The Glass Packaging Market is estimated to be valued at USD 62.8 billion in 2025 and is projected to reach USD 97.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. Market growth curve shape analysis indicates a stable, moderately upward trajectory characterized by steady, predictable increments across the forecast horizon.

In the early phase (2025–2030), the market grows from USD 62.8 billion to USD 78.2 billion, adding USD 15.4 billion or around 44% of total growth, supported by sustained demand in food and beverage packaging, particularly premium alcoholic beverages, along with pharmaceutical glass adoption for sterile drug storage. The later phase (2030–2035) contributes USD 19.3 billion, taking the market to USD 97.5 billion, with acceleration linked to increased glass use in sustainable packaging strategies and the expansion of recycling infrastructure to meet circular economy targets. The smooth, non-volatile curve demonstrates that glass retains relevance against competing packaging substrates due to its inertness, reusability, and premium appeal.

Growth opportunities will favor players investing in lightweight glass technology, advanced forming processes, and high-recycled-content packaging solutions, ensuring cost optimization and environmental compliance. The curve’s consistency reflects a market balancing traditional strengths with evolving sustainability and performance demands in global packaging applications.

| Metric | Value |

|---|---|

| Glass Packaging Market Estimated Value in (2025 E) | USD 62.8 billion |

| Glass Packaging Market Forecast Value in (2035 F) | USD 97.5 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The glass packaging market holds a significant position within broader packaging ecosystems. In the packaging materials market, glass accounts for about 10–12%, as plastics dominate but glass remains vital for premium and sustainable applications. Within the container packaging market, its share is stronger at around 18–20%, driven by widespread use in bottles, jars, and vials for beverages and food items. In the food and beverage packaging market, glass contributes approximately 12–14%, reflecting its continued dominance in alcoholic beverages, sauces, and premium drink segments despite competition from PET and metal cans.

For the pharmaceutical and healthcare packaging market, glass holds nearly 8–9%, largely due to its role in vials, ampoules, and sterile packaging that ensures chemical stability and product safety. In the personal care and cosmetics packaging market, glass represents about 6–7%, as it is widely used for perfumes and high-end skincare products, emphasizing luxury and shelf appeal. Growth is supported by strong demand for recyclable and inert materials, especially in food and pharma sectors, where safety and purity are critical. Increasing preference for premium packaging in beverages and cosmetics continues to reinforce glass as a key packaging material across these markets, sustaining its relevance amid growing sustainability pressures.

The glass packaging market is experiencing steady growth, driven by increasing demand for sustainable, inert, and premium-quality packaging formats across industries such as beverages, pharmaceuticals, and personal care. Regulatory efforts to phase out single-use plastics and growing consumer awareness regarding health and environmental impacts have reinforced glass as a preferred material.

Investments in lightweighting technologies, returnable bottle infrastructure, and enhanced recyclability have further improved the environmental footprint of glass packaging. Manufacturers are also leveraging design innovations in bottle shape, color, and embossing to support product differentiation and brand positioning.

Future expansion is expected to be supported by premiumization trends in the beverage industry and the increasing deployment of closed-loop recycling systems that favor glass’s infinite recyclability..

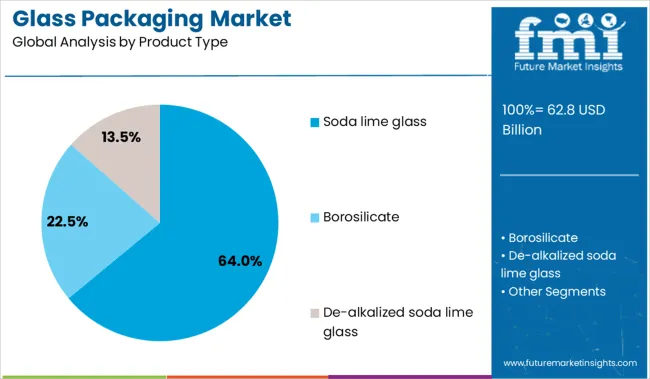

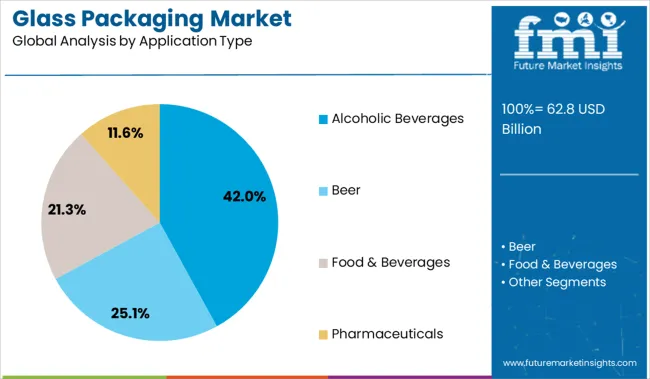

The glass packaging market is segmented by product type, application type, and geographic regions. The glass packaging market is divided by product type into Soda lime glass, Borosilicate, and De-alkalized soda lime glass. In terms of application, the glass packaging market is classified into Alcoholic Beverages, Beer, Food & Beverages, and Pharmaceuticals. Regionally, the glass packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Soda lime glass is projected to dominate the market in 2025 with a 64.0% share of total revenue, positioning it as the leading product type. This dominance is being driven by its favorable chemical durability, ease of molding, and cost-effectiveness in large-scale production.

Its compatibility with food and beverage contents, including both acidic and alcoholic formulations, has made it the material of choice for high-volume packaging applications. The segment’s growth is further supported by the widespread availability of raw materials and energy-efficient furnace designs, which have improved cost efficiency across manufacturing lines.

Additionally, soda lime glass benefits from high recycling rates and regulatory approval for food contact safety, making it suitable for returnable and multi-use container systems..

Alcoholic beverages are anticipated to contribute 42.0% of the overall market revenue in 2025, making it the largest application segment in the glass packaging market. This leadership is attributed to the long-standing preference for glass in preserving flavor integrity, maintaining product shelf life, and delivering a premium consumer experience.

Glass packaging offers an inert barrier that does not react with contents, which is particularly critical for alcoholic drinks where flavor profile and purity are essential. The growing demand for craft and premium spirits, along with branding opportunities enabled by decorative glass designs, has further cemented its position.

Moreover, the cultural and regulatory significance of glass in alcoholic packaging across many countries supports its continued dominance, particularly in returnable bottle markets and high-end segments..

Glass packaging is widely used in food, beverages, pharmaceuticals, and cosmetics due to its inert nature, barrier properties, and recyclability. Products such as bottles, jars, and ampoules are dominant in these applications. Adoption has been encouraged by demand for premium and safe packaging formats that preserve product quality. Manufacturers have emphasized lightweight designs, improved durability, and customizable aesthetics to meet brand differentiation requirements.

Growth in alcoholic beverages, ready-to-drink products, and high-value cosmetics has influenced consumption patterns. Strategic expansions in manufacturing capacity and technological enhancements in forming processes have strengthened market competitiveness globally.

Adoption of glass packaging has been supported by its ability to maintain product integrity without interacting with contents, ensuring longer shelf life. High demand for alcoholic beverages, including beer, wine, and spirits, has reinforced the preference for glass bottles due to their premium perception and ability to preserve taste. Pharmaceutical applications such as injectable drugs and sensitive formulations have driven usage of glass vials and ampoules because of their superior chemical resistance. Consumer inclination toward aesthetic appeal and brand differentiation has encouraged brands to choose custom-designed glass formats. Supply consistency and scalability have been prioritized by major producers to support growing demand from beverage and personal care sectors.

Market penetration has been constrained by the heavier weight of glass containers compared to alternative materials like PET or aluminum, which increases transportation and logistics costs. Breakage risk during handling and distribution has required additional protective packaging, raising operational expenses for manufacturers and distributors. Production of glass packaging involves high energy consumption, leading to elevated manufacturing costs and sensitivity to energy price fluctuations. Recycling infrastructure limitations in certain regions have posed challenges for closed-loop supply models. Adoption in emerging markets has been hindered by cost-sensitive consumer segments favoring lower-priced plastic-based packaging alternatives. These factors have collectively created barriers to widespread glass packaging use in mass-market categories.

Significant opportunities have emerged in premium product categories where glass packaging enhances perceived value and supports brand positioning. Growth in craft beverages, luxury spirits, and niche cosmetics has created demand for specialized glass designs with decorative finishes. Pharmaceutical and healthcare industries present a strong avenue for expansion as injectable and biologic drugs require chemically stable containers. Innovations in lightweight glass bottles have opened new possibilities for cost reduction while maintaining functional integrity. Partnerships with recycling firms and adoption of recycled glass cullet in manufacturing have positioned producers to tap into markets emphasizing eco-compliance and material circularity. Development of smart glass packaging incorporating traceability features offers potential in high-value applications.

Recent trends include advancements in lightweight glass technologies to reduce transport costs without compromising strength. Increased investment in high-speed forming machines and precision molding techniques has been observed to improve production efficiency. Digital printing and embossing technologies have enabled customization, meeting demand for limited-edition and premium packaging formats. Smart glass packaging solutions featuring embedded QR codes and NFC tags for product authentication and consumer engagement have gained traction. Growing e-commerce adoption has influenced packaging designs focused on improved durability during last-mile delivery. Integration of hybrid packaging combining glass with protective coatings for strength and scratch resistance has been explored by leading manufacturers to enhance functionality.

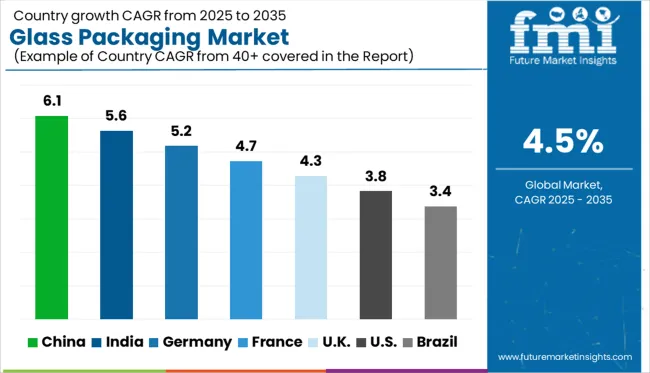

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

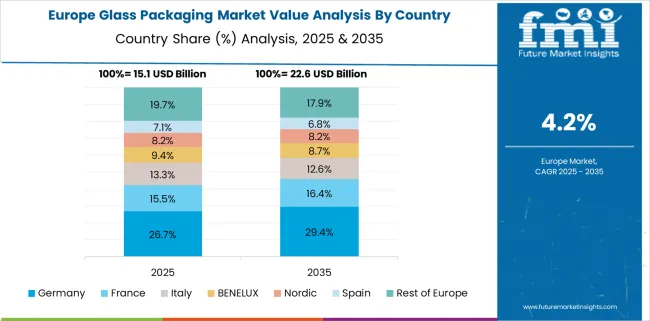

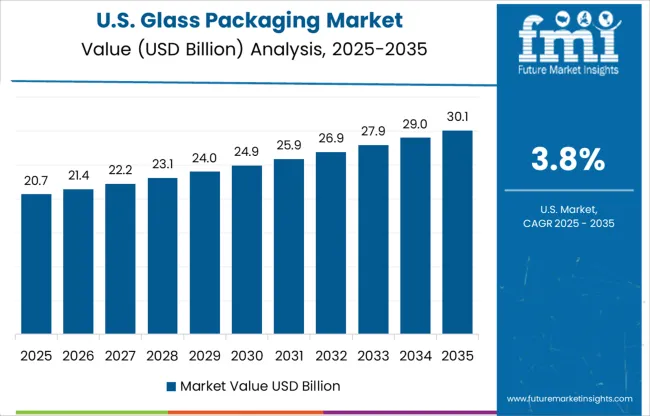

The glass packaging market is projected to grow at a CAGR of 4.5% through 2035, supported by strong demand in beverages, pharmaceuticals, and premium cosmetic products. China leads at 6.1%, driven by high-volume beverage bottling and rising health-conscious consumption trends. India follows at 5.6%, benefiting from increasing demand for alcoholic beverages and sustainable packaging in the food sector. Among OECD nations, Germany posts 5.2%, the United Kingdom records 4.3%, and the United States grows at 3.8%, influenced by a shift toward recyclable and premium-grade packaging solutions for specialty products. The analysis includes over 40 countries, with the top five detailed below.

China is projected to grow at a CAGR of 6.1% through 2035, fueled by rapid expansion in beverage bottling and pharmaceutical applications. Demand for glass packaging remains strong in alcoholic drinks, premium mineral water, and carbonated soft drinks. Growth in ready-to-drink teas and juices has created additional opportunities for customized glass bottle designs. In the pharmaceutical sector, the adoption of glass vials and ampoules has surged due to the rising production of injectable drugs and biologics. Domestic manufacturers are focusing on lightweight glass technologies to lower production and transportation costs while maintaining strength and durability.

"India is expected to grow at a CAGR of 5.6% through 2035, driven by increasing adoption of glass packaging in alcoholic beverages, packaged food, and pharmaceuticals. Rising disposable incomes and a shift toward premiumization in the beverage segment are accelerating the demand for decorative and embossed glass bottles. Growing consumption of beer, wine, and spirits in urban centers further strengthens demand for high-quality glass packaging solutions. Pharmaceutical applications are expanding rapidly due to the increased production of vaccines, injectable medicines, and nutraceuticals requiring sterile packaging. Domestic glass manufacturers are enhancing capacity and focusing on energy-efficient technologies to improve productivity and reduce operating costs. Customized solutions for cosmetics and personal care products are creating additional growth opportunities.

Germany is forecasted to achieve a CAGR of 5.2% through 2035, supported by strong demand from the beer, wine, and premium spirits segments. Glass remains the material of choice for high-end beverage packaging due to its chemical inertness and ability to maintain product quality. Increased investments in decorative glass designs with embossing, etching, and advanced coatings are fueling adoption in luxury and artisanal beverage categories. The pharmaceutical industry is also a key growth contributor, driven by rising demand for glass vials and ampoules for injectable drugs and biologics. Germany’s strong recycling infrastructure enables closed-loop systems, significantly improving cost efficiency and resource utilization for glass manufacturers. The shift toward lightweight bottle manufacturing is another major trend aimed at reducing transportation costs and carbon emissions without compromising durability.

The United Kingdom is projected to grow at a CAGR of 4.3% through 2035, supported by rising demand in premium alcoholic beverages, personal care products, and artisanal food packaging. Craft beer and premium spirits brands are increasingly adopting glass packaging for its aesthetic value and ability to preserve flavor integrity. The cosmetic and fragrance sectors are also fueling demand for customized decorative glass bottles with unique designs and advanced finishing techniques. E-commerce growth is influencing innovation in shatter-resistant glass packaging to reduce breakage during transit. Manufacturers are investing in lightweight glass technologies to minimize material usage while retaining structural strength.

The United States is expected to grow at a CAGR of 3.8% through 2035, driven by strong demand for glass containers in premium beverages, pharmaceuticals, and personal care products. The market is witnessing significant adoption of glass packaging in craft beer, specialty wines, and functional beverages as consumers increasingly favor eco-friendly and aesthetically appealing solutions. Pharmaceutical applications remain robust, with glass vials and ampoules preferred for injectable drugs and biologics due to their superior barrier properties. Manufacturers are introducing innovations such as tempered glass, lightweight bottles, and sustainable production processes to meet performance and environmental objectives.

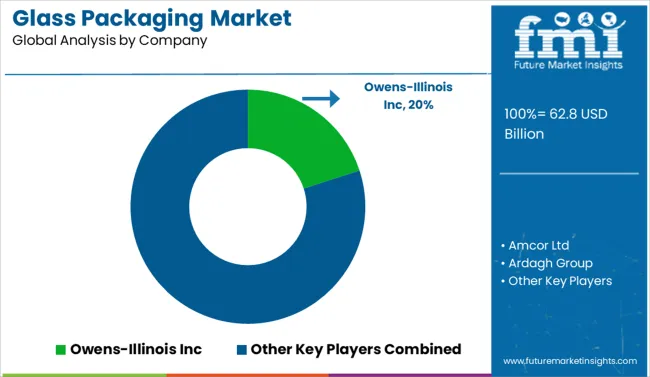

The glass packaging market is dominated by global packaging companies and regional specialists serving food, beverage, pharmaceutical, and cosmetic industries. Owens-Illinois Inc. holds a leading position with a strong portfolio of glass containers for alcoholic beverages and food segments, emphasizing lightweighting technologies to reduce material use and enhance sustainability.

Amcor Ltd offers innovative glass packaging solutions alongside its diversified packaging portfolio, catering to premium beverage and personal care markets. Ardagh Group specializes in high-end glass containers for beer, wine, and spirits, supported by extensive manufacturing networks across Europe and North America. Consol Specialty Glass (Pty) Limited targets niche segments with custom-designed glass solutions for specialty beverages and luxury products, while Gerresheimer AG is recognized for advanced pharmaceutical glass packaging solutions, ensuring stringent quality and safety standards.

Hindusthan National Glass & Industries Ltd serves a large share of the Indian market with competitive pricing and strong local distribution. Heinz-Glas GmbH and Stölzle-Oberglas GmbH lead in premium cosmetic glass packaging, focusing on aesthetics and decoration capabilities. Nihon Yamamura Glass Co Ltd. and Saint-Gobain S.A. leverage advanced technologies for durable and lightweight glass bottles for various consumer applications.

Competitive differentiation relies on innovation in lightweight glass, product design flexibility, and compliance with recyclability and quality standards. Strategic moves include capacity expansion, partnerships with beverage manufacturers, and development of value-added glass packaging for premium positioning.

On July 22, 2025, Ardagh Glass Packaging-Europe introduced its lightest wine bottle at 300g, designed for still wines. The ultra-lightweight 75cl glass bottle ensures high strength, compatibility with high-speed filling lines, and premium shelf appeal while significantly reducing material usage, aligning with evolving packaging design strategies in the glass sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 62.8 Billion |

| Product Type | Soda lime glass, Borosilicate, and De-alkalized soda lime glass |

| Application Type | Alcoholic Beverages, Beer, Food & Beverages, and Pharmaceuticals |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Owens-Illinois Inc, Amcor Ltd, Ardagh Group, Consol Specialty Glass (Pty) Limited, Gerresheimer AG, Hindusthan National Glass & Industries Ltd, Heinz-Glas GmbH, Nihon Yamamura Glass Co Ltd., Saint-Gobain S.A., and Stolzle-Oberglas GmbH |

The global glass packaging market is estimated to be valued at USD 62.8 billion in 2025.

The market size for the glass packaging market is projected to reach USD 97.5 billion by 2035.

The glass packaging market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in glass packaging market are soda lime glass, borosilicate and de-alkalized soda lime glass.

In terms of application type, alcoholic beverages segment to command 42.0% share in the glass packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drugs Glass Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Retail Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Retail Glass Packaging Industry Analysis in Europe and the Middle East and Africa - Size, Share, and Forecast 2025 to 2035

Market Share Distribution Among Retail Glass Packaging Companies

GCC Retail Glass Packaging Market Insights – Growth & Forecast 2023-2033

Europe Glass Prefilled Syringes and Glass Vials Packaging Equipment Market Analysis – Outlook & Forecast 2025–2035

Recycled Glass Packaging Market Trends & Growth Forecast 2024-2034

Market Share Breakdown of GCC Retail Glass Packaging Manufacturers

Pharmaceutical Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Pharmaceutical Glass Packaging Manufacturers

Glass Rolling Forming Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Liquor Bottle Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottles Market Forecast and Outlook 2025 to 2035

Glass Laser Engraving Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Restoration Kit Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottle and Container Market Forecast and Outlook 2025 to 2035

Glass Additive Market Forecast and Outlook 2025 to 2035

Glass Reactor Market Size and Share Forecast Outlook 2025 to 2035

Glass Cosmetic Bottle Market Size and Share Forecast Outlook 2025 to 2035

Glass & Metal Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA