The Glass Liquor Bottle market is witnessing steady growth driven by the increasing demand for premium alcoholic beverages and the rising focus on sustainable packaging solutions. The future outlook for this market is shaped by innovations in manufacturing processes that enhance product quality, durability, and aesthetic appeal. Consumers are increasingly preferring glass bottles due to their recyclability, inert properties, and ability to preserve flavor and aroma, which supports the expansion of the market.

Additionally, growing consumer awareness about environmental sustainability has encouraged the adoption of glass over alternative packaging materials. The market is further supported by rising investments in the alcoholic beverage industry, with producers seeking to differentiate their products through distinctive packaging and branding strategies.

The demand for various bottle sizes to cater to different consumption patterns also fuels market growth As premiumization trends continue and regulatory frameworks favor sustainable packaging, the Glass Liquor Bottle market is expected to maintain steady growth, particularly in regions with a high consumption of spirits and a focus on environmental responsibility.

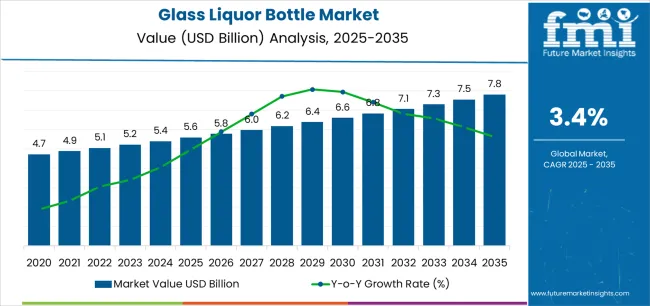

| Metric | Value |

|---|---|

| Glass Liquor Bottle Market Estimated Value in (2025 E) | USD 5.6 billion |

| Glass Liquor Bottle Market Forecast Value in (2035 F) | USD 7.8 billion |

| Forecast CAGR (2025 to 2035) | 3.4% |

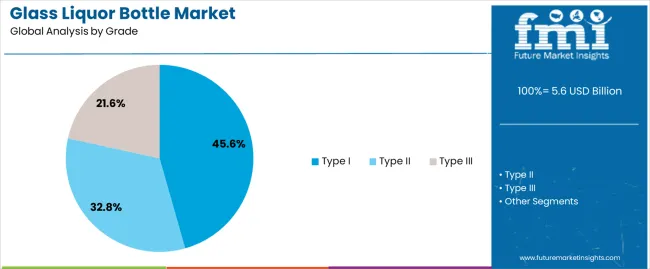

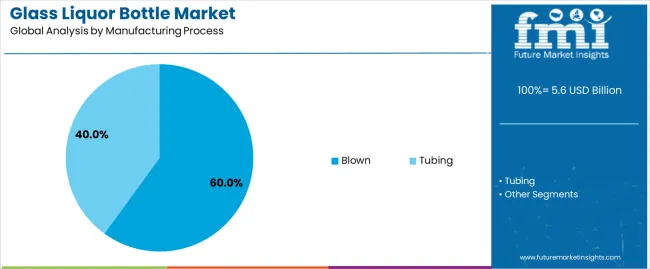

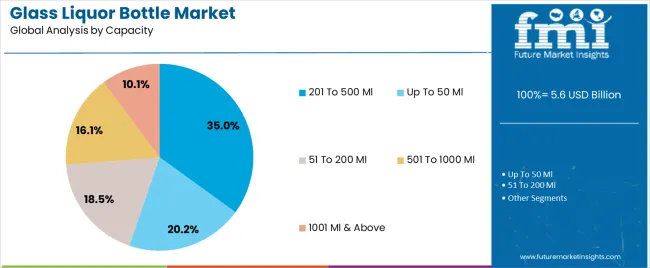

The market is segmented by Grade, Manufacturing Process, Capacity, and End Use and region. By Grade, the market is divided into Type I, Type II, and Type III. In terms of Manufacturing Process, the market is classified into Blown and Tubing. Based on Capacity, the market is segmented into 201 To 500 Ml, Up To 50 Ml, 51 To 200 Ml, 501 To 1000 Ml, and 1001 Ml & Above. By End Use, the market is divided into Beer, Wine, Spirits, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Type I grade segment is projected to hold 45.60% of the Glass Liquor Bottle market revenue share in 2025, establishing it as the leading grade. This segment has been driven by the superior chemical resistance and durability of Type I glass, making it ideal for high-quality liquor storage. The segment has benefited from the ability to preserve the taste, aroma, and color of beverages over extended periods, which is critical for premium spirits.

Additionally, regulatory standards and industry guidelines favor Type I glass for alcoholic products, reinforcing its widespread adoption. The growth of the segment is further supported by increasing consumer demand for premium and collectible bottles, as well as the trend toward sustainable and reusable packaging solutions.

Manufacturers are increasingly investing in Type I glass production to meet these market demands, enhancing its availability and cost-effectiveness The combination of functional benefits, compliance advantages, and premium appeal ensures that the Type I grade segment remains dominant in the market.

The blown manufacturing process segment is expected to capture 60.00% of the Glass Liquor Bottle market revenue share in 2025, making it the leading manufacturing process. The growth of this segment is driven by the flexibility and precision offered by the blown glass technique, which allows for customized shapes, designs, and sizes. The process ensures uniform wall thickness and high structural integrity, critical for maintaining the quality and safety of alcoholic beverages.

Moreover, the adaptability of blown glass production supports aesthetic innovations that enhance brand identity and consumer appeal. Increasing demand for visually distinctive packaging in the premium liquor market has accelerated the adoption of blown glass bottles.

The process also facilitates scalable production, meeting the needs of both large-scale commercial producers and smaller artisanal brands The continued emphasis on design differentiation, quality preservation, and regulatory compliance underpins the dominance of the blown manufacturing process in the Glass Liquor Bottle market.

The 201 to 500 Ml capacity segment is anticipated to account for 35.00% of the Glass Liquor Bottle market revenue in 2025, positioning it as the leading capacity range. The growth of this segment is influenced by consumer preference for convenient and moderate serving sizes, which are suitable for personal consumption, gifting, and sampling purposes.

This capacity range allows manufacturers to target a broad audience by offering products that balance affordability with premium quality. Additionally, these bottles are easier to handle, store, and transport, which supports supply chain efficiency and retail distribution.

The segment has also benefited from marketing trends that emphasize portion control, portability, and premium packaging for smaller bottle sizes The combination of consumer convenience, operational efficiency, and premium presentation ensures that the 201 to 500 Ml capacity segment maintains a strong share of the Glass Liquor Bottle market.

The below table presents the expected CAGR for the global glass liquor bottle market over several semi-annual periods spanning from 2025 to 2035. First half (H1) from 2025 to 2035, the sector is seen to have growth of CAGR 3.2%, followed by surging numbers of 3.6% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 3.2% (2025 to 2035) |

| H2 | 3.6% (2025 to 2035) |

| H1 | 3.3% (2025 to 2035) |

| H2 | 3.8% (2025 to 2035) |

In the next decade though, the first half maintains a steady CAGR of 3.3%. The second half of 2025 to 2035, however, sees a CAGR of 3.8%.

Sustainability and Environmental Accountability to Shape the Future of this Industry

This industry's future is being shaped by the growing emphasis on environmental accountability and sustainability. Customers want packaging that fits their values as they grow more environmentally concerned. In an effort to minimize raw material consumption and carbon emissions, brands are allocating funds in creation of environmentally friendly glass bottles, with a focus on lightweight models. There is a growing tendency towards using recycled glass, known as cullet, in the production circle, which further enriches the sustainability profile of glass bottles.

Innovations in Bottle Design and Collaborations with Artists to Augment Growth

Brands are scouring distinctive and innovative bottle designs to distinguish their products on shop racks and build a strong graphic identity. This includes the use of custom forms, detailed embossing, and creative labels that enhance the prevailing aesthetic charm of the product.

Advances in digital printing technology are also leading to better and more dynamic designs, making bottles not just containers but critical aspects of the brand experience. Limited-edition bottles and affiliations with artists are also becoming widespread, adding a collectible element to the packaging.

Manufacturing Process and Sourcing of Raw Materials to Raise Concerns

While glass is recyclable and regarded as more sustainable than plastic, the manufacturing procedure itself has a consequential carbon footprint. The technique of thawing raw materials and creating glass bottles mandates elevated temperatures, which lead to considerable emissions of greenhouse gases.

The extraction and conveyance of raw materials including silica sand, soda ash, and limestone contribute to environmental deterioration. These facets have ushered increasing scrutiny from environmental bodies and increased regulatory forces, which can inhibit market growth.

The glass liquor bottle industry size was tipped to be USD 4.7 billion in 2020. Throughout the recorded course, the industry developed at a CAGR of 2.5%, attaining a size of USD 5.6 billion in 2025.

Several governments imposed bans on public gatherings during the initial pandemic-phase. This LED to the closures of pubs, hotels, restaurants, etc. The demand for these bottles plunged as the on premise consumption segment tightened sharply.

As the pandemic advanced and governments started to acclimate to the latest reality, the glass liquor bottle industry underwent a stretch of comeback. With the easing of lockdown efforts and the incremental reopening of hospitality sectors, the demand for alcoholic beverages commenced to pick up. There was also a striking transition towards off-premise consumption, with more consumers buying liquor for residential consumption.

The rise of e-commerce and direct-to-consumer sales channels furnished unexplored prospects for brands to attain consumers, further bolstering demand for glass bottles. Manufacturers adapted by improving their supply chain stability and executing strict health and safety standards to guarantee continued production.

As of now, companies are concentrating on innovation, sustainability, and digital modification to steer these challenges and capitalize on emerging possibilities.

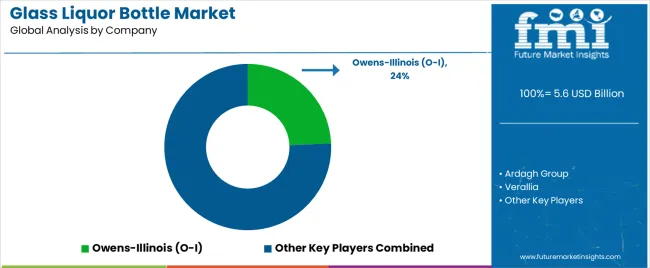

Tier one firms like Owens-Illinois (O-I), Ardagh Group, and Verallia are leveraging their comprehensive resources and market presence to propel invention and sustainability in the glass liquor bottle market. These companies are investing in Avant technologies to diminish energy consumption and CO2 emissions.

Some of them are also concentrating on feather-weight glass bottles, which lessen raw material use and lower transport expenses.

Tier two organizations like Vidrala, AGI Glaspac, and Nihon Yamamura Glass are making their mark by specializing in niche markets and proposing tailored solutions to their customers. These companies are also known for their emphatic emphasis on customer assistance and flexibility, delivering customized bottle designs that cater to the explicit requirements of craft distilleries and premium brands.

They are augmenting their presence in emerging markets, such as India, by funding new manufacturing establishments and embracing cutting-edge technologies to enhance production efficiency.

Tier three parties like Consol Glass, Piramal Glass, and Wiegand-Glas are focusing on skill and provincial powers to cut out their position in the market. Consol Glass is a leading supplier in Africa, leveraging its provincial expertise to cater to local needs and foster sustainable approaches within the continent. These companies are enhancing their competitive advantage through acquisitions and mergers.

The following section offers insights into leading segment. Type II is the preferred grade. Beer manufacturers, on the other hand, continue to reign at the top when it comes to the end users.

Glass liquor bottles are often classified on the basis of grade. Grade I, II, and III are some of the popular ones. Among these, the grade II holds a majority share of 45.6%.

| Segment | Grade II (Grade) |

|---|---|

| Value Share (2025) | 45.6% |

Quality and cost-effectiveness are the two main reasons why businesses are picking grade II glass in the manufacturing of liquor bottles. Bottles made from this glass is also clearer. Consumers like to see the inner contents, and this glass types makes it happen. The demand is also due to their durability.

This grade of glass is also UV-proof, meaning that it does not react easily. This preserves the flavor and quality of the liquor. Artisanal and craft beer manufacturers are some of the largest consumers of these bottles. These bottles are often perceived as an affordable yet premium packaging solution.

Glass liquor bottles are used in a wide spectrum of industries such as beer, wine, spirits, ciders, etc. These bottles are increasingly being used in beer manufacturing, which hold a market share of 39.2%, as of 2025.

| Segment | Beer (End User) |

|---|---|

| Value Share (2025) | 39.2% |

Beer manufacturers are one of the largest consumers of these bottles. These distilleries prefer packaging solutions that preserve beer quality as well as flavor. Their demand is also due to the excellent barrier properties. These bottles are well known for their protection from external oxygen and light, something that plastic and metal bottles find difficulty in.

The expansion of craft beer industry in countries like India, China, and the United States is also one of the main reason for this. These bottles also give a premium feel to the consumers. Amid the sustainability tendencies in the packaging industry, glass bottles are going to gain prominence in the coming future.

Consumers are acquainted with relishing their favourite alcoholic booze in glass bottles. In the American province, the United States is one of the most lucrative markets for this industry. Asian nations like India, and China, are also leading the charts when it comes to the glass liquor bottle industry. Among the European countries, it can be figured that the United Kingdom made it one of the most thriving markets in the world.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 2.9% |

| United Kingdom | 2.4% |

| France | 2.6% |

| India | 4.9% |

| China | 4.4% |

The industry in India is projected to progress at a CAGR of 4.9% throughout the forecast period.

The rise of the middle class are compelling higher consumption of superior alcoholic drinks in the country. These drinks are usually packaged in glass bottles to improve their perceived worth. This has generated an outstanding demand for these bottles in the urban parts of India.

The glass liquor bottle market in India is also developing due to the country’s emphasis on sustainability. This also encourages the usage of glass over plastic, as glass is totally recyclable. Consumers in India are also preferring glass as it has a lower environmental influence.

The expanding grid of contemporary retail outlets and e-commerce outlets is making premium and imported spirits more affordable to customers, further stimulating the need for glass liquor bottles.

The sector is set to register a CAGR of 4.4% over the forecast period in China, making it a highly lucrative country.

The demand for orthodox spirits like ‘baijiu’, which is commonly packaged in decorated glass bottles contributes to market expansion in China. Severe environmental decrees and government guidelines striving to diminish plastic debris are also prompting the adoption of glass packaging. Innovations in glass bottle design and manufacturing, coupled with assertive marketing tactics by leading brands, are further propelling the market in China.

In China, the growth of the glass liquor bottle market is also fueled by the burgeoning need for premium and extravagant alcoholic drinks, driven by a growing wealthy population and a cultural transition towards higher-quality products.

The United States industry is poised to progress at a CAGR of 2.9% over the forecast period.

Consumers in the United States are fond of high-quality, artisanal products. Glass bottles are, thus, preferred for their aesthetic charm. They are also in demand due to their capability to hold the taste of the contents. The growing focus on sustainability and eco-friendly packaging solutions is another consequential factor, as glass is perceived as a better sustainable alternative compared to plastic.

The glass liquor bottle market in the United States is also encountering augmentation due to the rising tendency of craft spirits and premiumization. Improvements in glass manufacturing technologies are making glass bottles more cost-effective. This has made them attractive to both manufacturers and customers in the United States.

In the glass liquor bottle industry, the competition is very cut-throat. International companies have tie-ups with leading alcoholic beverage producers. Tier two companies, on the other hand, serve to craft liquor manufacturers. Industry-giants like Owens-Illinois (O-I), Ardagh Group, Verallia, Vidrala, AGI Glaspac, etc., have a strong consumer base. Their worldwide reach and focus on sustainable solutions have helped them attract a substantial clientele. These brands also collaborate with artists to curate limited-edition bottles and containers to lure consumers.

Some companies are also into the business of recycling used glass liquor bottles. This trend of upcycling has influenced this industry in a positive manner.

Key Industrial Developments

By grade, the market is divided into Type I, Type II, and Type III glass bottles.

In terms of manufacturing process, the market includes blown and tubing methods.

When segmented by capacity, the categories are up to 50 ml, 51 to 200 ml, 201 to 500 ml, 501 to 1000 ml, and 1001 ml & above.

By end use, the market is categorized into beer, wine, spirits, and others (including ciders and flavored alcoholic beverages).

The sector has been analyzed with the following regions covered: North America, Latin America, Europe, South Asia & Pacific, East Asia, and the Middle East and Africa.

The global glass liquor bottle market is estimated to be valued at USD 5.6 billion in 2025.

The market size for the glass liquor bottle market is projected to reach USD 7.8 billion by 2035.

The glass liquor bottle market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in glass liquor bottle market are type i, type ii and type iii.

In terms of manufacturing process, blown segment to command 60.0% share in the glass liquor bottle market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Glass Bottles Market Forecast and Outlook 2025 to 2035

Glass Bottle and Container Market Forecast and Outlook 2025 to 2035

Glass Bottles And Containers Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Glass Bottles Market Share

Glass Cosmetic Bottle Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Glass Cosmetic Bottles

Glass Medicine Bottles Market

Returnable Glass Bottle Market Trends – Size & Forecast 2024-2034

Boston Round Glass Bottle Market Size and Share Forecast Outlook 2025 to 2035

Demand for Glass Cosmetic Bottles in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Glass Cosmetic Bottles in USA Size and Share Forecast Outlook 2025 to 2035

Premium Spirits Glass Bottle Market Size and Share Forecast Outlook 2025 to 2035

Glass Rolling Forming Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Laser Engraving Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Restoration Kit Market Size and Share Forecast Outlook 2025 to 2035

Glass Additive Market Forecast and Outlook 2025 to 2035

Glass Reactor Market Size and Share Forecast Outlook 2025 to 2035

Glass & Metal Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Glass Product Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA