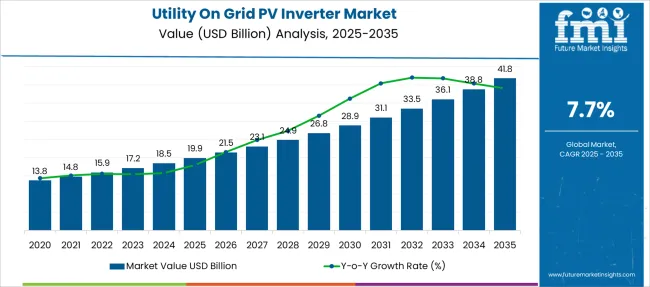

The Utility On Grid PV Inverter Market is estimated to be valued at USD 19.9 billion in 2025 and is projected to reach USD 41.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.7% over the forecast period.

| Metric | Value |

|---|---|

| Utility On Grid PV Inverter Market Estimated Value in (2025 E) | USD 19.9 billion |

| Utility On Grid PV Inverter Market Forecast Value in (2035 F) | USD 41.8 billion |

| Forecast CAGR (2025 to 2035) | 7.7% |

The utility on grid PV inverter market is expanding steadily due to global commitments toward renewable energy transition and increasing investments in large-scale solar power generation. With utility-scale solar installations gaining traction across regions like North America, Asia-Pacific, and the Middle East, demand for efficient and high-capacity PV inverters is surging.

Grid modernization initiatives and government policies promoting decarbonization have further strengthened the market outlook. As solar farms grow in size and complexity, advanced inverters with higher voltage handling, smart grid compatibility, and real-time monitoring capabilities are becoming critical.

The integration of energy storage and digital control systems into PV inverters is enhancing overall grid stability and energy management, accelerating adoption. The market is poised for long-term growth as utilities prioritize scalability, system efficiency, and grid compliance in large solar deployments, driving continued innovation and competition among inverter manufacturers.

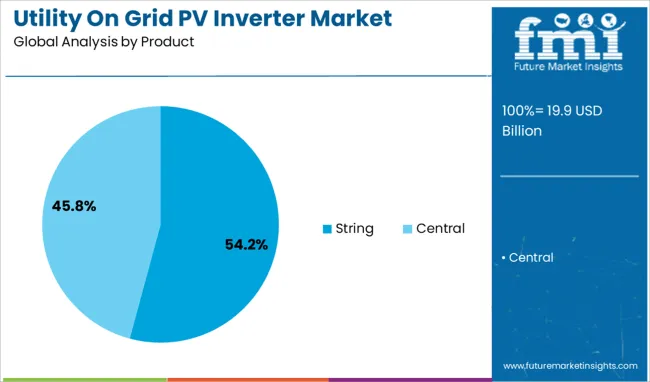

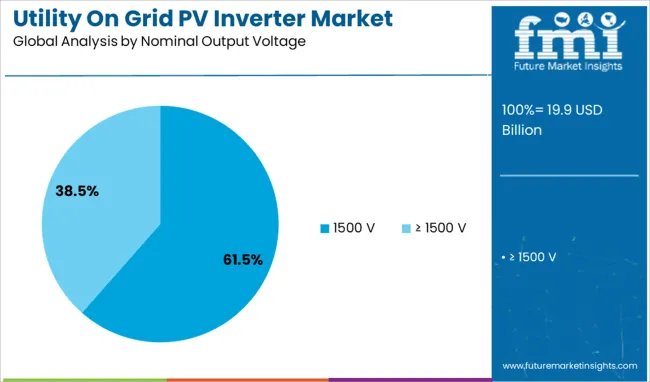

The utility on grid pv inverter market is segmented by product and nominal output voltage and geographic regions. By product of the utility on grid pv inverter market is divided into String and Central. In terms of nominal output voltage of the utility on grid pv inverter market is classified into 1500 V and ≥ 1500 V. Regionally, the utility on grid pv inverter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The string inverter segment holds a leading 54.2% market share within the product category, driven by its modular design, ease of installation, and cost-effectiveness in utility-scale solar projects. These inverters are increasingly favored for large field arrays where localized power conversion and flexible system layouts are required.

Their ability to maintain high efficiency and enable selective troubleshooting of individual panel strings enhances reliability and simplifies maintenance. The segment's growth is further supported by continuous advancements in string inverter capacity, integration of MPPT technologies, and support for remote monitoring.

Manufacturers are also optimizing designs to meet utility requirements for grid support functions and cybersecurity standards. As solar farms expand in size and number, the scalability and operational benefits of string inverters are expected to sustain their dominance across utility installations.

The 1500 V segment leads the nominal output voltage category with a substantial 61.5% market share, underscoring its importance in enhancing system efficiency and reducing overall project costs. Operating at higher voltages allows for longer string lengths and fewer components, which lowers cabling, labor, and installation expenses in large-scale solar projects.

This voltage level also improves power conversion efficiency and reduces transmission losses, making it ideal for utility-grade solar plants. The segment’s growth has been driven by the rising adoption of high-capacity solar modules and the need for optimized plant designs with minimal energy losses.

Regulatory support for efficient grid-tied solar infrastructure and increasing utility preference for high-voltage inverters further solidify the segment’s leadership. Continued evolution of inverter technology to support 1500 V systems with integrated monitoring and safety features is expected to reinforce its dominant market position.

Utility on grid PV inverters convert direct current from solar arrays into alternating current for integration into power grids in utility‑scale solar installations. These inverters are used in solar farms, commercial power plants, and large‑scale energy projects. Demand is driven by growth in grid‑connected solar capacity, regulatory incentives for renewable generation, and integration requirements with utility systems. Providers supplying robust inverter platforms with high conversion efficiency, reliable grid synchronization, and advanced fault detection have been well placed. Systems offering simplified commissioning, integrated monitoring features, and long service life continue to guide procurement across energy developers, utilities, and EPC contractors.

Deployment of on grid PV inverters has been supported by the expansion of utility‑scale solar installations and mandates for clean energy adoption by utilities. Demand is raised by requirements for stable grid interfacing, reactive power support, and fault ride‑through capabilities. Optimization of power output and minimization of conversion losses have reinforced preference for high‑efficiency inverter models. Interest in inverters that support smart grid features such as voltage regulation and frequency control is increasing. Availability of financial incentives and tender programs for large power projects has driven inverter procurement. Suppliers offering scalable inverter platforms that can handle high DC input and provide flexible modular options have been favored by developers.

Expansion has been limited by varying grid codes and utility interconnection requirements across regions, which complicate standard inverter design. Configuration of advanced protection settings and reactive power controls has required engineering expertise. High-capacity inverter systems require significant upfront investment and associated civil works for installation. Disparities in grid quality such as voltage fluctuation and harmonics have affected inverter performance reliability. Complexity in integrating inverters into supervisory control systems and SCADA networks has slowed commissioning. Maintenance of large inverter fleets in remote solar farms has added logistical and support burden. Ongoing firmware updates and grid code revisions have necessitated periodic reconfiguration or replacement of systems.

Opportunities are being identified in modular inverter designs that enable phased capacity addition and easier system scaling. Hybrid inverter platforms supporting energy storage integration offer enhanced grid stability and serve peak shaving applications. Adoption of string inverters for segmented array sections and micro‑inverter arrays for distributed deployment provides flexibility. Partnerships with energy developers and EPC firms for customized inverter solutions tailored to site conditions are gaining traction. Cloud‑based monitoring and remote diagnostics services for predictive maintenance offer recurring revenue potential. Inverter-as-a-service models offering leasing and operational support are emerging. Solutions adapted for high altitude, dusty, or tropical environments are gaining interest among solar project operators.

Inverter designs with improved maximum power point tracking efficiency and lower idle consumption are being adopted to boost overall system yields. Features such as remote firmware upgrades, real‑time performance tracking, and alert systems are being integrated. DC and AC modular scalability is being offered to accommodate expanding solar blocks without full system replacement. Inverters supporting grid ancillaries such as reactive power injection and voltage ride‑through enhancement are being prioritized. Increased use of dual MPPT inputs for each inverter to manage varying string orientations is being seen. Emphasis on reliability, redundancy and temperature tolerant designs is guiding supplier road maps for utility‑scale PV plants.

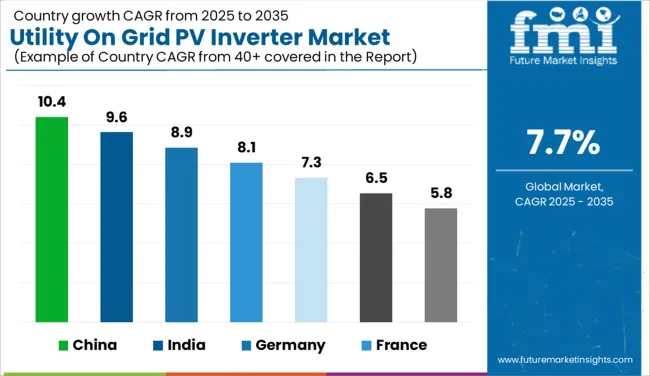

| Country | CAGR |

|---|---|

| China | 10.4% |

| India | 9.6% |

| Germany | 8.9% |

| France | 8.1% |

| UK | 7.3% |

| USA | 6.5% |

| Brazil | 5.8% |

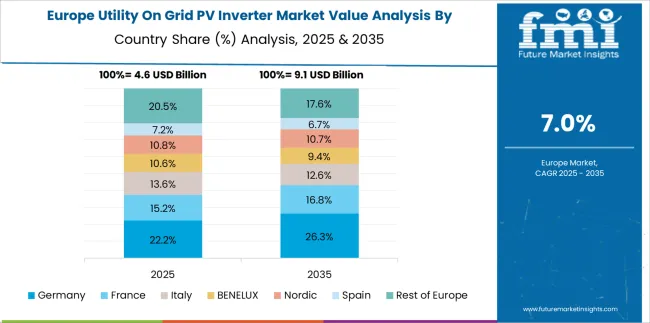

The utility on-grid PV inverter market is projected to grow at a CAGR of 7.7% from 2025 to 2035, driven by increasing solar farm installations, demand for grid stability, and advancements in inverter technology for higher efficiency. China leads at 10.4% CAGR, supported by ultra-large photovoltaic projects and government-backed renewable programs. India follows with 9.6%, driven by utility-scale solar parks and improved power distribution infrastructure. Among OECD economies, Germany posts 8.9%, emphasizing advanced grid integration solutions and voltage management systems. France records 8.1%, driven by hybrid power projects, while the United Kingdom grows at 7.3%, supported by investments in grid modernization and offshore-connected solar networks. The analysis includes over 40 countries, with the top five detailed below.

China is forecast to grow at a 10.4% CAGR, driven by large-scale solar power installations and advanced inverter solutions for grid stability. Ultra-mega solar parks and decentralized generation projects create strong demand for high-capacity central inverters. Domestic manufacturers are introducing next-generation string inverters with modular designs for simplified maintenance. Integration of smart monitoring platforms ensures real-time performance optimization for grid-connected PV systems. Hybrid inverter systems are gaining popularity in combined solar and energy storage projects. International partnerships with technology providers are further enhancing innovation and driving exports to Asia-Pacific and Middle Eastern markets.

India is projected to achieve 9.6% CAGR, supported by strong policy measures for solar adoption and infrastructure modernization. Utility-scale solar parks under national renewable programs drive the demand for high-efficiency on-grid PV inverters. Indian EPC firms are adopting three-phase string inverters for distributed solar generation, improving operational flexibility. Grid integration upgrades, including automated frequency regulation, are essential to support expanding solar capacity. Domestic manufacturing initiatives are reducing dependency on imported inverters, while collaborations with global brands ensure access to advanced control technologies. Demand is further strengthened by hybrid installations combining solar with battery storage in rural electrification projects.

Germany is expected to post an 8.9% CAGR, driven by advanced grid integration for large-scale photovoltaic systems. The country emphasizes smart inverter technologies that support grid voltage regulation and reactive power management for stable operations. Deployment of PV inverters in hybrid renewable projects is gaining traction to ensure an uninterrupted energy supply. German manufacturers are innovating with inverters featuring high conversion efficiency and extended operational life for utility-scale installations. Integration with digital monitoring platforms enables predictive maintenance and performance optimization, reducing operational costs. Strategic collaborations with European energy firms are further enhancing the adoption of intelligent grid-compatible inverter solutions.

France is forecast to grow at 8.1% CAGR, supported by increasing deployment of hybrid solar systems and grid-connected energy storage solutions. Utility-scale PV plants are integrating advanced inverters capable of dynamic grid support to manage intermittent generation. Manufacturers are focusing on multi-MPPT inverters for optimized power conversion across large installations. The expansion of floating solar farms on reservoirs is creating additional demand for corrosion-resistant inverters. Partnerships between energy developers and technology suppliers are introducing modular inverter designs to reduce project commissioning timelines and improve scalability for large photovoltaic projects.

The United Kingdom is projected to grow at a 7.3% CAGR, driven by grid modernization efforts and expansion of utility-scale solar projects. On-grid PV inverters with advanced grid-forming capabilities are being deployed to manage fluctuating renewable input. The integration of inverters with energy storage systems is enabling better peak load management and frequency control. Demand is rising for inverters compatible with offshore-connected solar arrays to enhance the resilience of renewable power systems. Manufacturers are focusing on compact modular inverter designs to cater to limited-space installations in urban solar farms and hybrid renewable energy parks.

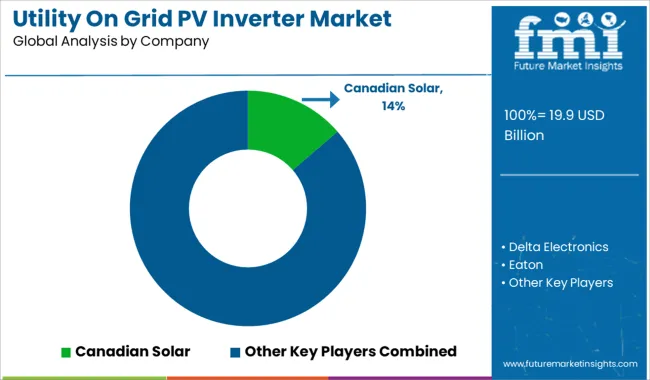

The utility on grid PV inverter market is highly competitive, with key players such as Canadian Solar, Delta Electronics, Eaton, Enphase Energy, Fimer Group, GoodWe, Schneider Electric, SMA Solar Technology, Sungrow Power Supply, Solis Inverters, SolarEdge Technologies, and V-Guard Industries driving technological innovation and global adoption. SMA Solar Technology and Sungrow lead with high-capacity central and string inverter solutions tailored for large-scale utility projects, offering superior efficiency and integrated monitoring systems.

Enphase Energy focuses on microinverter technology, targeting distributed solar installations, while SolarEdge Technologies emphasizes power optimizers and advanced energy management platforms for optimized performance in grid-tied systems. Delta Electronics and Fimer Group strengthen their positions with modular inverter solutions and grid support features for utility-scale deployments, ensuring compliance with evolving grid codes. Canadian Solar and GoodWe combine inverter manufacturing with strong module expertise, delivering bundled solutions for utility projects, while Schneider Electric leverages its power management capabilities to offer hybrid and grid-stabilizing inverter systems.

Regional competitors like V-Guard Industries focus on cost-effective solutions for emerging markets with growing utility-scale solar investments. Competitive differentiation hinges on inverter efficiency, grid stability features, integration with digital platforms for remote monitoring, and compliance with global standards such as UL, IEC, and IEEE. Future competitiveness will be shaped by innovations in high-voltage string inverters, energy storage integration, and AI-enabled predictive maintenance tools. Companies investing in IoT connectivity, modular designs, and enhanced cooling technologies are expected to maintain leadership as global demand for large-scale solar power and smart grid interconnection accelerates.

| Item | Value |

|---|---|

| Quantitative Units | USD 19.9 Billion |

| Product | String and Central |

| Nominal Output Voltage | 1500 V and ≥ 1500 V |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Canadian Solar, Delta Electronics, Eaton, Enphase Energy, Fimer Group, GoodWe, Schneider Electric, SMA Solar Technology, Sungrow Power Supply, Solis Inverters, SolarEdge Technologies, and V-Guard Industries |

| Additional Attributes | Dollar sales by inverter type (central, string, microinverter) and application (utility-scale solar farms, hybrid systems, smart grids), with demand driven by falling solar installation costs, renewable energy targets, and grid modernization initiatives. Regional dynamics highlight Asia-Pacific as the largest and fastest-growing market due to aggressive solar capacity additions in China and India, while Europe and North America drive adoption through stringent renewable energy mandates. Innovation trends include advanced MPPT algorithms, high-voltage inverters for utility-scale efficiency, AI-driven fault detection, and integrated storage-ready PV inverter solutions. |

The global utility on grid PV inverter market is estimated to be valued at USD 19.9 billion in 2025.

The market size for the utility on grid PV inverter market is projected to reach USD 41.8 billion by 2035.

The utility on grid PV inverter market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in utility on grid PV inverter market are string and central.

In terms of nominal output voltage, 1500 v segment to command 61.5% share in the utility on grid PV inverter market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Utility Markers Market Size and Share Forecast Outlook 2025 to 2035

Utility Energy as a Service (EaaS) Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Utility Terrain Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Open Loop Current Transducer Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Utility Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Utility Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale High Voltage Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility Pouches Market Size and Share Forecast Outlook 2025 to 2035

Utility Cases Market Insights - Growth & Demand 2025 to 2035

Utility Locator Market Report – Growth & Industry Forecast 2025 to 2035

Industry Share Analysis for Utility Pouches Companies

Utility Analytics and Energy Analytics Market Growth - Trends & Forecast through 2035

Utility Solar PV EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA