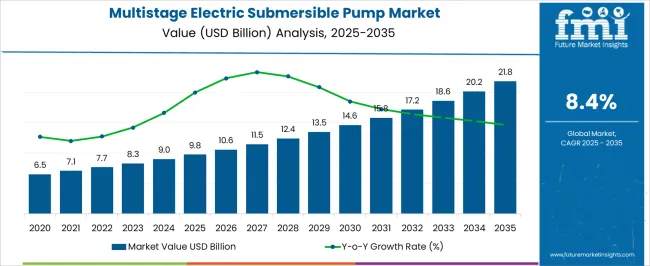

The multistage electric submersible pump market is projected to rise from USD 9.8 billion in 2025 to USD 21.8 billion in 2035 at a CAGR of 8.4%. Adoption is being supported by artificial lift requirements in mature onshore fields and offshore platforms, higher water cut wells, and brownfield redevelopment that favors reliable lift capacity.

The curve signals durable momentum as operators prioritize uptime, predictable lifecycle cost, and dependable output in oil and gas production using ESP systems. Demand is being shaped by corrosion-resistant metallurgy, improved seal sections, sand handling stages, variable speed drives, and remote condition monitoring that extends mean time between failures. Procurement teams favor OEM service contracts, rigless workovers, and standardized assemblies that shorten intervention time. Curve shape resilience is evident, with ESP solutions embedded as essential artificial lift assets across upstream portfolios and water management projects.

| Metric | Value |

|---|---|

| Multistage Electric Submersible Pump Market Estimated Value in (2025 E) | USD 9.8 billion |

| Multistage Electric Submersible Pump Market Forecast Value in (2035 F) | USD 21.8 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The multistage electric submersible pump segment is assessed to account for about 30% of the artificial lift systems market, nearly 11% of the oil and gas production equipment market, close to 9% of the water and wastewater pumps market, around 8% of the industrial pumps market, and roughly 20% of the groundwater and borehole pumps market.

These proportions aggregate to approximately 78% across the listed parent categories. Performance advantages are delivered through compact hydraulics, stacked impeller stages, corrosion-resistant metallurgy, and compatibility with variable speed drives that stabilize drawdown and limit power penalties. ESPs set the practical standard for brownfield uplift and greenfield ramp up, bridging onshore shale pads, offshore producers, and municipal wellfields with a single engineering logic focused on rate, sand handling, gas mitigation, and MTBF.

Demand has been reinforced by production optimization programs, water cut management, and the need to evacuate liquids from declining wells to preserve flowing pressure. Specification choices are guided by motor temperature margins, seal section reliability, cable integrity, and surface drive efficiency, which favors vendors with field service depth and quick turnaround refurbishment.

The multistage electric submersible pump market is experiencing significant growth driven by rising demand from oil and gas, water management, and industrial sectors. The increased need for efficient fluid handling solutions in challenging environments is accelerating the adoption of advanced pump technologies. Investments in upstream oil and gas exploration and production activities, alongside growing infrastructure development, are supporting market expansion.

Technological innovations such as improved motor efficiency, corrosion-resistant materials, and enhanced multistage designs are contributing to higher reliability and longer operational life spans. Growing awareness of energy efficiency and cost optimization in pumping systems is also influencing market dynamics.

Additionally, the expanding use of multistage pumps in municipal water supply and wastewater treatment is further boosting growth prospects. As industries seek robust, scalable, and efficient pumping solutions to meet evolving operational requirements, the market is poised for continued growth supported by product advancements and increasing application diversity.

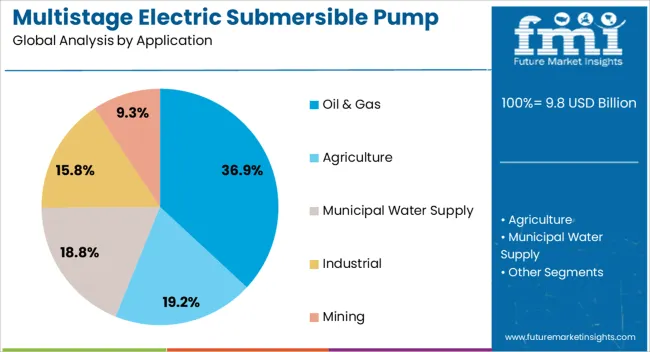

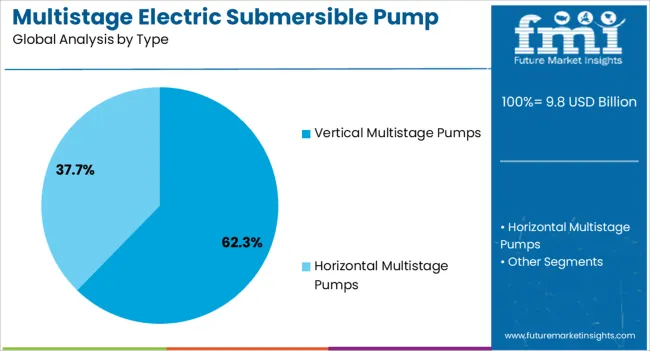

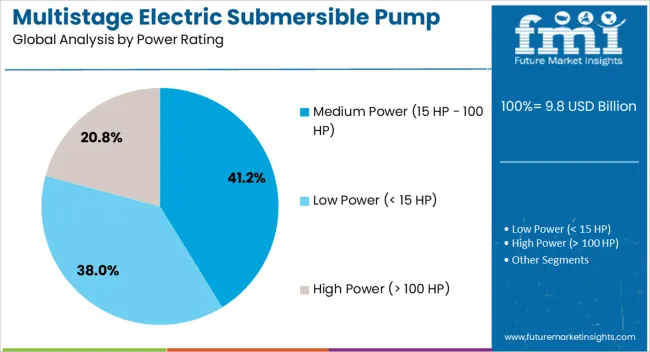

The multistage electric submersible pump market is segmented by application, type, power rating, material, end-user industry, and geographic regions. By application, multistage electric submersible pump market is divided into oil & gas, agriculture, municipal water supply, industrial, and mining. In terms of type, multistage electric submersible pump market is classified into vertical multistage pumps and horizontal multistage pumps. Based on power rating, multistage electric submersible pump market is segmented into medium power (15 HP - 100 HP), low power (< 15 HP), and high power (> 100 HP). By material, multistage electric submersible pump market is segmented into stainless steel, cast iron, plastic composites, and others. By end-user industry, multistage electric submersible pump market is segmented into Industrial manufacturing, residential, commercial, energy & power, and construction. Regionally, the multistage electric submersible pump industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The oil and gas segment is projected to hold 36.9% of the multistage electric submersible pump market revenue share in 2025, making it the leading application segment. This dominance is attributed to the critical role these pumps play in extracting hydrocarbons from deep wells, where high pressure and reliable fluid movement are essential.

The ability of multistage pumps to handle varying flow rates and pressures while maintaining energy efficiency makes them highly suitable for complex oilfield environments. Increasing offshore and onshore drilling activities, coupled with efforts to optimize reservoir management and production rates, are driving adoption.

Furthermore, advancements in pump design tailored for harsh and corrosive conditions are enhancing operational reliability and reducing downtime. The segment’s growth is supported by stringent regulatory requirements emphasizing operational safety and environmental protection, encouraging the deployment of robust, energy-efficient pumping solutions in the oil and gas industry.

Vertical multistage pumps are expected to account for 62.3% of the market revenue share in 2025, positioning this type as the most widely adopted. Their popularity is linked to the compact design that allows for high-pressure output in limited installation spaces, making them ideal for deep well and industrial applications.

The vertical arrangement facilitates efficient hydraulic performance and ease of maintenance, while enabling multistage configurations that achieve desired pressure and flow parameters. These pumps are favored in sectors requiring consistent and reliable fluid transport under varying operating conditions.

Their adaptability to a range of power ratings and robust construction materials enhances durability in demanding environments The combination of energy efficiency, operational flexibility, and low footprint has led to widespread adoption, cementing vertical multistage pumps as a leading product type within the market.

The medium power rating segment, encompassing pumps rated between 15 HP and 100 HP, is forecasted to hold 41.2% of the market revenue share in 2025, marking it as the dominant power category. This range offers an optimal balance between energy consumption and pumping capacity, meeting the needs of a broad spectrum of applications across oil and gas, water management, and industrial sectors.

Pumps in this power class provide sufficient pressure and flow rates for medium-depth wells and moderate fluid volumes, making them versatile and cost-effective choices. The segment benefits from technological enhancements improving motor efficiency and reliability, contributing to reduced operating costs and extended service life.

Additionally, the widespread availability of standardized medium power pumps simplifies maintenance and replacement, driving preference among end users. The combination of performance, efficiency, and affordability supports the continued growth of this segment within the global multistage electric submersible pump market.

The multistage electric submersible pump market is expected to expand at a steady pace as water supply, energy projects, and industrial services require deep-well and high-head pumping. Demand has been reinforced by artificial lift in oil and gas, municipal water transfer, mining dewatering, geothermal wells, and agricultural irrigation. Opportunities are opening in offshore fields, brownfield upgrades, and aftermarket services that bundle VFDs, cables, and monitoring. Trends center on reliability, energy efficiency, and predictive maintenance. Challenges persist around harsh fluids, price volatility for metals, complicated logistics, and competition from alternative lift systems.

Demand has been reinforced by broad adoption of multistage electric submersible pumps in artificial lift for oil and gas wells, municipal boreholes, and industrial water transfer. High head and compact footprints have been favored where deep aquifers, desalination intake lines, and fire-water systems require dependable pressure. Mining operations have relied on ESPs for pit dewatering and tailings management, while agriculture has used them for high-flow irrigation. Geothermal projects and power plants have specified multistage impellers to manage hot brines and condenser makeup. It is believed that the clearest pull comes from applications where rod lift or surface pumps underperform due to depth, gas handling, or vibration limits. Procurement has been supported by package offerings that include submersible motors, seal sections, intakes, downhole cable, and matched variable frequency drives for soft starts and optimized duty points, securing consistent demand across regions.

Opportunities have been created by offshore redevelopment, brownfield optimization, and municipal upgrades that favor standardized ESP skids with shorter lead times. Condition-based service contracts, rental fleets, and refurbishment programs have opened recurring revenue, while VFD retrofits on legacy strings have improved efficiency and grid compatibility. The most attractive openings lie in corrosive or abrasive duty where duplex stainless alloys, carbide bearings, and gas-handling stages command price premiums. Lithium brine extraction, geothermal reinjection, and large campus water systems have been cited as new avenues. EPC partnerships that bundle engineering, installation, and pull-and-replace crews have been rewarded in bid evaluations. Digital monitoring tied to pump curves and motor amps has enabled remote optimization that reduces trips. With many municipalities pursuing pressure-zone balancing and leakage reduction, turnkey ESP stations with surge control and soft-start profiles are expected to gain share.

Trends have centered on reliability upgrades and energy-focused designs that lower lifecycle cost per cubic meter. Abrasion-resistant bearings, anti-gas-lock impeller geometries, and improved seal sections have been specified for sandy or gassy wells. Permanent-magnet and high-efficiency submersible motors have been paired with VFDs to widen the operating envelope, while cable systems with improved insulation and splices have reduced downhole failures. Skid modularization for quick swaps has been preferred in platforms and remote stations. Remote diagnostics that track vibration, temperature, and load against the pump curve have moved from optional to standard, enabling predictive maintenance. Materials such as duplex and super duplex stainless steel have been adopted for chloride stress resistance, and coatings have been used to limit scaling. Practical reliability features beat headline horsepower, since fewer pulls and stable drawdown deliver the real economic win.

Challenges have been posed by input-cost volatility for copper, nickel, and stainless steel, which has pressured ESP pricing and strained budgets. Harsh fluids with H2S, CO2, fines, and scale have reduced run life, increasing pull frequency and workover expense. Complex logistics for offshore platforms, desert fields, and remote municipalities have extended downtime when spare strings are not staged nearby. Power quality issues, such as voltage dips and harmonics affecting VFDs, have caused nuisance trips.

Qualification requirements and variable regional codes for potable water or hazardous locations have added engineering time. Competition from rod lift, gas lift, and progressive cavity pumps has capped adoption in certain well profiles. It is argued that many failures remain preventable through proper well-intake design, sand control, surge relief, and disciplined calibration. Without stronger service networks and transparent lifecycle cost models, replacement cycles are likely to stretch.

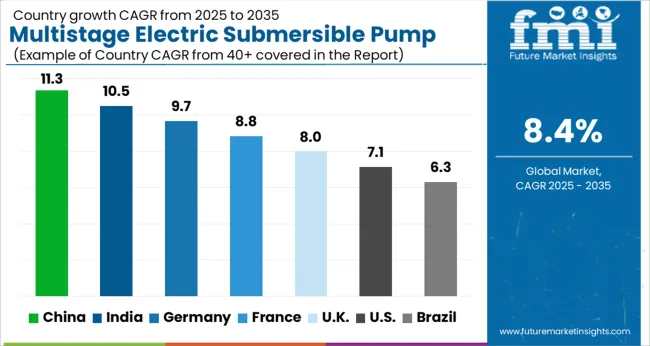

| Country | CAGR |

|---|---|

| China | 11.3% |

| India | 10.5% |

| Germany | 9.7% |

| France | 8.8% |

| UK | 8.0% |

| USA | 7.1% |

| Brazil | 6.3% |

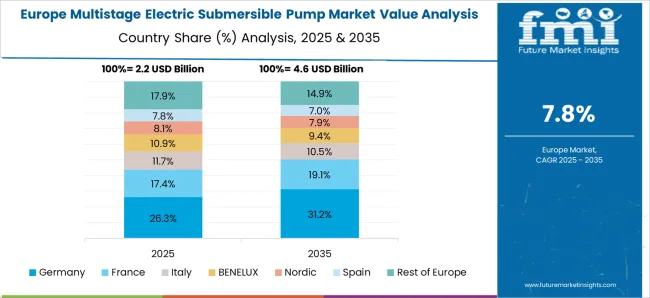

The global multistage electric submersible pump (ESP) market is projected at an 8.4% CAGR through 2025–2035. China (11.3%), India (10.5%), and Germany (9.7%) are expected to outpace the United Kingdom (8.0%) and the United States (7.1%). Growth is being anchored by artificial lift in mature oilfields, produced-water handling, mine dewatering, deep-well groundwater extraction, and geothermal reinjection. Higher stage counts, abrasion-tolerant hydraulics, and gas-handling designs are being specified to stabilize uptime in sand-bearing or gassy wells.

Asia is likely to lead on drilling intensity, municipal water build-outs, and cost-effective manufacturing. Continental Europe is expected to favor premium alloy construction and rigorous certification. A steadier USA outlook is anticipated as shale programs emphasize disciplined capex, retrofit cycles, and service-heavy aftermarket contracts. This report spans 40 plus countries, though the leading five are highlighted below.

The multistage electric submersible Pump Market in China is projected to expand at a CAGR of 11.3%. Brownfield oil recovery in Daqing, Changqing, and Bohai is being prioritized, while large municipal and industrial deep-well projects sustain steady baseline demand. Local OEM clusters have been scaled, allowing rapid delivery of abrasion-resistant stages, gas-handling sections, and corrosion-proof metallurgy for sour environments. Price–performance positioning is viewed as decisive, with domestic content targets in public tenders reinforcing share. Export shipments into Southeast Asia and MENA are gaining traction, supported by standardized skids and field commissioning teams. Leadership is likely to be retained as lifecycle support networks broaden, mean-time-between-failure improves, and spare-parts logistics tighten across oil, mining, and groundwater markets.

The multistage electric submersible pump market in India is expected to grow at a CAGR of 10.5%. Onshore oilfields in Rajasthan and Assam, expanding CBM blocks, and produced-water reinjection programs are driving artificial-lift demand, while irrigation, municipal deep-well supply, and industrial users provide durable volume. Public-sector procurement has been oriented toward longer-life hydraulics, sand-tolerant stages, and stainless shafts to curb unplanned pulls. Domestic manufacturers are broadening casting and winding capacity, with regional service partners handling field pulls and failure analysis. India is well placed to translate PSU capex pipelines and state-level water schemes into consistent ESP placements, as training, documentation, and warranty protocols mature across EPCs and local operators.

The multistage electric submersible pump market in Germany is projected to rise at a CAGR of 9.7%. Demand is centered on groundwater abstraction, geothermal doublets, chemical and food plants, and wastewater lift stations, where quiet operation, high efficiency, and certified materials are favored. Specifiers are emphasizing duplex and super-austenitic alloys, low-vibration stacks, and seal systems qualified for aggressive media. Lifecycle-cost evaluation is commonly applied, with remanufacture and rebuild programs used to extend asset life. Germany will continue to command premium share on the strength of precision assembly, documented calibration, and strict conformance to EU pressure equipment, ATEX, and drinking-water contact standards.

The multistage electric submersible pump market in the UK is forecast to expand at a CAGR of 8.0%. North Sea brownfield optimization, produced-water handling, and offshore tie-backs are keeping artificial-lift programs active, while water utilities and quarry dewatering deliver steady inland orders. Project engineers are leaning toward modular skids that simplify topside swaps and reduce vessel time offshore. Framework agreements with utilities are securing predictable volumes for deep-well sets and control gear. Momentum will be maintained as condition monitoring, standardized spares, and quick-pull designs trim downtime across harsh marine and onshore environments. Import channels remain important, yet local service bases around Aberdeen and northern England provide credible turnaround.

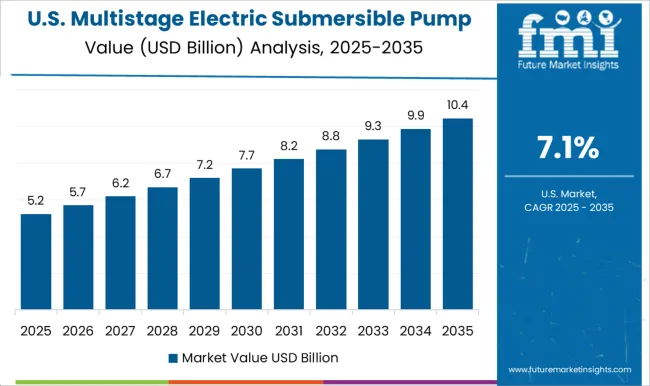

The multistage electric submersible pump market in the United States is projected to grow at a CAGR of 7.1%. Tight-oil basins are relying on ESPs for early-life flow, with retrofit cycles expected as decline curves steepen. Produced-water transfer and saltwater disposal wells provide a stable floor for unit demand, while municipal and agricultural deep-well applications add breadth. Procurement is being shaped by efficiency ratings, power-quality tolerance, and service reach across the Permian, Bakken, and Eagle Ford. Disciplined capex and consolidation among service providers will keep growth measured but reliable, with rentals and rebuilds absorbing short-cycle volatility. Premium motors, abrasion-resistant hydraulics, and robust seals should command share where uptime is priced above initial capex.

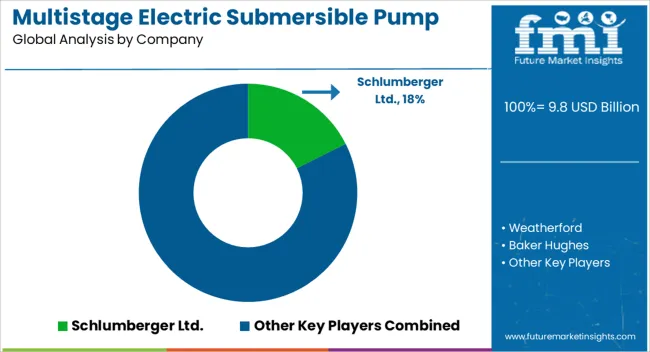

The multistage electric submersible pumps (ESPs) market is highly competitive, driven by increasing demand in oil and gas production, water supply, and industrial applications requiring high-efficiency pumping solutions. Market rivalry is influenced by pump capacity, head, efficiency, material construction, reliability, and cost-effectiveness. Companies differentiate through advanced hydraulic designs, corrosion- and abrasion-resistant materials, motor efficiency, and customizable solutions for challenging operating conditions.

Key players such as Schlumberger, Halliburton, Baker Hughes, Weatherford, Flowserve, Sulzer, KSB, Grundfos, Ebara Corporation, and Weir Group dominate the market by offering high-performance, durable, and technologically advanced multistage ESP solutions. Strategic partnerships with oilfield operators, water utilities, and industrial end-users are leveraged to expand market reach. Regional and emerging manufacturers compete by providing cost-effective, application-specific, and energy-efficient pumps. The market is moderately consolidated, with leading companies focusing on R&D, enhanced product reliability, after-sales support, and regulatory compliance to maintain market share and meet growing global demand for efficient and robust multistage submersible pumping systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.8 Billion |

| Application | Oil & Gas, Agriculture, Municipal Water Supply, Industrial, and Mining |

| Type | Vertical Multistage Pumps and Horizontal Multistage Pumps |

| Power Rating | Medium Power (15 HP - 100 HP), Low Power (< 15 HP), and High Power (> 100 HP) |

| Material | Stainless Steel, Cast Iron, Plastic Composites, and Others |

| End-User Industry | Industrial Manufacturing, Residential, Commercial, Energy & Power, and Construction |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schlumberger Ltd., Weatherford, Baker Hughes, Flowserve Corporation, EBARA CORPORATION, Atlas Copco AB, WILO SE, Grundfos Holding A/S, Gorman-Rupp Pumps, Crompton Greaves Consumer Electricals Limited, Sulzer Ltd, Tsurumi Manufacturing Co., Ltd., Novomet, and Halliburton |

| Additional Attributes | Dollar sales by pump type (radial, mixed flow), Dollar sales by application (onshore oil, offshore oil, water, mining), Dollar sales by motor type (induction, permanent magnet), Trends in high temperature, sand handling, corrosion resistant designs, VSDs, downhole sensing, predictive maintenance, Regional demand across North America, Middle East, Asia Pacific. |

The global multistage electric submersible pump market is estimated to be valued at USD 9.8 billion in 2025.

The market size for the multistage electric submersible pump market is projected to reach USD 21.8 billion by 2035.

The multistage electric submersible pump market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in multistage electric submersible pump market are oil & gas, agriculture, municipal water supply, industrial and mining.

In terms of type, vertical multistage pumps segment to command 62.3% share in the multistage electric submersible pump market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Multistage Ring Section Pumps Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA