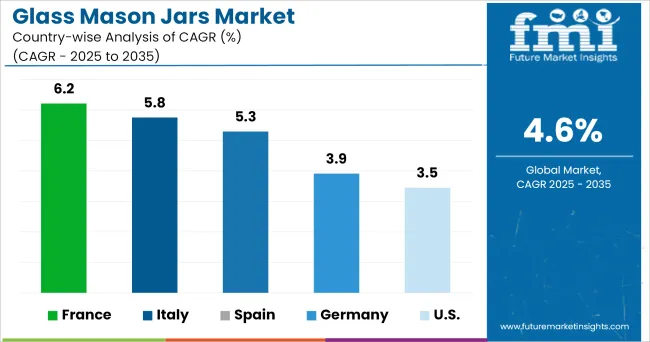

The Glass Mason Jars Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 1.8 billion |

| Market Size in 2035 | USD 2.8 billion |

| CAGR (2025 to 2035) | 4.6% |

The glass mason jars market is gaining momentum as sustainability, versatility, and consumer lifestyle trends converge to favor reusable and aesthetically appealing packaging solutions. Growing consumer interest in home canning, food preservation, and eco-conscious storage has positioned mason jars as both functional and decorative.

The resurgence of traditional culinary practices and the popularity of DIY culture have further fueled demand, particularly within premium and niche food segments. Advances in manufacturing techniques, improved material strength, and enhanced sealing mechanisms are enhancing product appeal and broadening application scope.

The future trajectory of the market is expected to benefit from increased adoption in the foodservice sector, rising awareness of the health and environmental benefits of glass over plastics, and the growing gifting and craft market that values the mason jar’s distinctive design and reusability. These dynamics are laying a strong foundation for continued growth and wider market penetration.

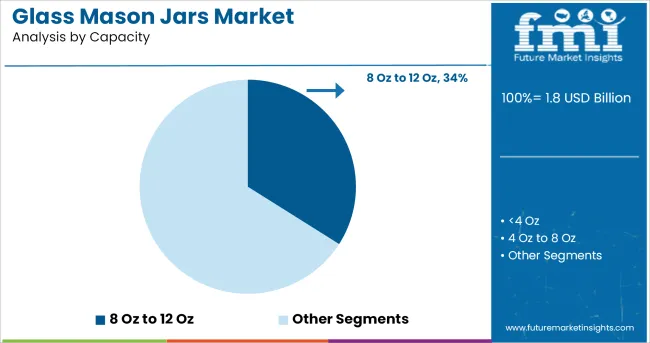

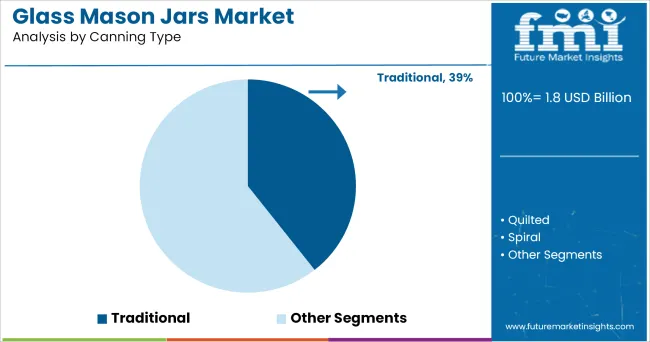

The market is segmented by Capacity, Canning Type, and Application and region. By Capacity, the market is divided into 8 Oz to 12 Oz, <4 Oz, 4 Oz to 8 Oz, and >12 Oz. In terms of Canning Type, the market is classified into Traditional, Quilted, Spiral, Aqua, and Amber.

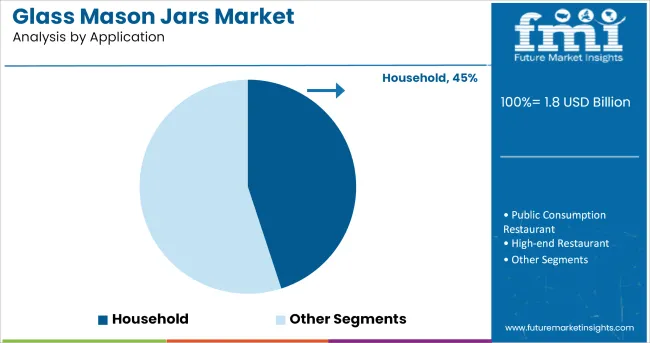

Based on Application, the market is segmented into Household, Public Consumption Restaurant, and High-end Restaurant. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by capacity, jars sized 8 oz to 12 oz are projected to hold 34.0% of total market revenue in 2025, emerging as the leading capacity segment. This leadership is attributed to their optimal balance between portability and practicality, which meets a wide range of consumer storage needs.

Their suitability for portion-controlled servings, single-serve beverages, and small-batch canning has aligned well with modern consumer lifestyles favoring convenience and reduced waste. The compact form factor enhances shelf appeal and ease of transport, contributing to their popularity in both household and commercial contexts.

Manufacturers have focused on refining this segment with improved lids, ergonomic designs, and decorative finishes, further reinforcing its preference among consumers. The ability of this size range to cater to both functional and decorative purposes has sustained its demand and secured its position as the most favored capacity category.

By canning type, the traditional segment is expected to capture 39.4% of the market revenue in 2025, retaining its dominance within the market. This prominence is being driven by the enduring consumer trust in time-tested preservation methods that emphasize safety, reliability, and authenticity.

Traditional canning jars have maintained favor due to their proven ability to securely seal and preserve food without reliance on modern additives or complex equipment. Their association with homemade quality and artisanal appeal has strengthened their relevance amidst the rising popularity of organic and locally-produced foods.

Product developments that improve seal integrity and ease of use while maintaining the familiar form have also supported the traditional segment’s leadership. Continued consumer appreciation for heritage-inspired designs and confidence in the performance of traditional canning jars have ensured their sustained preference over alternative types.

Segmented by application, the household sector is forecast to command 45.0% of the market revenue in 2025, establishing itself as the largest application segment. This dominance stems from the widespread use of mason jars in kitchens, pantries, and home-based activities such as meal prep, canning, and decorative storage.

The household segment benefits from strong emotional and cultural associations with homemade goods, self-reliance, and sustainable living practices. Consumers increasingly view glass jars as a healthier, environmentally friendly alternative to plastic containers, aligning with broader lifestyle trends toward minimalism and conscious consumption.

Their versatility, allowing use for food storage, beverages, crafts, and even home décor, has enhanced their utility and value perception in the household domain. Marketing efforts emphasizing nostalgia, sustainability, and multi-functionality have reinforced household adoption, cementing its position as the primary driver of market growth.

Glass mason jars are an unbeatable option as a packaging material supported by their superior attributes of sterility, reusability, chemical stability, durability, non-permeability, and malleability. They are also hygienic, eco-friendly, and aesthetically pleasing. Mason jars are mainly used in home canning and preserving food, packaging of food, and other consumer goods.

Home preserving is a growing and popular pastime for all ages as consumers look for healthier and more sustainable methods of feeding themselves and their families with freshly-grown and picked food. Home canning is one of the most efficient and sought-after ways to preserve food and prevent bacterial growth. Glass container jars are also available in colors other than transparent to prevent sunlight as per the specific need of few items.

Apart from food preservation and food packaging mason jars are used for decorative purposes also. Glass mason jars are gaining popularity in the alcoholic and non-alcoholic beverages section also.

North America held the majority of the revenue share of the global market in 2024. The presence of strong infrastructure, packaging industries, and large numbers of key players in the area are the contributing factors for growth in the region. Further, supply chain, logistics, and a large number of end-users for the glass mason jars are adding to the growth of the market in the forecasted period.

The alcohol industry in Europe is on large scale and the increasing popularity of mason jars in alcoholic beverages will lead to the growth of the market in the region. Also with the growing end, consumers and packaging industries, and food manufacturers in the region are going to propel the growth of glass mason jars in Europe in the forecasted period.

Some of the key players of Glass Mason Jars include

These companies followed certain strategies like partnership, manufacturing plant expansion, mergers, and acquisitions to gain a good position in the market. For instance, in June 2024, Jiangsu Rongtai Glass Products Co., Ltd. offered custom glass container manufacturing to help brand owners in making their products unique and attractive. Aside from manufacturing exclusive glass bottles.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments.

The report also maps the qualitative impact of various market factors on market segments and geographies.

The global glass mason jars market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the glass mason jars market is projected to reach USD 2.8 billion by 2035.

The glass mason jars market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in glass mason jars market are 8 oz to 12 oz, <4 oz, 4 oz to 8 oz and >12 oz.

In terms of canning type, traditional segment to command 39.4% share in the glass mason jars market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

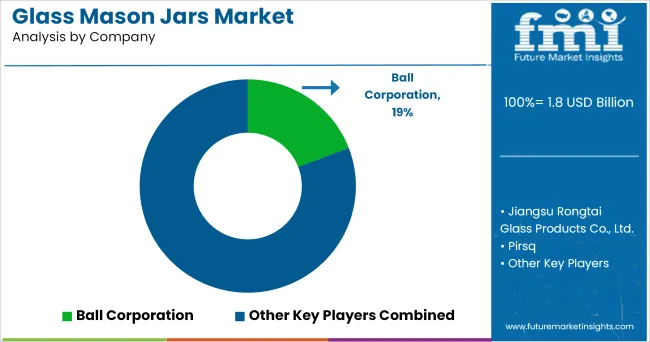

Market Share Distribution Among Glass Mason Jars Companies

Glass Liquor Bottle Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottles Market Forecast and Outlook 2025 to 2035

Glass Laser Engraving Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Restoration Kit Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottle and Container Market Forecast and Outlook 2025 to 2035

Glass Additive Market Forecast and Outlook 2025 to 2035

Glass Reactor Market Size and Share Forecast Outlook 2025 to 2035

Glass Cosmetic Bottle Market Size and Share Forecast Outlook 2025 to 2035

Glass & Metal Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Glass Product Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Market Size and Share Forecast Outlook 2025 to 2035

Glass Container Market Size and Share Forecast Outlook 2025 to 2035

Glass Fibre Yarn Market Size and Share Forecast Outlook 2025 to 2035

Glass Cloth Electrical Insulation Tape Market Size and Share Forecast Outlook 2025 to 2035

Glass Bonding Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Glass Mat Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Glass Table Bacteria Tank Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA