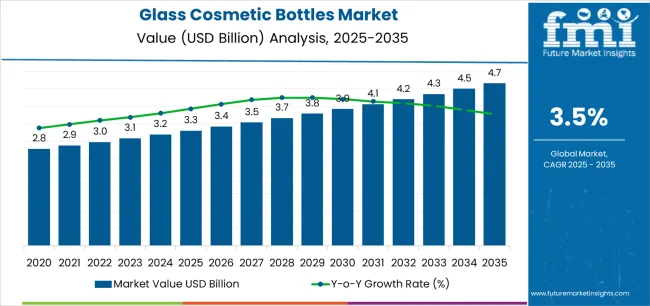

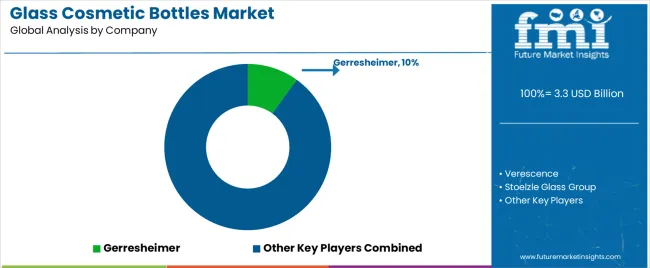

The global Glass Cosmetic Bottle Market is projected to expand from USD 3.3 billion in 2025 to approximately USD 4.7 billion by 2035, recording an absolute increase of USD 1.4 billion over the forecast period. This translates into total growth of 42.4%, with the market forecast to expand at a CAGR of 3.5% between 2025 and 2035.

The market size is expected to grow by more than 1.4X during the decade, supported by surging demand for premium, sustainable, and recyclable cosmetic packaging formats. Market growth will be driven by increased demand for skincare, perfume, and makeup packaging, as well as the premiumization trend impacting luxury glass containers.

Between 2025 and 2030, the Glass Cosmetic Bottle Market is projected to evolve from USD 3.3 billion to approximately USD 4.1 billion, resulting in a value increase of USD 0.8 billion, which represents over 57% of the total forecasted growth for the decade.

This period of development will be shaped by premiumization in skincare and fragrance packaging, rapid growth in Asia Pacific led by China and India, and increasing investments in advanced manufacturing for sustainable and visually appealing glass bottles. Manufacturers are enhancing their product offerings by focusing on design innovation, specialty dispenser formats such as droppers, and low-carbon footprint glass production technologies.

From 2030 to 2035, the market is projected to rise from approximately USD 4,113 million to USD 4,671.9 million, adding around USD 558.9 million, which will account for about 42% of the overall ten-year expansion. This period is likely to be characterized by intensified investment in lightweight, luxury-quality glass technology, regulatory-driven sustainability initiatives, and booming demand for premium, recyclable cosmetic packaging formats.

Brands will further differentiate through eco-friendly glass containers, focusing on design, finish, and customized dispenser formats to address the needs of luxury skincare, perfume, and specialty makeup applications.

Between 2020 and 2025, the Glass Cosmetic Bottle Market experienced steady expansion, fueled by consumer and regulatory shifts toward environmentally friendly packaging and increased demand for premium cosmetic containers. Glass emerged as the preferred packaging material, offering chemical inertness, protection from oxygen and moisture, and an upscale aesthetic.

Manufacturers invested heavily in advanced production processes, surface treatments, and glass light-weighting technologies, enabling faster adoption across leading skincare and fragrance brands. Research and development over this period emphasized recyclable materials, design innovation, and finish quality to capture the evolving preferences of global beauty consumers.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 3,312 million |

| Forecast Value in (2035F) | USD 4,671.9 million |

| Forecast CAGR (2025 to 2035) | 3.5% |

Market expansion is supported by rising demand for premium, sustainable cosmetic packaging, preferences for recyclable and eco-friendly solutions, and the increasing global presence of skincare, perfume, and luxury makeup brands.

Modern beauty and personal care brands now prioritize high-quality glass packaging that enhances product safety, shelf life, and consumer experience, while meeting stringent sustainability goals and regulatory standards. The proven superior protection and inertness of glass cosmetic bottles for sensitive products like serums and moisturizers drive adoption, especially as consumers and regulators push for cleaner alternatives to plastic.

Growing emphasis on "clean beauty," luxury experiences, and market premiumization is driving demand for visually appealing, customizable glass packaging formats that strengthen brand identity and customer loyalty. Manufacturers are innovating with lightweight glass technologies, improved surface finishes, and creative designs to address both aesthetic and functional needs. This dynamic is supported by the global trend toward sustainable living, regulatory restrictions on plastic, and expanding online retail channels for premium beauty products.

The Glass Cosmetic Bottle Market represents a premium growth opportunity, expanding from USD 3,312 million in 2025 to USD 4,671.9 million by 2035 at a 3.5% CAGR.

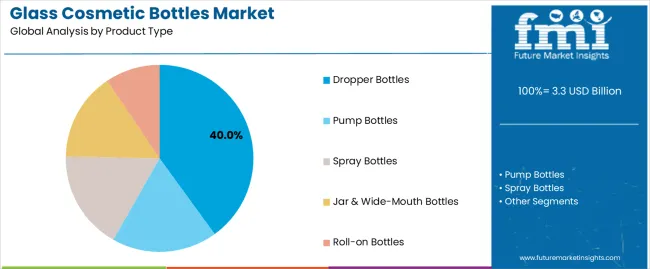

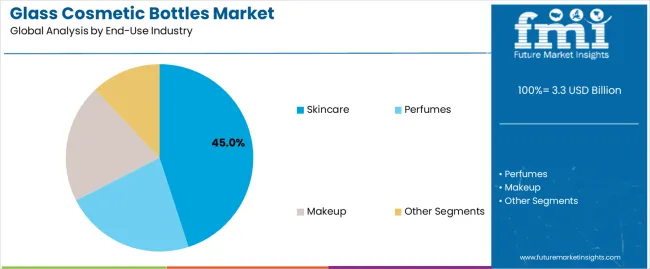

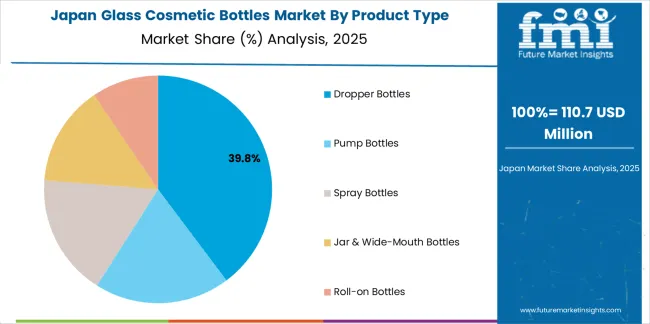

The market is segmented by product type, end-use industry, and region. By product type, the market is divided into Dropper Bottles, Pump Bottles, Spray Bottles, Jar & Wide-Mouth Bottles, and Roll-on Bottles. Based on end-use industry, the market includes Skincare, Perfumes, Makeup, and Other Segments. Regionally, the market is categorized into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

The dropper bottles segment is projected to account for 40% of the Glass Cosmetic Bottle Market in 2025, maintaining its dominance as the leading product type. Beauty and personal care brands increasingly utilize dropper bottles for high-value serums, oils, and skincare concentrates that demand precision dispensing and superior protection against contamination. This segment combines functional precision with a premium feel—critical for premium skincare formulations, serums, and specialty oils.

Dropper bottles have become an industry standard for products positioned as high-performance and luxury, providing both consumer convenience and a visually upscale presentation. As the preference for clean dispensing and product integrity rises, dropper bottles are set to remain the anchor of innovation and market premiumization in glass cosmetic packaging.

The skincare segment is projected to represent 45% of glass cosmetic bottle demand in 2025, highlighting its role as the core application area driving market expansion. Key drivers include the sustained surge in global skincare routines, demand for high-quality preservation of sensitive ingredients, and the strong association of glass with upscale product positioning and sustainability.

Glass bottles offer unmatched inertness and barrier properties, protecting active skincare ingredients making them a preferred choice for brands communicating commitment to product safety and luxury. The segment’s growth is reinforced by ongoing consumer preference shifts toward natural, preservative-free, and eco-friendly cosmetic solutions, with glass packaging supporting these value propositions and regulatory requirements.

The Glass Cosmetic Bottle Market is advancing due to increasing consumer demand for premium, sustainable, and recyclable packaging solutions, particularly within high-value skincare, perfume, and luxury beauty segments. Glass packaging is favored for its inertness, impermeability, and luxury look, which preserve product efficacy and appeal to eco-conscious consumers and brands alike.

The market faces notable challenges—glass is heavier and more fragile than plastic, elevating shipping costs and risks, and sometimes complicating e-commerce fulfillment or travel use. The transitioning manufacturing lines from plastic to glass involves investing in new molds, surface treatments, and coating technologies to balance luxury perception with functional durability.

The rise of advanced glass manufacturing facilities and the adoption of lightweight glass technologies have enabled the development of versatile, premium bottles for delicate skincare and high-end perfume products. Modern plants can produce thinner yet stronger glass, integrating decorative features, protective coatings, and seamless closures that meet evolving brand aesthetic and performance goals.

Sustainable manufacturing processes also prioritize recycled glass inputs and energy-efficient operations to reduce carbon footprints and comply with increasing regulatory demands. As a result, beauty manufacturers have access to next-generation bottles that combine luxury visuals, eco-friendly materials, and cost-efficient production for global distribution.

Key trends driving market expansion include “clean beauty” and luxury positioning, with brands increasingly opting for customizable, limited-edition glass packaging to reinforce exclusivity, authenticity, and customer loyalty. Regulatory and consumer preference shifts toward plastic waste reduction and circular packaging systems have led brands to adopt refillable bottles, digital-print glass decoration, and personalized branding at scale.

The integration of technology such as digital labeling, QR codes, and traceability further supports premiumization and consumer engagement while enabling greater manufacturing flexibility and rapid response to changing trends. Despite the cost and logistical restraints associated with glass, technological advancements and market premiumization are expected to enhance adoption and ensure sustained global growth through 2035.

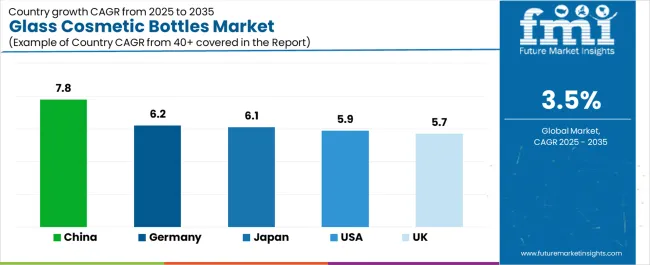

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.9% |

| Germany | 6.2% |

| UK | 5.7% |

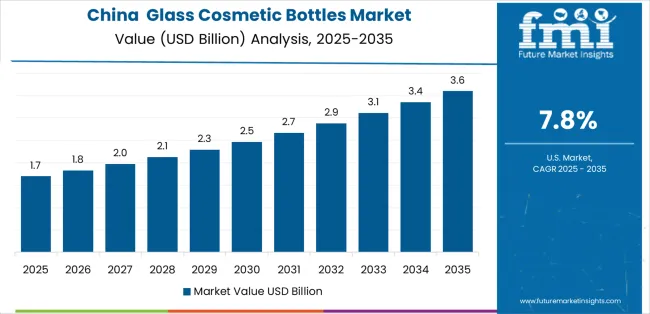

| China | 7.8% |

| Japan | 6.1% |

The glass cosmetic bottle market is experiencing robust growth globally, with China leading at a 7.8% CAGR through 2035, driven by the expanding prestige beauty industry, growing middle-class consumption, and increasing adoption of premium skincare formats. The USA follows at 5.9%, supported by rising clean beauty trends, expanding luxury personal care infrastructure, and growing acceptance of premium packaging solutions.

Germany shows growth at 6.2%, emphasizing established glass manufacturing capabilities and comprehensive packaging development. The UK records 5.7%, focusing on premium fragrance packaging and beauty innovation expansion. Japan demonstrates 6.1% growth, prioritizing quality cosmetic packaging solutions and technological advancement.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

Revenue from glass cosmetic bottle consumption and sales in the USA is projected to exhibit exceptional growth with a CAGR of 5.9% through 2035, driven by the country's rapidly expanding prestige beauty sector, favorable consumer attitudes toward premium packaging solutions, and initiatives promoting clean beauty formulation across major metropolitan regions.

The USA's position as a leading luxury cosmetics market and increasing focus on ingredient transparency are creating substantial demand for high-quality glass cosmetic bottles in both commercial and specialty markets. Major beauty brands and independent skincare companies are establishing comprehensive packaging capabilities to serve growing demand and emerging market opportunities.

Revenue from glass cosmetic bottle products in Germany is expanding at a CAGR of 6.2%, supported by rising cosmetic packaging sophistication, growing luxury beauty requirements, and expanding manufacturing infrastructure.

The country's developing glass production capabilities and increasing commercial investment in advanced packaging are driving demand for glass cosmetic bottles across both imported and domestically produced applications. International beauty packaging companies and domestic manufacturers are establishing comprehensive operational networks to address growing market demand for quality glass cosmetic bottles and efficient premium packaging solutions.

Revenue from glass cosmetic bottle products in the UK is projected to grow at a CAGR of 5.7% through 2035, supported by the country's mature prestige beauty market, established luxury retail culture, and leadership in cosmetic innovation standards. Britain's sophisticated distribution infrastructure and strong support for premium beauty formats are creating steady demand for both traditional and innovative glass cosmetic bottle varieties. Leading beauty retailers and specialty fragrance providers are establishing comprehensive operational strategies to serve both domestic markets and growing export opportunities.

Revenue from glass cosmetic bottle products in China is projected to grow at a CAGR of 7.8% through 2035, driven by the country's emphasis on beauty market expansion, manufacturing leadership, and sophisticated production capabilities for bottles requiring specialized glass varieties.

Chinese manufacturers and distributors consistently seek commercial-grade cosmetic packaging that enhances brand differentiation and supports beauty operations for both traditional and innovative product applications. The country's position as an Asian manufacturing leader continues to drive innovation in specialty glass cosmetic bottle applications and commercial production standards.

Revenue from glass cosmetic bottle products in Japan is projected to grow at a CAGR of 6.1% through 2035, supported by the country's emphasis on quality manufacturing, beauty innovation standards, and advanced technology integration requiring efficient packaging solutions.

Japanese businesses and beauty brands prioritize material performance and manufacturing precision, making glass cosmetic bottles essential packaging for both traditional and modern skincare applications. The country's comprehensive quality excellence and advancing cosmetic packaging patterns support continued market expansion.

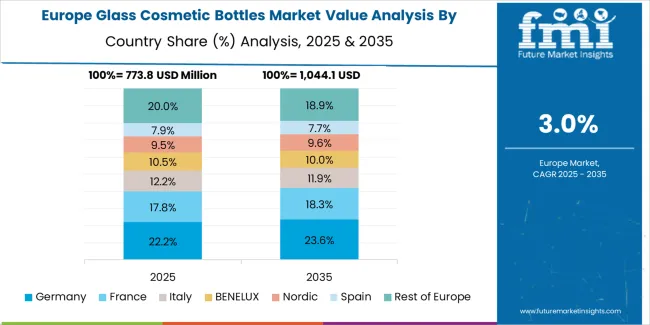

The Europe glass cosmetic bottle market is projected to grow from USD 1.3 billion in 2025 to USD 2.5 billion by 2035, recording a CAGR of 6.8% over the forecast period. Germany leads the region with a 32.0% share in 2025, moderating slightly to 31.5% by 2035, supported by its strong glass manufacturing base and demand for premium, technically advanced beauty packaging products.

France follows with 28.0% in 2025, maintaining 28.5% by 2035, driven by its sophisticated fragrance industry and emphasis on luxury cosmetic positioning standards. The United Kingdom accounts for 18.5% in 2025, easing to 18.0% by 2035, reflecting steady adoption of prestige skincare packaging solutions and brand differentiation optimization. Italy holds 12.0% in 2025, expanding to 12.5% by 2035 as luxury beauty innovation and specialty bottle applications grow. Spain contributes 5.0% in 2025, growing to 5.5% by 2035, supported by expanding cosmetic manufacturing sector and premium product handling.

The Nordic countries rise from 3.0% in 2025 to 3.2% by 2035 on the back of strong clean beauty adoption and advanced material technologies. BENELUX remains at 1.5% share across both 2025 and 2035, reflecting mature, efficiency-focused markets.

The market is defined by competition among established global glass packaging manufacturers, specialty cosmetic bottle producers, and companies focused on delivering premium, eco-friendly, and customizable packaging solutions to the beauty and personal care industry.

Industry leaders invest in advanced manufacturing technologies, sustainable materials, decorative finishes, and strategic partnerships, ensuring their product portfolios meet the evolving demands for luxury aesthetics and environmental sustainability. Key areas of focus include product customization, lightweight glass innovation, recycling, and regional manufacturing optimization, enabling these firms to distinguish themselves in a crowded luxury packaging segment.

Gerresheimer leads the market with a comprehensive portfolio of high-quality, customizable glass bottles for premium skincare, fragrance, and cosmetic brands, excelling in sustainable finishes and refillable packaging. Verescence specializes in eco-designed, recycled, and PCR (post-consumer recycled) glass packaging, serving luxury and high-end beauty clients with innovative green solutions and award-winning bottle designs.

Stoelzle Glass Group is recognized for its decorative capabilities, creating visually distinctive and durable bottles tailored for luxury cosmetic and fragrance brands through advanced finishing and embossing techniques.

Vidrala and Piramal Glass maintain strong regional influence through efficient supply chain networks, quality solutions for multinational and local brands, and investments in both standard and bespoke bottle manufacturing. Second-tier manufacturers, such as Saverglass and Bormioli Luigi, compete by offering niche, design-driven packaging and supporting emerging brands or regional markets.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 3.3 billion |

| Product Type | Dropper Bottles, Pump Bottles, Spray Bottles, Jar & Wide-Mouth Bottles, Roll-on Bottles |

| End-Use Industry | Skincare, Perfumes, Makeup, Other Segments |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, U.S., U.K., Japan, Brazil, France, Italy, South Korea |

| Key Companies Profiled | Gerresheimer, Verescence, Stoelzle Glass Group, Vidrala, Piramal Glass |

| Additional Attributes | Sales by product type and end-use industry, regional demand trends, competitive landscape, sustainability initiatives, customization capabilities, manufacturing innovations, decorative finishes, supply chain optimization |

The global Glass Cosmetic Bottle Market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the Glass Cosmetic Bottle Market is projected to reach USD 4.7 billion by 2035.

The Glass Cosmetic Bottle Market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in Glass Cosmetic Bottle Market are dropper bottles, pump bottles, spray bottles, jar & wide-mouth bottles and roll-on bottles.

In terms of end-use industry, skincare segment to command 45.0% share in the Glass Cosmetic Bottle Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industry Share & Competitive Positioning in Glass Cosmetic Bottles

Glass Additive Market Forecast and Outlook 2025 to 2035

Glass Reactor Market Size and Share Forecast Outlook 2025 to 2035

Glass & Metal Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Glass Product Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Market Size and Share Forecast Outlook 2025 to 2035

Glass Container Market Size and Share Forecast Outlook 2025 to 2035

Glass Fibre Yarn Market Size and Share Forecast Outlook 2025 to 2035

Glass Cloth Electrical Insulation Tape Market Size and Share Forecast Outlook 2025 to 2035

Glass Bonding Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Glass Mat Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Glass Table Bacteria Tank Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Glass Mat Market Size and Share Forecast Outlook 2025 to 2035

Glassware Market Size and Share Forecast Outlook 2025 to 2035

Glass Prepreg Market Size and Share Forecast Outlook 2025 to 2035

Glass Reinforced Plastic (GRP) Piping Market Size and Share Forecast Outlook 2025 to 2035

Glass Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA