumer electronics into automotive, healthcare, and industrial applications where precision display functionality is critical. Future growth could be influenced by alternative display technologies, such as microLED or polymer-based touch panels, which may offer similar functionality at lower production costs, potentially altering market dynamics.

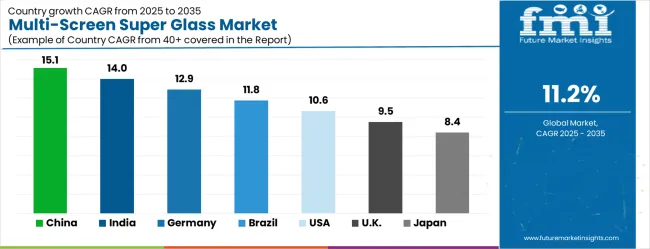

| Country | CAGR (2025-2035) |

|---|---|

| China | 15.1% |

| India | 14% |

| Germany | 12.9% |

| Brazil | 11.8% |

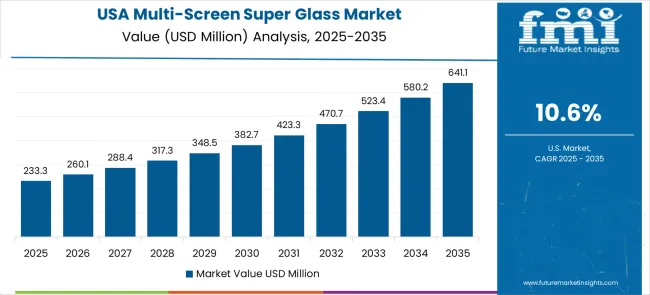

| USA | 10.6% |

| UK | 9.5% |

| Japan | 8.4% |

The multi-screen super glass market is gathering pace worldwide, with China taking the lead thanks to massive electronics manufacturing capacity and automotive industry digitalization. Close behind, India benefits from consumer electronics growth and smart city infrastructure development, positioning itself as a strategic growth hub. Germany shows steady advancement, where precision manufacturing expertise strengthens its role in the regional supply chain. Brazil is sharpening its focus on automotive electronics and smart building applications, signaling an ambition to capture niche opportunities. The USA stands out for its technology innovation leadership, and the UK and Japan continue to record consistent progress. Together, China and India anchor the global expansion story, while the rest build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

The multi-screen super glass market in China is projected to grow at a CAGR of 15.1% from 2025 to 2035. China’s leadership in consumer electronics, especially smartphones, tablets, and foldable devices, has created strong demand for high-durability glass capable of supporting multi-screen designs. Domestic brands like Huawei, Xiaomi, and Oppo are investing heavily in advanced displays and form factors that require thinner, flexible, and scratch-resistant glass. Beyond consumer electronics, the rapid expansion of electric vehicles and smart cockpits is fueling adoption of multi-screen dashboards, where advanced glass improves visual quality, safety, and touch responsiveness. Government-backed initiatives to strengthen domestic materials manufacturing encourage local sourcing, which is positioning Chinese glass makers to scale rapidly. Growing investments in AR/VR and immersive gaming devices also expand the use case of multi-screen super glass across new verticals. With both export potential and strong internal consumption, China will remain the global hub for multi-screen super glass innovation and volume growth.

The multi-screen super glass market in India is anticipated to expand at a CAGR of 14% from 2025 to 2035. India’s consumer electronics market is witnessing rapid growth due to rising disposable incomes and a strong push from local manufacturing under the “Make in India” initiative. Demand for smartphones, tablets, and laptops with advanced display technologies is boosting the adoption of multi-screen super glass, which offers higher strength and clarity compared to traditional alternatives. Automotive digitization, particularly in connected cars, is another key driver as OEMs integrate multiple infotainment and navigation screens that require durable and lightweight glass. India’s thriving IT services and digital-first consumer base create opportunities for laptops, gaming consoles, and productivity devices with advanced glass-based displays. Policy support for electronics manufacturing clusters and semiconductor fabs will improve local supply chain reliability, ensuring reduced dependence on imports. With strong consumption growth and industrial investment, India is set to become a fast-scaling market for multi-screen super glass.

The multi-screen super glass market in Germany is projected to register a CAGR of 12.9% from 2025 to 2035. As Europe’s automotive powerhouse, Germany plays a critical role in the integration of advanced glass for digital cockpits, head-up displays, and smart infotainment systems. Luxury carmakers such as BMW, Mercedes-Benz, and Audi are leading adopters of multi-screen layouts, requiring durable glass with anti-reflective, scratch-resistant, and shatter-proof features. In parallel, Germany’s industrial base in machinery and medical technology is also leveraging multi-screen displays, further boosting adoption of advanced glass. The growing demand for consumer electronics with premium design and durability, particularly in laptops and tablets, adds an additional growth layer. Research and innovation in specialty glass production, combined with Europe’s focus on supporting the use of recyclable and eco-friendly glass solutions. With its blend of industrial applications and automotive innovation, Germany’s market will see strong medium-term growth.

The multi-screen super glass market in Brazil is forecast to grow at a CAGR of 11.8% from 2025 to 2035. Brazil’s growing middle-class population and strong appetite for smartphones and tablets drive steady demand for durable, premium glass products. The expansion of Latin America’s automotive sector, with Brazil at its center, is fueling adoption of digital cockpit and infotainment systems that rely on multi-screen layouts. Local assembly plants operated by global OEMs are increasingly sourcing advanced materials to enhance vehicle safety and consumer appeal. In addition, Brazil’s entertainment and gaming market is driving adoption of AR/VR devices and large-screen displays, both of which rely on high-performance glass. While import reliance remains high, regional manufacturing incentives and digital transformation programs are expected to improve domestic production capacity over time. The combination of consumer electronics growth, automotive digitization, and entertainment device adoption positions Brazil as a rising market within Latin America.

The multi-screen super glass market in the USA is expected to grow at a CAGR of 10.6% between 2025 and 2035. The USA is a hub for consumer electronics innovation, with major tech companies driving demand for durable and foldable glass solutions in smartphones, laptops, and next-gen devices. Automotive digitization is another key driver, with American carmakers and EV manufacturers deploying multi-screen cockpits and advanced HUDs (head-up displays) that rely on scratch-resistant and high-transparency glass. The medical device and defense industries also adopt multi-screen displays requiring robust glass materials for durability and precision. Rising demand for AR/VR headsets, gaming consoles, and professional monitors strengthens the market outlook. USA-based research into advanced glass coatings production methods further enhances competitiveness. With a balance of consumer, industrial, and defense applications, the USA market offers steady growth, supported by high innovation and domestic R&D capabilities.

The multi-screen super glass market in the UK is projected to grow at a CAGR of 9.5% from 2025 to 2035. The UK’s consumer electronics sector is advancing steadily, with strong demand for premium smartphones, tablets, and laptops requiring advanced display glass. The automotive industry, though smaller in scale compared to Germany, is actively integrating multi-display cockpits and advanced navigation systems into premium and electric vehicle segments. Growth in AR/VR applications, particularly in gaming and training simulations, further boosts demand for multi-screen super glass. Healthcare and medical imaging equipment also rely on advanced glass solutions for precise, durable displays. The UK’s focus on innovation and technology, combined with partnerships between academia and industry, is fostering research in advanced glass coatings and smart displays. While import dependency is high, strong demand from consumer and industrial sectors supports resilient growth.

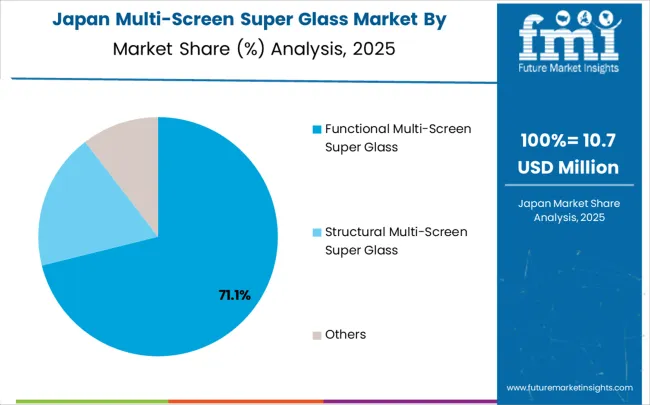

The multi-screen super glass market in Japan is forecast to grow at a CAGR of 8.4% from 2025 to 2035. Japan’s advanced electronics ecosystem is a key driver, with companies like Sony, Panasonic, and Sharp integrating multi-screen displays into next-gen consumer devices. The country’s automotive industry, led by Toyota, Honda, and Nissan, is rapidly digitizing vehicle dashboards with multi-display systems that demand high-strength and lightweight glass. In addition, Japan’s leadership in gaming and entertainment supports strong adoption of advanced display glass in consoles, monitors, and AR/VR devices. The healthcare technology sector also leverages super glass for medical imaging and diagnostic equipment, highlighting its cross-industry importance. Ongoing R&D in glass nanotechnology and coatings positions Japan as a global innovator, though growth is comparatively slower due to a saturated consumer market. Nonetheless, its focus on premium, high-quality applications ensures a stable and technologically advanced growth path.

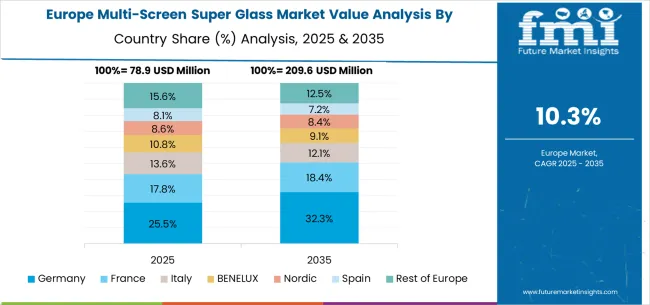

The European multi-screen super glass market reflects mature technology adoption with distinct regional specializations across major economies. Germany leads through automotive electronics integration and precision manufacturing expertise, while France contributes through aerospace applications and luxury automotive systems requiring sophisticated glass technologies. The United Kingdom emphasizes smart building applications and architectural glazing solutions with integrated display capabilities, while Italy focuses on design-oriented consumer electronics and automotive interior applications.

Market development occurs through cross-border automotive supply chains and electronics manufacturing operations that serve multinational device manufacturers. Regulatory standards for automotive safety and building efficiency create consistent quality requirements across the region, while research collaboration supports technology advancement in transparent electronics and smart glass applications. The regional market demonstrates stability through diversified industrial applications and technology expertise, with growth driven by automotive digitalization and smart building implementation rather than basic capacity expansion.

In Japan, the multi-screen super glass market is largely driven by the functional multi-screen super glass segment, which accounts for 78% of total market revenues in 2025. The superior integration capabilities enabling multiple display functions within single glass components and stringent optical quality protocols mandated in consumer electronics and automotive production are key contributing factors. Structural multi-screen super glass follows with an 18% share, primarily in architectural applications that integrate building automation systems with transparent display surfaces. Other specialized variants contribute only 4% as adoption in standard commercial applications remains limited due to cost considerations and technical complexity.

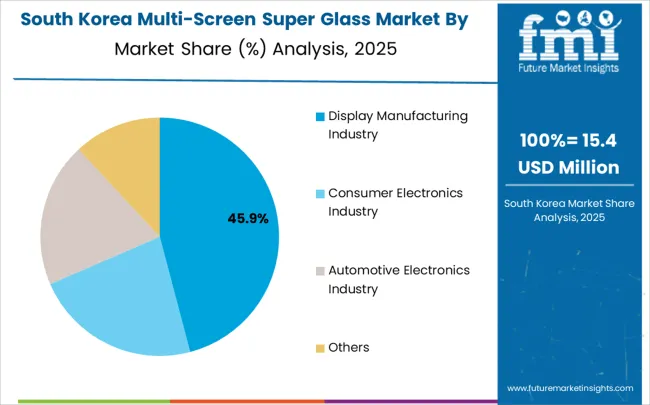

In South Korea, the market is expected to remain dominated by display manufacturing applications, which hold a 48% share in 2025. These applications typically represent the most demanding technical requirements where glass quality directly affects final product performance in smartphone displays, television systems, and computer monitors. Consumer electronics applications and automotive electronics applications each hold 26% market share, with increasing standardization in glass specifications across diverse electronic device categories. Other specialized applications account for the remaining share, but gradually gain traction in smart building and industrial automation development due to expanding requirements for interactive surfaces and transparent display technologies.

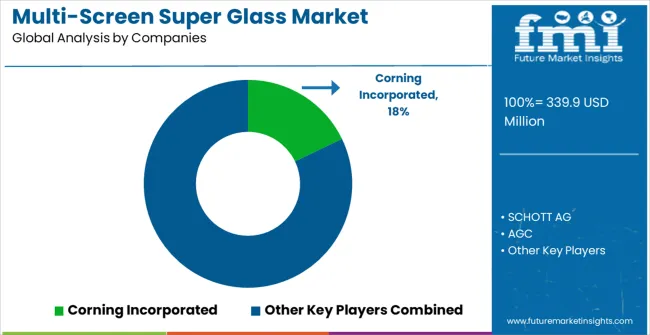

The multi-screen super glass market consists of approximately 12-15 meaningful players with moderate concentration where the top five companies control roughly 65% of global market share. Competition emphasizes technical innovation, manufacturing capability, and customer partnership development rather than commodity pricing strategies, reflecting the specialized nature of applications requiring advanced glass technologies and integrated electronic functionality.

Leaders include Corning Incorporated with a comprehensive glass technology portfolio and established customer relationships in consumer electronics and automotive markets, leveraging proprietary glass formulations and manufacturing scale advantages. SCHOTT AG provides innovative specialty glass solutions with a focus on optical performance and technical application support, while AGC offers reliable glass materials with a focus on automotive and architectural applications requiring durability and performance consistency.

Challengers encompass Nippon Electric Glass and Interpane Glass, companies with specialized technologies and regional market presence, while specialists include Abrisa Technologies and Saint-Gobain, serving niche applications with customized solutions and technical expertise. Emerging players like Liaoning Multi-Screen Technology and Foshan Xunuo Energy-Saving Doors and Windows focus on cost-effective alternatives and regional market development, particularly in Asian markets where manufacturing scale enables competitive pricing and local customer support.

| Item | Value |

|---|---|

| Quantitative Units | USD 340 million |

| Product Type | Functional Multi-Screen Super Glass, Structural Multi-Screen Super Glass, Others |

| Application | Display Manufacturing Industry, Consumer Electronics Industry, Automotive Electronics Industry, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | Corning Incorporated, SCHOTT AG, AGC, Nippon Electric Glass, Interpane Glass, Abrisa Technologies, Saint-Gobain, Liaoning Multi-Screen Technology, Foshan Xunuo Energy-Saving Doors and Windows |

| Additional Attributes | Dollar sales by glass thickness and optical specifications, regional demand trends across electronics and automotive manufacturing centers, competitive landscape with established glass manufacturers and emerging technology providers, adoption patterns for premium versus standard performance applications, integration with advanced display technologies and smart building systems, innovations in transparent electronics and flexible glass capabilities, and development of application-specific formulations with enhanced conductivity, durability, and optical clarity characteristics. |

The global multi-screen super glass market is estimated to be valued at USD 339.9 million in 2025.

The market size for the multi-screen super glass market is projected to reach USD 982.7 million by 2035.

The multi-screen super glass market is expected to grow at a 11.2% CAGR between 2025 and 2035.

The key product types in multi-screen super glass market are functional multi-screen super glass, structural multi-screen super glass and others.

In terms of application, display manufacturing industry segment to command 45.0% share in the multi-screen super glass market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Super Calendered Glassine Paper Market Size and Share Forecast Outlook 2025 to 2035

Superabrasive Electroplated Grinding Wheel Market Size and Share Forecast Outlook 2025 to 2035

Glass Rolling Forming Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Liquor Bottle Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottles Market Forecast and Outlook 2025 to 2035

Glass Laser Engraving Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Restoration Kit Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottle and Container Market Forecast and Outlook 2025 to 2035

Glass Additive Market Forecast and Outlook 2025 to 2035

Superconducting Detector Market Size and Share Forecast Outlook 2025 to 2035

Glass Reactor Market Size and Share Forecast Outlook 2025 to 2035

Glass Cosmetic Bottle Market Size and Share Forecast Outlook 2025 to 2035

Super Absorbent Polymer Market Size and Share Forecast Outlook 2025 to 2035

Glass & Metal Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Glass Product Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Market Size and Share Forecast Outlook 2025 to 2035

Glass Container Market Size and Share Forecast Outlook 2025 to 2035

Superalloys Market Size and Share Forecast Outlook 2025 to 2035

Super Antioxidant Supplement Market Size and Share Forecast Outlook 2025 to 2035

Glass Fibre Yarn Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA