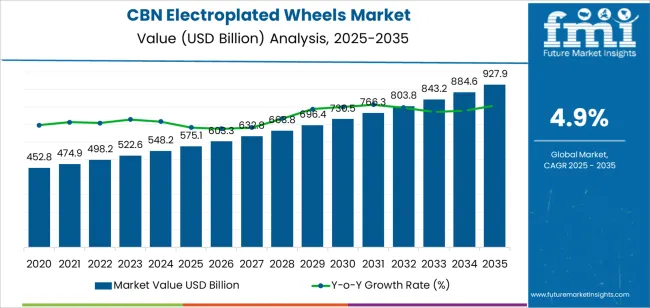

The global CBN electroplated wheels market is forecasted to grow from USD 575.1 million in 2025 to approximately USD 928 billion by 2035, recording an absolute increase of USD 352.80 million over the forecast period. This translates into a total growth of 61.4%, with the CBN electroplated wheels market forecast to expand at a compound annual growth rate (CAGR) of 4.9% between 2025 and 2035. The overall CBN electroplated wheels market size is expected to grow by nearly 1.61X during the same period, supported by increasing global demand for precision grinding solutions in aerospace component manufacturing, growing adoption of advanced abrasive technologies in automotive powertrain machining, and rising quality standards driving specialized tooling procurement across various industrial grinding applications.

The CBN electroplated wheels market expansion reflects fundamental shifts in precision manufacturing requirements and hard material machining protocols. Aerospace manufacturers are implementing comprehensive grinding programs to ensure consistent component quality across turbine blade production and structural part finishing operations, particularly for facilities serving commercial aviation and defense contractors. Automotive producers require advanced grinding wheel systems to optimize hardened steel machining performance in transmission component manufacturing and engine part production. Tool manufacturing operations are investing in specialized abrasive technologies to support cutting tool resharpening programs and precision instrument fabrication.

Regional dynamics demonstrate concentrated growth in established manufacturing economies with mature aerospace infrastructure and expanding automotive production sectors. Asian markets, led by China and India, are experiencing accelerated adoption driven by manufacturing capacity expansion and precision machining capability enhancement programs. European markets maintain steady growth supported by stringent aerospace quality standards and continuous grinding technology improvement initiatives in advanced manufacturing industries. North American operations focus on aerospace component production optimization and grinding process standardization across precision manufacturing workflows.

Technology adoption patterns reflect the transition from conventional grinding wheels to CBN electroplated systems capable of superior material removal rates and enhanced dimensional accuracy. Abrasive tool manufacturers are developing integrated platforms that combine optimized grain distribution with durable electroplated bonding systems, addressing manufacturer requirements for operational efficiency and component quality consistency. The market faces ongoing challenges related to wheel dressing requirements, performance optimization across diverse workpiece materials, and cost justification for small-batch production operations with limited grinding volumes.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 575.1 million |

| Market Forecast Value (2035) | USD 928 billion |

| Forecast CAGR (2025-2035) | 4.9% |

| PRECISION MANUFACTURING GROWTH | MATERIAL PROCESSING CHALLENGES | TECHNOLOGICAL ADVANCEMENT |

|---|---|---|

|

|

|

| Category | Segments Covered |

|---|---|

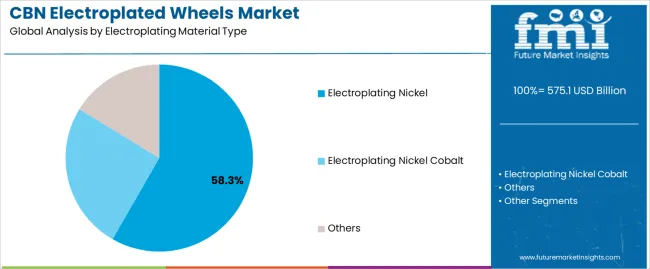

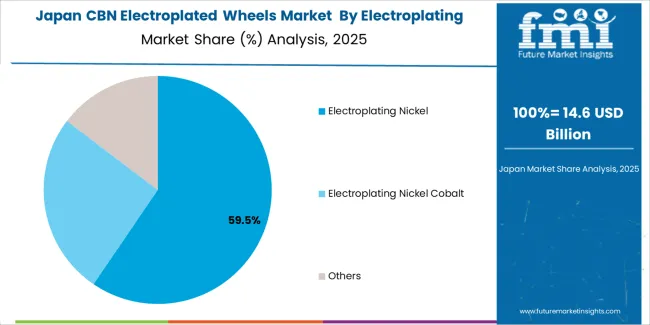

| By Electroplating Material Type | Electroplating Nickel, Electroplating Nickel Cobalt, Others |

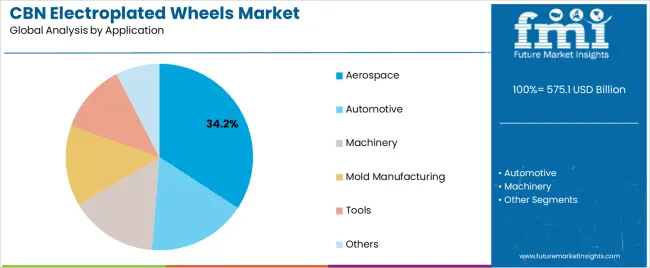

| By Application | Aerospace, Automotive, Machinery, Mold Manufacturing, Tools, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Electroplating Nickel | Leader in 2025 with 58.3% market share projected to maintain dominance through 2035. Established electroplating protocol with proven performance across diverse grinding applications and workpiece materials. Cost-effective bonding system providing reliable grain retention and consistent grinding characteristics. Momentum: steady growth driven by general industrial grinding expansion and automotive component manufacturing. Watchouts: competition from nickel-cobalt alloys in high-performance aerospace applications and thermal limitation concerns in aggressive grinding operations. |

| Electroplating Nickel Cobalt | Growing segment with 28.6% market share benefiting from aerospace manufacturing requirements and high-performance grinding applications. Superior thermal resistance and enhanced grain retention supporting aggressive material removal in difficult-to-machine materials. Adoption concentrated in turbine component grinding and precision aerospace manufacturing operations. Momentum: rising through aerospace production expansion and advanced material processing requirements. Watchouts: higher material costs compared to pure nickel systems and specialized electroplating process requirements affecting manufacturing scalability. |

| Others | Niche segment with 13.1% market share encompassing emerging electroplating technologies and specialized bonding systems. Limited commercial adoption with focus on research applications and experimental grinding operations. Small installed base concentrated in advanced manufacturing research facilities and specialty grinding operations. Momentum: selective adoption in specialized aerospace applications and experimental material processing programs. Watchouts: standardization challenges and limited wheel availability from mainstream abrasive manufacturers. |

| Segment | 2025 to 2035 Outlook |

|---|---|

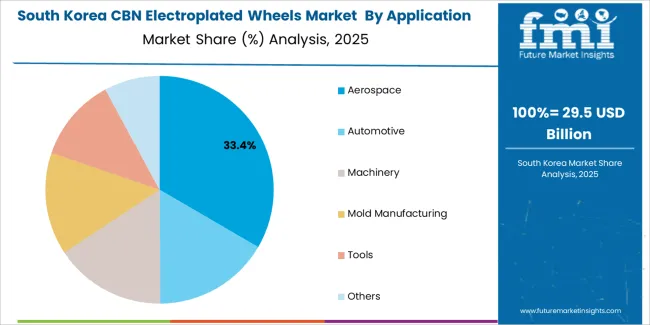

| Aerospace | Dominant segment at 34.2% market share in 2025 with established turbine component manufacturing and structural part grinding operations. Critical for nickel-based superalloy processing and titanium component finishing requiring superior dimensional accuracy. Mature procurement protocols with rigorous wheel qualification procedures and supplier certification requirements. Momentum: steady growth driven by commercial aviation production expansion and defense manufacturing programs. Watchouts: extended qualification cycles for new wheel specifications and stringent quality documentation requirements affecting supplier flexibility. |

| Automotive | Expanding segment with 23.7% market share driven by transmission component manufacturing and engine part precision grinding requirements. Essential for hardened steel crankshaft grinding and gear finishing operations requiring consistent surface quality. Adoption concentrated in powertrain manufacturing facilities and specialized automotive component suppliers. Momentum: moderate growth through electric vehicle component manufacturing and traditional powertrain production optimization. Watchouts: cost sensitivity in high-volume production environments and grinding process automation requirements affecting wheel specification complexity. |

| Machinery | Growing segment at 16.4% share focused on general industrial component manufacturing and equipment part grinding. Diverse applications requiring versatile grinding wheel specifications across various hardened steel grades and component geometries. Investment driven by industrial equipment manufacturing expansion and maintenance operations. Momentum: steady growth driven by industrial machinery production and equipment refurbishment programs. Watchouts: fragmented application requirements and variable grinding parameters complicating wheel optimization across diverse machinery segments. |

| Mold Manufacturing | Specialized segment with 10.8% market share serving injection mold production and die finishing operations requiring superior surface quality. Premium applications demanding consistent grinding performance across hardened tool steels and cavity surface finishing procedures. High-precision requirements supporting investment in specialized CBN grinding technologies. Momentum: moderate growth through plastic injection molding expansion and precision mold manufacturing capability development. Watchouts: small-batch production characteristics and custom grinding parameters requiring flexible wheel specifications and inventory management. |

| Tools | Established segment at 9.2% share focused on cutting tool resharpening and precision instrument manufacturing. Critical for carbide tool grinding and high-speed steel processing requiring consistent edge quality and dimensional accuracy. Adoption concentrated in tool service centers and cutting tool manufacturing facilities. Momentum: steady growth through advanced cutting tool technology adoption and precision grinding service expansion. Watchouts: competition from alternative resharpening technologies and cost pressures in commodity cutting tool segments. |

| Others | Residual segment with 5.7% market share encompassing diverse applications including bearing manufacturing, medical device production, and specialty component grinding. Small volume with specialized grinding requirements and limited standardized procedures. Adoption concentrated in niche precision manufacturing operations and research facilities. Momentum: flat to modest growth with application-specific requirements. Watchouts: limited wheel optimization for specialized applications and small market size constraining manufacturer development investment. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

|

|

|

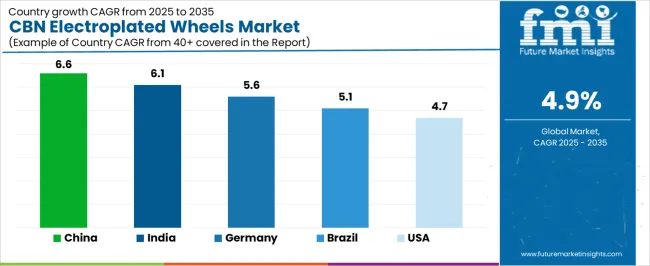

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| Brazil | 5.1% |

| United States | 4.7% |

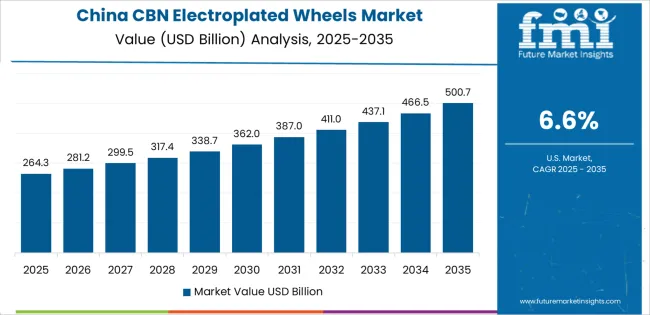

Revenue from CBN Electroplated Wheels in China is projected to exhibit strong growth with a market value of USD 197.84 million by 2035, driven by expanding aerospace manufacturing capacity and comprehensive automotive production infrastructure creating substantial opportunities for precision grinding tool suppliers across component manufacturing operations, mold production facilities, and tool manufacturing sectors. The country's massive industrial manufacturing base and expanding precision machining capabilities are creating significant demand for advanced abrasive systems supporting operational efficiency and component quality standards. Major manufacturing companies and aerospace contractors are establishing comprehensive grinding capabilities to support large-scale production operations and meet growing domestic quality requirements.

Revenue from CBN Electroplated Wheels in India is expanding to reach USD 117.4 million by 2035, supported by extensive automotive manufacturing capacity expansion and comprehensive aerospace component production development creating sustained demand for precision grinding technologies across diverse industrial operations and tool manufacturing segments. The country's growing manufacturing infrastructure and expanding precision machining awareness are driving demand for CBN electroplated wheels that provide consistent grinding performance while supporting cost-effective operational requirements. Abrasive tool suppliers and manufacturers are investing in local distribution infrastructure to support growing industrial grinding requirements and technology adoption.

Demand for CBN Electroplated Wheels in Germany is projected to reach USD 28.3 million by 2035, supported by the country's leadership in aerospace technology and advanced automotive engineering requiring sophisticated grinding systems for component manufacturing and precision tooling applications. German manufacturers implement high-quality grinding programs that support advanced quality specifications, operational reliability, and comprehensive process documentation. The market is characterized by focus on grinding precision, surface quality standards, and compliance with stringent aerospace and automotive manufacturing regulations.

Revenue from CBN Electroplated Wheels in Brazil is growing to reach USD 12.5 million by 2035, driven by automotive manufacturing expansion and aerospace component production development creating sustained opportunities for grinding tool suppliers serving both multinational manufacturing operations and domestic component producers. The country's expanding automotive production infrastructure and growing precision machining capabilities are creating demand for abrasive technologies that support diverse grinding requirements while maintaining performance standards. Manufacturers and industrial service organizations are developing procurement strategies to support grinding capability enhancement and quality program implementation.

Demand for CBN Electroplated Wheels in United States is projected to reach USD 52.8 million by 2035, expanding at a CAGR of 4.7%, driven by aerospace manufacturing optimization and automotive powertrain production supporting comprehensive grinding programs and advanced precision machining capabilities. The country's extensive aerospace manufacturing infrastructure and established automotive engineering capabilities are creating demand for CBN electroplated wheels that support operational efficiency and component quality standards. Abrasive tool manufacturers and suppliers are maintaining comprehensive technical support capabilities to serve diverse precision grinding requirements.

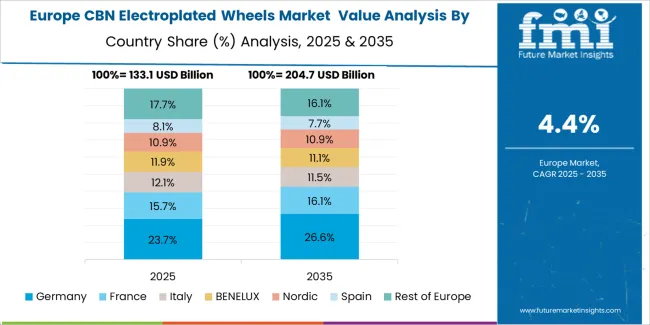

The CBN electroplated wheels market in Europe is projected to grow from USD 138.2 million in 2025 to USD 222.4 million by 2035, registering a CAGR of 4.9% over the forecast period. Germany is expected to maintain its leadership position with a 31.4% market share in 2025, declining slightly to 30.8% by 2035, supported by its advanced aerospace manufacturing infrastructure and precision automotive engineering facilities concentrated in Baden-Württemberg and Bavaria regions.

United Kingdom follows with a 24.6% share in 2025, projected to reach 25.1% by 2035, driven by comprehensive aerospace component manufacturing and specialized grinding operations serving Rolls-Royce and other turbine manufacturers. France holds a 19.8% share in 2025, expected to maintain 19.6% by 2035 with aerospace and automotive grinding applications. Italy commands a 13.7% share, while Spain accounts for 6.9% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 3.6% to 4.2% by 2035, attributed to increasing CBN grinding technology adoption in Nordic countries and emerging Eastern European precision manufacturing operations implementing advanced abrasive systems.

Japanese CBN electroplated wheels operations reflect the country's exacting aerospace component standards and comprehensive automotive manufacturing protocols. Major aerospace manufacturers including Mitsubishi Heavy Industries and IHI Corporation require rigorous grinding wheel qualification procedures that exceed international standards, driving demand for CBN electroplated systems with validated performance specifications. Organizations maintain comprehensive grinding process protocols and wheel inspection procedures supporting consistent component quality across precision manufacturing operations.

The automotive sector demonstrates particular strength in applying CBN grinding technologies to transmission component manufacturing, with companies including Toyota and Honda implementing sophisticated grinding operations for hardened gear production. Regulatory oversight through aerospace certification bodies emphasizes comprehensive process validation and grinding parameter documentation that favors established abrasive manufacturers with proven CBN electroplating technologies.

South Korean CBN electroplated wheels operations reflect the country's aerospace manufacturing development and comprehensive automotive engineering capabilities. Major automotive manufacturers including Hyundai Motor Group and Kia implement sophisticated grinding procurement strategies supporting both powertrain component production and precision machining operations targeting international quality standards. Organizations are investing in advanced CBN grinding systems to enhance operational efficiency while meeting global aerospace and automotive specifications.

The aerospace component manufacturing sector drives demand for high-performance CBN electroplated wheels capable of supporting superalloy grinding operations and precision surface finishing requirements. Korean manufacturers prioritize abrasive tool suppliers with comprehensive technical support capabilities and established quality assurance systems supporting consistent grinding performance across high-precision manufacturing operations.

Market dynamics favor established abrasive manufacturers with proven CBN electroplating expertise and comprehensive aerospace industry relationships supporting component manufacturing and precision grinding operations. Value concentration occurs around validated wheel specifications capable of delivering consistent grinding performance with extended service life, creating barriers for new entrants lacking aerospace certification credentials and manufacturing process validation. Several competitive archetypes dominate market positioning: global abrasive companies leveraging broad superabrasive portfolios and established aerospace relationships across commercial and defense segments; specialized CBN wheel manufacturers offering focused electroplating technologies with advanced performance characteristics in difficult material grinding; regional grinding tool suppliers providing localized technical support and cost-competitive solutions for emerging market manufacturing operations; and innovative electroplating technology developers creating next-generation bonding systems with enhanced thermal management capabilities.

Switching costs remain elevated due to wheel qualification requirements, grinding process validation, and established supplier relationships that favor incumbent manufacturers in conservative aerospace industries. Technology transitions toward optimized grain distribution and advanced electroplating formulations create opportunities for suppliers offering performance advantages and operational efficiency benefits, while aerospace certification requirements and manufacturing validation processes slow adoption in risk-averse precision manufacturing environments. Consolidation pressure increases as larger industrial companies acquire specialized CBN wheel manufacturers to expand superabrasive capabilities and strengthen aerospace market positions.

Strategic positioning requires comprehensive performance validation across diverse grinding applications and proven consistency in aerospace component manufacturing, particularly for turbine blade grinding operations and critical powertrain component production programs. Technical support capabilities and application engineering services become critical differentiation factors as manufacturers prioritize grinding process optimization and consistent component quality in high-value aerospace operations. Market share stability depends on maintaining aerospace industry certification and quality system acceptance while adapting CBN electroplating technologies to emerging manufacturing requirements and material processing challenges without disrupting established grinding workflows or requiring extensive process revalidation investments.

| Items | Values |

|---|---|

| Quantitative Units | USD 575.1 million |

| Electroplating Material Type | Electroplating Nickel, Electroplating Nickel Cobalt, Others |

| Application | Aerospace, Automotive, Machinery, Mold Manufacturing, Tools, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, China, India, Brazil, and other 40+ countries |

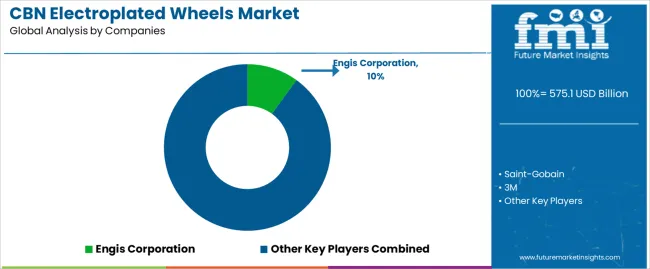

| Key Companies Profiled | Engis Corporation, Saint-Gobain, 3M, Eagle Superabrasives, Mirka, Continental Diamond Tool, Diprotex, Muzzi, JTEKT, Asahi Diamond Industrial, A.L.M.T. Corp, KURE GRINDING WHEEL, Tokyo Diamond Tools, Advanced Superabrasives Inc., Fuhang Superhard Material, Zhengzhou Research Institute for Abrasives & Grinding |

| Additional Attributes | Dollar sales by electroplating material type and application, regional demand across NA, EU, APAC, competitive landscape, aerospace manufacturing adoption patterns, precision grinding process integration, and wheel performance optimization initiatives driving component quality, operational efficiency, and manufacturing standards |

The global cbn electroplated wheels market is estimated to be valued at USD 575.1 billion in 2025.

The market size for the cbn electroplated wheels market is projected to reach USD 927.9 billion by 2035.

The cbn electroplated wheels market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in cbn electroplated wheels market are electroplating nickel, electroplating nickel cobalt and others.

In terms of application, aerospace segment to command 34.2% share in the cbn electroplated wheels market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Micron CBN Powder Market Size and Share Forecast Outlook 2025 to 2035

Diamond and CBN Micron Powder Market Size and Share Forecast Outlook 2025 to 2035

Handwheels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Wheels Market

Motorcycle Wheels Market Size and Share Forecast Outlook 2025 to 2035

Helicopter Wheels Market

Boat Steering Wheels Market Size and Share Forecast Outlook 2025 to 2035

Continuous Track Wheels Market

Carbon Fiber Bike Wheelset Market Size and Share Forecast Outlook 2025 to 2035

Adventure Motorcycle Wheels Market Size and Share Forecast Outlook 2025 to 2035

Motors for Robot Body and Robot Wheels Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA