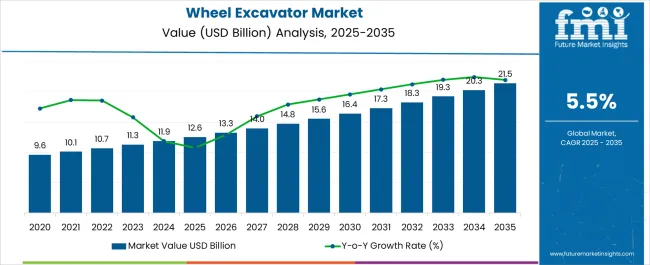

The wheel excavator market is expected to grow from USD 12.6 billion in 2025 to USD 21.5 billion by 2035, reflecting a 5.5% CAGR and generating an absolute dollar opportunity of USD 8.9 billion. Growth is driven by increasing infrastructure development, urban construction projects, and rising demand for efficient, versatile excavation equipment in commercial, industrial, and municipal projects. Technological advancements, including automation, telematics, fuel-efficient engines, and enhanced mobility features, further support adoption and long-term market expansion across global regions.

The long-term value accumulation curve illustrates how revenue and market value build progressively over the forecast period. In the early years, from 2025 to 2028, the curve shows steady accumulation, with North America and Europe driving initial adoption due to replacement cycles and modernization of construction fleets. Between 2029 and 2032, accumulation accelerates as the Asia Pacific experiences rapid urbanization, infrastructure development, and industrial expansion, contributing the largest share of incremental value. From 2033 to 2035, accumulation continues at a slightly moderated pace, reflecting market maturation in developed regions, while emerging markets sustain growth through fleet expansion and the introduction of upgraded models. The cumulative value trajectory highlights the compounding effect of both volume adoption and price-driven premium models, demonstrating how consistent market expansion over the decade results in substantial long-term value creation of USD 8.9 billion for the wheel excavator market.

| Metric | Value |

|---|---|

| Wheel Excavator Market Estimated Value in (2025 E) | USD 12.6 billion |

| Wheel Excavator Market Forecast Value in (2035 F) | USD 21.5 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The wheel excavator market is driven by five primary parent markets with specific shares. Construction leads with 38%, as wheel excavators are widely used for urban development, road building, and commercial projects. Mining and quarrying contribute 27%, employing excavators for material handling, excavation, and site preparation. Infrastructure and civil engineering account for 14%, supporting bridges, highways, and large-scale public works. Utilities and energy sectors represent 11%, using excavators for pipelines, power line installation, and renewable energy projects. Agriculture and forestry hold 10%, leveraging excavators for land preparation, drainage, and timber operations. These segments collectively shape global demand for wheel excavators. Recent developments in the wheel excavator market focus on efficiency, automation, and sustainability. Manufacturers are introducing hybrid and fully electric models to reduce fuel consumption and emissions. Enhanced hydraulic systems, ergonomic cabins, and telematics integration improve productivity, safety, and remote performance monitoring. Automation technologies, GPS-based precision control, and predictive maintenance systems are gaining adoption in construction and mining sectors. Rising urbanization, large infrastructure investments, and emphasis on eco-friendly machinery are accelerating market growth. These trends are driving innovation, operational efficiency, and broader adoption of wheel excavators worldwide.

The wheel excavator market is demonstrating steady growth, driven by infrastructure development, urban construction projects, and increased investment in utility and road maintenance activities. The versatility of wheel excavators in navigating paved and semi-urban terrains has positioned them as a preferred choice over tracked alternatives in specific applications.

The market benefits from technological advancements in hydraulic systems, operator comfort, and telematics integration, which enhance operational efficiency and reduce downtime. Additionally, the ease of transportation without specialized trailers has improved mobility, making these machines suitable for projects requiring frequent relocation.

Ongoing government spending on infrastructure modernization and municipal projects is expected to further stimulate demand. With the integration of energy-efficient engines and hybrid prototypes, the market outlook remains positive, supported by expanding rental fleets and the adoption of advanced attachments that broaden application scope.

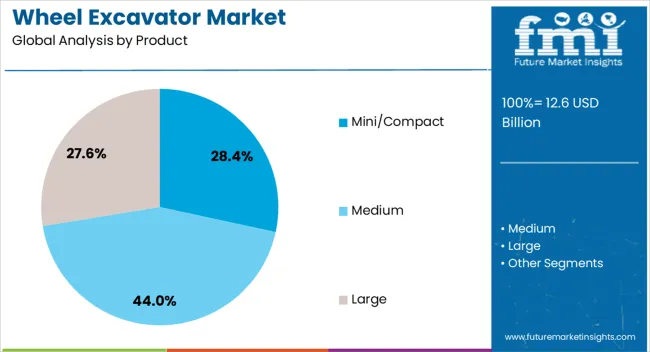

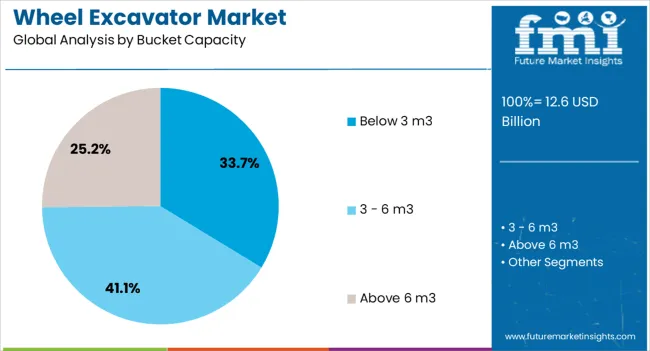

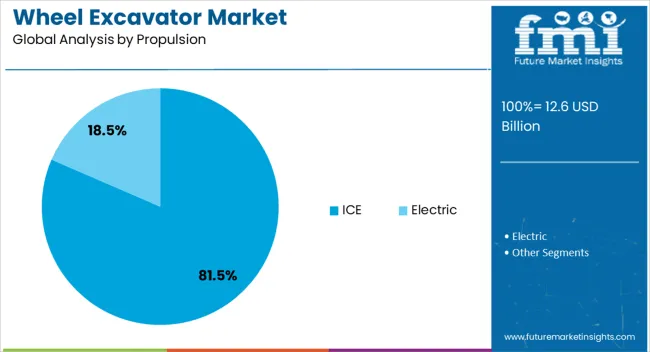

The wheel excavator market is segmented by product, bucket capacity, propulsion, application, and geographic regions. By product, wheel excavator market is divided into Mini/Compact, Medium, and Large. In terms of bucket capacity, wheel excavator market is classified into Below 3 m3, 3 - 6 m3, and Above 6 m3. Based on propulsion, wheel excavator market is segmented into ICE and Electric. By application, wheel excavator market is segmented into Construction, Forestry & agriculture, Mining, and Rental. Regionally, the wheel excavator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The mini/compact segment accounts for approximately 28.4% of the product category in the wheel excavator market. This segment’s leadership is supported by its adaptability to tight urban job sites and operations where maneuverability is critical. Compact dimensions allow operators to work efficiently in confined spaces without compromising performance, making these excavators suitable for landscaping, utility trenching, and small-scale construction.

Lower operating costs, reduced fuel consumption, and simplified transport logistics contribute to their market appeal. Rental companies have increasingly favored mini/compact models due to high utilization rates and broad applicability across projects.

The segment’s growth is further reinforced by innovations in quick-coupler technology, enabling rapid attachment changes to enhance versatility. With urbanization trends accelerating and demand for compact, efficient equipment on the rise, the mini/compact segment is positioned to retain a significant share in the forecast period.

The below 3 m³ segment dominates the bucket capacity category, holding approximately 33.7% share. This segment’s advantage lies in its suitability for applications requiring precise digging, loading, and material handling in environments where larger capacities are impractical.

Operators in municipal maintenance, utility repair, and road construction favor this capacity range due to its balance of productivity and control. Lower fuel consumption and reduced strain on hydraulic systems enhance operational lifespan and cost-efficiency.

The segment also benefits from high compatibility with various attachments, allowing for versatility across different project types. With increasing emphasis on operational flexibility and the need for equipment capable of working efficiently in space-restricted zones, the below 3 m³ segment is expected to maintain its dominance in the coming years.

The internal combustion engine (ICE) segment leads the propulsion category with approximately 81.5% share, reflecting its entrenched role in delivering reliable power for heavy-duty excavation tasks. ICE-powered wheel excavators offer high torque and operational autonomy, particularly in remote sites where access to charging infrastructure is limited.

The segment’s prevalence is supported by mature manufacturing infrastructure, widespread service availability, and the capability to handle intensive workloads without significant downtime. Diesel-powered variants remain the preferred choice for construction and infrastructure projects in emerging markets due to cost efficiency and proven performance.

While electrification trends are emerging, ICE technology continues to dominate given current energy storage limitations for high-load applications. With incremental improvements in fuel efficiency and emission control systems, the ICE segment is expected to retain its leadership over the short to medium term.

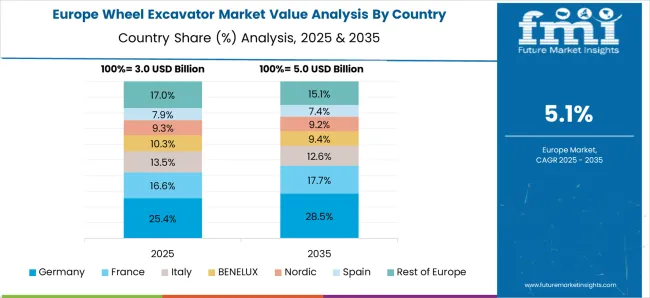

The global wheel excavator market is growing due to urban infrastructure development, road construction, and industrial projects. Asia Pacific accounts for over 45% of adoption, led by China, India, and Japan. Europe emphasizes compact, energy-efficient excavators for urban construction and utility projects, while North America focuses on mining, highway construction, and municipal applications. Key models include 14–25 ton mid-sized wheel excavators and high-capacity units above 25 tons. Rising demand for maneuverable, fuel-efficient construction equipment and automation integration is driving measurable growth in commercial, industrial, and municipal projects globally.

The primary driver of the wheel excavator market is the expanding urban construction and infrastructure development. Asia Pacific leads due to rapid road construction, metro rail projects, and industrial park development in China, India, and Southeast Asia. Europe is adopting compact and low-emission wheel excavators for urban sites where maneuverability and noise reduction are critical. North America focuses on mining, highway projects, and municipal operations requiring robust and versatile machinery. Technological enhancements, such as fuel-efficient engines, hydraulic system improvements, and telematics integration, increase productivity and reduce operational costs. Rising investments in smart city and infrastructure modernization projects globally continue to accelerate wheel excavator adoption.

Opportunities are increasing from automation, digital monitoring, and connected construction equipment. Integration of GPS, telematics, and remote-control systems enables predictive maintenance, real-time performance tracking, and optimized fleet management. Asia Pacific is witnessing growth in semi-autonomous wheel excavators for large urban and industrial projects. Europe focuses on electric and hybrid wheel excavators to meet emission standards and reduce operational costs. North America is deploying smart construction equipment for mining and road development, improving efficiency and safety. Manufacturers offering modular, hybrid, and digitally connected excavators can capture opportunities across global construction, infrastructure, and industrial sectors, addressing the increasing demand for productivity and operational cost reduction.

Key trends include adoption of electric and hybrid powertrains, telematics systems, and compact designs for urban operations. Hybrid wheel excavators reduce fuel consumption by 15–25% and lower greenhouse gas emissions. Telematics and IoT systems allow remote monitoring, predictive maintenance, and optimized utilization in fleets. Asia Pacific is leading adoption in construction and urban infrastructure projects, while Europe emphasizes electric wheel excavators for noise-sensitive urban environments. Compact and lightweight excavators facilitate maneuvering in tight spaces without compromising lifting and digging performance. These trends are transforming the market, enhancing energy efficiency, operational visibility, and suitability for modern urban and industrial applications globally.

High capital investment and maintenance requirements restrain wheel excavator adoption. High-end mid-sized and large excavators involve significant upfront costs, limiting procurement in small and medium construction projects. Advanced technology integration, including telematics, hydraulic systems, and electric powertrains, requires skilled operators and regular maintenance, increasing operating expenses. Availability of spare parts and technical expertise in emerging markets remains a challenge. Additionally, competition from tracked excavators in off-road or rough terrain applications limits market penetration in certain regions. Manufacturers must focus on cost-optimized, modular, and low-maintenance designs to expand adoption across urban, industrial, and infrastructure projects globally.

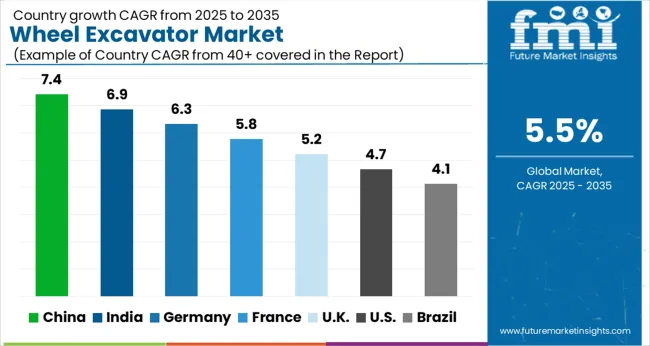

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The wheel excavator market is expected to grow at a global CAGR of 5.5%, driven by increasing construction and mining activities, infrastructure development, and industrial applications. China leads at 7.4%, a 1.35× multiple of the global rate, supported by BRICS-driven urban development, industrial expansion, and equipment modernization. India follows at 6.9%, a 1.26× multiple, reflecting rising infrastructure projects, industrial growth, and mechanization in construction. Germany records 6.3%, a 1.15× multiple, shaped by OECD-focused technological upgrades, industrial efficiency, and sustainable construction initiatives. The United Kingdom posts 5.2%, slightly below the global rate, supported by selective infrastructure projects and niche industrial applications. The United States stands at 4.7%, 0.85× the benchmark, driven by replacement demand and construction modernization. BRICS economies lead volume growth, OECD countries focus on innovation and efficiency, and ASEAN contributes through urbanization and industrial development. This report includes insights on 40+ countries; the top markets are shown here for reference.

The wheel excavator market in China is projected to grow at a CAGR of 7.4%, driven by rapid construction activity, infrastructure expansion, and industrial equipment modernization. Leading manufacturers such as Sany, Zoomlion, and XCMG supply advanced wheel excavators with high-efficiency hydraulics, fuel-efficient engines, and ergonomic designs. Adoption is concentrated in urban construction projects, mining operations, and industrial development zones. Technological trends include telematics integration, hybrid power systems, and automated operational features to improve efficiency and reduce downtime. Government infrastructure initiatives, combined with increasing demand for compact and versatile machinery, reinforce market expansion. Rising investment in urban and industrial projects accelerates the adoption of wheel excavators across China.

The wheel excavator market in India is expected to grow at a CAGR of 6.9%, supported by rising urbanization, infrastructure development, and industrial equipment modernization. Key suppliers including Tata Hitachi, L&T Construction Equipment, and JCB provide wheel excavators with fuel-efficient engines, high-capacity hydraulic systems, and operator-friendly cabins. Adoption is concentrated in road construction, mining, and industrial projects. Technological trends include telematics-enabled machinery, hybrid-powered wheel excavators, and automated operational functions. Government initiatives to improve infrastructure and accelerate construction activity reinforce market growth. Increasing demand for versatile, efficient, and compact machinery drives the adoption of wheel excavators across India.

The wheel excavator market in Germany is projected to grow at a CAGR of 6.3%, driven by industrial construction, infrastructure maintenance, and mining operations. Leading suppliers such as Liebherr, Wacker Neuson, and Volvo CE provide high-performance wheel excavators with advanced hydraulic systems, fuel efficiency, and telematics-enabled operations. Adoption is concentrated in industrial construction, municipal infrastructure projects, and mining activities. Technological trends include automation, hybrid systems, and smart telematics solutions for predictive maintenance and operational efficiency. Germany’s emphasis on efficient construction equipment, industrial modernization, and smart construction solutions strengthens market adoption.

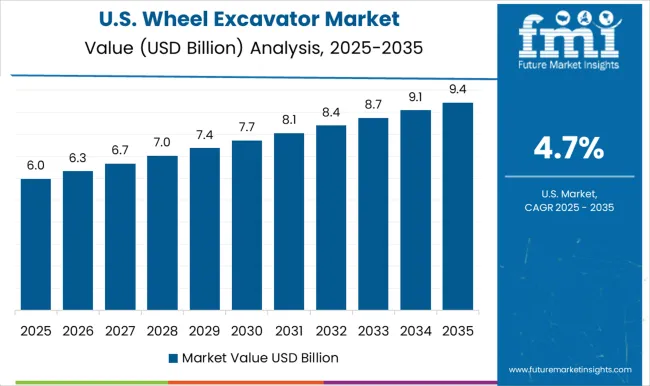

The wheel excavator market in the United States is projected to grow at a CAGR of 4.7%, driven by urban development, industrial infrastructure, and road construction projects. Key players such as Caterpillar, John Deere, and Volvo CE supply high-efficiency wheel excavators with advanced hydraulics, operator-friendly cabins, and fuel-saving technologies. Adoption is concentrated in construction, industrial projects, and municipal infrastructure. Technological trends include telematics integration, automation, and hybrid power systems. Federal and state initiatives for infrastructure development, combined with rising demand for efficient and versatile machinery, support steady market growth across the United States.

The wheel excavator market in the United Kingdom is expected to grow at a CAGR of 5.2%, supported by road and urban infrastructure development, industrial projects, and construction modernization. Suppliers such as JCB, Volvo CE, and Liebherr provide wheel excavators with fuel-efficient engines, telematics integration, and ergonomic design features. Adoption is concentrated in municipal infrastructure, urban construction, and industrial projects. Technological trends include automation, predictive maintenance systems, and hybrid power integration for fuel savings and operational efficiency. Growing construction activity and modernization of industrial facilities reinforce market expansion in the United Kingdom.

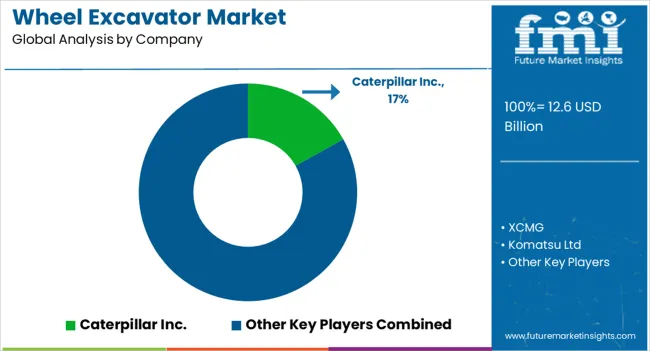

Competition in the wheel excavator market is driven by global construction equipment manufacturers and specialized heavy machinery providers, focusing on productivity, fuel efficiency, and operational versatility. Caterpillar Inc., Komatsu Ltd, and Liebherr Group lead with high-performance models designed for mining, construction, and infrastructure projects, emphasizing hydraulic efficiency, operator comfort, and durability in their brochures. AB Volvo, Deere & Company, and Hitachi Construction Machinery Co. Ltd target medium- to large-scale projects, promoting advanced control systems and low operating costs. XCMG, Sany Heavy Industry Co. Ltd, and Doosan Infracore Co. Ltd focus on cost-effective solutions for regional and emerging markets, highlighting compact design, maneuverability, and reliability. J.C. Bamford Excavators Ltd emphasizes precision engineering and customization options for specialized tasks. Brochures detail lifting capacity, reach, fuel consumption, maintenance intervals, and safety features, enabling buyers to evaluate performance and suitability. Marketing materials shape competitive advantage, combining technical schematics, operational guidance, and real-world application examples. Frequent updates reflect technological improvements, emission compliance, and ergonomic innovations. Larger manufacturers leverage global distribution networks and brand recognition, while smaller players emphasize flexibility, niche applications, and rapid delivery. Market leadership depends on how effectively brochures communicate operational efficiency, reliability, and long-term value in wheel excavator solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.6 Billion |

| Product | Mini/Compact, Medium, and Large |

| Bucket Capacity | Below 3 m3, 3 - 6 m3, and Above 6 m3 |

| Propulsion | ICE and Electric |

| Application | Construction, Forestry & agriculture, Mining, and Rental |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar Inc., XCMG, Komatsu Ltd, AB Volvo, Deere & Company, Liebherr Group, Hitachi Construction Machinery Co. Ltd, Sany Heavy Industry Co., Ltd., J.C.Bamford Excavators Ltd, and Doosan Infracore Co. Ltd |

| Additional Attributes | Dollar sales by excavator type and end use, demand dynamics across construction, mining, and infrastructure projects, regional trends in urban development and mechanization, innovation in fuel efficiency, hydraulic systems, and operator comfort, environmental impact of emissions and noise, and emerging use cases in smart construction and autonomous machinery. |

The global wheel excavator market is estimated to be valued at USD 12.6 billion in 2025.

The market size for the wheel excavator market is projected to reach USD 21.5 billion by 2035.

The wheel excavator market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in wheel excavator market are mini/compact, medium and large.

In terms of bucket capacity, below 3 m3 segment to command 33.7% share in the wheel excavator market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wheeled Bins Market Size and Share Forecast Outlook 2025 to 2035

Wheel Loader Scales Market Size and Share Forecast Outlook 2025 to 2035

Wheel Loader Market Size and Share Forecast Outlook 2025 to 2035

Wheel Balancing Market Size and Share Forecast Outlook 2025 to 2035

Wheel Aligner Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wheel Tractor Scrapers Market Size and Share Forecast Outlook 2025 to 2035

Wheeled Insulated Cooler Market Trends - Growth & Demand Forecast 2025 to 2035

Competitive Breakdown of Wheeled Bin Providers

Germany Wheeled Bin Industry Analysis – Growth & Outlook 2024-2034

Wheelchair Market Analysis – Size, Share & Forecast 2024-2034

Wheel studs Market

3-Wheel Sit-Down Counterbalance Forklift Market Size and Share Forecast Outlook 2025 to 2035

4-Wheel Sit-Down Counterbalance Forklift Market Size and Share Forecast Outlook 2025 to 2035

4-Wheel Mobility Scooters Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of 4-Wheeled Container Companies

4-Wheeled Container Market Trends – Size, Demand & Forecast 2024-2034

Flywheel Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Two-Wheeler Lubricants Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Anti-lock Braking System Market Size and Share Forecast Outlook 2025 to 2035

Two Wheeler Rental Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA