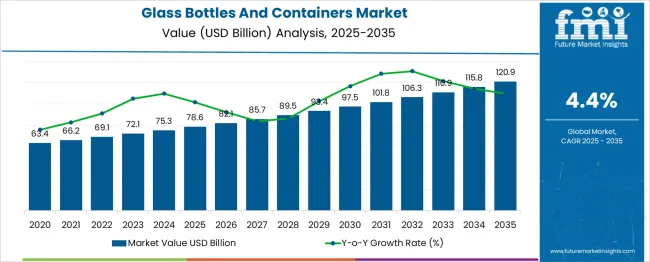

The glass bottles and containers market is estimated to be valued at USD 78.6 billion in 2025. It is projected to reach USD 120.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period. In 2025, the glass bottles and containers segment is positioned in the growth phase of its maturity curve, supported by expanding demand in beverages, pharmaceuticals, and cosmetics, coupled with brand preference for premium, recyclable packaging. The CAGR of 4.4% indicates steady but not rapid expansion, consistent with a category that is established but still finding incremental growth through niche applications and regional expansion. Between 2025 and 2030, growth will be driven primarily by replacement of single-use plastics, increased adoption in alcoholic beverages, and premiumization in cosmetic packaging. This period will reflect moderate acceleration as regulatory pressures and consumer preference for inert, safe materials sustain volume and value gains.

By 2030–2033, the curve is expected to flatten slightly, moving toward the mature stage, as core beverage and food applications approach saturation in developed markets. Growth will increasingly depend on innovation—lightweighting to reduce logistics costs, embossing and decoration for brand differentiation, and integration of QR codes or smart packaging features. In the 2033–2035 window, the category will likely stabilize in a late-growth / early maturity position, with steady replacement demand dominating, but emerging markets in Asia-Pacific, Africa, and parts of Latin America still offering above-average growth pockets.

| Metric | Value |

|---|---|

| Glass Bottles And Containers Market Estimated Value in (2025 E) | USD 78.6 billion |

| Glass Bottles And Containers Market Forecast Value in (2035 F) | USD 120.9 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The glass bottles and containers market is experiencing consistent growth, primarily driven by increased demand for sustainable and recyclable packaging across food, beverage, pharmaceutical, and personal care sectors. The heightened environmental awareness among consumers and regulatory pressure on single-use plastics have accelerated the transition toward glass packaging solutions. Glass has been favored for its chemical inertness, premium appeal, and ability to preserve product integrity without leaching harmful substances.

Technological improvements in lightweight glass production and energy-efficient manufacturing have further supported the expansion of the market. In addition, the rising demand for premium packaging, particularly in alcoholic beverages, cosmetics, and gourmet food products, has contributed to broader adoption. Growth has also been sustained by investments in automated glass molding and filling technologies, improving throughput and cost-efficiency for manufacturers.

The ongoing trend of health-conscious consumption and preference for non-reactive packaging continues to reinforce glass as a trusted material. This combination of sustainability, consumer preference, and regulatory alignment is expected to sustain market momentum in the years ahead.

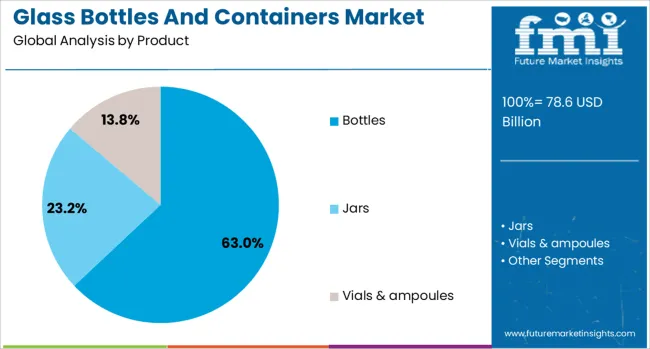

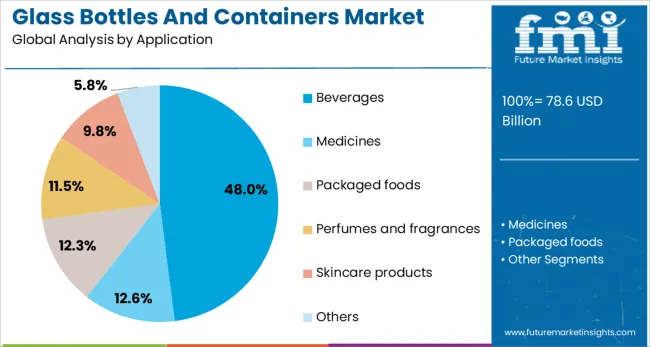

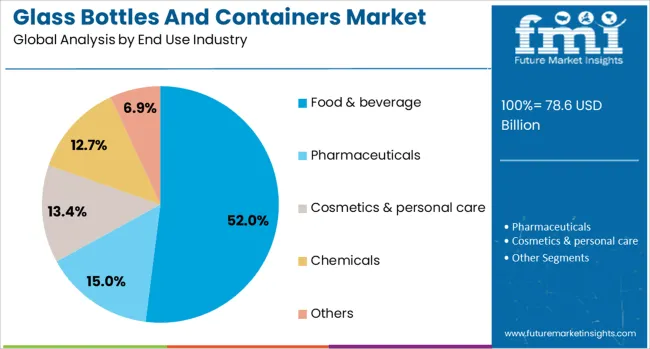

The glass bottles and containers market is segmented by product, application, end use industry, and geographic regions. The glass bottles and containers market is divided into Bottles, Jars, and vials and ampoules. The glass bottles and containers market is classified into Beverages, Medicines, Packaged foods, Perfumes and fragrances, Skincare products, and Others. Based on end-use industry, the glass bottles and containers market is segmented into Food & beverage, Pharmaceuticals, Cosmetics & personal care, Chemicals, and Others. Regionally, the glass bottles and containers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The bottles segment is projected to account for 63% of the Glass Bottles And Containers market revenue in 2025, making it the dominant product category. This leadership has been influenced by the segment’s widespread utility across food, beverage, and healthcare applications. Bottles have been favored for their ability to offer product visibility, safe containment, and extended shelf life.

The segment has grown due to increasing demand for both standard and premium packaging in water, alcoholic beverages, sauces, and pharmaceutical liquids. The recyclability and reusability of glass bottles have resonated with sustainability-focused consumers, enhancing their preference over alternative materials. Additionally, bottles have been used extensively in refillable packaging systems, which are being adopted by both retailers and brands aiming to reduce plastic waste.

Their compatibility with automated bottling lines and consistent quality control has supported high-volume commercial use. As industries continue to emphasize eco-friendly packaging, the bottle format is expected to maintain its prominence across a wide spectrum of end-use categories..

The beverages segment is anticipated to hold 48% of the Glass Bottles And Containers market revenue in 2025, establishing it as the leading application area. This segment’s dominance has been supported by the growing global consumption of both alcoholic and non-alcoholic drinks packaged in glass due to their perceived purity and product quality preservation. Glass containers have been increasingly used in premium beverage packaging, where aesthetics, taste preservation, and branding are critical.

The trend of healthy and organic beverage consumption has also encouraged manufacturers to use glass, which does not alter the composition or flavor of the liquid. Moreover, the rising demand for craft beverages and artisanal drinks has contributed to this segment’s sustained expansion.

Beverage companies have recognized the branding advantage of glass packaging, leading to its preference in marketing and retail strategies. As the beverage industry continues to evolve with premiumization and sustainability as core drivers, the role of glass in this segment is projected to remain significant..

The food and beverage segment is expected to capture 52% of the Glass Bottles And Containers market revenue in 2025, positioning it as the most prominent end-use industry. This growth has been attributed to the widespread use of glass packaging in sauces, condiments, dairy products, ready-to-eat meals, and all categories of beverages. Food safety concerns and consumer demand for packaging that maintains product freshness without chemical interaction have driven the adoption of glass in this sector.

In addition, the transparency of glass allows consumers to assess product quality visually, fostering trust and enhancing purchase appeal. The rise in premium and organic food product lines has further increased the demand for glass containers, which align with clean-label marketing.

Furthermore, glass has been widely accepted in foodservice and retail channels due to its recyclability and compatibility with deposit return systems. The commitment of global food and beverage brands to achieve sustainability goals by reducing plastic use has also played a critical role in the segment’s leading market position..

The global demand for glass bottles and containers has been driven by non-reactive packaging needs, with widespread deployment across food, beverages, pharmaceuticals, and cosmetics. Adoption rates have grown due to inertness, clarity, and recyclability features preferred over plastic or metal alternatives. Segment expansion has been concentrated in premium beverage packaging and refillable applications. Asia Pacific led unit shipments, followed by Europe, while niche growth was observed in Latin America’s pharmaceutical use cases. Innovations in lightweighting and embossing have improved brand differentiation.

Glass packaging in beverages has been scaled up, with premium product positioning being supported through embossed branding and specialty tints. Refillable glass bottles have gained 21 % more retail penetration in urban and high-income clusters. In the carbonated and alcoholic drinks segments, nearly 44 % of unit packaging was reported as glass in 2024, with large brewers shifting away from PET and metal formats. Reuse programs have raised bottle return rates, reducing lifecycle cost by up to 18 % over two refilling cycles. Brands now offer incentive programs tied to collection, aligning product image with cleaner environmental messaging. Glass containers are also being preferred for temperature stability and inertness under pasteurization conditions.

Glass packaging has encountered limitations due to weight, breakage risk, and volumetric inefficiencies during transit. Average freight cost per unit has remained 27 % higher than plastic, limiting deployment in remote or low-margin distribution zones. Retail breakage rates have reached 4 % in long-haul inland deliveries for food-grade glass bottles, compelling distributors to restrict shipment stacking height. Foam and cardboard inserts have been used, adding 8 % to the average packaging cost. Retailers in South Asia and Africa have resisted full transitions due to loading issues and in-store handling losses. Despite recyclability, the additional cost of dedicated glass collection and washing infrastructure has lowered uptake among small producers.

High growth has been tracked in small-volume glass bottle formats under 200 ml, primarily for high-value segments like cosmeceuticals, essential oils, and nutraceutical syrups. This category grew by 14 % YoY in 2024, driven by online direct-to-consumer packaging strategies. Glass has offered UV protection, chemical stability, and tactile premium cues, improving consumer perception in the skincare and wellness sectors. Amber and cobalt glass variants have increased adoption for antioxidant preservation, with up to 19 % of glass bottle output in China now dedicated to health and beauty SKUs. Compact bottle formats have supported single-dose and dropper-based packaging. Closure innovation, including anti-counterfeit features, has expanded brand security in this sector.

Manufacturers have invested in lightweighting to reduce glass-to-product ratios while maintaining bottle strength. Average mass reduction of 12 % has been achieved in wine and juice bottle formats since 2021. Advanced IS machines and dual-gob configurations have enabled faster production cycles, improving throughput by 17 % in high-volume plants. AI-based defect detection and mold calibration tools are now present in 41 % of European glass bottle plants. Supply chains have adopted synchronized hot-end and cold-end inspection systems, reducing reject rates. A shift toward narrow neck press-and-blow technology has increased usage in precision pharmaceutical packaging. Automation has allowed hybrid batch manufacturing for shorter production runs without major tool changes.

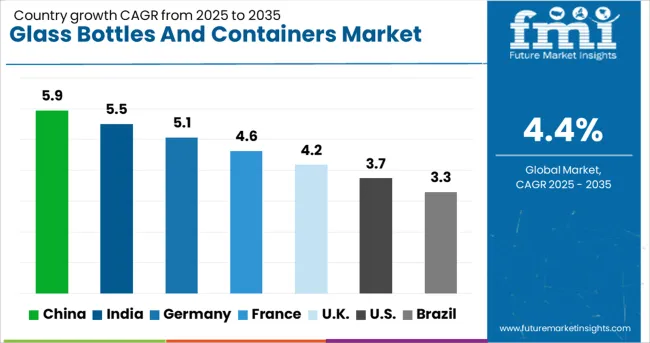

| Country | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

| USA | 3.7% |

| Brazil | 3.3% |

The global glass bottles and containers market is expanding at a CAGR of 4.4% from 2025 to 2035. China leads with 5.9%, growing 34% faster than the global average, supported by increased beverage production and demand for recyclable packaging. India, at 5.5%, exceeds the global CAGR by 25%, aided by a rising shift toward glass alternatives in personal care and food sectors. Germany follows at 5.1%, about 16% above the global average, with investments in pharmaceutical-grade glass driving growth. The UK grows at 4.2%, slightly underperforming the global average by 4.5%, while the US trails at 3.7%, falling behind by 15.9%. The report covers a detailed analysis of 40+ countries, with the top countries shared as a reference.

China has remained one of the most active producers and exporters of glass bottles and containers, driven by sustained demand across food, beverage, and pharmaceutical sectors. The domestic glass industry has benefited from access to cost-effective raw materials such as silica sand and soda ash, which support volume manufacturing. Glass packaging solutions are being increasingly adopted by regional beverage companies aiming to position products as premium through aesthetic shelf appeal. Innovations in lightweight container design have allowed producers to minimize logistics costs, which is a major driver for expansion in interprovincial supply chains. Rising export orders from Southeast Asia and Latin America have reinforced long-term production planning among Tier 1 Chinese manufacturers.

India has been witnessing an uptick in domestic consumption of glass packaging across food condiments, cosmetics, and home care product segments. The shift toward non-reactive and inert packaging has contributed to the gradual replacement of certain plastic containers with glass variants. Regional bottlers have diversified their offerings with unique embossing and surface finishes to meet demand from small-batch beverage startups. Supply-side activity has been bolstered by increased furnace capacity additions, especially in western India. While cost competitiveness remains essential, producers are placing growing emphasis on improving turnaround cycles through batch change flexibility and localized mold production.

Germany has positioned itself as a high-quality glass container market, where precision manufacturing standards and returnable bottle systems are deeply integrated into supply networks. Regulatory preferences for reusable glass formats in dairy and beer segments have supported steady demand. Automation across forming, annealing, and inspection phases is being prioritized to reduce defect rates and improve energy efficiency. Germany-based producers have been leading the adoption of hybrid furnaces that blend hydrogen and electric power, aligning with national emissions directives. OEMs are exploring partnerships with circular packaging platforms to extend the lifecycle of glass containers through closed-loop systems.

In the United Kingdom, glass bottles and containers are seeing increased traction in artisanal food and beverage sectors, where shelf differentiation and product integrity are key drivers. Growth in microbreweries, flavored spirits, and cold-pressed juices has helped support domestic demand, especially for small-batch custom packaging. While manufacturing volume remains relatively modest, firms are investing in short-run production facilities to cater to seasonal and brand-specific campaigns. Glass imports from mainland Europe continue to supplement domestic needs, particularly for pharmaceutical and lab-use formats. Adoption of single-trip containers has grown within foodservice contracts due to traceability requirements and glass's chemical inertness.

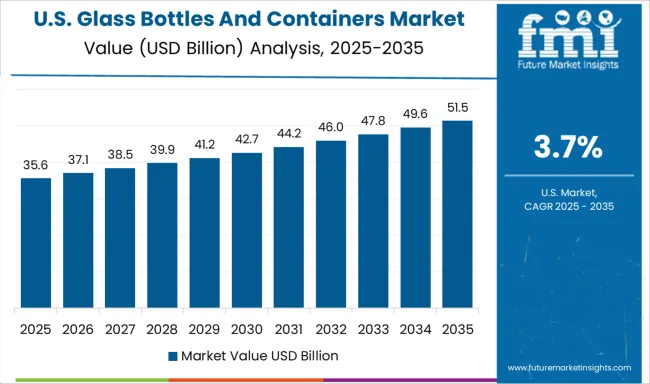

The United States has seen steady demand for glass packaging, supported by consistent beverage consumption patterns, particularly in wine, spirits, and craft soda markets. Regulatory shifts at the state level promoting container deposit systems have reinforced regional reuse and recycling loops, creating stable demand for durable container designs. Advanced forming technologies, such as narrow neck press-and-blow systems, are being scaled to increase throughput without compromising structural integrity. Imports from Mexico and Canada remain critical for certain specialty glass types, but USA manufacturers are investing in furnace upgrades to reduce gas dependence. Demand for tamper-evident and embossed formats has also grown among wellness beverage brands.

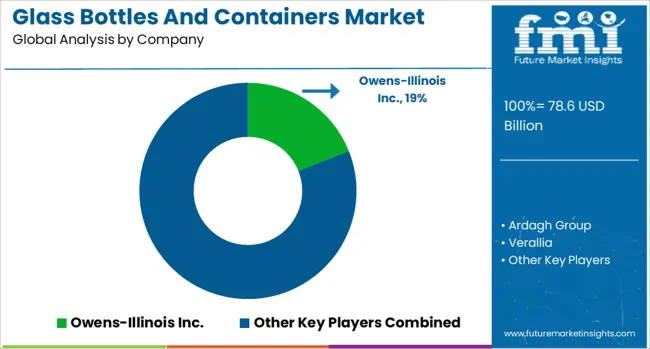

The competitive landscape for glass bottles and containers is shaped by a mix of multinational manufacturers and regionally dominant producers, each leveraging scale, product diversification, and strategic expansion to strengthen their positions. Owens-Illinois Inc. remains one of the most prominent players, with a strong global footprint supported by extensive manufacturing capacity and innovation in lightweight glass designs to enhance cost efficiency. Ardagh Group has established a broad market reach across food, beverage, and pharmaceutical packaging, focusing on sustainability-oriented production processes and premium bottle aesthetics to cater to brand-conscious clients.

Verallia continues to expand its influence through investments in advanced furnace technology and increased customization capabilities, targeting high-value wine and spirits segments. Vidrala, with a solid presence in Europe, maintains competitive pricing while prioritizing energy-efficient production, strengthening relationships with regional beverage companies. Piramal Glass commands a strong position in Asia and select international markets, particularly in cosmetics, pharmaceuticals, and specialty food packaging, benefiting from its diverse product mix and competitive export pricing.

| Item | Value |

|---|---|

| Quantitative Units | USD 78.6 Billion |

| Product | Bottles, Jars, and Vials & ampoules |

| Application | Beverages, Medicines, Packaged foods, Perfumes and fragrances, Skincare products, and Others |

| End Use Industry | Food & beverage, Pharmaceuticals, Cosmetics & personal care, Chemicals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Owens-Illinois Inc., Ardagh Group, Verallia, Vidrala, and Piramal Glass |

| Additional Attributes | Dollar sales by container type (bottles, jars, specialty) and application (beverage, food, pharmaceuticals, cosmetics), demand dynamics across beverage packaging, premium FMCG, and pharma vials, regional trends led by Asia‑Pacific with North America catching up, innovation in lightweight glass, antimicrobial coatings, and recyclable/sustainable closed‑loop systems, and environmental impact via reduced plastic use, enhanced recyclability, and support for circular economy initiatives. |

The global glass bottles and containers market is estimated to be valued at USD 78.6 billion in 2025.

The market size for the glass bottles and containers market is projected to reach USD 120.9 billion by 2035.

The glass bottles and containers market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in glass bottles and containers market are bottles, jars and vials & ampoules.

In terms of application, beverages segment to command 48.0% share in the glass bottles and containers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Glass Rolling Forming Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Liquor Bottle Market Size and Share Forecast Outlook 2025 to 2035

Glass Laser Engraving Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Restoration Kit Market Size and Share Forecast Outlook 2025 to 2035

Glass Additive Market Forecast and Outlook 2025 to 2035

Glass Reactor Market Size and Share Forecast Outlook 2025 to 2035

Glass Cosmetic Bottle Market Size and Share Forecast Outlook 2025 to 2035

Glass & Metal Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Glass Product Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Market Size and Share Forecast Outlook 2025 to 2035

Glass Container Market Size and Share Forecast Outlook 2025 to 2035

Glass Fibre Yarn Market Size and Share Forecast Outlook 2025 to 2035

Glass Cloth Electrical Insulation Tape Market Size and Share Forecast Outlook 2025 to 2035

Glass Bonding Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Glass Mat Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Glass Table Bacteria Tank Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Glass Mat Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA