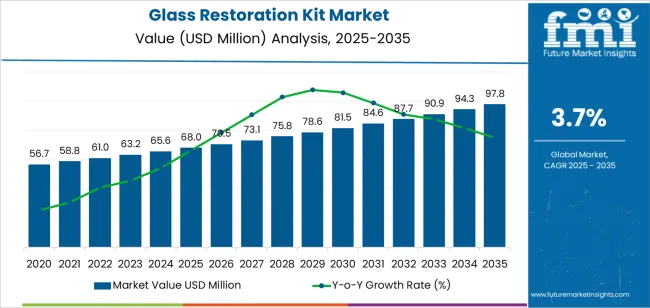

The glass restoration kit market stands at the threshold of a decade-long expansion trajectory that promises to reshape surface maintenance technology and aesthetic preservation innovation across global consumer and professional markets. The market's journey from USD 68 million in 2025 to USD 97.8 million by 2035 represents substantial growth, demonstrating the accelerating adoption of advanced glass repair technology and cost-effective restoration solutions across automotive maintenance facilities, residential property care sectors, commercial building management operations, and diversified glass surface applications. This remarkable expansion reflects the fundamental transformation occurring within surface restoration industries, where glass restoration kits have evolved from basic scratch removal compounds to sophisticated multi-component systems that enable professional-grade surface repair, optical clarity restoration, and preventive maintenance across multiple glass types and damage scenarios.

The first half of the decade (2025-2030) will witness the market climbing from USD 68 million to approximately USD 78.6 million, adding USD 10.6 million in value, which constitutes 36% of the total forecast growth period. This phase will be characterized by the rapid adoption of user-friendly restoration systems, driven by increasing glass replacement cost avoidance, the growing awareness of sustainable repair alternatives, and the worldwide emphasis on asset preservation that extends product lifecycles rather than premature replacement. Enhanced kit formulations with superior scratch removal effectiveness, optimized mineral deposit dissolution capabilities, and improved polishing performance will become standard expectations rather than premium options. Automotive detailing professionals will increasingly mandate glass restoration kits that deliver windshield clarity improvement while meeting safety standards and customer satisfaction requirements. Building maintenance contractors will accelerate adoption of commercial-grade restoration systems to optimize glass facade appearance, reduce tenant complaints, and defer costly glass panel replacement across office buildings, retail establishments, and hospitality properties.

The latter half (2030-2035) will witness accelerated growth from USD 78.6 million to USD 97.8 million, representing an addition of USD 19.2 million or 64% of the decade's expansion. This period will be defined by mass market penetration of professional-grade consumer products, integration with comprehensive surface care platforms, and seamless compatibility with automated application systems. Advanced formulations including nanotechnology-enhanced polishing compounds for superior optical clarity, ceramic-infused protective coatings for long-term damage resistance, and environmentally friendly water-based systems will dominate new product launches, while digital application guidance systems leveraging augmented reality for technique instruction and artificial intelligence for damage assessment will gain significant market traction driven by consumer empowerment trends and professional efficiency mandates. The market trajectory signals fundamental shifts in how consumers and professionals approach glass maintenance and repair, with participants positioned to benefit from growing demand across multiple kit types, application categories, and distribution channels. Emerging markets in Asia Pacific and Latin America will continue driving volume growth through automotive ownership expansion and building maintenance professionalization, while developed economies will focus on premium restoration systems and specialty glass applications, creating a balanced global growth dynamic that sustains market momentum throughout the forecast period with particular emphasis on ease of use, result quality, and environmental sustainability across diverse glass surfaces and restoration scenarios.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | Scratch removal kits (automotive windshields, residential windows) | 48% | Largest segment, consumer and professional use |

| Mineral stain removal kits (hard water deposits, etching) | 28% | Commercial buildings, shower doors | |

| Polishing kits (clarity restoration, surface finishing) | 18% | Professional detailing, maintenance contractors | |

| Other specialty kits (coating removal, deep restoration) | 6% | Specialized applications, restoration professionals | |

| Future (3-5 yrs) | Advanced scratch removal systems | 45-48% | Nanotechnology compounds, multi-stage processes |

| Commercial-grade restoration kits | 25-28% | Building maintenance, large-scale applications | |

| Premium polishing systems | 20-23% | Professional detailing, high-end applications | |

| Eco-friendly formulations | 5-8% | Water-based, biodegradable alternatives | |

| Application equipment & tools | 3-5% | Powered applicators, precision equipment | |

| Training & certification programs | 2-3% | Professional development, technique mastery |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 68 million |

| Market Forecast (2035) | USD 97.8 Million |

| Growth Rate | 3.7% CAGR |

| Leading Product Type | Scratch Removal Kit |

| Primary Application | Automotive |

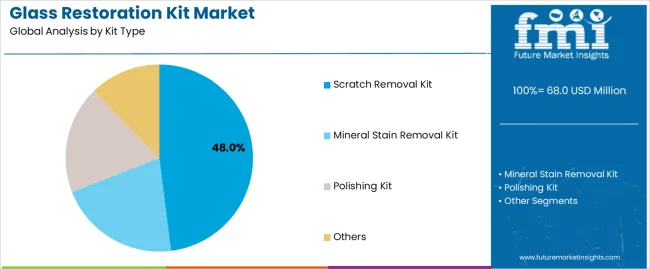

The market demonstrates solid fundamentals with scratch removal kits capturing dominant 48% market share through essential damage repair capabilities and widespread application utility. Automotive applications drive primary demand, supported by increasing vehicle ownership and windshield maintenance requirements. Geographic expansion remains concentrated in developed markets with established automotive aftermarket infrastructure, while emerging economies show accelerating adoption rates driven by vehicle population growth and professional detailing service expansion.

Primary Classification: The market segments by kit type into scratch removal kits, mineral stain removal kits, polishing kits, and other specialty kits, representing the evolution from basic surface repair to comprehensive glass restoration solutions for diverse damage scenarios.

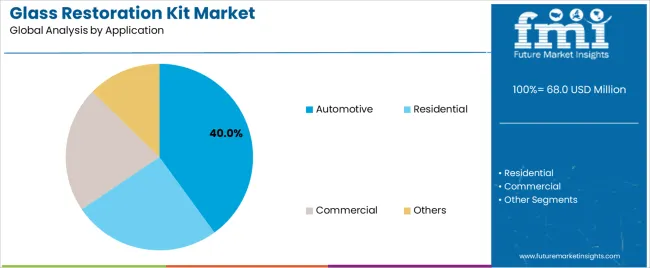

Secondary Classification: Application segmentation divides the market into automotive, residential, commercial, and other sectors, reflecting distinct requirements for glass types, damage patterns, and restoration outcome standards.

Tertiary Classification: End-user segmentation covers professional detailers, building maintenance contractors, automotive dealerships, and do-it-yourself consumers.

Regional Classification: Geographic distribution covers East Asia, South Asia Pacific, North America, Europe, Latin America, and Middle East & Africa, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by automotive ownership expansion and professional service development programs.

The segmentation structure reveals product progression from single-purpose scratch repair compounds toward sophisticated multi-component systems with comprehensive restoration and protection capabilities, while application diversity spans from individual consumer windshield repair to professional commercial building glass maintenance requiring specialized formulations.

Market Position: Scratch removal kits command the leading position in the glass restoration kit market with 48% market share through essential damage repair capabilities, including superior scratch elimination performance, optical clarity restoration, and cost-effective glass replacement avoidance that enable consumers and professionals to address common glass surface damage across diverse automotive and architectural applications.

Value Drivers: The segment benefits from widespread scratch damage occurrence providing consistent market demand, established product efficacy supporting consumer confidence, and significant cost savings versus glass replacement motivating purchase decisions. Advanced compound formulations enable effective removal of wiper blade scratches, minor vandalism damage, and environmental etching, where restoration effectiveness and ease of application represent critical consumer acceptance requirements.

Competitive Advantages: Scratch removal kits differentiate through proven damage elimination capabilities, accessible application techniques requiring minimal specialized equipment, and substantial value proposition delivering professional-quality results at fraction of replacement costs suitable for consumer and professional markets.

Key market characteristics:

Mineral stain removal kits maintain a 28% market position in the glass restoration kit market due to their specialized capabilities for hard water deposit elimination, mineral etching reversal, and surface contamination removal. These products appeal to building maintenance professionals requiring effective solutions for commercial glass facade cleaning, shower door restoration, and exterior window treatment in regions with hard water conditions and environmental contamination.

Polishing kits capture 18% market share through specialized requirements for final surface finishing, optical clarity optimization, and protective coating application. These systems demand technique expertise while providing professional-grade surface refinement for automotive detailing services, architectural glass maintenance, and restoration project completion requiring premium aesthetic results.

Other specialty kits account for 6% market share, including deep restoration systems for severe damage scenarios, coating removal products for surface preparation, and specialized formulations for specific glass types requiring tailored restoration approaches beyond standard scratch and stain removal applications.

Market Context: Automotive applications dominate the market with significant share, reflecting the primary demand driver for glass restoration kit utilization in windshield repair, side window restoration, and vehicle detailing services addressing scratch damage and visibility impairment.

Appeal Factors: Automotive applications appeal to vehicle owners prioritizing driving safety through windshield clarity optimization, cost avoidance versus expensive windshield replacement, and vehicle appearance maintenance for resale value preservation. The segment benefits from high windshield damage incidence and consumer awareness of restoration options as viable alternatives to replacement.

Growth Drivers: Expanding vehicle populations, increasing average vehicle age extending maintenance requirements, professional automotive detailing service growth, and windshield scratch damage from wiper blade wear, environmental debris, and improper cleaning techniques driving consistent product demand across consumer and professional markets.

Market Challenges: Application technique requirements and unrealistic consumer expectations regarding severe damage repair may limit satisfaction in cases exceeding product capability limitations.

Application dynamics include:

Residential applications capture market share through homeowner requirements for window scratch removal, shower door restoration, and glass furniture maintenance. These applications demand user-friendly products with straightforward application procedures for consumer confidence and successful restoration outcomes in home maintenance scenarios.

Commercial applications account for market share including building facade maintenance, retail storefront glass care, office building window restoration, and hospitality property glass maintenance requiring professional-grade products for large-scale applications and consistent aesthetic results across commercial property portfolios.

Other applications maintain market share through marine glass restoration, aviation window repair, specialty architectural glass maintenance, and industrial facility glass care requiring specialized formulations for unique glass types and operating environments beyond conventional automotive and building applications.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Glass replacement cost avoidance & economic value (windshield costs USD 200-600, restoration USD 20-80) | ★★★★★ | Significant cost differential drives restoration adoption; economic value proposition enables market penetration across price-sensitive consumers and cost-conscious professionals. |

| Driver | Environmental sustainability & waste reduction (glass recycling challenges, landfill impact) | ★★★★☆ | Sustainability awareness favors repair over replacement; restoration reduces waste disposal and manufacturing carbon footprint appealing to environmentally conscious consumers. |

| Driver | Professional detailing service growth & automotive care market expansion (car wash evolution, detailing demand) | ★★★★☆ | Professional automotive services market growing; detailing businesses adopt restoration capabilities for service expansion and revenue diversification opportunities. |

| Restraint | Application skill requirements & result variability (technique sensitivity, user experience dependency) | ★★★★☆ | Restoration effectiveness depends on proper application technique; inconsistent results from improper use create customer dissatisfaction and product reputation challenges. |

| Restraint | Damage severity limitations & unrealistic expectations (deep scratches, crack repair impossibility) | ★★★☆☆ | Products cannot repair all damage types; consumer misunderstanding of capability limitations leads to disappointment and negative reviews affecting market growth. |

| Trend | Nanotechnology formulations & advanced compounds (molecular-level polishing, superior clarity) | ★★★★★ | Conventional compounds reaching performance limits; nanotechnology enables superior scratch removal and optical clarity creating premium product differentiation. |

| Trend | Powered application tools & automated systems (cordless polishers, precision equipment) | ★★★★☆ | Manual application labor-intensive and inconsistent; powered tools reduce application time and improve result consistency creating professional efficiency and consumer accessibility. |

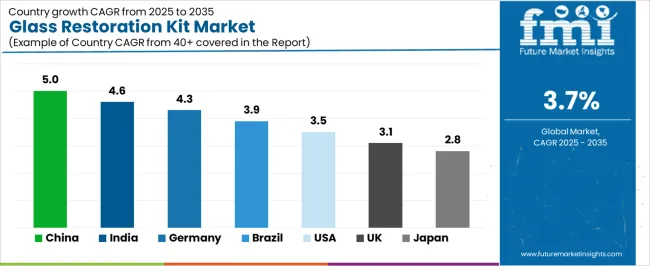

The glass restoration kit market demonstrates varied regional dynamics with Growth Leaders including China (5.0% growth rate) and India (4.6% growth rate) driving expansion through automotive ownership growth and professional service development. Steady Performers encompass Germany (4.3% growth rate), Brazil (3.9% growth rate), and developing regions, benefiting from established automotive markets and building maintenance industries. Established Markets feature United States (3.5% growth rate), United Kingdom (3.1% growth rate), and Japan (2.8% growth rate), where mature automotive aftermarket infrastructure and consumer awareness support consistent growth patterns.

Regional synthesis reveals East Asian markets leading adoption through rapid vehicle population expansion and professional detailing service growth, while South Asian countries maintain solid growth supported by automotive market development and increasing service professionalization. North American and European markets show moderate growth driven by sustainability trends and professional restoration service expansion.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 5.0% | Lead with professional-grade products and training programs | Quality perception challenges; counterfeit products |

| India | 4.6% | Focus on value pricing and automotive service channels | Price sensitivity; application expertise gaps |

| Germany | 4.3% | Offer premium formulations and automotive industry partnerships | High quality expectations; conservative adoption |

| Brazil | 3.9% | Provide accessible products and technique education | Economic volatility; distribution challenges |

| United States | 3.5% | Push DIY retail channels and professional certification | Market maturity; competitive intensity |

| United Kingdom | 3.1% | Emphasize sustainability benefits and professional services | Market saturation; regulatory considerations |

| Japan | 2.8% | Focus on quality and automotive detailing integration | Conservative market; perfection expectations |

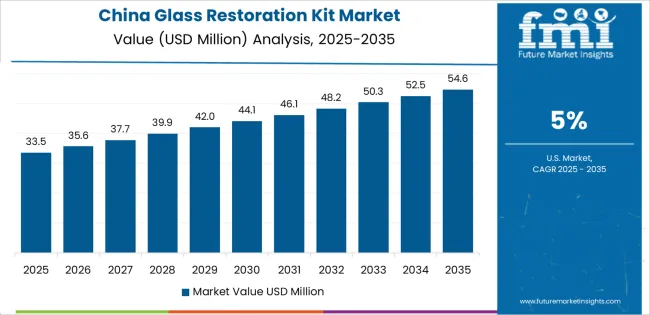

China establishes fastest market growth through explosive automotive ownership expansion and comprehensive professional detailing service development, integrating glass restoration kits as essential products in automotive maintenance facilities, professional car wash operations, and consumer retail channels. The country's 5.0% growth rate reflects rising vehicle populations and increasing automotive care sophistication that support adoption of professional maintenance products including glass restoration solutions. Growth concentrates in major urban centers, including Beijing, Shanghai, and Guangzhou, where automotive aftermarket development showcases professional detailing services that appeal to vehicle owners seeking appearance maintenance and cost-effective repair alternatives to expensive glass replacement.

Chinese automotive service providers and retail distributors are developing market access for glass restoration products that combine international quality standards with competitive pricing, including professional-grade systems for detailing businesses and consumer-friendly kits for retail distribution. Distribution channels through automotive aftermarket suppliers, e-commerce platforms, and professional service distributors expand market penetration, while growing middle-class vehicle ownership and increasing automotive care awareness support adoption across professional and consumer segments.

Market Intelligence Brief:

In Mumbai, Delhi, and Bangalore, automotive service providers and vehicle owners are adopting glass restoration kits as cost-effective maintenance solutions for windshield scratch repair and glass surface restoration applications, driven by increasing vehicle ownership and growing automotive service professionalization that emphasize the importance of appearance maintenance and cost-conscious repair alternatives. The market holds a 4.6% growth rate, supported by expanding automotive populations and professional detailing service emergence that promote advanced maintenance products for vehicle care. Indian consumers and service providers are adopting restoration technologies that provide acceptable results with competitive pricing, particularly appealing in price-sensitive markets where glass replacement costs represent significant vehicle maintenance expenses.

Market expansion benefits from growing automotive aftermarket sophistication and international product availability that enable adoption of proven restoration technologies for domestic market applications. Product adoption follows patterns established in automotive care markets, where value proposition and cost savings drive purchase decisions across professional service providers and individual vehicle owners seeking maintenance solutions.

Market Intelligence Brief:

Germany establishes automotive excellence leadership through comprehensive automotive care culture and advanced professional detailing infrastructure, integrating glass restoration kits across professional automotive services, dealership maintenance programs, and consumer automotive care routines. The country's 4.3% growth rate reflects established automotive industry sophistication and quality-conscious consumer preferences that support adoption of premium restoration products and professional application services. Growth concentrates in automotive service centers and professional detailing operations, where restoration capabilities showcase professional service quality that appeals to German vehicle owners seeking appearance preservation and technical expertise.

German automotive service providers leverage technical competence and quality management systems, including certified application procedures and comprehensive customer education that create competitive advantages in restoration service delivery. Distribution channels through automotive parts suppliers, professional detailing distributors, and specialty retail channels expand market access, while strong automotive care culture supports adoption across professional service operations and enthusiast consumer segments.

Market Intelligence Brief:

Brazil establishes regional leadership through expanding automotive ownership and developing professional automotive service infrastructure, integrating glass restoration kits across urban automotive markets and professional car care facilities. The country's 3.9% growth rate reflects growing vehicle populations and increasing automotive service sophistication that support adoption of maintenance products including glass restoration solutions. Growth concentrates in major metropolitan areas, including São Paulo, Rio de Janeiro, and Brasília, where automotive aftermarket development showcases professional detailing services that appeal to vehicle owners seeking appearance maintenance and cost-effective repair solutions.

Brazilian automotive service providers and distributors leverage growing professional service market and expanding consumer automotive care awareness, including retail distribution development and professional product availability that enable market penetration. Distribution channels through automotive parts retailers, car wash operations, and professional service suppliers expand market access, while economic value proposition and visible results support adoption across professional and consumer market segments.

Market Intelligence Brief:

United States establishes mature market presence through comprehensive automotive aftermarket infrastructure and extensive professional detailing service industry, integrating glass restoration kits across professional automotive services, retail consumer channels, and automotive maintenance facilities. The country's 3.5% growth rate reflects established product awareness and mature distribution infrastructure that supports widespread availability of restoration products across professional and consumer markets. Activity concentrates across automotive service markets nationwide, where restoration products showcase established market presence appealing to professional detailers, automotive enthusiasts, and cost-conscious vehicle owners seeking maintenance solutions.

American product suppliers and distributors leverage established retail distribution networks and professional service relationships, including automotive parts retailers, professional detailing suppliers, and e-commerce platforms that create comprehensive market coverage. Distribution channels through national automotive retailers, professional distributors, and online marketplaces expand product accessibility, while consumer awareness and professional service adoption support sustained demand across diverse market segments and application scenarios.

Market Intelligence Brief:

United Kingdom's automotive market demonstrates sophisticated glass restoration adoption with emphasis on professional detailing services and automotive care specialization across urban markets and service facilities. The country maintains a 3.1% growth rate, driven by established automotive care culture and professional service development. Automotive service centers and professional detailing operations showcase restoration capabilities integrated with comprehensive vehicle care services to optimize customer satisfaction and service revenue diversification.

UK automotive service providers and product distributors focus on professional-grade products and application technique development in restoration service delivery, creating demand for quality restoration systems with proven performance characteristics. Distribution channels through automotive trade suppliers, professional detailing distributors, and specialty retailers expand market access, while established automotive care market supports adoption across professional service facilities and enthusiast consumer segments.

Market Intelligence Brief:

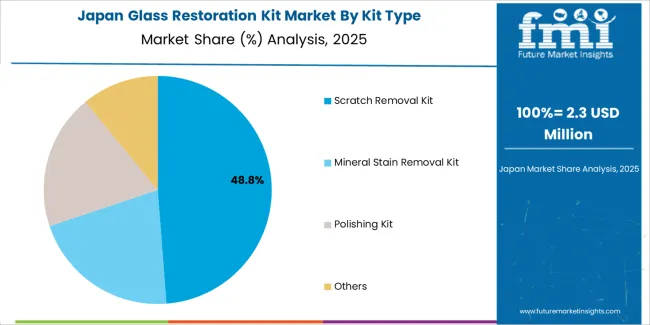

Japan's sophisticated automotive market demonstrates advanced glass restoration adoption with emphasis on quality standards and application precision in professional detailing services and automotive maintenance facilities. The country maintains a 2.8% growth rate, characterized by mature automotive care infrastructure and exacting quality expectations. Professional detailing centers and automotive service facilities showcase restoration applications where result quality and application technique represent primary service delivery considerations.

Japanese automotive service providers prioritize application excellence and result consistency in restoration service delivery, creating stable demand for premium products with proven performance characteristics and comprehensive application guidance. Distribution channels through automotive parts distributors, professional detailing suppliers, and specialty retail channels expand market reach, while automotive care culture supports adoption across professional service operations serving quality-conscious vehicle owners.

Market Intelligence Brief:

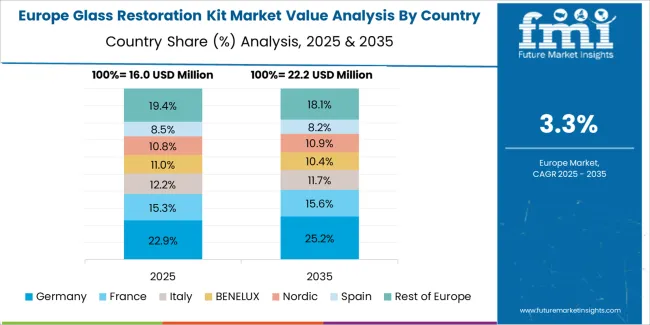

The European glass restoration kit market is projected to grow from USD 24.0 million in 2025 to USD 33.2 million by 2035, registering a CAGR of 3.7% over the forecast period. Germany is expected to maintain its leadership position with a 32.6% market share in 2025, supported by its advanced automotive culture and professional detailing infrastructure.

United Kingdom follows with a 24.8% share in 2025, driven by comprehensive automotive aftermarket services and professional detailing industry development. France holds a 17.9% share through automotive care market sophistication and professional service adoption. Italy commands a 13.4% share, while Spain accounts for 11.3% in 2025. The rest of Europe region is anticipated to gain momentum, expanding its collective share from 8.7% to 9.5% by 2035, attributed to increasing glass restoration adoption in Nordic countries and emerging Eastern European automotive markets implementing professional service development programs.

Japan establishes precision application excellence through comprehensive automotive care standards and advanced professional detailing expertise, supporting automotive service markets with glass restoration products emphasizing quality and result consistency. The country's 2.8% growth rate reflects established automotive care culture and sophisticated service delivery standards that support consistent demand for premium restoration products in professional service applications. Activity concentrates in major urban automotive service centers and professional detailing facilities, where restoration capabilities showcase application technique mastery that appeals to quality-conscious Japanese vehicle owners seeking professional service excellence.

Japanese product distributors and automotive service providers leverage decades of automotive care expertise and comprehensive quality assurance approaches, including certified application procedures and rigorous result verification that create service quality foundations. Distribution channels through automotive parts trading networks, professional detailing suppliers, and specialty automotive retailers expand market reach, while quality culture supports sustained adoption across professional service facilities serving discerning vehicle owner populations.

Market Intelligence Brief:

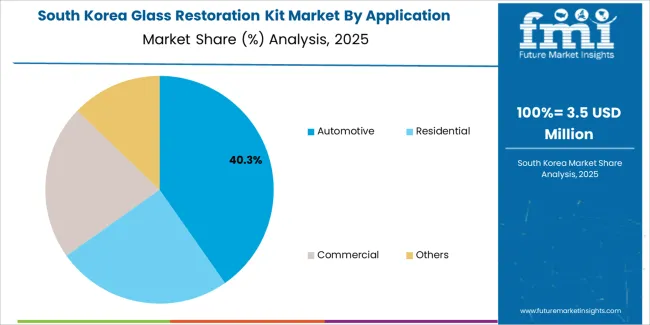

South Korea establishes automotive care market growth through comprehensive vehicle ownership expansion and professional automotive service development, incorporating glass restoration kits across urban automotive markets and professional detailing operations with emphasis on appearance maintenance and service quality. The country demonstrates solid growth through expanding automotive populations and increasing service professionalization that supports adoption of advanced maintenance products. Activity concentrates in major metropolitan automotive service areas, including Seoul region, Busan, and urban centers, where professional detailing facilities showcase restoration capabilities that appeal to vehicle owners seeking appearance preservation and professional service quality.

Korean automotive service providers leverage growing professional service infrastructure and comprehensive automotive care awareness, including modern facility development and service quality emphasis that enable advanced product adoption. Distribution channels through automotive parts distributors, professional service suppliers, and consumer retail channels expand market access, while growing automotive care culture and quality expectations drive adoption across professional service operations and consumer maintenance product markets.

Market Intelligence Brief:

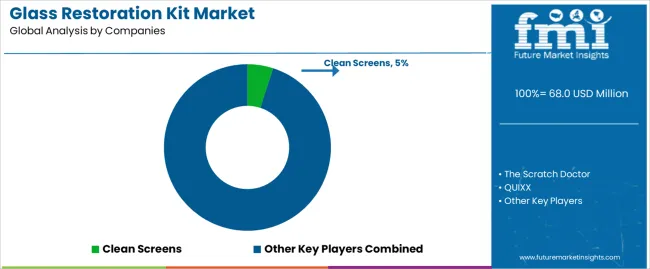

The glass restoration kit market exhibits a fragmented competitive structure with approximately 15-25 credible players, where the top 5-7 manufacturers hold roughly 40-45% combined market share by revenue. Market leadership is maintained through product efficacy, brand reputation, distribution network strength, and professional endorsements that enable market positioning across diverse consumer and professional segments. Clean Screens leads with 5% market share.

Structure: Specialized glass restoration companies dominate through focused product development and professional market relationships, while automotive care product companies compete on brand recognition and retail distribution strength. The competitive landscape divides between professional-grade system manufacturers targeting detailing services and commercial contractors, and consumer-oriented brands focusing on retail distribution and do-it-yourself accessibility.

Leadership is maintained through: Product performance and result consistency, professional endorsements and training programs, comprehensive distribution networks, and customer education content (instructional videos, application guides). Leading manufacturers leverage chemical formulation expertise and application technique development for competitive advantages.

What's commoditizing: Basic scratch removal compounds using conventional abrasive formulations, standard polishing pads and application tools, and entry-level consumer kits face increasing price competition as formulation knowledge spreads and manufacturing barriers decrease in basic product segments.

Margin Opportunities: Premium nanotechnology-enhanced formulations for superior results, professional certification and training programs, powered application equipment and precision tools, comprehensive multi-stage restoration systems, and specialty formulations for specific damage types command higher pricing. Value-added content including detailed video instruction, technical support services, and satisfaction guarantees create differentiation beyond basic product supply. Strategic partnerships with professional detailing associations, automotive dealership networks, and building maintenance organizations secure distribution access and professional endorsements.

Competitive Dynamics: Established specialty manufacturers compete on product performance track records and professional market relationships, maintaining advantages through proven formulation effectiveness and comprehensive professional support programs. Consumer brands differentiate through retail distribution presence, marketing investment, and accessible packaging targeting do-it-yourself users. Market fragmentation creates opportunities for niche players serving specific applications or damage types. Strategic partnerships between product manufacturers and professional service providers drive market development, creating integrated service offerings that reduce competitive intensity through preferred product relationships and training program integration securing professional loyalty and customer referrals.

| Item | Value |

|---|---|

| Quantitative Units | USD 68 million |

| Kit Type | Scratch Removal Kit, Mineral Stain Removal Kit, Polishing Kit, Others |

| Application | Automotive, Residential, Commercial, Others |

| End User | Professional Detailers, Building Maintenance Contractors, Automotive Dealerships, Do-It-Yourself Consumers |

| Regions Covered | East Asia, South Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, United States, Germany, United Kingdom, Japan, South Korea, Brazil, France, Italy, and 20+ additional countries |

| Key Companies Profiled | Clean Screens, The Scratch Doctor, QUIXX, Glass Restore, CARPRO, Mirka, GLASS POLISH |

| Additional Attributes | Dollar sales by kit type and application categories, regional adoption trends across East Asia, South Asia Pacific, and North America, competitive landscape with specialized restoration product manufacturers and automotive care companies, consumer preferences for ease of use and result quality, integration with professional service offerings and retail distribution channels, innovations in formulation technology and application systems, and development of comprehensive restoration solutions with enhanced effectiveness and user accessibility capabilities. |

The global glass restoration kit market is estimated to be valued at USD 68.0 million in 2025.

The market size for the glass restoration kit market is projected to reach USD 97.8 million by 2035.

The glass restoration kit market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in glass restoration kit market are scratch removal kit, mineral stain removal kit, polishing kit and others.

In terms of application, automotive segment to command 40.0% share in the glass restoration kit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Glass Laser Engraving Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottle and Container Market Forecast and Outlook 2025 to 2035

Glass Additive Market Forecast and Outlook 2025 to 2035

Glass Reactor Market Size and Share Forecast Outlook 2025 to 2035

Glass Cosmetic Bottle Market Size and Share Forecast Outlook 2025 to 2035

Glass & Metal Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Glass Product Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Market Size and Share Forecast Outlook 2025 to 2035

Glass Container Market Size and Share Forecast Outlook 2025 to 2035

Glass Fibre Yarn Market Size and Share Forecast Outlook 2025 to 2035

Glass Cloth Electrical Insulation Tape Market Size and Share Forecast Outlook 2025 to 2035

Glass Bonding Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Glass Mat Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Glass Table Bacteria Tank Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Glass Mat Market Size and Share Forecast Outlook 2025 to 2035

Glassware Market Size and Share Forecast Outlook 2025 to 2035

Glass Prepreg Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA