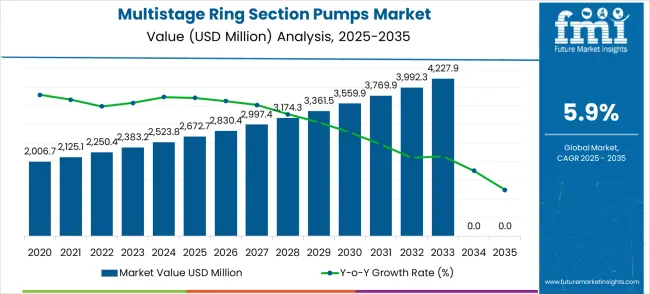

The multistage ring section pumps market is expected to grow from an estimated USD 2,672.7 million in 2025 to USD 4,741.5 million by 2035, representing a forecast CAGR of 5.9%. This steady growth reflects increasing demand for efficient pumping solutions across industries such as oil and gas, water treatment, power generation, and chemical processing. Over the decade, the market is projected to add USD 2,068.8 million in absolute terms, driven by industrial expansion, infrastructure development, and the growing need for high-performance pump systems in energy-intensive applications. The CAGR indicates a balanced long-term growth trend, with each year contributing consistently to cumulative growth, underpinned by technological advancements in pump design and energy efficiency.

Analyzing the share of total growth reveals that early years contribute proportionally less compared to later years. From USD 2,672.7 million in 2025, the market grows to USD 2,830.4 million in 2026, adding USD 157.7 million, about 7.6% of the total growth over ten years. By 2027, with a value of USD 2,997.4 million, the market has contributed roughly 8.9% of total growth. The initial phase of the forecast reflects foundational expansion driven by replacement of legacy pump systems and growing industrial capacity. Energy efficiency regulations and innovations such as multi-stage configurations that reduce energy consumption are influencing early growth dynamics.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2,672.7 million |

| Market Forecast Value (2035) | USD 4,741.5 million |

| Forecast CAGR (2025–2035) | 5.9% |

The mid-phase of the forecast period (2028–2032) emerges as the most significant contributor to cumulative growth. By 2030, the market reaches USD 3,559.9 million, representing an increase of USD 887.2 million from 2025, accounting for more than 42% of the total growth over the decade. This growth phase benefits from expanding infrastructure projects globally, particularly in emerging economies where demand for robust pump systems is rising. Industrial applications in oil refineries, desalination plants, and power generation are projected to be major growth segments, contributing significantly to YoY gains.

In the later years (2033–2035), the market continues a healthy growth trajectory, reaching USD 4,741.5 million. This final stage contributes about 28% of the total decade growth, supported by mature adoption in developed markets and intensified expansion in industrial segments. By this time, the integration of smart monitoring systems, IoT-enabled controls, and predictive maintenance technologies will further enhance pump efficiency and reliability. The ratio and proportion analysis reflects an increasingly weighted contribution from later years, signaling that market momentum strengthens as advanced solutions gain traction globally.

Market expansion is being supported by the continuous growth of global power generation capacity across established and emerging markets and the corresponding need for reliable high-pressure pumping solutions that ensure optimal boiler feed water delivery and thermal power plant efficiency. Modern power generation facilities require sophisticated pumping systems that can deliver precise pressure control, high reliability, and energy-efficient operation while handling demanding thermal cycling and operational requirements. The superior pressure generation capabilities and operational efficiency characteristics of multistage ring section pumps make them essential components in power plant operations where consistent high-pressure water delivery directly impacts generation efficiency and plant availability.

The growing focus on urban infrastructure development and water supply optimization is driving demand for advanced pumping technologies from certified manufacturers with proven track records of reliability and performance in critical infrastructure applications. Municipal water utilities and building developers are increasingly investing in multistage pumping systems that offer exceptional pressure capabilities while maintaining energy efficiency and reducing operational costs over extended service periods. Regulatory requirements and infrastructure standards are establishing performance benchmarks that favor high-efficiency multistage pumping solutions with intelligent control capabilities and proven durability.

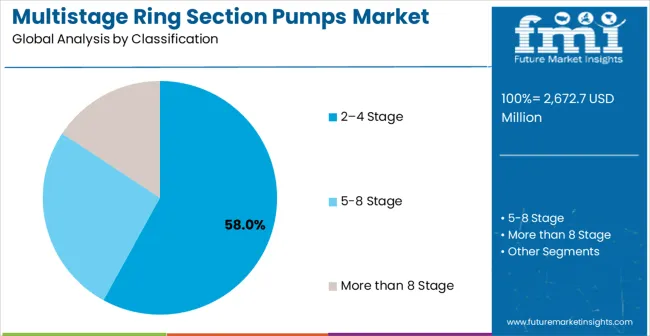

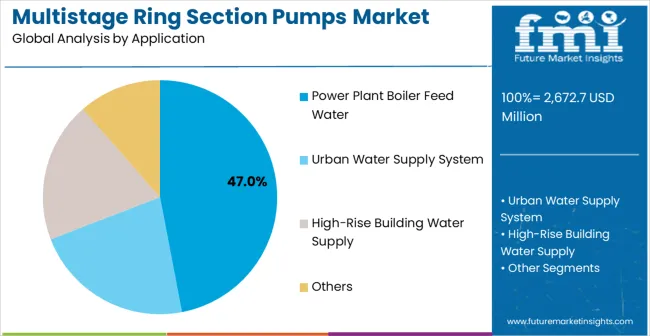

The market is segmented by stage type, application, and region. By stage type, the market is divided into 2-4 stage, 5-8 stage, and more than 8 stage configurations. Based on application, the market is categorized into power plant boiler feed water, urban water supply system, high-rise building water supply, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

2-4 Stage configurations are projected to account for 58% of the multistage ring section pumps market in 2025. This leading share is supported by the optimal balance of pressure generation, energy efficiency, and cost-effectiveness that low-stage multistage systems offer for diverse industrial and municipal applications. 2-4 stage pumps provide adequate pressure boost for most standard applications while maintaining reasonable power consumption and installation complexity, making them the preferred choice for urban water supply, building pressurization, and moderate-pressure industrial processes. The segment benefits from technological advancements that have improved hydraulic efficiency, reduced maintenance requirements, and enhanced control system integration.

Modern 2-4 stage multistage ring section pumps incorporate advanced impeller designs, optimized hydraulic geometries, and sophisticated balancing technologies that deliver exceptional efficiency while maintaining compact footprints and simplified maintenance procedures. These innovations have significantly improved pump reliability while maintaining compatibility with various control systems and reducing total cost of ownership through enhanced efficiency and extended service intervals. The municipal water supply sector particularly drives demand for 2-4 stage solutions, as water utilities require reliable pumping systems that can provide consistent pressure delivery while minimizing energy consumption and operational costs.

Power Plant Boiler Feed Water applications are expected to represent 47% of multistage ring section pumps demand in 2025. This dominant share reflects the critical importance of reliable boiler feed water systems in thermal power generation and the need for high-pressure pumping solutions capable of supporting efficient steam cycle operations across diverse power generation technologies. Power utilities require advanced and reliable pumping systems for coal-fired plants, natural gas facilities, biomass power generation, and combined cycle operations requiring precise pressure control and exceptional reliability. The segment benefits from ongoing power capacity expansion and increasing focus on power plant efficiency optimization and environmental compliance.

Power plant boiler feed water applications demand exceptional pumping performance to ensure reliable high-pressure water delivery, precise flow control, and continuous operation under demanding thermal and pressure conditions that support optimal steam generation and power plant efficiency. These applications require pumping systems capable of handling extreme operating pressures, temperature variations, and continuous duty cycles while maintaining precise control and automated operation integration with plant control systems. The growing focus on power plant efficiency improvement, particularly in emerging markets expanding generation capacity and developed markets upgrading aging infrastructure, drives consistent demand for advanced multistage pumping solutions.

The market is advancing steadily due to increasing global energy demand and growing recognition of efficient pumping system importance in power generation efficiency and infrastructure reliability. The market faces challenges including high capital costs for complex multistage systems, need for specialized maintenance expertise and spare parts availability, and varying operational requirements across different applications affecting pump selection criteria. Standardization efforts and certification programs continue to influence pump design quality and market development patterns.

The growing deployment of Internet of Things sensors, vibration monitoring systems, and predictive analytics platforms is enabling real-time performance optimization and proactive maintenance scheduling in multistage pumping installations. Smart monitoring systems and machine learning algorithms provide continuous performance assessment while enabling automated fault detection and optimized operation based on real-time operating conditions and historical performance data. These technologies are particularly valuable for power plants and critical infrastructure applications that require maximum uptime and operational reliability.

Modern pump manufacturers are incorporating advanced variable frequency drives, high-efficiency motor technologies, and intelligent control systems that optimize energy consumption while maintaining precise flow and pressure control across varying demand conditions. Integration of premium efficiency motors, advanced hydraulic designs, and sophisticated control algorithms enables significant energy savings and operational cost reduction compared to traditional fixed-speed pumping systems. Advanced materials and manufacturing techniques also support development of more durable and efficient pump components for demanding industrial applications.

| Country | CAGR (2025–2035) |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| Brazil | 6.2% |

| United States | 5.6% |

| United Kingdom | 5.0% |

| Japan | 4.4% |

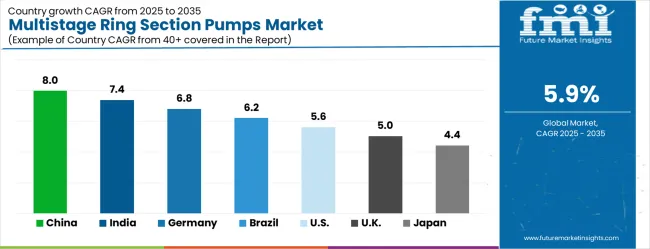

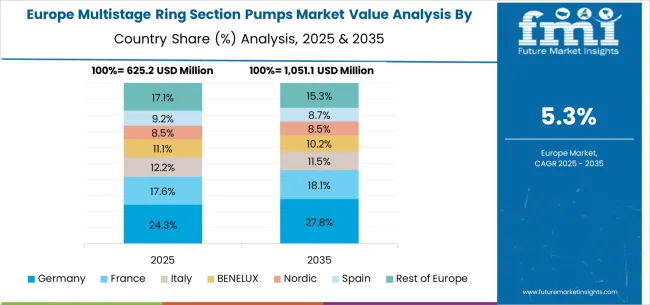

The market is growing steadily, with China leading at a 8.0% CAGR through 2035, driven by massive power generation capacity expansion, comprehensive urbanization programs requiring advanced water infrastructure, and growing industrial automation across manufacturing sectors. India follows at 7.4%, supported by rapid power sector development, expanding urban water supply infrastructure, and increasing investments in industrial facilities requiring reliable high-pressure pumping systems. Germany records strong growth at 6.8%, focusing precision engineering excellence, advanced power plant technologies, and comprehensive industrial automation supporting efficient pumping solutions. Brazil grows steadily at 6.2%, integrating advanced pumping systems into expanding power generation capacity and urban infrastructure development. The United States shows solid growth at 5.6%, focusing on power plant modernization, infrastructure replacement, and energy efficiency improvements. The United Kingdom maintains steady expansion at 5.0%, supported by power sector upgrades and water infrastructure modernization. Japan demonstrates consistent growth at 4.4%, focusing technological innovation and industrial efficiency optimization.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China is projected to grow at a CAGR of 8.0% from 2025 to 2035, driven by rising demand in power generation, water treatment, and oil and gas industries. Multistage ring section pumps are highly valued for their efficiency, reliability, and capability to handle high-pressure applications. Chinese manufacturers are investing in the development of energy-efficient, high-capacity pumps to support industrial projects and infrastructure upgrades. Expansion of water supply networks, power plant modernization, and increased demand for petroleum refining support market growth. Government policies promoting industrial efficiency and environmental regulations are boosting adoption. Collaborations between pump manufacturers and engineering firms enable technology enhancement. Demand from industrial automation projects and large-scale infrastructure continues to drive the market in China.

India is expected to register a CAGR of 7.4% during 2025–2035, supported by expansion in water infrastructure, power generation, and petroleum refining. Multistage ring section pumps are widely adopted for high-pressure pumping needs due to their robustness and reliability. Indian manufacturers are focusing on producing cost-efficient, high-performance pumps for domestic and industrial applications. Growth is driven by government initiatives in rural water supply, renewable energy projects, and expansion of refineries. Demand is also supported by rising investments in infrastructure and manufacturing sectors. Adoption is increasing in power plants and industrial complexes. Collaborative efforts between Indian pump makers and global technology providers are strengthening the market.

Germany is expected to grow at a CAGR of 6.8% from 2025 to 2035, supported by high demand in water management, power plants, and industrial automation. Multistage ring section pumps are preferred for their efficiency in high-pressure applications and reliability in long-term operation. German manufacturers are focusing energy-efficient designs, automation integration, and compliance with strict environmental standards. Growth is driven by the modernization of water treatment plants, expansion of renewable energy facilities, and increased demand in the chemical processing industry. Adoption in critical infrastructure and industrial automation projects is increasing. Germany’s engineering expertise and strong manufacturing base sustain steady demand for advanced pump systems.

Brazil is forecasted to grow at a CAGR of 6.2% between 2025 and 2035, supported by growth in water treatment, agriculture irrigation, and petroleum refining industries. Multistage ring section pumps are valued for durability, high efficiency, and suitability for high-pressure fluid transfer. Local manufacturers focus on cost-efficient production while importing advanced systems for specialized applications. Growth is fueled by investments in water infrastructure projects, oil refining capacity expansion, and industrial modernization. Government programs to improve water supply reliability and energy efficiency further support growth. Partnerships with global pump technology providers enhance access to advanced designs. Increasing adoption in infrastructure and industrial projects strengthens market growth in Brazil.

The United States is projected to grow at a CAGR of 5.6% from 2025 to 2035, driven by demand in water infrastructure, power generation, and chemical processing. Multistage ring section pumps are valued for their high efficiency, reliability, and ability to manage large-scale pumping requirements. USA manufacturers focus on energy efficiency, smart pump integration, and compliance with environmental standards. Growth is supported by upgrades to water treatment plants, expansion of chemical manufacturing, and renewable energy projects. Adoption is increasing in municipal water supply and large-scale industrial facilities. Partnerships with technology innovators ensure advanced product offerings. Increasing focus on green industrial processes supports steady growth in this market.

The United Kingdom is expected to grow at a CAGR of 5.0% during 2025–2035, driven by demand in water treatment, power generation, and industrial sectors. Multistage ring section pumps are preferred for their high efficiency and ability to operate under demanding conditions. UK manufacturers focus on producing reliable, energy-efficient systems while meeting strict environmental standards. Growth is supported by government initiatives to improve water infrastructure, modernize power plants, and enhance industrial processes. Adoption is increasing in municipal water systems and renewable energy projects. Collaborative partnerships with global pump suppliers ensure access to cutting-edge technologies. Expanding infrastructure investment fuels steady market growth.

Japan is forecasted to grow at a CAGR of 4.4% between 2025 and 2035, supported by demand in industrial automation, water treatment, and power generation. Multistage ring section pumps are valued for precision engineering, reliability, and efficiency in high-pressure applications. Japanese manufacturers focus on precision manufacturing, durability, and integration of smart pump technology. Growth is driven by upgrades to water treatment infrastructure, expansion of manufacturing plants, and renewable energy projects. Adoption is particularly strong in critical industrial processes. Government incentives for energy efficiency and infrastructure modernization encourage pump adoption. Japan’s engineering excellence and commitment to quality sustain steady market growth.

The market is defined by competition among established industrial pump manufacturers, specialized power generation equipment providers, and emerging automation technology companies. Companies are investing in advanced hydraulic design technologies, energy efficiency optimization, intelligent control system integration, and global service capabilities to deliver reliable, efficient, and cost-effective pumping solutions. Strategic partnerships, technological advancement, and geographic expansion are central to strengthening product portfolios and market presence.

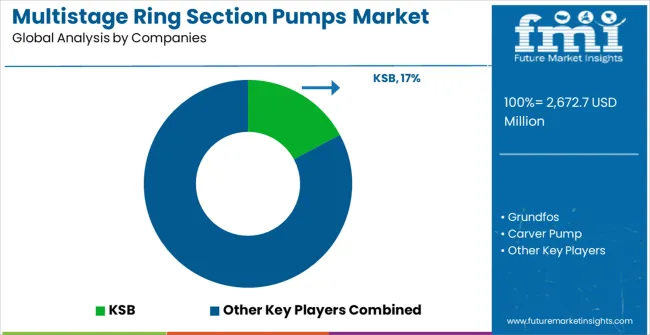

KSB, operating globally, offers comprehensive multistage pumping solutions with focus on power generation applications, energy efficiency, and technical support excellence. Grundfos, multinational pump manufacturer, provides advanced pumping systems with focus on intelligent controls and energy optimization technologies. Carver Pump, specialized in industrial applications, delivers robust multistage solutions with focus on heavy-duty performance and reliability. Sulzer offers comprehensive pumping technologies with emphasis on power generation and industrial process applications.

Goulds provides industrial pumping systems with focus on reliability and comprehensive service support. Flowserve Corporation delivers advanced pump technologies with global manufacturing capabilities and technical expertise. Ebara Corporation offers specialized multistage pumps with focus on power generation and water supply applications. TORISHIMA provides high-pressure pumping solutions with focus on power plant and industrial applications.

DESMI, SanChang Pump, MTH Pumps, Speck, Shipco Pumps, Roth Pump, and Zoomlian Pump offer specialized pumping expertise, regional manufacturing capabilities, and technical support across diverse industrial and infrastructure applications.

The multistage ring section pumps market underpins power generation efficiency, urban infrastructure reliability, industrial process optimization, and water supply security. With energy demand growth, infrastructure modernization requirements, and increasing efficiency mandates, the sector must balance performance reliability, energy efficiency, and cost competitiveness. Coordinated contributions from governments, industry associations, equipment manufacturers, utilities, and investors will accelerate the transition toward intelligent, efficient, and highly reliable pumping systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 2,672.7 million |

| Stage Type | 2-4 Stage, 5-8 Stage, More than 8 Stage |

| Application | Power Plant Boiler Feed Water, Urban Water Supply System, High-Rise Building Water Supply, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries |

| Key Companies Profiled | KSB, Grundfos, Carver Pump, Sulzer, Goulds, Flowserve Corporation, Ebara Corporation, TORISHIMA, DESMI, SanChang Pump, MTH Pumps, Speck, Shipco Pumps, Roth Pump, Zoomlian Pump |

| Additional Attributes | Dollar sales by stage type and application, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established pump manufacturers and emerging technology specialists, deployment preferences for different stage configurations across various applications, integration with power plant systems and water infrastructure networks, innovations in hydraulic design and energy efficiency technologies for enhanced performance and reliability, and adoption of smart pumping systems with IoT connectivity and predictive maintenance capabilities for improved operational efficiency and system optimization. |

The global multistage ring section pumps market is estimated to be valued at USD 2,672.7 million in 2025.

The market size for the multistage ring section pumps market is projected to reach USD 4,741.5 million by 2035.

The multistage ring section pumps market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in multistage ring section pumps market are 2–4 stage, 5-8 stage and more than 8 stage.

In terms of application, power plant boiler feed water segment to command 47.0% share in the multistage ring section pumps market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Multistage Electric Submersible Pump Market Size and Share Forecast Outlook 2025 to 2035

Ring Pull Cap Market Size and Share Forecast Outlook 2025 to 2035

Ring Lights Market Size and Share Forecast Outlook 2025 to 2035

Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Ring Panel Filters Market Size and Share Forecast Outlook 2025 to 2035

Ringworm Treatment Market - Growth & Drug Innovations 2025 to 2035

Ring Rolling Products Market Size, Growth, and Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for the Ring Lights Market

Market Share Distribution Among Ring Panel Filters Providers

Ring Laser Gyroscope Market

String Power Conversion System(PCS) Market Size and Share Forecast Outlook 2025 to 2035

Moringa Tea Market Size and Share Forecast Outlook 2025 to 2035

Curing Oven Market Analysis Size and Share Forecast Outlook 2025 to 2035

String PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Spring Applied Clutches Market Size and Share Forecast Outlook 2025 to 2035

String Inverter Market Size and Share Forecast Outlook 2025 to 2035

Moringa Oil Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Syringes and Injectable Drugs Packaging Market Size and Share Forecast Outlook 2025 to 2035

Syringe Scale Magnifiers Market Size and Share Forecast Outlook 2025 to 2035

Boring Bars Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA