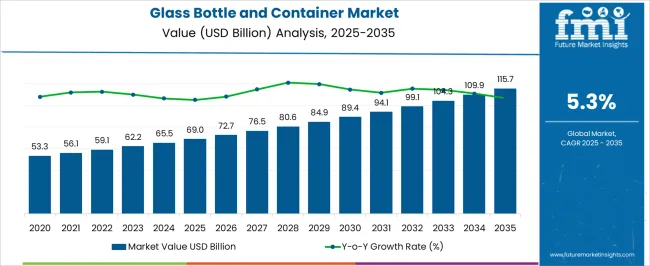

The Glass Bottle and Container Market is estimated to be valued at USD 69.0 billion in 2025 and is projected to reach USD 115.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

The glass bottle and container market is exhibiting steady expansion, supported by the increasing preference for sustainable and recyclable packaging solutions across multiple industries. Growing consumer awareness regarding environmental preservation and product purity has reinforced the demand for glass as a non-toxic, reusable, and chemically inert packaging material. The market benefits from rising adoption in food, beverage, and pharmaceutical applications due to superior barrier properties and aesthetic appeal.

Technological advancements in lightweighting and automated manufacturing have improved production efficiency and reduced transportation costs, further enhancing market competitiveness. Additionally, premiumization trends in beverages and personal care sectors are driving higher consumption of glass containers.

With expanding recycling infrastructure and government emphasis on eco-friendly packaging standards, the future outlook remains strong. Continuous innovation in design, along with expansion in developing regions, is expected to sustain the market’s positive trajectory over the forecast period.

| Metric | Value |

|---|---|

| Glass Bottle and Container Market Estimated Value in (2025 E) | USD 69.0 billion |

| Glass Bottle and Container Market Forecast Value in (2035 F) | USD 115.7 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

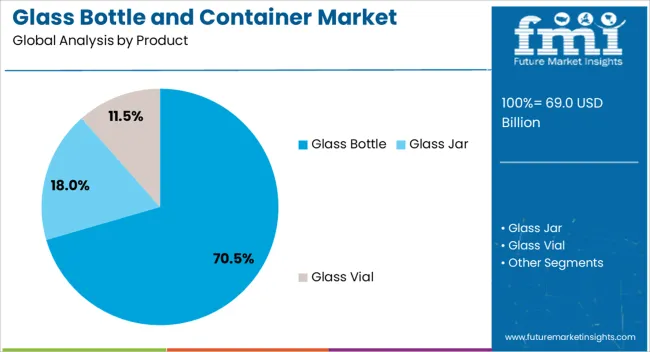

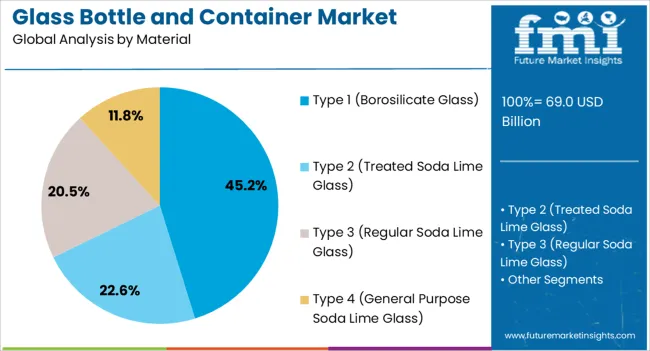

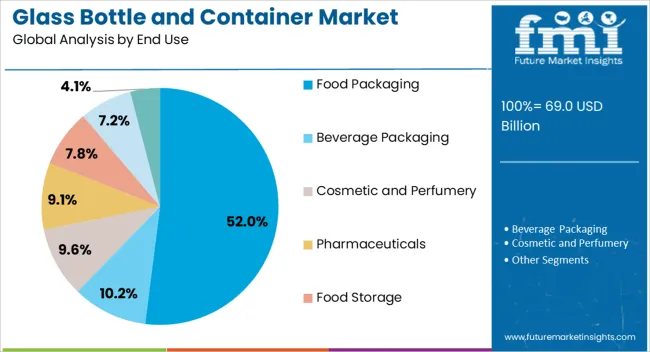

The market is segmented by Product, Material, and End Use and region. By Product, the market is divided into Glass Bottle, Glass Jar, Glass Vial, and Other Glass Bottles & Containers (Syringe, Ampoules, etc.). In terms of Material, the market is classified into Type 1 (Borosilicate Glass), Type 2 (Treated Soda Lime Glass), Type 3 (Regular Soda Lime Glass), and Type 4 (General Purpose Soda Lime Glass). Based on End Use, the market is segmented into Food Packaging, Beverage Packaging, Cosmetic and Perfumery, Pharmaceuticals, Food Storage, Candles and Fragrance, and Others (Home & Personal Care, Specialty, and Craft Products). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The glass bottle segment dominates the product category, accounting for approximately 70.5% share of the overall market. This leadership is attributed to its widespread application in beverages, food packaging, and pharmaceuticals, where product safety and preservation are critical.

Glass bottles offer superior resistance to contamination and maintain flavor integrity, which enhances their suitability for premium and health-focused product categories. The segment’s growth is reinforced by the increasing use of returnable and refillable bottle systems promoted by beverage manufacturers and sustainability-driven retailers.

Technological improvements in production efficiency and customization have further strengthened adoption. With expanding demand for recyclable packaging and the continued growth of high-end beverage segments, the glass bottle segment is expected to maintain its leading position in the global market.

The Type 1 (Borosilicate Glass) segment holds approximately 45.2% share within the material category, primarily due to its superior chemical resistance, thermal stability, and strength. This material is widely preferred in pharmaceutical and laboratory applications where product purity and temperature endurance are vital.

Its expanding use in food and beverage packaging, particularly for products requiring extended shelf life, further supports segmental growth. Manufacturers are increasingly leveraging borosilicate glass for premium packaging designs that enhance brand differentiation.

The material’s recyclability and long service life also align with sustainability objectives across industries. As demand for high-performance glass solutions rises globally, the Type 1 (Borosilicate Glass) segment is expected to sustain strong growth momentum in the coming years.

The food packaging segment leads the end-use category, holding approximately 52% share of the glass bottle and container market. Its dominance is supported by glass’s ability to preserve food quality without chemical leaching, maintaining freshness and nutritional integrity.

Rising consumer demand for clean-label and minimally processed food products has further accelerated glass adoption. The segment also benefits from expanding use in sauces, dairy, condiments, and ready-to-eat products, where transparency and product visibility are important marketing attributes.

Growing awareness of plastic waste and a shift toward eco-conscious packaging among major food brands have reinforced this trend. With increasing regulatory emphasis on recyclable materials, the food packaging segment is expected to remain the primary driver of demand in the global glass container market.

The glass bottle and container market is anticipated to surpass a valuation of USD 110,017.6 million by 2035, growing at a 5.3% CAGR. While the market is experiencing growth, several restraining factors can adversely affect its development and expansion.

| Top Material | Market Share in 2025 |

|---|---|

| Type 1 (Borosilicate Glass) | 45.2% |

The type I grade glass segment is anticipated to gain around 45.2% of the market share in 2025.

| Top Product | Market Share in 2025 |

|---|---|

| Glass Bottles | 70.5% |

Glass bottles dominate the glass bottle and container market, and it is envisioned to gain an incremental opportunity worth USD 14,277.7 million in the upcoming years.

The section analyzes the glass bottle and container market by country. The table presents the CAGRs for each country, indicating the expected market growth in that country through 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.9% |

| Canada | 4.7% |

| Brazil | 5.1% |

| Mexico | 4.2% |

| Germany | 4.5% |

| France | 5.6% |

| United Kingdom | 5.2% |

| China | 6.4% |

| India | 9.4% |

| Japan | 7.2% |

| GCC countries | 5.5% |

| South Africa | 5.1% |

India is the leading Asian country in the market, which is expected to expand at a CAGR of 9.4% during the forecast period.

Growing consumption of cosmetics in Germany is anticipated to offer an incremental opportunity of USD 2,176.3 million, expanding at a CAGR of 4.5% during the forecast years.

The United States is another country growing globally in the glass bottles and container market. The United States is expected to register a CAGR of 3.9% over the forecast period.

Japan is another Asian country leading the glass bottle and container market. The market in Japan is anticipated to register a CAGR of 7.2% through 2035.

China is another Asian country in the glass bottle and container market, which is anticipated to register a CAGR of 6.6% through 2035.

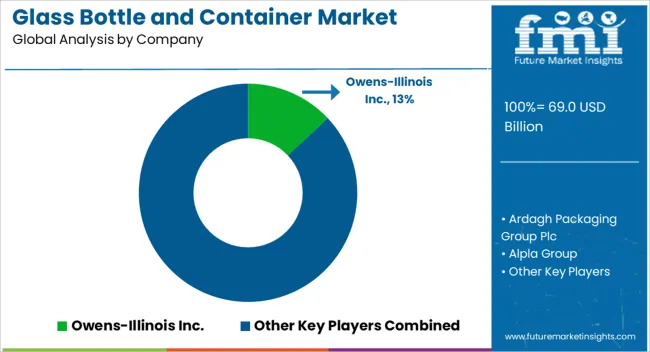

Manufacturing companies operating in the glass bottle and container market develop innovative designs catering to specific products or applications. Major players in the market are expanding their presence and manufacturing capabilities and moving towards adopting and offering sustainable solutions to customers. Companies are expanding by integrating with different forms and collaborating to develop designs and products.

Recent Developments

The global glass bottle and container market is estimated to be valued at USD 69.0 billion in 2025.

The market size for the glass bottle and container market is projected to reach USD 115.7 billion by 2035.

The glass bottle and container market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in glass bottle and container market are glass bottle, _sauce / syrup bottle, _french square bottle, _boston rounds bottle, _glass jug, _others (rio rounds, woozy bottles, pill packer etc.), glass jar, _mason jar, _hexagonal glass jar, _paragon glass jar, _straight sided jar, _others (facet jar, tempered round jar, etc.), glass vial, _food grade vial, _pharma grade vial and other glass bottles & containers (syringe, ampoules, etc.).

In terms of material, type 1 (borosilicate glass) segment to command 45.2% share in the glass bottle and container market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Glass Bottles And Containers Market Size and Share Forecast Outlook 2025 to 2035

Glass Additive Market Forecast and Outlook 2025 to 2035

Glass Reactor Market Size and Share Forecast Outlook 2025 to 2035

Glass & Metal Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Glass Product Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Market Size and Share Forecast Outlook 2025 to 2035

Glass Fibre Yarn Market Size and Share Forecast Outlook 2025 to 2035

Glass Cloth Electrical Insulation Tape Market Size and Share Forecast Outlook 2025 to 2035

Glass Bonding Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Glass Mat Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Glass Table Bacteria Tank Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Glass Mat Market Size and Share Forecast Outlook 2025 to 2035

Glassware Market Size and Share Forecast Outlook 2025 to 2035

Glass Prepreg Market Size and Share Forecast Outlook 2025 to 2035

Glass Reinforced Plastic (GRP) Piping Market Size and Share Forecast Outlook 2025 to 2035

Glass Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA