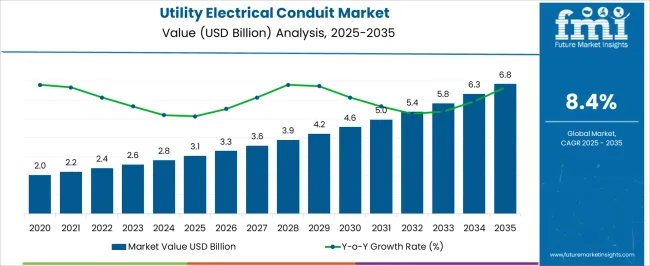

The utility electrical conduit sector is forecasted to expand from USD 3.1 billion in 2025 to USD 4.6 billion by 2030, marking the first five-year block of a broader growth path toward USD 6.8 billion in 2035 at a CAGR of 8.4%. Yearly progression shows values rising from 3.1 billion in 2025 to 3.6 billion in 2027 and 4.2 billion by 2029. This block of growth reflects the steady requirement for conduit systems in energy transmission, commercial construction, and utility-scale projects.

The trajectory demonstrates reliability, where installation safety, durability, and compliance with regulatory standards remain the strongest adoption drivers. By 2030, the industry value is expected to reach 4.6 billion, delivering a gain of USD 1.5 billion during the initial half of the projection period. The five-year block highlights consistent opportunities across underground, concealed, and exposed wiring applications in utilities and infrastructure. The expansion pattern reinforces long-term confidence, with steady adoption supported by grid modernization and large-scale construction activity. The block analysis suggests a dependable foundation for continued growth throughout the decade.

| Metric | Value |

|---|---|

| Utility Electrical Conduit Market Estimated Value in (2025 E) | USD 3.1 billion |

| Utility Electrical Conduit Market Forecast Value in (2035 F) | USD 6.8 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The utility electrical conduit segment is estimated to contribute nearly 22% of the electrical conduit market, about 17% of the power transmission and distribution market, close to 14% of the utility infrastructure market, nearly 11% of the construction materials market, and around 10% of the industrial electrical equipment market. Collectively, this equals an aggregated share of approximately 74% across its parent categories. This proportion underscores the crucial role of utility electrical conduits in safeguarding power lines and wiring networks against physical damage, moisture, and environmental stress. Their importance has been recognized in underground and overhead utility projects where resilience and safety compliance dictate engineering standards.

Demand has been shaped by investments in grid modernization, expansion of utility-scale projects, and ongoing upgrades to distribution networks in both developed and emerging economies. Their contribution is also amplified by growing reliance on durable conduit systems in high-voltage applications, where uninterrupted performance is essential. Utility electrical conduits are considered indispensable within their parent markets, driving specification choices, shaping procurement strategies, and ensuring operational reliability across the global utility sector. This central positioning secures their role as a defining category within the interconnected ecosystem of construction, utilities, and industrial electrical equipment.

Demand is being fueled by the need for reliable and durable conduit systems that ensure safe wiring and protection in both new installations and retrofitting projects.

Rising adoption of renewable energy projects and the integration of smart grid systems are further contributing to the market’s expansion. Utility providers are prioritizing solutions that offer long service life, corrosion resistance, and compliance with evolving safety standards.

The trend toward underground power cabling and enhanced load-bearing capacity in urban environments is also supporting the demand for advanced conduit products. The market is poised for continued growth as infrastructure upgrades accelerate and regulatory requirements for electrical safety become more stringent across multiple regions.

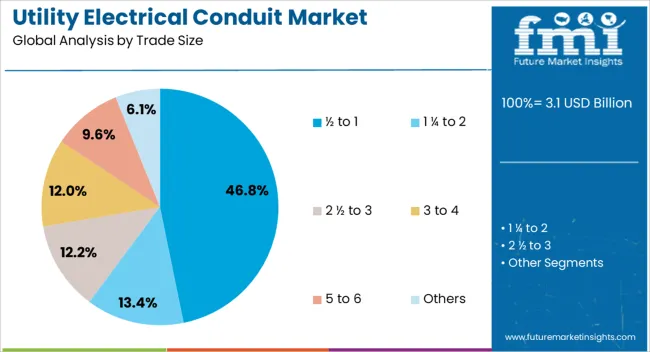

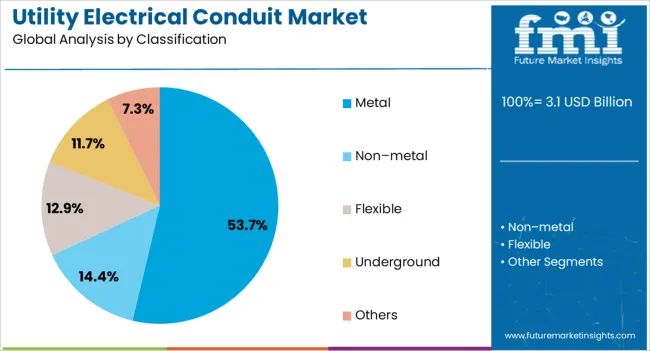

The utility electrical conduit market is segmented by trade size, classification, and geographic regions. By trade size, utility electrical conduit market is divided into ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and others. In terms of classification, utility electrical conduit market is classified into metal, non–metal, flexible, underground, and others. Regionally, the utility electrical conduit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ½ to 1 trade size segment is projected to hold 46.8% of the utility electrical conduit market revenue in 2025, making it the leading trade size category. This dominance is being driven by its wide applicability in residential, commercial, and utility-scale electrical installations.

The size range offers an optimal balance between flexibility and capacity, allowing it to be used in a variety of wiring configurations while maintaining compliance with standard electrical codes. Growth has been supported by the increased need for efficient space utilization in conduit layouts, particularly in densely built environments. Its compatibility with a broad range of fittings and accessories has made it a preferred choice for installers seeking versatility and ease of integration The segment’s leadership is also being reinforced by its cost-effectiveness and availability in multiple material options, which ensures suitability across diverse project specifications.

The metal classification segment is expected to account for 53.7% of the market revenue in 2025, securing its position as the dominant classification type. This leadership is being attributed to the superior mechanical strength, durability, and fire resistance offered by metal conduits.

Their ability to provide enhanced protection for electrical wiring in demanding environments such as industrial plants, transportation hubs, and high-density urban infrastructure has reinforced their market share. The segment’s growth has also been influenced by regulatory preferences for robust conduit solutions that meet stringent safety and performance standards.Advancements in corrosion-resistant coatings and manufacturing processes have improved the longevity and reliability of metal conduits, making them more cost-effective over their service life As infrastructure projects increasingly emphasize resilience and long-term operational safety, the metal classification segment is expected to maintain its market leadership.

The utility electrical conduit market is projected to expand steadily, supported by growing investments in power infrastructure, telecom networks, and commercial construction. Demand is reinforced by the need for reliable protection of wiring against mechanical stress, moisture, and environmental damage. Opportunities are unfolding in underground cabling, renewable energy projects, and smart grid installations. Trends highlight the adoption of flexible conduits, halogen-free materials, and pre-fabricated assemblies. However, challenges such as raw material volatility, high installation costs, and compliance with diverse regional standards continue to influence the pace of global market expansion.

Demand for utility electrical conduits has been reinforced by the expansion of power distribution networks, telecom projects, and commercial construction activities. Conduits are preferred for their ability to protect electrical wiring from external hazards while ensuring system longevity. Opinions suggest that the strongest demand is evident in underground cabling projects, where conduits offer mechanical strength and moisture resistance. Telecom operators deploying fiber optic networks also rely heavily on conduits for secure installations. Replacement demand has been steady in developed regions, where older systems are upgraded for safety compliance. With increasing dependence on electricity and data networks, the role of conduits has moved from a basic accessory to a critical infrastructure element.

Opportunities in the utility electrical conduit market are being shaped by renewable energy expansion, smart grid deployment, and regional electrification programs. Solar and wind projects require extensive underground cabling, creating demand for durable conduit systems. Opinions highlight that the integration of conduits into smart grids offers strong opportunities, as utilities seek enhanced monitoring and control capabilities. Emerging economies investing in rural electrification are also presenting growth avenues, with conduits being essential for safe and reliable distribution. Opportunities further lie in customized conduit solutions designed for high-temperature or chemical-prone environments. Suppliers engaging in partnerships with EPC contractors and utility providers can secure long-term contracts, strengthening their market presence.

Trends in the utility electrical conduit market emphasize material innovation, modular assemblies, and flexible designs. Halogen-free and low-smoke conduits are trending as safety standards in commercial and utility sectors grow stricter. Lightweight flexible conduits are being preferred for faster installation in complex layouts, reducing labor time and costs. Opinions suggest that pre-fabricated conduit assemblies are trending strongly, especially in large-scale utility and renewable energy projects where efficiency is critical. Another visible trend is the growing use of conduits compatible with advanced cables used in smart grids and fiber optics. Digital tools for designing and simulating conduit layouts are also being integrated into project planning.

Challenges in the utility electrical conduit market stem from raw material price volatility, high installation costs, and regulatory variations. Steel, aluminum, and polymer price fluctuations impact manufacturing economics, creating instability for suppliers. Opinions emphasize that installation costs remain a significant barrier, particularly in large-scale underground cabling projects requiring skilled labor and specialized equipment. Regional variations in standards and certification requirements add complexity, delaying project execution and increasing costs for manufacturers seeking international reach. Smaller players face challenges in meeting compliance costs, reducing competitiveness against larger multinational suppliers. Supply chain disruptions for conduit materials and components have also impacted timely delivery.

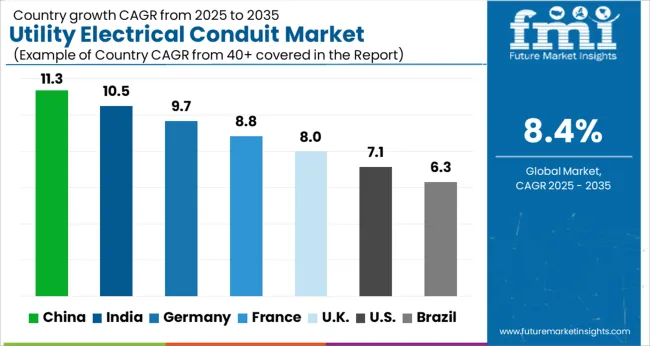

| Country | CAGR |

|---|---|

| China | 11.3% |

| India | 10.5% |

| Germany | 9.7% |

| France | 8.8% |

| UK | 8.0% |

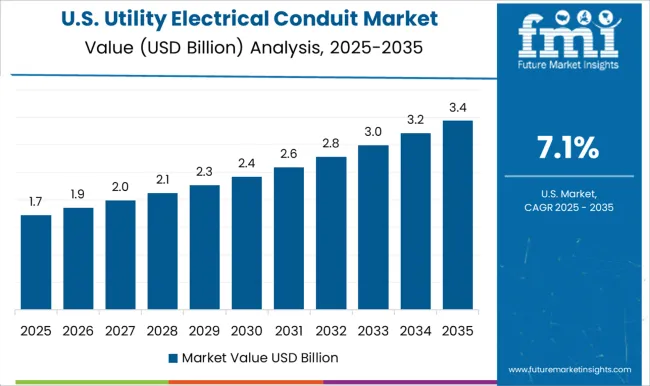

| USA | 7.1% |

| Brazil | 6.3% |

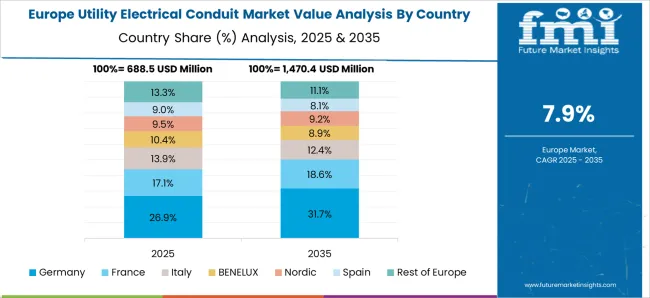

The global utility electrical conduit market is projected to grow at a CAGR of 8.4% between 2025 and 2035. China leads at 11.3%, followed by India at 10.5% and France at 8.8%. The United Kingdom is forecast to grow at 8.0%, while the United States records 7.1%. Rising demand for safe power transmission, modernization of distribution networks, and expansion of smart grid infrastructure are key growth drivers. Asia dominates through large scale electrification projects and competitive manufacturing capabilities, while Europe emphasizes premium, regulation compliant conduit systems. The USA market grows at a steadier pace, shaped by replacement cycles, retrofitting of aged utilities, and demand for conduits in renewable power installations and data centers. This report includes insights on 40+ countries; the top markets are shown here for reference.

The utility electrical conduit market in China is forecast to grow at a CAGR of 11.3%. Growth is fueled by rapid urban development, grid expansion projects, and integration of renewable energy infrastructure. Large scale power distribution programs ensure consistent demand for durable conduit systems across residential, industrial, and commercial sectors. Domestic producers scale up output of PVC, HDPE, and steel conduits, making China a key exporter in global supply chains. Government safety regulations reinforce adoption of high performance conduits in underground and overhead systems. With expanding smart grid initiatives and emphasis on durable infrastructure, China consolidates its leadership in the global utility electrical conduit industry.

The utility electrical conduit market in India is expected to expand at a CAGR of 10.5%. Expansion is supported by government electrification programs, rural infrastructure upgrades, and investments in industrial corridors. Rising demand for safe and reliable power transmission drives adoption of high quality conduit systems. Domestic producers expand capacity and collaborate with international firms to improve product durability and fire resistance. Smart city projects, metro expansions, and renewable energy parks provide steady opportunities for conduit installations. With strong demand from both urban and semi urban areas, India strengthens its role as one of the fastest growing global markets for utility electrical conduits.

The utility electrical conduit market in France is projected to grow at a CAGR of 8.8%. Growth is supported by EU backed renewable projects, modernization of power grids, and compliance with stringent safety standards. French utilities prioritize premium grade conduits with high fire resistance, durability, and regulatory certification. Strong adoption is observed in underground cabling for renewable integration, including wind and solar parks. Domestic and European manufacturers collaborate to supply advanced conduit systems tailored to high voltage and long distance transmission needs. With emphasis on quality and sustainability, France remains one of the key European hubs for advanced utility electrical conduit deployment.

The utility electrical conduit market in the UK is expected to grow at a CAGR of 8.0%. Growth is driven by retrofitting of aging power distribution systems, urban redevelopment projects, and regulatory focus on safety compliance. Adoption is reinforced by commercial and industrial facilities requiring advanced conduit solutions for reliability and long term performance. Import reliance plays a significant role, with distributors sourcing premium conduit systems from European and Asian producers. Offshore wind projects and modernization of grid networks also create opportunities for expansion. The UK shows steady progress, shaped by infrastructure replacement cycles and renewable power integration.

The utility electrical conduit market in the US is projected to expand at a CAGR of 7.1%. Growth is moderate, reflecting a mature infrastructure base, but steady adoption is driven by retrofitting, replacement demand, and integration of conduits into renewable energy projects. Data center expansion and energy efficiency upgrades reinforce adoption of advanced conduit systems. USA manufacturers focus on NEC compliant, high performance materials with improved fire and weather resistance. Federal and state programs supporting modernization of grid infrastructure provide consistent growth opportunities. Though slower than Asia and Europe, the USA remains an important market for innovation and premium conduit applications.

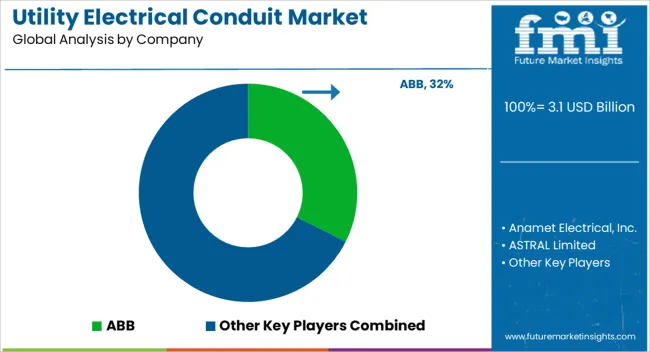

Competition is shaped by price sensitivity, product quality, and compliance with electrical and safety standards. Many companies focus on cost-effective polyvinyl chloride (PVC) conduit production, while others differentiate through metal conduit offerings like steel and aluminum for high-strength applications.

Market rivalry also intensifies due to fluctuating raw material costs, pushing firms to optimize supply chains and maintain steady pricing. Contractors and utilities often prefer suppliers with reliable delivery schedules and wide product portfolios, creating pressure for firms to expand distribution networks. Strategic mergers, acquisitions, and partnerships are commonly used to secure regional market share and gain access to utility projects. Players emphasize long-term contracts with electric utilities and government agencies to stabilize revenue streams. The market remains highly fragmented, which enables regional manufacturers to compete effectively through localized service and pricing strategies despite the presence of large established brands.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.1 billion |

| Trade Size | ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and Others |

| Classification | Metal, Non–metal, Flexible, Underground, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Anamet Electrical, Inc., ASTRAL Limited, Atkore, Austro Pipes, CANTEX INC., Champion Fiberglass, Inc., Electri-Flex Company, Guangdong Ctube Industry Co., Ltd., HellermannTyton, Hubbell, legrand, Liberty Electric Products, Schneider Electric, Tubecon, Wienerberger AG, and Zekelman Industries |

| Additional Attributes | Dollar sales by conduit type (rigid metal, flexible metal, non-metallic, PVC), Dollar sales by application (power distribution, transmission, telecom, industrial, residential), Trends in fire-resistant and corrosion-proof conduit adoption, Role in ensuring electrical safety and regulatory compliance, Growth from renewable integration and smart grid projects, Regional demand across North America, Europe, Asia Pacific. |

The global utility electrical conduit market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the utility electrical conduit market is projected to reach USD 6.8 billion by 2035.

The utility electrical conduit market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in utility electrical conduit market are ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6 and others.

In terms of classification, metal segment to command 53.7% share in the utility electrical conduit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Utility-Scale Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Low Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Markers Market Size and Share Forecast Outlook 2025 to 2035

Utility Energy as a Service (EaaS) Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Utility Terrain Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Open Loop Current Transducer Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Low Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Utility Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale High Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar PV EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale High Voltage Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA