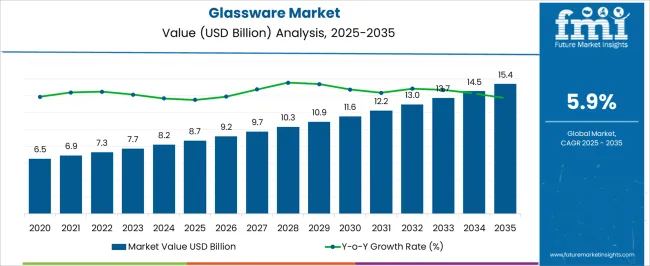

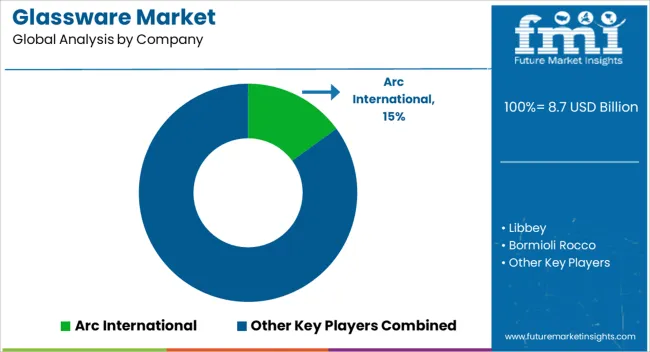

The glassware market is estimated to be valued at USD 8.7 billion in 2025 and is projected to reach USD 15.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

This growth is largely attributed to increasing consumer preference for high-quality, aesthetically appealing glass products, especially in the hospitality and retail sectors. The rising demand for premium glassware, such as decorative and functional pieces, has further fueled this market expansion. The glassware industry is benefiting from trends such as the growing popularity of home décor, luxury dining experiences, and the use of glass in diverse applications across various industries.

From 2025 to 2035, the market will exhibit consistent growth, with yearly gains pushing the market from USD 9.2 billion in 2026 to USD 15.4 billion by 2035. The increasing adoption of glass for sustainable packaging solutions and the expanding use of glass products in the food and beverage industry will continue to boost market value. As consumers opt for durable, reusable products over single-use plastics, the glassware segment stands to benefit from this shift in consumer mindset. Over the forecast period, higher disposable incomes and the growing presence of e-commerce platforms will further accelerate the demand for high-end glass products globally.

| Metric | Value |

|---|---|

| Glassware Market Estimated Value in (2025 E) | USD 8.7 billion |

| Glassware Market Forecast Value in (2035 F) | USD 15.4 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The glassware market holds a noteworthy share across several parent markets. Within the household goods market, it represents around 4-5%, driven by the constant demand for glassware in everyday home use, including drinking glasses, vases, and decorative items. In the packaging market, the glassware segment contributes about 7-8%, as glass is widely used for premium packaging in industries like beverages, cosmetics, and pharmaceuticals due to its aesthetic appeal and recyclability. In the home decor market, glassware accounts for approximately 6-7%, as consumers often choose decorative glass items for interior design purposes, such as glass vases, sculptures, and candle holders.

In the hospitality and food service market, glassware makes up around 10-12%, being a critical component for bars, restaurants, and hotels, which require a wide range of glass products for serving drinks and meals. Lastly, in the luxury goods market, glassware holds about 3-4%, particularly high-end glassware items like crystal glasses and limited-edition pieces sought after by collectors and luxury buyers. The steady demand across these markets reflects the versatility, appeal, and enduring popularity of glassware in both functional and decorative applications.

The glassware market is experiencing steady expansion as demand for functional and aesthetically appealing glass products continues to rise across households, hospitality, and commercial settings. Growth has been influenced by increasing consumer preference for durable, recyclable, and safe materials, alongside evolving lifestyle trends that emphasize premium dining and presentation experiences. Manufacturers are increasingly adopting advanced forming techniques and automated production lines to improve quality consistency and efficiency.

Global hospitality sector expansion, combined with growing interest in home décor and tableware customization, is further supporting market performance. Environmental sustainability is also becoming a decisive factor, driving the use of recyclable glass materials and eco-friendly manufacturing practices.

With rising disposable incomes and urbanization in emerging economies, the market is expected to see increased consumption across all product categories Strategic collaborations between designers and glass manufacturers are enabling product innovation, while regulatory support for sustainable packaging and reusable items is reinforcing the market’s long-term growth outlook.

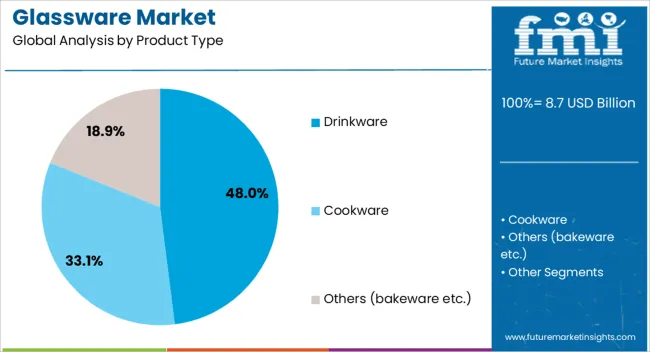

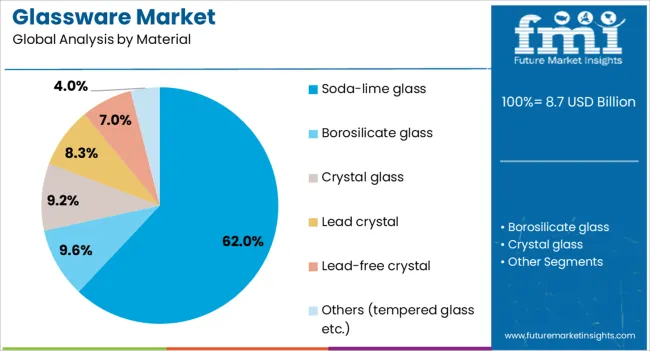

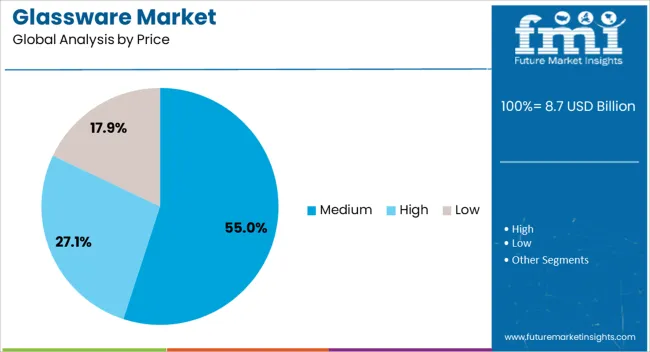

The glassware market is segmented by product type, material, price, end use, distribution channel, and geographic regions. By product type, glassware market is divided into drinkware, cookware, others (bakeware etc.), and serve ware. In terms of material, glassware market is classified into soda-lime glass, borosilicate glass, crystal glass, lead crystal, lead-free crystal, and others (tempered glass etc.). Based on price, glassware market is segmented into medium, high, and low. By end use, glassware market is segmented into residential and commercial. By distribution channel, glassware market is segmented into offline and online. Regionally, the glassware industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The drinkware segment is projected to account for 48% of the market revenue share in 2025, making it the leading product type. This dominance has been supported by the high and consistent demand from residential consumers, restaurants, hotels, and catering services. Drinkware products are essential in daily usage as well as in formal dining and hospitality settings, ensuring steady sales volume.

Manufacturers have focused on innovative designs, ergonomic features, and durability improvements to meet diverse consumer preferences. The availability of drinkware in a range of styles and capacities, combined with its frequent replacement cycle due to breakage or upgrades, has further contributed to its market strength.

Additionally, branding and custom-engraving options have increased appeal among both individual and corporate buyers The segment’s leadership position has also been reinforced by expanding e-commerce platforms, which provide consumers with easy access to a wide range of drinkware products, driving steady growth in both established and emerging markets.

The soda-lime glass segment is anticipated to hold 62% of the market revenue share in 2025, positioning it as the dominant material type. Its market leadership has been supported by its cost-effectiveness, ease of production, and versatility in shaping and coloring. Soda-lime glass is widely used for a variety of glassware applications due to its durability, resistance to chemical reactions, and suitability for both mass production and custom manufacturing.

It has become the preferred choice for drinkware, tableware, and decorative items because of its clarity and ease of recycling. Additionally, soda-lime glass manufacturing benefits from an abundant supply of raw materials, contributing to stable pricing and consistent availability.

Ongoing technological improvements in glass tempering and finishing processes have enhanced its performance characteristics, increasing its suitability for everyday and high-volume commercial use As sustainability trends continue to influence purchasing decisions, the recyclability of soda-lime glass will further strengthen its market position in the coming years.

The medium price segment is projected to represent 55% of the market revenue share in 2025, making it the most preferred pricing category. This leadership is attributed to its balance between affordability and quality, meeting the needs of a wide spectrum of consumers. Medium-priced glassware offers durability, aesthetic appeal, and functional performance without the premium cost, making it attractive to both retail and commercial buyers.

In the hospitality sector, medium-priced products are favored for large-scale procurement as they provide value without compromising on design and usability. This segment has also benefited from strong retail penetration, both in physical stores and online platforms, ensuring widespread accessibility.

Seasonal promotions, bundled offers, and branded collections within this price range have contributed to sustained demand The ability to cater to both everyday household needs and formal occasions has allowed the medium price category to remain resilient against economic fluctuations, securing its dominant share in the overall market.

The glassware market is expanding, driven by increasing demand for premium and aesthetically pleasing products across residential and commercial sectors. Opportunities for growth lie in the expansion of personalized offerings and customized designs to cater to consumer desires for individuality. Key trends like eco-friendly materials and the rise of home bar setups are shaping the market. However, challenges such as the fragility of products and the competition from alternative materials continue to persist. Despite these challenges, the glassware market is poised for growth as manufacturers innovate to meet evolving consumer demands.

The demand for premium glassware products is on the rise, as consumers increasingly seek quality and design in everyday items. The growing preference for aesthetically appealing and functional glassware in both residential and commercial settings is driving this demand. High-quality glassware is seen as an indicator of sophistication, especially in fine dining and hospitality sectors. The rise of social media and the emphasis on tableware aesthetics in online food culture is further contributing to the market's growth. As disposable incomes rise in emerging economies, demand for premium glassware products is expected to increase.

Opportunities in the glassware market are expanding with an increasing shift toward personalized and custom-made products. Consumers are looking for unique and exclusive items to express individuality, which has led to the rise in demand for bespoke glassware. Manufacturers are capitalizing on this opportunity by offering personalized engraving and custom designs, especially in the luxury segment. Moreover, the increasing trend of glassware in gifting and special occasions is driving demand, with consumers seeking high-quality glass items for weddings, birthdays, and other celebrations. This diversification of product offerings is expected to fuel market growth.

One of the key trends in the glassware market is the growing interest in eco-friendly and sustainable products. While traditional glassware remains popular, consumers are showing increased interest in glass products made with recycled materials and those that have minimal environmental impact. Another trend is the increasing use of glassware in home bar setups and beverage service, driven by the rising popularity of home entertaining. As more consumers focus on creating sophisticated at-home experiences, the demand for specialized glassware, such as wine glasses, cocktail glasses, and decanters, continues to grow.

Despite the growing demand, the glassware market faces challenges such as the fragility and high cost of production associated with high-quality glass items. Glassware is prone to damage during shipping, storage, and daily use, which increases the need for more durable, break-resistant materials. Furthermore, rising raw material costs for glass production, especially due to supply chain disruptions, are impacting profit margins for manufacturers. Competition from cheaper alternatives like plastic and acrylic products also poses a challenge, as these materials are often perceived as more durable and cost-effective.

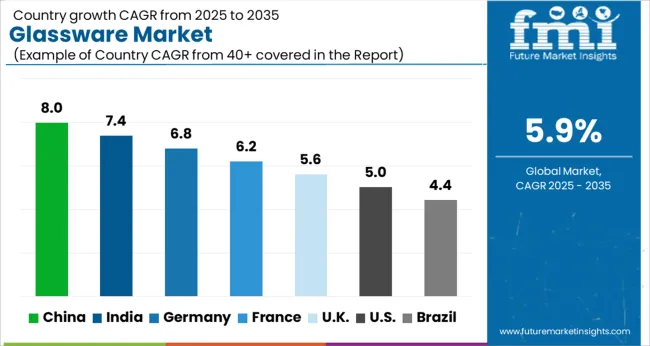

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

The global glassware market is projected to grow at a 5.9% CAGR from 2025 to 2035. China leads with a growth rate of 8%, followed by India at 7.4%, and Germany at 6.8%. The United Kingdom records a growth rate of 5.6%, while the United States shows the slowest growth at 5%. The increasing demand for premium glassware products, driven by rising disposable incomes, changing consumer preferences for aesthetics, and the growing popularity of luxury goods, is fueling market growth. Emerging markets like China and India are experiencing higher growth due to increasing industrialization, urbanization, and a growing middle class, while mature markets like the USA and the UK see steady growth supported by the demand for high-quality glassware and home décor items. This report includes insights on 40+ countries; the top markets are shown here for reference.

The glassware market in China is projected to grow at a CAGR of 8%. China’s rapidly expanding middle class and rising disposable incomes are driving the demand for premium and luxury glassware products. The increasing popularity of decorative and functional glassware in both domestic and commercial settings, such as hotels and restaurants, is also contributing to market growth. Additionally, the growing e-commerce sector and increased access to global glassware brands are fueling the adoption of glassware in China. As urbanization continues to rise, the demand for stylish and high-quality glassware continues to grow.

The glassware market in India is expected to grow at a CAGR of 7.4%. India’s increasing urbanization and growing middle class are major drivers of market growth, with consumers seeking high-quality, aesthetically pleasing glassware for both personal and commercial use. The rise in disposable income and changing lifestyles are contributing to a shift toward luxury and premium glassware products, especially in urban areas. Additionally, the increasing demand for glassware in the hospitality sector, including hotels and restaurants, continues to drive market expansion. India’s growing retail and e-commerce sectors are also playing a role in the market's growth.

The glassware market in Germany is projected to grow at a CAGR of 6.8%. Germany’s strong consumer demand for high-quality glassware, particularly in home décor and dining, is a key factor driving market growth. The country’s growing interest in sustainable and eco-friendly glassware products, such as recycled glass and biodegradable alternatives, is also contributing to market expansion. Additionally, Germany’s robust retail and hospitality sectors continue to support demand, with increasing consumption in restaurants, hotels, and bars. The trend of upgrading home décor with designer glassware is further boosting sales.

The glassware market in the United Kingdom is expected to grow at a CAGR of 5.6%. The UK’s demand for premium glassware, driven by the popularity of fine dining and home décor, continues to support steady market growth. Increasing interest in sustainable and eco-friendly glassware products, such as those made from recycled glass, is fueling the adoption of glassware across various consumer segments. Additionally, the strong presence of high-end retailers and the growing trend of home entertainment, including luxury tableware, contribute to the market's expansion in the UK.

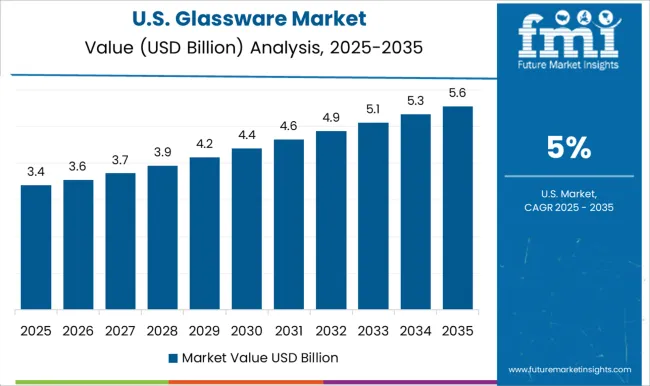

The glassware market in the United States is projected to grow at a CAGR of 5%. The demand for premium and high-quality glassware products, driven by an increasing focus on home décor and luxury dining experiences, continues to drive market growth in the USA Additionally, the increasing interest in sustainable and eco-friendly glassware, particularly made from recycled materials, is contributing to market expansion. The strong presence of online retail channels and brick-and-mortar stores, along with the rise in consumer spending on home entertainment products, further accelerates the adoption of glassware in the USA

The glassware market is highly competitive, with major players such as Arc International, Libbey, Bormioli Rocco, Duralex, and Krosno leading the industry. Arc International is a global leader known for its wide range of glassware products, including dinnerware, drinkware, and cookware. The company focuses on innovation and design, offering products that cater to both the retail and hospitality sectors. Libbey, a prominent name in the glassware market, offers a diverse product portfolio, including glass tableware and drinkware, with a strong emphasis on quality and aesthetic appeal. The brand is recognized for its commitment to sustainability and expanding its presence in both established and emerging markets.

Bormioli Rocco, an Italian glassware manufacturer, is well-regarded for its premium glass containers, drinkware, and home decor items. The company focuses on design-driven products and continues to innovate, particularly in the food and beverage packaging sector. Duralex, a renowned French brand, is famous for its durable glassware, particularly tempered glass, which is resistant to breakage and thermal shock. The company has strong market presence in both the retail and foodservice sectors. Krosno, a Polish glassware manufacturer, has established itself as a premium brand known for its hand-blown glass products, offering elegant glassware and personalized designs. The competitive landscape is driven by product innovation, design excellence, and a strong commitment to sustainability across these key players.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.7 Billion |

| Product Type | Drinkware, Cookware, Others (bakeware etc.), and Serve ware |

| Material | Soda-lime glass, Borosilicate glass, Crystal glass, Lead crystal, Lead-free crystal, and Others (tempered glass etc.) |

| Price | Medium, High, and Low |

| End Use | Residential and Commercial |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Arc International, Libbey, Bormioli Rocco, Duralex, and Krosno |

| Additional Attributes | Dollar sales by product type (drinking glasses, cookware, decorative glassware, laboratory glassware), dollar sales by form (clear, frosted, colored), trends in premium and personalized glass products, use in hospitality, home décor, and laboratory applications, growth in demand for eco-friendly and sustainable materials, and regional patterns of glassware consumption across global markets. |

The global glassware market is estimated to be valued at USD 8.7 billion in 2025.

The market size for the glassware market is projected to reach USD 15.4 billion by 2035.

The glassware market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in glassware market are drinkware, _wine glass, _beer glass, _bottle, _pitchers, _cocktail glasses, _water glasses, _others (juice glasses etc.), cookware, _casserole, _cooking pot, _saucepan, _others (kettle etc.), others (bakeware etc.), serve ware, _serving bowls, _serving trays and _platters.

In terms of material, soda-lime glass segment to command 62.0% share in the glassware market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Beer Glassware Market Share

Restaurant Glassware Market Size and Share Forecast Outlook 2025 to 2035

Laboratory Glassware and Plasticware Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA