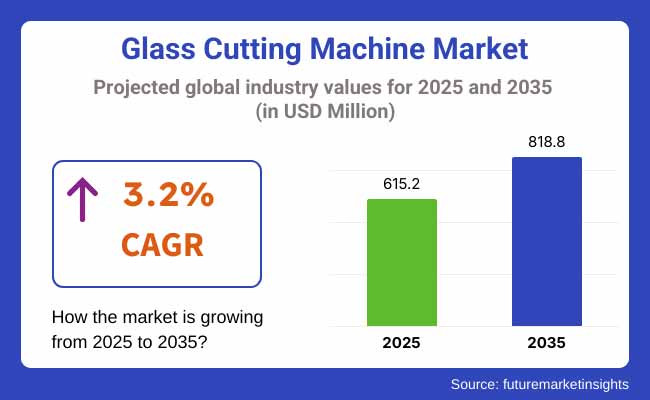

Glass cutting machine market is valued at USD 615.2 million in 2025 and is expected to reach USD 818.8 million by 2035, expanding at CAGR of 3.2% over the forecast period (2025 to 2035). In 2025, China represents the most lucrative country, driven by rapid urbanization and electronics manufacturing demand, while China also emerges as the fastest growing national market with an anticipated CAGR of 4.0% between 2025 and 2035.

The Asia Pacific region dominates the market, accounting for over 45% of global revenue in 2025, driven by infrastructure projects in China and India.

The market is witnessing a shift toward automation and digital integration, with AI-driven precision cutting and IoT-enabled monitoring reducing waste and improving accuracy. Growth is driven by demand from automotive OEMs for lightweight glass, construction firms prioritizing energy-efficient facades, and electronics manufacturers requiring ultra-thin glass solutions.

However, high upfront equipment costs and maintenance complexity constrain adoption among small and medium enterprises. Key trends include development of modular machine designs, enhanced material utilization techniques, and the emergence of waterjet and hybrid cutting methods to balance performance with environmental compliance.

Regulatory requirements and fluctuating raw material prices limit market expansion. In addition, service and maintenance offerings are emerging as revenue streams for machine manufacturers.

Looking ahead, between 2025 and 2035 the industry is expected to increasingly embrace smart manufacturing platforms featuring real-time analytics and predictive maintenance. Eco-conscious regulations will drive the adoption of power-efficient cutting processes and recyclable material handling.

Regional production in India and Southeast Asia is likely to expand as companies seek to mitigate supply chain risks and capitalize on lower labor costs. Furthermore, the integration of robotics and advanced sensor systems will enable fully automated glass-processing lines, positioning the market for accelerated innovation and sustainable growth through the next decade.

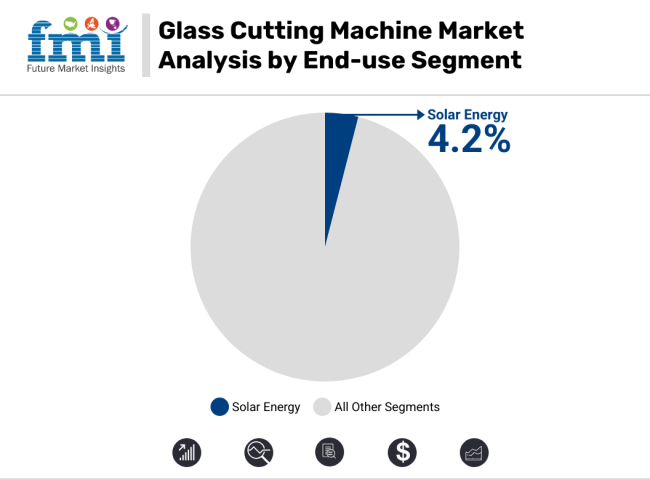

The solar energy sector is driving demand for precision-cut glass panels used in photovoltaic modules. As countries push renewable targets, glass-cutting machinery for ultra-thin, high-transparency glass is in high demand. Construction (for facades and smart windows), automotive (for windshields and HUDs), electronics (for displays and touchscreens), furniture, aerospace, and solar energy all compete for capacity-but solar leads on growth.

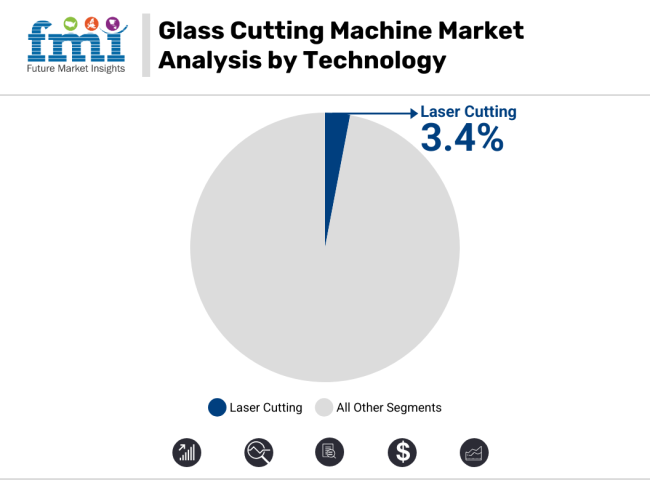

Laser cutting offers high-speed, intricate patterning with minimal edge chipping, making it ideal for architectural glass and specialty electronics. CNC-based systems remain the workhorse for bulk automotive and construction applications, while waterjet and hybrid cutting balance precision and thermal constraints. Yet laser cutting’s precision and automation compatibility drive the fastest uptake.

Future Market Insights conducted a comprehensive survey among key stakeholders of the glass-cutting industry, including manufacturers, suppliers and end-users. The findings of the survey disclosed that automation and digitalisation are the major seeking to improve efficiency and precision.

(Surveyed Q1 2024, n=500 stakeholder participants, including manufacturers, suppliers, construction firms, automotive OEMs, electronics manufacturers, and glass processing specialists across North America, Europe, and Asia-Pacific)

Regional Variance

High Variance in Adoption

ROI Perspectives

Consensus

Regional Variance

Shared Challenges

Regional Differences

Manufacturers

End-Users

Alignment

Divergence

High Consensus

Key Variances

| Countries/Region | Impact of Policies, Regulations, and Mandatory Certifications |

|---|---|

| India | Manufacturers adhere to stringent regulations and policies imposed by regulatory authorities to offer valuable products. The increasing integration of solar panels to promote renewable energy has led manufacturers to seek premium-quality glass materials, driving the glass-cutting machine industry in India. |

| European Union | Products must comply with the CE marking, indicating conformity with health, safety, and environmental protection standards. This certification is mandatory for products sold within the European Economic Area (EEA). |

| China | Manufacturers often obtain CE certification to ensure their products meet EU safety, health, and environmental protection requirements, facilitating exports to Europe. |

| Turkey | Companies like CMS Glass Machinery are officially certified by the Republic of Turkey Ministry of Industry and Technology, indicating compliance with national industry standards. |

| Global | ISO certifications provide a globally recognized framework for enhancing product quality, improving efficiency, and meeting customer expectations in glass manufacturing. |

The United States glass-cutting machine industry is projected to grow at a CAGR of around 3.5% during the forecasted period. The growing construction industry stressing energy-efficient buildings is expected to boost the demand for tempered glass, which will propel this growth.

The focus on safety and durability in the automotive sector is also driving the demand for glass-cutting machines. In addition, the industry growth is being further supported by improved production efficiencies resulting from technological advancements in the manufacturing process as well as automation.

FMI opines that the United States Glass-cutting machines sales will grow at nearly 3.5% CAGR through 2025 to 2035.

In the United Kingdom, the glass-cutting machine industry is projected to grow at a CAGR of approximately 2.8% during the forecast period. Demand for tempered glass is driven by the country’s focus on sustainable construction practices and green building initiatives.

A growing focus on safety standards in the automotive industry is also driving growth in the industry. Additionally, with an emphasis on technological innovation and automation in manufacturing processes, the country is expected to support the adoption of advanced glass-cutting machinery.

FMI opines that the United Kingdom Glass-cutting machine sales will grow at nearly 2.8% CAGR through 2025 to 2035.

The glass-cutting machine industry in France is expected to grow at a CAGR of around 2.7% during the period 2025 to 2035. This is due to the construction industry's growth in the country and the use of tempered glass in residential, and commercial buildings for aesthetic and safety reasons.

The steady growth of the automotive industry and the growing use of tempered glass in vehicles will act as industry catalysts. The growth of the industry can also be attributed to government initiatives that promote energy efficiency and sustainability.

FMI opines that France's Glass-cutting machine sales will grow at nearly 2.7% CAGR through 2025 to 2035.

The glass-cutting machine industry in Germany is projected to grow with around 3.0% CAGR during the forecast period. The strong automotive industry, which is known for maintaining high safety standards and quality, is also driving the tempered glass demand in the country.

Moreover, the emphasis on high-end manufacturing solutions and Industry 4.0 concepts by Germany further stimulates the demand for advanced glass-cutting equipment. The industry’s growth is further accelerated by the construction sector's focus on energy-efficient structures.

FMI opines that Germany’s Glass-cutting machine sales will grow at nearly 3.0% CAGR through 2025 to 2035.

The glass-cutting machine industry in Italy is expected to register a CAGR of around 2.6% over the period of 2025 to 2035. The demand for high-quality tempered glass meets the needs of construction and interior design applications in Italy's rich design and architecture tradition.

The sector’s growth is further supported by the revival of the automotive industry and expanding applications of tempered glass in different vehicle parts. Additionally, the Italian manufacturers' emphasis on the incorporation of advanced technologies into production processes further facilitates the adoption of contemporary glass-cutting machines.

FMI opines that Italy’s Glass-cutting machine sales will grow at nearly 2.6% CAGR through 2025 to 2035.

The glass-cutting machine industry in South Korea is anticipated to grow at a CAGR of around 3.3% during the period of projection. The strong electronics industry of the country that manufactures devices that contain tempered glass has been driving the industry.

The growth of the automotive industry and increasing focus on vehicle safety regulations also contribute to the demand for glass-cutting machines. In addition, the adoption of advanced equipment in the glass processing industry also benefits from South Korea's drive for technological innovation and emphasis on smart manufacturing practices.

FMI opines that South Korean glass-cutting machine sales will grow at nearly 3.3% CAGR through 2025 to 2035.

The glass-cutting machine industry in Japan is projected to grow at a CAGR of nearly 2.9% between 2025 and 2035. The industry’s growth is driven by the country's advanced automotive and electronics industries, both of which are substantial tempered glass consumers.

The Japanese emphasis on precision manufacturing and automation promotes the use of high-quality glass-cutting machines. In addition, the focus on earthquake-resistant buildings and energy-efficient buildings in the construction sector promotes the growth of tempered glass usage.

FMI opines that Japan Glass-cutting machine sales will grow at nearly 2.9% CAGR through 2025 to 2035.

The China glass-cutting machine industry is expected to register a strong CAGR of around 4.0% throughout the forecast period. The country's fast-paced urbanization and infrastructure growth have led to significant glass demand in the construction industry. With China being a giant car manufacturer, there is an increased demand for glass-cutting machinery.

That growth is also driven by the burgeoning consumer electronics industry, which manufactures products such as smartphones and tablets that use tempered glass. Advocating advanced manufacturing and automation are government initiatives aimed at enhancing this industry's attractiveness.

FMI opines that China’s Glass-cutting machine sales will grow at nearly 4.0% CAGR through 2025 to 2035.

The glass-cutting machine industry in Australia and New Zealand is expected to rise at a CAGR of 3.0%. The growing emphasis in the construction industry on modern and sustainable building practices is also increasing the demand for tempered glass.

Furthermore, the automotive industry focuses on safety, and the rising adoption of electronic vehicles, which implement tempered glass, accelerates the industry's growth. Moreover, the region's focus on implementing advanced manufacturing technologies enables the incorporation of advanced glass-cutting machines into waves of production.

FMI opines that Australia & NZ Glass-cutting machine sales will grow at nearly 3.0% CAGR through 2025 to 2035.

The glass-cutting equipment comes under the industrial machinery and equipment industry sector which is further driving its growth in the manufacturing and automation industry. This industry is heavily linked to macroeconomic elements like industrial development, construction, automotive manufacturing, renewable energy growth, and technology progress.

During the forecasted period, several international economic trends will play a major role in determining the glass-cutting machine industry. Growing infrastructure spending, urbanization, and smart city initiatives will boost demand for precise glass cutting in construction.

The growth of the automotive sector toward electric and autonomous cars will necessitate sophisticated glass solutions, accelerating industry expansion further. Furthermore, the swift growth of solar energy will demand large amounts of ultra-thin and high-transparency glass, so manufacturers will embrace automated and AI-based glass-cutting technology.

Global trade policies, tariffs, and supply chain dynamics will affect industry stability. Nations emphasizing domestic production and sustainability will have tighter regulations, promoting investment in energy-efficient glass processing technologies.

However, Inflation and fluctuations in raw material prices may affect the cost of production, but technological advancements will enhance efficiency and minimize waste. Asia-Pacific and the Middle East are among the emerging markets that will experience higher usage of sophisticated glass-cutting solutions, fueling the overall industry growth.

The glass-cutting machine industry holds robust growth prospects in the high-precision cutting of smart glass, foldable screens, and ultra-thin solar panels. Investors must invest in AI-based automation and laser cutting to fulfil the growing demand for complex and defect-free glass parts. The growing use of electrochromic and energy-efficient glass in buildings requires sophisticated cutting solutions that reduce material loss but improve precision.

Companies should set up local production bases in India and Southeast Asia to mitigate supply chain dislocation and de-risk dependence on China. Strategic partnerships with auto and electronics OEMs can tie up long-term deals, especially as EV makers look for lightweight, crash-resistant glass.

Governments are enforcing stricter sustainability regulations, which necessitate the adoption of energy-efficient cutting tools and investigation into recyclable glass processing. Predictive maintenance software should also be incorporated into companies in order to maximize machine uptime and efficiency. Growth in aftermarket services and retrofitting automation for vintage machines will create more revenue streams.

Major competitors in the glass-cutting machine industry are competing with technological innovation, strategic alliances, and internationalization. Firms are making significant investments in automation, AI-powered cutting systems, and laser accuracy technology to boost efficiency and cater to changing industry needs.

Developments in CNC-based machines, waterjet cutting, and energy-efficient processes are differentiators that enable companies to gain competitive advantages. Pricing approaches will differ, with high-precision, automated offerings from premium players and cost-conscious models for small-scale producers from mid-range and low-end players.

Strategic alliances in the form of mergers, acquisitions, and joint ventures enable companies to increase their industry coverage. Companies are also setting up regional manufacturing bases in Asia-Pacific and the Middle East to reduce supply chain risks, bring down production costs, and access emerging industry growth.

Growth in construction, automotive safety, smart glass, and solar energy adoption.

Construction, automotive, aviation, solar energy, electronics, and furniture.

It enhances precision, reduces waste, and speeds up production with AI and CNC technology.

High costs, regulatory compliance, raw material fluctuations, and skilled labour shortages.

Asia-Pacific leads, while North America and Europe focus on high-tech and sustainable solutions.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Application, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 16: Latin America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 22: Western Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 24: Western Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: Eastern Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 30: Eastern Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Application, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 40: East Asia Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 42: East Asia Market Volume (Units) Forecast by Application, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Units) Forecast by Application, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 9: Global Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 13: Global Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 16: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 17: Global Market Attractiveness by Application, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 27: North America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 31: North America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 34: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 35: North America Market Attractiveness by Application, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 45: Latin America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 53: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 63: Western Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 67: Western Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 117: East Asia Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 121: East Asia Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 125: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Glass Liquor Bottle Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottles Market Forecast and Outlook 2025 to 2035

Glass Restoration Kit Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottle and Container Market Forecast and Outlook 2025 to 2035

Glass Additive Market Forecast and Outlook 2025 to 2035

Glass Reactor Market Size and Share Forecast Outlook 2025 to 2035

Glass Cosmetic Bottle Market Size and Share Forecast Outlook 2025 to 2035

Glass & Metal Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Glass Product Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Market Size and Share Forecast Outlook 2025 to 2035

Glass Container Market Size and Share Forecast Outlook 2025 to 2035

Glass Fibre Yarn Market Size and Share Forecast Outlook 2025 to 2035

Glass Cloth Electrical Insulation Tape Market Size and Share Forecast Outlook 2025 to 2035

Glass Bonding Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Glass Mat Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Glass Table Bacteria Tank Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Glass Mat Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA