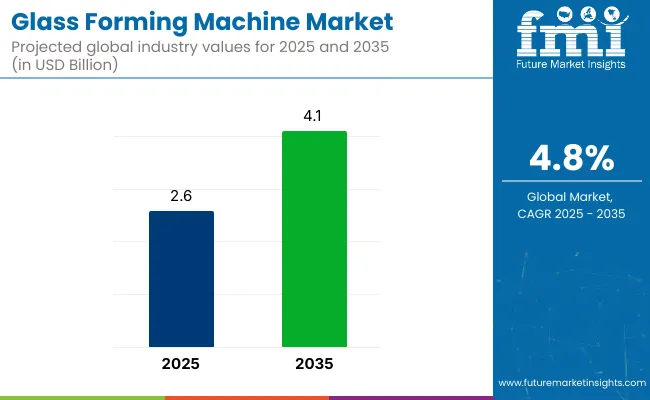

The global glass forming machine market is valued at USD 2.6 billion in 2025 and is slated to be worth USD 4.1 billion by 2035, reflecting a CAGR of 4.8%. Growth is anticipated due to rising demand for sustainable glass packaging in food, beverage, and pharmaceutical sectors, as well as increasing automation across glass manufacturing lines.

Additionally, the integration of Industry 4.0 technologies like AI, IoT, and predictive maintenance has significantly enhanced forming accuracy, reduced downtime, and improved energy efficiency, further reinforcing market momentum through 2035.

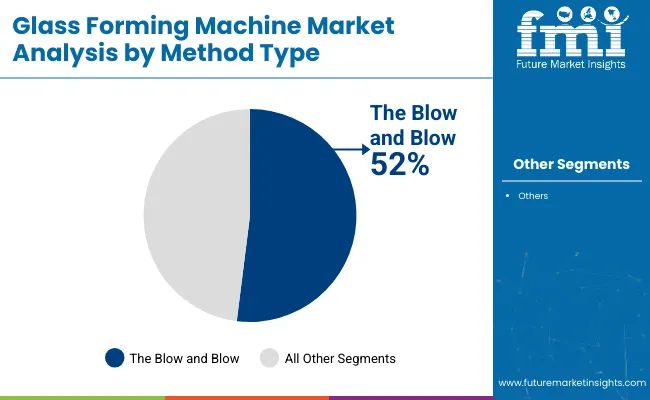

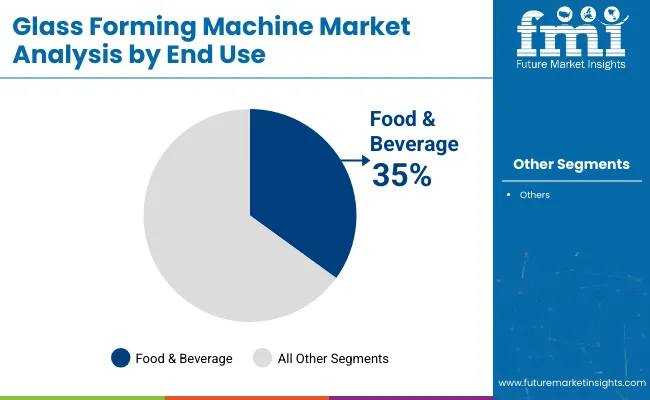

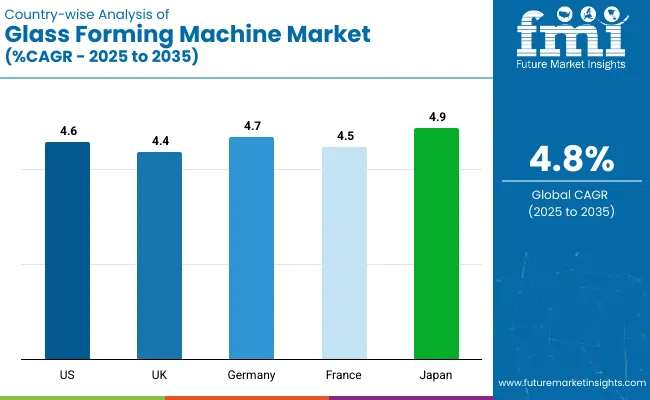

North America accounted for the largest share in 2025, supported by automation investments and strict sustainability mandates, with the USA growing at a CAGR of 4.6%. Meanwhile, Japan is anticipated to register the fastest growth with a CAGR of 4.9% closely followed by Germany with 4.7% CAGR. By method type, the Blow and Blow segment held a prominent market share of 52% in 2025. Meanwhile, the food and beverage sector remained the top contributor among end users due to the rising shift away from plastic packaging in developed economies, accounting for a share of 35%.

Heye International and Bottero S.P.A. have recorded robust gains through their investment in AI-integrated high-speed forming machines. Conversely, small and medium manufacturers in emerging economies continue to face financial constraints due to high capital and maintenance costs and slow adoption rates. Companies operating in regions with volatile raw material pricing and weak infrastructure, such as parts of Africa and Latin America, have reported sluggish returns, despite growing demand.

Looking ahead, the market is expected to witness notable innovation in sustainable manufacturing. Companies are actively developing electric and hybrid glass forming machines to reduce their carbon footprints. Integration of digital twins and cloud-based diagnostics is also being scaled. Countries such as Japan and Germany are leading in smart glass technologies and R&D efforts aimed at producing lightweight, shatterproof, and recyclable glass. These trends are likely to define the next growth phase of the glass forming machine market through 2035.

The global glass forming machine market is segmented based on method type, end use and region. By method type, it is segmented as blow and blow method and press and blow method, by end use it includes healthcare, chemical, food & beverages, laboratories, and others (which includes cosmetics, industrial, and household glassware), and by region North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and Middle East & Africa.

The blow and blow method is expected to retain dominance with 52% of the market share in 2025, largely due to its effectiveness in manufacturing premium glass bottles for beverages, cosmetics, and pharmaceuticals. The method’s precision and strength make it ideal for high-value packaging, especially in developed markets.

Food & beverages will lead the end-use segment with approximately 35% market share in 2025. Glass packaging demand is rising sharply due to the global shift from plastics to recyclable materials, especially for sauces, beverages, and dairy products. The growing popularity of artisanal and small-batch products has further accelerated the need for aesthetically appealing and durable glass containers.

Recent Trends in the Glass Forming Machine Market

Key Challenges Facing the Glass Forming Machine Market

The glass forming machine sales in the USA is anticipated to grow at a CAGR of 4.6% from 2025 to 2035, driven by surging demand in the food, beverage, and pharmaceutical packaging sectors. Automation and AI integration in forming machines have seen widespread adoption, reducing waste and improving throughput. Regulatory emphasis on energy efficiency and sustainability is pushing manufacturers to upgrade existing systems with cleaner, smarter technologies.

The glass forming machine market revenue in the UK is projected to expand at a CAGR of 4.4% during the forecast period, propelled by the country’s robust packaging sector and increasing demand for sustainable glass solutions. Premium liquor and high-end food brands are opting for custom glass containers, boosting machine demand. Additionally, investments in eco-friendly production technologies are growing, spurred by stringent UK environmental mandates.

The glass forming machine sales in Germany is forecasted to witness a CAGR of 4.7% between 2025 and 2035, anchored by its leadership in industrial automation and sustainable engineering. Advanced R&D, especially in smart manufacturing, is fostering the development of efficient and adaptive glass forming systems. Germany’s automotive and construction sectors are also key demand contributors for durable and lightweight glass applications.

The glass forming machine market in France is expected to register a CAGR of 4.5% from 2025 to 2035, supported by a shift toward recyclable packaging and high-performance architectural glass. With rising consumer awareness and government regulations phasing out plastics, glass manufacturers are investing in modern forming equipment. France is also witnessing the adoption of forming technologies in the pharmaceutical and cosmetic industries.

The glass forming machine sales in Japan is poised to grow at a CAGR of 4.9% through 2035, led by its world-class electronics and automotive sectors. Demand for ultra-thin, high-strength, and smart glass has spurred innovation in forming machines. Government sustainability policies and rapid deployment of robotics in manufacturing continue to enhance operational precision and energy efficiency across the glass forming industry.

The glass forming machine market is moderately consolidated, with top-tier companies like Bucher Emhart Glass, Bottero S.p.A., and Heye International commanding substantial global market share. These firms are actively competing on the fronts of precision engineering, automation capabilities, energy efficiency, and AI-driven monitoring technologies. In contrast, regional players such as China Glass Machinery and Tianjin Jingpeng are focusing on cost-effective solutions and expanding presence in emerging economies like India, Brazil, and Southeast Asia.

Strategic priorities across the industry include smart manufacturing integration, digitization of forming lines, sustainability-focused retrofits, and turnkey automation services. Leading companies are increasingly entering technology partnerships and regional joint ventures to scale up local production, enhance service capabilities, and adhere to tightening energy and emission regulations.

For example, Bottero S.p.A has been investing in fully automated forming machines with AI-based control systems, while BDF Industries has strengthened its product range through strategic alliances and energy-efficient machine upgrades.

Recent Glass Forming Machine Market News

In June 2024, Bucher Emhart Glass announced its upgrade to IFS Cloud software across 13 international sites, aiming to drive efficiency, process automation, and predictive maintenance as part of its servitization strategy.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.6 billion |

| Projected Market Size (2035) | USD 4.1 billion |

| CAGR (2025 to 2035) | 4.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in Units |

| By Method Type | Blow and Blow Method, Press and Blow Method |

| By End Use | Health Care, Chemical, Food & Beverages, Laboratories, Others (cosmetics, industrial, household) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Bucher Emhart Glass, Bottero S.p.A, Heye International, Sklostroj, BDF Industries, China Glass Machinery, Kanger Glass Technologies, Tianjin Jingpeng, Horn Glass Industries, and Olivotto Glass Technologies |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

In terms of Structure Type, the industry is divided into Blow and Blow Method, Press and Blow Method

In terms of End Use, the industry is divided into Health Care, Chemical, Food & Beverages, Laboratories, Others

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The market is valued at USD 2.6 billion in 2025.

The market is forecasted to reach USD 4.1 billion by 2035, reflecting a CAGR of 4.8%.

The blow and blow method is expected to lead with 52% of the market share in 2025.

The food & beverage segment is anticipated to hold a 35% market share in 2025.

Japan is expected to be the fastest-growing country with a CAGR of 4.9% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Glass Rolling Forming Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Cutting Machine Market Size, Growth, and Forecast 2025 to 2035

Industry Share & Competitive Positioning in Roll Forming Machines

Roll Forming Machine Market by Type from 2024 to 2034

Thermoforming Machines Market Trends - Demand & Forecast 2025 to 2035

Glass Laser Engraving Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Powder Forming Machine Market Forecast and Outlook 2025 to 2035

Double Decker Roll Forming Machine Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Double Decker Roll Forming Machine Market Share

Semi-Auto Egg Tart Forming Machine Market

Automatic Thermoforming Vacuum Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Glass Liquor Bottle Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottles Market Forecast and Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Glass Restoration Kit Market Size and Share Forecast Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottle and Container Market Forecast and Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Glass Additive Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA