The Utility Vehicle Market is estimated to be valued at USD 1108.9 million in 2025 and is projected to reach USD 1894.2 million by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

In the period from 2025 to 2030, market expansion will be influenced by rising adoption in agriculture, construction, and logistics sectors, with values expected to surpass USD 1450.0 million as multipurpose vehicles become integral to operational efficiency.

Between 2030 and 2035, growth is projected to sustain momentum as technological upgrades such as electric drivetrains, telematics, and enhanced load-bearing capabilities gain traction. The incremental rise of USD 785.3 million over the forecast period indicates a steady shift toward more durable, fuel-efficient, and customized vehicle designs. Competitive intensity will strengthen, with manufacturers focusing on product differentiation through safety features, modular designs, and regional customization. With the Asia-Pacific region expected to remain a dominant demand hub and North America witnessing strong fleet modernization, utility vehicles are poised to serve as reliable solutions for industries requiring adaptable mobility and productivity.

| Metric | Value |

|---|---|

| Utility Vehicle Market Estimated Value in (2025 E) | USD 1108.9 million |

| Utility Vehicle Market Forecast Value in (2035 F) | USD 1894.2 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

The utility vehicle market is experiencing steady expansion as industries increasingly prioritize multifunctional, terrain-capable transportation solutions for both commercial and operational applications. Growth is being fueled by infrastructure development, agricultural modernization, and increased mining and defense activities that demand durable and adaptable vehicle formats.

The adoption of utility vehicles has been further supported by technological advancements in drivetrains, suspension systems, and load-handling capabilities, enhancing operational efficiency across diverse terrain. Stringent safety regulations and emission standards are also influencing design innovations, with manufacturers investing in more fuel-efficient and ergonomically optimized platforms.

As global economies continue to invest in construction, logistics, and mobility infrastructure, the demand for utility vehicles is set to rise steadily, particularly in sectors requiring off-road capability and payload flexibility.

The utility vehicle market is segmented by cargo configuration, propulsion type, application, drivetrain configuration, and geographic region. By cargo configuration, the utility vehicle market is divided into those with beds and those without beds. In terms of propulsion, the utility vehicle market is classified into Gasoline, Diesel, and Electric. Based on application, the utility vehicle market is segmented into Construction, Universities, Government/Municipalities, Entertainment, Hospitality, and Others. The drivetrain configuration of the utility vehicle market is segmented into 2-wheel drive (2WD) and four-wheel drive (4WD). Regionally, the utility vehicle industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The with bed cargo configuration segment is expected to account for 38.50 percent of total market revenue by 2025, positioning it as the dominant cargo configuration. This preference is largely driven by its superior load-carrying capacity and utility in transporting tools, materials, and equipment across varied job sites.

Its flexibility in accommodating a wide range of cargo has made it essential for construction, agriculture, and industrial maintenance applications. Additionally, vehicles with bed configurations support enhanced productivity by enabling easy loading and unloading, especially in field operations.

Their rugged build and adaptable design continue to meet the diverse payload requirements of industries, solidifying their dominance in the cargo configuration category.

The with bed cargo configuration segment is expected to account for 38.50 percent of total market revenue by 2025, positioning it as the dominant cargo configuration. This preference is largely driven by its superior load-carrying capacity and utility in transporting tools, materials, and equipment across varied job sites.

Its flexibility in accommodating a wide range of cargo has made it essential for construction, agriculture, and industrial maintenance applications. Additionally, vehicles with bed configurations support enhanced productivity by enabling easy loading and unloading, especially in field operations.

Their rugged build and adaptable design continue to meet the diverse payload requirements of industries, solidifying their dominance in the cargo configuration category.

The construction application segment is forecasted to represent 36.90 percent of overall market revenue by 2025, establishing it as the leading end-use category. This is driven by the increasing use of utility vehicles on construction sites for material transport, personnel movement, and equipment hauling.

Their compact design and terrain-handling capabilities make them ideal for navigating confined and rugged construction environments. Moreover, the expansion of infrastructure projects worldwide, particularly in emerging economies, has significantly boosted demand for versatile vehicles that can operate under heavy-duty and continuously changing site conditions.

As a result, the construction industry remains the primary driver of utility vehicle adoption, owing to its consistent and high-volume operational demands.

Government incentives, infrastructure growth, versatile vehicle demand, and the rise of electric utility vehicles are driving the market. Manufacturers are focusing on efficiency and flexibility to meet diverse industrial requirements.

Utility vehicle manufacturers are heavily influenced by government regulations and incentives that promote eco-friendly alternatives. Governments are introducing stricter emissions standards and offering tax breaks for companies producing electric or hybrid utility vehicles. These regulations, along with grants and incentives, are fueling the demand for more sustainable and efficient vehicles in various sectors, from agriculture to construction. As utility vehicles play a key role in industries such as logistics and maintenance, policy changes that encourage the transition to greener fleets are expected to drive the market. Manufacturers are focusing on creating products that comply with environmental regulations while improving performance and cost-efficiency.

The demand for utility vehicles is closely tied to the growth of infrastructure development, particularly in the construction and transportation sectors. As countries continue to expand their infrastructure, utility vehicles are increasingly required for material handling, transportation of equipment, and on-site maintenance tasks. These vehicles are essential for completing large-scale construction projects, roadworks, and urban development initiatives. As the construction sector booms, utility vehicle manufacturers are ramping up production to meet the rising demand for robust and efficient vehicles that can handle tough working conditions. This growth is also supported by global investments in public and private infrastructure.

A key driver in the utility vehicle market is the growing demand for versatile, multi-functional vehicles that can be used across various industries. Utility vehicles are increasingly being favored due to their ability to perform a range of tasks, from off-road transport to material handling. This versatility allows businesses to reduce costs by investing in one vehicle for multiple applications. In sectors like agriculture, emergency services, and utilities, the need for adaptable, all-terrain vehicles has become more pronounced. Manufacturers are responding to this by designing utility vehicles with customizable features and capabilities to suit specific industry requirements.

The shift toward electric and hybrid utility vehicles is becoming a major trend as manufacturers focus on reducing fuel consumption and lowering emissions. With advancements in electric powertrains and battery technology, electric utility vehicles are becoming more feasible for heavy-duty applications. These vehicles offer reduced operational costs, longer service life, and enhanced environmental performance. As more industries embrace eco-friendly solutions, the demand for electric and hybrid utility vehicles is expected to rise. Manufacturers are investing in research and development to increase the efficiency, durability, and affordability of electric utility vehicles, aiming to meet the growing needs of industries that rely on these versatile machines.

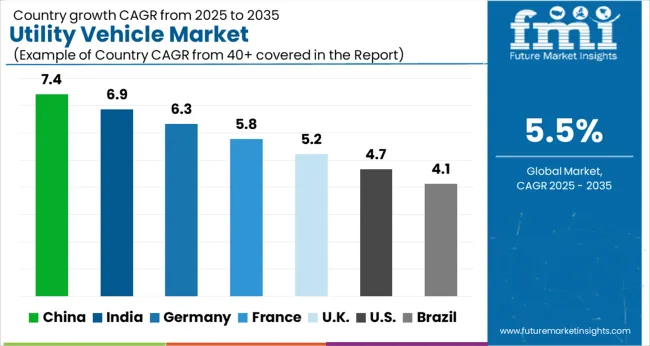

| Countries | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The utility vehicle market is expected to grow globally at a CAGR of 5.5% from 2025 to 2035, fueled by increasing demand for versatile vehicles in sectors such as construction, agriculture, and logistics. China leads with a CAGR of 7.4%, driven by rapid industrialization, significant infrastructure investments, and the growing need for utility vehicles in both urban and rural areas. India follows closely with a CAGR of 6.9%, spurred by ongoing development in infrastructure, agriculture, and logistics, alongside rising demand for vehicles capable of operating in challenging terrains. Germany records a 6.3% growth, benefiting from robust demand in the construction and agricultural sectors, while France posts 5.8%, backed by investments in utility vehicles for public services, construction, and agriculture. The UK shows 5.2% growth, driven by the need for versatile vehicles in urban and rural maintenance sectors, while the USA demonstrates more moderate growth at 4.7%, supported by increased demand for utility vehicles in construction, agricultural, and municipal applications. This analysis highlights China, India, and Germany as key players in driving demand for utility vehicles, with significant contributions from Europe and North America, supported by sector-specific demand and infrastructure growth.

The utility vehicle market in the UK is projected to post a CAGR of 5.2% during 2025–2035, slightly below the global average of 5.5%. This growth is driven by increasing demand from the construction, logistics, and municipal sectors. The UK's need for versatile, all-terrain vehicles is rising due to ongoing urban and infrastructure projects, agricultural demands, and environmental concerns. Additionally, the country’s push for clean energy and government support for green initiatives is expected to contribute significantly to the market’s growth. From 2020 to 2024, the UK market grew at a CAGR of 4.5%, driven by stable demand across various industries, including public services, municipal maintenance, and construction. As the government intensifies its focus on clean energy, utility vehicle manufacturers are increasing production of electric and hybrid models to meet this demand, which is expected to fuel a faster growth rate in the upcoming period.

China is forecast to post a CAGR of 7.4% during 2025–2035, leading the global average of 5.5%. This growth is largely driven by rapid industrialization, expanding infrastructure projects, and government-led initiatives in agriculture and logistics. The demand for utility vehicles in China has risen as the construction, agriculture, and mining industries continue to grow rapidly, requiring specialized vehicles to handle material transportation and off-road operations. Additionally, the government’s focus on energy-efficient vehicles and the push for cleaner energy sources will drive demand for electric and hybrid utility vehicles. Between 2020 and 2024, the market grew at a rate of 6.8%, driven by significant investments in infrastructure development and robust demand from various industries. The upcoming decade will see more government-driven initiatives and market growth in the utility vehicle sector.

India is expected to post a CAGR of 6.9% during 2025–2035, surpassing the global average of 5.5%. The country’s growing infrastructure, agriculture, and logistics sectors, combined with increasing demand for multi-functional, all-terrain vehicles, are key drivers of this growth. India's need for utility vehicles has been steadily increasing, particularly in rural and semi-urban regions, where these vehicles are essential for agricultural and logistical operations. The market grew at 6.2% between 2020 and 2024, driven by strong governmental support for infrastructure projects and improved accessibility to financing options. The rise of e-commerce and investments in smart cities will further contribute to the market’s growth. Localized manufacturing and favorable government policies, including incentives for electric vehicles, will also enhance affordability and accelerate adoption.

The utility vehicle market in France is projected to grow at a CAGR of 5.8% during 2025–2035, slightly above the global average of 5.5%. France's expanding infrastructure and agriculture sectors are key contributors to the growing demand for utility vehicles. The government’s focus on green energy and increasing demand for electric vehicles are expected to drive the adoption of environmentally friendly utility vehicles. From 2020 to 2024, the market grew at a CAGR of 5.2%, with steady demand across the agricultural, construction, and logistics industries. The upcoming years will likely witness stronger demand driven by governmental policies supporting clean energy solutions, such as incentives for electric utility vehicles. Additionally, innovations in vehicle technology and efficiency will also play a key role in the growth of the utility vehicle market in France.

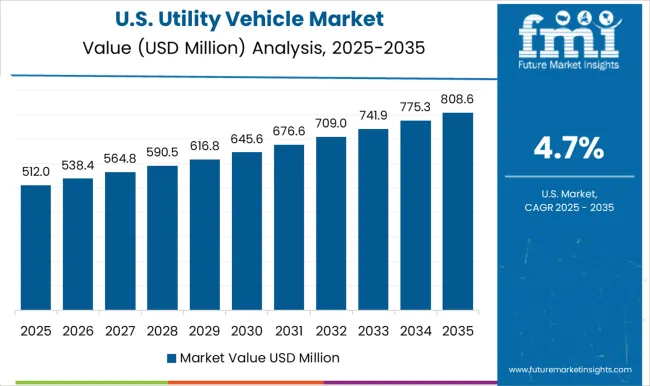

The utility vehicle market in the USA is expected to grow at a CAGR of 4.7% during 2025–2035, slightly below the global rate of 5.5%. This growth is driven by steady demand from construction, agriculture, and municipal sectors. The market between 2020 and 2024 grew at a CAGR of 4.2%, supported by strong demand for off-road and utility vehicles in sectors such as construction and emergency services. The USA market is expected to see a rise in utility vehicle adoption, driven by investments in infrastructure and technology. Electric vehicle adoption is expected to increase as government policies, such as tax incentives and green energy initiatives, promote the transition to environmentally friendly transportation solutions. The growing need for multi-functional vehicles in rural and suburban areas will further contribute to growth in the USA utility vehicle market.

The utility vehicle market is shaped by key global players such as Club Car, Columbia Vehicle Group Inc., Cushman, Garia, John Deere, Kubota, Star EV Corporation, USA, The Toro Company, and Yamaha, each contributing significantly to the development of vehicles for commercial, industrial, agricultural, and recreational use.

Club Car is renowned for its high-quality, electric-powered vehicles, which are designed to meet the needs of both leisure and commercial sectors, particularly in golf and resort industries. Columbia Vehicle Group Inc. excels in electric vehicles for diverse applications, including golf courses and industrial settings. Cushman offers versatile, durable vehicles, catering to hospitality, municipal, and industrial markets. Garia stands out with its luxury electric vehicles tailored for the upscale golf course and resort markets. John Deere, a global leader in agricultural equipment, provides robust utility vehicles for farm and commercial use. Kubota’s vehicles are widely known for their compactness and versatility in the agricultural and construction sectors. Star EV Corporation focuses on cost-effective, eco-friendly electric vehicles, while The Toro Company specializes in high-performance turf care equipment and utility vehicles for landscaping and golf courses. Yamaha offers a comprehensive range of recreational and utility vehicles, catering to both consumers and businesses.

The competitive strategies in the market revolve around product diversification, electric vehicle innovations, and meeting the increasing demand for energy-efficient and multi-functional vehicles. These players are continuously improving vehicle performance, focusing on energy efficiency, and expanding their presence in the global market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1108.9 Million |

| Cargo Configuration | With bed and Without bed |

| Propulsion | Gasoline, Diesel, and Electric |

| Application | Construction, Universities, Government/Municipalities, Entertainment, Hospitality, and Others |

| Drivetrain Configuration | 2WD and 4WD |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Club Car, Columbia Vehicle Group Inc., Cushman, Garia, John Deere, Kubota, Star EV Corporation, USA, The Toro Company, and Yamaha |

| Additional Attributes | Dollar sales by segment, they also seek insights into customer preferences, technological trends, and regulatory impacts on vehicle adoption. |

The global utility vehicle market is estimated to be valued at USD 1,108.9 million in 2025.

The market size for the utility vehicle market is projected to reach USD 1,894.2 million by 2035.

The utility vehicle market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in utility vehicle market are with bed, _2-seater, _street legal, without bed, _4-seater, _6-seater, _8-seater and _street legal.

In terms of propulsion, gasoline segment to command 44.7% share in the utility vehicle market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Utility Terrain Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Compact Utility Vehicles Market Growth - Trends & Forecast 2025 to 2035

Electric Utility Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Low Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Markers Market Size and Share Forecast Outlook 2025 to 2035

Utility Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Energy as a Service (EaaS) Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Open Loop Current Transducer Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Low Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Utility Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale High Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar PV EPC Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA