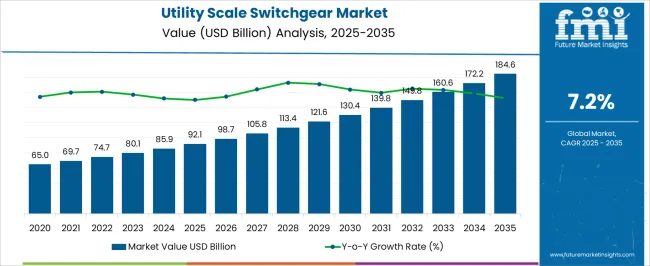

The utility scale switchgear market is projected to grow at a CAGR of 7.2% from 2025 to 2035, with the market estimated at USD 92.1 billion in 2025 and reaching USD 184.6 billion by 2035. Early-stage deployment across emerging economies and industrialized regions has created a moderate level of saturation, particularly in high-voltage transmission and distribution networks in North America, Europe, and parts of Asia-Pacific. As renewable energy integration, grid modernization, and digital substations accelerate, demand for advanced, compact, and modular switchgear solutions is intensifying. Utilities are increasingly replacing aging air-insulated switchgear (AIS) with gas-insulated (GIS) and hybrid solutions to optimize footprint, enhance reliability, and meet stricter environmental and safety standards.

Market saturation varies by voltage class, with extra-high-voltage (EHV) and high-voltage (HV) segments seeing higher adoption rates in industrialized nations, while medium-voltage (MV) and low-voltage (LV) segments show growth potential in developing regions. Manufacturers are leveraging smart monitoring, IoT-enabled diagnostics, and predictive maintenance offerings to capture untapped demand and extend the lifecycle of existing infrastructure. Supply chain dynamics, raw material availability, and government-driven grid modernization programs also play a crucial role in defining saturation thresholds and growth opportunities. The market’s evolution suggests that while certain regions approach near-peak deployment levels, ongoing technology upgrades and renewable energy expansion continue to push overall adoption and revenue growth globally.

| Metric | Value |

|---|---|

| Utility Scale Switchgear Market Estimated Value in (2025 E) | USD 92.1 billion |

| Utility Scale Switchgear Market Forecast Value in (2035 F) | USD 184.6 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The utility scale switchgear market is strongly shaped by five interrelated parent markets, each contributing uniquely to overall demand and adoption. The high-voltage transmission market holds the largest share at 40%, as utilities and independent power producers require reliable, efficient switchgear to manage bulk power transfer across national grids, integrate renewable generation, and maintain system stability.

The substation and distribution infrastructure segment contributes 25%, driven by upgrades to aging grids, replacement of conventional air-insulated switchgear (AIS) with gas-insulated (GIS) and hybrid solutions, and expansion of urban and industrial electricity networks. The renewable energy integration market accounts for 15%, with wind, solar, and hydro projects necessitating advanced switchgear capable of handling variable loads, ensuring fault protection, and supporting grid synchronization. The industrial and heavy manufacturing sector holds a 12% share, as plants adopt utility-scale switchgear for safe, high-capacity power distribution, minimizing downtime and operational hazards.

The smart grid and digital substations segment represents 8%, promoting IoT-enabled monitoring, predictive maintenance, and automated control for enhanced efficiency and reliability. Transmission, distribution, and renewable integration segments account for 80% of total demand, highlighting that infrastructure expansion, grid modernization, and renewable adoption are the primary growth drivers, while industrial applications and digital solutions provide incremental opportunities for global market growth.

The utility scale switchgear market is experiencing strong growth driven by the expansion of power transmission and distribution networks, the integration of renewable energy sources, and the modernization of grid infrastructure. The need for improved system reliability, safety, and operational efficiency is fueling the demand for high-performance switchgear.

Utilities are increasingly investing in advanced switchgear solutions to support higher voltage levels, reduce downtime, and enable remote monitoring and control through digital technologies. The market outlook remains positive as governments and private sector operators prioritize infrastructure upgrades to handle growing energy demand.

The ongoing shift toward cleaner energy generation and the increasing complexity of grid operations are creating favorable conditions for innovation and adoption of advanced switchgear. This combination of technological advancements and strategic infrastructure investments is expected to maintain the upward trajectory of the Utility Scale Switchgear market in the years ahead.

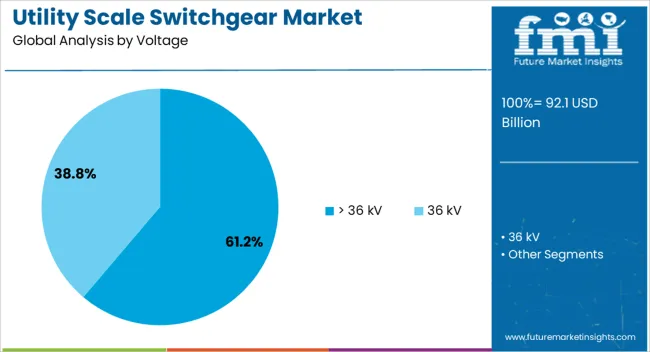

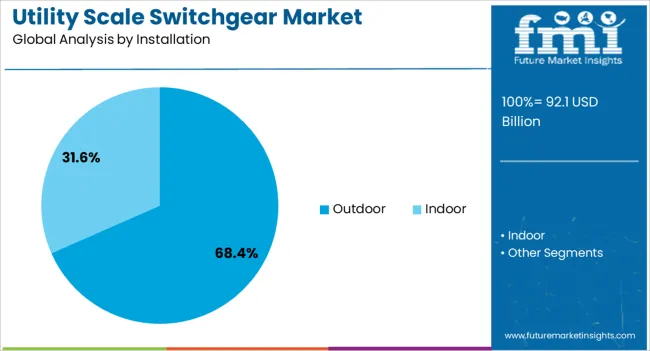

The utility scale switchgear market is segmented by voltage, installation, and geographic regions. By voltage, utility scale switchgear market is divided into > 36 kV and 36 kV. In terms of installation, utility scale switchgear market is classified into Outdoor and Indoor. Regionally, the utility scale switchgear industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The > 36 kV voltage segment is projected to account for 61.2% of the Utility Scale Switchgear market revenue in 2025, making it the leading segment by voltage rating. This dominance is being attributed to its suitability for high-capacity power transmission and distribution applications where reliability and efficiency are critical.

The growing demand for stable and secure power supply in industrial, commercial, and utility-scale projects has reinforced the adoption of higher voltage switchgear. This segment benefits from the ability to handle increased electrical loads over long distances with minimal losses, making it essential for expanding and upgrading national grid networks.

The rising integration of renewable energy plants, which require efficient high-voltage connections to the main grid, has further contributed to the growth of this category. In addition, the long operational lifespan and reduced maintenance requirements of > 36 kV switchgear are supporting its continued preference among utilities and large-scale power operators.

The outdoor installation segment is expected to capture 68.4% of the Utility Scale Switchgear market revenue in 2025, positioning it as the dominant installation type. This leading position is being driven by the suitability of outdoor switchgear for large-scale, high-voltage power distribution systems in open environments.

The ability to withstand harsh weather conditions, combined with enhanced durability and safety features, has increased its adoption across utility substations and renewable energy integration points. Outdoor switchgear offers flexibility in layout and scalability, allowing utilities to expand capacity without major structural changes.

The segment’s growth is also supported by the increasing need for reliable infrastructure in remote or space-constrained locations where indoor installations are not practical. With the expansion of renewable energy projects and transmission lines into diverse geographic areas, outdoor switchgear is expected to remain the preferred choice due to its proven performance and cost-effectiveness in utility-scale applications.

Utility scale switchgear growth is driven by transmission and distribution expansion, renewable energy integration, industrial adoption, and smart grid implementation. These dynamics collectively enhance reliability, operational efficiency, and system resilience worldwide.

The utility scale switchgear market is witnessing significant growth due to expanding high-voltage transmission and substation networks. Aging infrastructure in developed countries and the need for modernizing legacy systems are driving replacement of conventional air-insulated switchgear (AIS) with gas-insulated (GIS) and hybrid solutions. Utilities are investing in high-capacity switchgear to enhance reliability, minimize power outages, and improve system efficiency. Industrial and commercial end-users also demand robust switchgear for uninterrupted operations, safety compliance, and regulatory adherence. Governments and private operators are emphasizing enhanced fault detection, load balancing, and protection mechanisms to ensure grid stability. Rising investments in national transmission projects, interconnection initiatives, and regional power corridors further propel adoption globally.

The rise of renewable energy projects is influencing utility scale switchgear demand significantly. Wind farms, solar parks, and hydroelectric installations require switchgear capable of handling fluctuating loads, intermittent generation, and fault protection. Switchgear facilitates seamless integration with national grids, enabling synchronization, reactive power control, and energy quality management. Utilities are increasingly adopting GIS and hybrid systems for renewable substations to optimize land use, reduce maintenance, and enhance operational safety. Independent power producers and renewable EPC companies prioritize switchgear with high voltage ratings, compact design, and robust fault isolation. The accelerating transition to green energy, government incentives, and renewable portfolio standards collectively drive switchgear adoption, particularly in Asia-Pacific and Europe, where large-scale renewable capacity is being commissioned.

Industrial facilities and heavy manufacturing units contribute substantially to the utility scale switchgear market. Switchgear ensures reliable power distribution for high-capacity equipment, minimizes operational downtime, and protects critical assets from electrical faults. Key industries include steel, chemical, petrochemical, cement, and automotive manufacturing, which require robust and modular switchgear solutions for plant-wide electrification. Facility managers increasingly prefer GIS and hybrid systems due to reduced footprint, lower maintenance needs, and improved safety during high-voltage operations. Industrial expansion, capacity augmentation projects, and compliance with occupational safety and energy efficiency regulations drive demand. Long-term operational reliability, reduced incident risk, and compatibility with plant automation systems remain primary factors influencing industrial switchgear purchases globally.

The integration of digital monitoring, remote control, and IoT-based systems is redefining utility scale switchgear utilization. Smart grid initiatives leverage switchgear for predictive maintenance, real-time fault detection, and automated load management. Utilities and grid operators deploy sensors, communication modules, and analytics platforms to enhance energy reliability, reduce operational costs, and improve decision-making. Digital switchgear enables seamless interaction with grid management software, supports renewable integration, and facilitates faster outage restoration. The adoption of predictive diagnostics and automated controls reduces unplanned downtime and improves asset utilization. Growth is fueled by increasing investments in smart substations, microgrid projects, and automation-driven electricity networks, particularly in developed economies and fast-growing energy markets globally.

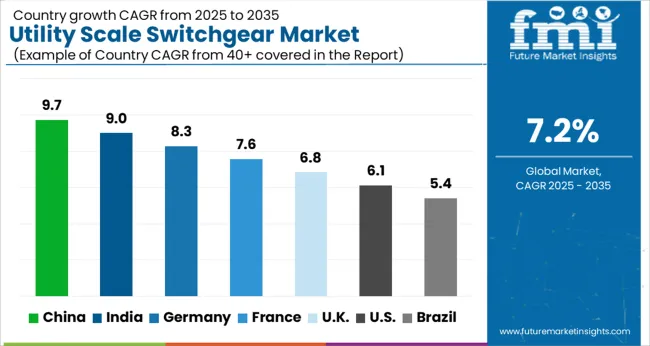

| Country | CAGR |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| France | 7.6% |

| UK | 6.8% |

| USA | 6.1% |

| Brazil | 5.4% |

The global utility scale switchgear market is projected to grow at a CAGR of 7.2% from 2025 to 2035. China leads at 9.7%, followed by India at 9.0%, Germany at 8.3%, the UK at 6.8%, and the USA at 6.1%. Growth is driven by expanding high-voltage transmission networks, increasing adoption of gas-insulated and hybrid switchgear, and modernization of aging grid infrastructure. Utilities and industrial operators prioritize reliability, fault protection, and operational efficiency in new installations and replacement projects. Rapid deployment of renewable energy projects, government policies, and smart grid initiatives further accelerate adoption. Asia-Pacific exhibits strong growth due to large-scale grid expansion and industrial electrification, while Europe and North America focus on digital integration, compliance, and high-voltage network optimization. The analysis spans over 40+ countries, with the leading markets detailed below.

The utility scale switchgear market in China is projected to grow at a CAGR of 9.7% from 2025 to 2035, driven by large-scale grid expansion, high-voltage transmission projects, and rapid industrial electrification. Government-backed investments in smart grid modernization, renewable energy integration, and regional interconnections are significantly increasing the demand for gas-insulated, vacuum, and hybrid switchgear solutions. Domestic manufacturers are enhancing production capacities while incorporating digital monitoring, predictive maintenance, and compact designs to improve operational reliability. Large urbanization and industrial zones require robust fault protection and high-capacity load handling, while collaboration with global technology providers ensures compliance with international safety and performance standards. Retrofit projects in aging substations further augment adoption, supported by government incentives and utility modernization programs.

The utility scale switchgear market in India is expected to expand at a CAGR of 9.0% from 2025 to 2035, supported by ongoing electrification projects, industrial expansion, and government policies promoting renewable energy integration. Rapid deployment of solar and wind farms, coupled with upgrades to existing transmission and distribution networks, is driving demand for advanced switchgear solutions. Local and international manufacturers are focusing on gas-insulated, vacuum, and hybrid switchgear that offer compact design, high reliability, and fault protection. Smart monitoring, predictive maintenance, and modular installation capabilities are increasingly prioritized by utilities to minimize downtime. Large-scale infrastructure investments, including regional grid interconnections and urban industrial electrification, further accelerate adoption across the country.

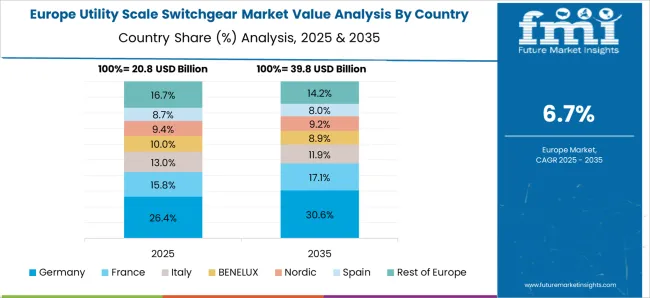

Germany’s utility scale switchgear market is projected to grow at a CAGR of 8.3% from 2025 to 2035, fueled by the country’s energy transition initiatives and grid modernization programs. Expansion of renewable energy capacity, particularly offshore wind and solar PV integration, is driving demand for high-voltage gas-insulated and hybrid switchgear systems. Utilities and industrial operators focus on reliable fault management, compact substation design, and digital monitoring for predictive maintenance. Retrofit and replacement of aging equipment in transmission and distribution networks further contribute to market growth. Collaboration between local manufacturers and global technology providers ensures compliance with European safety standards, operational efficiency, and integration with smart grid systems.

The utility scale switchgear market in the UK is expected to expand at a CAGR of 6.8% from 2025 to 2035, supported by grid modernization, renewable energy adoption, and industrial infrastructure expansion. Offshore wind, solar, and hydroelectric projects are increasing the demand for gas-insulated, vacuum, and hybrid switchgear. Utilities are implementing digital control, predictive maintenance, and modular designs to enhance system reliability and fault protection. Retrofit projects targeting legacy substations and industrial facilities further stimulate market growth. Collaboration with global technology providers ensures integration with smart grid solutions and compliance with international safety and performance standards. Government incentives for energy-efficient infrastructure accelerate adoption across commercial and industrial sectors.

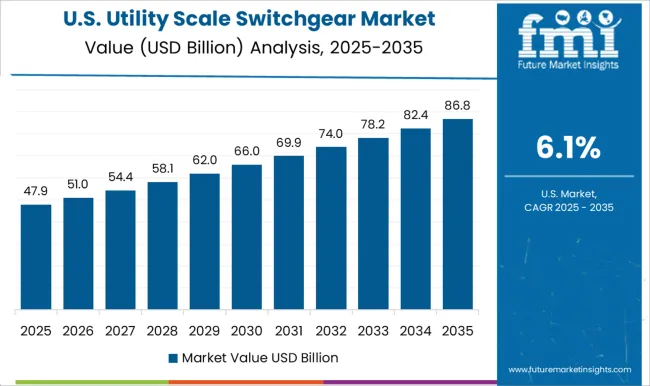

The utility scale switchgear market in the USA is projected to grow at a CAGR of 6.1% from 2025 to 2035, driven by modernization of aging transmission networks, renewable energy integration, and industrial infrastructure upgrades. Utilities are investing in gas-insulated, hybrid, and vacuum switchgear solutions to improve system reliability, reduce fault risks, and enhance load management. Smart grid initiatives, predictive maintenance systems, and modular designs are increasingly adopted to optimize performance and minimize operational costs. Large-scale deployment of wind, solar, and storage projects contributes significantly to market expansion, while retrofitting older substations ensures compliance with evolving safety and performance standards. Collaboration with technology partners enhances design, monitoring, and integration capabilities.

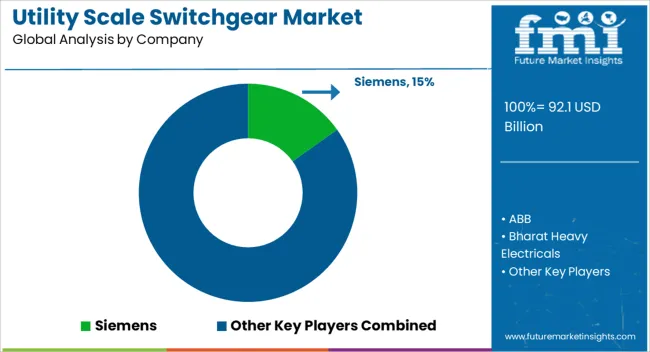

Competition in the utility scale switchgear market is defined by reliability, high-voltage performance, and integration with transmission and distribution networks. Siemens leads with advanced gas-insulated, vacuum, and hybrid switchgear solutions emphasizing digital monitoring, fault detection, and modular designs for industrial and utility applications. ABB competes through high-capacity, flexible switchgear systems tailored for renewable integration, smart grids, and substation automation. Bharat Heavy Electricals and CG Power and Industrial Solutions focus on robust, scalable switchgear for transmission networks, prioritizing reliability, long operational life, and adherence to national and international standards.

Eaton, Fuji Electric, and General Electric differentiate through energy-efficient designs, predictive maintenance integration, and turnkey solutions for utility-scale projects. Regional and specialized players such as HD Hyundai Electric, Hitachi, Hyosung Heavy Industries, Lucy Group, Mitsubishi Electric, Ormazabal, Schneider Electric, Skema, and Toshiba provide niche solutions including compact GIS, hybrid switchgear, and digitalized monitoring systems for industrial, commercial, and renewable applications. Strategies emphasize compliance with IEC and ANSI standards, integration with smart grids, lifecycle support, and retrofitting capabilities for aging infrastructure. Partnerships with EPC contractors, utility operators, and technology providers accelerate adoption and enhance system reliability.

| Item | Value |

|---|---|

| Quantitative Units | USD 92.1 Billion |

| Voltage | > 36 kV and 36 kV |

| Installation | Outdoor and Indoor |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens, ABB, Bharat Heavy Electricals, CG Power and Industrial Solutions, E + I Engineering, Eaton, Fuji Electric, General Electric, HD Hyundai Electric, Hitachi, Hyosung Heavy Industries, Lucy Group, Mitsubishi Electric, Ormazabal, Schneider Electric, Skema, and Toshiba |

| Additional Attributes | Dollar sales, market share by voltage class, segment-wise adoption (GIS, AIS, hybrid), end-use demand (utilities, renewables, industrial), CAGR trends, competitive positioning, and regulatory compliance impact, key suppliers, emerging market opportunities, retrofit demand, digital monitoring adoption, and growth drivers across transmission, distribution, and renewable integration projects. |

The global utility scale switchgear market is estimated to be valued at USD 92.1 billion in 2025.

The market size for the utility scale switchgear market is projected to reach USD 184.6 billion by 2035.

The utility scale switchgear market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in utility scale switchgear market are > 36 kv and 36 kv.

In terms of installation, outdoor segment to command 68.4% share in the utility scale switchgear market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Utility Markers Market Size and Share Forecast Outlook 2025 to 2035

Utility Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Energy as a Service (EaaS) Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Utility Terrain Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Utility Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Utility Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar PV EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility Pouches Market Size and Share Forecast Outlook 2025 to 2035

Utility On Grid PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Utility Cases Market Insights - Growth & Demand 2025 to 2035

Utility Locator Market Report – Growth & Industry Forecast 2025 to 2035

Industry Share Analysis for Utility Pouches Companies

Utility Analytics and Energy Analytics Market Growth - Trends & Forecast through 2035

Utility Based Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Low Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Open Loop Current Transducer Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Low Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA