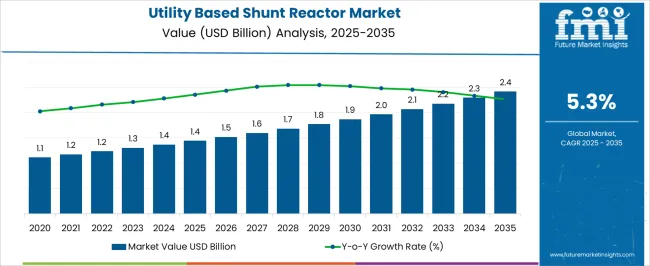

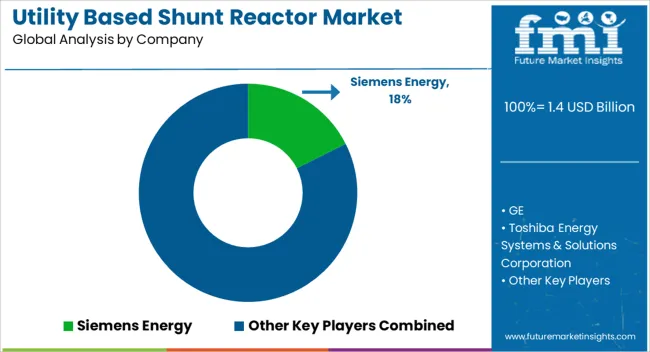

The global utility-based shunt reactor market is projected at USD 1.4 billion in 2025 and anticipated to reach USD 2.4 billion by 2035, expanding at a CAGR of 5.3% over the forecast period. In the first five-year block (2025–2030), the market is expected to see a steady climb from USD 1.4 billion to approximately USD 1.7 billion, reflecting consistent investments by utilities in grid stabilization and reactive power management. This phase will be marked by accelerated adoption in Asia-Pacific, where rapid urban electrification and renewable energy integration demand stable transmission systems.

Moving into the 2030–2035 block, the market is likely to advance from USD 1.9 billion to 2.4 billion, driven by the modernization of aging infrastructure in developed economies, alongside policy-driven renewable integration in emerging markets. Technological improvements in reactor efficiency and compact designs will also enhance replacement demand. Furthermore, rising electricity consumption in industrial clusters, combined with stricter grid reliability standards, will boost adoption across regions. By the end of the forecast period, shunt reactors will play an indispensable role in balancing voltage fluctuations, particularly in transmission networks handling large-scale wind and solar capacities. These growth blocks underline how investment priorities, regional demand patterns, and regulatory frameworks reinforce steady market expansion worldwide.

| Metric | Value |

|---|---|

| Utility Based Shunt Reactor Market Estimated Value in (2025 E) | USD 1.4 billion |

| Utility Based Shunt Reactor Market Forecast Value in (2035 F) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The utility-based shunt reactor market is shaped by interconnected parent markets, each contributing differently to overall demand and long-term growth. The power transmission and distribution infrastructure market holds the largest share at 35%, as utilities deploy shunt reactors to regulate voltage stability and improve grid efficiency in high-voltage networks. The renewable energy integration market contributes 25%, with wind and solar projects requiring advanced reactive power compensation to ensure smooth transmission of variable energy output. The industrial power demand sector accounts for 20%, as heavy industries and manufacturing clusters adopt shunt reactors to manage fluctuating loads and maintain uninterrupted operations.

The urban electrification and smart grid development market holds 12%, driven by expanding city power networks, smart metering systems, and grid automation initiatives worldwide. Finally, the aging infrastructure modernization and replacement market represents 8%, with utilities across developed economies upgrading outdated grid assets to align with new efficiency standards. Collectively, transmission infrastructure, renewable integration, and industrial demand account for nearly 80% of total market share, highlighting that grid stability, renewable energy growth, and industrial expansion remain the central growth drivers, while urban electrification and modernization initiatives contribute incremental but critical opportunities in shaping global adoption.

The utility based shunt reactor market is experiencing steady expansion, supported by increasing investments in transmission and distribution infrastructure and the ongoing need to enhance grid stability and efficiency. Market growth is being reinforced by the integration of renewable energy sources, which has heightened the demand for voltage regulation equipment to manage fluctuations in power generation.

Regulatory initiatives promoting grid modernization, coupled with rising electricity consumption in developing economies, are driving procurement of advanced shunt reactors. The industry is also benefiting from technological advancements in design and materials, improving operational reliability and reducing maintenance requirements.

Furthermore, strategic collaborations between utilities and equipment manufacturers are enabling customized solutions that meet specific operational parameters. Over the forecast period, continued urbanization, industrial expansion, and large-scale renewable projects are expected to provide consistent demand momentum, while competitive dynamics will be shaped by innovation in insulation systems, energy efficiency, and lifecycle cost optimization.

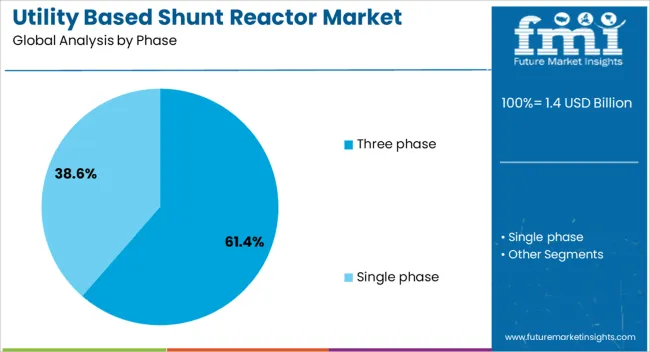

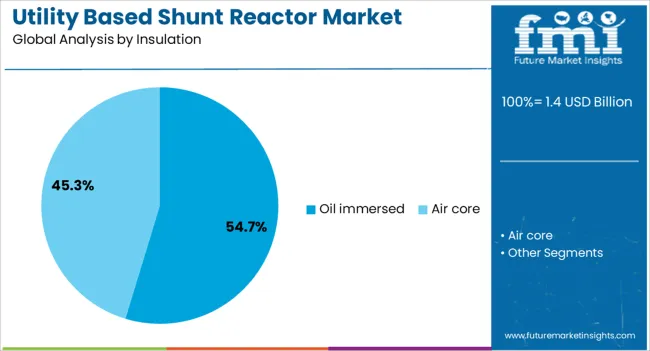

The utility based shunt reactor market is segmented by phase, insulation, product, and geographic regions. By phase, the utility-based shunt reactor market is divided into three-phase and single-phase. In terms of insulation, utility based shunt reactor market is classified into Oil immersed and Air core.

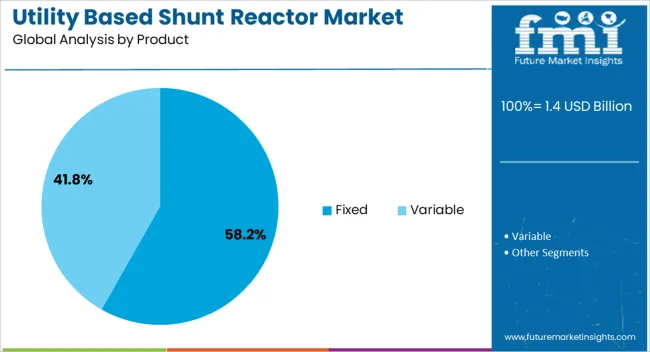

Based on the product, the utility-based shunt reactor market is segmented into Fixed and Variable. Regionally, the utility based shunt reactor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The three phase segment, accounting for 61.4% of the phase category, has maintained its dominance due to its capability to support large-scale utility applications with higher efficiency and lower installation complexity compared to single-phase units. Its preference is reinforced by widespread adoption in high-capacity transmission lines and interconnectors where stable voltage regulation is critical.

Standardization in design and easier integration into substation infrastructure have further supported demand. Manufacturing efficiency and economies of scale in production have contributed to competitive pricing, enhancing adoption rates across both developed and emerging markets.

Grid modernization projects, particularly in regions with rapidly expanding renewable integration, are expected to sustain demand for three-phase units, while technological improvements in core materials and magnetic design are anticipated to improve operational efficiency and reduce lifecycle costs, ensuring the segment’s continued leadership in the market.

The oil immersed segment, representing 54.7% of the insulation category, leads the market owing to its proven performance, cost-effectiveness, and long-standing operational reliability in high-voltage applications. Its thermal management capability and resistance to electrical stress have made it a preferred choice for utilities seeking stable, long-duration operation.

The segment benefits from established maintenance protocols, readily available spare parts, and a global base of experienced operators, reducing operational risk for utilities. In addition, the oil immersed design supports high-capacity operation with minimal degradation over time, making it suitable for demanding grid environments.

Regulatory compliance regarding insulating oils has influenced design adaptations, but its performance advantages continue to outweigh competitive alternatives in many applications. Future growth is expected to be supported by incremental improvements in oil quality, sealing systems, and environmental safeguards, which will enhance operational safety and efficiency while sustaining its leading market share.

The fixed segment, holding 58.2% of the product category, has maintained a leading position due to its robust design, lower maintenance needs, and suitability for continuous voltage stabilization in transmission networks. Its simplicity in operation and relatively lower initial cost compared to variable units have made it a preferred choice for utilities aiming to optimize capital expenditure.

The segment’s adoption has been further supported by its high reliability in grid environments with stable load patterns, reducing the need for frequent adjustments or complex control systems. Technological advancements in core and coil design have improved energy efficiency and reduced losses, contributing to better lifecycle economics.

As global power demand continues to grow, particularly in regions undergoing infrastructure upgrades, the fixed shunt reactor is expected to retain its dominance, bolstered by ongoing investments in grid reinforcement projects and the integration of high-voltage direct current (HVDC) systems where fixed solutions remain highly effective.

The utility-based shunt reactor market is fueled by rising power demand, renewable integration, grid modernization, and utility investments. Together, these drivers reinforce its importance in future global energy infrastructure.

The utility-based shunt reactor market is projected to grow steadily as global electricity demand continues to rise, particularly in developing economies. Shunt reactors are increasingly deployed to manage reactive power, stabilize voltage fluctuations, and prevent grid failures during peak load conditions. Utility providers are recognizing their importance in ensuring uninterrupted electricity supply to both urban and industrial consumers. The expansion of high-voltage transmission lines across long distances creates an urgent need for shunt reactors to mitigate energy losses. Grid operators are prioritizing these installations to address reliability issues and improve overall power efficiency, making shunt reactors an integral part of future energy infrastructure planning.

Renewable energy projects are rapidly shaping the demand for utility-based shunt reactors as wind and solar farms expand worldwide. The intermittent and variable output from renewable sources creates voltage instability, which shunt reactors help regulate efficiently. Governments and utilities are deploying these systems in renewable corridors to ensure smooth integration with transmission grids. This role becomes increasingly vital as countries push for higher renewable energy penetration to meet climate goals and energy security targets. In addition, hybrid power networks combining conventional and renewable generation further drive adoption. As renewable integration accelerates, shunt reactors become indispensable for maintaining grid balance and avoiding blackouts.

The modernization of aging power infrastructure is another significant factor boosting the utility-based shunt reactor market. Many developed economies, such as the USA and parts of Europe, are upgrading decades-old grid networks to handle rising electricity loads and improve efficiency. Shunt reactors are key elements of this transformation, ensuring stability across high-capacity lines and enabling greater energy efficiency. Governments are investing heavily in grid refurbishment programs, aligning with energy reliability and efficiency standards. Furthermore, grid interconnections between countries are expanding, requiring advanced solutions to maintain consistent voltage levels across borders. These modernization efforts ensure long-term demand for shunt reactor installations globally.

Utility companies worldwide are allocating larger budgets toward power stability solutions, including shunt reactors, to meet growing consumer and industrial needs. These investments are driven by regulatory mandates, rising energy demand, and the requirement to reduce transmission losses. Emerging economies in Asia and Africa are particularly witnessing heavy utility spending, as electricity consumption soars with industrialization and infrastructure growth. In addition, public-private partnerships in energy projects are further propelling market expansion. Utility providers are viewing shunt reactors as cost-effective tools for achieving grid stability and efficiency, positioning them as a priority in long-term infrastructure investments across global markets.

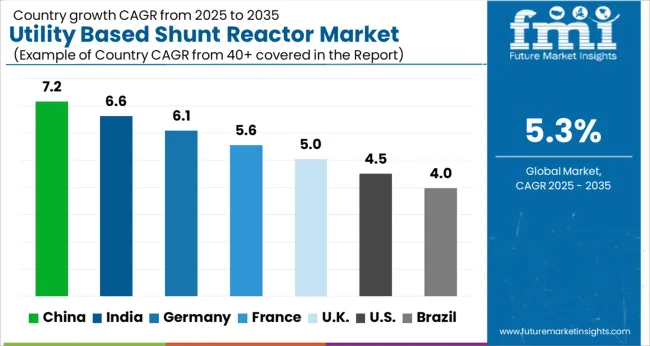

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

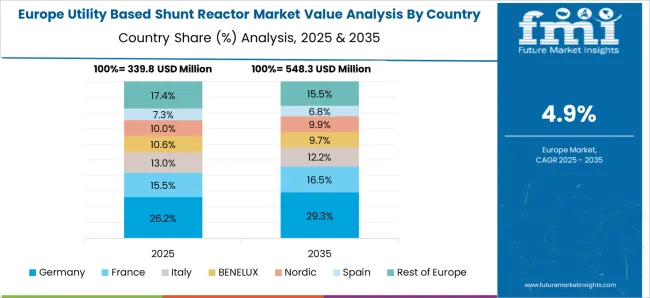

The global utility-based shunt reactor market is projected to grow at a CAGR of 5.3% from 2025 to 2035. China leads with a CAGR of 7.2%, followed by India at 6.6%, Germany at 6.1%, the UK at 5.0%, and the USA at 4.5%. Growth is fueled by rising electricity demand, long-distance transmission line expansions, and the integration of renewable energy sources into national grids. Asia, particularly China and India, shows the fastest growth due to rapid industrialization, urban electrification, and government-backed grid modernization projects. Europe focuses on grid stability, cross-border transmission networks, and renewable energy integration, with Germany at the forefront. North America emphasizes reliability upgrades and loss minimization across aging power infrastructure. Utility providers worldwide are investing heavily in shunt reactors to ensure stable voltage profiles, reduce transmission losses, and improve efficiency across power distribution networks. The analysis spans over 40+ countries, with the leading markets highlighted below.

The utility-based shunt reactor market in China is projected to grow at a CAGR of 7.2% from 2025 to 2035, supported by rapid power grid expansion, renewable energy integration, and large-scale industrial electrification. China’s focus on reducing transmission losses across its extensive extra-high-voltage (EHV) and ultra-high-voltage (UHV) networks is accelerating demand for advanced shunt reactors. Government-driven initiatives to integrate wind and solar power into the national grid require voltage stabilization equipment to manage intermittency. Domestic manufacturers are enhancing technology capabilities, while global players are partnering with utilities to meet growing demand. Continuous investments in smart grid projects, will significantly expand reactor adoption across both urban and rural networks.

The utility-based shunt reactor market in India is expected to expand at a CAGR of 6.6% from 2025 to 2035, driven by rising electricity consumption, rapid industrialization, and infrastructure expansion. India’s renewable energy ambitions, targeting 500 GW of capacity by 2030, necessitate grid stabilization technologies such as shunt reactors to balance intermittent solar and wind inputs. State-owned utilities, including Power Grid Corporation of India, are investing in modernizing long-distance transmission networks, particularly to manage rural and industrial load centers. Public-private collaborations and FDI in the power sector are boosting reactor deployment. The government’s push toward smart grid development and rural electrification ensures strong demand growth. Domestic manufacturers are enhancing production capacity, while international firms introduce advanced designs for high-capacity networks.

Germany’s utility-based shunt reactor market is projected to grow at a CAGR of 6.1% from 2025 to 2035, fueled by the country’s aggressive renewable energy targets under its Energiewende policy. With the planned phase-out of nuclear and coal power, Germany is expanding renewable capacity, particularly wind and solar, which drives demand for voltage control solutions in transmission systems. Cross-border power trade within the European Union further necessitates high grid stability, enhancing shunt reactor installations. Domestic energy firms and European manufacturers are focusing on supplying advanced, environmentally friendly shunt reactors that meet stringent EU efficiency standards. Investments in smart grids, coupled with the rising integration of offshore wind farms, provide a strong foundation for reactor demand in the country.

The utility-based shunt reactor market in the UK is projected to grow at a CAGR of 5.0% from 2025 to 2035, driven by transmission network modernization, offshore wind integration, and aging infrastructure upgrades. The UK’s renewable energy mix, especially large-scale offshore wind farms, necessitates advanced shunt reactors to maintain grid stability and minimize transmission losses. National Grid ESO is actively deploying voltage stabilization solutions to manage fluctuating renewable inputs while ensuring energy security. Collaborations between international suppliers and UK-based utilities are enhancing market penetration of advanced and compact reactor technologies. Investment in transmission infrastructure and smart grid solutions is set to support steady demand growth.

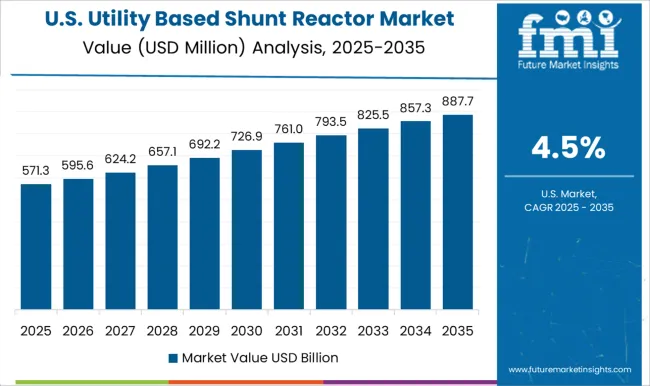

The utility-based shunt reactor market in the USA is anticipated to grow at a CAGR of 4.5% from 2025 to 2035, supported by modernization of aging grid infrastructure and increasing renewable penetration. While growth is slower compared to Asia and Europe, the USA market benefits from significant investments in transmission upgrades, especially to integrate large-scale solar and wind projects in states like Texas and California. Federal energy transition policies and investments through infrastructure bills also encourage adoption of advanced shunt reactors to reduce energy losses. Domestic and global manufacturers are competing to provide reactors tailored for high-capacity, long-distance transmission lines. Utility companies focus on improving system reliability and reducing operational costs through efficient voltage management solutions.

Competition in the utility-based shunt reactor market is defined by grid efficiency, reactive power compensation, and the integration of advanced monitoring technologies. Siemens Energy and GE lead with a wide range of high-voltage shunt reactors tailored for grid operators, renewable energy projects, and smart transmission systems. Toshiba Energy Systems & Solutions Corporation and Hitachi Energy Ltd. differentiate through innovative insulation technologies, compact reactor designs, and solutions optimized for ultra-high-voltage networks. CG Power & Industrial Solutions Ltd. and Shrihans Electricals Pvt. Ltd. maintain strong positions in South Asia by offering cost-effective yet reliable shunt reactors suited for regional grid stability requirements.

Asian companies such as HYOSUNG Heavy Industries, NISSIN Electric Co., Ltd., and Fuji Electric Co., Ltd. bring significant expertise in designing reactors for both AC and HVDC systems, ensuring compatibility with expanding renewable integration and industrial applications. European firms like GBE S.p.A., GETRA S.p.A., and SGB SMIT emphasize eco-efficient technologies, energy loss reduction, and compliance with stringent EU grid codes. WEG and HICO America provide advanced air-core and oil-immersed shunt reactors that target utility providers seeking operational reliability and long service lifespans. TMC Transformers Manufacturing Company has carved a niche in dry-type and custom-engineered solutions addressing specific industrial and utility needs.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Phase | Three phase and Single phase |

| Insulation | Oil immersed and Air core |

| Product | Fixed and Variable |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens Energy, GE, Toshiba Energy Systems & Solutions Corporation, CG Power & Industrial Solutions Ltd., Hitachi Energy Ltd., HYOSUNG HEAVY INDUSTRIES, TMC TRANSFORMERS MANUFACTURING COMPANY, NISSIN ELECTRIC Co.,Ltd., Fuji Electric Co., Ltd., GBE S.p.A, WEG, HICO America, SGB SMIT, GETRA S.p.A., and Shrihans Electricals Pvt. Ltd. |

| Additional Attributes | Dollar sales, share, market size trends, competitive positioning, regional demand outlook, regulatory impacts, pricing benchmarks, technology adoption, and customer preferences. |

The global utility based shunt reactor market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the utility based shunt reactor market is projected to reach USD 2.4 billion by 2035.

The utility based shunt reactor market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in utility based shunt reactor market are three phase and single phase.

In terms of insulation, oil immersed segment to command 54.7% share in the utility based shunt reactor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Utility-Scale Low Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Markers Market Size and Share Forecast Outlook 2025 to 2035

Utility Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Energy as a Service (EaaS) Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Terrain Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Open Loop Current Transducer Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Low Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Utility Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale High Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar PV EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale High Voltage Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Microgrid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA