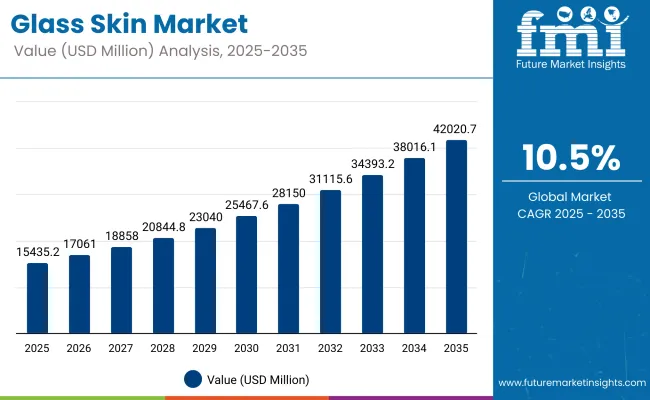

The Glass Skin Market is expected to record a valuation of USD 15,435.2 million in 2025 and USD 42,020.7 million in 2035, with an increase of USD 26,585.5 million, which equals a growth of 172% over the decade. The overall expansion represents a CAGR of 10.5% and a 2.7X increase in market size.

Glass Skin Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 15,435.2 million |

| Market Forecast Value in (2035F) | USD 42,020.7 million |

| Forecast CAGR (2025 to 2035) | 10.5% |

During the first five-year period from 2025 to 2030, the market increases from USD 15,435.2 million to USD 25,467.6 million, adding USD 10,032.4 million, which accounts for 37.7% of the total decade growth. This phase records steady adoption of premium skincare routines and K-beauty-inspired regimens, driven by consumer demand for hydration & moisture retention products. Skincare dominates this period with a 78.3% share, reflecting its strong position in the glass skin concept.

The second half from 2030 to 2035 contributes USD 16,553.1 million, equal to 62.3% of total growth, as the market jumps from USD 25,467.6 million to USD 42,020.7 million. This acceleration is powered by widespread global adoption, the rise of AI-driven personalized skincare recommendations, and expansion into emerging economies such as India and China. Online distribution channels capture a dominant 64.7% share by 2025 and continue to lead, supported by e-commerce marketplaces, social commerce, and DTC brand strategies. Leading players such as Laneige, Sulwhasoo, and Innisfree leverage digital-first campaigns to strengthen their market position.

From 2020 to 2024, the Glass Skin Market expanded steadily, driven primarily by skincare-centric adoption rooted in the K-beauty trend. During this period, the competitive landscape was dominated by established beauty brands controlling nearly 80% of revenue in the skincare category, with leaders such as Laneige, Sulwhasoo, and Innisfree focusing on hydration, moisture retention, and brightening formulations.

Competitive differentiation relied on product efficacy, ingredient innovation, and brand storytelling, while beauty tools and devices contributed a much smaller share to overall revenues. Service-based professional skincare solutions (e.g., dermatology clinics) had minimal traction, contributing less than 10% of the total market value.

Demand for glass skin products will grow to USD 15,435.2 million in 2025, with the revenue mix increasingly influenced by online distribution channels holding 64.7% share. Traditional beauty leaders face rising competition from niche digital-first brands leveraging social commerce, influencer-led campaigns, and direct-to-consumer strategies.

Major incumbents are pivoting toward AI-driven personalization and hybrid retail models to maintain relevance. Emerging entrants specializing in functional skincare (e.g., barrier repair, tone correction) and clean-label formulations are gaining share. Competitive advantage is shifting from brand heritage alone to ecosystem strength, digital scalability, and recurring consumer engagement.

The glass skin market is expanding rapidly as cities push for buildings that double as landmarks. Developers in regions like the UAE, Singapore, and Shanghai are using double-curved and fritted glass to create unique geometries that steel or concrete can’t match. Demand is also rising for blast-resistant and cyclone-rated facades in high-risk zones, turning glass skin into a safety as well as a style choice. This shift is fuelled by high-profile projects airports, sports arenas, and corporate headquarters that treat facades as brand statements visible from miles away.

Growth is further driven by the integration of advanced technologies into facades themselves. Photovoltaic glass panels now generate energy without altering aesthetics, while electrochromic glazing adjusts tint in real time to manage solar heat gain. These features allow developers to meet strict carbon-reduction targets while reducing operational costs. The convergence of performance, safety, and visual impact is pushing glass skin adoption far beyond luxury builds into public infrastructure and large-scale mixed-use projects cementing its role in the next wave of urban architecture.

The glass skin-inspired beauty market can be divided into three main product categories: skincare, color cosmetics, and beauty tools & devices. The skincare segment includes cleansers in multiple formats (gel, foam, oil-based, balm), hydrating and exfoliating toners, active-rich essences and serums (hyaluronic acid, niacinamide, peptides, vitamin C), high-potency ampoules and concentrates, moisturizers (gel creams, emulsions, lotions), sheet and overnight masks, chemical and enzyme exfoliators, and sunscreens with hydrating, dewy-finish formulations.

Color cosmetics focus on achieving a luminous, natural finish, with products like skin tints and lightweight foundations, illuminating primers, dewy finish setting sprays, and liquid or cream highlighters. Beauty tools & devices encompass facial rollers and GuaSha tools, LED light masks, ultrasonic infusion devices, microcurrent devices, and skin analyzers, targeting both home-spa experiences and professional-level results.

These segments address functional benefits such as hydration and moisture retention, skin brightening and tone correction, barrier repair and strengthening, gentle exfoliation and smoothing, and delivering a radiant, luminous finish. Distribution channels are split into onlineincluding DTC brand websites, e-commerce marketplaces, and social commerce platformsand offline, which spans beauty retail chains, department stores, specialty boutiques, and dermatology clinics or medical spas.

Regionally, the scope spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

| Product Category | Value Share% 2025 |

|---|---|

| Skincare | 78.3% |

| Others | 21.7% |

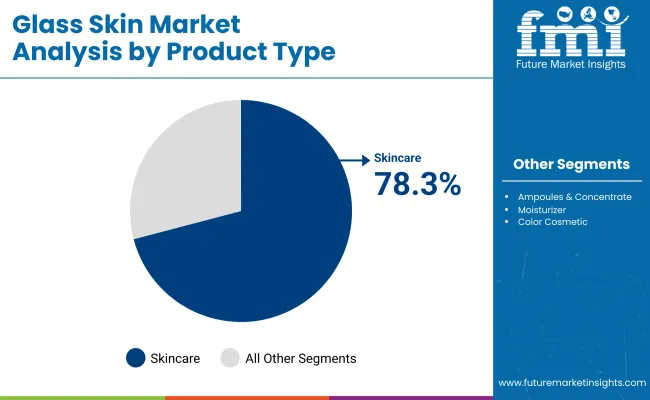

The skincare segment is projected to contribute 78.3% of the glass skin-inspired beauty market revenue in 2025, maintaining its lead as the dominant product category. This is driven by sustained consumer preference for multi-step routines incorporating cleansers, toners, serums, moisturizers, and sunscreens formulated for hydration, brightening, and barrier repair.

The segment’s strength is further supported by innovation in active ingredients, texture formats, and hybrid skincare-makeup solutions that deliver both immediate radiance and long-term skin health benefits. Rising adoption of targeted treatments such as ampoules and sheet masks also fuels growth. Skincare is expected to remain the foundation of the glass skin trend globally.

| Functional Benefit | Value Share% 2025 |

|---|---|

| Hydration & Moisture Retention | 42.5% |

| Others | 57.5% |

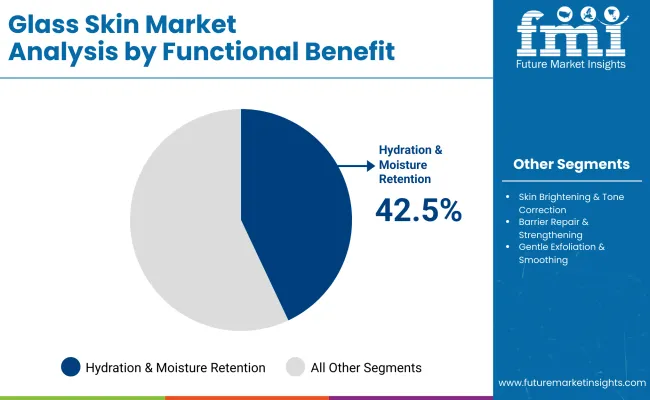

The hydration and moisture retention segment is projected to contribute 42.5% of the glass skin-inspired beauty market revenue in 2025, retaining its position as the leading functional benefit. This dominance is driven by strong consumer demand for products that deliver deep, long-lasting hydration essential for achieving the smooth, dewy complexion associated with the glass skin aesthetic.

Advances in formulations featuring hyaluronic acid, ceramides, and botanical humectants are enhancing product efficacy and appeal. Seasonal climate variations, increased screen exposure, and urban pollution are further boosting the need for moisture-locking solutions. Hydration-focused products are expected to remain a core driver of category growth worldwide.

| Distribution Channel | Value Share% 2025 |

|---|---|

| Online | 64.7% |

| Others | 35.3% |

The online retail segment is projected to contribute 64.7% of the glass skin-inspired beauty market revenue in 2025, solidifying its position as the primary distribution channel. Growth is fueled by the dominance of e-commerce marketplaces, direct-to-consumer brand websites, and social commerce platforms, which offer consumers convenience, product variety, and access to global brands. Influencer-driven marketing, livestream shopping, and personalized recommendations are further accelerating digital sales.

Mobile-first shopping behaviors, particularly in Asia-Pacific, are enhancing platform engagement and conversion rates. As virtual try-on tools and AI-powered skin analysis become mainstream, online retail is expected to remain the leading driver of market accessibility and expansion.

Shift Toward Layer-Friendly Formulations

A growing number of skincare brands are engineering products with ultra-light textures and low pH balance, specifically designed to layer without pilling. This is crucial for glass skin enthusiasts, who may apply six to eight products in one routine. By focusing on molecular compatibility and absorption rates, brands are enabling consumers to stack multiple actives without irritationsomething that was far harder with older, heavier formulations. This “layer-ability” is becoming a unique selling point and a key growth driver, as it addresses a functional need at the core of the glass skin ritual.

Rise of Dew-Enhancing SPF HybridsSPF is no longer seen as a final, matte stepit’s becoming an integral part of the glow. Formulations that combine high UVA/UVB protection with humectants, light-reflecting particles, and skin-tone blurring technology are gaining rapid traction. These SPF hybrids allow consumers to skip a makeup step while still achieving the luminous finish, especially appealing in hot and humid climates where heavy cosmetics don’t last. The dual function also improves compliance, making daily SPF use more appealing to younger demographics who are focused on prevention over correction.

Incompatibility of Certain Actives in Multi-Step RoutinesWhile layering is core to the glass skin approach, it comes with the challenge of active ingredient incompatibility. For example, using strong exfoliating acids alongside high concentrations of retinoids or vitamin C can cause irritation or reduce efficacy. This not only risks adverse skin reactions but also creates consumer confusion about “what goes with what.” Such concerns can deter new users from adopting full routines and push them toward simplified skincare, slowing down the expansion of multi-step product sales.

Skin Barrier-First Glass SkinA notable shift is the redefinition of glass skin from being purely about surface radiance to representing a healthy, resilient skin barrier. Post-pandemic, many consumers experienced skin sensitivity from over-exfoliation, mask use, or aggressive actives. This has fueled demand for barrier-supporting productsceramide-rich essences, probiotic-infused serums, and pH-restoring tonersthat still deliver a luminous finish. The trend blends the glow aesthetic with long-term dermal health, and brands are now marketing “barrier glass skin” as a safer, more sustainable interpretation of the look.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 8.2% |

| USA | 5.1% |

| India | 12.4% |

| UK | 7.2% |

| Germany | 6.5% |

| Japan | 5.8% |

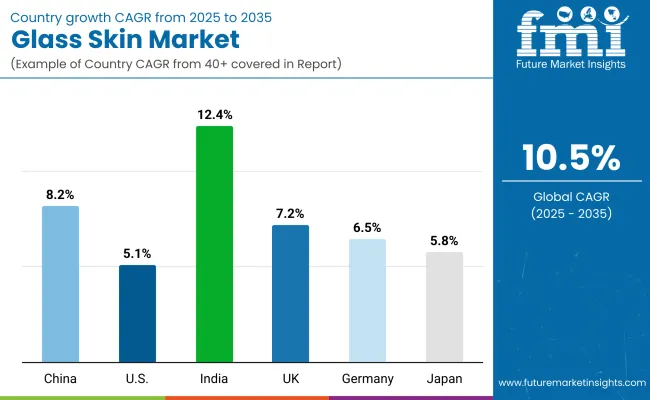

The glass skin market shows varied growth potential across key countries, with India emerging as the fastest-growing market at an estimated 12.4% CAGR between 2025 and 2035, driven by a rapidly expanding beauty-conscious consumer base, rising disposable incomes, and the growing influence of K-beauty-inspired skincare. China, with a projected 8.2% CAGR, remains a powerhouse due to its strong e-commerce infrastructure, domestic brand innovation, and high adoption of multi-step skincare regimens.

The UK and Germany are set to grow at 7.2% and 6.5% respectively, supported by premium beauty demand and clean formulation trends. Japan is expected to see steady growth at 5.8%, benefiting from its reputation for high-quality skincare innovation and product safety. Meanwhile, the USA market, growing at 5.1%, will be driven by hybrid skincare-makeup innovations and the increasing popularity of influencer-led product launches. Overall, Asia-Pacific leads in both growth rate and cultural influence, while Western markets focus on premium positioning and multifunctional product formats.

| Year | USA Glass Skin Market (USD Million) |

|---|---|

| 2025 | 4028.59 |

| 2026 | 4383.43 |

| 2027 | 4769.53 |

| 2028 | 5189.64 |

| 2029 | 5646.75 |

| 2030 | 6144.13 |

| 2031 | 6685.32 |

| 2032 | 7274.17 |

| 2033 | 7914.89 |

| 2034 | 8612.05 |

| 2035 | 9370.62 |

The USA glass skin market is projected to experience steady growth from USD 4,028.59 million in 2025 to USD 9,370.62 million by 2035, reflecting a consistent upward trajectory. This growth is underpinned by rising consumer interest in hybrid skincare-makeup products, the influence of social media-driven beauty trends, and the adoption of advanced formulations targeting hydration, radiance, and skin barrier health.

The market is set to cross the USD 6 billion mark by 2030, supported by strong e-commerce expansion, celebrity brand endorsements, and technological integration in beauty devices. Post-2030, growth will be fueled by premium product adoption and the continued mainstreaming of multi-step skincare routines. The CAGR over this period indicates sustained demand across both mass and prestige segments, with online retail remaining a dominant channel for sales.

The Glass Skin Market in the United States is expected to grow from USD 4,028.59 million in 2025 to USD 9,370.62 million by 2035, registering sustained growth driven by innovation in hybrid skincare-makeup products, increased adoption of multi-step routines, and advancements in beauty device integration. Influencer-led marketing campaigns, coupled with the rise of SPF hybrids and barrier-repair-focused formulations, are fueling consumer interest.

Premium skincare brands are capitalizing on clean beauty positioning, while mass-market players leverage affordable yet high-performance formulations to expand reach. Online retail continues to dominate, supported by AI-based skin analysis tools and virtual try-on experiences that enhance digital purchasing confidence.

India is experiencing the fastest growth in the Glass Skin Market, with a forecast CAGR of 12.4% through 2035, driven by a surge in beauty-conscious consumers across both metro and tier-2 cities. Expanding access to global beauty brands via e-commerce platforms, coupled with rising influence of K-beauty-inspired multi-step routines, is fueling demand.

Domestic and international brands are launching cost-effective yet high-performance formulations tailored to Indian skin types and climates, particularly focusing on hydration and brightening benefits. Social media platforms, influencer-driven tutorials, and regional language content are accelerating awareness and adoption, while dermatology clinics and beauty tech devices are making advanced skincare more accessible.

The Glass Skin Market in China is expected to grow at a CAGR of 8.2%, one of the strongest among leading economies, supported by high consumer adoption of multi-step skincare regimens and continuous innovation from domestic beauty brands. The market is benefiting from the rapid expansion of e-commerce platforms like Tmall and JD.com, livestream selling, and influencer-led marketing campaigns that drive immediate purchase decisions.

Local companies are introducing competitively priced yet premium-quality formulations enriched with actives such as niacinamide, hyaluronic acid, and ginseng, catering to the demand for hydration, brightening, and anti-aging benefits. Cross-category expansion into SPF hybrids, skin tints, and beauty-tech devices is further boosting market momentum.

| Countries | 2025 Share (%) |

|---|---|

| USA | 25.1% |

| China | 10.5% |

| Japan | 7.2% |

| Germany | 9.3% |

| UK | 8.6% |

| India | 5.5% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 22.3% |

| China | 13.5% |

| Japan | 8.4% |

| Germany | 14.2% |

| UK | 9.5% |

| India | 6.8% |

Germany’s share of the global glass skin market is poised to climb from 9.3% in 2025 to 14.2% by 2035, reflecting a pronounced shift from niche trend to mainstream daily regimen within a highly regulated, quality-driven market. Growth is being driven less by fast-fashion influencer cycles and more by product credibilitydermatologically tested actives, clinically-backed hydration systems (multi-molecular hyaluronic complexes, ceramide blends), and multifunctional formulations that meet EU safety and labeling standards.

German consumers favour evidence over hype, so brands that offer transparent testing data, microbiome-friendly claims, and recyclable packaging gain disproportionate traction. The country’s strong pharmacy (Apotheke) channel and drugstore innovation pipeline (masstige launches with clinical claims) create reliable distribution for both prestige and mass players. Meanwhile, demand from aging but skin-conscious cohortsplus rising male grooming adoptionsupports premiumization of hydration and barrier-repair SKUs, while indie brands leverage regional botanicals and clean-certifications to capture urban millennial shoppers.

| USA By Product Category | Value Share% 2025 |

|---|---|

| Skincare | 75.2% |

| Others | 24.8% |

The Glass Skin Market in the United States is projected to be valued at USD 4,028.59 million in 2025, with skincare dominating at 75.2% of category share and “others” accounting for 24.8%. This clear segment dominance reflects the deep-rooted consumer preference for targeted skincare solutionshydration serums, barrier-repair creams, SPF hybrids, and brightening treatmentsthat deliver both functional results and the luminous aesthetic associated with the glass skin trend.

The market is also seeing accelerated adoption of hybrid formats such as serum foundations and moisturizer-primers, appealing to time-conscious consumers seeking efficiency without compromising skin health. Growth is further supported by the integration of beauty-tech devices and AI-driven skin analysis tools into retail and online shopping journeys, enabling personalized product recommendations. Premium skincare continues to gain momentum, while mass-market brands leverage affordable, active-rich products to capture younger demographics.

| China By Functional Benefit | Value Share% 2025 |

|---|---|

| Hydration & Moisture Retention | 42.5% |

| Others | 57.5% |

The Glass Skin Market in China is projected to hold a 42.5% share for the hydration and moisture retention functional benefit segment in 2025, reflecting the country’s strong alignment between consumer needs and the core glass skin aesthetic. This dominance stems from China’s climate diversityranging from dry northern winters to humid southern summerswhich drives year-round demand for moisture-locking products that deliver a dewy, plump complexion.

Domestic and international brands are leveraging advanced humectants, fermented extracts, and botanical actives to create high-performance hydrating serums, essences, and ampoules specifically formulated for Chinese skin types. E-commerce livestreaming and social commerce platforms like Taobao Live and Douyin are amplifying awareness and encouraging impulse purchases of hydration-focused routines. As consumer education on skin barrier health deepens, brands combining hydration benefits with secondary claims such as brightening and anti-aging are expected to see accelerated growth.

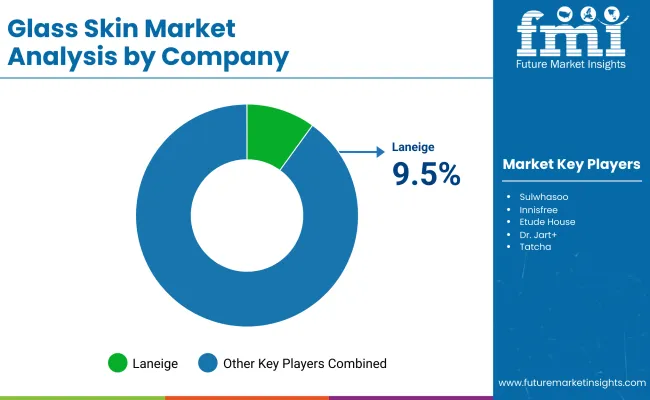

The Glass Skin Market in 2025 is led by Laneige, holding a 9.5% global value share, with the remaining 90.5% distributed among a highly fragmented set of competitors. Laneige’s leadership is anchored by its hero products, particularly its Water Bank line and Sleeping Masks, which directly address the hydration and moisture retention needs central to the glass skin aesthetic. The brand’s strong presence in Asia-Pacific, combined with strategic expansion into North America and Europe via Sephora and other premium retailers, has reinforced its global visibility.

Heavy investment in social media campaigns, K-beauty storytelling, and influencer partnerships has helped Laneige maintain a premium yet approachable positioning. The rest of the market consists of both established multinational skincare brands and emerging indie labels leveraging niche formulations, localized ingredients, and competitive pricing to capture market share. As consumer interest in multi-step routines grows, competition is expected to intensify, particularly in the hydration and barrier-repair subcategories.

Key Developments in GLASS SKIN Market

| Item | Value |

|---|---|

| Quantitative Units | USD 15,435.2 Million |

| Product Category | Skincare - Cleansers (gel, foam, oil-based, balm), Toners & Mists (hydrating, exfoliating), Essences & Serums (hyaluronic acid, niacinamide, peptides, vitamin C), Ampoules & Concentrates, Moisturizers (gel creams, emulsions, lotions), Sheet Masks & Overnight Masks, Exfoliators (chemical peels, enzyme scrubs), Sunscreens (hydrating, dewy-finish formulations). Color Cosmetics - Skin Tints & Lightweight Foundations, Illuminating Primers, Dewy Finish Setting Sprays, Liquid & Cream Highlighters. Beauty Tools & Devices - Facial Rollers & Gua Sha Tools, LED Light Masks, Ultrasonic Infusion Devices, Microcurrent Devices, Skin Analyzers. |

| Functional Benefit | Hydration & Moisture Retention, Skin Brightening & Tone Correction, Barrier Repair & Strengthening, Gentle Exfoliation & Smoothing, Radiance & Luminous Finish. |

| Distribution Channel | DTC Brand Websites, E-commerce Marketplaces (Amazon, YesStyle, StyleKorean), Social Commerce (Instagram, TikTok shops, WeChat mini-programs). Offline: Beauty Retail Chains (Sephora, Ulta, Olive Young), Department Stores, Specialty Beauty Boutiques, Dermatology Clinics & Medical Spas. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Laneige, Sulwhasoo, Innisfree, Etude House, Dr. Jart +, Tatcha, Missha, COSRX, Belif, Klairs. |

| Additional Attributes | Additional Attributes: dollar sales by product category and SKU, reven ue split by functional benefit, channel mix and conversion rates across DTC, marketplaces, and social commerce, influencer and livestream ROI metrics, adoption ra tes and ASPs for beauty devices, ingredient-le vel penetration, SKU churn and new-product launch velocity, private-label and pharmacy-brand share, price-tier segmentation, seasonal and climate-driven demand patterns, sustainability and recyclability adoption in packaging, regulatory & clean-label certification impact, re gional assortment localization, returns and trial-to-repeat purchase ratios, retail planogram depth and omni -channel attribution, R&D spend on stable active delivery systems and hybrid formulations, patent filings and ingredient exclusivity deals, and integration with AR/AI skin-analysis tools for personalization. |

The global GLASS SKIN Market is estimated to be valued at USD 15,435.2 million in 2025.

The market size for the GLASS SKIN Market is projected to reach USD 42,020.7 million by 2035.

The GLASS SKIN Market is expected to grow at a 10.5% CAGR between 2025 and 2035.

The key product types include skincare (such as cleansers, toners, essences, serums, moisturizers, masks, exfoliators, and sunscreens), color cosmetics (like skin tints, illuminating primers, dewy finish setting sprays, and liquid/cream highlighters), and beauty tools & devices (including facial rollers, LED light masks, ultrasonic infusion devices, microcurrent devices, and skin analyzers).

The hydration & moisture retention segment has the majority of functional benefit value share, estimated at 42.5% in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA