The glass mat market, valued at USD 1.4 billion in 2025 and expected to reach USD 2.2 billion by 2035 at a CAGR of 4.8%, reflects a gradual but steady adoption curve. From 2020 to 2024, the early adoption phase moved the market from USD 1.1 billion in 2020 to USD 1.3 billion in 2024, showing incremental demand as industries integrated glass mats into structural and insulation applications. The scaling phase from 2025 to 2030 indicates stronger traction, with values climbing from USD 1.4 billion in 2025 to USD 1.7 billion by 2030, highlighting wider acceptance and consistent expansion.

Between 2030 and 2035, the consolidation stage defines the market’s maturity, with growth rates stabilizing. The market rises from USD 1.7 billion in 2030 to USD 2.2 billion in 2035, signaling a transition from expansion-driven adoption to maintenance and optimization.

The shift reflects a balanced demand where large-scale infrastructure, automotive, and construction applications continue to support revenues, but the pace of new adoption slows. This lifecycle shows how the glass mat market progresses from cautious entry to scalable integration and finally to maturity, ensuring stable and reliable contributions within the broader composite materials sector.

| Metric | Value |

|---|---|

| Glass Mat Market Estimated Value in (2025 E) | USD 1.4 billion |

| Glass Mat Market Forecast Value in (2035 F) | USD 2.2 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The glass mat market, valued at USD 1.4 billion in 2025 and projected to reach USD 2.2 billion by 2035 at a CAGR of 4.8%, is a specialized segment of the global composites market, which is expected to exceed USD 150 billion in 2025. Within the parent industry, glass fiber composites represent about 35% of total value, while carbon fiber composites account for nearly 20%, natural fiber composites about 10%, and other advanced composites make up the balance.

Glass mats specifically contribute around 5% of the glass fiber composites category, translating to about 2% of the total composites market in 2025. By 2035, the composites industry is forecast to surpass USD 250 billion, with glass fiber maintaining its dominant share at around 33%. Within this, glass mats are expected to retain their 2% share of the parent market, reflecting steady demand from construction, automotive, marine, and wind energy applications.

Frames and reinforcements dominate glass fiber applications at 40%, rovings at 25%, chopped strands at 15%, and mats, including continuous and chopped formats, at 10%. The relatively modest share of glass mats highlights their specialized role, but their consistency ensures they remain a reliable revenue contributor in the composites sector.

The glass mat market is experiencing steady growth driven by the expanding use of composite materials across construction, infrastructure, automotive, and industrial applications. Rising demand for lightweight, durable, and corrosion resistant reinforcement materials is fueling adoption, particularly in regions with ongoing infrastructure development and urban expansion.

Technological advancements in mat production have improved resin compatibility, structural performance, and surface finish, making glass mats suitable for a wide range of end uses. Increasing awareness about sustainable building materials and compliance with stringent performance standards is further accelerating uptake.

The future outlook remains positive as industries continue to seek cost effective reinforcement solutions that combine high mechanical strength with ease of processing, thereby positioning glass mats as a key material in the composites sector.

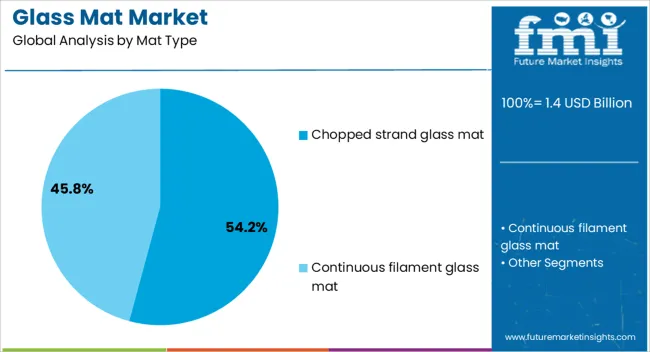

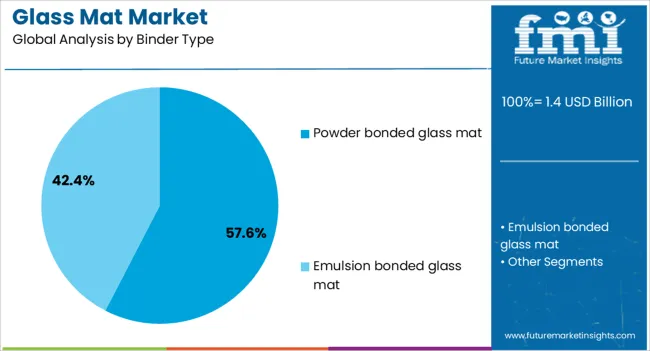

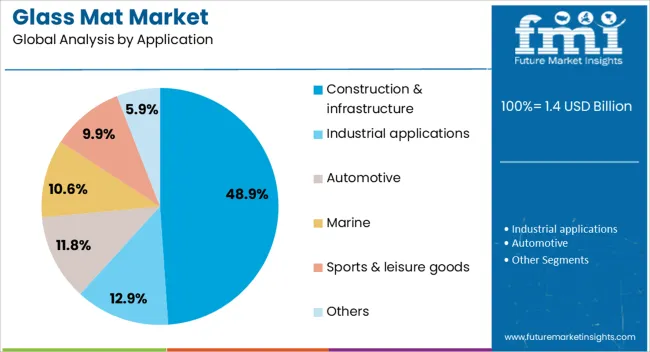

The glass mat market is segmented by mat type, binder type, application, and geographic regions. By mat type, the glass mat market is divided into Chopped strand glass mat and Continuous filament glass mat. In terms of binder type, the glass mat market is classified into powder-bonded glass mat and emulsion-bonded glass mat. Based on application, glass mat market is segmented into Construction & infrastructure, Industrial applications, Automotive, Marine, Sports & leisure goods, and Others.

Regionally, the glass mat industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The chopped strand glass mat segment is projected to hold 54.20% of total market revenue by 2025, making it the leading mat type. This dominance is attributed to its excellent conformability, high tensile strength, and versatility in both hand lay-up and closed mold processes.

Its ability to deliver uniform mechanical properties in various composite applications has enhanced its preference across automotive parts, marine structures, and construction panels.

Additionally, its cost effectiveness and compatibility with multiple resin systems contribute to its widespread adoption in high volume manufacturing.

The powder bonded glass mat segment is expected to account for 57.60% of the total market by 2025 within the binder type category, positioning it as the leading choice. Its popularity stems from superior resin penetration, improved handling characteristics, and enhanced surface finish in finished products.

The reduced emissions during processing and the ability to produce composites with higher strength-to-weight ratios have further supported its growth.

These advantages have reinforced its use in sectors where performance consistency and aesthetic quality are critical.

The construction and infrastructure segment is anticipated to capture 48.90% of market revenue by 2025, making it the largest application area. This growth is driven by increasing demand for durable, weather-resistant, and lightweight reinforcement materials in building facades, roofing, and bridges.

Glass mats are being adopted for their ability to improve structural performance while reducing maintenance costs over the lifecycle of the infrastructure.

Ongoing urbanization and government investments in public works are further bolstering the segment’s dominance in the market.

The glass mat market is expanding as industries demand lightweight, durable, and cost-effective reinforcement materials for composites, roofing, flooring, and automotive components. North America and Europe lead with high-performance glass mats for construction and transportation sectors, emphasizing strength and sustainability. Asia-Pacific shows rapid growth due to infrastructure projects, wind energy, and automotive manufacturing. Producers differentiate through advanced binder systems, surface treatments, and customized mat structures. Regional differences in industrial investment, material standards, and application requirements shape global adoption and competitiveness.

Adoption of glass mats is driven by their versatility across industries such as construction, automotive, marine, and wind energy. North America and Europe prioritize high-strength mats in roofing systems, flooring, and automotive composites to reduce weight while enhancing performance. Asia-Pacific markets emphasize cost-efficient mats for large-scale construction and wind turbine blade production. Differences in application diversity influence material selection, procurement strategies, and product demand. Leading suppliers provide tailored mat solutions for high-value sectors, while regional producers deliver practical, affordable alternatives. End-use diversity and industrial contrasts define adoption, growth pace, and competitiveness in the global glass mat market.

Performance characteristics such as tensile strength, dimensional stability, and resin compatibility play a central role in glass mat adoption. North America and Europe focus on advanced chopped strand and continuous strand mats optimized for mechanical reinforcement in composites and roofing. Asia-Pacific markets favor robust, versatile mats designed for construction and cost-sensitive applications. Differences in performance standards impact durability, product quality, and end-user confidence. Suppliers investing in innovative binders, resin compatibility testing, and improved fiber dispersion gain premium adoption, while regional players emphasize functional performance at lower costs. Performance contrasts shape market adoption, application suitability, and competitiveness globally.

Regulations related to fire resistance, environmental safety, and building codes strongly influence glass mat adoption. North America and Europe enforce strict material standards requiring certified performance in roofing, flooring, and insulation systems. Asia-Pacific markets vary, with advanced economies adopting international norms while emerging countries implement local standards for affordability and scalability. Differences in compliance rigor affect procurement approvals, building safety assurance, and long-term adoption. Suppliers offering certified, regulation-compliant glass mats gain market credibility, while regional manufacturers prioritize cost-effective compliance with domestic requirements. Regulatory contrasts shape adoption, building practices, and competitive positioning across the global glass mat market.

The economics of glass mat production depend on raw material availability, supply chain stability, and cost competitiveness. North America and Europe emphasize integrated supply models ensuring consistent fiber quality and logistics reliability. Asia-Pacific markets focus on cost-competitive sourcing and large-scale manufacturing to support rapid construction and industrialization. Differences in supply chain resilience and cost dynamics influence market penetration, procurement preferences, and pricing strategies. Leading suppliers invest in localized manufacturing and fiber innovations to reduce costs, while regional players compete on affordability and volume. Supply chain contrasts shape adoption, pricing competitiveness, and overall growth in the global glass mat market.

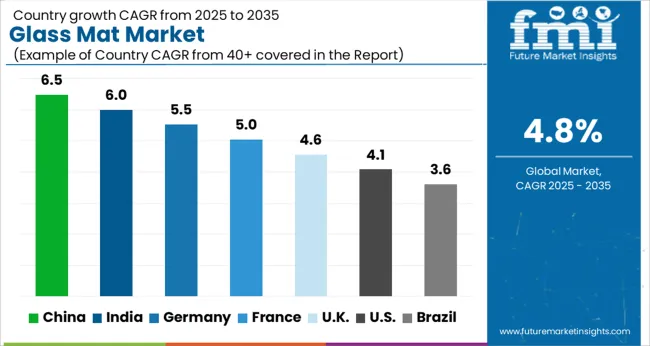

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

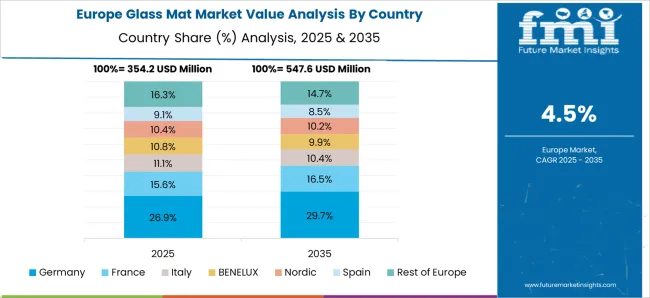

The global glass mat market is projected to expand at a 4.8% CAGR through 2035, supported by applications across construction, automotive, and industrial sectors. Within BRICS nations, China registered 6.5% growth as large-scale facilities for composite material production were operated and export volumes were strengthened, while India at 6.0% growth reflected expanded manufacturing aligned with demand from building and transportation projects. In the OECD region, Germany at 5.5% remained a key hub where production processes were standardized under stringent material regulations, and the United Kingdom at 4.6% contributed steadily through mid-scale output for insulation and industrial uses. The USA, with growth of 4.1%, continued as a mature market where consistent demand for reinforced composites was sustained in infrastructure and manufacturing applications. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The glass mat market in China is being driven at a CAGR of 6.5% as demand for reinforcement materials in construction, automotive, and industrial applications increases. Glass mats made from fiberglass are being adopted to provide strength, durability, and resistance to heat and corrosion. Manufacturers are being encouraged to supply lightweight, high-performance, and cost-effective solutions. Distribution through industrial suppliers, construction contractors, and authorized dealers is being maintained. Research and development in advanced glass fiber production, resin compatibility, and performance optimization is being conducted. Rising infrastructure projects, expanding automotive production, and growing demand for composite materials are being considered key drivers of growth in China.

Glass mat market in india is being expanded at a CAGR of 6.0% with growing use of glass mats in construction, automotive, and wind energy industries. Glass mats are being adopted to improve strength, durability, and fire resistance in composites and building materials. Manufacturers are being focused on delivering reliable, durable, and cost-efficient products. Distribution through authorized suppliers, construction dealers, and industrial partners is being ensured. Training sessions and awareness programs for proper application are being conducted. Increasing urban infrastructure, rising automobile production, and renewable energy investments are being recognized as important factors supporting market expansion in India.

Germany engineering focus and demand for advanced composites are pushing the glass mat market forward at 5.5% CAGR. The glass mat market is being supported by adoption of fiberglass mats with enhanced strength, lightweight properties, and thermal resistance to meet strict quality standards. Manufacturers are being encouraged to provide advanced, reliable, and environmentally friendly products. Distribution through industrial partners, authorized dealers, and specialized suppliers is being maintained. Research and development in sustainable materials, improved fiber alignment, and advanced composite technologies is being conducted. The glass mat market in Germany is being strengthened by the country focus on engineering excellence, environmental performance, and advanced manufacturing.

Applications in marine, construction, and industrial sectors have made the glass mat market in the United Kingdom grow steadily at 4.6% CAGR. The glass mat market is being supported by adoption of lightweight and durable reinforcement materials that improve structural strength, corrosion resistance, and composite performance. Manufacturers in the glass mat market are being focused on supplying high quality, cost effective, and reliable products. Distribution through authorized suppliers, construction partners, and industrial distributors is being ensured. Awareness campaigns and technical workshops are being conducted to promote correct applications. Rising construction activity, growth of the marine industry, and demand for advanced composites are being considered drivers for expansion of the glass mat market in the United Kingdom.

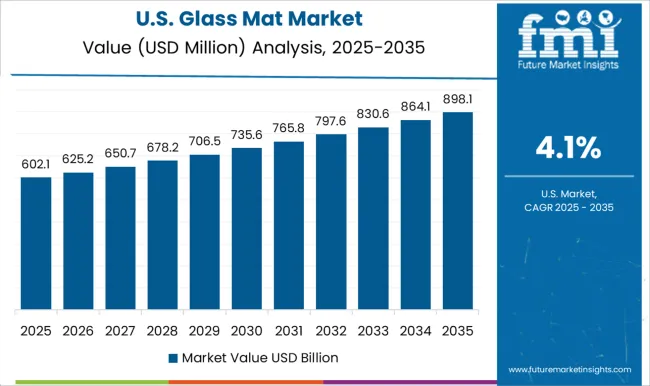

Rising renewable energy projects and strong demand from automotive are shaping the glass mat market in the United States, which is advancing at a 4.1% CAGR. The glass mat market is being supported by the use of mats to enhance strength, durability, and thermal resistance in composite products. Manufacturers are being encouraged to deliver advanced, lightweight, and performance optimized solutions. Distribution through authorized dealers, industrial partners, and online platforms is being maintained. Research and development in fiber reinforcement, resin compatibility, and durability testing is being conducted. Rising renewable energy projects, automotive production, and construction activity are being considered key factors supporting the growth of the glass mat market in the United States.

The glass mat market is experiencing consistent growth due to its widespread use in construction, automotive, marine, and industrial applications. Glass mats, known for their durability, dimensional stability, and resistance to corrosion, are utilized in roofing materials, insulation products, and as reinforcements in composites. Increasing demand for lightweight and high-performance materials in the automotive and aerospace industries, coupled with rising infrastructure development, has been fueling the adoption of glass mats globally. Additionally, the shift towards energy-efficient and sustainable construction solutions continues to drive innovation and product development in this sector.

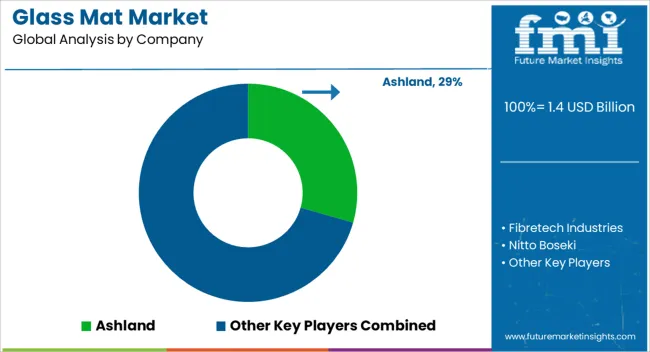

Prominent companies operating in the glass mat market include Ashland, Fibretech Industries, Nitto Boseki, P-D Glasseiden, PPG Industries, and Taishan Fiberglass. These players are focused on enhancing product performance through advanced manufacturing processes and expanding their application range to meet evolving industry requirements. Innovations in fiberglass composites and the integration of glass mats in energy-efficient building materials are among the strategies employed by these companies to maintain a competitive edge. Ashland is recognized for its expertise in specialty materials and resins that complement glass mat applications. Fibretech Industries and Nitto Boseki contribute to the market with a strong focus on high-quality, customized glass mat solutions for industrial and construction purposes.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Mat Type | Chopped strand glass mat and Continuous filament glass mat |

| Binder Type | Powder bonded glass mat and Emulsion bonded glass mat |

| Application | Construction & infrastructure, Industrial applications, Automotive, Marine, Sports & leisure goods, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ashland, Fibretech Industries, Nitto Boseki, P-D Glasseiden, PPG Industries, and Taishan Fiberglass |

| Additional Attributes | Dollar sales vary by product type, including chopped strand mats, continuous filament mats, and woven mats; by application, such as construction, automotive, marine, and industrial; by end-use industry, spanning building & infrastructure, transportation, and wind energy; by region, led by Asia-Pacific, North America, and Europe. Growth is driven by rising demand for composites, lightweight materials, and infrastructure expansion. |

The global glass mat market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the glass mat market is projected to reach USD 2.2 billion by 2035.

The glass mat market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in glass mat market are chopped strand glass mat and continuous filament glass mat.

In terms of binder type, powder bonded glass mat segment to command 57.6% share in the glass mat market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Glass Mat Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Absorbent Glass Mat (AGM) Battery Market Size and Share Forecast Outlook 2025 to 2035

Adsorbent Glass Mat (AGM) Battery Market Report – Demand, Trends & Industry Forecast 2025-2035

UK Adsorbent Glass Mat (AGM) Battery Market Trends – Growth, Demand & Innovations 2025-2035

USA AGM Battery Market Outlook – Demand, Innovations & Forecast 2025-2035

Japan AGM Battery Market Trends – Size, Share & Growth 2025-2035

ASEAN Adsorbent Glass Mat (AGM) Battery Market Insights – Size, Share & Innovations 2025-2035

Germany Adsorbent Glass Mat Battery Market Trends – Size, Growth & Outlook 2025-2035

Glass Bottles Market Forecast and Outlook 2025 to 2035

Glass Laser Engraving Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Restoration Kit Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottle and Container Market Forecast and Outlook 2025 to 2035

Glass Additive Market Forecast and Outlook 2025 to 2035

Glass Reactor Market Size and Share Forecast Outlook 2025 to 2035

Glass Cosmetic Bottle Market Size and Share Forecast Outlook 2025 to 2035

Glass & Metal Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Glass Product Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Market Size and Share Forecast Outlook 2025 to 2035

Glass Container Market Size and Share Forecast Outlook 2025 to 2035

Glass Fibre Yarn Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA