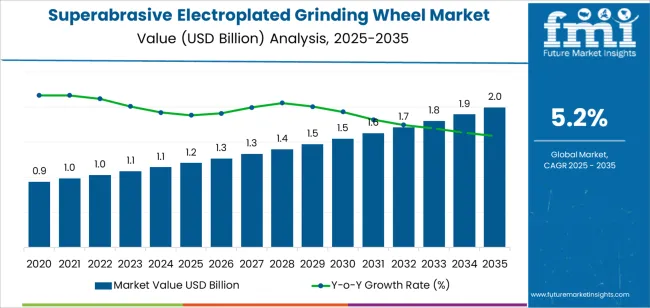

The superabrasive electroplated grinding wheel market is forecast to grow from USD 1.2 billion in 2025 to USD 2 billion by 2035, reflecting a CAGR of 5.2%. Growth is primarily driven by increasing demand for high-performance grinding wheels across industries such as automotive, aerospace, electronics, and metalworking. Superabrasive grinding wheels, made with materials such as diamond and cubic boron nitride (CBN), offer superior cutting efficiency, precision, and durability, making them ideal for applications that require high material removal rates and exceptional surface finishes. As industries continue to adopt advanced manufacturing processes, the demand for such specialized grinding tools will rise. The growing trend toward precision engineering and quality assurance in production will further support market growth.

The demand for superabrasive electroplated grinding wheels will benefit from innovations in grinding technologies, which are driving the need for more efficient and cost-effective solutions. Electroplated grinding wheels, known for their reliability, long service life, and high cutting performance, are particularly valuable in difficult-to-machine materials such as turbine blades, automotive components, and electronic devices. As advanced materials and high-performance alloys become more prevalent, the requirement for high-quality grinding wheels will continue to increase. Furthermore, the continued development of automated manufacturing processes will further accelerate the adoption of superabrasive grinding wheels.

From 2025 to 2030, the market is expected to grow from USD 1.2 billion to USD 1.5 billion, an increase of USD 300 million. This phase of growth will be fueled by the rising demand for precision grinding in industries such as automotive and aerospace, where high-performance materials and components require specialized grinding solutions. Additionally, as industrial applications push for higher efficiency and faster production cycles, the need for durable and effective grinding tools will drive the market forward.

Between 2030 and 2035, the market will continue to expand from USD 1.5 billion to USD 2 billion, adding USD 500 million in value. This growth will be supported by technological advancements in grinding equipment and the continued adoption of automated systems in manufacturing processes. The increasing focus on advanced materials and high-precision grinding will further boost the demand for superabrasive electroplated grinding wheels. As industries increasingly prioritize productivity and cost-efficiency, the demand for high-quality grinding wheels capable of handling the demands of modern manufacturing will remain strong, ensuring sustained market growth through 2035.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 379 million |

| Market Forecast Value (2035) | USD 666 million |

| Forecast CAGR (2025 to 2035) | 5.8 |

The superabrasive electroplated grinding wheel market is growing due to the increasing demand for high-performance grinding solutions across a wide range of industries, including aerospace, optical glass, medical devices, and semiconductors. These grinding wheels, made primarily from diamond or CBN (Cubic Boron Nitride), offer superior cutting capabilities, high precision, and long service life, making them essential for applications that require fine grinding and polishing of hard materials. Industries like aerospace and semiconductors have particularly high demand for these products, as they require extremely precise, durable, and reliable grinding tools. Additionally, as technological advancements continue in manufacturing and precision engineering, the demand for these grinding wheels, which can withstand high levels of heat and pressure, is expanding. Emerging economies, particularly in Asia-Pacific regions like China and India, are experiencing industrial growth, which is increasing the demand for advanced grinding solutions. The 5.2% CAGR of the market reflects this trend, with automated and high-efficiency manufacturing processes further driving demand for electroplated grinding wheels. As industries continue to focus on precision, efficiency, and quality control, superabrasive grinding wheels will remain critical in various manufacturing sectors.

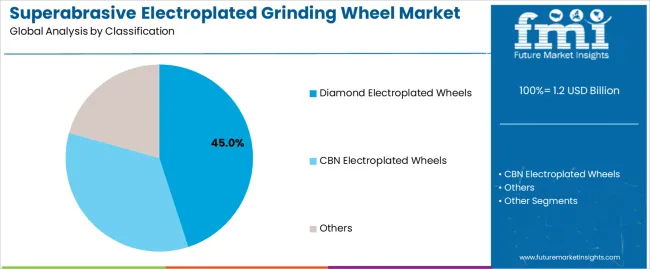

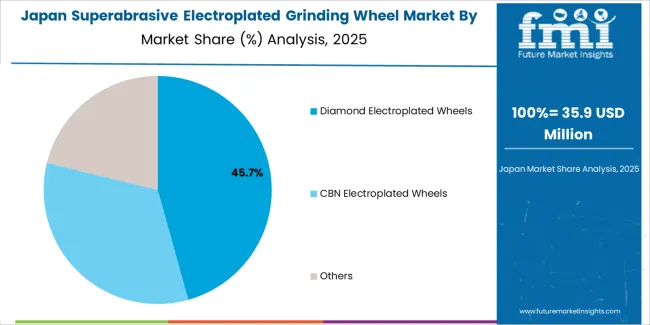

The superabrasive electroplated grinding wheel market is segmented by classification and application, reflecting the varied technical requirements across industries and geographies. By classification, the market is divided into diamond electroplated wheels, CBN electroplated wheels, and other types, with diamond electroplated wheels holding the leading share of approximately 45 %.

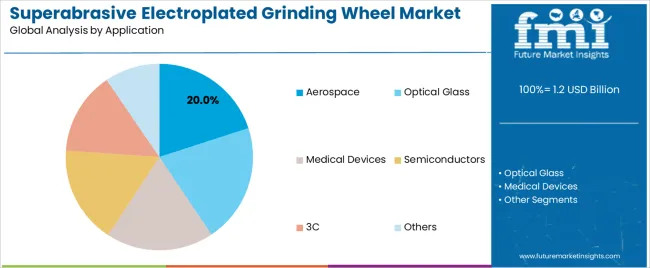

By application, the market covers sectors like aerospace, optical glass, medical devices, semiconductors, 3C (consumer electronics), and others, among which the aerospace application carries around 20 % share. Growth in Asia Pacific (notably China and India) is particularly strong, while mature markets in Europe (Germany) and North America (USA) drive replacement demand and high precision manufacturing.

The diamond electroplated wheel segment dominates the superabrasive electroplated grinding wheel market, capturing around 45 % of total share. This leadership is due to the exceptional hardness and abrasive performance of diamond coatings, making these wheels ideal for high precision and high demand applications across sectors such as aerospace, optical glass, and medical devices. Diamond electroplated wheels are able to grind hard, brittle, and composite materials with minimal heat damage, superior surface finish, and long service life.

In aerospace manufacturing, where components like titanium alloys, composite frames, and ceramic matrix parts require tight tolerances and high reliability, diamond electroplated grinding wheels enable manufacturers to meet stringent regulatory and performance standards. In optical glass and semiconductor manufacturing, the need for ultra fine finishing and minimal defects further drives use of diamond wheels. Additionally, the growing manufacturing base in Asia Pacific means volume demand for such high performance tools is rising rapidly. Given these factors, the diamond electroplated wheel classification remains the preferred choice for manufacturers seeking efficiency, durability, and precision.

The aerospace application segment commands approximately 20 % of the superabrasive electroplated grinding wheel market, making it the largest usage category. Aerospace manufacturing demands high precision grinding of materials such as titanium, nickel based superalloys, composite materials, and hardened ceramics, all of which require superabrasive tools with exceptional durability and accuracy. Diamond electroplated grinding wheels are heavily used in the production of aircraft structural components, engine turbine blades, landing gear parts, and other mission critical systems, where surface finish, dimensional accuracy, and component longevity are vital.

The global expansion of aviation, increasing demand for lightweight materials, and the rise of next generation engines with tougher materials further accelerate the need for advanced grinding solutions. Regions such as North America and Europe continue to lead in aerospace innovations, while Asia Pacific is rapidly ramping up production, driving the volume for superabrasive grinding wheels. As aerospace manufacturing becomes more automated and cost efficient, demand for electroplated grinding wheels tailored to these tough materials will persist, cementing the aerospace application as the largest segment in this market.

The superabrasive electroplated grinding wheel market is experiencing growth driven by the increasing demand for high-precision grinding solutions across key industries such as aerospace, optical glass, medical devices, and semiconductors. The ability of diamond electroplated wheels to cut hard and brittle materials with superior surface finishes and longer tool life is a major advantage. The rising focus on manufacturing efficiency, automated systems, and high-performance tools further contributes to the market’s growth. Strong industrial expansion in regions like Asia-Pacific (China and India) and advancements in precision engineering are also key growth drivers.

Key drivers for the superabrasive electroplated grinding wheel market include the increasing demand for precision manufacturing in industries such as aerospace, optical glass, and medical devices. As these industries continue to push for higher-quality parts, there is a growing need for grinding wheels capable of processing tough, hard materials efficiently. Additionally, technological advancements in superabrasive materials and the rise of automated production systems are making these grinding wheels more accessible and cost-effective. The global trend toward industrial automation, sustainability, and energy-efficient manufacturing processes also contributes to the adoption of high-performance grinding wheels.

Despite the strong growth, the superabrasive electroplated grinding wheel market faces several challenges. High production costs and the expensive nature of diamond and CBN abrasives make it difficult for some smaller manufacturers or price-sensitive industries to adopt these solutions. Moreover, the complexity of maintenance and the need for skilled labor to handle and operate these machines can pose barriers, especially in developing regions with limited expertise. The market is also challenged by competition from alternative grinding technologies and abrasive wheels, which are perceived as more affordable in certain applications.

Key trends in the superabrasive electroplated grinding wheel market include the increasing adoption of smart manufacturing and Industry 4.0 technologies, which are enabling real-time monitoring and optimization of grinding processes. There is also a growing emphasis on sustainable manufacturing practices, pushing for eco-friendly abrasive materials and energy-efficient solutions. Additionally, the market is seeing a rise in the demand for customized grinding solutions tailored to specific industrial applications, such as medical devices and semiconductor manufacturing, where high precision and unique material requirements are essential.

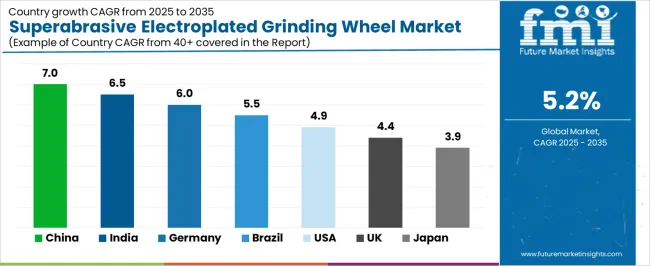

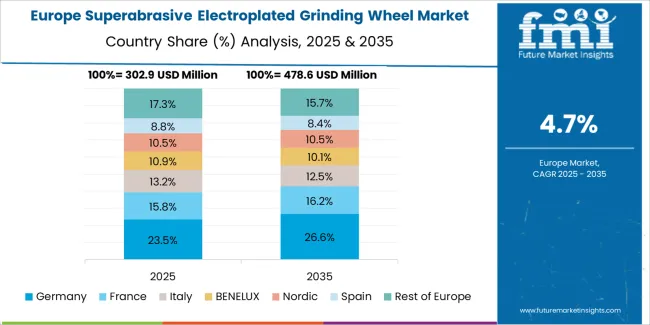

The superabrasive electroplated grinding wheel market is witnessing diverse growth trends across countries, with key industrial sectors, such as automotive, aerospace, and manufacturing, contributing to its expansion. The demand for these high-performance grinding wheels, known for their durability and precision, is increasing as industries seek advanced solutions for cutting and grinding applications.

Countries like China and India are leading the market growth due to their rapidly expanding manufacturing sectors, while developed nations such as Germany and the USA also show steady growth driven by technological advancements and industrial upgrades. The compound annual growth rate (CAGR) for the superabrasive electroplated grinding wheel market varies across regions, reflecting differing industrial needs, technological investments, and economic conditions. This analysis highlights key growth drivers in each region and how they shape the market's future.

| Country | CAGR (2025 - 2035) |

|---|---|

| China | 7% |

| India | 6.5% |

| Germany | 6% |

| Brazil | 5.5% |

| USA | 4.9% |

| United Kingdom | 4.4% |

| Japan | 3.9% |

China is leading the superabrasive electroplated grinding wheel market with a robust CAGR of 7.0%. The country’s rapid industrial growth, particularly in manufacturing, automotive, and electronics, is a significant factor driving the demand for advanced grinding solutions. As China continues to expand its manufacturing capabilities, the need for high-precision tools, such as superabrasive grinding wheels, is increasing. These wheels are essential for achieving fine finishes and precision cuts, which are crucial in industries like automotive, aerospace, and semiconductor manufacturing.

Additionally, China’s growing focus on technology and innovation is driving investments in high-performance grinding tools. With a strong focus on enhancing production efficiency and product quality, the demand for superabrasive grinding wheels is expected to remain strong. The country’s emphasis on industrial automation and advanced manufacturing technologies will further fuel market growth, positioning China as the dominant player in this market.

India is experiencing significant growth in the superabrasive electroplated grinding wheel market, with a CAGR of 6.5%. The country’s expanding manufacturing sector, particularly in automotive, machinery, and metalworking, is fueling the demand for advanced grinding solutions. As India becomes a global hub for manufacturing, industries are increasingly seeking precision tools that offer higher efficiency and better finishes. Superabrasive grinding wheels, known for their durability and precision, are meeting this demand in various industries.

India's focus on industrial development, coupled with rising automation and digitization in manufacturing processes, is driving the adoption of advanced grinding technologies. The automotive industry, in particular, is one of the primary drivers, with increasing demand for high-precision components. As the country modernizes its manufacturing capabilities, the superabrasive electroplated grinding wheel market is expected to grow at a rapid pace.

Germany’s superabrasive electroplated grinding wheel market is projected to grow at a CAGR of 6.0%. As one of Europe’s largest manufacturing and industrial hubs, Germany continues to lead in sectors like automotive, aerospace, and precision engineering, all of which demand high-performance grinding tools. The demand for superabrasive grinding wheels is driven by their ability to provide precise cuts and finishes, which are critical in industries requiring high accuracy.

Germany's strong emphasis on advanced manufacturing technologies, such as Industry 4.0, is contributing to the growth of the market. The integration of automation, digital tools, and smart factories in the country is pushing the demand for tools that offer both precision and efficiency. The ongoing modernization of Germany's manufacturing sector, combined with its focus on high-quality, precision-based industries, will continue to drive the growth of the superabrasive electroplated grinding wheel market.

Brazil’s superabrasive electroplated grinding wheel market is experiencing steady growth, with a CAGR of 5.5%. The demand for these high-performance grinding wheels is largely driven by Brazil’s expanding industrial base, particularly in the automotive, machinery, and metalworking sectors. As Brazil continues to invest in manufacturing and infrastructure development, industries are seeking advanced grinding solutions to meet rising demands for precision and efficiency.

Brazil’s efforts to improve its industrial productivity and compete on the global stage are also pushing the adoption of superabrasive grinding wheels. Additionally, the country’s automotive industry, a significant contributor to manufacturing growth, continues to demand high-precision tools for production. With Brazil focusing on modernizing its manufacturing technologies and increasing export capacity, the superabrasive grinding wheel market is poised for steady growth in the coming years.

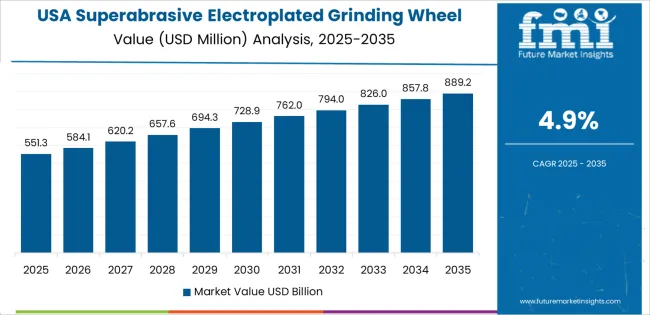

The United States has a projected CAGR of 4.9% for the superabrasive electroplated grinding wheel market. As one of the leaders in industrial automation and high-precision manufacturing, the USA continues to drive demand for advanced grinding solutions. The need for superabrasive grinding wheels is particularly strong in industries like aerospace, automotive, and medical devices, where high-quality finishes and precision are critical.

The U.S. market is also witnessing a shift towards automation and digitalization in manufacturing, pushing the demand for more efficient and accurate grinding technologies. As industries increasingly embrace advanced manufacturing processes and technologies, the demand for superabrasive grinding wheels is expected to grow steadily. The country’s established industrial base and focus on high-precision engineering ensure that the superabrasive electroplated grinding wheel market remains strong.

The superabrasive electroplated grinding wheel market in the United Kingdom is growing at a CAGR of 4.4%. The UK’s well-established manufacturing and automotive sectors, combined with a focus on advanced engineering and precision manufacturing, continue to drive the demand for high-performance grinding wheels. The superabrasive electroplated grinding wheels are essential in achieving fine finishes and precision cuts in industries like aerospace, automotive, and medical device manufacturing.

The UK’s commitment to embracing Industry 4.0 technologies, such as automation and digital tools in manufacturing, further supports the growth of the superabrasive grinding wheel market. As the demand for precision tools and high-quality finishes increases across industries, the market for these grinding wheels is expected to experience steady growth. The UK’s growing focus on innovation in manufacturing and automation technologies will continue to drive the adoption of advanced grinding tools.

Japan’s superabrasive electroplated grinding wheel market is projected to grow at a CAGR of 3.9%. The country’s advanced manufacturing sector, especially in automotive and electronics, is a major driver of demand for high-precision grinding solutions. Japan’s focus on quality, innovation, and efficiency in manufacturing makes the need for superabrasive grinding wheels increasingly important as industries require precision cutting and finishing solutions.

The growth in Japan’s superabrasive grinding wheel market is supported by the country’s continued emphasis on automation and digital technologies in manufacturing. Although Japan’s market growth is slower compared to some emerging economies, its sophisticated manufacturing environment ensures a steady demand for high-performance grinding wheels. As Japan continues to lead in precision engineering and automotive manufacturing, the superabrasive electroplated grinding wheel market is expected to maintain stable growth.

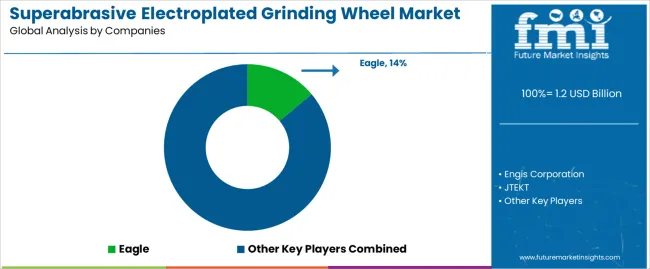

The superabrasive electroplated grinding wheel market is highly competitive, with a few key players dominating the industry, including Eagle, Engis Corporation, and JTEKT. Eagle holds a substantial market share of around 14%, owing to its advanced grinding solutions and diverse product portfolio, catering to industries like aerospace, optical glass, and medical devices. Other significant players such as Saint-Gobain Norton, Asahi Diamond Industrial Co., Ltd., and Mirka Ltd also maintain strong positions through continuous innovation, technological advancements, and an extensive global reach.

These companies focus on producing high-quality, precise grinding wheels that offer superior performance in high-demand applications, including those requiring hard material grinding. Additionally, these industry leaders are expanding their research and development (R&D) capabilities, enabling them to meet the ever-evolving needs of industries seeking customized, efficient solutions. Companies are also investing in sustainability by developing eco-friendly grinding materials, further enhancing their competitive edge in a market that values both performance and environmental responsibility.

Smaller regional players such as FSK and Henan More Super Hard Products Co., Ltd continue to carve out a niche by offering cost-effective solutions and specialized products to serve local markets. These players often focus on affordable pricing and customization, allowing them to compete in price-sensitive markets. The increasing demand for precision grinding tools in emerging industries is also benefiting regional manufacturers, especially in Asia-Pacific, where China and India are expanding their manufacturing capacities. As innovation in superabrasive materials continues and demand grows across industries like semiconductors and aerospace, the competitive landscape will evolve, with both global and regional players vying for a share of this expanding market.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | China, India, Germany, Brazil, USA, UK, Japan |

| Classification | Diamond Electroplated Wheels, CBN Electroplated Wheels, Others |

| Application | Aerospace, Optical Glass, Medical Devices, Semiconductors, 3C (Computers, Communications, Consumer Electronics), Others |

| Key Companies Profiled | Eagle, Engis Corporation, JTEKT, Continental Diamond, Asahi Diamond Industrial Co., Ltd, Saint-Gobain Norton, EHWA DIAMOND, A.L.M.T. Corp, Muzzi, Mirka Ltd, KURE GRINDING WHEEL CO., LTD, DIPROTEX S.A.S, FSK, Xiamen Chiaping Diamond Industrial Co., Ltd., Suzhou Sail Science & Technology Co., Ltd, Fu Hang Superhard Material Co., Ltd, Henan More Super Hard Products Co., Ltd |

| Additional Attributes | The market analysis includes dollar sales by classification and application categories. It also covers regional adoption trends across major markets like China, India, Germany, and the USA. The competitive landscape focuses on leading players in the superabrasive electroplated grinding wheel industry, with innovations in diamond and CBN (Cubic Boron Nitride) electroplated wheels. Trends in aerospace, medical devices, and semiconductor applications are explored, along with advancements in grinding wheel performance and material technologies. |

The global superabrasive electroplated grinding wheel market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the superabrasive electroplated grinding wheel market is projected to reach USD 2.0 billion by 2035.

The superabrasive electroplated grinding wheel market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in superabrasive electroplated grinding wheel market are diamond electroplated wheels, cbn electroplated wheels and others.

In terms of application, aerospace segment to command 20.0% share in the superabrasive electroplated grinding wheel market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

CBN Electroplated Wheels Market Size and Share Forecast Outlook 2025 to 2035

Wheeled Bins Market Size and Share Forecast Outlook 2025 to 2035

Wheel Loader Scales Market Size and Share Forecast Outlook 2025 to 2035

Wheel Excavator Market Size and Share Forecast Outlook 2025 to 2035

Wheel Loader Market Size and Share Forecast Outlook 2025 to 2035

Wheel Balancing Market Size and Share Forecast Outlook 2025 to 2035

Wheel Aligner Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wheel Tractor Scrapers Market Size and Share Forecast Outlook 2025 to 2035

Wheeled Insulated Cooler Market Trends - Growth & Demand Forecast 2025 to 2035

Competitive Breakdown of Wheeled Bin Providers

Germany Wheeled Bin Industry Analysis – Growth & Outlook 2024-2034

Wheelchair Market Analysis – Size, Share & Forecast 2024-2034

Wheel studs Market

3-Wheel Sit-Down Counterbalance Forklift Market Size and Share Forecast Outlook 2025 to 2035

4-Wheel Sit-Down Counterbalance Forklift Market Size and Share Forecast Outlook 2025 to 2035

4-Wheel Mobility Scooters Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of 4-Wheeled Container Companies

4-Wheeled Container Market Trends – Size, Demand & Forecast 2024-2034

Flywheel Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Two-Wheeler Lubricants Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA