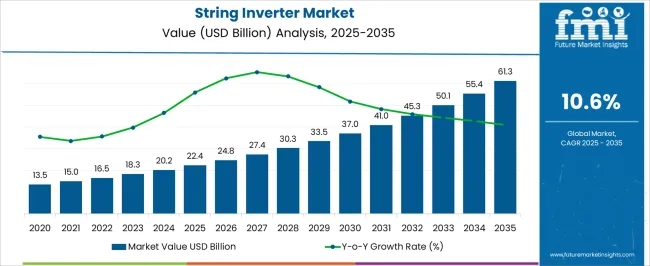

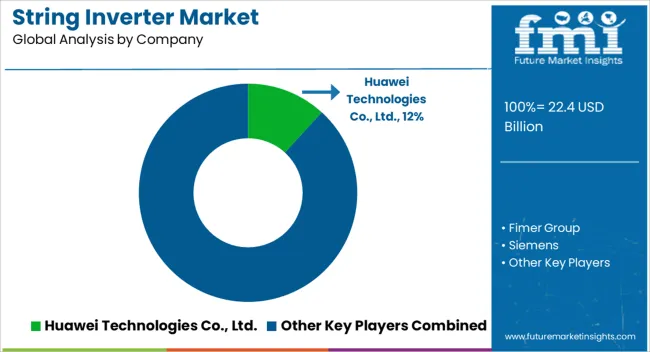

The string inverter market is at USD 22.4 billion in 2025 and is expected to reach USD 61.3 billion by 2035, growing at a CAGR of 10.6%, with a multiplying factor of about 2.73x. Breakpoint analysis identifies critical phases where market growth experiences acceleration or temporary moderation due to technological, regulatory, or adoption-related factors. In the early phase, from 2025 to 2028, growth is driven by residential and commercial solar installations, government incentives, and increasing awareness of renewable energy solutions.

During this period, string inverters with improved efficiency, reliability, and monitoring capabilities are rapidly adopted, marking the first breakpoint where adoption begins to accelerate significantly. The mid-phase, from 2028 to 2032, reflects a second breakpoint as industrial-scale solar projects, utility-scale deployments, and hybrid solar-plus-storage solutions gain momentum. Technological innovations, such as higher efficiency conversion, advanced fault detection, and enhanced grid compatibility, further boost adoption. Growth may experience temporary moderation in specific regions due to policy adjustments, tariff changes, or supply chain disruptions, creating minor troughs within the overall upward trajectory.

From 2032 to 2035, expansion stabilizes as string inverters achieve broad market penetration, and incremental gains result from retrofits, performance upgrades, and emerging market adoption.

| Metric | Value |

|---|---|

| String Inverter Market Estimated Value in (2025 E) | USD 22.4 billion |

| String Inverter Market Forecast Value in (2035 F) | USD 61.3 billion |

| Forecast CAGR (2025 to 2035) | 10.6% |

The string inverter market is supported by several upstream sectors. Solar photovoltaic (PV) system integrators account for approximately 38%, deploying string inverters for residential, commercial, and industrial solar installations. Solar module and panel manufacturers contribute around 27%, supplying compatible modules optimized for inverter efficiency. Power electronics and semiconductor manufacturers represent roughly 17%, providing IGBT, MOSFET, and controller components for inverters.

Energy storage and battery system providers hold close to 11%, integrating string inverters for hybrid PV-storage setups. Installation and maintenance service providers make up the remaining 7%, supporting operational reliability and system upgrades. The market is evolving as string inverters are increasingly combined with energy storage and smart monitoring systems. Residential and small-scale commercial PV installations now account for over 45% of new inverter deployments, driven by rising adoption of rooftop solar solutions.

Multi-MPPT (maximum power point tracking) string inverters are growing by ~14% year-on-year, enhancing efficiency under partial shading conditions. Advanced grid-tie features are improving energy export management and reducing losses by 8–10%. Remote monitoring and predictive maintenance platforms are being integrated, allowing operators to reduce downtime and improve performance.

The string inverter market is experiencing steady growth, fueled by the global acceleration of solar power deployment and advancements in inverter efficiency. Industry reports and energy sector announcements have emphasized the importance of string inverters in enabling grid stability, optimizing energy conversion, and reducing system downtime in photovoltaic installations.

Supportive government policies, such as feed-in tariffs, net metering programs, and renewable energy targets, have driven large-scale solar adoption in both residential and commercial sectors. Technological innovations, including higher efficiency ratings, integrated monitoring systems, and enhanced safety features, have further increased the appeal of string inverters to developers and EPC contractors.

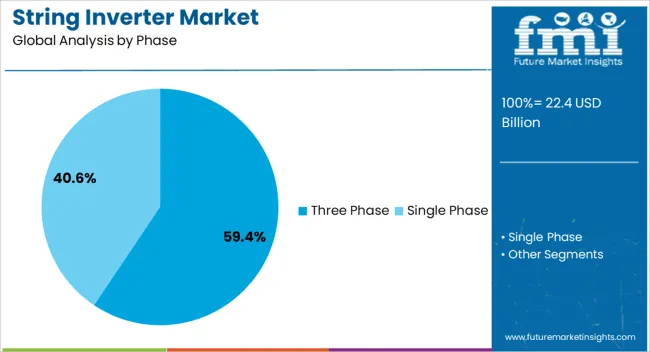

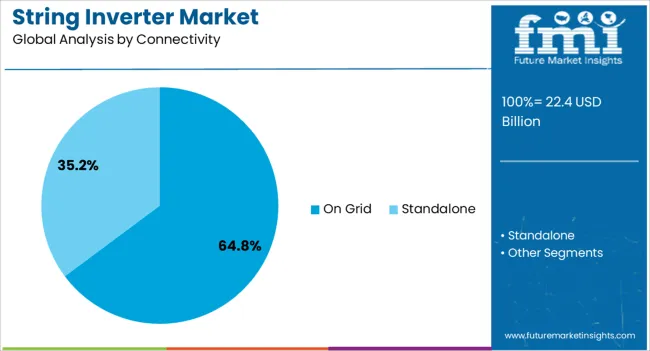

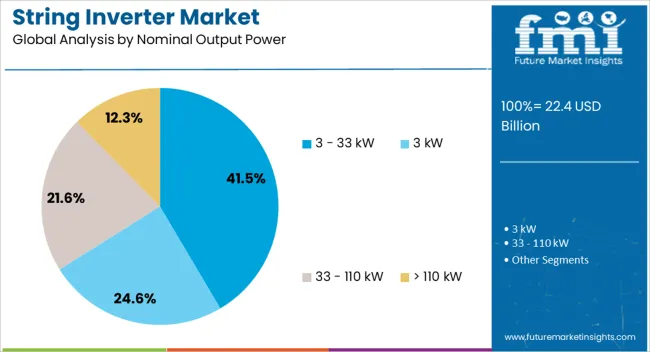

Market momentum is also supported by declining costs of photovoltaic components, which have made solar systems more accessible and economically viable. Growth is expected to be led by three phase models for large-scale projects, on-grid systems for efficient energy distribution, and nominal output power ranges of 3–33 kW, which are widely adopted in commercial and small utility-scale applications.

The string inverter market is segmented by phase, connectivity, nominal output power, nominal output voltage, application, and geographic regions. By phase, string inverter market is divided into Three Phase and Single Phase. In terms of connectivity, string inverter market is classified into On Grid and Standalone. Based on nominal output power, string inverter market is segmented into 3 - 33 kW, 3 kW, 33 - 110 kW, and > 110 kW. By nominal output voltage, string inverter market is segmented into 230 - 400 V, ≤ 230 V, 400 - 600 V, and > 600 V. By application, string inverter market is segmented into Utility, Residential, and Commercial & Industrial. Regionally, the string inverter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The three phase segment is projected to account for 59.4% of the string inverter market revenue in 2025, securing its leadership due to its suitability for medium- to large-scale solar installations. This segment’s growth has been driven by its ability to efficiently handle higher power capacities, distribute electrical loads evenly, and minimize transmission losses.

Utility-scale and commercial solar projects have favored three phase inverters for their compatibility with grid infrastructure and capacity to maintain voltage stability under varying load conditions. Additionally, advancements in three phase inverter technology, including smart grid integration and advanced fault detection systems, have enhanced reliability and operational lifespan.

The segment’s scalability, along with compliance with grid codes in multiple regions, has reinforced its dominance, particularly in markets with rapidly expanding commercial and industrial solar capacity.

The on grid segment is projected to hold 64.8% of the string inverter market revenue in 2025, maintaining its top position due to the growing prevalence of grid-tied solar systems. This segment has benefited from the ability to export excess electricity to the grid, generating additional revenue through feed-in tariffs and net metering schemes.

On grid inverters are favored for their role in stabilizing voltage output, synchronizing with utility grids, and ensuring efficient energy utilization. Their application in residential, commercial, and industrial settings has expanded due to favorable regulatory frameworks promoting renewable energy integration.

Technological advancements, such as remote monitoring, enhanced safety protocols, and anti-islanding protection, have further strengthened adoption. As urban energy demands rise and governments prioritize decentralized power generation, the on grid segment is expected to remain the dominant connectivity type in the market.

The 3–33 kW segment is projected to contribute 41.5% of the string inverter market revenue in 2025, leading the nominal output power category due to its versatility in commercial rooftops, small utility-scale projects, and community solar installations. This range offers an optimal balance between system size, efficiency, and cost, making it attractive for installers and end users seeking reliable performance without the complexities of larger-scale systems.

The segment has also benefited from advancements in modular inverter design, enabling easier installation and maintenance while supporting system scalability. In emerging solar markets, this capacity range aligns well with government programs aimed at promoting distributed generation.

Furthermore, manufacturers have introduced models with higher efficiency ratings and integrated communication capabilities, enhancing monitoring and performance optimization. These advantages are expected to sustain the dominance of the 3–33 kW segment in the near term.

Residential, commercial, and utility-scale solar projects are driving adoption due to improved energy efficiency, modularity, and cost-effectiveness. Asia Pacific leads deployment due to high solar capacity additions, while North America and Europe emphasize advanced energy management and grid compliance. Technological advancements in inverter efficiency, integrated monitoring, and remote diagnostics enhance performance. Growing demand for decentralized energy solutions, grid stability, and renewable energy integration supports consistent adoption of string inverters across residential, commercial, and industrial sectors worldwide.

The rising installation of residential, commercial, and utility-scale solar systems is a primary driver of string inverter adoption. String inverters are preferred for their modular design, ease of maintenance, and high efficiency in small to medium-scale projects. Integration with monitoring platforms allows real-time performance tracking, fault detection, and optimization of energy output. The growing trend of rooftop solar for residential and commercial buildings and the expansion of distributed energy resources reinforces market demand. Increasing solar capacity targets and government incentives for renewable energy further accelerate the deployment of string inverters worldwide.

Technological enhancements such as higher conversion efficiency, integrated MPPT, and remote monitoring are creating growth opportunities. Advanced string inverters reduce energy losses, improve grid compatibility, and enable predictive maintenance. Integration with IoT-enabled platforms allows real-time monitoring of solar systems, remote diagnostics, and fault management. Manufacturers offering smart, modular, and scalable inverters are well-positioned to capitalize on increasing adoption. Demand is rising for systems capable of supporting hybrid energy solutions, energy storage integration, and smart grid applications. These trends drive adoption in both urban and off-grid solar installations, enhancing energy efficiency, operational reliability, and system uptime.

String inverters are increasingly integrated with energy storage systems and advanced grid management services. Coupling with batteries allows load shifting, peak shaving, and uninterrupted power supply. Integration with smart grids enables demand response, voltage regulation, and improved energy management. Emerging trends include AI-based predictive maintenance, remote firmware upgrades, and enhanced cybersecurity features for grid-connected systems. Adoption of these technologies supports utility-scale and distributed solar projects by improving operational efficiency, system reliability, and energy optimization. The convergence of renewable energy growth, smart energy management, and storage solutions is expected to expand the market for string inverters globally.

High upfront costs and technical complexity present challenges for string inverter adoption. System selection, installation, and integration with monitoring and storage platforms require skilled personnel. Variability in grid standards and compliance regulations across regions adds complexity. Maintenance, firmware updates, and inverter replacement contribute to operational expenditure. Manufacturers offering modular, user-friendly, and service-supported solutions are better positioned to overcome these challenges. Ensuring high reliability, safety, and cost-effectiveness is critical to sustaining adoption and competitiveness in the global string inverter market.

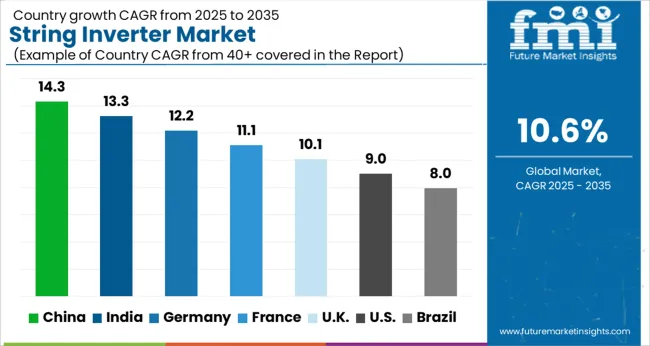

| Country | CAGR |

|---|---|

| China | 14.3% |

| India | 13.3% |

| Germany | 12.2% |

| France | 11.1% |

| UK | 10.1% |

| USA | 9.0% |

| Brazil | 8.0% |

The string inverter market is growing at a global CAGR of 10.6% from 2025 to 2035, driven by rising solar energy installations, renewable energy integration, and increasing demand for efficient power conversion systems. China leads with a CAGR of 14.3%, +35% above the global benchmark, supported by BRICS-driven expansion in solar capacity, government incentives, and large-scale adoption in residential and utility-scale projects. India follows at 13.3%, +25% over the global average, reflecting rapid solar capacity addition, renewable energy targets, and growing investment in decentralized power solutions. Germany records 12.2%, +15% above the global CAGR, shaped by OECD-backed innovation in high-efficiency inverters and integration with advanced grid management systems. The United Kingdom posts 10.1%, slightly below the global rate, influenced by steady solar adoption and modernization of existing installations. The United States stands at 9.0%, −15% under the global benchmark, reflecting mature solar markets but sustained demand for upgrades and high-performance inverter solutions. BRICS nations are driving scale, while OECD countries focus on efficiency, technology, and regulatory compliance.

China is growing at a CAGR of 14.3%, 3.7% above the global CAGR of 10.6%, driven by large-scale solar power installations, utility-scale PV projects, and distributed energy adoption. Domestic manufacturers are investing in high-efficiency string inverters with improved conversion efficiency, thermal management, and grid connectivity. Government policies promoting renewable energy generation and subsidy programs for solar rooftops are accelerating market uptake. Strategic collaborations between inverter manufacturers and EPC contractors enhance technology deployment and project execution. Rising demand from commercial, industrial, and residential solar projects supports sustained adoption. China’s export potential of advanced inverter technologies strengthens its position as a leading global player in the string inverter market.

India is progressing at a CAGR of 13.3%, 2.7% above the global CAGR, supported by increasing solar capacity installations and government-backed renewable energy programs. Residential, commercial, and industrial rooftop solar segments are driving string inverter adoption. Manufacturers are investing in high-performance inverters with enhanced efficiency, connectivity, and reliability. Collaboration with global technology providers ensures advanced product availability and faster deployment. Rising demand for decentralized energy generation and smart grid integration further accelerates market growth. India’s focus on renewable energy expansion and industrial solar adoption positions it as a key growth market in the Asia-Pacific region.

Germany is growing at a CAGR of 12.2%, 1.6% above the global CAGR, supported by residential and commercial solar adoption, and stable industrial PV projects. High-efficiency string inverters are increasingly deployed to optimize energy conversion, support grid integration, and improve system reliability. R&D investment and collaboration with European EPC and utility providers drive technological advancements. Export of advanced inverter technologies sustains steady growth. Germany’s focus on renewable energy integration, energy storage solutions, and industrial solar projects maintains market expansion above global benchmarks.

The United Kingdom is expanding at a CAGR of 10.1%, slightly below the global CAGR of 10.6%, reflecting moderate growth. Adoption is driven by rooftop solar, commercial PV projects, and distributed renewable energy systems. Imports of advanced string inverters supplement domestic supply. Industrial, commercial, and residential projects are gradually increasing penetration of high-efficiency inverters. R&D initiatives and technology partnerships support reliability improvements and grid integration. Steady growth is observed due to incremental solar capacity expansion, energy storage integration, and government policies promoting low-carbon energy solutions.

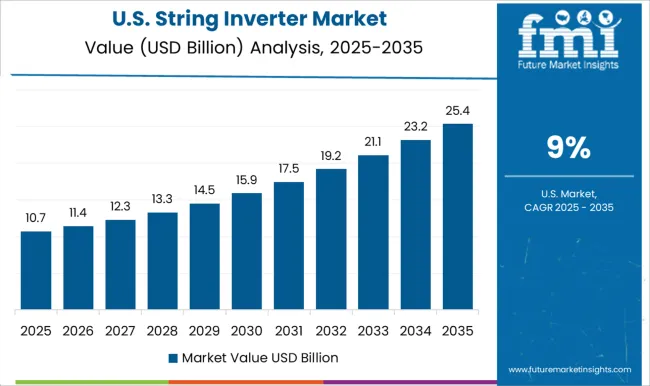

The United States is progressing at a CAGR of 9.0%, 1.6% below the global CAGR of 10.6%, reflecting slower growth due to mature solar markets. Adoption is driven by utility-scale solar, commercial rooftops, and distributed generation projects. Domestic manufacturers focus on high-reliability and grid-compliant string inverters. Imports from Europe and Asia supplement advanced inverter technologies. Growth is supported by renewable energy policies, solar project development, and industrial PV adoption. Market expansion remains steady, with growth concentrated in high-value projects, technological upgrades, and decentralized energy systems.

The string inverter market is shaped by companies providing reliable and efficient power conversion solutions for solar photovoltaic systems, energy storage integration, and grid-tied applications. Huawei Technologies Co., Ltd. is assumed to be the leading player, offering a portfolio of string inverters designed for high conversion efficiency, advanced monitoring, and robust performance under varying environmental conditions. Fimer Group and Siemens maintain competitive positions with modular, scalable inverters optimized for commercial and industrial solar installations. Schneider Electric and Darfon Electronics Corp. focus on smart inverter platforms, emphasizing integrated communication protocols, remote monitoring, and safety features. Growatt New Energy, Sungrow, and SMA Solar Technology AG enhance market presence with high-efficiency inverters supporting residential, commercial, and utility-scale applications. Sineng Electric Co., Ltd., Hitachi Hi-Rel Power Electronics, Delta Electronics, Inc., and Fronius International GmbH provide hybrid inverter solutions, advanced thermal management, and grid support functions. SolarEdge Technologies, Inc. specializes in module-level optimization, energy harvesting, and enhanced safety measures, while Eaton, SHENZHEN SOFARSOLAR CO., LTD., GoodWe, Ginlong Technologies, Panasonic Corporation, Canadian Solar, and Tabuchi Electric Co., Ltd. strengthen the market with reliable inverters and technical support for diverse solar installations.

| Item | Value |

|---|---|

| Quantitative Units | USD 22.4 Billion |

| Phase | Three Phase and Single Phase |

| Connectivity | On Grid and Standalone |

| Nominal Output Power | 3 - 33 kW, 3 kW, 33 - 110 kW, and > 110 kW |

| Nominal Output Voltage | 230 - 400 V, ≤ 230 V, 400 - 600 V, and > 600 V |

| Application | Utility, Residential, and Commercial & Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Huawei Technologies Co., Ltd., Fimer Group, Siemens, Schneider Electric, Darfon Electronics Corp., Growatt New Energy, Sungrow, SMA Solar Technology AG, Sineng Electric Co., Ltd., Hitachi Hi-Rel Power Electronics Private Limited, Delta Electronics, Inc., Fronius International GmbH, SolarEdge Technologies, Inc., Eaton, SHENZHEN SOFARSOLAR CO., LTD., GoodWe, Ginlong Technologies, Panasonic Corporation, Canadian Solar, and Tabuchi Electric Co., Ltd. |

| Additional Attributes | Dollar sales by inverter type and installation segment, demand dynamics across residential, commercial, and utility-scale solar projects, regional trends across North America, Europe, and Asia-Pacific, innovation in high-efficiency, smart monitoring, and grid-compatible designs, environmental impact of energy savings and material lifecycle, and emerging use cases in hybrid solar systems, energy storage integration, and microgrid applications. |

The global string inverter market is estimated to be valued at USD 22.4 billion in 2025.

The market size for the string inverter market is projected to reach USD 61.3 billion by 2035.

The string inverter market is expected to grow at a 10.6% CAGR between 2025 and 2035.

The key product types in string inverter market are three phase, low power (≤ 99 kw), high power (> 99 kw) and single phase.

In terms of connectivity, on grid segment to command 64.8% share in the string inverter market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

String PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Three Phase String Inverter Market Size and Share Forecast Outlook 2025 to 2035

Single Phase String Inverter Market Size and Share Forecast Outlook 2025 to 2035

String Power Conversion System(PCS) Market Size and Share Forecast Outlook 2025 to 2035

Stringer Pallets Market Size and Share Forecast Outlook 2025 to 2035

Understanding Market Share Trends in String Cheese Production

Astringent Skin Care Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Astringents Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Inverter Duty Motor Market Size and Share Forecast Outlook 2025 to 2035

PV Inverter Market Analysis by Product, Phase, Connectivity, Nominal Power Output, Nominal Output Voltage, Application, and Region through 2035

Power Inverter Market Size and Share Forecast Outlook 2025 to 2035

Micro Inverter Market Size and Share Forecast Outlook 2025 to 2035

Solar Inverter Market Growth - Trends & Forecast 2025 to 2035

Digital Inverter Market Report – Growth & Forecast 2017-2027

PV Micro Inverters Market Trends & Forecast 2025 to 2035

Portable Inverter Generators Market Analysis by Power Rating, Power Source, Application, and Region through 2035

Traction Inverter Market

On Grid PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Solar Microinverter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automotive Inverters Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA