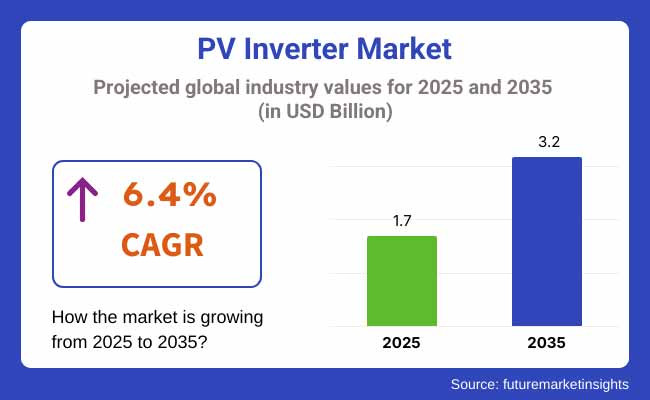

The PV inverter generators industry is valued at USD 1.7 billion in 2025. As per FMI's analysis, the PV inverter will grow at a CAGR of 6.4% and reach USD 3.2 billion by 2035.

In 2024, the PV inverter market experienced consistent growth as a result of increasing solar installations in Asia-Pacific (particularly China and India) with government incentives and declining solar panel prices. Residential surged in Europe, fueled by energy security needs following the Russia- Ukraine war. Supply chain issues in semiconductor components temporarily held back production. Micro inverters and hybrid inverters picked up the pace, especially in the USA, as homeowners increasingly opted for battery storage solutions.

Looking forward to 2025 and beyond, the industry will ramp up because of the following

Growing utility-scale solar deployments in emerging economies (Middle East, Africa).

Net-zero government policies driving solar uptake (e.g., EU's RE Power EU, USA Inflation Reduction Act).

Advancements in technology (AI-based smart inverters, more efficient models).

Growing commercial & industrial adoption as companies look for energy cost savings.

Challenges such as high upfront costs and competition from other renewables continue to exist, but declining battery storage costs will most likely spur hybrid inverter demand. The industry is expected to grow beyond USD 3.2 billion by 2035, driven by global decarbonization.

FMI Survey Findings: Trends Based on Stakeholder Inputs

(Surveyed Q4 2024, n=500 respondents evenly spread across manufacturers, distributors, installers, and end-users in North America, Europe, Asia-Pacific, and the Middle East & Africa)

Energy Efficiency & ROI: 85% worldwide listed high efficiency (98%+ conversion rates) as a priority.

Grid Compliance & Safety Certifications: 78% focused on regional grid code compliance (e.g., UL 1741 in the USA, IEC 62109 in Europe).

After-Sales Support & Warranty: 72% mentioned long-term service agreements as being essential.

Regional Variance

North America: 68% focused on battery-ready hybrid inverters (fueled by IRA tax incentives).

Europe: 82% appreciated smart grid integration (EU's Renewable Energy Directive III).

Asia-Pacific: 55% focused on low-cost string inverters (India/China's utility-scale leadership).

Middle East & Africa: 60% preferred dust- and heat-resistance-inspired designs (tough climate adaptation).

Use of Advanced Technologies

North America: 52% of installers installed AI-based inverters (predictive maintenance, self-optimizing arrays).

Europe: 47% embraced virtual power plant (VPP)-friendly inverters (Germany was at the forefront with 61%).

Asia-Pacific: Only 28% employed high-voltage 1500V inverters (lagging due to dispersed regulations).

Middle East: 40% invested in water-cooled inverters for desert solar farms.

ROI Perspectives

USA/Europe: 65% thought battery hybrids were warranted (20%+ bill savings).

India/Africa: 70% still use conventional string inverters (cost-sensitive).

String Inverters: 60% of the global industry (leading in utility-scale).

Micro inverters: 25% (USA residential solar boom, 45% of adoption).

Central Inverters: 15% (Middle East megaprojects).

Regional Material/Design Trends

Europe: 48% chose SiC (silicon carbide)-based inverters (efficiency savings).

Asia: 65% held on to conventional IGBT modules (cost-driven).

North America: 30% transition to GaN (gallium nitride) for lightweight rooftop installations.

Business Models & Price Sensitivity

Global Pain Point: 80% quoted increasing semiconductor prices (SiC chips 22% YoY increase).

North America/Europe: 55% ready to pay 10-15% premium for smart products.

Asia/Africa: 75% asked for sub-USD 0.10/watt inverters (price wars).

Leasing Models: 50% adoption in Africa, compared to 20% in Europe (CAPEX limitations).

Manufacturers

USA: 50% battle with transformer shortages.

Europe: 45% experienced CE mark delays (new EU cybersecurity regulations).

China: 60% experienced oversupply-driven margin erosion.

Distributors

Middle East: 70% blamed customs bottlenecks for European imports.

India: 55% complained of counterfeit inverters pricing below cost.

Installers/End-Users

USA: 40% reported complex permitting (NEM 3.0 backlash).

Europe: 35% battled legacy system retrofits.

Africa: 50% blamed lack of trained technicians.

Future Investment Priorities

Global Consensus: 70% of manufacturers investing in SiC/GaN semiconductors.

North America: 65% focusing on storage-integrated inverters.

Europe: 60% emphasizing grid-forming inverters (for blackout resilience).

Asia: 55% emphasizing modular, scalable designs (for quick deployment).

Regulatory Impact

USA: 60% referred to FERC Order 2023 as a "game-changer" (quicker grid interconnections).

Europe: 75% indicated the EU's Solar Standard mandate (PV on all new buildings) increased demand.

India: 50% condemned ALMM (Approved List of Models) delays.

Middle East: 30% viewed local content rules as a hindrance.

High Consensus: Efficiency, longevity, and regulatory compliance are everywhere.

Key Divergences

North America: Hybrids + AI for prosumers.

Europe: Smart grid + focus on sustainability.

Asia: Ultra-low-cost string inverters.

Middle East/Africa: Ruggedized designs + leasing.

Strategic Takeaway: One-size-fits-all does not work-localized inverter designs, financing structures, and compliance solutions are needed to achieve success.

| Country/Region | Key Policies, Regulations & Mandatory Certifications |

|---|---|

| United States |

|

| European Union |

|

| China |

|

| India |

|

| Japan |

|

| Australia |

|

The industry is on track to steady expansion (6.4% CAGR), stimulated by world decarbonization initiatives, increased solar take-up, and the need for hybrid/battery-compatible systems. Smart inverter technology (AI, VPP-capable) and localized compliance (UL, IEC, ALMM) are what win-making manufacturers do; cost-orientated actors following legacy designs are likely to lose share within price-sensitive regions such as India and Africa.

Regional Compliance & Certification Mastery

Action: Make R&D and testing a top priority to satisfy local certification criteria (UL 1741, IEC 62109, ALMM, INMETRO) in major industries. Spend money on regulatory teams to navigate changing grid codes (e.g., EU's cybersecurity regulations, FERC Order 2023).

Hybrid & Smart Inverter Leadership

Action: Ramp up production of battery-ready, AI-optimized, and VPP-compatible inverters to capture premium industries (USA, Europe). Collaborate with energy storage companies to provide integrated solutions.

Localized Manufacturing & Partnerships

Action: Build domestic production (India, USA, EU) to sidestep trade constraints (ALMM, IRA rules of domestic content). Form alliances with distributors in Africa/Middle East to deal with shipping roadblocks and head off cheap-priced competitors.

| Risk | Probability/Impact |

|---|---|

|

Medium-High/High |

|

Medium/High |

|

High/Medium-High |

| Priority | Immediate Action |

|---|---|

| Accelerate Hybrid/Battery-Ready Inverter Rollout | Launch a feasibility study for localized production (USA/EU) to qualify for IRA/CE tax credits. Partner with top 3 battery OEMs (Tesla, CATL, LG) for bundled offerings. |

| Preempt Regulatory Shifts in Key Players | Assign a dedicated compliance task force to track ALMM (India), EU Solar Mandate, and FERC 2023 updates. Pre-certify 2-3 inverter models per region by Q2 2025. |

| Counter Low-Cost Chinese Competition | Pilot a stripped-down inverter line ( |

To stay ahead, companies should capitalize on the USD 2.8B product opportunity by 2033 and immediately shift investment to hybrid-capable inverters with AI optimization, aimed at USA/EU prosumers and utility-scale installations in developing industries. Distinguish through local manufacturing in India (ALMM compliant) and Mexico (IRA sourcing advantages) to avoid tariffs and supply chain threats, and initiate a low-cost leasing model in Africa/SE Asia to beat Chinese competition.

This smartness requires a roadmap change: accelerate R&D for grid-forming inverters (essential for EU's VPP requirements) and redirect 20% of CAPEX to strategic collaborations with battery OEMs-or lose share in high-margin segments to nimble competitors like Sun Grow and Solar Edge.

String inverters are the most common product technology worldwide, based mainly on their affordability, scalability, and well-established reliability for utility-scale and commercial solar projects. With less initial cost per watt than micro inverters and easier installation than central inverters, string inverters find a balance between efficiency and cost and are thus the go-to choice for large solar farms and commercial rooftops.

Their modular nature enables simpler maintenance and mitigation of partial shading by means of power optimizers, with newer models incorporating smart grid and battery-ready features.

Three-phase PV inverters are used most commonly all over the world, especially in commercial, industrial, and utility-type solar arrays, owing to their improved efficiency, equal power distribution, and suitability with grid infrastructure. The majority of electricity grids are based on three-phase power, and hence, three-phase inverters are necessary for larger systems (10kW and more) to maintain energy delivery stability and follow grid regulations.

They lead in industries with strong solar uptake, including Europe, China, and the Middle East, where utility-scale solar farms and commercial rooftops demand greater power output and grid synchronization.

Grid-connected (on-grid) PV inverters are used most extensively throughout the world with a share of more than 80%, thanks to their cost-effectiveness, easier design, and suitability with net metering regulations. The inverters supply electricity from the sun into the utility grid directly, making battery storage expensive and redundant and achieving a high return on investment through energy credits or feed-in tariffs.

They excel where the grid is solid and friendly toward renewable policies, including in Europe, North America, and China, where large-scale solar farms and roof installations thrive.

The most common PV inverters are in the range of 3 - 33 kW. This is due to their suitability for residential, commercial, and small-scale industrial solar installations that make up a majority of the solar energy industry. The inverters are a balance between cost, efficiency, and scalability and can, therefore, be used both for single-phase and three-phase applications.

Smaller inverters (≤ 0.5 kW and 0.5 - 3 kW) are generally employed for micro-generation and off-grid applications, whereas larger inverters (33 - 110 kW and > 110 kW) are mainly utilized for large solar farms and utility systems. Nevertheless, with the growing popularity of rooftop solar systems and medium-scale solar projects, the 3 - 33 kW category is still the most widely used.

The most commonly employed PV inverters are those in the range of 230 - 400 V. They are so, as they fit residential and business solar installations, which account for a large majority of the solar industry. A majority of residential and commercial units employ single-phase (230 V) or three-phase (400 V) electric systems, which means that the inverters of this range are the most convenient to connect to the grid.

Lower voltage inverters (≤ 230 V) are typically employed for small-scale or off-grid operations, whereas higher voltage inverters (400 - 600 V and > 600 V) are generally implemented in large-scale utility and industrial solar farms. The 230 - 400 V range offers an optimal balance of efficiency, safety, and compatibility with existing electrical infrastructure, rendering it the most widely utilized choice.

Residential PV inverters are most commonly utilized due to the widespread installation of rooftop solar globally. With increasing energy prices and government incentives for the use of solar, increasing numbers of homeowners are investing in solar energy to save on electricity bills and become energy-independent. Residential inverters, usually from 3 kW to 10 kW, are for single-phase or three-phase grid connection, thus perfect for household usage.

| Countries | CAGR |

|---|---|

| USA | 6.2% |

| UK | 5.5% |

| France | 5.2% |

| Germany | 4.8% |

| Italy | 5.1% |

| South Korea | 4.6% |

| Japan | 5.0% |

| China | 5.8% |

The USA industry is anticipated to see a CAGR of around 6.2% during the period 2025 to 2035. This growth is driven by federal tax incentives such as the Investment Tax Credit (ITC), state-level Renewable Portfolio Standards (RPS), and falling solar technology costs.

The USA industry led the North American landscape in 2022 and is expected to lead it further, reaching a sector value of USD 7,118.5 million by 2030. The residential segment's growing use of rooftop solar panels, as well as utility-scale projects, drives this growth considerably.

The UK industry is expected to expand at a CAGR of approximately 5.5% during 2025 to 2035. The expansion is bolstered by the ambition of the UK to reach net-zero carbon emissions by 2050, resulting in massive investments in renewable energy infrastructure.

Solar panel installations are promoted through government schemes like the Smart Export Guarantee (SEG), under which households are paid for excess energy fed back into the grid. Further, innovation in smart inverter technologies raises grid efficiency and stability, driving further growth.

The French industry is also expected to have a CAGR of around 5.2% between 2025 and 2035. The government of France's initiative to develop renewable energy capacity, as stated in the Multiannual Energy Plan (PPE), will help develop solar power installations considerably.

Feed-in tariffs and tenders for large-scale solar installations offer economic incentives, creating a favorable environment for PV inverter growth. The focus on integrating sophisticated inverter technologies to enhance grid resilience also contributes significantly to this growth.

Germany is anticipated to witness a CAGR of approximately 4.8% in its industry between 2025 and 2035. Being the leader in the adoption of solar power, Germany continues to invest in the development of solar infrastructure. The Renewable Energy Sources Act (EEG) provides economic incentives for the generation of solar power, and rigorous grid codes demand the use of sophisticated inverter technologies.

Despite a mature industry, ongoing technological innovations and the push for energy transition (Energiewende) sustain steady growth in the sector.

Italy's industry is expected to register a CAGR of approximately 5.1% during the period 2025 to 2035. Italy's climate and government incentives, including the Conto Energeia scheme, have traditionally encouraged the use of solar energy. Ongoing support through tax deductions and streamlined authorization processes for photovoltaic installations stimulate residential and commercial sectors to invest in solar power, thus propelling the demand for efficient products.

South Korea is expected to witness a CAGR of about 5.5% for its industry over the 2025 to 2035 period. The government has put forth the Renewable Energy 3020 Implementation Plan, which seeks to boost the proportion of renewable energy to 20% by 2030, and solar power will play a key role in this. Solar installation subsidies and the establishment of smart grids require sophisticated inverter technologies to promote the growth of the industry. In addition, South Korea's emphasis on technological development promotes the use of high-efficiency inverters.

Japan's industry is expected to grow at a CAGR of roughly 4.9% during 2025 to 2035. Since the Fukushima accident, renewable energy has been a top priority for Japan, and solar energy has taken center stage. The support of feed-in tariffs and favorable policy has resulted in the widespread deployment of solar systems. Energy storage systems integration and smart community development support the demand for sophisticated products that handle sophisticated energy flows.

China, the largest solar industry in the world, is predicted to have a CAGR of around 6.0% in its industry during the period 2025 to 2035. The country's resolve to cut carbon emissions and develop renewable energy has seen enormous installations of solar power. Programs such as the Top Runner Program favor the use of high-efficiency technology, including inverters with higher efficiency. China's strong manufacturing base and economies of scale also add to the dynamic growth of its industry.

Huawei: (25-30%)

Key Strengths: Dominance in string inverters and smart PV solutions.

Sungrow: (20-25%)

Key Strengths: Strong utility-scale presence and cost leadership.

SMA Solar: (10-15%)

Key Strengths: High-quality inverters, strong in Europe.

Fronius: (8-12%)

Key Strengths: Strong in residential, hybrid inverters.

SolarEdge: (7-10%)

Key Strengths: Leading in power optimizers & residential.

Enphase: (6-9%)

Key Strengths: Microinverter dominance, USA-focused.

Others: (15-20%)

Key Strengths: Emerging players (Growatt, GoodWe, etc.)

With respect to the product, it is classified into string, micro, and central.

In terms of phase, it is divided into a single phase and three phases.

In terms of connectivity, it is divided into standalone and on-grid.

In terms of nominal power output, it is divided into ≤ 0.5 kW, 0.5 - 3 kW, 3 - 33 kW, 33 - 110 kW, and > 110 kW.

In terms of nominal output voltage, it is divided into ≤ 230 V, 230 - 400 V, 400 - 600 V, and > 600 V.

In terms of application, it is divided into residential, commercial & industrial, and utility.

In terms of region, it is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, and MEA.

Huawei holds the highest market share worldwide.

Solar installation growth, government policies, and technological improvements.

China, the United States, and Europe exhibit the most extensive usage.

Typical certifications are IEC 62109, UL 1741, and VDE-AR-N 4105.

Through the addition of AI, energy storage compatibility, and higher-power electronics.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Phase, 2017 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Connectivity , 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Nominal Power Output, 2017 to 2033

Table 6: Global Market Value (US$ Million) Forecast by Nominal Output Voltage, 2017 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Phase, 2017 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Connectivity , 2017 to 2033

Table 12: North America Market Value (US$ Million) Forecast by Nominal Power Output, 2017 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Nominal Output Voltage, 2017 to 2033

Table 14: North America Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Phase, 2017 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by Connectivity , 2017 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Nominal Power Output, 2017 to 2033

Table 20: Latin America Market Value (US$ Million) Forecast by Nominal Output Voltage, 2017 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 22: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 24: Europe Market Value (US$ Million) Forecast by Phase, 2017 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Connectivity , 2017 to 2033

Table 26: Europe Market Value (US$ Million) Forecast by Nominal Power Output, 2017 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Nominal Output Voltage, 2017 to 2033

Table 28: Europe Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 30: Asia Pacific Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 31: Asia Pacific Market Value (US$ Million) Forecast by Phase, 2017 to 2033

Table 32: Asia Pacific Market Value (US$ Million) Forecast by Connectivity , 2017 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Nominal Power Output, 2017 to 2033

Table 34: Asia Pacific Market Value (US$ Million) Forecast by Nominal Output Voltage, 2017 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Application, 2017 to 2033

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2017 to 2033

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by Phase, 2017 to 2033

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Connectivity , 2017 to 2033

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by Nominal Power Output, 2017 to 2033

Table 41: Middle East and Africa Market Value (US$ Million) Forecast by Nominal Output Voltage, 2017 to 2033

Table 42: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Phase, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Connectivity , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Nominal Power Output, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Nominal Output Voltage, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 7: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Phase, 2017 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Phase, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Phase, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Connectivity , 2017 to 2033

Figure 18: Global Market Value Share (%) and BPS Analysis by Connectivity , 2023 to 2033

Figure 19: Global Market Y-o-Y Growth (%) Projections by Connectivity , 2023 to 2033

Figure 20: Global Market Value (US$ Million) Analysis by Nominal Power Output, 2017 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Nominal Power Output, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Nominal Power Output, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Nominal Output Voltage, 2017 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Nominal Output Voltage, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Nominal Output Voltage, 2023 to 2033

Figure 26: Global Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 27: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 28: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 29: Global Market Attractiveness by Product, 2023 to 2033

Figure 30: Global Market Attractiveness by Phase, 2023 to 2033

Figure 31: Global Market Attractiveness by Connectivity , 2023 to 2033

Figure 32: Global Market Attractiveness by Nominal Power Output, 2023 to 2033

Figure 33: Global Market Attractiveness by Nominal Output Voltage, 2023 to 2033

Figure 34: Global Market Attractiveness by Application, 2023 to 2033

Figure 35: Global Market Attractiveness by Region, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Phase, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Connectivity , 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Nominal Power Output, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Nominal Output Voltage, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Phase, 2017 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Phase, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Phase, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Connectivity , 2017 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Connectivity , 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Connectivity , 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Nominal Power Output, 2017 to 2033

Figure 56: North America Market Value Share (%) and BPS Analysis by Nominal Power Output, 2023 to 2033

Figure 57: North America Market Y-o-Y Growth (%) Projections by Nominal Power Output, 2023 to 2033

Figure 58: North America Market Value (US$ Million) Analysis by Nominal Output Voltage, 2017 to 2033

Figure 59: North America Market Value Share (%) and BPS Analysis by Nominal Output Voltage, 2023 to 2033

Figure 60: North America Market Y-o-Y Growth (%) Projections by Nominal Output Voltage, 2023 to 2033

Figure 61: North America Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 62: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 63: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 64: North America Market Attractiveness by Product, 2023 to 2033

Figure 65: North America Market Attractiveness by Phase, 2023 to 2033

Figure 66: North America Market Attractiveness by Connectivity , 2023 to 2033

Figure 67: North America Market Attractiveness by Nominal Power Output, 2023 to 2033

Figure 68: North America Market Attractiveness by Nominal Output Voltage, 2023 to 2033

Figure 69: North America Market Attractiveness by Application, 2023 to 2033

Figure 70: North America Market Attractiveness by Country, 2023 to 2033

Figure 71: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 72: Latin America Market Value (US$ Million) by Phase, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Connectivity , 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Nominal Power Output, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Nominal Output Voltage, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 79: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Latin America Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 82: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 83: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 84: Latin America Market Value (US$ Million) Analysis by Phase, 2017 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Phase, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Phase, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Connectivity , 2017 to 2033

Figure 88: Latin America Market Value Share (%) and BPS Analysis by Connectivity , 2023 to 2033

Figure 89: Latin America Market Y-o-Y Growth (%) Projections by Connectivity , 2023 to 2033

Figure 90: Latin America Market Value (US$ Million) Analysis by Nominal Power Output, 2017 to 2033

Figure 91: Latin America Market Value Share (%) and BPS Analysis by Nominal Power Output, 2023 to 2033

Figure 92: Latin America Market Y-o-Y Growth (%) Projections by Nominal Power Output, 2023 to 2033

Figure 93: Latin America Market Value (US$ Million) Analysis by Nominal Output Voltage, 2017 to 2033

Figure 94: Latin America Market Value Share (%) and BPS Analysis by Nominal Output Voltage, 2023 to 2033

Figure 95: Latin America Market Y-o-Y Growth (%) Projections by Nominal Output Voltage, 2023 to 2033

Figure 96: Latin America Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 99: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 100: Latin America Market Attractiveness by Phase, 2023 to 2033

Figure 101: Latin America Market Attractiveness by Connectivity , 2023 to 2033

Figure 102: Latin America Market Attractiveness by Nominal Power Output, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Nominal Output Voltage, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 106: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 107: Europe Market Value (US$ Million) by Phase, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) by Connectivity , 2023 to 2033

Figure 109: Europe Market Value (US$ Million) by Nominal Power Output, 2023 to 2033

Figure 110: Europe Market Value (US$ Million) by Nominal Output Voltage, 2023 to 2033

Figure 111: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 113: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Europe Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 117: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 118: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 119: Europe Market Value (US$ Million) Analysis by Phase, 2017 to 2033

Figure 120: Europe Market Value Share (%) and BPS Analysis by Phase, 2023 to 2033

Figure 121: Europe Market Y-o-Y Growth (%) Projections by Phase, 2023 to 2033

Figure 122: Europe Market Value (US$ Million) Analysis by Connectivity , 2017 to 2033

Figure 123: Europe Market Value Share (%) and BPS Analysis by Connectivity , 2023 to 2033

Figure 124: Europe Market Y-o-Y Growth (%) Projections by Connectivity , 2023 to 2033

Figure 125: Europe Market Value (US$ Million) Analysis by Nominal Power Output, 2017 to 2033

Figure 126: Europe Market Value Share (%) and BPS Analysis by Nominal Power Output, 2023 to 2033

Figure 127: Europe Market Y-o-Y Growth (%) Projections by Nominal Power Output, 2023 to 2033

Figure 128: Europe Market Value (US$ Million) Analysis by Nominal Output Voltage, 2017 to 2033

Figure 129: Europe Market Value Share (%) and BPS Analysis by Nominal Output Voltage, 2023 to 2033

Figure 130: Europe Market Y-o-Y Growth (%) Projections by Nominal Output Voltage, 2023 to 2033

Figure 131: Europe Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 132: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 133: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 134: Europe Market Attractiveness by Product, 2023 to 2033

Figure 135: Europe Market Attractiveness by Phase, 2023 to 2033

Figure 136: Europe Market Attractiveness by Connectivity , 2023 to 2033

Figure 137: Europe Market Attractiveness by Nominal Power Output, 2023 to 2033

Figure 138: Europe Market Attractiveness by Nominal Output Voltage, 2023 to 2033

Figure 139: Europe Market Attractiveness by Application, 2023 to 2033

Figure 140: Europe Market Attractiveness by Country, 2023 to 2033

Figure 141: Asia Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) by Phase, 2023 to 2033

Figure 143: Asia Pacific Market Value (US$ Million) by Connectivity , 2023 to 2033

Figure 144: Asia Pacific Market Value (US$ Million) by Nominal Power Output, 2023 to 2033

Figure 145: Asia Pacific Market Value (US$ Million) by Nominal Output Voltage, 2023 to 2033

Figure 146: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 148: Asia Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 149: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 150: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 151: Asia Pacific Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 152: Asia Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 153: Asia Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 154: Asia Pacific Market Value (US$ Million) Analysis by Phase, 2017 to 2033

Figure 155: Asia Pacific Market Value Share (%) and BPS Analysis by Phase, 2023 to 2033

Figure 156: Asia Pacific Market Y-o-Y Growth (%) Projections by Phase, 2023 to 2033

Figure 157: Asia Pacific Market Value (US$ Million) Analysis by Connectivity , 2017 to 2033

Figure 158: Asia Pacific Market Value Share (%) and BPS Analysis by Connectivity , 2023 to 2033

Figure 159: Asia Pacific Market Y-o-Y Growth (%) Projections by Connectivity , 2023 to 2033

Figure 160: Asia Pacific Market Value (US$ Million) Analysis by Nominal Power Output, 2017 to 2033

Figure 161: Asia Pacific Market Value Share (%) and BPS Analysis by Nominal Power Output, 2023 to 2033

Figure 162: Asia Pacific Market Y-o-Y Growth (%) Projections by Nominal Power Output, 2023 to 2033

Figure 163: Asia Pacific Market Value (US$ Million) Analysis by Nominal Output Voltage, 2017 to 2033

Figure 164: Asia Pacific Market Value Share (%) and BPS Analysis by Nominal Output Voltage, 2023 to 2033

Figure 165: Asia Pacific Market Y-o-Y Growth (%) Projections by Nominal Output Voltage, 2023 to 2033

Figure 166: Asia Pacific Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 167: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 168: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 169: Asia Pacific Market Attractiveness by Product, 2023 to 2033

Figure 170: Asia Pacific Market Attractiveness by Phase, 2023 to 2033

Figure 171: Asia Pacific Market Attractiveness by Connectivity , 2023 to 2033

Figure 172: Asia Pacific Market Attractiveness by Nominal Power Output, 2023 to 2033

Figure 173: Asia Pacific Market Attractiveness by Nominal Output Voltage, 2023 to 2033

Figure 174: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 175: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) by Phase, 2023 to 2033

Figure 178: Middle East and Africa Market Value (US$ Million) by Connectivity , 2023 to 2033

Figure 179: Middle East and Africa Market Value (US$ Million) by Nominal Power Output, 2023 to 2033

Figure 180: Middle East and Africa Market Value (US$ Million) by Nominal Output Voltage, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 182: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 183: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 184: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 185: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 186: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2017 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 189: Middle East and Africa Market Value (US$ Million) Analysis by Phase, 2017 to 2033

Figure 190: Middle East and Africa Market Value Share (%) and BPS Analysis by Phase, 2023 to 2033

Figure 191: Middle East and Africa Market Y-o-Y Growth (%) Projections by Phase, 2023 to 2033

Figure 192: Middle East and Africa Market Value (US$ Million) Analysis by Connectivity , 2017 to 2033

Figure 193: Middle East and Africa Market Value Share (%) and BPS Analysis by Connectivity , 2023 to 2033

Figure 194: Middle East and Africa Market Y-o-Y Growth (%) Projections by Connectivity , 2023 to 2033

Figure 195: Middle East and Africa Market Value (US$ Million) Analysis by Nominal Power Output, 2017 to 2033

Figure 196: Middle East and Africa Market Value Share (%) and BPS Analysis by Nominal Power Output, 2023 to 2033

Figure 197: Middle East and Africa Market Y-o-Y Growth (%) Projections by Nominal Power Output, 2023 to 2033

Figure 198: Middle East and Africa Market Value (US$ Million) Analysis by Nominal Output Voltage, 2017 to 2033

Figure 199: Middle East and Africa Market Value Share (%) and BPS Analysis by Nominal Output Voltage, 2023 to 2033

Figure 200: Middle East and Africa Market Y-o-Y Growth (%) Projections by Nominal Output Voltage, 2023 to 2033

Figure 201: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2017 to 2033

Figure 202: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 203: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 204: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 205: Middle East and Africa Market Attractiveness by Phase, 2023 to 2033

Figure 206: Middle East and Africa Market Attractiveness by Connectivity , 2023 to 2033

Figure 207: Middle East and Africa Market Attractiveness by Nominal Power Output, 2023 to 2033

Figure 208: Middle East and Africa Market Attractiveness by Nominal Output Voltage, 2023 to 2033

Figure 209: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 210: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PV Micro Inverters Market Trends & Forecast 2025 to 2035

String PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

On Grid PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Standalone PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Single Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Utility On Grid PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

On-grid Three Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Standalone Three Phase PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

PVC-M High Impact Resistant Water Supply Pipe Market Size and Share Forecast Outlook 2025 to 2035

PVC UV Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

PVT Collectors Market Size and Share Forecast Outlook 2025 to 2035

PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

PVC Cling Film Market Size and Share Forecast Outlook 2025 to 2035

PV Combiner Box Market Size and Share Forecast Outlook 2025 to 2035

PVC Tapes Market Size and Share Forecast Outlook 2025 to 2035

PVC Footwear Market Analysis by Growth, Trends and Forecast from 2025 to 2035

PVC Packing Straps Market Report – Key Trends & Forecast 2025 to 2035

PV Module Encapsulant Film Market Analysis by Material Type, Application, Thickness, Weight, End-Use, and Region Forecast through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA