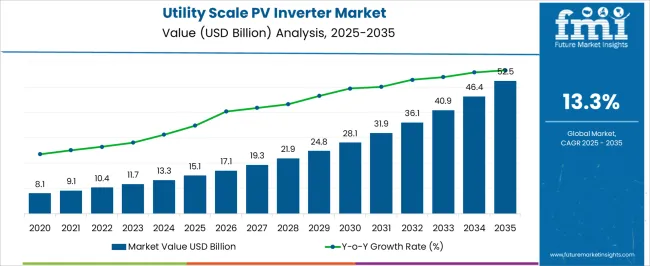

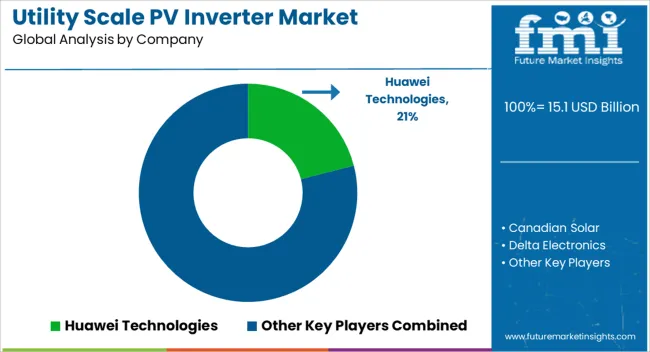

The Utility Scale PV Inverter Market is estimated to be valued at USD 15.1 billion in 2025 and is projected to reach USD 52.5 billion by 2035, registering a compound annual growth rate (CAGR) of 13.3% over the forecast period. The market demonstrates a steady year-on-year growth trajectory, starting with USD 8.1 billion in 2020 and reaching USD 13.3 billion by 2024, marking the early adoption phase characterized by pilot projects and selective utility investments. In 2025, the market achieves USD 15.1 billion, entering a scaling phase where rapid deployment of utility-scale solar farms accelerates revenue growth, supported by declining solar module costs, favorable policies, and increased grid integration capacity.

Between 2025 and 2030, the market shows significant annual increases, climbing from USD 15.1 billion to USD 28.1 billion, as large projects in emerging markets and the modernization of existing solar infrastructure drive adoption. Post-2030, the market transitions into a consolidation phase, where growth continues at a moderate pace, reaching USD 52.5 billion in 2035. During this period, technology standardization, improved inverter efficiency, and enhanced reliability reduce installation costs, stabilizing the adoption rate. The consistent year-on-year expansion highlights the utility-scale PV inverter market’s vital role in meeting global renewable energy targets while maintaining strong investment attractiveness for industry stakeholders.

| Metric | Value |

|---|---|

| Utility Scale PV Inverter Market Estimated Value in (2025 E) | USD 15.1 billion |

| Utility Scale PV Inverter Market Forecast Value in (2035 F) | USD 52.5 billion |

| Forecast CAGR (2025 to 2035) | 13.3% |

Growing demand for renewable energy integration into power grids has been accelerating the adoption of utility-scale inverters that enable high efficiency, grid stability, and advanced power electronics capabilities. Government initiatives promoting solar capacity additions, particularly in Asia, Europe, and North America, have supported the scaling of solar farms, thereby increasing the need for robust inverter technologies.

Utility operators are prioritizing products that support remote diagnostics, real-time performance optimization, and compliance with evolving grid codes. As noted in industry announcements and investor briefings, advances in digital control systems, remote firmware upgrades, and modular power blocks are driving the transition toward more flexible and efficient inverter solutions.

Future growth is expected to be shaped by innovation in smart grid technology, increasing energy storage integration, and regulatory support for carbon-neutral targets.

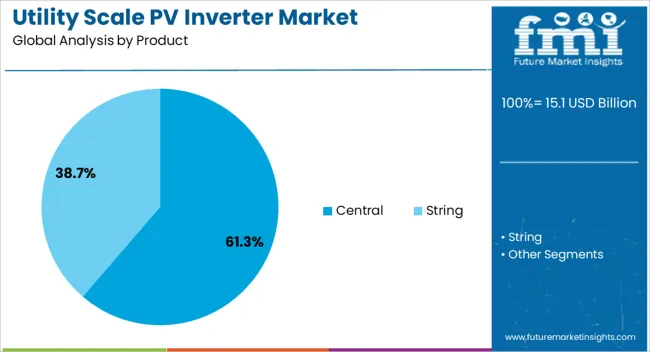

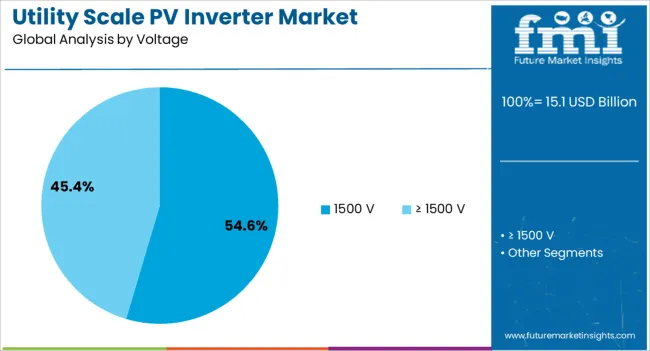

The utility scale PV inverter market is segmented by product, voltage, and geographic regions. By product, the utility scale PV inverter market is divided into Central and String. In terms of voltage, the utility scale PV inverter market is classified into 1500 V and ≥ 1500 V. Regionally, the utility scale PV inverter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The central inverter segment is projected to account for 61.3% of the Utility Scale PV Inverter market revenue share in 2025, making it the dominant product category. This position has been driven by the segment's suitability for high-capacity solar installations, offering streamlined operations and centralized control. Central inverters have been widely adopted for utility-scale projects due to their ability to manage high DC input and deliver grid-compliant AC output efficiently.

Investor briefings and technical bulletins have indicated that their long-standing presence in large-scale installations is supported by proven durability, simplified maintenance, and lower balance-of-system costs when deployed at scale. Central inverters are also being favored for their enhanced grid support functions, such as reactive power compensation and fault ride-through capabilities.

Additionally, compatibility with supervisory control and data acquisition systems has contributed to higher operational visibility and performance tracking These attributes have reinforced the central segment’s leadership in 2025, as project developers and utilities continue to focus on scalable and economically viable inverter solutions.

The 1500 V segment is expected to hold 54.6% of the Utility Scale PV Inverter market revenue share in 2025, securing its place as the leading voltage configuration. Its growth has been enabled by its ability to deliver increased system efficiency, reduced installation costs, and improved energy yield compared to lower voltage options. Industry publications and engineering specifications have emphasized that 1500 V systems support longer string lengths, which minimize cable losses and reduce component count across large installations.

This configuration has been increasingly integrated into modern utility-scale solar projects as operators aim to optimize land use, labor, and capital expenditures. Press releases from inverter manufacturers have also noted the segment’s role in supporting higher power densities and operational reliability under extreme conditions.

Grid integration standards in multiple regions are now aligning with 1500 V architectures, which has further reinforced adoption These benefits have positioned the 1500 V segment as the preferred choice in the market for projects targeting improved performance and cost efficiency in 2025.

The utility scale PV inverter market is growing rapidly due to the global expansion of large solar power plants. These inverters convert DC power from photovoltaic arrays into AC for grid integration, ensuring high efficiency and stable energy delivery. Rising investments in renewable energy, supportive policies, and grid modernization initiatives are driving adoption. Regions like North America, Europe, and Asia-Pacific lead installations, while emerging economies show increasing interest. Manufacturers focus on high-capacity, reliable inverters capable of remote monitoring and efficient performance under variable conditions.

Utility scale PV inverters are critical for large solar farms, where efficiency and reliability directly impact energy yield. High-capacity centralized and modular inverter systems allow for better grid compliance and reduced power losses. Solar developers prioritize inverters that can handle extreme weather conditions, voltage fluctuations, and system expansion requirements. Continuous advancements in inverter design improve performance under partial shading, soiling, or mismatched panels, minimizing downtime and maximizing energy output. As governments and private players invest in large-scale solar infrastructure, demand for robust, high-capacity inverters continues to rise.

Reliable operation and grid stability are essential for utility-scale PV systems. Inverters must support grid codes, reactive power management, and frequency regulation. Remote monitoring and control features enable operators to track performance, detect faults, and perform predictive maintenance without on-site intervention. Manufacturers offering integrated monitoring platforms and intelligent control systems gain preference among utility operators. High reliability, easy commissioning, and minimal maintenance requirements reduce operational costs and extend equipment lifespan. Efficient integration with energy storage systems further enhances grid flexibility and renewable energy utilization.

Emerging markets are increasingly adopting utility-scale solar projects to meet energy demand and sustainability goals. Governments introduce incentives, feed-in tariffs, and policy frameworks to encourage renewable capacity expansion. Developers seek cost-effective, high-capacity inverter solutions compatible with local grid standards. Partnerships with local EPC companies, training programs for technicians, and tailored financing models improve market penetration. Expanding solar installations in Asia, Latin America, and Africa offer significant growth potential. Suppliers capable of delivering reliable, high-performance inverters at competitive prices gain an advantage in these developing regions.

The market features strong competition among established inverter manufacturers and new entrants, driving innovation in efficiency, capacity, and service support. Component availability, including power semiconductors, affects production timelines and costs. Companies differentiate by offering superior warranty terms, technical services, and modular designs for scalability. Strategic collaborations with project developers and grid operators enhance market reach. Maintaining a reliable supply chain, managing logistics, and meeting local regulatory requirements are key to sustaining market share. Market growth depends on balancing technological performance, operational reliability, and cost-effectiveness to meet utility-scale project demands.

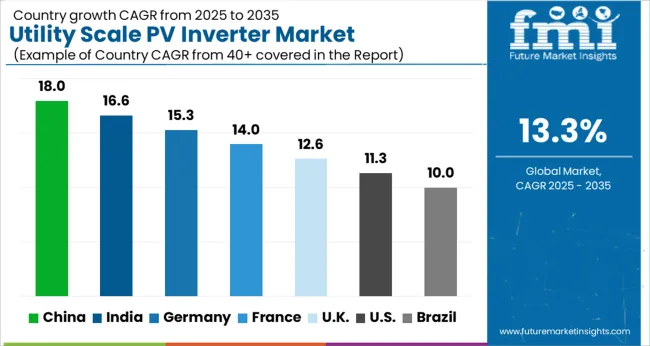

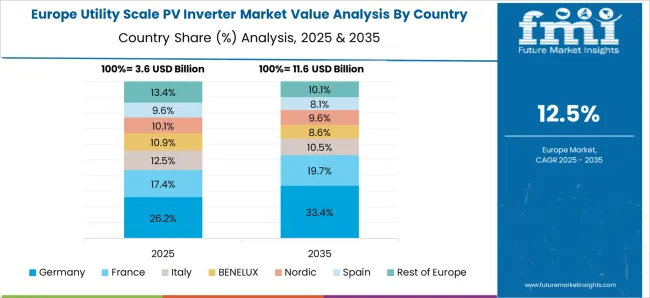

The global utility scale PV inverter market is projected to grow at a CAGR of 13.3%, driven by the rising deployment of large-scale solar power projects worldwide. China leads the market with an 18% growth rate, supported by extensive solar farms and government initiatives for renewable energy. India follows at 17%, fueled by increasing utility-scale solar installations and energy infrastructure development. Germany shows steady growth at 15%, leveraging advanced solar technologies and strong renewable energy policies. The UK and USA record growth rates of 13% and 11%, respectively, reflecting ongoing investments in large-scale solar energy projects. This report includes insights on 40+ countries; the top countries are shown here for reference.

The utility scale PV inverter market in China is expanding at 18%, fueled by rapid deployment of large-scale solar projects and government initiatives to increase renewable energy capacity. China’s focus on achieving carbon neutrality and reducing dependence on fossil fuels has accelerated the installation of utility-scale photovoltaic systems. Manufacturers are emphasizing high-efficiency inverters that support grid stability, optimize power output, and integrate with smart energy management systems. Technological advancements such as central inverters, string inverters, and hybrid solutions are enabling large-scale solar plants to maximize performance and reliability. The country’s supportive policies, subsidies, and favorable financing options for renewable energy projects further drive demand for utility scale PV inverters. As China continues to invest in clean energy infrastructure, the market for utility-scale PV inverters is expected to witness sustained growth, offering opportunities for domestic and international suppliers.

The utility scale PV inverter market in India is growing at 17%, supported by the country’s ambitious renewable energy goals and increasing adoption of large-scale solar power projects. Government initiatives such as solar parks, subsidies, and incentives for clean energy infrastructure encourage investment in high-capacity PV inverters. Utility-scale solar plants in India are integrating central and string inverters to optimize performance, reduce energy losses, and maintain grid reliability. Technological improvements in inverter efficiency, durability, and monitoring systems further enhance their adoption. Rising electricity demand, coupled with policies promoting sustainable energy, is driving the deployment of utility-scale photovoltaic systems across states. As India continues to prioritize solar energy and green power generation, the demand for utility-scale PV inverters is projected to grow steadily, offering significant opportunities for domestic and international manufacturers.

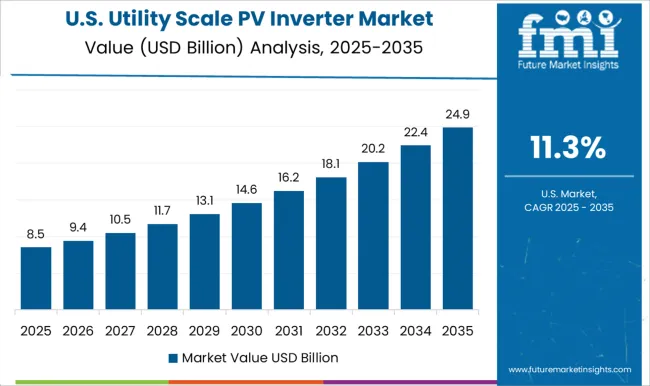

The utility scale PV inverter market in the United States is expanding at 11%, driven by growing utility-scale solar projects and renewable energy adoption across the country. Large solar farms are increasingly deploying central and string inverters to improve energy efficiency, reliability, and integration with the grid. Government incentives, tax credits, and state-level renewable energy programs support the adoption of advanced inverter technologies. Technological developments in high-capacity inverters, real-time monitoring, and hybrid systems are enhancing performance and operational efficiency. Rising demand for clean energy, carbon reduction initiatives, and corporate sustainability goals contribute to market growth. The United States continues to present strong opportunities for utility-scale PV inverter manufacturers, supported by ongoing solar capacity expansion and increasing renewable energy penetration.

Utility scale PV inverter market in Germany is growing at 15%, bolstered by the country’s energy transition policies, renewable energy targets, and strong solar infrastructure. Large-scale solar projects are increasingly adopting high-capacity PV inverters to optimize energy conversion, improve reliability, and integrate with the national grid. Manufacturers are focusing on improving inverter efficiency, monitoring systems, and durability to meet stringent German energy regulations. Incentives for renewable energy adoption, as well as the trend toward decentralized and smart grid systems, are accelerating demand for advanced inverter technologies. With continuous solar capacity expansion and increasing emphasis on sustainability, Germany presents a stable and growing market for utility-scale PV inverters, offering opportunities for innovative solutions and energy management technologies.

The utility scale PV inverter market in the United Kingdom is growing at 13%, fueled by government policies promoting solar energy and sustainability initiatives. Utility-scale solar farms are adopting advanced PV inverters to enhance power conversion efficiency, system reliability, and integration with smart grid infrastructure. Technological advancements such as hybrid inverters, monitoring systems, and high-capacity designs are helping operators optimize energy generation and reduce operational losses. Financial incentives, renewable energy targets, and growing corporate sustainability commitments are boosting market adoption. As the UK continues to invest in renewable energy infrastructure, the demand for utility-scale PV inverters is expected to grow steadily, offering opportunities for both domestic and international suppliers.

Major players in this market include Huawei Technologies, a leader in smart PV solutions offering highly efficient utility-scale inverters with advanced monitoring capabilities. Sungrow Power Supply and Canadian Solar provide robust, grid-compliant inverters for large solar farms worldwide. Delta Electronics and Eaton offer high-performance, modular inverter systems that optimize energy output and ensure reliability in diverse environmental conditions. Fimer Group, GoodWe, and GE Vernova focus on utility-scale solutions with enhanced grid support and remote monitoring features. Sofar Solar, Solis Inverters, Solplanet, Sineng Electric, and SolarEdge Technologies provide scalable, high-efficiency inverters tailored for large-scale solar projects, emphasizing smart energy management and cost-effective deployment. As utilities and independent power producers increasingly adopt renewable energy, the demand for reliable, high-capacity PV inverters is expected to accelerate. Innovations in grid integration, digital monitoring, and energy optimization are further driving the adoption of utility-scale PV inverters, making them a crucial component in the global transition to sustainable and resilient power generation.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.1 Billion |

| Product | Central and String |

| Voltage | 1500 V and ≥ 1500 V |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Huawei Technologies, Canadian Solar, Delta Electronics, Eaton, Fimer Group, GoodWe, GE Vernova, Sungrow Power Supply, Sofar Solar, Solis Inverters, Solplanet, Sineng Electric, and SolarEdge Technologies |

| Additional Attributes | Dollar sales by type including central inverters, string inverters, and hybrid inverters, application across solar farms, commercial solar projects, and large-scale renewable energy installations, and region covering North America, Europe, and Asia-Pacific. Growth is driven by increasing solar energy adoption, government incentives for renewable energy, and demand for efficient grid integration. |

The global utility scale PV inverter market is estimated to be valued at USD 15.1 billion in 2025.

The market size for the utility scale PV inverter market is projected to reach USD 52.5 billion by 2035.

The utility scale PV inverter market is expected to grow at a 13.3% CAGR between 2025 and 2035.

The key product types in utility scale PV inverter market are central and string.

In terms of voltage, 1500 v segment to command 54.6% share in the utility scale PV inverter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Utility Markers Market Size and Share Forecast Outlook 2025 to 2035

Utility Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Energy as a Service (EaaS) Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Utility Terrain Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Utility Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Utility Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility Pouches Market Size and Share Forecast Outlook 2025 to 2035

Utility Cases Market Insights - Growth & Demand 2025 to 2035

Utility Locator Market Report – Growth & Industry Forecast 2025 to 2035

Industry Share Analysis for Utility Pouches Companies

Utility Analytics and Energy Analytics Market Growth - Trends & Forecast through 2035

Utility Solar PV EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility On Grid PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Low Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Open Loop Current Transducer Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA