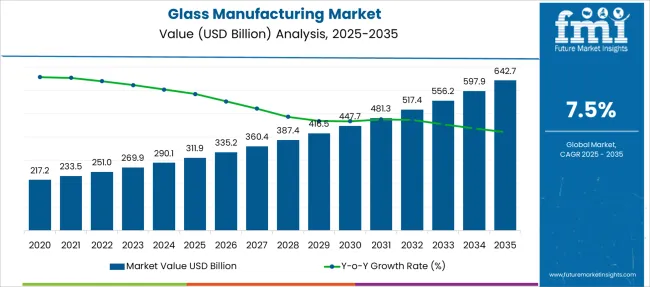

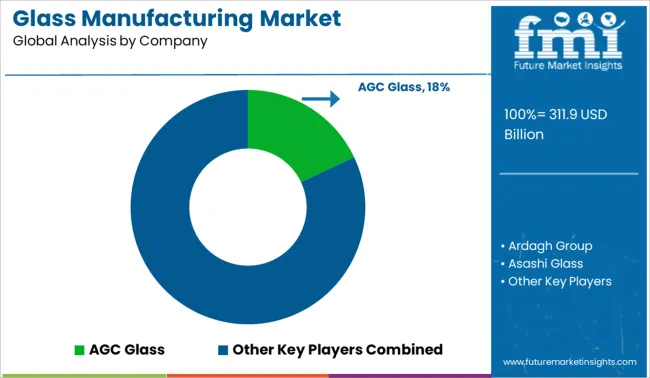

The Glass Manufacturing Market is estimated to be valued at USD 311.9 billion in 2025 and is projected to reach USD 642.7 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

| Metric | Value |

|---|---|

| Glass Manufacturing Market Estimated Value in (2025 E) | USD 311.9 billion |

| Glass Manufacturing Market Forecast Value in (2035 F) | USD 642.7 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The glass manufacturing market is experiencing sustained growth as industries prioritize energy efficiency, aesthetic appeal, and environmental sustainability. Rising urbanization and infrastructural investments have intensified demand across construction, automotive, and solar applications, creating a favorable environment for advanced glass solutions.

The shift toward energy-efficient buildings and renewable energy integration has further amplified the market’s relevance, with manufacturers innovating in coatings, strength, and recyclability to meet evolving standards. Future growth is anticipated to be supported by technological advancements in production processes, regulatory pushes for green construction, and increased adoption of glass in interior design and automotive safety features.

Collaborative efforts between architects, engineers, and manufacturers are paving the way for innovative applications and wider acceptance of premium glass products..

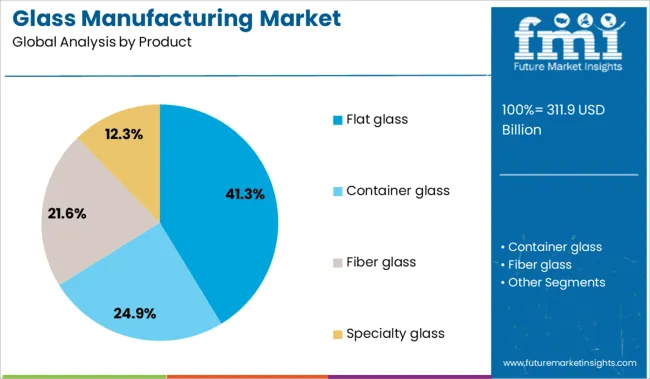

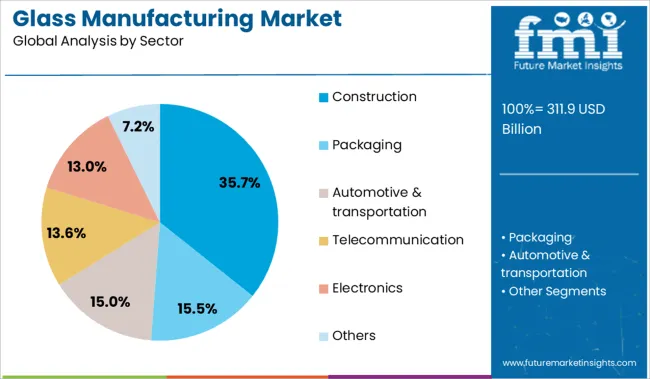

The market is segmented by Product and Sector and region. By Product, the market is divided into Flat glass, Container glass, Fiber glass, and Specialty glass. In terms of Sector, the market is classified into Construction, Packaging, Automotive & transportation, Telecommunication, Electronics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product, flat glass is projected to hold 41.30% of the total market revenue in 2025, establishing itself as the dominant product category. This leadership has been reinforced by its versatility in applications such as windows, facades, and interior partitions, which align with growing construction and refurbishment activities.

Its ability to incorporate advanced coatings and treatments for thermal insulation, soundproofing, and UV protection has significantly enhanced its appeal among developers and architects. Manufacturing efficiency and scalability of flat glass production lines have also contributed to its widespread adoption, allowing consistent quality at competitive costs.

Additionally, increasing consumer preference for daylight utilization and transparent designs in modern buildings has bolstered the segment’s prominence, ensuring its continued dominance in the overall product landscape..

Segmenting by sector shows that construction is expected to capture 35.70% of the glass manufacturing market revenue in 2025, making it the leading sector. This dominance has been driven by rapid urban development, infrastructural investments, and heightened emphasis on green building certifications that prioritize natural light and energy efficiency.

Demand from both residential and commercial projects has encouraged adoption of advanced glass solutions that enhance aesthetics while meeting regulatory and environmental standards. Glass has become integral to modern architectural designs, offering flexibility, durability, and performance attributes that align with sustainable construction practices.

Furthermore, increasing adoption of double-glazing and smart glass technologies in buildings has reinforced the construction sector’s leadership, with continued investments and innovation ensuring its strong position in the market..

Demand for glass manufacturing is expanding as energy-efficient glazing, solar applications, and lightweight packaging reshape production priorities. Sales of flat glass, container glass, and specialty formats are surging across construction, automotive, and pharmaceutical sectors. Automation, batch optimization, and fuel substitution are redefining profitability in the global glass value chain.

Demand for glass manufacturing in the construction sector grew 19% YoY in 2025, led by commercial buildings adopting low-emissivity (low-E) and triple-glazed units. Developers in Germany, the USA, and UAE integrated solar-control laminated panels into high-rise façades, reducing HVAC load by up to 28%. Vacuum-insulated glass gained traction in retrofits across Nordic countries, extending building envelope performance without structural overhaul. Sales of tempered and coated architectural glass surged as curtain wall suppliers standardized modular formats. Furnace scheduling for architectural glass lines improved by 22%, as plants synchronized coating and annealing phases to fulfill short-lead custom orders in metro markets.

Sales of specialty glass products rose 24% in 2025 due to sharp demand in electric vehicles and parenteral drug packaging. EV makers in China and Europe switched to chemically strengthened windshield and roof glass to reduce shattering risk and meet weight targets. Hollow-glass sensor covers also scaled with ADAS integration. Meanwhile, injectable drug manufacturers ramped up demand for borosilicate vials and prefilled syringes. Conversion to Type I glass containers reduced contamination events by 32%, prompting regulatory fast-tracking in India and Brazil. Glass tube manufacturers increased lehr throughput by 17% through hybrid furnaces, enabling quicker format switching and consistent melt quality.

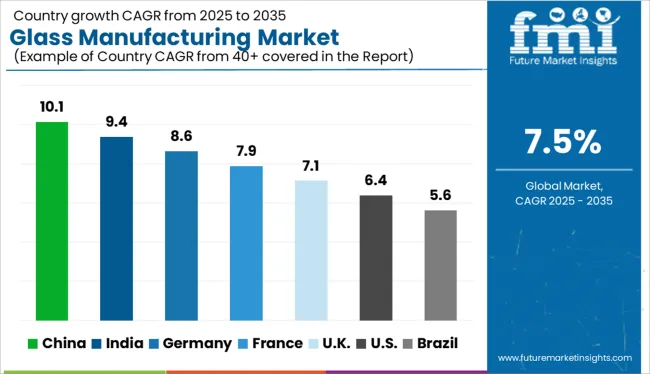

| Country | CAGR |

|---|---|

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

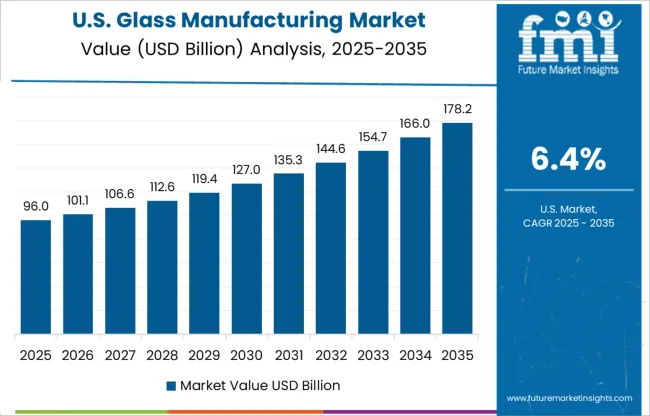

| USA | 6.4% |

| Brazil | 5.6% |

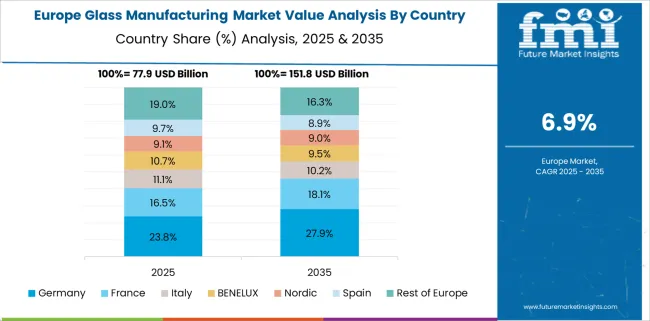

The global glass manufacturing market is anticipated to grow at a CAGR of 7.5% between 2025 and 2035. Among BRICS economies, China leads with a CAGR of 10.1%, driven by rapid construction, solar PV expansion, and industrial capacity upgrades. India follows at 9.4%, supported by urban infrastructure projects and increasing demand from automotive and consumer electronics sectors. In the OECD bloc, Germany is progressing at 8.6%, benefitting from energy-efficient glass demand and investments in advanced float lines. The UK is tracking slightly below the global average at 7.1%, influenced by a strong architectural glass segment. The USA lags at 6.4%, as domestic capacity expansion is slower and import dependence remains in some categories. While ASEAN is not detailed here, regional output is rising with Vietnam and Thailand strengthening their float glass export capabilities, particularly toward Asia-Pacific and Middle East construction hubs. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

Glass manufacturing in China is forecasted to expand at a robust CAGR of 10.1% from 2025 to 2035. While demand between 2020 and 2024 was led by construction and consumer electronics, the next decade will experience a major shift driven by solar energy infrastructure and electric vehicle applications. Sales of glass manufacturing products are expected to grow rapidly in industrial hubs like Guangdong and Jiangsu, where smart factory models are being widely adopted. Innovation in ultra-clear and solar-optimized glass is positioning China as a global supply leader.

The market in India is projected to grow at a CAGR of 9.4% through 2035. During 2020–2024, growth was primarily fueled by urban real estate, automotive glass, and container packaging. In contrast, the 2025–2035 decade will see rising demand for solar control glass and high-performance architectural glazing. Glass manufacturing capacity is expanding in Gujarat and Telangana to meet rising domestic and export needs. Demand for glass manufacturing is increasingly being influenced by green building codes and digital fabrication methods.

Germany is set to register a CAGR of 8.6% from 2025 to 2035 in the market. From 2020 to 2024, the sector was sustained by demand in precision optics and pharmaceutical vials. Looking ahead, the transition to net-zero buildings and advances in lightweight automotive glazing will reshape the landscape. Demand for glass manufacturing will surge in Bavaria and Baden-Württemberg due to high-end manufacturing and sustainability targets. Germany’s industry is further supported by energy recovery technologies and stringent quality norms.

The United Kingdom is expected to witness a CAGR of 7.1% in glass manufacturing between 2025 and 2035. While the 2020–2024 period focused heavily on flat glass for renovations and double-glazing upgrades, the next decade will be characterized by demand for energy-efficient and decorative glass in retail, hospitality, and high-rise construction. Sales of glass manufacturing products will also rise due to domestic sourcing preferences post-Brexit. Sustainability policies will push adoption of glass recycling and hybrid fuel furnaces.

The USA market is projected to grow at a CAGR of 6.4% between 2025 and 2035. During 2020–2024, the market was dominated by container glass and tempered safety products. Moving forward, a key trend will be the rising demand for smart glass and electrochromic panels in corporate and residential real estate. Demand for glass manufacturing is also being influenced by infrastructure modernization and Buy American procurement policies. Investment is growing in digitized furnaces and recyclable input materials.

Demand for glass manufacturing solutions in 2025 is expanding due to sustained growth in construction, automotive, and pharmaceutical packaging. AGC Glass leads the market with a prominent share, supported by extensive architectural and automotive product lines. Saint-Gobain, Guardian Glass, and Asahi Glass continue to compete closely, particularly in float and solar glass segments. Corning Inc. dominates high-tech and specialty glass, fueled by strong electronics demand. In packaging glass, Ardagh Group and Vetropack Holding SA are increasing production volumes across Europe and North America. Schott AG remains pivotal in pharmaceutical glass tubing and vials. Companies like Stoelzle Glass Group and Virdala are leveraging customized glass solutions to win contracts in premium packaging and tableware categories, reinforcing momentum in value-added segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 311.9 Billion |

| Product | Flat glass, Container glass, Fiber glass, and Specialty glass |

| Sector | Construction, Packaging, Automotive & transportation, Telecommunication, Electronics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AGC Glass, Ardagh Group, Asashi Glass, Corning Inc, Guardian Glass, Saint Gobain, Schott AG, Stoelzle Glass Group, Vetropack Holding SA, and Virdala |

| Additional Attributes | Dollar sales by glass type and end-use industry, demand dynamics across construction and automotive sectors, regional trends in float and container glass production, innovation in low-emissivity coatings and smart glass technologies, environmental impact of furnace emissions and recycling efficiency, and emerging use cases in solar panels and energy-efficient glazing systems. |

The global glass manufacturing market is estimated to be valued at USD 311.9 billion in 2025.

The market size for the glass manufacturing market is projected to reach USD 642.7 billion by 2035.

The glass manufacturing market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in glass manufacturing market are flat glass, container glass, fiber glass and specialty glass.

In terms of sector, construction segment to command 35.7% share in the glass manufacturing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Glass Bottles Market Forecast and Outlook 2025 to 2035

Glass Laser Engraving Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Restoration Kit Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottle and Container Market Forecast and Outlook 2025 to 2035

Glass Additive Market Forecast and Outlook 2025 to 2035

Glass Reactor Market Size and Share Forecast Outlook 2025 to 2035

Glass Cosmetic Bottle Market Size and Share Forecast Outlook 2025 to 2035

Glass & Metal Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Glass Product Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Market Size and Share Forecast Outlook 2025 to 2035

Glass Container Market Size and Share Forecast Outlook 2025 to 2035

Glass Fibre Yarn Market Size and Share Forecast Outlook 2025 to 2035

Glass Cloth Electrical Insulation Tape Market Size and Share Forecast Outlook 2025 to 2035

Glass Bonding Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Glass Mat Thermoplastic Market Size and Share Forecast Outlook 2025 to 2035

Glass Table Bacteria Tank Market Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Glassine Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Glass Mat Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA